1. Introduction to Cash Flow Statements

2. Understanding the Components of a Cash Flow Statement

5. How Companies Fund Their Operations?

6. The Link Between Cash Flow and Company Health

7. Statement of Changes in Equity Explained

8. Interpreting Equity Changes Alongside Cash Flow

9. Making Informed Decisions with Cash Flow and Equity Insights

Cash Flow Statement and Statement of Changes in Equity: Cash Flow Statement Essentials: How to Read and Interpret

1. Introduction to Cash Flow Statements

Understanding the flow of cash is like reading the vital signs of a business. It tells you where the money is coming from, where it's going, and most importantly, how a company manages its financial health. A cash Flow statement, one of the essential financial statements alongside the balance sheet and income statement, provides a detailed analysis of what happened to a company's cash during a given period. Unlike the income statement, which can include non-cash transactions, the cash flow statement only deals with actual cash transactions, offering a transparent view of a company's liquidity.

The statement is divided into three main parts: cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities. Each section tells a different story about the company's financial strategy and priorities.

1. Cash Flows from Operating Activities: This section reflects the cash generated from a company's core business operations. It adjusts net income for items that affected reported net income but didn't affect cash. For example, depreciation expenses are added back to net income because they represent a non-cash charge against income.

2. Cash Flows from Investing Activities: Here, you'll find transactions involving the purchase and sale of long-term assets, such as property, plant, and equipment, or investment securities. If a company is selling more than it's investing, it might indicate a strategy focused on short-term liquidity over long-term growth.

3. Cash Flows from Financing Activities: This part shows the flow of cash between a company and its owners and creditors. It includes dividends paid, stock issued or bought back, and loans received or paid off. An increase in debt might suggest a need for external financing to support the company's operations or expansion.

To illustrate, let's consider a hypothetical tech startup, Innovatech Ltd.. In their first year, they report a net income of \$100,000. However, their cash flow from operating activities is \$150,000 after adding back \$50,000 in depreciation expenses. This indicates that while their net income is positive, the actual cash generated from their operations is even higher, a good sign for investors.

In the same period, Innovatech spent \$200,000 on new software development (an investing activity), showing a commitment to growth and innovation. However, they also took out a loan of \$100,000 (a financing activity), suggesting that while they are investing heavily, they also need external funds to support their ambitious projects.

By analyzing these sections, stakeholders can discern the company's strategy and financial health. A company with positive cash flow from operations and balanced investing and financing activities is generally considered stable and well-managed. Conversely, heavy reliance on external financing or significant cash outflows for investments could raise concerns about sustainability.

The Cash Flow Statement is a crucial tool for investors, creditors, and management to evaluate the financial viability and strategic direction of a company. It's not just about how much money a company made, but about understanding the quality of those earnings and the company's ability to sustain and grow its operations over time. In-depth analysis of this statement, combined with other financial data, can provide invaluable insights into a company's operational efficiency and future potential.

Introduction to Cash Flow Statements - Cash Flow Statement and Statement of Changes in Equity: Cash Flow Statement Essentials: How to Read and Interpret

2. Understanding the Components of a Cash Flow Statement

The cash flow statement, a crucial part of any financial report, offers a transparent view of a company's liquidity and its ability to generate cash to fund operations, pay debts, and invest in future growth. Unlike the income statement, which can be influenced by accounting policies and non-cash items, the cash flow statement strips away all such elements to focus purely on cash transactions. This makes it an invaluable tool for stakeholders to assess the financial health and operational efficiency of a business.

1. Operating Activities:

This section reflects the cash generated from the company's core business operations. It starts with net income and adjusts for non-cash items like depreciation and changes in working capital. For example, if a company reports a net income of \$100,000, but it also reports \$20,000 in depreciation (a non-cash expense), the net cash provided by operating activities would be \$120,000.

2. Investing Activities:

Here, the statement shows cash used for or generated from investing in assets, and it's a window into how a company is planning for the future. Purchases of property, plant, and equipment (PPE) are common examples. If a company buys a new piece of machinery for \$50,000, this amount is reflected as a cash outflow in this section.

3. Financing Activities:

This part details the flows of cash between the company and its owners and creditors. It includes dividends paid, proceeds from issuing stock, or cash used to pay down debt. For instance, if a company issues new shares and receives \$200,000, this would be shown as a cash inflow.

4. Supplemental Information:

The cash flow statement often includes supplemental information, such as the amount of interest and income taxes paid, as these are considered operating cash flows but are often settled in different periods.

5. Non-Cash Investing and Financing Activities:

Some transactions don't involve cash but still affect the financial position. These are disclosed in a separate section or in the notes. An example is the conversion of debt to equity.

6. free Cash flow:

Although not a formal part of the cash flow statement, free cash flow is a metric derived from it, calculated as net cash from operating activities minus capital expenditures. It represents the cash a company can use for dividends, paying down debt, or reinvestment.

By dissecting each component, stakeholders can piece together a narrative of the company's past, present, and future cash flow story. The cash flow statement thus serves as a compass, guiding investors, creditors, and management in their decision-making processes. It's the financial equivalent of checking the pulse of a business, providing a real-time assessment of its financial vitality.

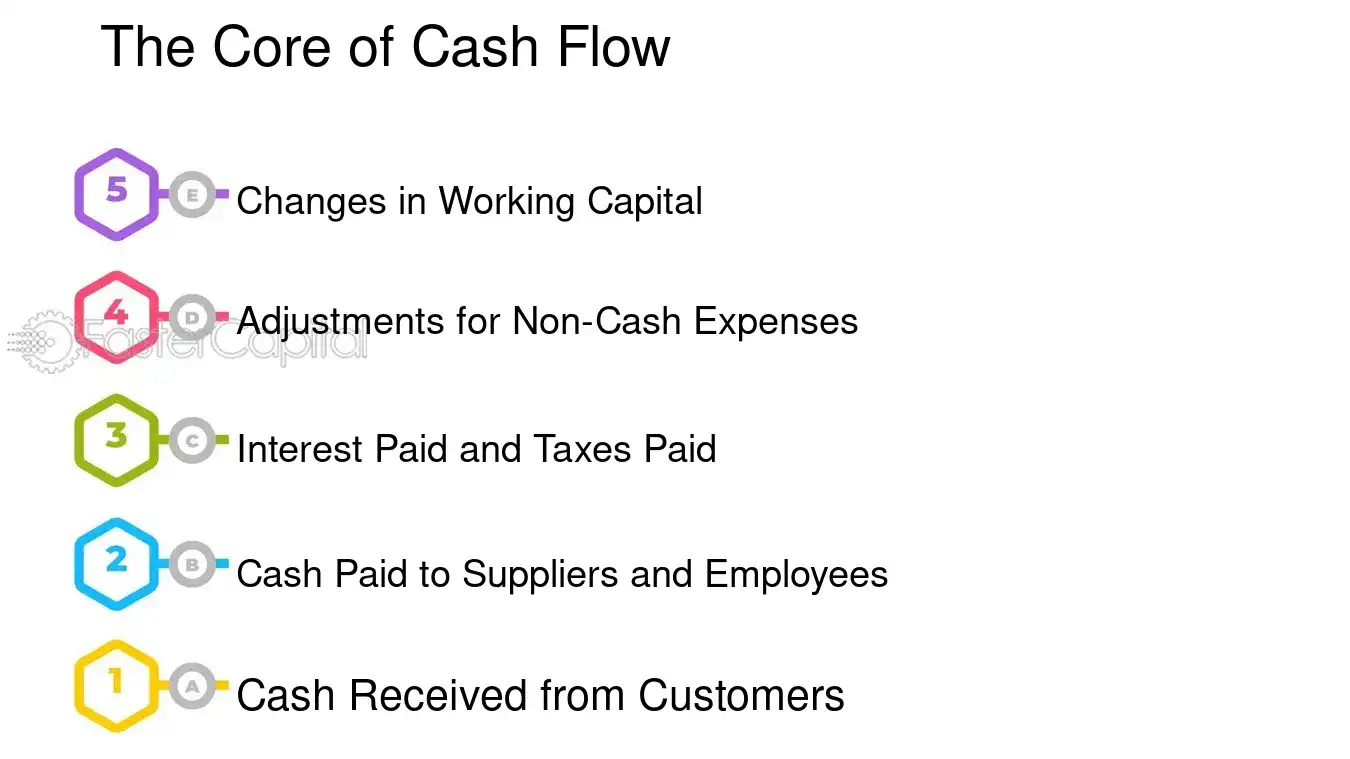

3. The Core of Cash Flow

Operating activities form the essence of a company's cash flow, as they directly relate to the core business operations such as selling products, providing services, and other activities that generate revenue. This section of the cash flow statement is pivotal because it offers investors and analysts a glimpse into the company's operational efficiency and its ability to generate profit from its regular business activities. Unlike other sections that may include investments or financing transactions, operating activities reflect the cash flow that is sustainable and repeatable, making it a critical indicator of the company's financial health.

From the perspective of a financial analyst, operating activities are scrutinized to assess the quality of earnings. A company that generates substantial cash flow from operating activities is often seen as having high-quality earnings, which are sustainable over the long term. Conversely, if a company relies heavily on financing or investing activities for its cash flow, it may raise concerns about the sustainability of its business model.

From a managerial standpoint, the cash flow from operating activities is essential for day-to-day operations. It ensures that a company has enough liquidity to pay its bills, invest in inventory, and manage its working capital. Managers use this section to make strategic decisions about cost-cutting, pricing, and operational improvements.

Here are some key components of operating activities and their implications:

1. Cash Received from Customers: This is the lifeblood of any business. A high amount of cash received indicates strong sales and market demand. For example, a retail company that sees a consistent increase in cash received from customers might be experiencing growth in its customer base or an increase in average transaction value.

2. Cash Paid to Suppliers and Employees: These are the primary expenses for most businesses. A company that manages to reduce these payments without sacrificing quality or employee satisfaction may improve its cash flow from operating activities. For instance, a manufacturing company that negotiates better terms with suppliers or improves its production efficiency can reduce the cash outflow, thus enhancing its operating cash flow.

3. Interest Paid and Taxes Paid: While these are not operational costs, they are tied to the operational earnings before interest and taxes (EBIT). A company with a stable and growing operating cash flow will be better positioned to handle its interest obligations and tax liabilities.

4. adjustments for Non-Cash expenses: Items like depreciation and amortization are non-cash charges that reduce net income but do not affect cash flow. Adjusting for these items is crucial to understand the actual cash generated from operations. For example, a company with heavy machinery will have significant depreciation expenses, but these do not represent an outflow of cash.

5. Changes in Working Capital: This reflects the cash tied up in the day-to-day operations. An increase in inventory or receivables may signal growth but also indicates cash tied up in operations. Conversely, an increase in accounts payable may boost cash flow but could also suggest delayed payments to suppliers.

The operating activities section of the cash flow statement is a mirror reflecting the company's operational health. It provides a transparent view of how effectively a company is turning its core business activities into cash, which is essential for sustaining operations, investing in growth, and returning value to shareholders. Understanding this section is crucial for anyone interested in the financial fortitude and future prospects of a business.

The Core of Cash Flow - Cash Flow Statement and Statement of Changes in Equity: Cash Flow Statement Essentials: How to Read and Interpret

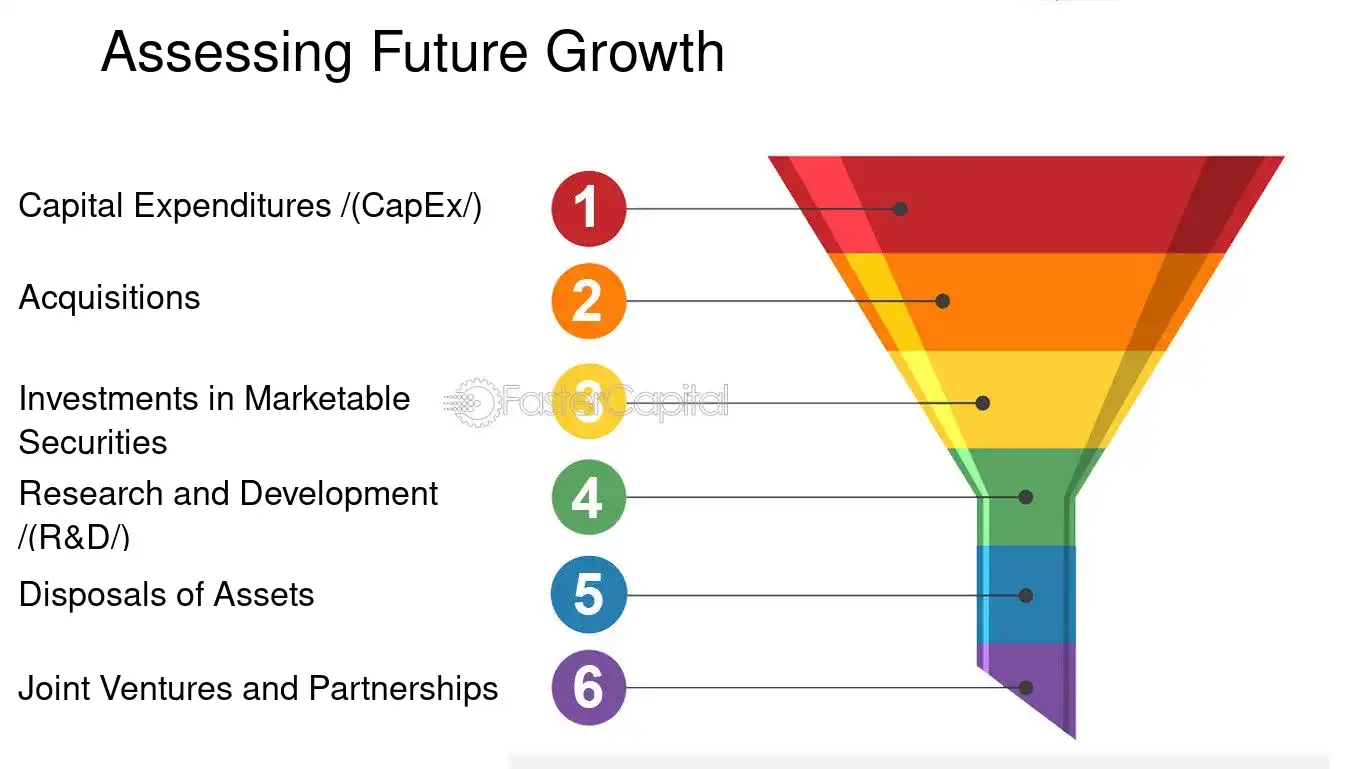

4. Assessing Future Growth

Investing activities are a crucial aspect of a company's cash flow statement, providing insights into the capital expenditures, acquisitions, and investments a company makes to secure its future growth. These activities are indicative of a company's long-term strategic plans and can often signal the management's confidence in the company's future. Unlike operating activities, which reflect the day-to-day business operations, investing activities show how a company allocates resources to generate future income and cash flows. This can include the purchase or sale of long-term assets, such as property, plant, and equipment, or investments in other companies. Assessing these activities requires a forward-looking approach, as they may not immediately contribute to current cash flows but are expected to do so in the future.

From an investor's perspective, a company with a robust portfolio of investing activities is often seen as one that is poised for growth. However, it's essential to differentiate between mere expenditure and strategic investment. Here's an in-depth look at how to assess investing activities for future growth:

1. Capital Expenditures (CapEx): This refers to the funds used by a company to acquire, upgrade, and maintain physical assets. A high CapEx can indicate a company's commitment to growth, but it's important to consider the industry context. For example, technology companies may have lower CapEx compared to manufacturing firms due to the nature of their assets.

2. Acquisitions: When a company acquires another, it can potentially tap into new markets, technologies, or product lines. For instance, when Google acquired YouTube, it significantly boosted its presence in the online video market.

3. Investments in Marketable Securities: Companies often invest in stocks, bonds, or funds to manage excess cash. A well-managed portfolio can contribute to a company's income through dividends and interest, as well as capital gains.

4. Research and Development (R&D): While R&D expenses are often reported under operating activities, they are essentially investments in a company's future capabilities. A consistent investment in R&D can be a strong indicator of future growth, especially in industries like pharmaceuticals or technology.

5. Disposals of Assets: selling off non-core assets can streamline operations and free up capital for more profitable investments. This was the case when eBay spun off PayPal, allowing both companies to focus on their core strengths.

6. joint Ventures and partnerships: These can allow companies to share risks and combine resources for projects that are too large or risky to undertake alone. An example is the partnership between NASA and SpaceX, which combines public and private resources for space exploration.

By examining these aspects of investing activities, stakeholders can gain a better understanding of a company's growth potential. It's not just about the amount of money being spent, but how effectively it's being used to secure future profitability and market position. A company that strategically invests in assets and opportunities that align with its core competencies and market trends is more likely to see sustained growth over time.

Assessing Future Growth - Cash Flow Statement and Statement of Changes in Equity: Cash Flow Statement Essentials: How to Read and Interpret

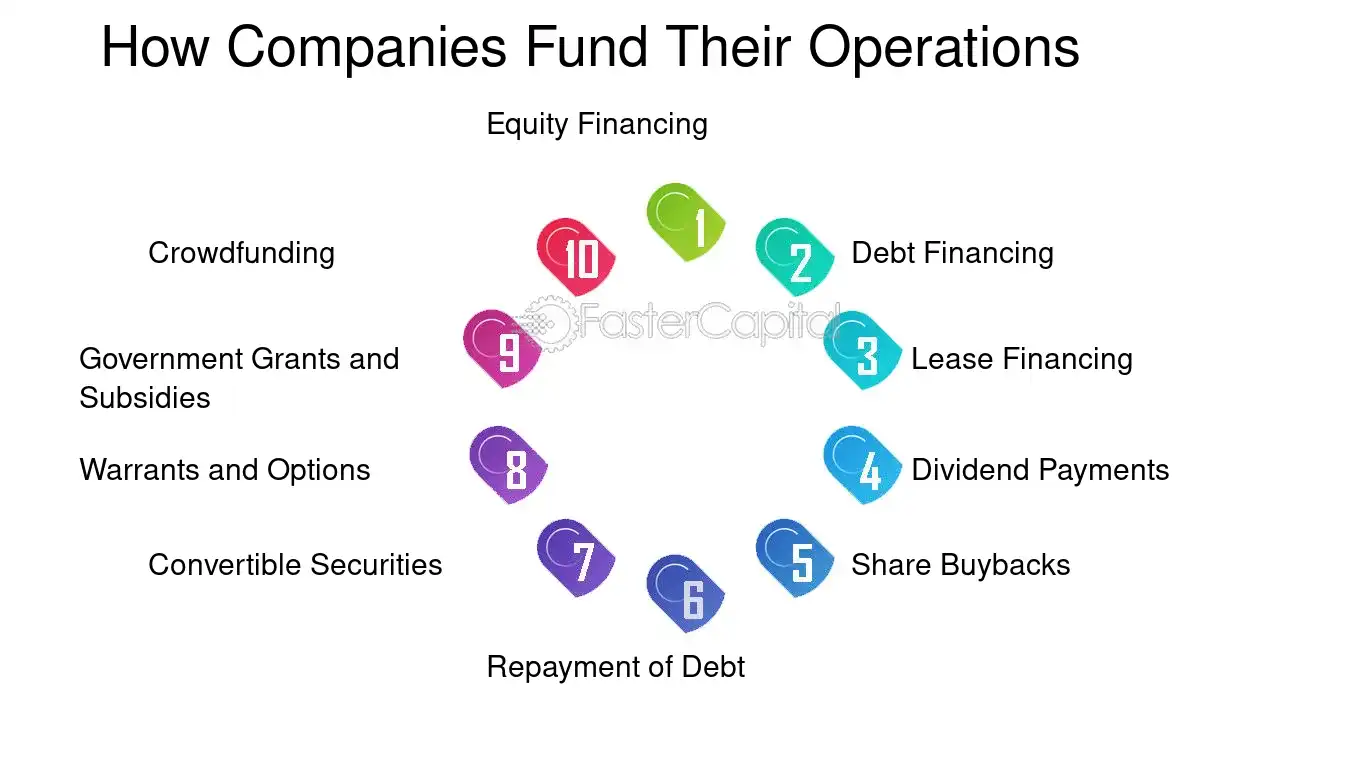

5. How Companies Fund Their Operations?

Financing activities are a critical aspect of a company's cash flow statement, reflecting transactions that result in changes to the size and composition of the equity capital or borrowings of the entity. Unlike operating activities which capture the day-to-day business transactions, and investing activities which reflect asset purchases or sales, financing activities provide insights into how a company funds its operations and growth, and how it returns value to shareholders.

From issuing stocks or bonds to taking out loans, companies have various avenues to secure the necessary capital. These activities are essential for understanding a company's financial strategy and its ability to manage long-term obligations. They also offer a window into the company's future, revealing how it positions itself for sustainable growth or navigates through challenging economic times.

Let's delve deeper into the intricacies of financing activities with a detailed exploration:

1. Equity Financing: This involves raising capital by selling shares of the company to investors. For instance, a startup might issue new shares to venture capitalists to get the funding needed for expansion. A well-known example is Facebook's IPO in 2012, which was one of the biggest in tech history, raising $16 billion and valuing the company at $104 billion.

2. Debt Financing: Companies can borrow funds by issuing bonds or taking out loans. The advantage of debt is that it doesn't dilute ownership like equity does. For example, in 2017, Netflix issued $1.6 billion in senior notes to finance content acquisition and production.

3. Lease Financing: Instead of purchasing assets, companies may opt for leasing to preserve cash. This is common in industries like airlines, where companies like Emirates often lease aircraft rather than buying them outright to maintain liquidity.

4. Dividend Payments: When companies generate excess profits, they may choose to distribute dividends to shareholders. This is a return on investment for the shareholders and can influence the stock price. Apple, for instance, resumed paying dividends in 2012 and has been increasing them annually.

5. Share Buybacks: Another way to return value to shareholders is through share buybacks. This reduces the number of outstanding shares, potentially increasing the value of remaining shares. In 2018, Cisco announced a massive $25 billion share buyback plan.

6. Repayment of Debt: The repayment schedule of a company's debt is a key indicator of its financial health. Early repayment can save interest costs, while restructuring debt can provide relief if a company is facing cash flow issues.

7. Convertible Securities: These are hybrid financing options, like convertible bonds, which can be converted into a predetermined number of shares. This provides investors with an option to participate in the company's equity growth.

8. Warrants and Options: Companies may issue warrants or options as part of financing deals, which give the holder the right to buy shares at a specific price in the future. This can be an attractive incentive for investors.

9. government Grants and subsidies: Some companies may qualify for government grants or subsidies, which can provide a significant boost without the need to repay. Tesla, for example, has benefited from government subsidies in various forms over the years.

10. Crowdfunding: A modern approach to financing, crowdfunding allows companies to raise small amounts of money from a large number of people, typically via the internet. Pebble Time holds the record for the most funded Kickstarter campaign, raising over $20 million.

understanding these financing activities is crucial for stakeholders to assess a company's financial strategy and risk profile. It also helps in predicting the company's ability to generate future cash flows and its potential for growth and expansion. By examining the cash flow from financing activities, one can gauge the company's financial flexibility and its reliance on external funding sources.

How Companies Fund Their Operations - Cash Flow Statement and Statement of Changes in Equity: Cash Flow Statement Essentials: How to Read and Interpret

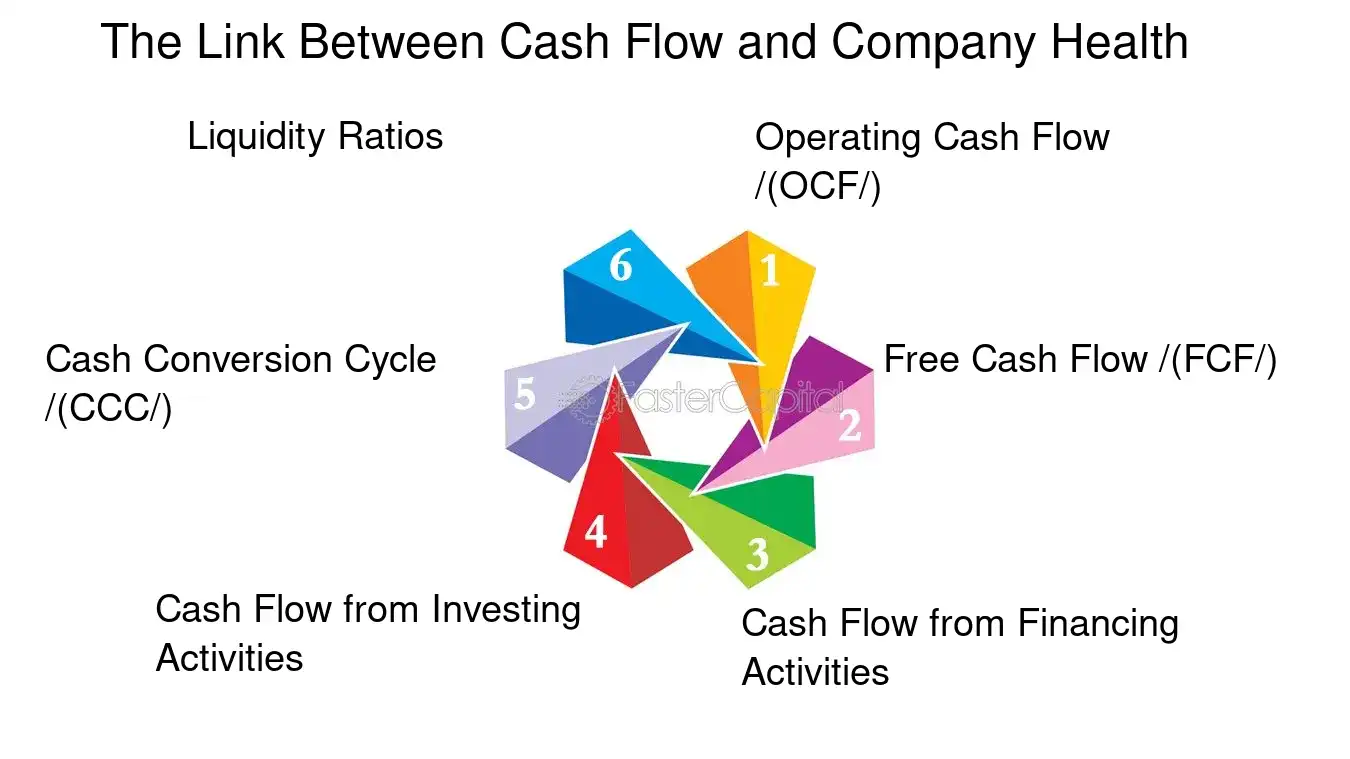

6. The Link Between Cash Flow and Company Health

cash flow is the lifeblood of any business, representing the amount of cash that is flowing in and out of a company's coffers. It is a critical indicator of a company's financial health, providing insights into its operational efficiency, liquidity, and overall stability. Unlike net income, which can be influenced by non-cash transactions and accounting practices, cash flow offers a more tangible measure of a company's ability to sustain operations, invest in growth, and return value to shareholders.

From an operational standpoint, positive cash flow indicates that a company is generating more cash than it is using, which is essential for covering day-to-day expenses, paying employees, and purchasing inventory. Conversely, negative cash flow can signal potential problems, such as slow sales, high expenses, or poor collections on accounts receivable. Over time, sustained negative cash flow can lead to increased debt, reduced creditworthiness, and ultimately, insolvency.

Investors and creditors often scrutinize cash flow statements to assess a company's financial viability. A strong cash flow can enhance a company's borrowing capacity, as lenders view it as a sign of a lower risk of default. Similarly, investors may prefer companies with robust cash flows, as they are more likely to fund dividends and share buybacks, contributing to shareholder wealth.

Now, let's delve deeper into the link between cash flow and company health with some in-depth points:

1. Operating Cash Flow (OCF): This is the cash generated from a company's core business operations. It is a pure measure of a company's ability to generate cash from sales after accounting for the costs of goods sold and operating expenses. For example, a manufacturing company with efficient production processes and strong demand for its products will typically exhibit strong OCF.

2. Free Cash Flow (FCF): FCF is the cash a company has left over after paying for operating expenses and capital expenditures. It is an important metric for investors because it shows how much cash a company can allocate to dividends, share repurchases, or growth investments. A tech startup, for instance, may reinvest its FCF in research and development to innovate and stay competitive.

3. Cash flow from Financing activities: This includes cash transactions related to a company's financing, such as issuing debt or equity, and paying dividends. A company with a healthy cash flow may choose to pay down debt to reduce interest expenses, as seen in the case of a retail chain that used its surplus cash to repay long-term loans ahead of schedule.

4. cash Flow from Investing activities: This reflects cash spent on investments like property, plant, and equipment (PP&E), or cash received from the sale of such assets. A positive cash flow from investing activities can sometimes be a red flag, as it might indicate that a company is selling off assets to fund operations, which is not sustainable in the long term.

5. cash Conversion cycle (CCC): The CCC measures how quickly a company can convert its investments in inventory and other resources into cash flows from sales. A shorter CCC indicates a more efficient management of inventory and receivables, which is crucial for maintaining healthy cash flow. A retailer with a streamlined supply chain and quick inventory turnover will typically have a shorter CCC.

6. Liquidity Ratios: Ratios such as the current ratio and quick ratio use elements of the cash flow statement to assess a company's short-term liquidity. These ratios help determine whether a company has enough cash or liquid assets to meet its short-term obligations. A service company with a high current ratio, for example, is in a good position to cover its immediate liabilities.

Understanding the nuances of cash flow is essential for gauging the financial health of a company. By examining cash flow through various lenses, stakeholders can make informed decisions about a company's operational efficiency, investment potential, and long-term sustainability. companies that manage their cash flow effectively are often more resilient, adaptable, and poised for success.

The Link Between Cash Flow and Company Health - Cash Flow Statement and Statement of Changes in Equity: Cash Flow Statement Essentials: How to Read and Interpret

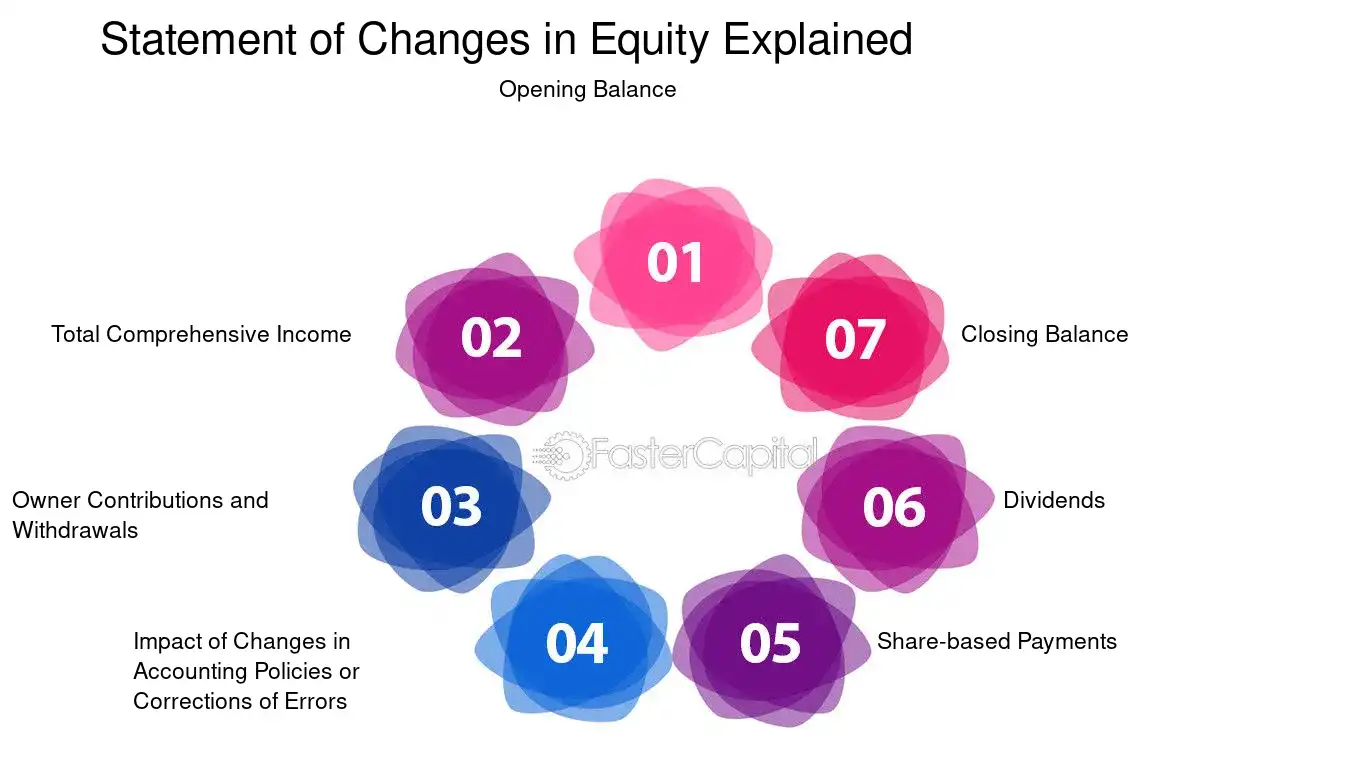

7. Statement of Changes in Equity Explained

The Statement of Changes in Equity is a crucial financial document that provides a detailed account of the changes in a company's equity over a specific period. This statement is integral to understanding the financial health and performance of a business, as it offers insights into how the company's equity has been impacted by various factors such as profits earned or losses incurred, dividends paid, changes in accounting policies, or issuance and repurchase of shares. It essentially tells the story of the company's internal financial activity and complements the balance sheet and income statement by providing a more comprehensive view of the company's financial situation.

From an accountant's perspective, this statement is a reconciliation of equity from the beginning to the end of the period, explaining each movement in the equity accounts. For investors, it serves as a tool to assess how the company is managing its profits—whether it is reinvesting the profits for growth or distributing them as dividends. For company management, it's a report card of their stewardship of the company's resources.

Here are some key elements typically included in the Statement of Changes in Equity:

1. Opening Balance: The starting point of the equity at the beginning of the accounting period.

2. Total Comprehensive Income: This includes all changes in equity during a period except those resulting from investments by owners and distributions to owners.

3. Owner Contributions and Withdrawals: Any amounts invested by the owners or distributions made to them during the period.

4. impact of Changes in Accounting policies or Corrections of Errors: These are adjustments made to the opening balance of equity to account for changes in accounting policies or to correct errors from prior periods.

5. share-based payments: This includes expenses related to employee share schemes.

6. Dividends: The amount of profits distributed to shareholders during the reporting period.

7. Closing Balance: The total equity at the end of the accounting period after all changes have been accounted for.

To illustrate, let's consider a hypothetical example. Imagine a company, XYZ Corp., started the year with an equity balance of \$10 million. During the year, the company reported a net profit of \$2 million and declared dividends worth \$500,000. Additionally, the company issued new shares worth \$1 million and reported a loss of \$200,000 due to a change in accounting policy. The closing balance of equity for XYZ Corp. Would be calculated as follows:

\begin{align*}

\text{Opening Balance} & : \$10,000,000 \\

+ \text{Net Profit} & : +\$2,000,000 \\

- \text{Dividends} & : -\$500,000 \\

+ \text{New Shares Issued} & : +\$1,000,000 \\

- \text{Loss from Change in Accounting Policy} & : -\$200,000 \\

\text{Closing Balance} & : \$12,300,000

\end{align*}

This simple example demonstrates how the Statement of Changes in Equity provides a transparent view of the company's transactions with its owners and the effects of other comprehensive income, giving stakeholders a clear picture of the sources and uses of equity over the period. It's a testament to the dynamic nature of a company's equity and its responsiveness to both internal management decisions and external economic events. Understanding this statement is essential for anyone looking to gain a deeper insight into a company's financial maneuvers and strategic direction.

Statement of Changes in Equity Explained - Cash Flow Statement and Statement of Changes in Equity: Cash Flow Statement Essentials: How to Read and Interpret

8. Interpreting Equity Changes Alongside Cash Flow

understanding the relationship between changes in equity and cash flow is crucial for investors, analysts, and business owners alike. Equity changes reflect a company's performance and financial health from an ownership perspective, while cash flow provides insight into the company's operational efficiency and liquidity. Interpreting these two elements together allows for a comprehensive analysis of a company's financial stability and future prospects. It's not just about how much money a company has, but also about where it comes from and where it's going. By examining both, one can discern the sustainability of a company's growth, the effectiveness of its management strategies, and the potential for future investments or dividends.

Here are some key insights from different perspectives:

1. From an Investor's Viewpoint:

- Investors look at equity changes to gauge the value creation over time. An increase in retained earnings, for example, indicates profitable operations, which could lead to higher dividends or an increase in share price.

- Cash flow, particularly free cash flow, is critical for investors as it shows the company's ability to generate cash after accounting for capital expenditures. This is the cash that can be used for paying dividends, buying back shares, or making strategic acquisitions.

2. From a Company Management Perspective:

- Management uses changes in equity to assess the effectiveness of their strategies and decisions. For instance, a decrease in total equity might signal a need to reevaluate operational tactics or cost structures.

- Positive cash flow from operating activities is a sign of good health, but it's also important to consider investing and financing activities. Management must balance these to fund growth without compromising liquidity.

3. From a Credit Analyst's Standpoint:

- Credit analysts monitor equity changes to understand a company's leverage and risk profile. A consistent increase in equity suggests a strengthening balance sheet, which could lead to better credit terms.

- cash flow analysis helps credit analysts determine a company's ability to service debt. They pay close attention to cash flow from operations and free cash flow as indicators of financial flexibility.

Examples to Highlight Ideas:

- Example of Equity Increase: A tech startup may report a significant increase in equity due to a new round of funding. This capital injection enhances the company's financial position, allowing for more aggressive growth strategies.

- Example of Cash Flow Insight: A manufacturing firm shows strong cash flow from operations but negative cash flow from investing due to heavy investments in new machinery. While this may raise short-term liquidity concerns, it could indicate a long-term strategy for increasing production capacity and efficiency.

By analyzing equity changes alongside cash flow, stakeholders can make more informed decisions and develop a deeper understanding of a company's financial narrative. It's a dual lens that brings into focus not just the current snapshot but also the unfolding story of a company's journey through the financial landscape.

Interpreting Equity Changes Alongside Cash Flow - Cash Flow Statement and Statement of Changes in Equity: Cash Flow Statement Essentials: How to Read and Interpret

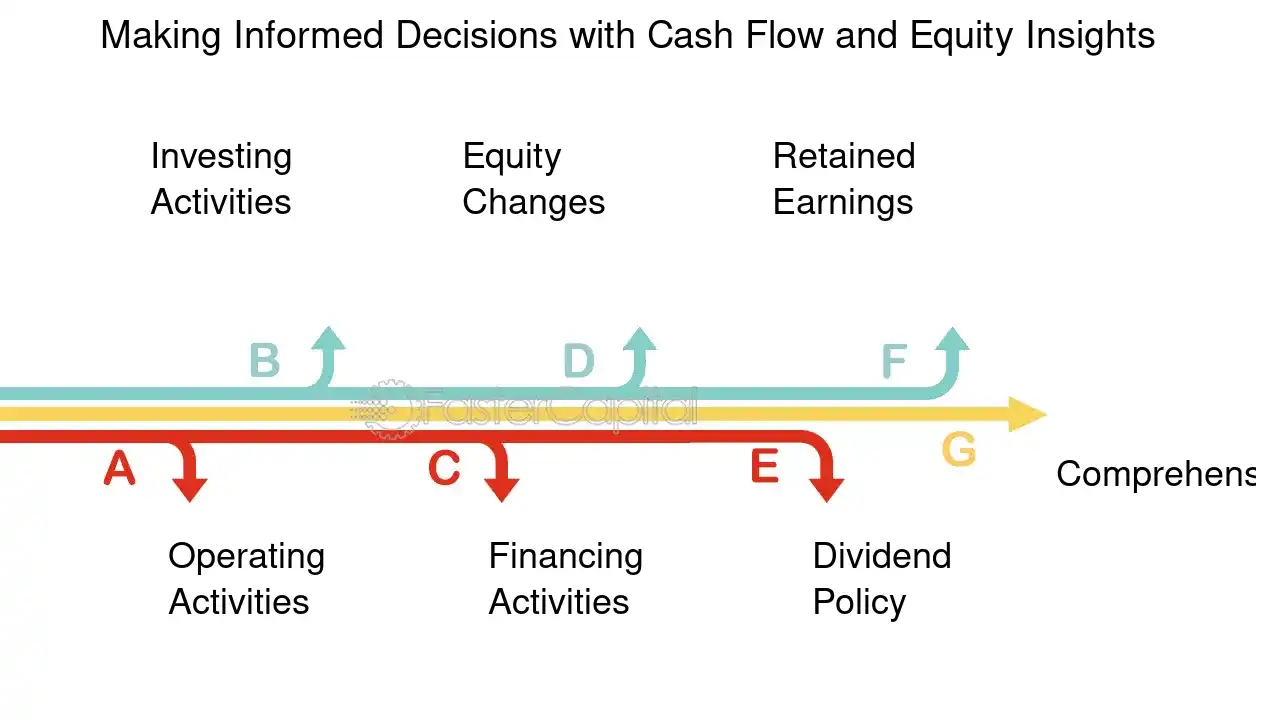

9. Making Informed Decisions with Cash Flow and Equity Insights

In the realm of financial analysis, the ability to make informed decisions is paramount. This is particularly true when it comes to understanding the intricacies of cash flow and equity. These two elements are the lifeblood of a company, providing insights into its operational efficiency, financial health, and overall value. Cash flow, the net amount of cash and cash-equivalents being transferred into and out of a business, is a clear indicator of a company's liquidity. On the other hand, equity, representing the value that would be returned to shareholders if all the assets were liquidated and all the company's debt was paid off, reflects the company's capacity to grow and return value to shareholders.

From the perspective of an investor, these statements offer a window into the company's operational performance and strategic direction. For managers, they serve as a roadmap for steering the company towards financial stability and growth. Creditors, too, analyze these statements to assess the risk associated with lending capital to the business. Each viewpoint underscores the importance of a thorough understanding of both the cash flow statement and the statement of changes in equity.

Here are some in-depth insights into how these financial statements can guide informed decision-making:

1. Operating Activities: The cash flow from operating activities is a key indicator of the company's core business strength. For example, a company consistently generating positive cash flow from its operations is generally considered financially healthy. This is because it indicates the company's products or services are generating enough revenue to cover its operating expenses and leave surplus cash.

2. Investing Activities: Cash flow from investing activities provides insights into a company's growth and future prospects. A company that is investing heavily in new assets, like technology or equipment, is positioning itself for future growth. Conversely, large cash outflows might also indicate that a company is divesting, which could be a red flag for investors.

3. Financing Activities: This section reveals how a company funds its operations and growth. For instance, if a company is raising more capital through debt rather than issuing new equity, it might suggest a preference for not diluting existing shareholders' equity but could also increase financial risk due to higher interest obligations.

4. Equity Changes: Changes in equity can occur due to various reasons such as issuance of new shares, repurchase of existing shares, dividends, and retained earnings. For example, a company that issues new shares may be looking to raise capital for expansion, while one that buys back its shares could be signaling confidence in its current operations and future outlook.

5. Dividend Policy: The statement of changes in equity can also shed light on a company's dividend policy. A consistent history of dividend payments might appeal to income-focused investors, while reinvestment of profits into the business (reflected in retained earnings) might be more attractive to growth-oriented investors.

6. retained earnings: Retained earnings reflect the cumulative profit of a company that has been reinvested in the business rather than distributed to shareholders. A growing retained earnings balance can be a sign of a company's long-term profitability and its commitment to reinvesting in its growth.

7. Comprehensive Income: This includes all changes in equity during a period except those resulting from investments by and distributions to owners. It provides a broader perspective on a company's financial performance, including items that have not yet affected the cash flow.

By analyzing these aspects of the cash flow statement and the statement of changes in equity, stakeholders can gain a comprehensive understanding of a company's financial health and make more informed decisions. Whether it's deciding on an investment, granting credit, or managing company resources, these insights are invaluable. They not only reflect the past and present financial performance but also provide indicators of future potential. In essence, they are not just financial statements but strategic tools for anyone involved in the financial well-being of a company.

Making Informed Decisions with Cash Flow and Equity Insights - Cash Flow Statement and Statement of Changes in Equity: Cash Flow Statement Essentials: How to Read and Interpret