AFC Iraq Fund (non-US) Factsheet July 2025

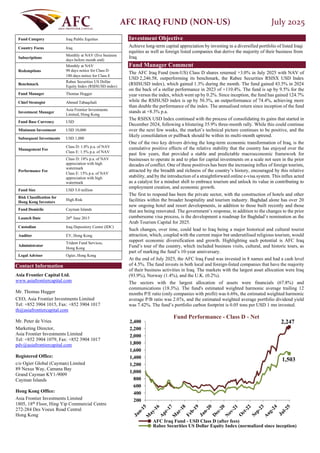

- 1. AFC IRAQ FUND (NON-US) July 2025 Fund Category Iraq Public Equities Country Focus Iraq Subscriptions Monthly at NAV (five business days before month end) Redemptions Monthly at NAV 90 days notice for Class D 180 days notice for Class E Benchmark Rabee Securities US Dollar Equity Index (RSISUSD index) Fund Manager Thomas Hugger Chief Strategist Ahmed Tabaqchali Investment Manager Asia Frontier Investments Limited, Hong Kong Fund Base Currency USD Minimum Investment USD 10,000 Subsequent Investments USD 1,000 Management Fee Class D: 1.8% p.a. of NAV Class E: 1.5% p.a. of NAV Performance Fee Class D: 18% p.a. of NAV appreciation with high watermark Class E: 15% p.a. of NAV appreciation with high watermark Fund Size USD 5.0 million Risk Classification for Hong Kong Investors High Risk Fund Domicile Cayman Islands Launch Date 26th June 2015 Custodian Iraq Depository Centre (IDC) Auditor EY, Hong Kong Administrator Trident Fund Services, Hong Kong Legal Advisor Ogier, Hong Kong Contact Information Asia Frontier Capital Ltd. www.asiafrontiercapital.com Mr. Thomas Hugger CEO, Asia Frontier Investments Limited Tel: +852 3904 1015, Fax: +852 3904 1017 th@asiafrontiercapital.com Mr. Peter de Vries Marketing Director, Asia Frontier Investments Limited Tel: +852 3904 1079, Fax: +852 3904 1017 pdv@asiafrontiercapital.com Registered Office: c/o Ogier Global (Cayman) Limited 89 Nexus Way, Camana Bay Grand Cayman KY1-9009 Cayman Islands Hong Kong Office: Asia Frontier Investments Limited 1805, 18th Floor, Hing Yip Commercial Centre 272-284 Des Voeux Road Central Hong Kong Investment Objective Achieve long-term capital appreciation by investing in a diversified portfolio of listed Iraqi equities as well as foreign listed companies that derive the majority of their business from Iraq. Fund Manager Comment The AFC Iraq Fund (non-US) Class D shares returned +3.0% in July 2025 with NAV of USD 2,246.58, outperforming its benchmark, the Rabee Securities RSISX USD Index (RSISUSD index), which gained 1.3% during the month. The fund gained 43.5% in 2024 on the back of a stellar performance in 2023 of +110.4%. The fund is up by 9.5% for the year versus the index, which went up by 0.2%. Since inception, the fund has gained 124.7% while the RSISUSD index is up by 50.3%, an outperformance of 74.4%, achieving more than double the performance of the index. The annualised return since inception of the fund stands at +8.3% p.a. The RSISX USD Index continued with the process of consolidating its gains that started in December 2024, following a blistering 35.9% three-month rally. While this could continue over the next few weeks, the market’s technical picture continues to be positive, and the likely consolidation or pullback should be within its multi-month uptrend. One of the two key drivers driving the long-term economic transformation of Iraq, is the cumulative positive effects of the relative stability that the country has enjoyed over the past few years, that provided a stable and predictable macroeconomic framework for businesses to operate in and to plan for capital investments on a scale not seen in the prior decades of conflict. One of these positives has been the increasing influx of foreign tourists, attracted by the breadth and richness of the country’s history, encouraged by this relative stability, and by the introduction of a straightforward online e-visa system. This influx acted as a catalyst for a mindset shift to embrace tourism and unlock its value in contributing to employment creation, and economic growth. The first to respond has been the private sector, with the construction of hotels and other facilities within the broader hospitality and tourism industry. Baghdad alone has over 20 new ongoing hotel and resort developments, in addition to those built recently and those that are being renovated. The government’s response, in addition to the changes to the prior cumbersome visa process, is the development a roadmap for Baghdad’s nomination as the Arab Tourism Capital for 2025. Such changes, over time, could lead to Iraq being a major historical and cultural tourist attraction, which, coupled with the current major but underutilised religious tourism, would support economic diversification and growth. Highlighting such potential is AFC Iraq Fund’s tour of the country, which included business visits, cultural, and historic tours, as part of marking the fund’s 10-year anniversary. At the end of July 2025, the AFC Iraq Fund was invested in 8 names and had a cash level of 4.5%. The fund invests in both local and foreign-listed companies that have the majority of their business activities in Iraq. The markets with the largest asset allocation were Iraq (93.9%), Norway (1.4%), and the U.K. (0.2%). The sectors with the largest allocation of assets were financials (67.8%) and communications (18.3%). The fund's estimated weighted harmonic average trailing 12 months P/E ratio (only companies with profit) was 6.69x, the estimated weighted harmonic average P/B ratio was 2.07x, and the estimated weighted average portfolio dividend yield was 7.42%. The fund’s portfolio carbon footprint is 0.05 tons per USD 1 mn invested. 2,247 1,503 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 2,200 2,400 Fund Performance - Class D - Net AFC Iraq Fund - USD Class D (after fees) Rabee Securities US Dollar Equity Index (normalized since inception)

- 2. AFC IRAQ FUND (NON-US) July 2025 NAV as of 31st July 2025 Class D Class E NAV 2,246.58 2,346.01 Since Inception 124.66% 134.60% Inception Date 26/06/2015 26/06/2015 Security Numbers for each of the Share Classes (for the “Lead Series”) Class D Class E ISIN KYG0133A1756 KYG0133A1830 CUSIP G0133A175 G0133A183 Bloomberg AFIRNUD KY AFIRNUE KY Valoren 28570227 28881954 93.9% 1.4% 0.2% 4.5% 0% 20% 40% 60% 80% 100% Country Allocation 67.8% 18.3% 7.9% 1.5% 4.5% 0% 20% 40% 60% 80% Sector Allocation Monthly Performances AFC Iraq Fund (non-US) Class D Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec YTD 2015 USD +0.00% -7.92% -5.20% -2.20% -7.00% -3.39% +0.56% -22.86% 2016 USD -9.71% -4.31% -5.85% -2.73% -8.59% +7.29% -1.92% -3.28% +0.55% +1.91% +0.53% +4.83% -20.50% 2017 USD +10.94% -0.14% -10.64% -2.65% -3.14% -5.94% +1.72% +1.17% -1.81% -2.61% +5.23% +1.75% -7.48% 2018 USD +6.33% +18.38% +0.46% -2.89% -2.16% -2.50% +1.04% -5.37% -7.09% -4.82% +5.27% -0.65% +3.60% 2019 USD -0.44% -7.48% -0.90% +3.74% +12.74% -0.85% -2.44% -0.10% +3.95% -2.04% +0.77% +0.78% +6.68% 2020 USD -4.75% -5.72% -7.11% -11.26% +10.17% +3.97% +11.40% +2.50% -1.55% -2.10% +2.37% -5.56% -9.80% 2021 USD -5.20% +19.34% +4.72% +6.99% -2.51% +7.28% -3.30% +4.98% -3.12% +6.21% -18.89% +9.09% +22.51% 2022 USD +7.41% +2.45% +5.48% -8.21% -7.06% +6.73% -8.93% +2.62% +5.16% -0.81% -4.52% -0.23% -1.87% 2023 USD -0.51% +23.27% +4.12% +15.85% -11.45% +5.78% +7.92% +16.84% +8.96% -1.35% +5.13% +6.55% +110.37% 2024 USD +9.95% +0.44% -5.33% +14.19% +0.11% -2.07% -1.31% -4.56% +11.55% +12.36% +2.81% +1.01% +43.49% 2025 USD -0.68% +0.43% +0.32% +3.29% +5.87% -2.84% +2.95% +9.45% Monthly Performances AFC Iraq Fund (non-US) Class E Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec YTD 2015 USD +0.00% -7.89% -5.17% -2.18% -6.98% -3.37% +0.59% -22.74% 2016 USD -9.69% -4.29% -5.83% -2.71% -8.57% +7.32% -1.89% -3.25% +0.57% +1.94% +0.56% +4.86% -20.26% 2017 USD +10.97% -0.11% -10.61% -2.63% -3.12% -5.92% +1.75% +1.20% -1.79% -2.59% +5.26% +1.77% -7.20% 2018 USD +6.35% +18.41% +0.49% -2.86% -2.14% -2.48% +1.07% -5.35% -7.06% -4.80% +5.30% -0.63% +3.91% 2019 USD -0.42% -7.46% -0.88% +3.77% +12.77% -0.83% -2.42% -0.07% +3.97% -2.01% +0.79% +0.80% +7.00% 2020 USD -4.73% -5.70% -7.08% -11.23% +10.19% +3.99% +11.42% +2.52% -1.53% -2.08% +2.40% -5.54% -9.53% 2021 USD -5.18% +19.37% +4.75% +7.02% -2.49% +7.30% -3.27% +5.00% -3.10% +6.23% -18.87% +9.11% +22.88% 2022 USD +7.43% +2.47% +5.50% -8.19% -7.04% +6.75% -8.91% +2.65% +5.18% -0.78% -4.49% -0.21% -1.58% 2023 USD -0.49% +23.30% +4.14% +14.17% -10.10% +5.08% +7.09% +17.62% +9.33% -1.33% +5.29% +6.81% +110.60% 2024 USD +10.34% +0.47% -5.49% +14.73% +0.13% -2.11% -1.28% -4.54% +11.76% +12.83% +2.93% +1.07% +45.66% 2025 USD -0.66% +0.45% +0.34% +3.43% +6.10% -2.92% +3.08% +9.97% DISCLAIMER Investments in equities in Iraq are subject to market risk, idiosyncratic risk, liquidity risk, and currency exchange rate risk. The fund may use financial derivative instruments as a part of the investment process. This document does not constitute an offer to sell, or a solicitation of an offer to buy shares in AFC Iraq Fund. We will not make such offer or solicitation prior to the delivery of an offering memorandum, the operating agreement or articles of association, a subscription booklet, and other materials relating to the matters herein. Before making an investment decision, we advise potential investors to read these materials carefully and to consult with their tax, legal, and financial advisors. The materials have not been reviewed by the regulatory authority of any jurisdiction. Investment is open only to accredited investors as defined by the relevant legal jurisdiction of residence and/or nationality. We have compiled this information from sources we believe to be reliable, but we cannot guarantee its accuracy. We present our opinions without warranty. Past performance is no guarantee of future results. © 2024 Asia Frontier Capital Ltd. All rights reserved. * Asia Frontier Capital manages funds for both US investors and non-US investors. This fund is for non-US investors only. If you are a US investor, please refer to the fact sheet for the fund called “AFC Iraq Fund”. By accessing information contained herein, users are deemed to be representing and warranting that they are either a Hong Kong Professional Investor or are observing the applicable laws and regulations of their relevant jurisdictions. * For Switzerland only: This is an advertising document. The state of the origin of the fund is the Cayman Islands. This document may only be provided to qualified investors within the meaning of art. 10 para. 3 and 3ter CISA. In Switzerland, the representative is Acolin Fund Services AG, Maintower, Thurgauerstrasse 36/38, 8050 Zurich, Switzerland, whilst the paying agent is NPB Neue Privat Bank AG, Limmatquai 1 / am Bellevue, 8024 Zurich, Switzerland. The basic documents of the fund report may be obtained free of charge from the representative. Past performance is no indication of current or future performance. The performance data do not take account of the commissions, if any, and fund transfer costs incurred on the issue and redemption of units. * AFC Iraq Fund (Non-US) is registered for sale to investors in Switzerland (qualified investors), Hong Kong & UK (professional investors), and Singapore (accredited investors).