HDFCsec-Learning Series - Option Trading Simplified

- 2. What is an option contract ? Options are contracts concluded between a buyer and a seller. The buyer has the rights for the purchase or sale of some underlying asset, at a pre-defined price and a specified validity period.

- 3. Explanation of “Options” with an Example Let us assume there is a fruit vendor. There is a caterer who needs fruits as an ingredient to make desserts. The fruit vendor expects the price of apples to fall to Rs 90 per kg from the current price of Rs.100 per kg in 3 months. The caterer, on the other hand, expects the price of apples to rise to Rs.120 per kg. in 3 months.

- 4. Options Example Both of them sign a contract with each other mentioning the fruit vendor would sell apples to the caterer at Rs. 110 per kg at the end of 3 months. Thus the fruit vendor is protected against any possible fall in prices. The caterer is protected against the any rise in the price of apples. Such a contract is called a Futures contract.

- 5. In a Futures Contract both the buyer and seller are obliged to honor the contract. There is no escape route for either of them. What if the contract gives the fruit vendor an “option” of either : Selling his produce to the caterer at the pre-agreed price of Rs 110 per kg. or Choosing to exit the contract and selling the produce in the open market or wherever he deems fit. Then the fruit vendor is not liable to honor the contract. Options Example

- 6. Options Example Such a contract which gives a leeway to the fruit vendor of either executing the contract or exiting the same is known as an “Options” contract. But the fruit vendor obviously cannot get this privilege free of cost. He obviously has to pay a premium for exercising this facility.

- 7. Now, let us assume the price of apples rises to Rs. 120 per kg in 3 months. In this case, the fruit vendor will want to exit the contract so that he is free to sell his produce in the open market for Rs. 120 per kg. Thus while the fruit vendor gets away the caterer is left high and dry and has no other option but to buy apples from the open market at Rs 120 per kg. Options Example

- 8. But it is not such a bad situation for the caterer as it appears. He gets compensated by the fruit vendor for having been a party to the “Options” contract. This compensation in the form of price is called the “Option premium”, which is borne by the fruit vendor and quite evidently it would be a small amount in comparison to profits he makes from the sale of apples. Let the amount be assumed at Rs 2. per kg. In this case, the fruit vendor is obliged to pay the caterer Rs 2 per kg as he has chosen to opt out of the contract. Options Example

- 9. The caterer has no other option left but to go to the open market and purchase apples at Rs. 120 per kg. But he gets a cost benefit of Rs 2 per kg as compensation for being a party to the “Options” contract. Although the price is Rs 120 per kg. in the open market, the effective price for the fruit vendor is Rs. (120 -2) = Rs 118 per kg. So by simply participating in the contract he too stands to gain something. Options Example

- 10. Options Example It is a win – win situation for the fruit vendor to participate in the contract. Had the prices fallen to Rs 90 per kg, he would have executed the Options Contract. But since prices rose to Rs 120 per kg. he chose to exit the contract. Thus he is blessed with the “Option” by signing such a contract.

- 11. Options Example It is important to understand that in an “Options” contract only one party gets the privilege to exercise the option while the other party is obliged to honor the chosen option. In this case, the fruit vendor has the option to either execute or exit the contract whereas the caterer is obliged to honor the decision of the fruit vendor. Such a contract which gives the flexibility only to the seller of the commodity to exercise or exit an option contract is known as “Put” option.

- 12. Options Example Even in an Options contract both parties land up achieving their goals and their interests are protected The fruit vendor stands to gain the most by getting to exercise a choice that benefits him the most The caterer too benefits by being a party to the contract due to the compensation he receives from the fruit vendor for not honoring the contract.

- 13. Options Example The caterer due to the compensation receives apples from the open market at an effective price of Rs 118 per kg. And hence is better off than the ordinary or spot buyer who would have to pay Rs 120 per kg. In an “Options” contract both the buyer and the seller makes some gains. However, unlike a “Futures” contract, in an “Options” contract one party gains more than the other party.

- 14. Common Terms used in Options Trading Option price – Price which a buyer pays to the seller, also known as premium Expiration date – The date specified in the options contract is known as the expiration date, the exercise date, the strike date or the maturity. Strike Price – Price specified in the options contract, also called exercise price. American Options – Options that can be exercised at any time up to the expiration date. Most exchange traded options are American. European Options – Options that can be exercised only on the expiration date.

- 15. Options Terminology In-the-money option – An option that brings a positive cash flow to the holder if exercised immediately. A call option is in-the-money if the current market price (CMP) of the underlying asset is higher than strike price. At-the-money option – An option that brings zero cash flow if exercised immediately. A call option is at- the-money if CMP of the underlying asset is equal to strike price. Out-of-the-money option – An option that brings negative cash flow if exercised immediately. A call option is out-of-the-money if CMP of underlying asset is less than strike price.

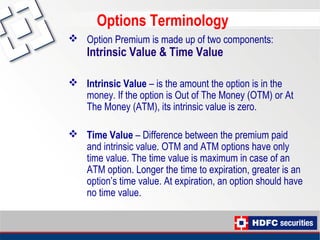

- 16. Options Terminology Option Premium is made up of two components: Intrinsic Value & Time Value Intrinsic Value – is the amount the option is in the money. If the option is Out of The Money (OTM) or At The Money (ATM), its intrinsic value is zero. Time Value – Difference between the premium paid and intrinsic value. OTM and ATM options have only time value. The time value is maximum in case of an ATM option. Longer the time to expiration, greater is an option’s time value. At expiration, an option should have no time value.

- 17. Difference between Futures and Options Futures have unlimited profit and loss potential. Options have limited risk and unlimited profit potential.

- 18. Multiple platforms for trading in Options Log on to trading a/c Click on Buy / Sell Enter name of the Gold ETF, Units & Pricewww.hdfcsec.com

- 19. For any further queries, visit our website www.hdfcsec.com Thank you