"A Framework-Based Approach to Building Quantitative Trading Systems" by Dr. Michael Halls-Moore, Founder of QuantStart.com

- 1. A Framework-Based Approach toA Framework-Based Approach to Building Quantitative Trading SystemsBuilding Quantitative Trading Systems QuantCon NYC – 29QuantCon NYC – 29thth April 2017April 2017 Michael Halls-MooreMichael Halls-Moore QuantStart.comQuantStart.com

- 2. Talk OutlineTalk Outline ● About QuantStart ● The US equities market ● Typical retail trader approach ● The need for a quantitative framework ● Portfolio management ● Risk management ● Forecasting ● Good tools ● Who to read

- 4. About QuantStart.comAbout QuantStart.com ● My Background: – Computational fluid dynamics (CFD) research in aerospace – Quant trading infrastructure development at London-based US equities fund ● QuantStart.com: – Founded in 2012 – Talks about systematic trading, quant development, careers and machine learning – Mainly Python, R, C++ and open-source backtesting – Bringing institutional methods to retail traders

- 5. The US Equities MarketThe US Equities Market

- 6. The US Equities Market #1The US Equities Market #1 ● Liquid Low spreads, easy to execute quickly at desired price→ ● Exchange-traded Not trading obscure OTC instruments→ ● Easy retail access Many retail equities brokerages→ ● Can access with smaller account sizes – Cash purchases – Individual stocks far cheaper than futures ● Various benchmark indexes – S&P, Dow, Russell – Mostly interested in S&P500 universe at retail level

- 7. The US Equities Market #2The US Equities Market #2 ● Indexes discussed in the media are misleading ● DJIA has price-weighted methodology ● S&P500 has market-capitalisation weighted methodology ● But...S&P500 is not 'the market': – By definition it disproportionately favours big firms, i.e. AAPL ● Does not include dividend reinvestment Total return→ ● A good benchmark instead would be S&P500 Total Return index

- 8. Typical Retail Trader ApproachTypical Retail Trader Approach

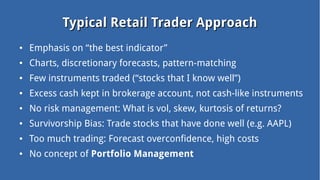

- 9. Typical Retail Trader ApproachTypical Retail Trader Approach ● Emphasis on “the best indicator” ● Charts, discretionary forecasts, pattern-matching ● Few instruments traded (“stocks that I know well”) ● Excess cash kept in brokerage account, not cash-like instruments ● No risk management: What is vol, skew, kurtosis of returns? ● Survivorship Bias: Trade stocks that have done well (e.g. AAPL) ● Too much trading: Forecast overconfidence, high costs ● No concept of Portfolio Management

- 10. Why Is This Bad? #1Why Is This Bad? #1 ● Discretionary forecasts are too inconsistent – Tied to emotional state and cognitive biases (see Kahneman et al) ● “Lines on charts” are too ambiguous – No repeatable methodology – Far better quantitative methods available ● No risk parity – Assets with higher vol dominate portfolio returns behaviour ● No rebalancing – Risk is dynamic, so allocations need adjustment over time

- 11. Why Is This Bad? #2Why Is This Bad? #2 ● Few instruments → No diversification ● Survivorship Bias Backtest→ optimism inflated ● Cash Positions Brokerages→ collapse taking cash with them ● No tail-risk planning – What rules are followed in 1987, 2001, 2008? – Often the worst time to tinker with a “system” ● In summary – No portfolio management, no risk management, no consistency

- 12. The Need for a Quantitative FrameworkThe Need for a Quantitative Framework

- 13. The Need for a Quantitative FrameworkThe Need for a Quantitative Framework ● Systematic Framework – Eliminates discretionary decision making – But requires substantial confidence and discipline! ● Risk Parity – Each asset is volatility standardised Equal “risk” in every asset→ ● Rebalancing – Risk is dynamic Periodically rebalance to reflect changing allocation of risk→ ● Position Sizing – Quantitative approach for how much to “bet” per asset ● Diversification – Enough stocks to ensure luck is less important in portfolio performance

- 14. Performance MeasurementPerformance Measurement ● Must decompose where our performance and risk comes from ● Important for equities: Alpha, Beta and Sharpe ● Beta: Risk arising from exposure to benchmark (or market) ● Alpha: Measures the excess return on a portfolio ● Sharpe: Mean excess return divided by std of returns – But...it is a very misleading metric for a number of reasons! ● “Vol is the currency we pay for performance” - Andreas Clenow ● All measures are backward-looking

- 16. Portfolio Management #1Portfolio Management #1 ● Requires a significant shift in thinking! ● Biggest difference between retail and institutional behaviour ● Portfolio management is not about allocation of cash but about allocation of risk – What risks am I taking in order to achieve my returns? ● The goal: – Obtain high risk-adjusted returns – Achieve good diversification – Minimise the costs of trading/rebalancing while doing so

- 17. Portfolio Management #2Portfolio Management #2 ● Began formally with Harry Markowitz in 1950s – His essay and PhD thesis became Modern Portfolio Theory (MPT) – He, along with Sharpe and Miller, received Nobel Prize in 1990 for this ● Extended into Capital Asset Pricing Model (CAPM) – Origins of “Alpha” and “Beta” as linear regression coefficients ● Efficient Market Hypothesis (EMH) dominated in 70s/80s ● Factor Analysis Fama & French three-factor model→ ● Behavioural Economics Cognitive biases and investor→ psychology grew in importance

- 18. Portfolio Management #3Portfolio Management #3 ● Today there is strong academic evidence for persistent equity market “anomalies”: – Value premium Graham & Dodd, Buffett→ – Size premium Small-cap stocks outperforming large-cap stocks→ – Momentum Positive serial correlation of returns→ – And others... ● Our portfolios can take advantage of these – Generate forecasts based on these anomalies – Systematically exploit them across a diversified set of stocks

- 20. Risk Parity #1Risk Parity #1 ● Allocation based on trailing std of returns of assets – Bonds get larger allocation than equities due to lower std – Increase leverage to get similar returns to equities with lower vol ● First used by Bridgewater Associates in their “All Weather” fund (1996) – Now all major asset allocators have a risk parity fund – Each of them have a proprietary methodology ● Is sometimes called “Volatility Standardisation” ● Can have a big impact on risk-adjusted returns over long-term

- 21. Risk Parity #2Risk Parity #2 ● We will define “risk parity” here as: – Volatility-adjusted allocations of stocks only – Higher std returns implies lower allocation – No other asset classes (don't need to worry about bonds!) ● Many ways to calculate it – Average True Range (ATR) – Trailing std of returns (250 trading days) – More technical estimates of volatility (large literature on this)

- 22. Risk Parity #3Risk Parity #3 ● Must also take correlation into account: – No value in having thirty highly correlated stocks, even if vol-adjusted – You're taking ONE bet not THIRTY! ● Volatility Measures: – Often backward-looking and non-stationary – Says nothing about future volatility – Must be periodically re-estimated

- 24. Portfolio Rebalancing #1Portfolio Rebalancing #1 ● Dynamically adjust risk allocation based on new information ● Another big difference between retail and institutional quants ● Volatility is dynamic – Modelled as conditional heteroskedastic (e.g. GARCH family of models) – Vol often higher in times of distress (e.g. 2008) ● Correlations are dynamic – Correlations can increase to unity in times of distress (again, 2008!)

- 25. Portfolio Rebalancing #2Portfolio Rebalancing #2 ● To maintain risk parity positions are periodically resized – Weekly or monthly – Daily can be too “noisy” and expensive for some asset allocators ● Most trades now become rebalances – Small adjustments are made to position sizes when it is not too expensive to carry out

- 27. Risk ManagementRisk Management ● How much to bet per desired asset? Position sizing→ ● Vol, skew and kurtosis: – What is the historical distribution of portfolio returns? ● Non-stationarity of returns: – Market regime filtering – Future is different from the past ● Counterparty Risk – Brokerage goes under (have seen this personally!) ● Trading infrastructure fails/has bugs

- 29. Position Sizing #1Position Sizing #1 ● How much risk to take per “bet” or per stock? ● Depends upon: – Desired level of diversification More stocks means less per stock→ – Total account size Small accounts reduce number of available bets→ – Your tolerance for risk What drawdowns can you stomach over a→ particular timeframe? ● For equities in particular: – Too few stocks is just random luck Apple vs Lehman Brothers→ – Too many stocks will have high beta

- 30. Position Sizing #2Position Sizing #2 ● Can use tools like Kelly criterion – Optimal size of a series of bets f*→ – Institutional constraints can limit optimal growth rate – “Fractional Kelly” or “Half Kelly” often used in practice ● Can target a level of desired volatility impact per stock – E.g. with a portfolio of $250,000 and risk target of 10 basis points daily vol per stock, we want each stock position to have $250 daily impact – Dividing this number ($250) by the daily std of the stock (say, $4.67), gives 250/4.67 ~= 53 shares – Increasing the risk target increases the shares purchased per asset

- 31. Market Regime FilteringMarket Regime Filtering

- 32. Market Regime FilteringMarket Regime Filtering ● Long-only stock strategies are often well-correlated to the market: – Become even more so in times of distress ● Basic idea is not to have high stock exposure in bear markets ● Can detect regimes in many ways: – Moving averages Index above or below its long-term moving average→ – State-space models Hidden Markov Models→ ● Why not short stocks? – Not symmetric due to availability of stock at broker and borrowing costs ● Regime filters can cause many “false positives”: – Better than the alternative of giving back substantial performance in a prolonged bear market!

- 34. Equities DataEquities Data ● Pay for good data ● Free data sources just don't cut it for the required accuracy ● Must be survivorship-bias free Include→ graveyard tickers ● Must have historical index constituents ● Must handle ticker mapping for mergers, spinoffs etc. ● Must have separate lists of dividends and splits ● All values of OHLCV should be split-adjusted, not just close ● Ideally use minutely OHLCV bars to better estimate fill price

- 35. BacktestingBacktesting ● Use robust backtesting software ● Most tools are “single instrument” Not good enough→ ● Should have extensible portfolio/risk management modules ● Free: Quantopian, zipline, QSTrader, PySystemTrade, others... ● Desktop/Paid: RightEdge, Deltix ● Will need to know programming Can't get away from this!→

- 37. ForecastingForecasting ● I've left it to the end - it's discussed to death elsewhere! ● As important as the other aspects, but not more so ● Look for equity market anomalies: – Value, size, momentum, PEAD, seasonal, etc. ● Can implement a lot of these with simpler “indicators” ● Or...more complex feature extraction (deep learning) ● Boils down to making a regressive forecast on an asset – Direction, with associated strength of conviction – E.g. momentum ranking, difference between two MA indicators

- 39. TakeawaysTakeaways ● Use a systematic portfolio management framework ● Benchmark against total return index of the stock universe ● Use risk parity for equal risk allocation ● Rebalance the portfolio to account for dynamic risk ● Choose own risk tolerance for position sizing, quantitatively ● Use a market regime filter to avoid prolonged bear markets ● Put cash in cash-like instruments ● Don't waste too much time on “the perfect indicator”

- 40. Who To ReadWho To Read

- 41. Who To Read #1 - BooksWho To Read #1 - Books ● W. Gray and J. Vogel: Quantitative Momentum ● A. Clenow: Stocks on the Move ● R. Carver: Systematic Trading ● G. Antonacci: Dual Momentum Investing ● L. Zacks: Equity Market Anomalies ● R. Grinold and R. Kahn: Active Portfolio Management ● D. Kahneman: Thinking Fast and Slow [for cognitive biases] ● ...some of the above are actually speaking here today!

- 42. Who To Read #2 - ResearchWho To Read #2 - Research ● AQR Research: – https://www.aqr.com/library ● BlackRock Research: – https://www.blackrock.com/corporate/en-br/insights/blackrock-investment-institute ● Bridgewater Associates Research: – https://www.bridgewater.com/research-library/daily-observations/ ● Cantab Capital: – https://www.cantabcapital.com/we-think/ ● Alpha Architect (Wes Gray et al): – http://www.alphaarchitect.com

![Who To Read #1 - BooksWho To Read #1 - Books

● W. Gray and J. Vogel: Quantitative Momentum

● A. Clenow: Stocks on the Move

● R. Carver: Systematic Trading

● G. Antonacci: Dual Momentum Investing

● L. Zacks: Equity Market Anomalies

● R. Grinold and R. Kahn: Active Portfolio Management

● D. Kahneman: Thinking Fast and Slow [for cognitive biases]

● ...some of the above are actually speaking here today!](https://image.slidesharecdn.com/aframework-basedapproachtobuildingquantitativetradingsystemsbydr-170503203629/85/A-Framework-Based-Approach-to-Building-Quantitative-Trading-Systems-by-Dr-Michael-Halls-Moore-Founder-of-QuantStart-com-41-320.jpg)