2022/11/17 PRIMA2022: Does Order Simultaneity Affect the Data Mining Task in Financial Markets? -- Effect Analysis of Order Simultaneity using Artificial Market

- 1. Does Order Simultaneity Affect the Data Mining Task in Financial Markets? -- Effect Analysis of Order Simultaneity using Artificial Market Masanori HIRANO, Kiyoshi IZUMI School of Engineering, The University of Tokyo research@mhirano.jp https://mhirano.jp/

- 2. ©M.HIRANO & Izumi Lab. Efficient Market Hypothesis PRIMA2022 https://medium.com/@100trillionUSD/efficient-market-hypothesis-and-bitcoin-stock-to-flow-model-db17f40e6107 2 11/17/2022

- 3. ©M.HIRANO & Izumi Lab. Adam Smith's The Invisible Hand • Adam Smith’s “An Inquiry into the Nature and Causes of the Wealth of Nations” Vol.4, Chap.2 “The invisible hand” • Even if investors act selfishly, they will eventually be guided by the invisible hand to make the economy efficient and grow. PRIMA2022 3 11/17/2022

- 4. ©M.HIRANO & Izumi Lab. Difficultness of prediction in Financial Market • In financial market • Prediction is difficult • Prediction models are always compared with chance rate • Prediction uncertainty in financial markets • It is not clear how to express the “uncertainty” • It is also unclear where the “uncertainty” come from • According to Efficient Market Hypothesis, • Easy prediction will be not working • Even small prediction is great PRIMA2022 4 11/17/2022

- 5. ©M.HIRANO & Izumi Lab. Try to Explain Scientifically • If we can’t predict… • Why it can’t? • What contribute the difficultness? • Want to make it clear: • What is truly unpredictable? • What is current technical problems? • Blueprint: decomposition of unpredictability PRIMA2022 Market Efficiency Trading rule Technical Unexpected outsider 5 11/17/2022

- 6. ©M.HIRANO & Izumi Lab. Advantages of Artificial Market Simulation • Everything are under control in simulations • Enabling comparative experiments • Artificial market simulation + Datamining • The predictive potential of data mining can be examined in controlled markets! • In our previous study, • Proposed a scheme for this, called “Artificial Market Data Mining Platform” • Demonstrated the potential of using financial market simulation + data mining PRIMA2022 6 11/17/2022

- 7. ©M.HIRANO & Izumi Lab. Artificial Market Data Mining Platform PRIMA2022 7 11/17/2022 https://doi.org/10.1109/CIFEr52523.2022.9776095

- 8. ©M.HIRANO & Izumi Lab. The hypothesis we test in this study • Target: Order sequence of financial markets • Order sequence generation is the most fundamental prediction task • We assumed order generation • Hypothesis: The order simultaneity has a significant effect on the prediction performances • In actual markets, the order sequence in a few ticks is meaningless: 𝑃 𝑥𝑖 𝑥𝑖−1, 𝑥𝑖−2, … , 𝑥0) = 𝑃 𝑥𝑖 𝑥𝑖−2, 𝑥𝑖−3, … , 𝑥0) = 𝑃 𝑥𝑖 𝑥𝑖−3, 𝑥𝑖−4, … , 𝑥0) • For example, if there are 10 high-speeding traders, does the order generation performance become lower? • Method: • Assume the simultaneity, then, compare the generation accuracy “for each trader’s order” vs. “for aggregated orders” 11/17/2022 PRIMA2022 8

- 9. ©M.HIRANO & Izumi Lab. Model & Experiments Outline 11/17/2022 PRIMA2022 9

- 10. ©M.HIRANO & Izumi Lab. Stylized Trader Agents [Chiarella et al. 02] • Logarithmic return prediction for bid/ask price 𝑟 = 1 𝑤𝐹+𝑤𝐶+𝑤𝑁 𝑤𝐹 ⋅ 𝐹 + 𝑤𝐶 ⋅ 𝐶 + 𝑤𝑁 ⋅ 𝑁 • Fundamentals 𝐹 = 1 mean reversion time ln current market price current fundamental price • Chartist (trend) 𝐶 = logarithm averaged return in the past • Noise 𝑁 ~ 𝑁 0, 𝜎𝑁 • + margin => decide price • We changed in 𝑤𝐹, 𝑤𝐶, 𝜎𝑁 • (More precisely, 𝑤𝐹, 𝑤𝐶, 𝜎𝑁 are given as a exponential distribution and they are representing values.) PRIMA2022 10 11/17/2022

- 11. ©M.HIRANO & Izumi Lab. Simulation Model PRIMA2022 … 10 agents Market 1 order for each step and each agent Arrival sequence are randomized for realizing order simultaneity Generate next orders for each agent Generate next orders for aggregated orders 11/17/2022 11

- 12. ©M.HIRANO & Izumi Lab. GAN for financial market • Policy Gradient Stock GAN (PGSGAN) • Unlike usual GANs, generate policy and sampling orders to consider the discreetness of orders • Generate next orders better than the previous works • We can also use the distributional policy (the distribution of the next orders) for the other purpose • https://arxiv.org/abs/2204.13338 PRIMA2022 12 Generator Condition Noise Critic Real Policy Fake Sampling Hinge Loss 11/17/2022

- 13. ©M.HIRANO & Izumi Lab. Parameters • Changing parameters • 𝑤𝐹 = 3.0, 10.0: The weight for Fundamentals • 𝑤𝐶 = 3.0, 10.0: The weight for Charts • 𝜎𝑁 = 0.01, 0.001, 0.0001: Noise Scale • Fixed parameters • Simulation parameter • # of agents: 10 (simultaneity) • Start price: 500 • Tick size: 1 • Fundamental: 500 • GAN parameter • Training epoch: 1000 (convergence is confirmed) • Learning Rate: 0.001 (convergence is confirmed) • TTUR: G:C = 5:1 • Price Class: 20 (ticks from the best values) • History input: 32 (ticks) • Random variable dimension for generation: 10 PRIMA2022 11/17/2022 13

- 14. ©M.HIRANO & Izumi Lab. Comparison • Compared between • The next order prediction of each agents (ABOG: Agent-Based Order Generation) • The next order prediction of aggregated order sequential (AggOG: Aggregated Order Generation) • Metrics • Likelihood (NLL) in validation data • Other metrics for additional analysis • GAN depends on random variable; therefore, metrics are calculated for 100 different random variables for each situation. PRIMA2022 11/17/2022 14

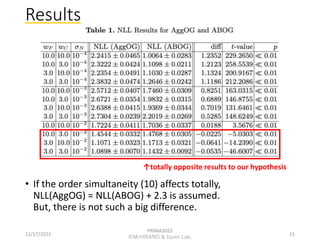

- 15. ©M.HIRANO & Izumi Lab. Results PRIMA2022 • If the order simultaneity (10) affects totally, NLL(AggOG) = NLL(ABOG) + 2.3 is assumed. But, there is not such a big difference. ↑totally opposite results to our hypothesis 11/17/2022 15

- 16. ©M.HIRANO & Izumi Lab. Discussion • Overall results • Moderate noise size cause the most prediction difficulties. • If the noise size is smaller, the effect of order simultaneity is marginally emerging. • Discussion on our hypothesis • The effect of order simultaneity can be admitted under some conditions. • 10 order simultaneity is equivalent to 2.3 (=ln(10)) in NLL. But, such a difference cannot be observed. • When the noise size is bigger, the generator can generate the next aggregated orders better than the individual agent’s orders. • Aggregated orders have a bigger size of data compared with individual ones. Bigger data can achieve better learning • Suggesting the potential of aggregated prediction • The current GAN approach in financial markets (aggregated order sequence generation) accords with our results. • Artificial market data mining platform seems promising PRIMA2022 11/17/2022 16

- 17. ©M.HIRANO & Izumi Lab. Conclusion & Future work • We investigated the effect of order simultaneity in financial market order generation tasks. • We showed that the effect is very limited, and aggregated order data is beneficial for generations when the noise is bigger. • Our results support the current approach of GANs in financial markets. • Artificial market data mining platform seems promising • For future work, more unknown phenomena in financial markets should be investigated using the platform. 11/17/2022 PRIMA2022 17

Editor's Notes

- #3: At first, I’ll explain the Efficient Market Hypothesis. As many of you know, this is a well-known principal but it is not proven. This art illustrates efficient market hypothesis. The man in the art say …. It means that everyone thinks money is not on the sidewalk because other people have already took it if it is worth. In the context of the financial market, the efficient market hypothesis means there is no beneficial information because if they exist, someone has already taken it. (you know), there are some types of level of this hypothesis such as weak, semi-strong, strong. But, in this study, we will not distinguish them.

- #4: Before the efficient market hypothesis, Adam smith also propose “the invisible hand”. According to him, Even if investors act selfishly, they will eventually be guided by the invisible hand to make the economy efficient and grow. Those assumptions, I mean the efficient market hypothesis and the invisiblehand, seems slightly strong assumption but widely spread.

- #5: On the contrary, difficultness of financial prediction tasks is frequently argued. And in many studies, the prediction performances are frequently compared with chance rate. I also understand the difficulty. However, many studies said the difficulties come from uncertainty or efficient market hypothesis. Of course, I think it is true. For example, it is …, it is …. Moreover, because of efficient market hypothesis, easy prediction… and even small …. However, are they quantitated? How big is the uncertainty? Which level of efficient market hypothesis you’re assuming?

- #6: Thus, for addressing those questions, I think explaining them scientifically is necessary, or it is exactory what we should do as academic research. More easier, if (スライドの文2段落) My blueprint for it is like this. For example, 40% of unpredictability comes from market efficiency and 20% … 20% … 20%..

- #7: For this purpose, we come up with the usage of artificial market simulations. The advantages of artificial market simulations are explained here. Firstly, (第一段落). Secondary, using the combination of artificial market simulation and datamining, The predictive potential…. In this study, … However, there are something we can't show in this study. The results obtained are still very limited and there are many things we should address in future work

- #8: This is the concept picture of Artificial Market Data Mining Platform. Basically, this is the combination of artificial market simulation and datamining. It is a kind of digital twin of financial markets. In this concept, data mining methods are applied under the artificial market simulation. Thus, we can control all the situation of markets. By controlling the market situation at all, we correctly compared the datamining performances. This is just a concept, so the different type of experiments also can be carried. But, we assumed that traders publish their orders in artificial market simulations and those orders are processed in artificial market. Then aggregating those orders, index or charts are generated. Using those data, data-mining methods are carried. But, the flow is not limited to this.

- #11: Next, I’ll explain The details of the stylized trader. In the stylized trader agents, as I mentioned in the previous slide, the traders decide there orders based on fundamentals, chart, and noise. In this simulation, those weight are important. Thus, we fixed the weight for noise and changed the weight for fundamentals and charts. Moreover, instead of noise weight, we changed the noise size (sigma N). In addition to those parameters, we also change in the number of agents existing in simulations.

![©M.HIRANO & Izumi Lab.

Stylized Trader Agents [Chiarella et al. 02]

• Logarithmic return prediction for bid/ask price

𝑟 =

1

𝑤𝐹+𝑤𝐶+𝑤𝑁

𝑤𝐹 ⋅ 𝐹 + 𝑤𝐶 ⋅ 𝐶 + 𝑤𝑁 ⋅ 𝑁

• Fundamentals

𝐹 =

1

mean reversion time

ln

current market price

current fundamental price

• Chartist (trend)

𝐶 = logarithm averaged return in the past

• Noise 𝑁 ~ 𝑁 0, 𝜎𝑁

• + margin => decide price

• We changed in 𝑤𝐹, 𝑤𝐶, 𝜎𝑁

• (More precisely, 𝑤𝐹, 𝑤𝐶, 𝜎𝑁 are given as a exponential distribution

and they are representing values.)

PRIMA2022

10

11/17/2022](https://image.slidesharecdn.com/20221117primafinancial-221117120732-1075f512/85/2022-11-17-PRIMA2022-Does-Order-Simultaneity-Affect-the-Data-Mining-Task-in-Financial-Markets-Effect-Analysis-of-Order-Simultaneity-using-Artificial-Market-10-320.jpg)