Technological impact in Banking Operations

- 1. Technological impact in Banking Operations

- 2. People Financial Institutions Technology Save for a rainy day Advent of micro-computers Diffusion of Internet Automation in related functions of other businesses Evolution of Smart Card Technology Mobile technology Cash on the go Bank in the wallet Anywhere anytime banking Reduce operational costs High value added services Product bundling & Cross Selling Piggy Banks Traditional Banking Modern Banking (online) Interest Protection against theft Transfer large sums of money Trade Instruments Interest Service Charges The Needs & Enablers of Modern Banking 2

- 3. Old and New banks

- 4. Superior customer experience New Customer Acquisition & Retention Maximization of Business Value Creating new opportunities for success Improving employee satisfaction Banking & Technology 3600 Customer view Products tailored to customer’s financial needs Reduced time to market new products Increased reach of banks Reduced operational costs 4 Core Banking Solutions CRM Electronic Clearing Services Cheque Truncation Systems Driving further technological innovation Technology Enables Impact on Business

- 5. Development of Key Payment Systems - India Non Cash & Paper based payment system 5 •Settlement in T+1 days Electronic Clearing Service (ECS) and the Electronic Funds Transfer System(EFT) •Settlement & Payments on near Real time basis for large value transactions Real Time Gross Settlement (RTGS) Real Time Payment & Settlement •Funds transfer on T+0 basis National Electronic Funds Transfer (NEFT) • Would enable realization of the Cheque on the same day Cheque Truncation System (CTS)

- 6. The Growth of ATMs 6 22110 25247 34547 44857 20 % 20 % 37 % 30 % 2005-06 2006-07 2007-08 2009-10 2010-11 > 60000

- 7. Adoption of CBS & RTGS • Early adopters of CBSPrivate Banks • 64,304 PSB branches (90.4% ) under CBS as on 2014- 15 • More than 15 PSBs have 100% branches under CBS • 95% PSB branches have achieved full computerization Public Sector Banks (PSBs)* • Keen to migrate to CBS Small Banks (including co- operatives) • More than 100,000 bank branches covered as on 2015RTGS# 7

- 8. Total Branch Computerization – concept and opportunities

- 9. Historical Perspective…. • Computerization of branches of banks began in the late eighties with the introduction of ledger posting machines (LPMs), advanced ledger posting machines (ALPMs), followed by Stand alone computer systems (LANs) which metamorphosed into network based systems (WANs), with the latest development being the installation of Core Banking solutions

- 11. Current Scenario • Distributed Data Base – A tool for acquiring, servicing and enhancing customer base – offering wide range of product options and delivery channels, Internet Banking, Phone/Mobile Banking, Any where – Any time Banking. • Vanilla Solutions vs End to End Single Platform Solutions across the Globe – Integration with other applications.

- 12. BANK Business Solutions Requirements Support Applications Regulatory Core Processing Employee Access Customer Access • Oracle GL • Oracle Performance Management • CRISIL & Reuters Credit & Risk Management • Data Warehouse • RTGS • Basel II through Oracle OFSA • Anti Money Laundering • Finacle CBS for domestic & int. • Document Mgmt & Workflow • Hire Purch. & Leasing • Depository • Credit Card • Asset Mgmt • Chq Clearing • Oracle HR & Self Service • Payroll • KM • Mail & Msg • Finacle Internet & SMS Banking • Phone Banking • Oracle CRM • Internet Payment Gateway • Online Trading • ATM Switch HP Superdome XP 1024 Datacenter Build RPC Build Network Solution overview across 5 pillars SOA - Technology Offerings HP OpenBank Architecture BizTalk EAI Single Sign On HP OV EMS

- 13. Technology – A great Enabler • Large volume and variety of business, accuracy and timeliness. • Large number of Products, Delivery Channels and Customer-centric Processes. • CRM – For cross selling and meeting the customer life cycle needs. • Redefining of Customer Convenience. • Decision support System, Supervisory Monitoring and Control.

- 14. ATM Typically, an ATM can be used for: • Withdraw Cash; • Check an account balance; • Order a statement or print a ‘mini statement;’ • Order a cheque book…

- 15. ATM What are the parts of an ATM? Magnetic Stripe Reader Screen to display menu options Keyboard Printer There will also be a slot somewhere on the machine to dispense the cash.

- 16. ATM Using an ATM: • Insert a debit or credit card into the magnetic stripe reader. • It will read an account number from the stripe on the back. • ATM will then ask customer to use their PIN (Personal Identification Number) for security. • Customer asked to select an option from a menu on the screen. • To withdraw cash, the customer selects the relevant options and the request is sent to the bank’s mainframe where it is approved and updated.

- 17. ATM Advantages of using an ATM: • Banks can keep their operating costs down as fewer employees are needed to work at the branches. • Customers have 24 hour access to their accounts seven days a week. • There’s no need to carry large amounts of cash around as the large number of ATMs means that it is readily available.

- 18. INTERNET BANKING

- 19. Branch Automation • In 80’s, banks started technology investments for the branches. • The first step is offline branches. • Terminals connected to local branch computer • Second step is online branches connected centrally. Most of the transactions started to be performed in the central mainframe.

- 20. Internet Banking Sample Internet Banking Architecture • More and more banks are coming to realize that internet is a part of banks' alternative delivery channel strategies activities concentrated in the business-to- consumer segment, focused on retaining clients • In Internet banking, security is a primary concern. Security concerns have been addressed from every angle within the architecture of the Internet banking application.

- 21. SERVICES Customised Home Page View Balances & Transactions Historic Information for up to two years will be available Reports, statements and transactions listings Payments – three day and immediate

- 22. Phone Banking

- 23. 23 The interest over "Mobile Banking" product is becoming increasingly intense. Applications and new technologies are spreading through modern banks mobilized to embrace this profitable product. Banks are clear that they have left "behind" in this technological innovation. Recent analyzes underscore the need for banks to actively respond to this new challenge and recent polls show that Mobile Banking will fundamentally change retail banking in the next five years. Mobile offers good opportunities to meet consumer preferences, increase loyalty, strengthen relationships and it will bring a positive impact on bank profits Mobile banking – Near Future of Banking

- 24. 24 Mobile Banking Future Money is changing as we become more mobile. We know that the young of today become banking customers of tomorrow New brands are emerging that are acting as ‘money vaults’ for consumers. They are not banks. A lot of financial services providers are ensure that they are leading the new way in shaping the Mobile Money The demand is growing consumer trust and engagement will rise further beyond mobile banking into payments and commerce Now is the time for banks to strengthen their hand in the mobile space and cement their position in the growing ecosystems in and beyond. Mobile banking – Near Future of Banking

- 25. 25 New Opportunities for Retail Banking Banks have start thinking about how best to respond to the opportunities of mobile banking. It is worth if retail management understand the nature of what they are dealing with. Bank customers can ‘meet’ their bank every day, albeit remotely. The mobile is : -portable and accessible 24/7, -simple and even exciting to use with its increasingly user-friendly interfaces -has a unique ID which means its use and identification is specific to each customer -Allows geographical positioning which in turn permits products and services to be tailored to different territories and in the panoply of electronic devices -the one that consumers most frequently use. Mobile Banking – convenient and innovative Banks are already seeing a step-change in the number and frequency of interactions they have with their customers via mobile; something that was once a monthly experience is now happening daily with a mobile device. Virtual commerce Banks acting as the engine that drives digital commerce from the pre-purchase phase, to purchase financing, to transaction processing, and finally through to consumer post-purchase activities. Low cost- win market To access under-banked and under-served customers in developed and developing markets and develop market the banks can use the low-cost mobile channel and innovative partnerships. Mobile banking – Near Future of Banking

- 26. 26 A Successful Mobile Banking Strategy Mobile banking has moved quickly and become a point of differentiation and a potential source of revenue for progressive banks. Online banking is not simply using a Smartphone but it is at the hub of the customer relationship. Mobile banking – Near Future of Banking

- 27. 27 A Successful Mobile Banking Strategy Increase enrollment and usage of Mobile Banking One of the biggest impediments to enrollment today is that many banks still require mobile banking customers to have an online banking relationship. Smartphone providers’ have found a way to sign up for mobile banking and use the service. It is recommended a consistent sign-in process be used for both the online and mobile banking relationships if the bank is going to require multifactor authentication. It is very important to have a customer service team familiar with the mobile banking platform and well trained to answer every question from customers. Mobile banking – Near Future of Banking

- 28. 28 A Successful Mobile Banking Strategy More touch points apps and support SMS banking Banks have be able to provide support across all touch points also they have to across alternative delivery methods, dedicated mobile website, downloadable phone apps and tablet apps. The offering of dedicated tablet mobile banking capabilities has definitely lagged behind Smartphone applications but provides greater promise in many ways due to the added functionality and preferable demographics of tablet users. Mobile banking – Near Future of Banking

- 29. 29 A Successful Mobile Banking Strategy Integration of Cross-Channel There are other ways for customer's interactions with a bank to be integrated. While being able to access customer support directly from the mobile app a great example of cross-channel support. It is very important the integration of social media within a bank's mobile banking application, not only to show live tweets in real time on their mobile banking platform, but their integration with Facebook and YouTube content is one of the strongest in the industry. Mobile banking – Near Future of Banking

- 30. 30 A Successful Mobile Banking Strategy Marketing and Cross-Selling Through Mobile Banks are doing very poorly virtual marketing through. Mobile Banking channels have a bog marketing potential. We think that the market is on stage of acceptance of mobile banking by the mass market. As a result, banks must begin to promote mobile banking to a wider audience using messaging those appeals to those consumers who don't understand the benefits of the channel. Mobile banking – Near Future of Banking

- 31. 31 Retail Banking in the next ……….years Mobile banking is the next big thing in the retail banking industry. Over the next five to 10 years, expect it to become as routine as using ATMs. Successful customer experiences will require large technology investments, tricky collaborations with competitors and a clear "own-the-customer" strategy. The rewards for banks could be great if they will be open minded, willing to learn marketing and security lessons drawn from trailblazing developing markets. Mobile banking opportunities may have looming on the horizon but these opportunities can create worth value if banks consider three separate prospective: 1. Bank profits. 2. Banking industry. 3. The wider ‘mobile’ industry. Mobile banking – Near Future of Banking

- 32. 32 With the growth in tablet use, consumers are able to access highly graphic and sophisticated financial planning tools on the road or while multi-tasking in their home. As more innovative Smartphone applications are developed within and outside the financial services sector, the ability for banks to keep pace becomes both more difficult and more important. By building an agile the impact can be realized through increased differentiation, lower cost customer acquisition, improved channel efficiency, enhanced customer retention, and greater revenues through cross-selling and up-selling of products and services and through merchant-funded rewards. By executing and optimizing a successful mobile banking strategy that is integrated with a wider multi-channel strategy, banks will be better positioned for the future mobile banking. Mobile banking – Near Future of Banking

- 33. CORE BANKING

- 34. INTRODUCTION • Traditional Banking System • CASH COUNTER • ACCOUNTANT • MANAGER • RECEIPTS • WITHDRAWALS • LOANS

- 35. NEED FOR CBS • Tremendous increase in the Customer Volume • Huge no. of day to day Transaction • Need for 24/7 Service • Influence of Internet and Mobile • Branch free Transaction • Enhanced service in less time • Rapid increase in competition among banks

- 36. CORE BANKING SOLUTION • CBS is a Three Tire Architecture • Data Base • Application • Presentation

- 37. VARIOUS CBS PLATFORMS COMPANY PRODUCT INFOSYS FINACLE 10 IFLEX FLEXCUBE TCS BANCS

- 38. CBS CONNECTION • A Central Data base Centre • All Circle Office are Connected to the Central Data Base Centre which acts as an application Tier • All end users connected in the Presentation Layer Branches ATM Internet Interface

- 39. DATA BASE TIER • SAN Storage (Storage Area network) Data Base of Core Banking • Two Servers with Oracle RDBMS • CENTRAL SERVER will be installed at the DATA CENTER • Central Server is Connected with Circle Offices • All Branch Servers are Connected with Circle Office

- 40. APPLICATION TIER • NETWORK COMPONENT WITH THE CIRCLE OFFICES • INDIVIDUAL SERVERS WITH THE BRANCHES • PROCESS AND APPLICATION ARE MADE IN THE CIRCLE OFFICE

- 41. CORE BANKING • Sum total of all the information technology components that enable a bank to manage its core business activities in a centralized model • Round the clock processing of all the products, services and information of a bank • 24/7/365 Model

- 42. BASIC COMPONENTS • Banking Application Software • Hardware Components • Network Infrastructure • Centralized Data Processing

- 43. APPLICATION AREAS • Balance of payments and withdrawal are done. • Mobile banking • Internet banking • ATM’s • Recording of transactions • Passbook maintenance • Interest calculations on loans and deposits • Customer records

- 44. TECHNICAL TERMS • Data Centre (DC) – The place where the central server / servers are housed. • Disaster Recovery Site (DRS) – An alternate data centre which will act as a backup resource and ensure business continuity in case of a DC failure. • Data Mirroring – Storage devices attached to Servers located in DC and DRS are updated on a real time basis, so that data integrity as well as availability are ensured even in case of a hardware failure. Bank’s real time data is stored in multiple devices and locations. • Backup – Data stored in the fixed storage devices are copied on to removable storage devices / tapes and preserved for any future contingency. These backups are stored in some off-site location to avoid the damages on account of a disaster like earth quake, fire, flood etc. • Leased Lines – These are the primary data links used for CBS networking. These are analog links on fixed yearly rentals and there are no additional usage charges.

- 45. • ISDN Lines – These are the secondary data links put to use in case of a Leased line failure. These are integrated services digital network lines which can carry various forms of information packets (data, voice and images and video) as digital signals. • Modem – This is networking equipment used to modulate and demodulate the data signals. Computers work on digital data signals where as the leased lines can carry only the analog signals. Modems modulate (convert the digital signals to analog signals) at the transmitting end and then demodulate (Convert the analog signals to digital signals) at the receiving end. • Switch – In a branch there can be more than one computer and these computers are networked to form a local area network (LAN) using a device called switch. • Router – Router is another network device that connects different LANs and facilitates intelligent data transfer. Router also functions as an intelligent switching device between various connectivity channels, viz., leased line, ISDN, PSTN etc. When the primary link (LL) is down, it automatically dials the ISDN and re-establishes the network connectivity.

- 46. Cont… • Regional Cluster Centre (RCC) - Instead of taking separate links between individual branches and the data centre, branches in a geographical region are first connected to a location in that region and this location is then connected to the data centre using links of higher band width. This location is termed as a regional cluster centre. Some banks also house their regional data servers in RCC, so that in case of a total network failure between RCC and DC, branches in that region can continue to operate and also provide Any Branch Banking (ABB) facilities within the cluster

- 47. NEED OF CBS • To meet the intense competition and changing market dynamics in an over banked environment. • To meet the regulations and compliance requirements (example in order to meet the Basel ll norms banks must enhance there IT infrastructure). • To meet the demands of customers who are better informed, more demanding and less loyal than ever. • To enhance efficiency and effectiveness.

- 48. • Increasing customer satisfaction and convenience • Freeing up time for branch staff to focus on sales and marketing • Simplifying process for employees • Enhancing bank’s competitiveness in the market • Improved process efficiency Shrinking margins.

- 49. BENEFITS 2 BANKS • Replace old technology seamlessly with a state-of-the-art n- tier application. • Replace multiple disparate and older generation systems with a single integrated multi-product processing application across various countries. • Streamline operations by integrating the enterprise, to existing in house applications and to offer a single customer view. • Create a virtual banking operation from ground-up and offer a host of banking products. • Enable multiple new delivery channels (Internet Banking, 7 X 24 ATM, Mobile Banking, Tele-banking and Point of Sale Terminals) allowing the bank to reach out to new customers and segments.

- 50. Cont…. • Move to centralized processing and handle much higher volumes without a proportionate increase in resources or infrastructure costs. • Use business intelligence tools to analyze customer needs and create new products and offerings. • Build and retain customer relationships based on the strength of customer service capability. • Enable and modify product offerings quickly and efficiently based on customer’s market needs. • Reduce costs, improve bottom-line and stakeholder rewards. • Quick and easy introduction of new products and services

- 51. BENEFITS 2 CUSTOMER • Customer can enjoy the Online and real time banking facilities through ATMs • Point of sale terminals (POS) Internet • Mobile phones and Kiosks • Quick realization of instruments lodged for collection • on-line and easy fund transfer (intra-bank as well as inter-bank) etc

- 52. Advantages of Core Banking 1. Limited Professional Manpower to be utilized more effectively 2. Customer can have anywhere, more convenient and easier banking 3. ATM, Internet Banking, Mobile Banking, Payment Gateways, Referral Business 4. More Strong and economical way for MIS 5. Reduction in Branch Manpower by 15-20%

- 53. 6. Quick and Accurate Implementation of Policies 7. Electronic Transactions with Other Financial Institutions. 8. Increased Speed in working resulting in more business opportunities and reduction in penalties, legal expenses etc 9. Additional Manpower available for Marketing, Recovery and Personalized banking. 10. Instant Information availability for decision support

- 54. Types of Cards There are 2 types of card you will need to be familiar with: • A Debit Card; • A Credit Card;

- 55. Types of Cards A Debit Card: • This card allows the user to transfer money from their bank account to the vendor’s bank account. • The money for the purchase of the item is taken from the customer’s bank account after 1 or 2 days. • The customer MUST have money in the account to cover the cost of the item.

- 56. Types of Cards A Credit Card: • This card allows the customer to purchase an item even if they do not have enough funds in their account. • The customer is then sent a bill each month totalling the cost of the items bought in that period. • The bill will contain an amount added for ‘interest.’ • The ‘interest rate’ will be determined by the Credit Card provider.

- 57. Chip and PIN What is Chip and PIN? • Found on debit and credit cards. • Customer places chip into a card reader and is asked to input their PIN (Personal Identity Number). • The PIN is the same one that is used in the ATM. • It is a security measure to stop people forging signatures and using a card fraudulently.

- 58. Credit cards and other revolving credit • Credit cards and over-lines tied to checking accounts are the two most popular forms of revolving credit agreements. • In 2001 consumers charged almost $650 billion on credit cards. • Most operate as franchises of MasterCard and/or Visa. o bank must pay a one-time membership fee plus an annual charge determined by the number of its customers actively using the cards.

- 59. Credit cards are attractive because they provide higher risk-adjusted returns than do other types of loans. • Card issuers earn income from three sources: o card holders annual fees, o interest on outstanding loan balances, and o discounting the charges that merchants accept on purchases.

- 60. Credit card transaction process Individual Card-Issuing Bank Clearing Network Local Merchant Bank Retail Outlet1 4 2 3 3 2 Steps Fees 1. Individual uses a credit card to purchase merchandise from a retail outlet. 1. None 2. Retail outlet deposits the sales slip or electronically transmits the purchase data at its local bank. 2. The merchant bank discounts the sales receipt. A 3 percent discount indicates the bank gives the retailer $97 in credit for each $100 receipt. 3. Local merchant bank forwards the transaction information to a clearing network, which routes the data to the bank that issued the credit card to the individual. 3. The card-issuing bank charges the merchant bank an interchange fee equal to 1 to 1.5 percent of the transaction amount for each item handled. 4. The card-issuing bank sends the individual an itemized bill for all purchases. 4. The card-issuing bank charges the customer interest and an annual fee for the privilege of using the card. A card-issuing bank also serves as a merchant bank.

- 61. Debit cards, smart cards, and prepaid cards • Debit cards are widely available o when an individual uses the card, their balance is immediately debited. o they have lower processing costs to the bank • A smart card is an extension of debit and credit cards o contains a memory chip which can manipulate information o it is programmable such that users can store information and recall this information when effecting transactions. o only modest usage in the U.S.

- 62. The future of smart cards • Smart card usage will likely increase dramatically in the U.S.: o firms can offer a much wider range of services o smart cards represent a link between the internet and real economic activity o suppliers of smart cards are standardizing the formats so that all cards work on the same systems

- 63. Prepaid cards • Prepaid cards such as phone cards, prepaid cellular, toll tags, subway, etc. are growing rapidly. • Prepaid cards are a hybrid of debit cards in which customers prepay for services to be rendered and receive a card against which purchases are charged.

- 64. Overdraft protection and open credit lines • Revolving credit also takes the form of overdraft protection against checking accounts. • One relatively recent innovation is to offer open credit lines to affluent individuals whether or not they have an existing account relationship. • In most instances, the bank provides customers with special checks that activate a loan when presented for payment.

- 65. Home equity loans and credit cards • Home equity loans grew from virtually nothing in the mid- 1980s to over $220 billion in 2001 o Home equity loans meet the tax deductibility requirements of the Tax Reform Act of 1986, which limits deductions for consumer loan interest paid by individuals, because they are secured by equity in an individual's home. o These credit arrangements combine the risks of a second mortgage with the temptation of a credit card, a potentially dangerous combination.

- 66. Overview of Payment & Settlement Systems 66

- 67. Payment System “A set of instruments, procedures and rules for the transfer of funds between or among participants, as well as the entity operating the arrangement typically based on an agreement between or among participants and the Financial Market Infrastructure transfer of funds is effected using an agreed-upon technical infrastructure” 67

- 68. 68 Legal Basis Payment and Settlement Systems Act, 2007 No payment system to operate without authorisation RBI as the regulator and supervisor Legal basis for Netting Dishonor of electronic debit instruction on par with Cheque Directives Issued Settlement and Default Handling Procedures Dispute Resolution framework

- 69. Mission 69 “To ensure that all the payment and settlement systems operating in the country are Safe, Secure, Sound, Efficient, Accessible and Authorised".

- 70. Payment Systems – Major Milestones 1986 2005 1994 2002 2008 MICR EFT / IDRBT IT ACT RTGS ECS INFINET CCIL DPSS / NEFT / NFS CTS / NECS / Mobile / NPCI / Act Notification HV Close / Directives on Settlement, Defaults and Disputes 70 INFINET : - Indian Financial Network IDRBT : -Institute for Development and research in Banking Technology PSS :- Payment and settlement system act DPSS: - Dept Of PSS RECS : - Regional ECS NPCI : - National Payment corpn

- 71. 71

- 73. Introduction to Electronic Payment Systems 73

- 74. Electronic Payment Systems (EPS) • Simpler • Safer • Faster • Cost Effective • Enhanced Reach • Eco-friendly 74

- 75. Why EPS Cash / Paper Electronic Physical Movement of cash / paper instruments Electronic Message movement Fraud prone as paper moves outside the banking system Message moves inside the banking system hence less prone to frauds Geographical restrictions No such restrictions. Payment anywhere in India possible Time required to move paper makes the system slow Electronic movement of messages makes the system real time Operational cost of running the system very high Operational cost is very low As volume increases, logistics to be increased No such requirement 75

- 76. EPS – Benefits • Individuals Beneficiaries – o Funds in on the due date o Bills / EMIs paid automatically o No frequent writing of cheques / standing in the queue • Govt. Departments / Corporates o Instruction based o Direct payment / receipt on due date / time o Easy Reconciliation o Cost effective o No interaction between payer and payee 76

- 77. EPS - Variants • Electronic Clearing Service (ECS) o ECS – Credit and Debit o National ECS o Regional ECS – Credit and Debit • National Electronic Funds Transfer (NEFT) • Real Time Gross Settlement (RTGS) • Alternate Payment Channels o Internet Banking o ATMs o Mobile Banking o Pre-paid Payment Instruments 77

- 78. Electronic Clearing Service (ECS) • Used for bulk transfers – repetitive payments or receipts • Disbursement of funds – from one source to many beneficiaries – called Credit • Collection of funds – to one beneficiary from many customer s – called Debit • Operates on a T+1 basis • Available at 90 major locations • Geographical restriction – confined to cover local Clearing House only 78

- 79. ECS – Users • All prominent listed companies on exchanges • Used for o Salaries o Vendor Payments o Dividends o IPO / FPO refunds o Bill Collections (Telephone, Electricity, Water), EMIs, School / Exam fee collection etc. • Handled 16.7 mn transactions for value Rs 253.51 bn during October 2010 79

- 80. 80 National ECS • Credit Clearing introduced in September 2008 • Centralised processing at Mumbai • Covers about 52,000 branches • File acceptance timings extended till 6.30 pm • Processes around 75% of total ECS Credit volumes • Handled 2.6 mn. transactions in a single day

- 81. 81 Regional ECS (RECS) • Credit and Debit Variants at Ahmedabad, Bangalore, Bhubaneshwar, Chennai, Kolkata – Since launched • Guwahati, Hyderabad and Jaipur – Ready for implementation • Bhopal, Kanpur, New Delhi, Nagpur and Patna – Being planned

- 82. National Electronic Funds Transfer (NEFT) • NEFT facilitates one-to-one funds transfers between banks, irrespective of location • Eleven Hourly Settlements from 9 am to 7 pm • Covers 101 banks and about 75,000 branches • Operates on a Batch+2 basis • Same day availability of funds • Returns within two hours of the settlement • Highly Secured – smart card based access – PKI security • Positive confirmation of credits to the originator • Highly popular – Number of transactions went up from 3.17 mn. during December 2008 to 13.46 mn. during December 2010 • Processed 13.46 mn. transactions worth Rs. 936.64 bn. during December 2010 • Processed a record 1.07 mn. transactions on a single day – January 31, 2010 82

- 83. Real Time Gross Settlement (RTGS) • For remitting large value payments • Credit on real time basis • Minimum amount limit – Rs. 2 lakh • Centralised processing at Mumbai • Covers 74,000 branches 83

- 84. Alternate Payment Channels 84 68,000+ ATMs Avg. daily turnover – 11 mn transactions of ` 30 bn National Infrastructure – NFS operated by NPCI – Largest network, covers 98% of ATMs Customer Service Issues – Withdrawal from any bank ATM made free up to 5 times a month Timely resolution of complaints / penalty Standardised template for complaints ATMs

- 85. Alternate Payment Channels… 85 0.55 mn terminals Avg. Daily Volume : 1.5 mn. Value : Rs. 3.20 bn. Cash withdrawal permitted up to Rs. 1,000 using Debit cards Forward Looking Possibility of IndiaCard by NPCI Points of Sale 0 50 100 150 200 250 300 350 400 450 500 550 Sep, 08 Sep, 09 Sep, 10 Numberin'000s Growth in POS Terminals

- 86. Alternate Payment Channels 86 Enables money transfer and m- commerce transactions through Mobile phones Implemented the bank-led model in October 2008 subject to certain limits Fund transfer for maximum Rs. 50,000 Beneficiary can receive funds up to Rs. 5,000 even without having a bank account with max. of Rs. 25,000 in a month Approval granted to 40 banks Monthly Volume : 0.50 mn Monthly Value : Rs. 0.44 bn Mobile Banking

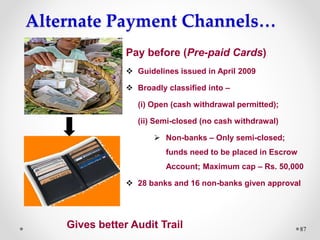

- 87. Alternate Payment Channels… 87 Pay before (Pre-paid Cards) Guidelines issued in April 2009 Broadly classified into – (i) Open (cash withdrawal permitted); (ii) Semi-closed (no cash withdrawal) Non-banks – Only semi-closed; funds need to be placed in Escrow Account; Maximum cap – Rs. 50,000 28 banks and 16 non-banks given approval Gives better Audit Trail

- 88. CTS – Clearing System 88

- 90. RTGS(Real Time Gross Settlement) • The acronym 'RTGS' stands for Real Time Gross Settlement • RTGS system is a funds transfer mechanism where transfer of money takes place from one bank to another on a 'real time' and on 'gross' basis • This is the fastest possible money transfer system through the banking channel • Settlement in 'real time' means payment transaction is not subjected to any waiting period. The transactions are settled as soon as they are processed • 'Gross settlement' means the transaction is settled on one to one basis without bunching with any other transaction • Considering that money transfer takes place in the books of the Reserve Bank of India, the payment is taken as final and irrevocable

- 91. National Electronics Funds Transfer System (NEFT) • The acronym “NEFT” stands for National Electronic Funds Transfer. • Funds are transferred to the credit account with the other participating Bank using RBI's NEFT service. • RBI acts as the service provider and transfers the credit to the other bank's account. • NEFT operate on a deferred net settlement (DNS) basis which settles transactions in batches. • In DNS, the settlement takes place at a particular point of time. All transactions are held up till that time

- 92. Why RTGS / NEFT • Lower cost of transaction of RTGS/NEFT as compared to cost of transaction and remmitance through draft • Draft Issue to Payment – long process, cancellation, duplicate draft issue, revalidation, IOR issues, frauds, Staff accountability • Customer Benefit – Immediate credit • Low transaction time, no printing, shorten the queues • Drafts will be phased out in the coming years

- 93. RTGS & NEFT service availability durations RTGS transactions will be sent to RBI based on the following schedule: Day Start Time End Time Monday to Friday 9:00 hrs 16:00 hrs Saturday 9:00 hrs 13:30 hrs NEFT transactions will be sent to RBI based on the following schedule: Day Start Time End Time Monday to Friday 8:00 hrs 18:30 hrs Saturday 8:00 hrs 11:30 hrs

- 94. RTGS/NEFT • For a funds transfer to go through RTGS/NEFT, both the sending bank branch and the receiving bank branch would have to be RTGS/NEFT enabled • In rare cases of system failure at RBI/Banks respective softwares, manual intervention is required to clear the Blocked funds • NEFT transactions are settled in batches based on the following timings: o 11 settlements on weekdays - at 09:00, 11:00, 12:00, 13:00, 15:00 and 17:00 hrs. o 5 settlements on Saturdays - at 09:00, 11:00 and 12:00 hrs.

- 95. Minimum / Maximum amount for RTGS /NEFT transactions Type Minimum Maximum RTGS Rs. 2 Lakh No Limit NEFT No Limit No Limit * HOWEVER MAXIMUM AMOUNT PER TRANSACTION IS LIMITED TO RS 2,00,000

- 96. Processing Charges/Service Charges for RTGS/NEFT transactions Amount Service Charge RTGS From Rs.2 lakh upto Rs.5 lakh Not exceeding Rs 30/- Rs. 5 lakh & above Not exceeding Rs 55/- NEFT Upto Rs.1 lakh Rs.5/- Rs.1 lakh & 2 lakh and above 2 lakh Rs.15/- maximum Rs 25/- maximum Inward transactions charges for RTGS/NEFT– Free, no charge to be levied

- 97. Essential Information needed • The essential information that the remitting customer would have to furnish to a bank for the remittance to be effected Amount to be remitted Account number which is to be debited Name of the beneficiary bank Name of the beneficiary customer Account number of the beneficiary customer Sender to receiver information, if any The IFSC Number of the receiving branch

- 98. Transaction Flow : RTGS ( usually it should be done in financle ) No special characters like *, /, @ to be used in any of the fields

- 99. Transaction Flow : RTGS contd.. (Outgoing Message (Cheque) Dimmed fields Cheque No Chq Date

- 100. Transaction Flow : RTGS contd.. (Outgoing Message (Cash) Remittance Amount excl Comm. Comm. Amount

- 101. STATUS ENQUIRY OF RTGS MESSAGES for Inward and Outward.

- 102. STATUS ENQUIRY OF RTGS MESSAGES for Inward and Outward.contd…

- 103. Track the remittance transaction • It depends on the arrangement between the remitting customer and the remitting bank. • Some banks with internet banking facility provide this service. • Once the funds are credited to the account of the beneficiary bank, the remitting customer gets a confirmation from his bank either by an e-mail or by a short message on the mobile

- 104. Volume of RTGS • On a typical day, RTGS handles about 60,000 transactions a day for an approximate value of Rs.2,700 billion • RTGS/NEFT facility is available in more than 53000 different bank branches throughout country Delay/Non credit • Contact bank / branch. • If the issue is not resolved satisfactorily, the Customer Service Department of RBI may be contacted