AIG Annual Report 2007

- 1. A M E R I C A N I N T E R N A T I O N A L G R O U P, I N C . Annual Report

- 2. C O N T E N T S Financial Highlights 1 Letter to Shareholders 2 AIG: What We See 11 AIG at a Glance 24 Review of Operations 26 Reconciliation in Accordance with Regulation G 42 Five Year Summary of Consolidated Operations 43 Five Year Summary of Selected Financial Information 44 Supplemental Financial Information 46 Board of Directors 50 Corporate Directory 51 Annual Report on Form 10-K Inside Shareholder Information Back Cover A B O U T A I G American International Group, Inc. (AIG), a world leader in insurance and financial services, is the leading international insurance organization, with operations in more than 130 countries and jurisdictions. AIG companies serve commercial, institutional and individual customers through the most extensive worldwide property-casualty and life insurance networks of any insurer. In addition, AIG companies are leading providers of retirement services, financial services and asset management around the world. AIG’s common stock is listed on the New York Stock Exchange, as well as the stock exchanges in Ireland and Tokyo. A B O U T T H E C O V E R AIG headquarters at 70 Pine Street is an Art Deco landmark and the tallest skyscraper in Lower Manhattan. In 1976, AIG purchased the 66-story building, which is crowned with a glass-enclosed observatory that offers a panoramic view of New York City and its surroundings. Today, it is an icon of AIG’s global stature in the insurance and financial services businesses.

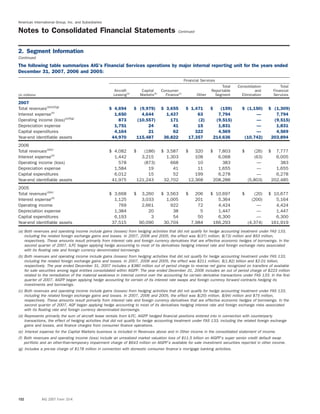

- 3. AIG 2007 Annual Report 1 (in millions, except per share data and ratios) 2007 2006 % Change Net income(a) $ 6,200 $ 14,048 (55.9) Net realized capital gains (losses), net of tax (2,386) 33 — Capital Markets other-than-temporary impairments, net of tax(b) (418) — — FAS 133 gains (losses), net of tax (304) (1,424) — Cumulative effect of an accounting change, net of tax — 34 — Adjusted net income(c) 9,308 15,405 (39.6) Net income, per common share—diluted 2.39 5.36 (55.4) Adjusted net income, per common share—diluted(c) 3.58 5.88 (39.1) Book value per common share 37.87 39.09 (3.1) Revenues(d)(e)(f) $ 110,064 $ 113,387 (2.9) Assets 1,060,505 979,410 8.3 Shareholders’ equity 95,801 101,677 (5.8) General Insurance combined loss and expense ratio 90.33 89.06 General Insurance combined loss and expense ratio, excluding catastrophe losses 89.73 89.06 F I N A N C I A L H I G H L I G H T S Net Income (billions of dollars) Revenues (billions of dollars) Assets (billions of dollars) Shareholders’ Equity (billions of dollars) Book Value per Common Share (dollars) Certain reclassifications have been made to prior period amounts to conform to the current period presentation. (a) In 2007 and 2006, includes out of period increases (decreases) of $(399) million and $65 million, respectively. (b)Represents Capital Markets other-than-temporary impairments on securities available for sale. (c) In 2007 and 2006, includes out of period increases (decreases) of $(261) million and $85 million, respectively. (d)In 2007 and 2006, includes other-than-temporary impairment charges of $4.7 billion and $944 million, respectively. Also in 2007 and 2006, includes gains (losses) of $(1.44) billion and $(1.87) billion, respectively, from hedging activities that did not qualify for hedge accounting treatment under FAS 133, including the related foreign exchange gains and losses. (e) In 2006, includes a $730 million increase in revenue for out of period adjustments related to the accounting for UCITS. (f) In 2007, includes an unrealized market valuation loss of $11.5 billion on AIGFP's super senior credit default swap portfolio. 8.1 9.8 10.5 14.0 6.2 3.07 3.73 3.99 5.36 2.39 675.6 801.0 853.0 979.4 1,060.5 69.2 79.7 86.3 101.7 95.8 26.54 30.69 33.24 39.09 37.87 79.6 97.8 108.8 113.4 110.1 Net Income per Common Share—Diluted (dollars) 2003 2004 2005 2006 2007 2003 2004 2005 2006 2007 2003 2004 2005 2006 2007 2003 2004 2005 2006 2007 2003 2004 2005 2006 2007 2003 2004 2005 2006 2007 (d)(e)(f) (a)

- 4. 2 AIG 2007 Annual Report We remain confident in our strategy to leverage our financial strength and global franchise to continue our growth in both emerging and developed markets. Martin J. Sullivan President and Chief Executive Officer A fter a promising start, 2007 had a disappointing conclusion, both in terms of our results and share price performance. The U.S. credit crisis, recession fears and record-high oil prices caused economic disruption and uncer- tainty. In addition, some of our businesses did not meet expectations. Nevertheless, the fundamental strength of our core operations is intact, and we made impor- tant advances in key markets. We remain confident in our strategy to leverage our financial strength and global franchise to continue our growth in both emerging and developed markets. Although it appears economic conditions will not be any better in 2008, we continue to see many opportunities to deliver quality insurance and financial products and services to customers around the world. 2007 Results AIG reported net income of $6.20 bil- lion, or $2.39 per diluted share for 2007, compared to $14.05 billion, or $5.36 per diluted share for 2006. Full year 2007 adjusted net income, excluding the effect of economically effective hedging activities that did not qualify for hedge accounting treatment under FAS 133, and the related foreign exchange gains and losses, was $9.31 billion, or $3.58 per diluted share, compared to $15.41 billion, or $5.88 per diluted share for 2006. Included in 2007 net income and adjusted net income was a charge of $11.47 billion pretax ($7.46 billion after tax) for unrealized market valuation losses related to the AIG Financial Products Corp. (AIGFP) super senior credit default swap portfolio. Based upon its most current analysis, AIG believes any losses that are realized over time on the super senior credit default swap portfolio of AIGFP will not be material to AIG’s D E A R F E L L O W S H A R E H O L D E R S :

- 5. AIG 2007 Annual Report 3 BusinessWeek named AIG one of the 100 Best Global Brands, a testament to the brand’s growing value in markets all over the world. overall financial condition, although it is possible that realized losses could be mate- rial to AIG’s consolidated results of oper- ations for an individual reporting period. Full year results also include pretax net realized capital losses of $3.59 billion. Consolidated assets increased in 2007 to $1.061 trillion, up from $979.41 billion in 2006. At year end, book value per share stood at $37.87, down from $39.09 at the end of 2006. Shareholders’ equity also declined to $95.80 billion from $101.68 billion at the end of 2006. AIG recorded total revenues during the year of $110.06 billion, 2.9 percent below 2006 revenues. Revenues, shareholders’ equity and book value per share were adversely affected by realized capital losses and the net unrealized market valuation loss recorded by AIGFP. 2007 Highlights We overcame the challenges of 2007 to make progress on several fronts. We were pleased when the China Insurance Regulatory Commission approved our application to establish a Wholly Owned Foreign Enterprise (WOFE) under the name AIG General Insurance Company China Limited (AIG General). Soon after, we opened a new AIG General headquarters in Shanghai and consoli- dated our Chinese general insurance operations there to capture efficiencies and provide a platform to establish new branches in other areas of China. AIA China continued to expand on the provincial licenses granted in 2006, opening 29 new sales and service centers in 2007, for a total of 104 centers in 19 cities. In addition, AIG InvestmentsSM received approval to set up a representative office in Tianjin, our first operation in China’s third-largest city. In Korea, we obtained preliminary approval from the Financial Supervisory Service to offer mortgage reinsurance through AIG United Guaranty Insurance (Asia) Limited. We signed a memoran- dum of understanding with the Bank of Investment and Development of Vietnam for the expansion of our business cooperation agreement in that rapidly growing country. The agreement will allow us to expand beyond our existing relationship in life insurance to include a wide range of areas such as general insurance, consumer finance, asset management and banking services. We are rapidly building a consumer finance franchise in India to complement our Tata AIG Life and General Insurance partnership. In 2007, we established a presence in housing finance and consumer durable finance. In addition, we are strengthening our presence in asset man- agement and real estate development. In the Middle East, American Life Insurance Company (ALICO) received a license to operate a retail life insurance business in the Qatar Financial Centre. ALICO is the first life insurance company to receive an expanded license, which is in addition to a wholesale life insurance license first obtained in February 2007. Our acquisition of the German insurer Württembergische und Badische Versicherungs-AG (WüBa) reaffirmed our commitment to growth in the German marketplace, and greatly enhanced our insurance offerings to small and midsize companies. We advanced our strategy in the auto insurance sector when we acquired the out- standing shares of 21st Century Insurance Group that we did not already own. In 2007, AIG received approval from the China Insurance Regulatory Commission to establish a wholly owned general insurance subsidiary in China(pictured, Shanghai skyline). The AIG Private Client Group’s Wildfire Protection Unit® uses the latest fire-mitigation technology to help protect policyholders’ proper- ties in the western United States.

- 6. 4 AIG 2007 Annual Report We then consolidated 21st Century with AIG’s existing auto platform. The com- bined operation, aigdirect.comSM , is an organization with the reach and expertise needed to compete more effectively in the U.S. auto insurance marketplace. Through AIG-managed funds, we are a leading investor in the infrastructure business. In 2007, our investments in P&O Ports North America, AMPORTS and MTC Holdings were organized under one management structure. We believe the new entity, Ports America, constitutes the largest and most experi- enced independent port operator and automotive import/export processor in the United States. In addition to these accomplishments, we made good progress on several other fronts. Customer Focus—We devoted a great deal of attention to our customers as we broadened the implementation of our “Deliver the Firm” strategy. Specifically, we examined how to realign the way AIG does business so we can deploy our products and services in ways that allow us to meet multiple needs of customers around the world. For our customers, it means more convenience, more choices and even better services. For our employees, it means broader engagement with other AIG businesses and colleagues. For our shareholders, it means tapping the vast potential for new growth and higher returns. Capital Management—The imple- mentation of our economic capital model provides us with a tool to help us allocate our capital efficiently. The tool provides one of the metrics we will use with increasing frequency to allocate cap- ital to promising growth areas, judge per- formance on a consistent basis across our business segments and help us set com- pensation policy. AIG’s capital position is excellent and we have the flexibility to take advantage of growth opportunities. Innovation—Our reputation as an industry innovator gained widespread recognition when AIG Private Client Group’s Wildfire Protection Unit acted swiftly to protect client homes from rag- ing wildfires in the western United States. The unit’s response teams treated client homes with a fire retardant in advance of the flames, reducing losses and claims. Meanwhile, AIG Product Development maintained a steady flow of new products, launching one every 14 days on average, with individual businesses launching even more. New offerings ranged from Family Protector, an urban protection package launched in South Africa, to AIG Oilfield Services Insurance, a one-stop coverage solution designed specifically for independent oil and gas clients. Building our Brand—We made sub- stantial progress in 2007 in strengthening worldwide recognition of the AIG brand. Our success is attributable to greater consistency in the implementation of our brand and judicious investments in brand advertising and sponsorship opportunities. Our sponsorship of the Manchester United Football Club has helped tremendously to increase our recognition worldwide, particularly in key Asian markets. Of course, it has helped build recognition in the United Kingdom as well. The consolidation of our New Hampshire and Landmark businesses under the name AIG UK Limited will allow us to further leverage our Manchester United sponsorship. In Australia and New Zealand, all of our businesses now market under the AIG brand name. We launched a vigorous branding campaign in India to support our business growth there. National Union Fire Insurance Company of Pittsburgh, Pa., now markets under the name AIG Executive LiabilitySM and AIG VALIC, a leader in the K-12, healthcare and higher education markets, has re-branded as AIG Retirement. It was gratifying to see the growing strength of our brand recognized when BusinessWeek magazine included AIG in its annual list of the world’s top brands, ranking us at 47, the highest rank of any insurer, in our first-ever appearance on the list. While we are proud of these successes, we clearly need to improve in several areas. There is no disputing the severity of the U.S. residential mortgage crisis and the dislocation in the credit markets, but that cannot be an excuse for poor per- formance. We need to reverse higher losses and expenses and work through product and distribution shortcomings in several other businesses. Even though we have made progress increasing the average number of products sold per customer, there is still room for improvement. We devoted a great deal of attention to our customers as we broadened the implementation of our “Deliver the Firm”strategy.

- 7. 1 2 6 3 7 8 9 4 5 12 11 10 AIG 2007 Annual Report 5 We are addressing these weaknesses through operational and structural invest- ments and improvements, and I can assure you we are doing so with a sense of urgency. Vision and Values While financial strength, quality assets and a solid strategy are critical elements of success, it is also important to synthe- size those elements with a set of core values that are shared by all employees. In 2007, we engaged a sampling of employees around the world and formal- ized a vision and set of values for AIG that will serve as our touchstone for future progress: Our Vision is to be the world’s first-choice provider of insurance and financial services. Our Values are People, Customer Focus, Performance, Integrity, Respect and Entrepreneurship. Our Vision and Values define and unite us as an organization. You can read more about our Vision and Values further on in this report. General Insurance In the United States and abroad, AIG’s General Insurance businesses write substantially all lines of commercial property-casualty insurance and various personal lines. A combination of product diversification, distribution strength and underwriting discipline allowed the General Insurance group to achieve higher operating income despite decidedly uneven market conditions. The Domestic Brokerage Group (DBG), which provides commercial insurance products and services to a wide range of businesses in the United States, had a record year, with operating income climbing 25 percent. DBG is the largest property-casualty insurance organization in the United States with market-leading businesses such as AIG Executive Liability, a premier provider of executive and professional liability insurance; Group Executive Committee Martin J. Sullivan4 President and Chief Executive Officer Edmund S.W. Tse5 Senior Vice Chairman Life Insurance Steven J. Bensinger2 Executive Vice President and Chief Financial Officer Anastasia D. Kelly3 Executive Vice President General Counsel and Senior Regulatory and Compliance Officer Rodney O. Martin, Jr.11 Executive Vice President Life Insurance Kristian P. Moor10 Executive Vice President Domestic General Insurance Win J. Neuger8 Executive Vice President and Chief Investment Officer Nicholas C. Walsh6 Executive Vice President Foreign General Insurance Jay S. Wintrob12 Executive Vice President Retirement Services William N. Dooley9 Senior Vice President Financial Services Andrew J. Kaslow1 Senior Vice President and Chief Human Resources Officer Brian T. Schreiber7 Senior Vice President Strategic Planning

- 8. 6 AIG 2007 Annual Report Lexington Insurance Company, the leading U.S.-based excess and surplus lines insurer; AIG Excess Casualty® , DBG’s leading commercial umbrella provider; and AIG Environmental® , a pioneer in pollution and eco-friendly liability coverages. AIG’s Domestic Accident & Health Division, which manages specialized accident and health risks for consumer, commercial and affinity group customers, and AIG Worldsource, which provides innovative global liability insurance solutions, as well as HSB Group, Inc., a leading worldwide provider of equipment break- down and engineered lines insurance, all performed well in 2007 due in part to their execution of unique Deliver the Firm strategies. Integration costs and higher claims activity adversely affected results in our Domestic Personal Lines businesses. However, consolidation and product innovation will improve our market position going forward. AIG Private Client Group, which insures more than one-third of the Forbes 400 Richest Americans, achieved net written premium growth in excess of 37percent. The group is building on the growing popularity of its Wildfire Protection Unit with the deployment of its Hurricane Protection Unit® in coastal regions. Transatlantic Holdings, Inc., a majority- owned holding company of international reinsurers, achieved record net income partly due to higher premium volume and favorable loss experience in its property lines. Significant home price deterioration associated with the ongoing U.S. housing crisis resulted in a challenging year for the domestic mortgage insurance business of United Guaranty Corporation (UGC). We expect similar domestic market conditions to last into 2009. Even so, growth in international markets, togeth- er with higher persistency that lifted domestic first-lien renewal premiums, produced solid growth in net premiums written. With operations today in 15 countries, UGC is prudently pursuing additional international opportunities in promising markets such as Japan, India, Australia and Germany. In addition to the WOFE license it received in China, AIG’s Foreign General Insurance group also launched a new operation in Oman and opened a new branch in Qatar, strengthening its position as the most extensive property-casualty network in the world. Full year results were adversely affected by the losses from the June 2007 U.K. floods and higher non-catastrophic losses; however, underwriting results were excellent. Foreign General continues to refine its customized product range to meet the requirements of a growing worldwide middle class while developing products for underserved markets. Life Insurance & Retirement Services AIG’s Life Insurance & Retirement Services group carries on a long tradition of excellence it has earned during many years of industry leadership. In 2007, the group had strong top line growth, and momentum is building on the strength of new and enhanced products, as well as new distribution initiatives. However, operating income decreased compared to 2006, primarily due to higher net realized capital losses in 2007. Foreign Life operations devoted significant management time and resources to building our business in China and India. Progress continues on the merger of AIG Star Life Insurance Co., Ltd., and AIG Edison Life Insurance Company, which we hope to complete in early 2009. We are encouraged by prom- ising results from the introduction of new variable annuity products. In addition, further deregulation in the bank channel and the privatization of Japan Post Insurance Co., Ltd., are creating opportu- nities to sell our products through vast new distribution systems. Ambassador Frank G. Wisner Vice Chairman External Affairs Dr. Jacob A. Frenkel Vice Chairman Global Economic Strategies

- 9. AIG 2007 Annual Report 7 AIG’s life insurance network is the most extensive of any life insurance organization. Our life businesses abroad include market-leading companies such as American International Assurance Company, Limited, consistently rated one of the most trusted brands in Southeast Asia. ALICO operates in more than 50 countries, with a strong and growing presence in Japan, Europe, the Middle East and Latin America. The Philippine American Life and General Insurance Company observed its 60th anniversary and remains the premier life insurer in the Philippines. Our Taiwan life insurance unit, Nan Shan Life Insurance Company, Ltd., once again received recognition throughout the year for its quality customer service. In the United States, AIG American General enhanced its position as a lead- ing life insurer by introducing more than 25 new or revised products and riders in 2007. Its acquisition of direct marketer Matrix Direct, Inc., helped the company expand beyond its traditional distribution methods. AIG American General contin- ues to place significant emphasis on cross-selling efforts by developing coordi- nated offerings with AIG Investments, DBG and AIG Retirement. Domestic retirement services opera- tions continue to address the growing need for asset accumulation, protection and guaranteed income solutions. AIG Annuity Insurance Company, the largest issuer of fixed annuities in the United States, responded to difficult market con- ditions by launching new products and by expanding distribution. AIG VALIC, now operating as AIG Retirement, achieved double-digit deposit growth and a steady increase in fee income and assets under management. AIG SunAmerica, a leader in variable annuities, achieved record fee income and assets under man- agement by responding to the demand for “income for life” solutions. The launch of the “Live Longer Retire Stronger” national advertising campaign boosted recognition of AIG’s retirement services capabilities while supporting our global branding initiative. Financial Services The Financial Services group recorded an operating loss of $9.52 billion for 2007 primarily due to the unrealized market valuation losses related to the AIGFP super senior credit default swap portfolio. We continue to believe that AIGFP will not realize significant losses from this derivative business, which insures against the default of certain securities. Since its creation, AIGFP has been a strong performer and is an important component of AIG’s diverse portfolio of businesses. We continue to see good potential across all product segments of our Financial Services group. Together, they diversify our revenues and comple- ment our core insurance operations. AIG was named one of “The Global 100” most sustainable companies at the World Economic Forum in Davos, Switzerland. AIG is develop- ing environmentally sustainable properties, such as Spruce Peak at Stowe, Vt.,developed by AIG Global Real Estate. AIG’s International Lease Finance Corporation (ILFC) has the largest aircraft fleet in the world, as measured by fleet value, and is the largest single customer to date for the new Boeing 787 Dreamliner. The launch of the“Live Longer Retire Stronger” national advertising campaign boosted recognition of AIG’s retirement services capabilities while supporting our global branding initiative.

- 10. 8 AIG 2007 Annual Report International Lease Finance Corporation (ILFC), for example, had an excellent year with strong operating income. A worldwide leader in aircraft leasing, ILFC executed lease agreements covering 138 aircraft and became the largest single customer to date for the new Boeing 787 Dreamliner. ILFC’s fleet of more than 900 modern, efficient passenger jets is the largest in the world, as measured by fleet value. American General Finance, Inc. (AGF), a major consumer finance organ- ization in the United States, weathered deteriorating market conditions with con- servative lending practices and a branch structure that allows it to stay in close touch with customers and market trends. AGF is in a position to oppor- tunistically expand its business portfolio, as it demonstrated in early 2008 when it agreed to acquire a substantial portion of the Equity One consumer branch loan portfolio from Popular, Inc. AIG Consumer Finance Group, Inc. achieved record earnings in Poland and expanded in key markets such as India, Thailand and Mexico. The Imperial A.I. Credit Companies maintained its position as the largest financer of insurance premiums in North America and continued to grow its high-net-worth life insurance business. Asset Management The Asset Management group provides a wide variety of investment-related services and investment products. Operating income decreased in 2007 due to foreign exchange, interest rate and credit related mark-to-market losses and other-than- temporary impairment charges on fixed income investments. However, the group grew unaffiliated client assets under man- agement by 26 percent to $94.2 billion. The group also manages AIG insurance and asset management portfolios, which exceeded $672.3 billion at year end. AIG is the world’s seventh-largest asset manager, with operations in 45 cities, including new offices in Dubai and Kampala, Uganda’s capital. Formerly known as AIG Global Investment Group, we re-branded our institutional asset management function AIG Investments, a name that succinctly conveys the group’s core business and is aligned with AIG’s global branding effort. AIG Private Bank Ltd., continued the expansion of its global wealth man- agement business, opening AIG’s first wealth management office in Taiwan. AIG Private Bank also entered into a joint venture agreement with Bank Sarasin & Co. Ltd. to establish a new Swiss bank with a goal of being a strong player in Switzerland and all of Europe. AIG Global Real Estate Investment Corp. expanded its investment and development platforms, increasing its equity under management to more than $23 billion, and adding new employees in strategic markets such as the Middle East, India and other countries throughout Asia. Public Policy and Corporate Responsibility Terrorism is an unconventional risk due to its unpredictability and the potential severity of losses. So we applaud the U.S. Congress and the White House for extending the federal Terrorism Risk Insurance Act as a backstop, which is vital to a secure economy. On another important policy front, we continued our efforts to open global markets to our insurance products, financial services and investments. At the same time, we are working to keep U.S. markets open to foreign trade and investment, which is so important to the health of the world economy. We recognize that our businesses cannot succeed over the long term unless we are mindful of the well-being of others. In 2007, AIG significantly expanded its corporate responsibility initiatives to make a greater positive contribution to society through both our core business activities and our philanthropic programs. AIG has a history of addressing soci- ety’s challenges through business success. Using the same tools that have helped AIG companies prosper, we leverage our experi- ence and global reach with organizations such as ACCION International and Pro Mujer to promote entrepreneurship, innovation, diversity and empowerment. A decade ago, AIG launched the first-ever microinsurance program for a group of local microlenders in Uganda. Today, the AIG companies are developing microinsurance markets in Africa, India, Latin America and Southeast Asia, and have helped some 2.5 million clients in 12 countries. A leader in environmental insurance, AIG last year developed a suite of new products to address client needs related to alternative energy and limiting carbon emissions. We also launched a program that enables homeowners to rebuild their property to green standards following a covered loss. We are working to keep U.S. markets open to foreign trade and investment, which is so important to the health of the world economy.

- 11. AIG 2007 Annual Report 9 We have also begun to address the environmental impact of our own operations. We conducted the first global inventory of AIG’s greenhouse gas emissions and began to develop a mitigation plan, including the purchase of carbon offsets. As a first step, we sponsored a forum in Beijing for our corporate clients, where we announced our intent to fund agricultural projects in rural China that reduce or sequester greenhouse gas emissions. We continue to support and participate in the Carbon Disclosure Project, the U.S. Climate Action Partnership and other climate initiatives. In September, AIG became an insurance-sector component of the Dow Jones Sustainability Index North America (DJSI North America). Index components are selected according to a systematic assessment that identifies the leading sustainability-driven compa- nies in each industry group. Following the appointment of our first Chief Diversity Officer early in 2007, we took a number of actions to help AIG realize the benefits of a more diverse organization. We established diversity steering committees at the business level to complement our Corporate Executive Steering Committee; implemented training programs for existing employees; and explored ways to improve how we attract and mentor diverse job candidates. We are also developing new products to address the needs of diverse clients, while increasing our supplier diversity. We still have work to do, but the actions we are taking today will help AIG build its reputation as a forward-thinking organization. Stock Price and Dividends As I mentioned at the outset, the perform- ance of AIG’s stock in 2007 and into 2008 was disappointing. The price of an AIG common share closed the year at $58.30, 18.6 percent below the close of 2006. By comparison, the S&P 500 Stock Index rose 3.5 percent in 2007. The Board of Directors took several steps during 2007 to demonstrate its confidence in AIG’s ability to continue to grow and generate excess capital. In March, the Board approved a new dividend policy, which provides that, under ordinary circumstances, AIG plans to increase its common stock dividend by approximately 20 percent annually. The new policy became effective in May 2007, when the Board voted to increase the quarterly cash dividend to 20 cents per share, a 21.2 percent increase over the previous quarterly dividend and the 22nd consecutive year that AIG has increased its dividend. Also in March, the Board expanded AIG’s existing share repurchase program by authorizing the repurchase of up to $8 billion in common stock. In November, we announced the Board’s decision to authorize the repurchase of an additional $8 billion in common stock. During 2007, AIG repurchased more than 76 million common shares. AIG does not expect to purchase additional shares in the foresee- able future, other than to meet commit- ments that existed at December 31, 2007. We believe this is a prudent decision in light of the unsettled capital markets and because it gives AIG maximum flexibility to pursue growth opportunities that may arise. Board and Management Changes Three directors who have made enormous contributions to AIG will retire at the annual meeting in May. It is impossible to overstate the contribution Frank Zarb made during his seven years on the Board, particularly during his tenure as interim Chairman. Frank’s clear judg- ment and exceptional organizational and leadership skills provided the support management needed to work through some of the most difficult challenges in AIG’s 89-year history. Marshall “Mickey” Cohen has been a valuable contributor throughout his 16 years on the Board. As AIG has evolved, the continuity of Mickey’s trusted counsel has been a steady reference point. As Chairman of the Board’s Compensation and Management Resources Committee, he has been at the forefront of significant enhancements in AIG’s compensation policies. Steve Hammerman’s three years of Board service coincided with a period of important transition at AIG. As Chairman of the Regulatory, Compliance and Legal Committee, his wisdom and common- sense approach guided AIG through difficult regulatory issues. We are truly grateful to all of these outstanding individuals for their dedicated service. The Board of Directors took several steps during 2007 to demonstrate its confidence in AIG’s ability to continue to grow and generate excess capital.

- 12. 10 AIG 2007 Annual Report In January 2008, the Board of Directors elected Stephen F. Bollenbach a director. Steve recently retired as Co-Chairman and Chief Executive Officer of Hilton Hotels Corporation, and possesses deep experience in managing complex global businesses. We look forward to his contributions. 2008 Outlook and Priorities We harbor no illusions about the chal- lenges ahead in 2008. The U.S. residential housing market is expected to remain weak throughout the year. Uncertainty persists about credit markets and the U.S. economy in general, and competition is increasing in many of our markets. However, while challenges limit some opportunities, they create others. These headwinds may require us to tack a different course, but we expect to achieve success nevertheless. Our five-year goal is to grow adjusted earnings per share by an average of 10 to 12 percent annually, and a significant portion of management compensation is linked to the achievement of this goal. We are confident that we have the right strategies and resources to succeed. AIG’s financial strength is formidable by any measure, and our capital position is solid. We have established, well-run businesses in every corner of the globe. We must remain disciplined in our underwriting, refusing to chase rates down in softening markets. We must continu- ally enhance distribution and improve cost efficiency. Yet, we will invest where we need to invest, especially to build out areas of infrastructure that are critical to growth. We will conduct our business respon- sibly, working constructively with regulators, minimizing our impact on the environment and cultivating a diverse workforce that acts in harmony with our core values. It is not enough simply to profit from our transactions with customers; we want them to manage risk effectively and to succeed in their endeavors. It is not enough to thrive in the markets where It is not enough for our shareholders merely to earn a steady return; we want you to earn superior returns and to be proud that you invest in AIG. we operate; we want those markets to grow and produce wealth and opportuni- ty for everyone in them. It is not enough for our employees simply to earn a living; we also want them to be personally satisfied in the work they do. And it is not enough for our shareholders merely to earn a steady return; we want you to earn superior returns and to be proud that you invest in AIG. AIG is a remarkable company, thanks to the support of many. I would like to thank the Board of Directors for its wise counsel; our customers and business partners for their loyalty; all of our dedicated employees around the world, who truly make AIG the great company that it is; and you, our shareholders, for your support and confidence in investing in AIG. Sincerely, Martin J. Sullivan President and Chief Executive Officer March 14, 2008

- 13. W H A T W E S E E The ability to see and seize opportunities in the markets we serve has always differentiated AIG from its peers. Where others may see little or no potential, we see new ways to deliver solutions to our 74 million customers worldwide. AIG has many strengths in markets around the world. Our 116,000 employees and over 700,000 agents, brokers and sales representatives strive to exceed client expectations with market-leading products and services. In the following pages, we share with you, our shareholders, what we see and what we do every day to help our clients achieve success—in both local and global markets. AIG 2007 Annual Report 11

- 14. 12 AIG 2007 Annual Report The AIG Strategic Relationship Group helped generate gross premiums written of over $350 million in insurance business in 2007 by access- ing AIG’s investment and other non-insurance relationships. One of the group’s long- standing relationships is with global growth equity firm General Atlantic, which was introduced by AIG Investments. General Atlantic sees AIG as a key insurance partner and says our ability to deliver a wide range of products and capabilities sets us apart. By facilitating an introduction to a Fortune 100 client, AIG Executive Liability provided AIG Investments with an opportunity to demonstrate its asset management capabilities in the corporate pension plan sponsor segment. After an extensive due diligence process, the client entrusted AIG Investments with $175 million to invest in its International Small Cap equity strategy, based on its strong long-term performance record and proven investment process, as well as the depth of experience of the portfolio management team. WE SEE OPPORTUNITIES TO INCREASE SHAREHOLDER VALUE BY LEVERAGING OUR CAPABILITIES TO MAXIMIZE RELATIONSHIPS WITH EXISTING AND NEW CUSTOMERS. AIG’s enterprise-wide initiative to “Deliver the Firm” gained momentum last year. Going beyond cross-selling, this key strategy represents a fully integrated approach to the way we focus on the market. It involves the level of customer service we provide…the type of customer information we develop…the way we collaborate…the way we develop new products and services… and the way our employees achieve a deeper knowledge of AIG’s full capabilities. Deliver the Firm defines the entire AIG experience for our customers.

- 15. AIG 2007 Annual Report 13 The Office of the Customer (OOC) contributes to AIG’s Deliver the Firm strategy by providing marketing and technology support to AIG businesses, including best practices in up-selling, cross-selling, retention and referrals. In just one example from commercial lines, OOC capabilities were used to develop and deliver over 90 types of “marketing opportunity alerts” in more than 30 countries. The Major Accounts Practice within American International Underwriters is focused on giving corporations with sales of over $500 million broader access to the AIG enterprise. Average products per customer increased from 3.63 to 4.12 in 2007— equating to 1,866 new prod- ucts for existing customers. The cross-sell rate for the top 100 accounts was 10 products per customer.

- 16. 14 AIG 2007 Annual Report Economic liberalization, technological advances, capital market developments and demographic changes are driving forces in global economic activity. Burgeoning markets such as China, India, Vietnam, Russia and Eastern Europe, where AIG already has a presence, will provide long-term growth opportunities for both commercial and personal insurance lines as these economies continue to grow. An aging global population is placing unprecedented demands on public pension and healthcare services. This demographic shift presents great opportunities for AIG’s Life Insurance & Retirement Services businesses, as well as Asset Management, to provide products such as supplemental medical coverage, investment options and retirement advice.

- 17. AIG 2007 Annual Report 15 Around the world, the middle class is growing and has more disposable income for housing, cars, life insurance, consumer goods and travel. This trend will continue to increase demand for AIG’s personal lines, travel insur- ance, consumer lending products and International Lease Finance Corporation’s modern aircraft. Corporate responsibility for social, environmental and governance issues is a trend that is accelerating, and AIG has been proactive in this area. We take pride in providing solutions that create long-term value for our customers—such as AIG Environmental’s Sustain-a-BuildSM Initiative, which provides policyholders with premium discounts for properties certified under the U.S. Green Building Council’s Leadership in Energy and Environmental Design (LEED®) Green Building Rating SystemTM . Increases in severe risks continue to be a challenge for all global businesses. At AIG, our underwriting experience and expertise enable us to respond to potentially devas- tating exposures our cus- tomers face. For example, in 2007 we formed AIG Homeland Security SolutionsSM to provide businesses with access to insurance and risk management products related to terrorism incidents and other catastrophic events. WE SEE GROWING DEMAND FOR PRODUCTS AND SERVICES ARISING FROM EVOLVING ECONOMIC AND DEMOGRAPHIC TRENDS. AIG has always been adept at staying ahead of important macro trends. But what truly differentiates us is how we leverage our unique strengths to capitalize on growth opportunities. AIG’s financial strength, worldwide footprint and diversified businesses enable us to respond quickly and effectively to our customers. Fueled by our entrepreneurial culture, the AIG franchise has an unequaled competitive advantage and growth platform.

- 18. 16 AIG 2007 Annual Report Another rapidly emerging market is Latin America, where we see opportunities for growing all of our lines of insurance. The region’s commercial and consumer insurance sectors both have high growth potential. In Brazil, for example, American Life Insurance Company’s joint venture, Unibanco AIG Seguros S.A., delivered strong revenue growth in insurance, pension and retirement products in 2007. Innovation and entrepreneurial spirit are AIG hallmarks, which we leverage to antici- pate client needs and create new products in developed markets. AIG Europe (UK) Limited, for example, identi- fied an opportunity in the directors and officers liability market for smaller companies listed on the London Stock Exchange’s Alternative Investment Market. Its award- winning product has generated significant new business and strong broker interest. Consumerism is gaining ground in many Eastern European countries. The appetite for consumer goods and upscale lifestyles offers AIG more opportunities to sell insurance products and financial services. For example, in Poland, AIG Consumer Finance Group is focused on growing its credit card business and expanding its branch-based system for making personal loans. AIG sees many opportunities in India (pictured) from changing lifestyles, a grow- ing middle class with more disposable income, a large rural population receptive to microinsurance and personal insurance products, and a fast-growing economy. We see growth potential in insurance, consumer finance, real estate, asset manage- ment, infrastructure investments, mutual funds and private equity.

- 19. AIG 2007 Annual Report 17 AIG uses strategic acquisitions to grow its business in market segments around the world. Through the acquisition of WüBa, a German insurer that serves small and midsize enterprises via the broker channel, we are better positioned to cater to this promising market with an extensive array of products and services. WE SEE GROWTH OPPORTUNITIES IN EMERGING AND DEVELOPED MARKETS. As trade barriers fall and more countries open their markets, AIG sees growth opportunities around the world for its full range of products and services. The demand for insurance, retirement services, consumer finance, private banking and asset management offerings is growing in tandem with the emerging markets of Asia, Latin America, Eastern Europe and the Middle East. In developed markets, AIG continues expanding with new and enhanced products for consumers and businesses of all sizes, and with strategic acquisitions and new lines of business.

- 20. 18 AIG 2007 Annual Report The Manchester United spon- sorship has brought significant visibility to AIG’s businesses around the world, particularly in Asia, where the club counts 83 million fans. Capitalizing on this unique opportunity to reach a mass audience, AIG companies executed more than 250 campaigns in 71 countries during the sponsorship’s first year— increasing excitement and recognition of the AIG brand among customers, producers and employees. For the first time, AIG made BusinessWeek’s annual list of the top 100 global brands in 2007, ranking 47th overall and first among insurance companies, with an estimated $7.5 billion brand value. AIG also ranked 30th on the Barron’s 2007 survey of “The World’s Most Respected Companies,”again placing first among insurance companies. WE SEE THE VALUE OF A UNIFIED GLOBAL BRAND. 2007 was a landmark year for the AIG brand, with the Manchester United Football Club sponsorship helping drive global awareness and recognition to unprecedented levels. As more customers around the world are exposed to the AIG brand, an opportunity exists to reinforce the consistency of our identity and messages across global markets. Doing so not only generates significant operational efficiencies and more effective selling throughout the organization, but also creates an invaluable platform for more meaningful, extensive and lasting relationships with our customers.

- 21. AIG 2007 Annual Report 19 AIG enhanced its online presence with the launch of a new version of AIG.com, which enables U.S.commer- cial clients and brokers to quickly access information and conduct business from a single website. The launch marked the first step in globalizing AIG.com with a consistent brand message that reflects the breadth and strength of our member companies’ products around the world. A number of business units in international markets also underwent brand changes to harness AIG’s worldwide brand recognition. In Australia and New Zealand, AIG’s life businesses changed their name from AIA to AIG Life. In the United Kingdom, ALICO introduced two new brands—AIG Life and AIG Life Wealth Management. And in Taiwan, AIU is now known as AIG General Insurance (Taiwan) Co., Ltd. To grow the strength of the AIG global brand and more clearly convey the products and services they offer, several U.S. business units changed their names last year. For example, National Union was re-branded as AIG Executive Liability, and AIG Global Investment Group as AIG Investments.

- 22. 20 AIG 2007 Annual Report AIG demonstrated its commit- ment to the environment when it became the first insurance organization to join the U.S. Climate Action Partnership last year. This organization advocates mandatory greenhouse gas (GHG) emissions limits in the United States. AIG also formed a dedicated alternative energy practice, as well as an eco-practice focused on climate change risks. And AIG announced plans to fund agricultural projects in China to generate 310,000 metric tons of carbon offset credits, representing about half the GHG emissions attributable to our global operations. Reflecting AIG’s core value of entrepreneurship and legacy as a microinsurance pioneer, we continue to help the world’s working poor build businesses. AIG member companies have developed microinsurance markets in Africa, India, Latin America and Southeast Asia—benefitting more than 2.5 million clients in 12 countries (pictured, owner of a weaving business in Peru and her family). AIG’s goal is to make a differ- ence with our philanthropic contributions in partnership with organizations that promote entrepreneurship, innovation, diversity and empowerment around the world. In 2007, AIG provided significant support to charitable organizations that address the needs of the communities where we do business—empowering women, promoting innovative education programs and providing opportunities for diverse populations. WE SEE THE CHANCE TO MAKE THE WORLD A MORE PROSPEROUS AND LIVABLE PLACE. One of the main points in AIG’s Vision is to contribute to the growth of sustainable, prosperous communities. We believe that corporate responsibility is essential to our long-term objective of creating value for our shareholders and serving the interests of our clients. In 2007, AIG took important steps to incorporate social, environmental and governance concerns into our underwriting, risk management and investment decision making. We also grew our philanthropic programs at both the corporate and local levels, leveraging our global reach and relationships with partners in the community.

- 23. AIG 2007 Annual Report 21 Since 2003, the AIG Disaster Relief Fund (DRF)—funded by donations from AIG and its employees—has contributed over $10 million to emer- gency relief organizations. In 2007, the DRF supported rebuilding and reconstruction efforts after the earthquake in Peru, and responded to the wildfires that burned through southern California. AIG also supports disaster preparedness organizations that focus on planned and coordinated responses to disasters. AIG’s commitment to diversity encompasses support for historically disadvantaged ethnic groups and women around the world. AIG is also recognized for reaching out to people with disabilities. In 2007, New York City Mayor Michael R. Bloomberg recognized AIG with the ADA (Americans with Disabilities Act) Employment Award for its disability initiatives.

- 24. 22 AIG 2007 Annual Report P E O P L E Our dedicated people are the cornerstone of AIG’s competitive advantage. We have a unique global franchise with a diversity of cultures, languages, back- grounds and experiences. Valuing people means devel- oping the talents and capa- bilities of each individual; recognizing and rewarding excellence; and encouraging and rewarding teamwork. P E R F O R M A N C E We are accountable for building and preserving AIG’s financial strength. AIG’s franchise has remarkable reach, relationships and resources. Our global footprint, diverse distribution model, extensive product range and financial strength make AIG uniquely suited to serve customers and communities around the world. C U S T O M E R F O C U S Focusing on AIG’s 74 million customers worldwide begins with anticipating their priorities—not only satisfying current needs, but looking to future needs and doing it better than our competitors. We strive to exceed our cus- tomers’ expectations by deliv- ering high-quality products and services at a better value.

- 25. AIG 2007 Annual Report 23 R E S P E C T Respect encom- passes how we interact with colleagues—seeing and valuing each other as diverse individuals. Our respect transcends national borders and is reflected in the ways we honor the people, history and culture of local communities. Collaboration, so critical in an organization of our size and scope, is built upon respect. I N T E G R I T Y Integrity means conducting every aspect of AIG’s business with honesty—meeting our com- mitments to our customers, colleagues, business partners and shareholders. Our empha- sis on improving compliance demonstrates our dedication to integrity and enhances our reputation for strong corporate governance. Integrity is not only a core belief, but a competitive necessity in today’s marketplace. E N T R E P R E N E U R S H I P Entrepreneurship speaks to AIG’s ability to capitalize on unmet customer needs. AIG has a long history of respon- sible risk taking, innovation and creative problem solving. Entrepreneurship entails championing new initiatives with energy and urgency, and recognizing the power that can be unleashed if each employee acts every day as an owner of the firm. WE SEE A CLEAR COURSE TOWARD BECOMING THE WORLD’S FIRST-CHOICE PROVIDER OF INSURANCE AND FINANCIAL SERVICES. Around the globe—in locations as diverse as Hong Kong (pictured), Stockholm, Los Angeles—AIG businesses and colleagues share a Vision and a set of core Values that play a fundamental role in our company’s global growth and success. Both distinctive and inclusive, the AIG Vision is: To be the world’s first-choice provider of insurance and financial services. We will create unmatched value for our customers, colleagues, business partners and shareholders as we contribute to the growth of sustainable, prosperous communities. Our core Values are: People. Customer Focus. Performance. Integrity. Respect. Entrepreneurship.

- 26. 24 AIG 2007 Annual Report A I G A T A G L A N C E United Guaranty Corporation United Guaranty Corporation subsidiaries provide residential mortgage guaranty insurance for first- and second-lien mortgages, private education loan default insurance, and other financial services to financial institutions and mortgage investors. Transatlantic Holdings, Inc. Transatlantic Holdings, Inc. (TRH), is a majority- owned subsidiary of AIG. TRH’s subsidiaries offer reinsurance capacity on both a treaty and faculta- tive basis worldwide—structuring programs for a full range of property and casualty products, with an emphasis on specialty risks. Foreign General Insurance Group The Foreign General Insurance Group comprises AIG’s international property-casualty operations. s American International Underwriters (AIU) is the marketing unit for AIG’s overseas property-casualty operations and the most extensive foreign network of any insurance organization. Stretching across Asia and the Pacific to Latin America, Europe, Africa and the Middle East, AIU markets a full range of property-casualty products to both commercial and consumer clients. s AIU Accident & Health Division is a leading provider of accident, supplemental health and travel insurance to international businesses and consumers. s AIU Commercial Lines Division is a market leader in financial lines in Europe, surpassing one billion dollars in premiums. s AIU Personal Lines Division operates globally to provide automobile, personal property and extended warranty coverages. It also provides products and services for the high-net-worth segment, institutional and individual clients. The General Insurance segment also includes AIG Global Marine and Energy which serves the global insurance, risk management and loss control needs of marine and energy clients, including renewable operations such as biofuel, hydroelectric, geothermal, solar and wind. Domestic Brokerage Group The principal units of the Domestic Brokerage Group (DBG) provide a wide range of commercial and industrial coverages. s AIG Executive Liability is the leading provider of directors and officers, and employment practices liability, and a premier underwriter of professional liability, fidelity coverage, network security insurance and fiduciary coverages. Its products were previously marketed under the National Union Fire Insurance Company of Pittsburgh, Pa., brand. s Lexington Insurance Company is the leading U.S.-based excess and surplus lines carrier, specializing in property, casualty, healthcare and program risks. s AIG Excess Casualty is the leading provider of commercial umbrella and excess casualty liability insurance. s AIG Specialty Workers’ Compensation® is a market-leading workers’ compensation insurer for small and midsize businesses. s AIG Risk Management® provides casualty risk management products and services to large commercial customers. s AIG Environmental is the largest U.S. provider of environmental liability coverages and services. s AIG Worldsource provides global insurance programs for U.S.- and Canadian-based multinationals, as well as foreign companies with operations in the United States and Canada. s DBG also includes many specialty business units that draw on the worldwide resources of AIG companies to meet client needs in the aviation, transportation and construction industries, the small business sector and the accident and health arena, as well as engineering services through AIG Consultants, Inc. s HSB Group, Inc., the parent company of The Hartford Steam Boiler Inspection and Insurance Company, HSB Engineering Insurance Limited, and The Boiler Inspection and Insurance Company of Canada, is a leading worldwide provider of equipment breakdown and engineered lines insurance. Domestic Personal Lines AIG’s growing Domestic Personal Lines opera- tions provide automobile insurance through aigdirect.com and AIG Agency AutoSM , and offer a broad range of coverages for high-net-worth individuals through AIG Private Client Group. AIG is among the top 10 writers of automobile insurance, with historical growth rates exceeding industry averages. The businesses in AIG’s Financial Services Group are leaders in the markets they serve. s International Lease Finance Corporation (ILFC) is AIG’s aircraft leasing business. With a fleet of more than 900 planes, ILFC is a market leader in the leasing and remarketing of new advanced technology commercial jet aircraft worldwide. ILFC is the largest single customer to date for the new Boeing 787Dreamliner. s Capital Markets operations are conducted through AIG Financial Products Corp., which engages in transactions, as principal, to provide clients with risk management solutions and sophisticated hedging and investment products in standard and customized transactions involving commodities, credit, currencies, energy, equities and rates. Clients include top-tier corporations, financial institutions, governments, agencies, institutional investors and high-net-worth individuals throughout the world. s AIG’s consumer finance business consists of American General Finance, Inc.(AGF) and AIG Consumer Finance Group, Inc.(CFG). AGF is one of the largest consumer finance organizations in the United States, with a branch network in 45 states, Puerto Rico and the U.S. Virgin Islands. AGF’s primary market is in the United States, but it continues to explore opportunities in interna- tional markets. CFG, through its subsidiaries, offers a broad range of consumer finance products, primarily in emerging markets. As these markets continue to attract investment, CFG’s businesses have significant potential to expand operations in developing countries around the world and provide consumers with more products. s Imperial A.I. Credit Companies, Inc., is the largest insurance premium finance provider in the United States. General Insurance AIG’s General Insurance operations include the largest U.S. underwriters of commercial and industrial insurance, the most extensive international property-casualty network, a personal lines business with an emphasis on auto insurance and high-net-worth clients, a mortgage guaranty insurance operation and a leading international reinsurer. AIG’s leadership is a result of its underwriting skill, innovative insurance solutions, financial strength, superior service and responsive claims handling. The AIG claims operation gives clients access to a vast worldwide network of dedicated experts and top legal firms. Financial Services AIG’s Financial Services businesses specialize in aircraft and equipment leasing, capital markets, consumer finance and insurance premium finance.These busi- nesses complement AIG’s core insurance operations and achieve a competitive advantage by capitalizing on opportunities throughout AIG’s global network.

- 27. AIG 2007 Annual Report 25 Foreign Life Insurance & Retirement Services AIG’s Foreign Life Insurance & Retirement Services operations are conducted principally through the following market-leading companies: s American International Assurance Company, Limited (AIA), is AIG’s flagship life insurance company for Southeast Asia and the leading life insurer in the region. Its extensive network of branches, subsidiaries and affiliates spans Australia, Brunei, China, Guam, Hong Kong, India, Indonesia, Macau, Malaysia, New Zealand, Singapore, South Korea, Thailand and Vietnam. s American Life Insurance Company (ALICO) is among the largest international life insurance companies in the world, with operations in more than 50 countries. ALICO’s operations stretch from Japan to Europe, the Middle East, Latin America, South Asia and the Caribbean. s AIG Star Life Insurance Co., Ltd., and AIG Edison Life Insurance Company contribute to AIG’s growing life insurance presence in Japan through the sale of life, accident and health, and retirement services products via agents, brokers and bank partners. s Nan Shan Life Insurance Company, Ltd., is Taiwan’s second-largest life insurer in terms of total premium. s The Philippine American Life and General Insurance Company (Philamlife) is the largest and most profitable life insurance company in the Philippines. Domestic Life Insurance & Retirement Services In the United States, AIG’s Domestic Life Insurance & Retirement Services businesses offer a comprehensive range of life insurance, annuity, and accident and health products for financial planning, estate planning and wealth transfer. They use a full complement of distribution channels, including banks, national and regional brokerage firms, independent financial planning firms, independent and national marketing organizations, brokerage general agencies, independent insurance producers and general agents, and worksite specialists. The principal operations include the following: s AIG American General, one of the largest life insurance organizations in the United States, distributes a broad range of life insurance, annuity, and accident and health products. s AIG Annuity Insurance Company is the largest issuer of fixed annuities in the United States and the leading provider of annuities sold through banks. s AIG Retirement (formerly branded as AIG VALIC) is the nation’s leading provider of group retirement plans to K-12 education and the third largest to healthcare and higher education institutions. s AIG SunAmerica Retirement Markets is one of the nation’s leading distributors of individual variable annuities and income solutions. Revenues by Major Business Segment* (billions of dollars) General Insurance Life Insurance & Retirement Services Financial Services Asset Management 49.2 51.7 (1.3) 5.6 53.6 50.9 7.8 4.5 2006 2007 * Includes net realized capital gains (losses). The businesses in AIG’s Asset Management Group leverage AIG’s deep knowledge of markets around the world and expertise in a wide range of asset classes. s AIG Investments manages equities, fixed income, private equity, hedge fund of funds and real estate investments for institutional, individual and high-net-worth investors around the world. AIG Investments ranks among the top seven money managers in the world by institutional assets under management. s AIG Private Bank Ltd., AIG’s Zurich-based private banking subsidiary, provides personalized private banking and structured wealth management solu- tions, including investment advisory and asset management products to a worldwide clientele. s AIG SunAmerica Asset Management Corp. manages and/or administers retail mutual funds, as well as the underlying assets in AIG SunAmerica and AIG Retirement variable annuities sold to individuals and institutional groups throughout the United States. s The AIG Advisor Group, Inc., broker-dealers provide financial products, technology support and business-building programs to independent financial advisors serving the retirement planning needs of clients in the United States. Life Insurance & Retirement Services Serving millions of customers around the world, AIG’s growing global Life Insurance busi- nesses make up the most extensive network of any life insurer. Strategies for enhancing growth focus on developing new markets, expanding distribution channels and broadening product offerings. AIG has one of the premier Retirement Services businesses in the United States and it also has an extensive international retirement services network—both poised to meet the asset accumulation, protection and lifetime income needs of individuals around the world. Asset Management AIG’s Asset Management businesses include institutional and individual asset management, broker-dealer services, private banking and spread-based investment programs, as well as the management of AIG insurance invested assets.

- 28. 26 AIG 2007 Annual Report R E V I E W O F O P E R A T I O N S — G E N E R A L I N S U R A N C E Domestic Brokerage Group AIG’s Domestic Brokerage Group (DBG) is the largest U.S. com- mercial property-casualty insurance organization. DBG companies provide commercial insurance products and services to a wide range of entities, from multinational and middle market companies to small entrepreneurs and nonprofit organizations. Record operating income in 2007 reflects DBG’s steadfast commitment to disciplined underwriting and focus on profitability. DBG’s principal operating subsidiaries include American Home Assurance Company, National Union Fire Insurance Company of Pittsburgh, Pa., and Lexington Insurance Company. Many of DBG’s operating units have been writing commercial insurance for decades. Capitalizing on its market advantages and key business strategies, DBG is well-positioned to capture new opportu- nities and continue leading the U.S. commercial insurance industry. Diversification is a bedrock DBG characteristic that is reflected in its products, distribution network, customer base, regional struc- ture and employees. This balanced approach helps the organization leverage growth opportunities even in the most challenging markets, exercise flexibility in selecting customers and business segments that offer the greatest potential, and expand a franchise that cannot easily be replicated. DBG companies hold high ratings for financial strength—an increasingly important consideration for insurance brokers and customers in placing their business. AIG Executive Liability has been a leading executive and professional liability underwriter for AIG’s General Insurance operations include the largest U.S. underwriters of commercial and industrial insurance, the most extensive international property-casualty network, a personal lines business with an emphasis on auto insurance and high-net-worth clients, a mortgage guaranty insurance operation and an international reinsurance organization. General Insurance Financial Results (in millions, except ratios) 2007 2006 Gross premiums written $58,798 $56,280 Net premiums written 47,067 44,866 Underwriting profit 4,500 4,657 Net investment income 6,132 5,696 Operating income before net realized capital gains 10,632 10,353 Net realized capital gains (losses) (106) 59 Operating income 10,526 10,412 Operating income before net realized capital gains (losses), excluding catastrophe losses 10,908 10,353 Consolidated net reserves for losses and loss expenses 69,288 62,630 Combined ratio 90.33 89.06 Combined ratio, excluding catastrophe losses 89.73 89.06 AIG Environmental designed an innovative insurance product to cover the specific risks associated with the clean up of Fort Ord, previously a U.S. Army base in California contaminated with munitions and explosives. The compre- hensive solution enabled the Fort Ord Reuse Authority to enter into a contract for munitions removal, leading to multimillion-dollar mixed-use development plans covering over 3,500 acres.

- 29. Workers’ Compensation 16.5% General Liability/Auto Liability 15.8% Property 14.1% Management/Professional Liability 11.2% Commercial Umbrella/Excess 9.7% Programs 4.7% A&H Products 4.2% Multinational P&C 4.1% Environmental 2.9% Boiler and Machinery 2.9% Aviation 2.1% All Other 11.8% Domestic Brokerage Group— Gross Premiums Written by Line of Business Total = $31.8 billion AIG 2007 Annual Report 27 more than 40 years. It benefited from its strong financial position as over 90 percent of its largest board and corporate customers renewed contracts in 2007. DBG companies are consistent, longstanding lead underwriters in most lines of business in which they participate. This provides them with an ability to anticipate emerging risks, which is a hallmark of AIG Excess Casualty, DBG’s market-leading commercial umbrella insurance provider. From this leadership position, AIG Excess Casualty can quickly recognize developing liability trends and respond with intelligent underwriting solutions. Perhaps no attribute defines DBG better than innovation. In 2007, DBG companies introduced an average of one new insurance product or service every week, including several groundbreaking products to address global warming risks. DBG’s Lexington Insurance Company, the leading U.S.-based excess and surplus lines insurer, introduced Upgrade To GreenSM Residential to help policyholders rebuild damaged homes to green standards using ENERGY STAR® or equivalent energy-efficient and environmentally friendly materials. Lexington’s accumulated expertise in specialized industries has also served as a foundation for product innovation and risk solutions for such key sectors as healthcare, real estate, higher education, agriculture and construction. AIG pioneered pollution liability insurance 27 years ago, and AIG Environmental is leading the way today with a new breed of environmentally friendly insurance products. Its Sustain-a-BuildSM coverage encourages environmentally responsible construction and building projects through premium discounts for operations that qualify for the U.S. Green Building Council’s Leadership in Energy and Environmental Design (LEED® ) certification program. Sustain-a-Build joins a portfolio of AIG Environmental products focused on pollution remediation and contaminated property clean up. DBG’s innovations have produced an extensive portfolio of insurance products and services. And nowhere is the significance of this range of offerings more evident than at AIG Risk Management (AIGRM), a provider of risk management solutions for the largest U.S. corporations. In 2007, AIGRM expanded its integrated insur- ance program approach, comprising primary casualty, excess workers’ compensation, surety, risk financing and captive management programs, in concert with loss control and claims services, to serve new industries and market segments. The result is a significant opportunity with construction, transportation, public entity, real estate and midsize organizations that require a comprehensive way to manage risk. AIG’s Deliver the Firm strategy is ingrained in every DBG unit. AIG Worldsource, which serves the needs of U.S. and Canadian customers overseas and foreign businesses with risks in the United States and Canada, is no exception. The unit is the primary facilitator for delivery of AIG PassportSM services. AIG Passport taps AIG’s global network to provide multinational customers with local insurance worldwide, while offering DBG a competitive edge in an increasingly global liability environment. AIG’s Domestic Accident & Health Division also demonstrates DBG’s commitment to the Deliver the Firm strategy. With more than 40 years of experience in managing specialized accident and health risks for consumer, commercial and affinity group customers, the division recorded excellent premium growth in 2007, in part because it integrated products such as accidental death and accidental medical coverages into policies offered by other DBG operating units, a unified solution that appeals to many customers. The unit’s growth also reflects its success in building strong direct marketing, travel insurance, and school and student insurance businesses. Several thousand independent insurance brokerage firms do business with DBG every year. Expanding these relationships is a business imperative well exemplified by AIG Specialty Workers’ Compensation, the nation’s leading private writer of this insurance to midsize and small businesses. The unit’s Internet-based eComp plat- form was enhanced in 2007 to offer greater quote-to-bind capabilities and improved service. eComp ranks among the top e-commerce sites, quoting an average of over $4 million in new business daily. The mission of AIG Small Business® is to be the insurer of choice for the more than 25 million small businesses in the United States. Using aggregation technologies and select distribution channels, the unit is able to provide the full range of DBG’s specialty products, opening the door to greater opportunities in this sector. AIG Global Marine and Energy and AIG Aviation bring extensive experience to some of the world’s most complex commer- cial sectors. In 2007, AIG Global Marine and Energy, which serves customers in the United States and internationally, launched an Alternative Energy practice to deliver insurance, engineering and financial resources to respond to risks posed by alternative and renewable energy technologies and climate change.The Marine unit also teamed with AIG Private Client Group to service the recreational marine exposures of the nation’s high-net-worth individuals. AIG Aviation weathered challenging market conditions by focusing on intelligent risk selection and by delivering a broad range of AIG products to this market.

- 30. 28 AIG 2007 Annual Report DBG’s Claims operations and loss prevention services are just as important to customers as its underwriting acumen. DBG enhanced its claims processes and introduced technologies in 2007 to reduce costs and enhance the customer service experience, as highlighted by the launch of the Catastrophe Advantage ProgramSM (CAP). CAP applies sophisticated hurricane modeling technology to DBG’s proprietary database of policyholders’ insured locations to secure critical disaster resources before a hurricane makes landfall and before these resources are engaged by others. The result is greater efficiency in the management of catastrophe-related claims and delivery of an invaluable service to customers. HSB Group, Inc. (HSB), the parent company of The Hartford Steam Boiler Inspection and Insurance Company, had excellent operating results in 2007 as it reported strong growth in net premi- ums written. In addition to equipment breakdown and engineered lines insurance, HSB provides specialty coverages and loss prevention services that become value-added components of other insurers’ commercial and personal lines insurance products. Including HSB’s specialty insurance coverages as an essential ele- ment of an overall policy allows for more affordable premiums and better integrated protections than when the coverages are purchased as standalone policies. This business model enables HSB to offer an appealing value proposition to many insurance providers in the United States and international markets. HSB’s integrated global loss prevention model includes inspecting many pressure vessels at the point of manufacture. This and other loss prevention initiatives play an important role in HSB’s underwriting performance and help deliver excellent returns on capital. In 2007, HSB conducted more than 1.6 million on-site loss prevention inspections of equipment and property-casualty risks. Domestic Personal Lines AIG’s Domestic Personal Lines—aigdirect.com, AIG Agency Auto and AIG Private Client Group—faced challenging economic and market conditions in 2007. Operating income declined due to losses from the California wildfires, unfavorable loss development from discontinued lines and AIG Agency Auto, and increased costs related to the acquisition of the minority interest in 21st Century. Premium growth exceeded expected industry growth once again, with strong growth from AIG Private Client Group and growth in aigdirect.com outpacing declines in AIG Agency Auto. In 2007, AIG acquired the remaining shares of 21st Century that it did not previously own. The combination of AIG Direct and 21st Century created aigdirect.com, a new private passenger auto- mobile insurance brand. The combined operation also made progress on plans to integrate its infrastructure as it consolidated customer call centers and improved efficiencies. The combination creates the fourth-largest direct response writer of automobile insurance in the United States. It will also help develop a strong brand identity in the private passenger market, while creating a low-cost, customer-focused platform for selling a wider range of AIG products to consumers. AIG Agency Auto remained focused on improving profitability, with competitive products, enhanced service offerings for agents and customers, and lower costs through operational efficiencies. It launched eRater, a new web-based quoting system for agents now available in 24 states. AIG Agency Auto also improved the timeliness and accuracy of policy billing information; enhanced the efficiency and service capabilities of customer call centers; and introduced processes and systems to support a faster, fairer and consistent claims experience. AIG Private Client Group continued its leadership position in the market for high-net-worth individuals, achieving excellent top line growth over the previous year. The unit continues to insure more than one-third of the Forbes 400 Richest Americans. It expanded the reach of its Hurricane Protection Unit—modeled after its acclaimed Wildfire Protection Unit, which protects high-value residences— aigdirect.com 59.2% AIG Agency Auto 22.5% AIG Private Client Group 18.3% Personal Lines—Gross Premiums Written Total = $5.0 billion Domestic Brokerage Group—Premiums Written (billions of dollars) 2003 2004 2005 2006 2007 19.9 28.6 30.0 31.6 31.8 30.5 22.8 23.1 24.3 24.1 Gross Premiums Written Net Premiums Written R E V I E W O F O P E R A T I O N S — G E N E R A L I N S U R A N C E , C O N T I N U E D