007 t econanalysis projects

- 1. Asian Develpment Bank Handbook for the Economic Analysis of Water Supply Projects ISBN: 971-561-220-2 361 pages Pub. Date: 1999 http://www.adb.org/Documents/Handbooks/Water_Supply_Projects Contents I. Introduction II. The Project Framework III. Demand Analysis and Forecasting IV. Least-Cost Analysis V. Financial Benefit-Cost Analysis VI. Economic Benefit-Cost Analysis VII. Sensistivity and Risk Analysis VIII. Financial Sustainability and Pricing IX. Distribution Analysis and Impact on Poverty Reduction Appendix A. Data Collection B. Case Study: Urban Water Supply Project 1. Annex B. Case Study: Rural Water Supply Project] 1. Annex Glossary References

- 3. 2 HANDBOOK FOR THE ECONOMIC ANALYSIS OF WATER SUPPLY PROJECTS CONTENTS 1.1 All about the Handbook .............................................................................................................. 3 1.1.1 Introduction..................................................................................................................... 3 1.1.2 Uses of the Handbook .................................................................................................. 4 1.2 Characteristics of Water Supply Projects .................................................................................. 4 1.2.1 Water as an Economic Good ....................................................................................... 4 1.3 The Water Supply Project ............................................................................................................ 6 1.3.1 Economic Rationale and Role of Economic Analysis ............................................. 6 1.3.2 Macroeconomic and Sectoral Context ........................................................................ 6 1.3.3 Procedures for Economic Analysis ............................................................................. 7 1.3.4 Economic Analysis and ADB’s Project Cycle ........................................................... 9 1.3.5 Project Preparation and Economic Analysis ............................................................. 9 1.3.6 Identifying the Gap between Forecast Need and Output from the Existing Facility.....................................................................11 1.4 Least-Cost Analysis for Choosing an Alternative.................................................................12 1.4.1 Introduction...................................................................................................................12 1.4.2 Choosing the Least-Cost Alternative ........................................................................12 1.5 Financial and Economic Analyses...........................................................................................13 1.5.1 With- and Without-Project Cases..............................................................................13 1.5.2 Financial vs. Economic Analysis ...............................................................................14 1.5.3 Financial vs. Economic Viability ...............................................................................15 1.6 Identification, Quantification, Valuation of Economic Benefits and Costs......................16 1.6.1 Nonincremental and Incremental Outputs and Inputs..........................................16 1.6.2 Demand and Supply Prices.........................................................................................16 1.6.3 Identification and Quantification of Costs ..............................................................16 1.6.4 Identification and Quantification of Benefits..........................................................18 1.6.5 Valuation of Economic Costs and Benefits.............................................................19 1.6.6 Economic Viability.......................................................................................................19 1.7 Sensitivity and Risk Analysis .....................................................................................................20 1.8 Sustainability and Pricing ...........................................................................................................20 1.9 Distribution Analysis and Impact on Poverty ..............................................................................21 Figures Figure1.1 Flow Chart for Economic Analysis of Water Supply and Sanitation Projects………..8

- 4. CHAPTER 1: INTRODUCTION 3 1.1 All about the Handbook 1.1.1 Introduction 1. Water is rapidly becoming a scarce resource in almost all countries and cities with growing population on the one hand, and fast growing economies, commercial and developmental activities on the other. 2. This scarcity makes water both a social and an economic good. Its users range from poor households with basic needs to agriculturists, farmers, industries and from commercial undertakings with their needs for economic activity to rich households for their higher standard of living. 3. For all these uses, the water supply projects (WSPs) and water resources development programs are being proposed for extension and augmentation; likewise with the rehabilitation of water supply for which measures for subsequent sustainability are being adopted. 4. It is, therefore, essential to carry out an economic analysis of projects so that planners, policy makers, water enterprises and consumers are aware of the actual economic cost of scarce water resources, and the appropriate levels of tariff and cost recovery needed to financially sustain it. 5. In February 1997, the Bank issued the Guidelines for the Economic Analysis of Projects for projects in all sectors, and subsequently issued the Guidelines for the Economic Analysis of Water Supply Projects” (March 1998) which focuses on the water supply sector. The treatment of subsidies and a framework for subsidy policies is contained in the Bank Criteria for Subsidies (September 1996). 6. This Handbook is an attempt to translate the provisions of the water supply guidelines into a practical and self-explanatory work with numerous illustrations and numerical calculations for the use of all involved in planning, designing, appraising and evaluating WSPs. 7. In this document, short illustrations have been used to explain various concepts of economic analyses. Subsequently, they are applied in real project situations which have been taken from earlier Bank-financed and other WSPs, or from case

- 5. 4 HANDBOOK FOR THE ECONOMIC ANALYSIS OF WATER SUPPLY PROJECTS studies conducted in different countries in Asia as part of a Bank-financed Regional Technical Assistance Project (RETA). 1.1.2 Uses of the Handbook 8. This Handbook is written for non-economists (planners, engineers, financial analysts, sociologists) involved in the planning, preparation, implementation, and management of WSPs, including: staff of government agencies and water utilities; consultants and staff of non-governmental organizations (NGOs); and staff of national and international financing institutions. 9. Since the Handbook focuses on the application of principles and methods of economic analysis to WSPs, it is also a practical guide that can be used by economists in the economic analysis of WSPs. 10. The Handbook can also be used for the following purposes: (i) as a reference guide for government officials, project analysts and economists of developing member counries (DMC) in the design, economic analysis and evaluation of WSPs; (ii) as a guide for consultants and other professional staff engaged in the feasibility study of WSPs, applying the provisions of the Bank’s Guidelines for the Economic Analysis of Water Supply Projects; and (iii) as a training guide for the use of trainors of “Economic Analysis of Water Supply Projects” 1.2 Characteristics of Water Supply Projects 1.2.1 Water as an Economic Good 11. The characteristic features of water supply include the following: (i) Water is usually a location-specific resource and mostly a nontradable output.

- 6. CHAPTER 1: INTRODUCTION 5 (ii) Markets for water may be subject to imperfection. Features related to the imperfect nature of water markets include physical constraints, the high costs of investment for certain applications, legal constraints, complex institutional structures, the vital interests of different user groups, limitations in the development of transferable rights to water, cultural values and concerns of resource sustainability. (iii) Investments are occurring in medium term (typically 10 years) phases and have a long investment life (20 to 30 years). (iv) Pricing of water has rarely been efficient. Tariffs are often set below the average economic cost, which jeopardizes a sustainable delivery of water services. If water availability is limited, and competition for water among potential water users (households, industries, agriculture) is high, the opportunity cost of water (OCW) is also high. Scarcity rent occurs in situations where the water resource is depleting. OCW and depletion premium have rarely been considered in the design of tariff structures. If the water entity is not fully recovering the average cost of water, government subsidies or finance from other sources is necessary to ensure sustainable water service delivery. (v) Water is vital for human life and, therefore, a precious commodity. WSPs generate significant benefits, yet water is still wasted on a large scale. In DMC cities and towns, there is a very high incidence of unaccounted-for-water (UFW). An ADB survey among 50 water enterprises in Asian countries over the year 1995 revealed an average UFW rate of 35 percent. (vi) Economies of scale in WSPs are moderate in production and transmission but rather low in the distribution of water. The above characteristics have implications on the design of WSPs and should be considered as early as the planning and appraisal stages of project preparation.

- 7. 6 HANDBOOK FOR THE ECONOMIC ANALYSIS OF WATER SUPPLY PROJECTS 1.3 The Water Supply Project 1.3.1 Economic Rationale and Role of Economic Analysis 12. The main rationale for Bank operations is the failure of markets to adequately provide what society wants. This is particularly true in the water supply sector. The provision of basic water supply services to poorer population groups generates positive external benefits, such as improved health conditions of the targeted project beneficiaries; but these are not internalized in the financial cost calculation. 13. The Bank provides the finance for water supply services to assist DMCs in providing safe water to households, promoting enhanced cost recovery over time, creating an enabling environment including capacity building and decentralized management of water supply operations, and setting up of autonomous water enterprises and private companies which are run on a commercial basis. 14. While economic analysis is useful in justifying the Bank’s intervention in terms of economic viability, it should also be considered as a major tool in designing water supply operations. There is a scope for better integrating social and economic considerations in the overall project design. Demand for water depends on the price charged, a function of the cost of water supply which, in turn, depends on demand. This interdependence requires careful analysis in all water supply operations. Safe water should be generally provided at an affordable price and using an appropriate level of service matching the beneficiaries’ preferences and their willingness to pay. 1.3.2 Macroeconomic and Sectoral Context 15. The purpose of the economic analysis of projects is to bring about a better allocation of scarce resources. Projects must relate to the Bank’s sectoral strategy and also to the overall development strategy of the country. 16. In a WSP, the goal may be “improved health and living conditions, reduction of poverty, increased productivity and economic growth, etc.”. Based on careful problem analysis, the Project (Logical) Framework establishes such a format showing the linkages between “Inputs and Outputs”, “Outputs and Purpose”, “Purpose and Sectoral Goal” and “Sectoral Goal and Macro Objective”. The key assumptions regarding project-related activities, management capacity, and sector policies beyond the control and management of the Project Authority are made explicit.

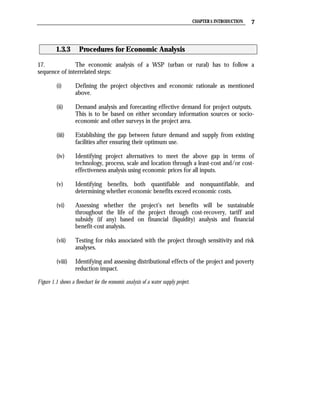

- 8. CHAPTER 1: INTRODUCTION 7 1.3.3 Procedures for Economic Analysis 17. The economic analysis of a WSP (urban or rural) has to follow a sequence of interrelated steps: (i) Defining the project objectives and economic rationale as mentioned above. (ii) Demand analysis and forecasting effective demand for project outputs. This is to be based on either secondary information sources or socio- economic and other surveys in the project area. (iii) Establishing the gap between future demand and supply from existing facilities after ensuring their optimum use. (iv) Identifying project alternatives to meet the above gap in terms of technology, process, scale and location through a least-cost and/or cost- effectiveness analysis using economic prices for all inputs. (v) Identifying benefits, both quantifiable and nonquantifiable, and determining whether economic benefits exceed economic costs. (vi) Assessing whether the project’s net benefits will be sustainable throughout the life of the project through cost-recovery, tariff and subsidy (if any) based on financial (liquidity) analysis and financial benefit-cost analysis. (vii) Testing for risks associated with the project through sensitivity and risk analyses. (viii) Identifying and assessing distributional effects of the project and poverty reduction impact. Figure 1.1 shows a flowchart for the economic analysis of a water supply project.

- 9. 8 HANDBOOK FOR THE ECONOMIC ANALYSIS OF WATER SUPPLY PROJECTS Figure 1.1 Flow Chart for Economic Analysis of Water Supply and Sanitation Projects Project Rationale & Objectives Socioeconomic Survey Survey of Existing Facilities,Uses Including Contingent & Constraints (if any) Valuation Identify Measures Demand Analysis for Optimum Use Institutional & Demand Forecasting of Existing Facilities (including effective demand) Assessment Establish the Gap Between Future Demand & Existing Facilities After Their Optimum Use Environmental Identify Technical Alternatives Assessment to meet the above Gap (IEE ,EIA) Least-cost Analysis (with Economic Price) & Choice of the Alternative (Design, Process, Technology, & Scale, etc.) (AIFC & AIEC) Identifying Benefits (Quantifiable) Tariff Design, Cost Recovery, Identifying Nonquantifiable items & Subsidy (if any) (if any) Enumeration Economic Financial Benefit-cost Benefit-cost Analysis with Analysis with Economic Price Financial Price (EIRR) (FIRR) Uncertainty Analysis (Sensitivity & Risk) Distribution of Project Effects Financial Sustainability Analysis & Poverty Reduction Plan for (Physical & Impact Environmental) Sustainability - parts of the economic analysis AIFC - average incremental financial cost; AIEC - average incremental economic cost; EIRR - economic internal rate of EIA - environmental impact return; ; FIRR - financial internal rate of return; IEE - initial environmental assessment examination

- 10. CHAPTER 1: INTRODUCTION 9 1.3.4 Economic Analysis and ADB’s Project Cycle 18. Economic analysis comes into play at the different stages of the project cycle: project identification, project preparation and project appraisal. 19. Project identification largely results from the formulation of the Bank’s country sectoral strategy and country program. This means that the basic decision to allocate resources to the water supply sector for a certain (sector) loan project has been taken at an early stage and that the project has, in principle, been identified for implementation with assistance from the ADB. 20. In the project preparation stage, the planner has to make an optimal choice of the design, process, technology, scale and location etc. based on the most efficient use of the countries’ resources. Here, the economic analysis of projects again comes into play. 21. In the project appraisal stage, the economic analysis plays a substantial part to ensure optimal allocation of a nation’s resources and to meet the sustainability criteria set by both the recipient country and the ADB from the social, institutional, environmental, economic and financial viewpoints. 1.3.5 Project Preparation and Economic Analysis 22. Before any detailed preparation is done, it is necessary for the design team to get acquainted with the area where the project is identified. This is to acquire knowledge about the physical features, present situation regarding existing facilities and their use constraints (if any) against their optimal use, the communities and users specially their socio-economic conditions, etc. 23. To get these information, the following surveys must be undertaken in the area: (i) Reconnaissance survey – to collect basic information of the area and to have discussions with the beneficiaries and key persons involved in the design, implementation and management of the project. Relevant data collection also pertains to information available in earlier studies and reports.

- 11. 10 HANDBOOK FOR THE ECONOMIC ANALYSIS OF WATER SUPPLY PROJECTS (ii) Socio-economic survey – to get detailed information about the household size, earnings, activities, present expenditure for water supply facilities, along with health statistics related to water-related diseases, etc. It is important to analyze the potential project beneficiaries, their preferences for a specific level of service and their willingness to pay for the level of service to be provided under the project. The analysis of beneficiaries should show the number of poor beneficiaries, i.e., those below the country’s poverty line, and their ability to pay. Such information is required to ensure that poor households will have access to the project’s services and to know whether, and to what extent, “cost- recovery” can be done. (iii) Contingent Valuation Method − An important contribution in arriving at the effective demand for water supply facilities, even where there are no formal water charges, is the contingent valuation survey. This is based on questions put to households on how much they are willing to pay (WTP) for the use of different levels of water quantities. These data may help build up some surrogate demand curve and estimate benefits from a WSP. (iv) Survey of existing water supply facilities − Knowledge of the present water supply sources, treatment (if any) and distribution is also needed. It is also necessary to know the quantity and quality of water and unaccounted-for-water (UFW) and any constraints and bottlenecks which are coming in the way of the optimum use of the existing facility. 24. Using the information taken from the survey results and other secondary data sources, effective demand for water can then be estimated. Two important considerations are: (i) Effective demand is a function of the price charged. This is ideally based on the economic cost of water supply provision to ensure optimal use of the facility, and neither over-consumption nor under-consumption especially by the poor should occur. The former leads to wastage contributing to operational deficits and the latter results in loss of welfare to the community. (ii) Reliable water demand projections, though difficult, are key in the analysis of alternatives for determining the best size and timing of investments.

- 12. CHAPTER 1: INTRODUCTION 11 25. Approaches to demand estimation for urban and rural areas are usually different. In the urban areas, the existing users are normally charged for the water supply; in the rural areas, there may not be any formal water supply and the rural households often do not have to pay for water use. An attempt can be made in urban areas to arrive at some figure of price elasticity and probably income elasticity of demand. This is more difficult in the case of water supply in rural areas with a preponderance of poor households. 1.3.6 Identifying the gap between Forecast Need and Output from the Existing Facility 26. Once demand forecasting has been done, it is necessary to arrive at the output (physical, institutional and organizational) which the project should provide. The existing facilities may not be optimally used due to several reasons, among them: (i) UFW due to high technical and nontechnical losses in the system; (ii) inadequate management system, organizational deficiency and poor operation and maintenance leading to deterioration of the physical assets; and (iii) any bottleneck in the supply network at any point starting from the raw water extraction to the households and other users’ end. 27. Before embarking on a detailed preparation of the project, it is necessary to take measures to ensure optimal use of the facilities. These measures should be both physical and policy related. The physical measures are like leakage control, replacing faulty valves and adequate maintenance and operation, etc.; policy measures can be charging an economically efficient tariff and implementing institutional reforms, etc. 28. The output required from the proposed WSP should only be determined after establishing the gap between the future needs based on the effective demand and the restored output of the existing facilities ensuring their optimal use. Attention needs to be focused on the identification and possible application of instruments to manage and conserve demand, such as (progressive) water tariffs, fiscal incentives, pricing of raw water, educational campaigns, introducing water saving devices, taxing of waste water discharges, etc.

- 13. 12 HANDBOOK FOR THE ECONOMIC ANALYSIS OF WATER SUPPLY PROJECTS 1.4 Least-Cost Analysis for Choosing an Alternative 1.4.1 Introduction 29. After arriving at the scope of the WSP based on the gap mentioned above, the next task is to identify the least-cost alternative of achieving the required output. Economic costs should be used for examining the technology, scale, location and timing of alternative project designs. All the life-cycle costs (market and non- market) associated with each alternative are to be taken into account. 30. The alternatives are not to be confined to technical or physical elements only, e.g., ground water or surface water, gravity or pumping, large or small scale, etc. They can also include activities due to policy measures, e.g., leakage detection and control, institutional reforms and managerial reorganization. 1.4.2 Choosing the Least-Cost Alternative 31. There can be two main cases for the choice from mutually exclusive options: (i) the alternatives deliver the same output or benefit, quantity wise and quality wise; (ii) the alternatives produce different outputs or benefits. Case 1. 32. In the first case, the least-cost analysis compares the life cycle cost Streams of all the options and selects the one with the lowest present value of the economic costs. The discount rate to be used is the economic opportunity cost of capital (EOCC) taken as 12 percent in real terms. 33. Alternatively, it is possible to estimate the equalizing discount rate (EDR) between each pair of mutually exclusive options for comparison. The EDR is also equal to the economic internal rate of return (EIRR) of the incremental cash flows of the

- 14. CHAPTER 1: INTRODUCTION 13 mutually exclusive options. The EDR/EIRR of the incremental cash flows can then be compared with the EOCC for choice among alternatives. 34. The least-cost choice can also be done by calculating the average incremental economic cost (AIEC) of each alternative. The AEIC is the present value of incremental investment and operating costs in with-project and without-project situations divided by the present value of incremental output (say, in m3) also in both with-project and without-project alternative. The discount rate to be used is the EOCC = 12 percent. This will establish the project alternative with the lower per unit economic cost. Case 2. 35. In this second case, it is possible to select the least economic cost option by calculating per unit economic costs of all the project options. Because water demand, supply cost and price charged for water tend to be closely interrelated, least- cost analysis should account for the effect of uncertain demand. Lower-than-forecast demand results in higher average costs, which can push up water prices and depress demand further. 36. Sensitivity analysis can be used to show whether the project option remains the least-cost alternative under adverse changes in key variables. The scale of the project may vary in relation to prices charged to consumers and the size may influence the least-cost alternative. 1.5 Financial and Economic Analyses 1.5.1 With- and Without-Project Cases 37. After choosing the best among alternatives, the next step is to test the financial and economic viability of the project, which is the chosen, least-cost alternative. The initial step in testing the financial and economic viability of a project is to identify and quantify the costs and benefits. 38. To identify project costs and benefits and to compare the net benefit flows, the without-project situation should be compared with the with-project situation. The without-project situation is different from the before-project situation. The without-project situation is that one which would prevail without the project vis-à-vis

- 15. 14 HANDBOOK FOR THE ECONOMIC ANALYSIS OF WATER SUPPLY PROJECTS factors like population increase. As water is getting more scarce, the water use pattern and the cost are also likely to change. 1.5.2 Financial vs. Economic Analysis 39. Financial and economic analyses have similar features. Both estimate the net benefits of an investment project based on the difference between the with-project and the without-project situations. 40. However, the concept of financial net benefit is not the same as economic net benefit. While financial net benefit provides a measure of the commercial (financial) viability of the project on the project-operating entity, economic net benefit indicates the real worth of a project to the country. 41. Financial and economic analyses are also complementary. For a project to be economically viable, it must be financially sustainable. If a project is not financially sustainable, there will be no adequate funds to properly operate, maintain and replace assets; thus the quality of the water service will deteriorate, eventually affecting demand and the realization of financial revenues and economic benefits. 42. It has sometimes been suggested that financial viability not be made a concern because as long as a project is economically sound, it can be supported through government subsidies. However, in most cases, governments face severe budgetary constraints and consequently, the affected project entity may run into severe liquidity problems, thereby jeopardizing even its economic viability. 43. The basic difference between the financial and economic benefit-cost analyses of the project is that the former compares benefits and costs to the enterprise in constant financial prices, while the latter compares the benefits and costs to the whole economy measured in constant economic prices. Financial prices are market prices of goods and services that include the effects of government intervention and distortions in the market structure. Economic prices reflect the true cost and value to the economy of goods and services after adjustment for the effects of government intervention and distortions in the market structure through shadow pricing of the financial prices. In such analyses, depreciation charges, sunk costs and expected changes in the general price should not be included. 44. In financial analysis, the taxes and subsidies included in the price of goods and services are integral parts of financial prices, but they are treated differently in economic analysis. Financial and economic analyses also differ in their treatment of

- 16. CHAPTER 1: INTRODUCTION 15 external effects (benefits and costs), favorable effects on health and the UFW of a WSP. Economic analysis attempts to value such externalities, health effects and nontechnical losses. 1.5.3 Financial vs. Economic Viability 45. The steps in determining the financial viability of the proposed project include: (i) identifying and quantifying the costs and revenues; (ii) calculating the project net benefits; (iii) estimating the average incremental financial cost, financial net present value and financial internal rate of return (FIRR). The FIRR is the rate of return at which the present value of the stream of incremental net flows in financial prices is zero. If the FIRR is equal to or greater than the financial opportunity cost of capital, the project is considered financially viable. Thus, financial benefit-cost analysis covers the profitability aspect of the project. 46. The steps in determining the economic viability of a project include the following: (i) identifying and quantifying (in physical terms) the costs and benefits; (ii) valuing the costs and benefits, to the extent feasible, in monetary terms; and (iii) estimating the EIRR or economic net present value (NPV) discounted at EOCC = 12 percent by comparing benefits with the costs. The EIRR is the rate of return for which the present value of the net benefit stream becomes zero, or at which the present value of the benefit stream is equal to the present value of the cost stream. For a project to be acceptable, the EIRR should be greater than the economic opportunity cost of capital. The Bank uses 12 percent as the minimum rate of return for projects; but for projects with considerable nonquantifiable benefits, 10 percent may be acceptable.

- 17. 16 HANDBOOK FOR THE ECONOMIC ANALYSIS OF WATER SUPPLY PROJECTS 1.6 Identification, Quantification, Valuation of Economic Benefits and Costs 1.6.1 Nonincremental and Incremental Outputs and Inputs 47. Nonincremental outputs are project outputs that replace existing water production or supply. For example, a water supply project may replace existing supply by water vendors or household/community wells. 48. Incremental outputs are project outputs that add to existing supply to meet new demands. For example, the demand for water is expected to increase in the case of a real decline in water supply costs or tariffs. 49. Incremental inputs are for project demands that are met by an overall expansion of the water supply system. 50. Nonincremental inputs are inputs that are not met by an expansion of overall supply but from existing supplies, i.e., taking supply away from existing users. For example, water supply to a new industrial plant is done by using water away from existing agricultural water. 1.6.2 Demand and Supply Prices 51. In economic analysis, the market prices of inputs and outputs are adjusted to account for the effects of government intervention and market structure. The adjusted prices are termed as shadow prices and are based either on the supply price, the demand price, or a weighted average of the two. Different shadow prices are used for incremental output, nonincremental output, incremental input and nonincremental input. 1.6.3 Identification and Quantification of Costs 52. In estimating the economic costs, some items of the financial costs are to be excluded while other items, which are not part of financial costs are to be

- 18. CHAPTER 1: INTRODUCTION 17 included. The underlying principle is that project costs represent the difference in costs between the without-project and the with-project situations. Cost items and the way they are to be treated in project economic analysis, are as follows: (i) Sunk Costs. They exist in both with-project and without-project situations and thus are not additional costs for achieving benefits. They are, therefore, not to be included. (ii) Contingencies. As the economic benefit-cost analysis is to be done in constant (or real) prices, the general price contingencies should not be included. (iii) Working Capital. Only inventories that constitute real claims on the nation’s resources should be included in the project economic costs. Others items of working capital reflect loan receipts and repayment flows are not to be included. (iv) Transfer payments. Taxes, duties and subsidies are transfer payments as they transfer command over resources from one party (taxpayers and subsidy receivers) to another (the government, the tax receivers and subsidy givers) without reducing or increasing the amount of resources available in the economy as a whole. Hence, these transfer payments are not economic costs. However, in certain circumstances when valuing the economic cost of an input or an output, taxes are to be included: (a) If the government is correcting for external environmental costs by a correcting tax to reduce the production of water, such a transfer payment is part of the economic costs. (b) The economic value of incremental outputs will include any tax element imposed on the output, which is included in the market price at which it sells. (v) External Costs. Environmental costs arising out of a project activity, such as river water pollution due to discharge of untreated sewage effluent, is an instance of such costs. It may be necessary to internalize this external cost by including all relevant effects and investments like pollution control equipment costs and effects in the project statement. (vi) Opportunity Cost of Water. If, for example, a drinking water project uses raw water diverted from agriculture, the use of this water for

- 19. 18 HANDBOOK FOR THE ECONOMIC ANALYSIS OF WATER SUPPLY PROJECTS drinking will result in a loss for farmers. These costs are measured as the opportunity cost of water which, in this example, equals the “benefits foregone” of the use of that water in agriculture. (vii) Depletion Premium. In water supply projects where the source of water is ground water and the natural rate of recharge or replenishment of the aquifer is less than its consumptive use, the phenomenon of depletion occurs. In such cases, significant cost increase may take place as the aquifer stock depletes; the appropriate valuation of water has to include a depletion premium in the economic analysis. (viii) Depreciation. The stream of investment assets includes initial investments and replacements during the project’s life. This stream of expenditure, which is included in the benefit-cost analysis, will generally not coincide with the time profile of depreciation and amortization in the financial accounts and as such, the latter should not be included once the former is included. 1.6.4 Identification and Quantification of Benefits 53. The gross benefit from a new water supply is made up of two parts: (i) resource cost savings on the nonincremental water consumed in switching from alternative supplies to the new water supply system resulting from the project; and (ii) the WTP for incremental water consumed. 54. Resource cost savings are estimated by multiplying the quantity of water consumed without the project (i.e., nonincremental quantity) by the average economic supply price in the without-project situation. 55. The WTP for incremental supplies can be estimated through a demand curve indicating the different quantities of water demand that could be consumed at different price levels between the without-project level of demand and the with-project level of demand. The economic value of incremental consumption is the average value derived from the curve times the quantity of incremental water. Where there is inadequate data to estimate a demand curve, a contingent valuation methodology can be applied to obtain an estimate of WTP for incremental output.

- 20. CHAPTER 1: INTRODUCTION 19 56. The gross benefit stream should be adjusted for the economic value of water that is consumed but not paid for, i.e., sold but not paid for (bad debts) and consumed but not sold (non-technical losses). It can be assumed that this group of consumers derives, on the average, the same benefit from the water as those who pay. 57. Other benefits of a WSP include health benefits. These benefits are due to the provision of safe water and are also likely to occur provided that the adverse health impacts of an increased volume of wastewaters can be minimized. 1.6.5 Valuation of Economic Costs and Benefits 58. The economic costs and benefits must be valued at their economic prices. For this purpose, the market prices should be converted into their economic prices to take into account the effects of government interventions and market structures. The economic pricing can be conducted in two different currencies (national vs. foreign currency) and at the two different price levels (domestic vs. world prices). 59. To remove the market distortions in financial prices of goods and services and to arrive at the economic prices, a set of ratios between the economic price value and the financial price value for project inputs and outputs are used to convert the constant price financial values of project benefits and costs into economic values. These are called conversion factors, which can be used for groups of typical items, like energy and water resources. 1.6.6 Economic Viability 60. Once the economic benefit and cost streams are derived, a project resource statement can be developed and the EIRR for the project can be calculated. Bank practice is to use 12 percent as the minimum rate of return for projects for which an EIRR can be calculated, although for projects with considerable nonquantifiable benefits, 10 percent may be acceptable. For rural WSPS, there may be limitations to value the economic benefits, thus making it difficult to calculate a reliable EIRR. However, the economic analysis may be undertaken on the basis of the least-cost or cost effectiveness analysis using the economic price of water.

- 21. 20 HANDBOOK FOR THE ECONOMIC ANALYSIS OF WATER SUPPLY PROJECTS 1.7 Sensitivity and Risk Analysis 61. In calculating the EIRR or ENPV for WSPs, the most likely values of the variables are incorporated in the cost and benefit streams. Future values are difficult to predict and there will always be some uncertainty about the project results. Sensitivity analysis is therefore undertaken to identify those benefit and cost parameters that are both uncertain and to which EIRR and FIRR are sensitive. 62. The results of the sensitivity analysis should be summarized, where possible, in a sensitivity indicator and in a switching value. A sensitivity indicator shows the percentage change in NPV (or EIRR) to the percentage change in a selected variable. A high value for the indicator indicates project sensitivity to the variable. Switching values show the change in a variable required for the project decision to switch from acceptance to rejection. For large projects and those close to the cut-off rate, a quantitative risk analysis incorporating different ranges for key variables is recommended. Measures mitigating against major sources of uncertainty are incorporated into the project design, thus improving it. 1.8 Sustainability and Pricing 63. For a project to be sustainable, it must be both financially and economically viable. A financially viable project will continue to produce economic benefits, which are sustained throughout the project life. 64. Assessing sustainability includes: (i) undertaking financial analysis at both the water enterprise level and the project level (i.e., covering the financial liquidity aspect of the project at both levels); (ii) examining the role of cost recovery through water pricing; and (iii) evaluating the project’s fiscal impact, i.e., whether the government can afford to pay the level of financial subsidies that may be necessary for the project to survive. 65. Subsidies aimed at helping the poor may not always benefit them in a sustained manner. Underpricing can lead to waste of water (by the non-poor in particular), deterioration of the water system and services, and ultimately to higher

- 22. CHAPTER 1: INTRODUCTION 21 prices for all. Cross subsidies could also distort prices and should generally be discouraged. To minimize economic costs and maximize socioeconomic development impact, any level of subsidies should be carefully targeted to lower the price charged for water to poor and low-income households. 66. To minimize financial subsidies, projects should be designed to supply services that people want and are willing to pay for. 1.9 Distribution Analysis and Impact on Poverty 67. Water supply provision, especially in the rural areas and shantytowns in urban areas, is considered to be important for poverty reduction. The poverty-reducing impact of a project is determined by evaluating the expected distribution of net economic benefits to different groups such as consumers and suppliers, including labor and the government.

- 24. 24 HANDBOOK FOR THE ECONOMIC ANALYSIS OF WATER SUPPLY CONTENTS 2.1 The Project Framework..............................................................................................................25 2.1.1 Introduction...................................................................................................................25 2.2 Purpose .........................................................................................................................................25 2.3. Concept of a Project Framework: Cause and Effect.............................................................26 2.4 Design of a Project Framework................................................................................................27 2.5 Project Targets: The Verifiable Indicators of Project Achievement...............................................29 2.6 Project Monitoring Mechanisms: The Means of Verification or “How Do We Obtain the Evidence?” .............................................................................................30 2.7 Risks and Assumptions ..............................................................................................................30 2.8 The Project Framework Matrix: An Example .........................................................................31 Figures Figure 2.1 The Project Cycle .................................................................................................................... 26 Figure 2.2 Basic Relations Between PFW Elements............................................................................ 27 Boxes Box 2.1 Logical Order of Cause and Effect……………………………………………….. 26 Box 2.2 Example of Project Goal………………………………………………………….. 28 Box 2.3 Example of the Purpose of the Project……………………………………………. 28 Box 2.4 Example of Project Outputs………………………………………………………. 28 Box 2.5 Example of Activities……………………………………………………….……... 28 Box 2.6 Example of Project Targets………………………………………………………... 29 Box 2.7 Example of Risks and Assumptions……………………………………………….. 30 Tables Table 2.1 Project Design Summary………………………………………………………… 27 Table 2.2 Example of Inputs in Water Supply Projects…………………………………….. 29 Table 2.3 Water Supply and Sanitation Project Framework………………………………... 32

- 25. CHAPTER 2 : PROJECT FRAMEWORK 25 2.1 The Project Framework 2.1.1 Introduction 1. The Project Framework (PFW) is a conceptual tool for preparing the design of a project. It is a disciplined approach to sector and project analysis. This part of the Handbook is based on the ADB publication Using the Logical Framework for Sector Analysis and Project Design: A User’s Guide (June 1998). 2. In February 1998, the ADB Post Evaluation Office has issued the first draft of a new Project Performance Management System (PPMS). With regard to project design, the PPMS incorporates the PFW but adds other techniques, like problem analyses, formulation of solutions, identification of baseline and target values and definition of accountabilities. Because the draft PPMS is yet to be finalized and approved, this Handbook will only refer to the PFW as the basic tool for project design. It is expected, however, that the PPMS will gradually be adopted as the methodology to be utilized. 2.2 Purpose 3. The first step in carrying out a feasibility study for a water supply project (WSP), and as such also the first step in the economic analysis of such projects, is to prepare a PFW. Its purposes are: (i) to establish clearly the objectives and outputs which the project will be accountable to deliver (these objectives and outputs must be quantifiable and measurable); (ii) to promote dialogue and participation by all stakeholders; (iii) to facilitate project implementation planning and monitoring; (iv) to establish a clear basis for project evaluation during the operational phase; this requires a systematic comparison of project objectives, outputs and with actual achievements.

- 26. 26 HANDBOOK FOR THE ECONOMIC ANALYSIS OF WATER SUPPLY 4. The PFW establishes the linkages between project design, project implementation and project evaluation. This is illustrated in Figure 2.1. Figure 2.1 The Project Cycle 5. The PFW is a tool for preparing the project design. It describes the Design goals, objectives, expected outputs, inputs and activities, key risks and assumptions and project costs. Preparing the PFW ensures that the project design is responsive to Logical specific needs, constraints and opportunities, Framework since it requires an analysis of problems and objectives to be achieved as a preparatory step leading to the design of a project. Evaluation Implementation 6. The preparation of the PFW is a team effort in which, ideally, all stakeholders involved in project preparation, should participate. The PFW facilitates project design and preparation by focusing attention on key project issues and laying out a process for establishing the main features of a project. As such, the preparation of a PFW should be an integrated and mandatory part of the Terms of Reference of any feasibility study. 2.3 The Concept of the Project Framework: Cause and Effect 7. The core concept underlying the PFW lies in creating a logical order of cause and effect. This is stated in Box 2.1. Box 2.1 Logical Order of Cause and Effect if certain inputs are provided and activities carried out, then a set of project outputs will be realized and if these outputs materialize, then the project will achieve certain project objectives, and if these objectives are achieved then the project will contribute to achieve the overall goal of the sector.

- 27. CHAPTER 2 : PROJECT FRAMEWORK 27 8. The above statement indicates a certain hierarchy between the different components of the PFW. The basic relations between inputs, activities, outputs and impacts, objectives and goal can be seen in Figure 2.2. Figure 2.2 Basic Relations Between PFW Elements if then ACTIVITIES PURPOSE GOAL OUTPUTS (objective) I if then if then 2.4 The Design of a Project Framework 9. The basic building blocks of a PFW are five key project elements, each one linked to another in a cause-effect relationship. These five elements are described as the design summary. They are presented in Table 2.1 and can be described as follows: Table 2.1 Project Design Summary DESIGN SUMMARY PROJECT PROJECT RISKS/ TARGETS MONITORING ASSUMPTIONS MECHANISMS 1. Goal 2. Purpose 3. Project Components Project Outputs 4. Activities 5. Inputs

- 28. 28 HANDBOOK FOR THE ECONOMIC ANALYSIS OF WATER SUPPLY 10. The Goal: the PFW begins with identifying the overall sector or area goal to be targeted by the project. It is the higher order or general objective to which the project contributes. Together with other projects, the proposed WSP will contribute to achieving such sector and area goals. An example is presented in Box 2.2. Box 2.2 Example of Project Goal In the case of water supply projects, a common goal is 'improved health and living conditions, reduced poverty and increased economic growth and productivity (goal)’. This goal has multiple dimensions as both human development and economic growth are targeted. 11. The Purpose, Immediate or Project-Specific Objective (why the project is being done): describes the immediate output or direct impact that we hope to achieve by carrying out the project. By achieving the immediate objective, the project will contribute to achieving the broader sector goal. An example is provided in Box 2.3. Box 2.3 Example of the Purpose of the Project If access to and use of clean water by the community is assured (purpose), then the project will contribute to improving community health and productivity (which is the broader sector goal). 12. Project Outputs (what the project will deliver): the tangible and measurable deliverables that the project is directly accountable for and for which it is given budgeted amounts of time and resources. Outputs are specific results, produced by managing well the project components. They should be presented as accomplishments rather than as activities. This is illustrated in Box 2.4. Box 2.4 Example of Project Outputs A typical project output could be phrased as: 'water supply systems rehabilitated and/or constructed' and 'O&M systems upgraded and operational'. Typical project components would include the procurement of materials and equipment, construction works, institutional strengthening and capacity building, community development and consultancy services. 13. Activities (how the project is carried out): each project output will be achieved through a series or cluster of activities. An example is shown in Box 2.5. Box 2.5 Example of Activities Typical examples of activities taking place in water supply projects include the acquisition of land, the procurement of materials and equipment, implementation of construction works, the preparation of an Operation & Maintenance Manual, training of staff, implementation of community education programs.

- 29. CHAPTER 2 : PROJECT FRAMEWORK 29 14. Inputs: the time and physical resources needed to produce outputs. These are usually comprised of the budgeted costs needed for the purchase and supply of materials, the costs of construction, the costs for consultancy services, etc. An example is shown in Table 2.2. Table 2.2 Example of Inputs in Water Supply Projects EXPENDITURE CATEGORIES COSTS (US$mn) 1. Land 2 2. Material Supplies 32 3. Physical Works 16 4. Consultancy Services 6 Total Cost of Inputs 55 2.5 Project Targets: The Verifiable Indicators of Project Achievement 15. Practical and cost-effective project measures need to be established to verify accomplishment of goal, objective and outputs. These performance indicators are referred to as the project’s operational targets. The project targets essentially quantify the results, benefits or impacts expected from the project and thus make them measurable or at least tangible. Performance measures at the ‘objective level’ measure End of Project Impact. 16. Project targets are measurable indicators which should be presented in terms of quantity, quality and time. This is illustrated in Box 2.6. Box 2.6 Example of Project Targets A quantitative target could be ‘to provide adequate water supply to 15,000 households in district Adebe’. The quality characteristic can be added to this target: ‘provide drinking water in accordance with WHO standards for 24 hours per day at a pressure of 10 mwc’. The time dimension can also be added: ‘before 31 December 1999’.

- 30. 30 HANDBOOK FOR THE ECONOMIC ANALYSIS OF WATER SUPPLY 2.6 Project Monitoring Mechanisms: The Means of Verification or “How Do We Obtain the Evidence?”1 17. The project manager, the government and the Bank need a management information system (MIS) that provides feedback on project progress at all levels of the Design Summary. This includes progress in disbursements, completion of activities, achievement of outputs, purpose and goals. Both measurable or verifiable indicators and means/mechanisms of verification provide the basis for project monitoring and evaluation systems. 18. To establish an effective monitoring and evaluation system or project performance management system, it is necessary to establish as part of the project design, flexible, inexpensive and effective means of verifying the status of project progress, at goal, objective and output level. In WSPs, sources of information could be progress reports, reports of review missions, water utility reports, statistical data, survey data, etc. 2.7 Risks and Assumptions 19. Risks and assumptions are statements about external and uncertain factors which may affect each of the levels in the Design Summary, and which have to be taken into account in the project design through mitigating measures. They may include the assumption that other projects will achieve their objectives. If worded positively, these statements are assumptions; if worded negatively, they are indicative of risk areas. This is illustrated in Box 2.7. Box 2.7 Example of Risks and Assumptions In water supply projects, assumptions could include: • the timely availability of land for construction of water intake; • the timely disbursement of funds; • a stable political situation; • the timely completion of the dam; and • regular adjustment of water tariffs. In terms of risks, these assumptions would be formulated as follows: • land not timely available for construction; • funds not timely disbursed; • political instability; • dam not ready in time; • water tariffs not regularly adjusted. 1 The newly-developed ADB-Project Performance Management System (PPMS) provides additional information and techniques on how to establish means and measures of verification.

- 31. CHAPTER 2 : PROJECT FRAMEWORK 31 20. Assumptions are conditions that must be fulfilled if the project is to succeed, but which are not under the direct control of the project. It is important to identify the so-called “killer assumptions” which, if not fulfilled, could stop the project from achieving its objectives. The following actions can be taken to manage killer assumptions: (i) assess the consequences of doing nothing; (ii) change project design; (iii) add a new project; (iv) closely monitor the project; and (v) ensure sufficient flexibility in the project design. 21. Certain risks can be eliminated by putting them as a condition to be fulfilled before project implementation. For example, water tariffs must be increased to achieve a targeted level of cost recovery; or the water enterprise should receive autono- mous status before the loan can become effective. In rural WSPs, another example would be to set certain criteria which must be met by sub-projects before they are approved. 22. Risks and assumptions made should be carefully taken into account in the risk and sensitivity analysis to be conducted as part of the economic and financial analysis. 2.8 The Project Framework Matrix: An example 23. Project Framework Matrices have been prepared for many projects. An example of such a matrix for a typical WSP is presented in Table 2.3.

- 32. Table 2.3 Water Supply Project Framework Design Summary Project Targets Proj. Monitoring Mechanisms Risks/Assumptions 1.Sector/Area Goals -Prevalence of water-related diseases among - Yearly epidemiological reports - no political 1.1 Improved target population reduced by 15% by 1999. of the Ministry of Health instability Health Situation -50% of people below poverty line have access - Water Enterprisereports - no natural disasters 1.2 Improved to water supply facilities by 1999. - Country report - sound macro- Living -Increased industrial development. - End of project reports economic policies Conditions -10% reduction of absenteeism by 1999 due to - Health Surveys 1.3 Sustained Socio- improved socio-economic/ living conditions. Economic Dev. -70% of women of target population have improved living conditions (more time, convenience, etc.) by 1999. 2. Project -no unexpected population growth in Objective/Purpose target areas. 2.1 Provide -Increase access to safe water supply to 70% of - Water Enterprise reports -current ground water improved and the target population by December 1999. - Progress reports tables will decrease sustained water dramatically because of drought (risk). supply to the -loan effectiveness by population of a first of January 1996. specified area. 3. Components/ - no delays in Outputs - four intakes, two treatment plants, 20,000 - Progress reports 3.1. - Existing house connections by 1997; - Water Enterprise reports contracting (building) infrastructure - 33.5 km transmission and distribution pipes contractors and rehabilitated; delivery of materials completed/replaced by 1997; -Physical - 24 hours service level operational; infrastructure - reduction of unaccounted for water from 40% constructed; to 30% by 1999.

- 33. 34 HANDBOOK FOR THE ECONOMIC ANALYSIS OF WATER SUPPLY Table 2.3 Water Supply Project Framework Design Summary Project Targets Proj. Monitoring Mechanisms Risks/Assumptions 3.2 Mitigating -Water resources study completed by 1995; - Environmental profile (and - no environmental -water quality protection measures in place by three yearly updates); disasters measures for - Progress reports - government ability 1996; negative -facilities to transport and treat wastewater in - Reports of Ministry of to enforce environmental place by 1997; Water & Provincial Water environmental -target population educated about water related Authorities effects in place. - Reports of Environmental protection environmental hazards; Protection Agency/Water Basin measures. -water reduction program operational by end of 1996. Authority 3.3 Sustainable Org. - 100% of required postings fulfilled with - Progress reports - sufficient qualified trained and motivated staff by 1999; - Water Enterprise reports local staff available and Management and willing to work in established. - effective O&M systems in place; - Management training reports remote areas; - management systems and procedures and training needs assessments of operational by 1997; staff; - no halt on governmental - autonomous status water enterprise approved - Data from management info vacancies; by 1997. systems; - Organogram of water - autonomy to water enterprise/staffing list indicating enterprise granted. qualifications of staff. 3.4 Financial -water enterprise ability to recover full costs by - monthly and yearly financial - proposed tariff 1998; reports of water enterprise; sustainability of -billing and collection system operational by increases approved by - progress reports. government. water enterprise January 1997; -financial management system effective; achieved -achieve reduction in “unaccounted for water” from 40% to 30% by 1999.

- 34. 3.5 User-oriented -achieve 90% coverage of target population - Special reports (Hygiene - no health disasters Activities (m/f) with hygiene education program by education/ environmental -Customers aware 1999; education at schools) about new services -70% of target population (m/f) know at least - Progress reports two out of three communicated hygiene - Water enterprise reports and about the safe messages; use of water; -collection rates increased from 60% to 85% by (consumer complaints list) -Customers use 1998; -Reports of the Ministry of - 50% of target population (m/f) apply at least Health and the Ministry of water supply two out of three communicated hygiene facilities safely Education behavior messages; 4. Activities 5. Inputs 4.1Develop Physical 5.1 - consultancy services for detailed eng’g. Infrastructure design / supervision (US$3 mn) -Detailed Eng’g. - $2 mn government funding for land - Progress reports and Review - loan awarded; Design acquisition; missions - government funds -Land acquisition - $50.5 mn funding for procurement of - Special reports awarded; -Procurement equipment and materials -Construction - provision for operational expenses -Supervision -Environmental Management 4.2.Environmental 5.2. - local consultancy services planned studies - Progress reports and Review - materials available component (10 person months) missions on time; -water rescues study - international consultancy services (6 - Special reports - no delay in -water quality person months) consultancy services; protection measures - local staff + government funding -facilities - US$1.5 mn funding for procurement of equipment and materials - US$3 mn for construction works

- 35. 36 HANDBOOK FOR THE ECONOMIC ANALYSIS OF WATER SUPPLY 4.3Establish 5.3. - US$ 0.8 mn p.a. government funding for - Progress reports and Review - resettlement Organization and local staff (operational costs) missions program effective - US$ 0.6 mn for consultancy - Special reports - contractors available Management - US$1.4 mn for training -Institutional Dev. on time; -Organization Dev. -Human Resource Dev. 4.4 Establish 5.4. - US$0.3 mn for computer and - Progress reports and Review sustainable financial management information system missions - international consultancy services (4 mm) - Special reports framework - local consultancy services (12 mm) -establish tariff - computer hardware US$0.7 mn structure -financial management system operational 4.5 Community- 5.6. - US$0.5 mn for training and extension - Progress reports and Review Oriented Activities materials; missions -community info - 36 person months local consultancy staff, - Special reports programs 12 person months international -Health education consultants; -community org - US$0.2 mn for vehicles/other transport -PublicRelations means; - US$0.5 mn for public relations and mass programs media activities; - local staff Source: RETA 5608 Case Studies on Selected Water Supply Projects

- 36. CHAPTER 3 DEMAND ANALYSIS AND FORECASTING

- 37. 38 HANDBOOK FOR THE ECONOMIC ANALYSIS OF WATER SUPPLY CONTENTS 3.1 Effective Water Demand ..........................................................................................................40 3.1.1 Defining Effective Demand for Water.....................................................................40 3.1.2 Increasing Cost of Water Supply ...............................................................................41 3.2 The Demand for Water: Some Concepts ................................................................................42 3.2.1 Incremental vs. Nonincremental Demand for Water.............................................42 3.2.2 The Relation between Price and Quantity................................................................42 3.2.3 The Concept of Price Elasticity of Demand............................................................44 3.2.4 Different Demand Curves for Different Products .................................................45 3.2.5 The Relation between Household Income and the Demand for Water .............46 3.2.6 Other Determinants of the Demand for Water ......................................................48 3.3 The Use of Water Pricing to “Manage” Demand ..................................................................51 3.3.1 Instruments of Demand Management......................................................................51 3.3.2 Cumulative Effects of Water Demand Management and Conservation Programs .......................................................................................54 3.4 Data Collection ............................................................................................................................55 3.4.1 Cost Effectiveness of Data Collection......................................................................55 3.4.2 Sources for Data Collection ......................................................................................55 3.4.3 Contingency Valuation Method (CVM)....................................................................56 3.5 Demand Forecasting...................................................................................................................56 3.5.1 Forecasting Urban Water Supply: the Case of Thai Nguyen ...............................56

- 38. CHAPTER 3: DEMAND ANALYSIS & FORECASTING 39 Figures Figure 3.1 An Individual’s Water Demand Curve: Linear and Non-Linear Relationships…………………………………………..…43 Figure 3.2 Demand Curves for Water from Public Taps vs. House Connections…………… 45 Figure 3.3 Relation between Demand and Income: Shift of Demand Curve……………….. 47 Figure 3.4 Demand Management………………………………………………………….. 51 Boxes Box 3.1 Example of Constrained Water Demand……………………………………………40 Box 3.2 The Future Costs of Water……………………………………………………….. 41 Box 3.3 Relationship between WTP and Income…………………………………………….46 Box 3.4 Increased Water Tariff in Bogor, Indonesia…………………………………………52 Box 3.5 Demand Management and Investment Planning in Australia……………………… 54 Box 3.6 Thai Nguyen Case Study: Description of Service Area…………………………… 57 Box 3.7 Thai Nguyen Case Study: Assumptions Used, Ability to Pay and Willingness to Pay………………………...…58 Box 3.8 Thai Nguyen Case Study: Number of Persons per Connection…………………… 60 Box 3.9 Thai Nguyen Case Study: Existing Consumption………………………………… 61 Box 3.10 Thai Nguyen Case Study: Indication of the Price Elasticity……………………….. 64 Box 3.11 Thai Nguyen Case Study: Estimating Future Demand…………………………… 65 Box 3.12 Thai Nguyen Total Domestic Demand…………………………………………… 66 Box 3.13 Example of Estimating Industrial Consumption…………………………………… 67 Box 3.14 Example of Estimating Nondomestic Consumption……………………… ……… 68 Box 3.15 Application of Technical Parameters……………………………………………….. 70 Box 3.16 Determination of Nonincremental Water………………………………………… 75 Tables Table 3.1 Major Determinants of Water Demand…………………………………………… 50 Table 3.2 Demand Forecast and Required……………………………………………………71 Table 3.3 Nonincremental Water from connected users (in lcd)…………………………… 73 Table 3.4 Average Nonincremental Water of nonconnected users (in lcd)……………………74 Table 3.5 Calculation of Nonincremental Demand…………………………………………. 77

- 39. 40 HANDBOOK FOR THE ECONOMIC ANALYSIS OF WATER SUPPLY 3.1 Effective Water Demand 3.1.1 Defining Effective Demand for Water 1. The “effective demand” for water is the quantity of water demanded of a given quality at a specified price. The analysis of demand for water, including realistically forecasting future levels of demand, is an important and critical step in the economic analysis of water supply projects. The results of demand analysis will enable the project team to: (i) determine the service level(s) to be provided; (ii) determine the size and timing of investments; (iii) estimate the financial and economic benefits of the project; and (iv) assess the ability and willingness to pay of the project beneficiaries. Furthermore, the surveys carried out during the demand assessment will provide data on cost savings, willingness to pay, income and other data needed for economic analysis. 2. It is useful to note the difference between “effective demand” for water and “actual consumption” of water. Water consumption is the actual quantity of water consumed whereas effective demand relates that quantity to the price of water. For example, a low level of water consumption may not represent effective demand but may instead indicate a constraint in the existing supply of water. This is illustrated in Box 3.1. Box 3.1 Example of Constrained Water Demand In Rawalpindi, Pakistan, the existing water supply system provided water for only an average of 3.8 hours per day and, on average, six days per week. Families connected to the public water supply system used an average 76 lcd. An additional 16 lcd was collected from secondary sources. From the household survey it appeared that during the (dry) summer, 86 percent of the population found the supply of water insufficient compared to 50 percent during the winter. Effective demand for water was higher than the quantity the utility was able to supply. This suggests that effective demand was constrained by existing supply levels. Source: RETA 5608 - Case Study on the Water Supply and Sanitation Project, Rawalpindi, Pakistan

- 40. CHAPTER 3: DEMAND ANALYSIS & FORECASTING 41 3.1.2 Increasing Cost of Water Supply 3. The demand for water is rising rapidly, resulting in water becoming increasingly scarce. At the same time, the unit cost of water is increasing, as water utilities shift to water sources farther away from the demand centers. Water from more distant sources may also be of lower quality. The costs of transporting water from the source to the consumer and that of water treatment necessary to meet potable water standards are becoming significant components of the unit cost of water. 4. The increase in the cost of water can be seen when the cost per cubic meter of water used by current water utilities is compared with the cost per cubic meter of water in new water supply projects (WSPs). This relation is shown in Box 3.2. Box 3.2 The Future Cost of Water For example, the current cost of water in Hyderabad is below $0.2 per m3 whereas in the figure below, the calculated cost of future water to be supplied through new schemes is more than $0.6 per m3. This means that future water is more than three times as expensive as water from the existing resources. Note that the points on line 1 indicate that future costs of water equal the current cost; the points on line 2 indicate that the future costs per unit are twice the current costs. Line 3 Line 2 Future Cost Line 1 1.4 Amman 1.2 1.0 Line 1: Current costs 0.8 Mexico City equal future costs Hyderabad Line 2: Future costs 0.6 Lima are twice as high Algiers as current costs 0.4 Dhaka Line 3: Future costs 0.2 Banglaore are three times as Shenyang high as current costs 0.0 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 3 US$/m Current Cost Source: Serageldin, Ismail. 1994. The Financing Challenge.

- 41. 42 HANDBOOK FOR THE ECONOMIC ANALYSIS OF WATER SUPPLY 5. Box 3.2 reinforces the importance of making optimum use of scarce water resources by avoiding inefficiencies and wastage in existing supplies and designing efficient future investment projects. In designing new projects, it is becoming increasingly important to make optimum use of existing resources to be able to avoid or postpone costly investments in the future. 3.2 The Demand for Water: Some Concepts 3.2.1 Incremental vs. Nonincremental Demand for Water 6. A WSP usually increases the supply of water either by making more effective use of existing supply capacity or by adding additional supply capacity. To the consumer, the additional capacity supplied will either displace and/or add to already existing water sources. Every person uses water for drinking, cooking, bathing, washing of clothes, for sanitation purposes, etc. Sources of water include piped water supply systems, dugwells, hand pumps, canals, ponds, rivers, bottled water, water from vendors, rainwater, etc. 7. If the additional supply of water is used to displace already existing sources, it is called nonincremental demand. For example, a household which obtains a new connection to the piped water supply system may no longer make use of the existing dugwell. 8. If the additional supply of water generates an increase in existing consumption, it is called incremental demand. For example, a household obtaining its water from a well at a distance of 300 meters may increase its water consumption from 450 liters to 650 liters per day after a public tap is installed in closer proximity to the house. 3.2.2 The Relation between Price and Quantity 9. From an economic perspective, the price of water is an important determinant of per capita water consumption. The relation between the quantity of water used and the price is illustrated by a demand or willingness-to-pay curve for water, an example of which is given in Figure 3.1.

- 42. CHAPTER 3: DEMAND ANALYSIS & FORECASTING 43 10. The downward sloping demand curve indicates the “decreasing marginal value” of water. The first five liters of water per capita per day will be extremely valuable as they are necessary to sustain life. This is illustrated by curve D1D1 in Figure 3.1. The second five liters will also be valuable, (e.g. in their use for hygienic purposes). The next five liters are valuable for food preparation, cooking and washing of clothes. All other factors being equal, for each additional increment of water, the marginal value of water tends to decline as the individual is putting the water to less and less valuable uses. Consequently, the individual’s willingness to pay for each increment of water will gradually decrease. 11. D1 D1 in Figure 3.1. represents a non-linear curve for an average household and shows an example of an individual’s water demand or willingness-to-pay curve. If the water tariff is increased from $0.25 to $0.50, this individual would (all other factors remaining equal) reduce daily consumption from 140 liters to 115 liters. Figure 3.1 An Individual’s Water Demand Curve: Linear and Non-linear Relationships Price (US$/m 3 D 1D 1 1.00 . 75 .50 D 2D 2 . 25 0 140 115 Quantity (lcd ) 12. In this Handbook, a linear demand curve will often be used for illustrative purposes, as indicated by line D2 D2. However, the nonlinear relationship between quantity and price is probably a better approximation of the actual behavior of water users.

- 43. 44 HANDBOOK FOR THE ECONOMIC ANALYSIS OF WATER SUPPLY 3.2.3 The Concept of Price Elasticity of Demand 13. One question which often arises when considering the demand curve is how much the quantity demanded by an individual will change when the price per unit of water changes. The price elasticity of demand is a measure that describes the degree of responsiveness of the quantity of water to a given price change and is defined as follows: percentage change in the quantity of water demanded ep = - --------------------------------------------------------------------------- percentage change in the price per unit of water dQ/Q dQ P dQ P P ep = - ------ = - ---- x ---- = - ----- x ---- = slope x ---- dP/P Q dP dP Q Q 14. The price elasticity of demand for water is normally negative because the demand curve is downward sloping, which means that an increase (decrease) in price is expected to lead to a reduction (increase) in demand. 15. If ep < |1 |, demand is ‘inelastic’. For example, if an increase of 25 percent in water fees leads to a 10 percent reduction in the demand for water, this would result in a price elasticity of -0.40. The relative change in quantity demanded (dQ/Q) is, in this case, smaller than the relative change in price (dP/P). 16. If ep > |1 |, demand is elastic. For example, if a 25 percent increase in water fees leads to a 50 percent reduction in demand, this would result in a price elasticity of -2. The percentage change in quantity demanded is larger than the percentage change in price. 17. For a linear demand curve as can be verified through the formula for ep, the higher the price, the higher the absolute value of price elasticity. Using a nonlinear demand curve (Figure 3.1), it can be seen that for the first few liters of water, demand will be very inelastic, meaning that the consumer is willing to pay a high price for the given volume of water. As the marginal value of the water gradually declines, the consumer’s demand will become increasingly elastic, meaning that price fluctuations will result in larger changes in quantity demanded. 18. In studies carried out by the World Bank (Lovei, 1992), it has been found that the price elasticity for water typically ranges between -0.2 and -0.8, indicating

- 44. CHAPTER 3: DEMAND ANALYSIS & FORECASTING 45 inelastic demand. For example, e = -0.2 means that a 10 percent increase in price would lead to a reduction in the quantity demanded by only 2 percent. 3.2.4 Different Demand Curves for Different Products 19. The definition of effective demand mentions “ the demand for water of a certain quality”. The quality of the product “water” is not easily explained and a number of characteristics are normally included in defining it, including chemical composition (e.g., WHO standards), taste and smell, water pressure, reliability of supply, accessibility and convenience. The first two characteristics determine the quality of water in the stricter sense. The other characteristics define water quality in its broader sense. 20. The combination of these characteristics will determine the “product” water or service level. Up to a certain point, an individual is prepared to pay a higher price for a product with a higher quality. For the same “quantity” of water, an individual will be willing to pay a higher price for a higher quality product. For example, consumers are normally willing to pay a higher price for water from a house connection than for water from a public tap. In this case, there are two different demand curves: one for house connections (HC) as shown in Figure 3.2, and one for public taps (PT) as shown in Figure 3.3. F i g u r e 3 . 2 D e m a n d C u r v e s f o r W a t e r f r o m P u b lic T a p s v s . H o u s e C o n n e c t i o n s WTP (price per m 3 ) P2 HC P1 PT O Q1 Quantity (m3)

- 45. 46 HANDBOOK FOR THE ECONOMIC ANALYSIS OF WATER SUPPLY 3.2.5 The Relation between Household Income and the Demand for Water 21. Households with high income are normally able and willing to pay more for a given quantity of water than households with lower incomes. In relative terms (as a percent of income) however, people with higher incomes are prepared to pay smaller percentages of their income for water than people with lower incomes. These statements were confirmed in the case studies and are illustrated in Box 3.3. Box 3.3 Relationship Between WTP and Income The relationship between willingness to pay and month income has been confirmed in the case studies. For example, in Jamalpur, Bangladesh, the relationship as illustrated below was found. WTP (TK/month) WTP % Income 140 3.5% 120 3.0% Average of WTP % of Income 1 100 2.5% Log.(Avg. of WTP) Log. (% of Income) 80 2.0% 60 1.5% Curve 1: Y = 20.891Ln(X) – 113.22 R 2 = 0.3848 Curve 2: Y = -0.008Ln(X) + 0.0821 40 1.0% R 2 = 0.8298 20 2 0.5% Y refers to dependent variable on vertical axis. 0 0.0% X refers to the independent 0 5000 10000 15000 20000 25000 30000 variable (horizontal axis) HH Income (TK/month) Curve 1 explains the relationship between income and WTP in absolute terms. Households with higher income are willing to pay more for the total quantity of water consumed. Curve 2 illustrates the relation between income and WTP as a percentage of income. When income increases, a smaller proportion of household income is set aside to pay for water. Source: RETA 5608 Case Study on the Jamalpur Water Supply and Sanitation Project, Bangladesh