E filing of transfer pricing reports

- 1. E-Filing of Transfer Pricing Reports As at 14th November, 2013 CA AMEET PATEL

- 2. 2

- 3. Recent Amendments in ITA

- 4. Recent Amendments in ITA W.e.f. AY 2012-13, any resident who is otherwise not required to furnish a ROI, will now be required to furnish a return if has asset located outside India including any financial interest in any entity, or has signing authority in any account located outside India New The Finance Act, 2013 has made an amendment to explanation to section 139(9) – treatment of return as defective if self assessment tax and interest not paid before filing of return of income New The amendment will be with effect from 1.6.2013 and is applicable to returns filed after that date

- 5. Introduction to the ‘New Uploading Requirements’

- 6. Introduction to the ‘New Uploading Requirements’ With effect from AY 2013-14, e-filing of Audit Reports under section 44AB (tax audit report ‘TAR’ alongwith Financial Statements and other Audit reports, if any), section 92E (transfer pricing – international & domestic), section 115JB (Form 29B for MAT), Form 10B (charitable trusts), Form 10BB (educational/medical institutions) and Form 10CCB (80-IA/80IB/80IC/ 80ID/80JJAA/80LA) have been made mandatory To be filed on or before the due date of filing the return To be filed before uploading the return Data to be entered in utility provided by income-tax department & converted into ‘xml’ before uploading or to be entered in an online form for online submission Tax Payer and the CA who will be signing Form 29B, TAR and Transfer Pricing report will have to be registered with the Income Tax Department Website. CA is required to have a valid PAN and DSC for the registration.

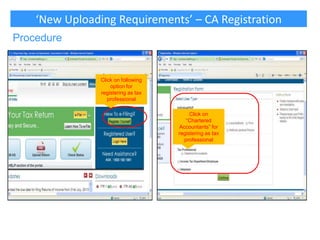

- 7. ‘New Uploading Requirements’ – CA Registration For registration and uploading of forms, steps shown in the following slides will have to be followed. Every auditor/certifying CA will be a new user for A.Y. 2013-14 and will have to click on the Register Yourself button given on the e-filing website. Under “Tax Professional”, select “Chartered Accountant” and click on the CONTINUE button. The REGISTRATION FORM screen will appear. Enter the details, upload the Digital Signature Certificate (DSC) and click CONTINUE button.

- 8. ‘New Uploading Requirements’ – CA Registration Procedure Click on following option for registering as tax professional Click on “Chartered Accountants” for registering as tax professional

- 9. ‘New Uploading Requirements’ – CA Registration Procedure Input following details for registering as tax professional

- 10. ‘New Uploading Requirements’ – CA Registration On successful validation, you will be directed to the next page of registration where you have to enter additional details like Password, Contact, Postal address and enter the Code displayed on the screen and click on the SUBMIT button.

- 11. ‘New Uploading Requirements’ – CA Registration On successful registration, a message will be displayed along with a transaction ID. An email with the user ID and activation link will be sent to your registered email ID. An alert will also be sent on the registered mobile number. Make sure you provide a valid mobile number and email ID as all the future communications will be sent to this mobile number and email ID.

- 12. ‘New Uploading Requirements’ – CA Registration After you login, the blue navigation bar on top will display additional menu options. Dashboard Option: Provides the current notifications and also the details of your previous e-filed reports. My Account option: Provides services such as View Forms and View Client List. e-File and Downloads options: Allows you to file your reports and download forms, respectively. Profile Settings option: Allows you to update your profile, details like DSC upload, secret question, contact details, change password, etc. Worklist option: Provides list of items, which may be pending for action at your end. Helpdesk option: Allow you to raise a query, if you face any issues while e-Filing and check status, if raised.

- 13. ‘New Uploading Requirements’ – Add CA Assessee has to add CA to enable the CA to upload the Forms (other than ITR) on his/her behalf Assessee should Login to e-Filing portal Navigate to My Account -> Add CA Enter the Membership No. of the CA, select the Form and Assessment Year and enter captcha code. Click submit. Success message should be displayed on the screen.

- 14. Step 1 for Adding CA by the Tax Payer 14

- 15. Step 2 for Adding CA by the Tax Payer Fill ICAI M. No. of CA here Name of CA will automatically appear here 15

- 16. Step 3 for Adding CA by the Tax Payer 16

- 17. Step 4 for Adding CA – View List of CA 17

- 18. ‘New Uploading Requirements’ – Offline Preparation • On www.incometaxindiaefiling.gov.in, from the ‘Downloads’ section on the right, either select ‘Forms (other than ITR)’ Click on following option for downloading E- forms

- 19. ‘New Uploading Requirements’ – Offline Preparation • On clicking on the e icon, a zip file appears. On selecting the zip file, a JAVA based utility is displayed. Hence, the user is required to update JAVA (version 7 update 6 or above) on the computer. Select following option to download E – utility File

- 20. ‘New Uploading Requirements’ – Offline Preparation Click on this option to view the list of forms.

- 21. ‘New Uploading Requirements’ – Offline Preparation • ‘File’ option under the utility provides option to select the Form which you want to fill. Click on appropriate form as desired

- 22. ‘New Uploading Requirements’ – Offline Preparation • User will fill in the details in the Form and save the same as draft in ‘xml’ format in the desired folder. • To reopen the draft for further editing the user needs to enter the utility on the income tax site, click on the ‘Open Draft’ option given on the taskbar, browse the saved xml file and update as per requirement. • Common details in the form get automatically updated once entered. (eg: data filled in 1st Tab is picked up automatically in the next tab - details like company name, address, previous year and assessment year) • Please ensure that you download the latest version of the utility from the site. As at 11th November, the latest utility is – FORMS_2013_PR13.exe

- 23. ‘New Uploading Requirements’ – Offline Preparation Procedure Click on “save draft” option to save the form Click on “open” to access / update form

- 24. ‘New Uploading Requirements’ – Offline Preparation • „Validate‟ option, validates all the pages of the Form and throws up the errors in the form. • Once the form is validated, „Generate xml‟ option creates a final xml which has to be uploaded with the department.

- 25. ‘New Uploading Requirements’ – Online Submission of Offline Preparation 1. Go to 'e-File' menu, Login and select “Upload Form“ 2. LOGIN to e-Filing application and GO TO --> e-File --> Upload Form 3. Enter the Tax payer’s PAN, CA’s PAN; select the Form Name (other than ITR) and the Assessment Year. 4. Browse and Select the XML file 5. Upload Digital Signature Certificate. 6. Click 'SUBMIT'. 7. On successful upload, the Form (other than ITR) is sent to Tax Payer's workflow for acceptance. 8. The Tax Payer should LOGIN to e-Filing application, GO TO Worklist and accept/reject the form. 9. A) On Approval, the Form is successfully submitted with e-Filing application. No further action is required. B) If Rejected, the Tax Professional can file the Form (other than ITR) again and follow the same process as mentioned earlier.

- 26. ‘New Uploading Requirements’ – Direct Online Submission 1. Go to 'e-File' menu, Login and select "Submit Form Online" 2. Enter the Assessee PAN, CA’s PAN, select the Form Name (other than ITR) and the Assessment Year. 3. Upload Digital Signature Certificate of the CA 4. Click 'SUBMIT'. 5. Enter the data and Submit. 6. On successful submission, the Form (other than ITR) is sent to Assessee's workflow for acceptance. 7. The Assessee should LOGIN to e-Filing application, go to Worklist and accept/reject the Form (other than ITR). 8. a) On approval, the Form is successfully submitted with e-Filing application. No further action is required. b) If rejected, the CA can file the Income Tax Form (other than ITR) again and follow the same process as mentioned above.

- 27. Acceptance / Rejection of Report by Assessee – Format of Acknowledgement 3CEB 27

- 28. Summary of Workflow – Registration and Uploading Step 1 CA registers in e-Filing portal Step 2 Assessee “adds CA” for the desired Form (Other than ITR) and Assessment Year Step 3 CA logs in e-Filing portal Step 4 CA Downloads the offline Form, fills the data, generates and uploads the XML Or CA opens the online Form, fills the data and submits the Form Step 5 CA gets the success message and the transaction ID Step 6 Assessee reviews and approves. An acknowledgment number is generated Step 7 CA can view/print the submitted Form using the functionality “View Forms” Assessee registers in e-Filing portal Assessee can view/print the submitted Form using the functionality “e-Filed Returns/Forms”

- 29. E-filing of Transfer Pricing Reports - Issues TAB Key cannot be used to navigate from one field of Form 3CD to another field User has to click every field manually Unlike the ITR form, the validation option cannot be used only for a specific page. The validation option validates the entire form To save the file, use “Save Draft” option. Unfortunately, every time you save the draft, it asks you for the path and file name.

- 30. E-filing of Transfer Pricing Reports - Issues Wherever the information is captured in tables To add row Click on “ADD ROW” button, fill in the data and click “ADD” button to add the data To delete row Select the “ROW “to DELETE from the list and click “DELETE ROW “button To edit row Select a row from the list, click on “EDIT ROW “and make changes as needed and click “SAVE” To copy row Select the row to copy from the list and click “COPY ROW” button

- 31. E-filing of Transfer Pricing Reports - Issues There are 25 clauses for FY 2012-13 (in earlier year there were 13 clauses) - The same is brought into force to harmonise with the extended scope of transfer pricing Causes 1 – 9 : General information about the assessee Clauses 10 – 20 : International transactions with associated enterprises (AE) Clauses 21 – 25 : Specified domestic transactions with related party Use of special characters like ,(comma) – (minus) is to be avoided. Because e-filing site shows errors at the time of uploading. Special characters should not be used in name of the assessee Example: ABC-XYZ Ltd or ABC (India) Ltd There is an upper limit of 125 characters for the Name Previously clause 7-13 was related to international transactions, now the additional reporting includes issue/buyback of equity shares, restructuring, guarantees, etc. 31

- 32. E-filing of Transfer Pricing Reports - Issues 32 Where do you write the notes, disclaimers etc? Option for notes is not available in utility. Even when uploading the Form 3CEB, there is no option for any attachment. So, unlike in case of 3CD, here we cannot attach a separate statement of disclaimers or notes.. Word limit has been fixed for reporting in the e-filing schema like under each clause of Form 3CEB limit has been set. Example - Business description of AE in clause 10 has the limit of 100 word count. Every field is to be entered separately into the utility – copy paste of a range of cells from a spreadsheet or a document is not possible Clause 8 & 9 (aggregate value of reportable transactions) does not get filled up automatically. Person who fills the form needs to take care of totalling.

- 33. E-filing of Transfer Pricing Reports - Issues Validation is not proper – There is a clause 10 for mentioning List of AEs. However, in the clauses of transactions with AEs, it is possible to mention some other AE (which is not mentioned in Clause 10). There is a clause 14 for giving details of lending/borrowing transactions. Here, if you put “Lending” as the activity and “Paid/Payable” as the “Amount paid/payable/received/receivable”, it does not show an error In respect of purchases and sales, there is a field for mentioning the quantity. This is an alpha numeric field. At many places, the currency has to be mentioned. There is no drop down list provided for the same. For every clause, one has to select “NO” if it‟s not applicable. Default does not work. 33

- 34. E-filing of Transfer Pricing Reports - Issues No print option: Print option is not available unless the form is uploaded. Once TP auditor uploads the form, then only assessee can view the PDF version of the Form 3CEB. Fake path problem: This problem is due to your internet explorer browser settings. Solution: • Option I : In internet explorer-> tools ->internet option >security -> custom level-> enable "include local directory path when uploading file to the server". • Option II : Create a folder in the "c" drive called “fakepath” (c:fakepath) and copy the XML files to this folder. (In Google chrome second option will work) 34

- 35. Thank You! You can contact me on patelameet@hotmail.com