Functions of Central Bank

Last Updated :

23 Jul, 2025

What is Central Bank?

An apex body that controls, operates, regulates, and directs a country's banking and monetary structure is known as a Central Bank. As the functions of a central bank are peculiar, there is only one central bank in a country. Every financially developed country has its own central bank. For example, the central bank of the UK is the Bank of England, and India is the Reserve Bank of India (RBI). The Reserve Bank of India was established on April 1, 1935, under the Reserve Bank of India Act, 1934.

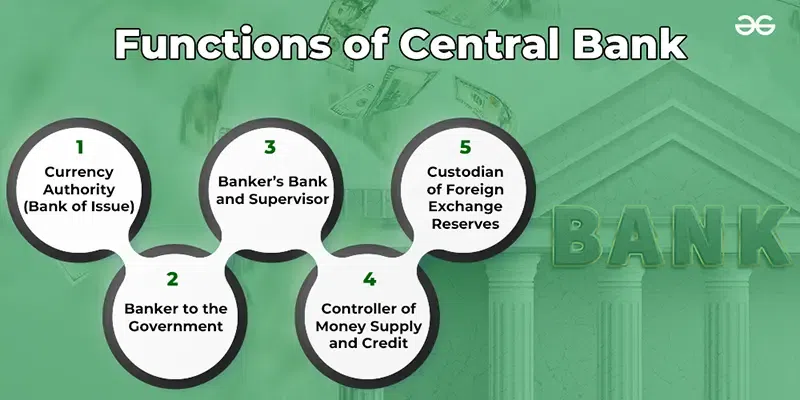

Functions of Central Bank

The Central Bank of India; i.e., the Reserve Bank of India performs the following functions:

1. Currency Authority (Bank of Issue)

The sole authority to issue the currency in the country lies with the Central Bank. In India, the sole right of issuing paper currency notes except one rupee note and coins is in the hands of the Reserve Bank of India. One rupee note and coins are issued by the Ministry of Finance. The currency issued by the Central Bank (RBI) is its monetary liability. It means that the Central Bank has the obligation to back the country with assets of equal value so that they can have public confidence in paper currency. Assets here consist of gold coins, foreign securities, domestic government's local currency securities, and gold bullions.

Advantages of Sole Authority of Note Issue with RBI:

Various benefits of RBI having the sole authority of Note Issue are as follows:

- It brings uniformity in note circulation.

- It helps in ensuring public faith in the currency system.

- It helps in stabilising internal and external value of currency.

- It gives power to the central bank in influencing money supply in the economy because it consist of currency with public.

- It also enables the government to supervise and control the central bank when it comes to issue of notes.

Central Government has the authority to borrow money from the Central Bank. It means that when the government incurs a deficit in the budget, it borrows money from Central Bank by selling its treasury bills. After acquiring these securities, the Central Bank issues new currency. It is known as Deficit Financing or Monetizing the Government's Debt.

2. Banker to the Government

The Central Bank (RBI) acts as a banker, agent, and financial advisor to the Central Government and all State Governments (including the Union Territories of Puducherry and Jammu and Kashmir).

As a banker, the Central bank carries out every banking business of the government, such as:

- To keep the cash balances of the Central and State Governments, the Central Bank maintains a current account.

- It accepts receipts and makes payments for the government, and also carries out exchange, remittance, and other banking operations of the Central and State Governments.

- Ultimately, it gives loans and advances to the government for temporary periods. The government sells its treasury bills to the Central Bank in order to borrow money.

As an agent, the Reserve Bank of India (Central Bank) is responsible for the management of public debt.

As a financial advisor, it gives advice to the government from time to time on financial, monetary, and economic matters.

3. Banker's Bank and Supervisor

There are several commercial banks in a country, and it is necessary that some agency regulates and supervises their functioning. As the central bank (RBI) is the apex bank, it acts as the banker to other banks of the country. In simple terms, the relationship between the central bank and commercial banks is the same as the relationship between commercial banks and the general public.

As the banker's bank, the central bank performs the following three functions:

- Custodian of Cash Reserves: It is essential for commercial banks to keep a certain part of their deposits, also known as CRR or Cash Reserve Ratio, with the central bank. By keeping this proportion of money, the central bank (RBI) acts as a custodian of cash reserves of commercial banks.

- Lender of the Last Resort: When commercial banks are unable to meet their financial requirements from other sources, they approach the central bank (RBI) to give them loans and advances as lender of the last resort. By discounting the approved securities and bills of exchange, the central bank assists the commercial banks.

- Clearing House: As the central bank has to hold the cash reserves of all commercial banks, it becomes convenient and easier for the central bank to act as a clearing house of these commercial banks. It means that every commercial bank has an account with the central bank through which the central bank can easily settle their claims against each other by making credit and debit entries in their accounts.

As a supervisor, the central bank (RBI) controls and regulates commercial banks. The regulation of commercial banks can be related to their branch expansion, licensing, management, merging, liquidity of assets, winding up, etc. The central bank controls the commercial banks by inspecting them and the returns filed by them on a periodic basis.

Advantages of Centralised Cash Reserves with Central Bank:

The main advantages of keeping centralised cash reserves with the central bank are as follows:

- It results in the effective utilisation of the country's cash reserves.

- It enables the central bank in controlling credit creation done by the commercial banks by making changes in the cash reserve requirements.

- It also enforces public's confidence in the strength of the country's banking system.

- Ultimately, the commercial banks can get financial help during temporary difficulties from the central bank.

Besides these advantages, the commercial banks do not favour this system because it reduces their liquid funds and do not carry any interest.

4. Controller of Money Supply and Credit

RBI has the sole monopoly in the issuance of currency through which it can control money supply and credit whenever there is economic fluctuation. To do so, the Reserve Bank of India uses the following methods of credit control:

A. Repo (Repurchase) Rate: The rate at which a country’s central bank (in the case of India, RBI) lends money to commercial banks to meet their short-term financial needs is known as the repo rate. The central bank advances loans to commercial banks against approved securities or eligible bills of exchange. An increase in the repo rate increases the cost of borrowing from the central bank, which ultimately forces the commercial banks to increase their lending rates, discouraging the borrowers from taking loans from the commercial banks and vice-versa.

Reverse Repo Rate: It is the exact opposite of repo rate. It means that Reverse Repo Rate is the rate at which the Reserve Bank of India borrows money from commercial banks. RBI borrows money from commercial banks when it feel that there is excess money supply in the banking system of the country. Besides, banks also happily lends money to the central bank as there money is in safe hands and they also get a good interest rate. An increase in the reverse repo rate induces the commercial banks to transfer more money to RBI because of the attractive interest rates.

B. Bank Rate(or Discount Rate): The rate at which a country’s central bank (in the case of India, RBI) lends money to commercial banks to meet their long-term financial needs is known as the bank rate. Bank Rate has the same effect on credit as that of Repo Rate. Simply put, an increase in the Bank Rate increases the cost of borrowing from the central bank, which ultimately increases the lending rates by commercial banks discouraging the borrowers from taking loans.

C. Open Market Operations: OMO or Open Market Operations means buying and selling of government securities by the Central Bank from/to the commercial banks and the general public, respectively. The Reserve Bank of India has the authority to sell or purchase government securities and treasury bills, whether bought or sold to the banks or the general public. It is because the amount given or received will ultimately be deposited in or transferred from some bank. By selling securities, the central bank reduces commercial banks' reserves, which has an adverse impact on their ability to create credit, ultimately decreasing the money supply in the economy. By purchasing securities, the central bank increases the reserves and raises the ability of the banks to give credit.

The four essential conditions required for the success of Open Market Operations are as follows:

- A well-developed and organised security market should exist.

- The value of government securities should not show frequent fluctuations.

- In order to influence the money supply in the economy, the central bank should hold adequate securities.

- Ultimately, the sale and purchase of securities should have an impact on the reserves of commercial banks.

D. Legal Reserve Requirements (Variable Reserve Ratio Method): According to the requirements of Legal reserve, commercial banks have the obligation to maintain reserves. It is a quick and direct method used by the central bank to control the credit-creating power of commercial banks. Commercial banks have to maintain reserves on two accounts; viz., Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR).

- Cash Reserve Ratio (CRR): It is the minimum percentage of the net demand and time liabilities that commercial banks have to keep with the central bank. By changing the cash reserve ratio, the central bank affects the ability of commercial banks to create credit. For example, if there is an increase in the cash reserve ratio, it reduces the excess reserves of commercial banks and limits their credit-creating power.

- Statutory Liquidity Ratio (SLR): It is the minimum percentage of net demand and time liabilities that commercial banks have to maintain with themselves. Commercial banks have to maintain SLR in the form of designated liquid assets, like excess reserves, current account balances with other banks, or unencumbered, government and other approved securities. By changing SLR, the central bank affects the freedom of commercial banks to borrow against the government securities or sell them to the Central Bank. It means that, if there is an increase in the statutory liquidity ratio, it reduces the ability of the banks to give credit and vice-versa.

Simply put, by making changes in the Cash Reserve Ratio and Statutory Liquidity Ratio, the Reserve Bank of India can influence the credit creation power of commercial banks.

Unencumbered Securities are those securities which do not act as security for loans from Central Bank.

Approved Securities are the securities for which the government guarantees repayment.

E. Margin Requirements: The difference between the loan amount and the market value of the security offered by the borrower against the loan is known as the margin requirement. It means that if the central bank fixes the margin as 30%, then the commercial banks are allowed to give a loan up to 70% of the value of the security. Margin is essential because if a bank gives a loan equal to the full value of the security, then it will suffer a loss if the price of a security falls. Hence, by making changes in the margin requirements, the central bank (RBI) can alter the loan amount made against the securities by the banks.

If there is an increase in the margin, it reduces the borrowing capacity and money supply in the economy. If there is a reduction in the margin, it encourages people to borrow more. The central bank may prescribe different margin requirements for different types of borrowers against the security of the same commodity.

5. Custodian of Foreign Exchange Reserves

The central bank (RBI) also acts as the custodian of the country's foreign exchange reserves and gold stock. By acting as the custodian of foreign exchange reserves, the central bank can exercise reasonable control over foreign exchange. The regulations of foreign exchange state that all foreign exchange transactions must be routed through the central bank (RBI).

Two major objectives behind the centralisation of foreign exchange transactions with the Reserve Bank are:

- It helps the bank stabilise the external value of the currency.

- It helps the bank in pursuing a coordinated policy towards the country's balance of payment situation.

Other Instruments of Credit Control

1. Moral Suasion: In order to get the commercial banks to act according to the policy, the Central Bank (RBI) applies a combination of persuasion and pressure on them, which is known as moral suasion. The central bank exercises moral suasion through letters, discussions, hints, and speeches to banks. The Reserve Bank of India announces its policy position frequently and urges commercial banks to cooperate in the implementation of these credit policies. The central bank can use moral suasion for both quantitative as well as qualitative credit control. In general, the central bank successfully convinces the banks, as it acts as their lender of last resort. However, if the commercial banks do not follow the advice or request of the central bank, no punitive action is taken against them.

2. Selective Credit Controls: Under this instrument of credit control, the Reserve Bank of India directs other banks regarding giving or not giving credit to specific sectors for certain purposes. The method of selective credit control can be applied in positive as well as negative manners. In a positive manner, it means using the measures in channelising credit to the priority sectors, which include exports, agriculture, small-scale industries, etc. In a negative manner, it means using measures in restricting the flow of credit to specific sectors.

Quantitative v/s Qualitative Instruments of Credit Control of RBI

The Reserve Bank of India controls credit through different methods, which are categorised as quantitative and qualitative methods:

Basis

| Quantitative Instruments

| Qualitative Instruments

|

|---|

Includes

| Quantitative instruments of credit control consist of bank rate policy, repo rate policy, open market operations, reverse repo rate policy, and varying reserve requirements. | Qualitative instruments of credit control consists of Moral suasion, margin requirements, and selective credit controls. |

Nature

| These are general in nature and have an impact on all sectors which make use of bank credit. | These are specific in nature and have an impact on the flow of credit for a specific use. |

Regulation

| The quantitative controls are designed for the regulation of the total volume of credit. | The qualitative controls are designed for the regulation of the direction of credit. |

Another Name

| Another name for quantitative instruments is Traditional Methods of Control. | Another name for qualitative instruments is Selective Methods of Control. |

Similar Reads

CBSE Class 12 Macroeconomics Notes Macroeconomics deals with the study of the national economy as a whole. In Class 11th notes, we covered the study of individuals through microeconomics, now we will learn about the whole economy through Macroeconomics. GeeksforGeeks has designed Notes for Class 12 Macroeconomics in a way that provid

6 min read

Chapter 1: Introduction

Introduction to MacroeconomicsMacroeconomics is a part of economics that focuses on how general economies, markets, or different systems that operate on a large scale behave. Macroeconomics concentrates on phenomena like inflation, price levels, rate of economic growth, national income, gross domestic product (GDP) and changes i

7 min read

Basic Concepts of MacroeconomicsMacroeconomics is a part of economics that focuses on how a general economy, the market, or different systems that operate on a large scale, behaves. Macroeconomics concentrates on phenomena like inflation, price levels, rate of economic growth, national income, gross domestic product (GDP), and cha

14 min read

What is Factor Income and Transfer Income?Macroeconomics is a part of economics that focuses on how a general economy, the market, or different systems that operate on a large scale, behaves. Macroeconomics concentrates on phenomena like inflation, price levels, rate of economic growth, national income, gross domestic product (GDP), and cha

3 min read

Consumption Goods and Capital GoodsMacroeconomics is a part of economics that focuses on how a general economy, the market, or different systems that operate on a large scale, behaves. Macroeconomics concentrates on phenomena like inflation, price levels, rate of economic growth, national income, gross domestic product (GDP), and cha

4 min read

Final Goods and Intermediate GoodsMacroeconomics is a part of economics that focuses on how a general economy, the market, or different systems that operate on a large scale, behaves. Macroeconomics concentrates on phenomena like inflation, price levels, rate of economic growth, national income, gross domestic product (GDP), and cha

9 min read

What is Net Indirect Tax (NIT)?Net Indirect Tax (NIT) refers to the difference between indirect taxes and subsidies. Indirect Taxes are the taxes imposed on the production and sale of goods and services by the Government of a country, for example, GST (Goods and Services Tax). An indirect tax imposed on a good or service results

3 min read

What is Net Factor Income from Abroad (NFIA)?It is the difference between the factor income earned by a country from abroad/rest of the world and factor income paid by a country abroad/rest of the world. Factor income from abroad is the income earned by a country's normal residents from the rest of the world for the factor services provided by

4 min read

Circular Flow of Income: Meaning, Phases, Types and SignificanceMacroeconomics tries to study the central questions of economies. Amongst these questions, the main question is how economies create wealth. In an economy, all factors of production (FoP) undergo a production flow/cycle; in the process of which, it generates wealth in the form of making payments to

6 min read

Difference between Real Flow and Money FlowThe circular flow of income is an economic model that reflects how money or income flows through the different sectors of the economy. A simple economy assumes that there exist only two sectors, i.e., Households and Firms. Households are consumers of goods and services and the owners of the factors

2 min read

Circular Flow of IncomeWhat is Circular Flow of Income? Macroeconomics tries to study the central questions of economies. Amongst these questions, the main question is how economies create wealth. In an economy, all factors of production (FoP) undergo a production flow/cycle; in the process of which it generates wealth in

6 min read

Leakages and Injections in Circular flow of IncomeThe circular flow of income is an economic model that reflects how money or income flows through the different sectors of the economy. A simple economy assumes that there exist only two sectors, i.e., Households and Firms. Households are consumers of goods and services and the owners of the factors

3 min read

Chapter 2: National Income Accounting

National Income and Related AggregatesNational Income is the aggregate value of all goods and services produced by firms in a given financial year. It can be stated that when the aggregate revenue generated by the firms is paid out to factors of production, it equals aggregate income or National Income. There are different variants or a

10 min read

Domestic Income and Personal IncomeWhat is Domestic Income? Domestic Income involves the value of final goods and services produced on a domestic territory of a country. It takes into account all producers doing business within the country's domestic boundary. A nation's domestic income (NDPFC) is generated by both the public and pri

3 min read

Private Income: Meaning, Types and StepsPrivate income can be defined as the income accruing to the private sector both from domestic and international sources. Types of Private Income The private sector (Private firms Households) receives both earned income (factor income) and unearned income (transfer income). It consists of two differe

4 min read

Personal, National, and Gross National Disposable IncomePersonal, National, and Gross National Disposable Income are three different types of income calculated by economists to measure the savings and spending rates of households and the whole country. Personal Disposable Income is part of personal income that is available at the disposal of a household.

4 min read

Difference between Stock and FlowEvery economy has a given set of natural resources, but it goes through the flow of production that adds certain value addition in these types of resources and returns produced goods and services, which differentiates a rich economy from that of a poor. An economy produces a lot of commodities and s

3 min read

Circular Flow of Income and Methods of Calculating National IncomeMacroeconomics tries to study the central questions of economies. Amongst these questions, the main question is how economies create wealth. In an economy, all factors of production (FoP) undergo a production flow/cycle, in the process of which, it generates wealth in the form of making payments to

7 min read

Product or Value Added Method of calculating National IncomeNational income refers to the value of goods & services produced by a nation during a particular financial year. Therefore, it is the net result of all the economic activities that take place during a financial year and is valued in monetary terms. It includes payments made to various resources

12 min read

Expenditure Method of calculating National IncomeNational Income is the aggregate value of all goods and services produced by firms in a given financial year. It can be stated that when the aggregate revenue generated by the firms is paid out to factors of production, it equals aggregate income or National Income. The National Income can be calcul

8 min read

Three Methods of calculating National Income: Value added Method, Expenditure Method and Income MethodNational Income refers to the value of goods & services produced by a nation during a particular financial year. Therefore, it is the net result of all the economic activities that take place during a financial year and is valued in monetary terms. It includes payments made to various resources

6 min read

Treatment of Different Items in National IncomeNational Income is the aggregate value of all goods and services produced by firms in a given financial year. It can be stated that when the aggregate revenue generated by the firms is paid out to factors of production, it equals aggregate income or National Income. The National Income can be calcul

8 min read

Treatment of Different Items in Domestic IncomeDomestic Income of an economy consists of income earned, i.e., only factor income and not transfer income by all the production units whether they are residents or non-residents, located within the domestic territory of the country, as the reward of their productive services or contribution to the f

5 min read

National Income at Current Price and Constant PriceNational Income at Current PriceNational Income at Current Price is the monetary value of the finished goods and services produced by normal residents of a nation in a year, calculated at the current year's prices. For example, consider calculating India's National Income for 2020-21 at 2020-21 pric

3 min read

GDP and WelfareGDP or Gross Domestic Product is the total value of all the final goods and services produced within the domestic boundaries of a country during a year. It can be calculated at Market Price or Factor Cost. Gross in Gross Domestic Product means that the total value of final goods and services include

4 min read

GDP Deflator | Meaning and FormulaWhat is GDP or Gross Domestic Product ?GDP or Gross Domestic Product is the total value of all the final goods and services produced within the domestic boundaries of a country during a year. It can be calculated at Market Price or Factor Cost. Gross in Gross Domestic Product means that the total va

2 min read

Chapter 3: Money and Banking

What is barter system and double coincidence of wants?A barter system is the oldest form of commerce. Earlier, all the trade practices were carried out according to the barter system of exchange. People used to exchange goods with each other to satisfy their wants. A barter system refers to the exchange of goods & services with two or more parties

5 min read

Evolution and Definitions of MoneyMoney is anything that is generally accepted as a mode for payment of goods & services and repayment of loans & debts such as taxes, etc., in a particular nation or country. Money was invented to facilitate trade as the barter system, but it can not express the value and prices of goods

7 min read

Significance of MoneyMoney is derived from the Latin word Moneta, which is another name for the Goddess Juno of Rome. The first mint was established in Rome in the temple of the Goddess Juno or Moneta. Money cannot be explained only in terms of the matter it embodies, such as metal or paper. It should be explained by th

6 min read

Functions of MoneyMoney is any object or item which is generally accepted as a mode for payment of goods & services and repayment of loans or debts, such as taxes, etc., in a particular nation or country. Money was invented to facilitate trade as the barter system was not able to express the value and prices of g

6 min read

Contingent, Static and Dynamic Functions of MoneyMoney is any object or item which is generally accepted as a mode for payment of goods & services and repayment of loans or debts such as taxes, etc., in a particular nation or country. Money was invented to facilitate trade as the barter system was not able to express the value and prices of go

3 min read

Classification of MoneyMoney is any object or item which is generally accepted as a mode for payment of goods & services and repayment of loans or debts such as taxes, etc., in a particular nation or country. Money was invented to facilitate trade as the barter system was not able to express the value and prices of go

4 min read

Monetary System in IndiaThe monetary history of India consists of different monetary standards. The present monetary system of India is known as Inconvertible Paper Currency Standard and is controlled and managed by the Reserve Bank of India. Rupee(₹) has been regarded as the standard currency of India and every transactio

2 min read

Money Supply - Features and MeasuresMoney is anything that is generally accepted as a medium of exchange, a store of value, a measure of value, and a means for the standard of deferred payment. Money considers everything that can be used for an accomplishment of a business transaction and settlement of the business claims, like curren

7 min read

Functions of Commercial Bank : Primary and Secondary FunctionsWhat is a Commercial Bank?An institution that provides its customers with services like accepting deposits, providing loans, and making investments, with the objective of earning profits is known as a Commercial Bank. The two main characteristics of commercial banks are lending and borrowing. They m

8 min read

Commercial Banks : Features, Advantages & DisadvantagesWhat are Commercial Banks?A commercial bank is a financial institution that provides services like accepting deposits, granting loans, bank overdrafts, offering certificates of deposits, and savings accounts to individuals and businesses. Commercial banks are considered to be an important component

6 min read

Credit CreationMoney is a concept that is much easier to understand than to explain in the form of words. However, it can be described as an instrument or thing that is generally accepted as a mode of payment or as a Medium of Exchange in the economy, like a Rupee in India, a Dollar in the USA, or a Yen in Japan.

7 min read

Money MultiplierMoney is a concept that is much easier to understand than to explain in the form of words. However, it can be described as an instrument or thing that is generally accepted as a mode of payment or as a Medium of Exchange in the economy, like a Rupee in India, a Dollar in the USA, or a Yen in Japan.

3 min read

Functions of Central BankWhat is Central Bank?An apex body that controls, operates, regulates, and directs a country's banking and monetary structure is known as a Central Bank. As the functions of a central bank are peculiar, there is only one central bank in a country. Every financially developed country has its own centr

12 min read

Difference between Commercial Bank and Central BankBanks are the backbone of any economy. Commercial Bank and Central Bank are two types of banks with various differences. Commercial Banks are responsible for accepting deposits and granting loans whereas Central Bank works as a regulatory body for all the commercial banks and monetary system. Table

3 min read

Chapter 4: Determination of Income and Employment

Components of Aggregate DemandWhat is Aggregate Demand?The word aggregate in the Aggregate Demand means 'Total', therefore, Aggregate Demand indicates the total demand of an economy. Aggregate Demand refers to the total demand for finished goods and services in the economy over a specific period. It also refers to a country's Gr

5 min read

Explain the Components of Aggregate Supply or National Income.The money value of all the final goods and services that all the producers are willing to supply in a given time period in an economy is known as Aggregate Supply. Also, when we express aggregate supply in physical terms, then it is an economy's total output of goods and services. The value of total

2 min read

What is Consumption Function (Propensity to Consume)?The functional relationship between consumption and national income is known as Consumption Function. It was introduced by John Maynard Keynes and represents the willingness of households to purchase goods and services at a given income level during a given period of time. It is represented as C = f

5 min read

Types of Propensities to ConsumeThe functional relationship between consumption and national income is known as Consumption Function. It represents the willingness of households to purchase goods and services at a given income level during a given period of time. It is represented as C = f(Y). The consumption function is a psychol

6 min read

Difference between APC and MPCThe functional relationship between consumption and national income is known as the Consumption Function. It represents the willingness of households to purchase goods and services at a given income level during a given period of time. It is represented as C = f(Y). The consumption function is a psy

3 min read

What is Saving Function (Propensity to Save)?The functional relationship between saving and national income is known as Saving Function. It shows the savings of households during a given period of time at a given income level. In alternate terms, the savings function shows different savings levels at different income levels in an economy. Savi

4 min read

Types of Propensities to SaveThe functional relationship between saving and national income is known as Saving Function. It shows the savings of households during a given period of time at a given income level. In alternate terms, the savings function shows different savings levels at different income levels in an economy. Savi

4 min read

Difference between APS and MPSThe functional relationship between saving and national income is known as Saving Function. It shows the savings of households during a given period of time at a given income level. In alternate terms, the savings function shows different savings levels at different income levels in an economy. Savi

2 min read

Relationship between different propensities (APC, MPC, APS and MPS)The four different types of propensities are Average Propensity to Consume (APC), Marginal Propensity to Consume (MPC), Average Propensity to Save (APS), and Marginal Propensity to Save (MPS). Average Propensity to Consume (APC) It is the ratio of consumption expenditure to the corresponding income

4 min read

Explain the Derivation of Saving Curve from Consumption Curve.As we know that Y = C + S, which means that as Consumption and Savings together make up income, the consumption curve and saving curve are complementary curves. Therefore, it is possible to derive the saving curve from consumption curve and consumption curve from saving curve. Let us derive saving c

2 min read

Investment Function: Induced Investment, Autonomous Investment and Determinants of InvestmentWhat is Investment Function? A strategy or concept of economics that helps in identifying the connection between shifts in the investment patterns of people and other variable factors affecting investment in an economy is known as Investment Function. The expenditure incurred to create new capital a

4 min read

Full Employment and Involuntary UnemploymentFull Employment and Involuntary Unemployment are two concepts that are closely related but have different meanings. Full Employment refers to a situation where all or nearly all individuals who are willing and able to work at the prevailing wage rates are employed. However, Involuntary Unemployment

3 min read

Determination of Equilibrium Level of Income: AD-AS Approach and S-I ApproachDetermination of Equilibrium Level The Keynesian Theory states that the equilibrium situation is usually expressed in terms of Aggregate Demand (AD) and Aggregate Supply (AS). When aggregate demand for products and services over a given period of time equals aggregate supply, an economy is in equili

3 min read

Aggregate Demand-Aggregate Supply (AD-AS) ApproachAggregate demand (AD) is the total amount of final products and services that all sectors of the economy intend to purchase over a single accounting year at a specific level of income. Whereas, Aggregate Supply (AS) refers to the monetary value of finished goods and services that all producers are p

4 min read

Saving-Investment (S-I) ApproachSaving means storing money safely for the future so that when one needs money, it is available for them. However, Investment means putting one's money to work in financial instruments like bonds, shares, etc., to grow money over time. Saving-Investment Approach (S-I Approach) is used to determine th

3 min read

What is Investment Multiplier?The term Investment Multiplier is an important contribution made by Prof. J.M. Keynes. Keynes felt that an initial rise in investment multiplies overall income by a large factor. The relationship between an initial increase in investment and the subsequent rise in total revenue is expressed by the m

6 min read

Explain the working of Investment Multiplier.To understand the Working of Investment Multiplier, let us first understand the meaning of Investment Multiplier. What is Investment Multiplier?The term Investment Multiplier is an important contribution made by Prof. J.M. Keynes. Keynes felt that an initial rise in investment multiplies overall inc

3 min read

Short-run Fixed Price Analysis of Product MarketThe prices in the short run take some time to react to factors of excess supply or demand as producers seek to modify their production plans in the meantime. For instance, if there is an excess supply, firms plan to produce less in the next cycle to prevent inventory accumulation. In addition, an in

3 min read

What is Excess Demand?According to Keynesian theory, an equilibrium income level might correspond to full employment, underemployment, or over employment of resources. Similarly, when the economy is not at full employment, there will be instances of surplus demand and deficit demand. Excess demand and deficit demand are

4 min read

What is Deficient Demand?According to Keynesian theory, an equilibrium income level might correspond to full employment, underemployment, or over the employment of resources. Similarly, when the economy is not at full employment, there will be instances of surplus demand and deficit demand. Excess demand and deficit demand

4 min read

Difference between Excess Demand and Deficient DemandExcess Demand and Deficient Demand are often used interchangeably. Excess demand and deficit demand are the two situations of disequilibrium. What is Excess Demand?When demand is more than what is necessary to utilise resources fully, it is called Excess Demand. In simple terms, when planned aggrega

3 min read

What are the different measures to control Excess Demand and Deficient Demand?When demand is more than what is necessary to utilise resources fully, it is called Excess Demand. In simple terms, when planned aggregate expenditure is more than aggregate supply at full employment, excess demand arises. However, when demand is not sufficient to fully utilise resources, it is refe

11 min read

Excess and Deficient Demand in Three-Sector EconomyExcess and Deficient Demand in Three-Sector Economy When demand is more than what is necessary to utilise resources fully, it is called Excess Demand. However, when demand is not sufficient to fully utilise resources, it is referred to as Deficient Demand. Excess Demand and Deficient Demand can occu

3 min read

What is Fiscal Policy and how it used to correct Excess Demand and Deficient Demand?Meaning of Fiscal Policy A fiscal policy is the policy of the central government which aims at controlling the situation of the money supply in the economy. Simply put, fiscal policy includes using taxation, government spending, and borrowing to change the level and growth of output, aggregate deman

4 min read

Chapter 5: Government Budget and the Economy

Chapter 6: Open Economy Macroeconomics

Foreign Exchange Rate : Meaning and TypesWhat is Foreign Exchange Rate?A medium of exchange for goods and services is called currency. In a nutshell, it is money issued by governments and accepted for payment in the country. It comes in the form of coins and paper. Every nation has a currency that is widely accepted within its boundaries.

10 min read

Currency Depreciation and Currency AppreciationWhat is Currency Depreciation?It refers to the decrease in the value of the domestic currency (₹) in terms of one or more foreign currencies (like $). It makes domestic currency less valuable and more is required to buy a unit of currency. For example, if the price of $1 rises from ₹60 to ₹64, then

4 min read

Demand and Supply for Foreign ExchangeWhat is Foreign Exchange?Foreign exchange refers to foreign currency. For example, for an Indian resident, the Indian rupee (₹) is a domestic currency that can be used as a medium of exchange in India. But the Indian rupee (₹) can not be used as a medium of exchange outside India. The currency used

9 min read

Determination of Exchange RateWhat is Foreign Exchange?Foreign exchange refers to foreign currency. For example, for an Indian resident Indian rupee(₹) is a domestic currency that can be used as a medium of exchange in India. But the Indian rupee (₹) can not be used as a medium of exchange outside India. The currency used in oth

7 min read

Foreign Exchange Market : Meaning, Functions and TypesEvery nation has a unique currency that it uses for commerce and business, in India, it's Indian Rupee, but what about the global market? The lack of flexibility of the currencies makes them a barrier to international trade. The Foreign Exchange Market was formed to solve this problem. This is a spe

9 min read

Fixed Exchange Rate System | Meaning, Methods, Merits and DemeritsA medium of exchange for goods and services is called currency, which is different from one country to another country. However, a country’s currency cannot be used in another country. For this purpose, the currency of one country is converted into the currency of another country, and the rate

7 min read

Flexible Exchange Rate System | Meaning, Merits and DemeritsA medium of exchange for goods and services is called currency, which is different from one country to another country. However, a country’s currency cannot be used in another country. For this purpose, the currency of one country is converted into the currency of another country, and the rate at wh

5 min read

Managed Floating Exchange Rate System : Meaning, Objectives, Merits and DemeritsA medium of exchange for goods and services is called currency, which is different from one country to another country. However, a country’s currency cannot be used in another country. For this purpose, the currency of one country is converted into the currency of another country, and the rate at wh

5 min read

Devaluation of Currency| Meaning, Reasons, Effects, Example and Critical EvaluationSometimes there arise some situations when the value of the domestic currency tends to increase drastically and faces monetary barriers. The government and the central bank intervene with some effective monetary policies for the correction of exchange rates, trade deficits, etc. One of these practic

5 min read

Depreciation of Currency : Effects, Examples and Critical EvaluationWhat is Depreciation of Currency?Currency Depreciation refers to a decrease in the value of a currency as compared to other currencies in a floating exchange rate system. Market forces of demand and supply work towards the depreciation of the currency and determine a currency depreciation rate. The

5 min read

Difference between Devaluation and DepreciationDevaluation and Depreciation are two examples of a situation when the value of domestic currency falls in terms of foreign currencies. Even though both include a reduction in the value of domestic currency, the way in which it happens is different. What is Devaluation? Devaluation means deliberately

2 min read

Balance of Payment and its Components: Capital and Current AccountUsually, government records all the transactions that arise between a country and the outside world. This record is titled Balance of Payments. Balance of Payments can also be known as the Balance of International Payments. It is a statement of all transactions between entities in one country and th

9 min read

Difference between Current Account and Capital Account of BoPBalance of Payment is a statement of all transactions between entities in one country and the outside world over a specified time period, such as a quarter or a year. It lists all interactions between residents of one country and residents of other countries that involve businesses, organizations, o

3 min read

Difference between Balance of Payment and Balance of TradeBalance of Payment and Balance of Trade are two important terms that are sometimes confused as the same. The former is a statement of all transactions between entities in one country and the outside world over a specified time period; however, the latter is the difference between the Export and Impo

3 min read

Balance of Payments: Surplus and Deficit, Autonomous and Accommodating Transactions, Errors and OmissionsA balance of payment (BoP) is a summary statement that lists all of the transactions that took place within a specific period between the resident and the outside world. The Balance of Payment indicates the extent to which a country saves enough money to cover its imports. It also reveals whether th

14 min read

Important Formulas

CBSE Previous Year Papers (2020)