Cola Wars Continue: Coke and Pepsi | Evolution | SWOT Analysis

- 1. Cola Wars Continue Cola Wars Continue CASE CASE STUDY STUDY ANALYZING THE RIVALRY, INDUSTRY, AND STRATEGIC EVOLUTION

- 2. "Cola Wars Continue: Coke and Pepsi” explains the economics of the soft drink industry and its relation with profits, taking into account all stages of the value chain of the soft drink industry. The study analyses the different stages of the value chain (concentrate producers, bottlers, retail channels, suppliers) and the impact of modern times and globalization on competition and interaction in the industry. Introduction

- 3. Overview 1. Evolution of Coke & Pepsi 2. Production & Distribution of CSD 3. Challenge 4. Leadership 5. SWOT Analysis 6. Segment & Key Aspects 7. Conclusion 8. Agenda

- 4. Brand Overview COKE VALUES Revolve around Optimism, Refreshment, and Bringing People Together. HISTORY cola was formulated by John Pemberton in 1886 in Atlanta, Georgia. MISSION TAGLINE Refresh the world, inspire moments of optimism and happiness, create value and make a difference Open Happiness. In 1899, Candler granted Coca Cola its first bottling franchise, which quickly grew. During the 1920s and 1930s, CEO Woodruff expanded Coke's international business. Then, 64 Coca Cola bottling plants were set up during World War II, contributing to Coke's dominant market shares in most European and Asian countries.

- 5. Brand Overview PEPSI VALUES Innovation, Youthfulness, and Inclusivity. HISTORY Pepsi was invented in 1893 in New Bern, North Carolina by pharmacist Caleb Bradhan. MISSION TAGLINE Create more smiles with every sip and every bite. For the Love of It Live for Now Like Coke, Pepsi adopted a franchise bottling system, and by 1910 it had built a network of 270 franchised bottlers. But in 1923 and 1932, Pepsi struggled and declared bankruptcy. Pepsi lowered the price and tried to expand its network. In 1938, Coke filed a suit against Pepsi, claiming that Pepsi-Cola was infringing on the Coca-Cola trademark. In 1941, the court ruled in favour of Pepsi. And Cola wars began.

- 6. ICE BREAKER The US CSD market has been lucrative, characterized by high profit margins and brand loyalty. Economics of the US Carbonated Soft Drink (CSD) Market Key Insights: Dominance by two players: Coke and Pepsi. Revenue sources: concentrate sales, bottling, and retail channels. Market maturity and declining growth post-1990s.

- 7. ICE BREAKER Highly concentrated with a duopoly (Coke and Pepsi) dominating. CSD Industry Overview Key Insights: Marketing, advertising, branding Barriers to Entry: High due to brand loyalty, economies of scale, and distribution networks.

- 8. ICE BREAKER Divided between concentrate producers and bottlers. Production & Distribution of CSD Concentrate Producer Bottlers Retail Channels Suppliers

- 9. ICE BREAKER Concentrate Producer Bottlers Retail Channels Suppliers Manufacturing and selling concentrate to bottlers. Diluting the concentrate with water and sweeteners, packaging, and distributing. Grocery stores, fast food outlets, vending machines, gas stations, and convenience stores. Aluminum for cans, sweeteners (corn syrup), plastic for bottles. Low capital investment, high profitability. High due to labor, Raw Materials, and Transportation. Influence of shelf space, product placement, and exclusive contracts with retailers. Rising commodity prices impacting bottlers' margins. Key Players: Coca-Cola, PepsiCo. Increasing consolidation to improve bargaining power. Divided between concentrate producers and bottlers. Production & Distribution of CSD

- 10. CHALLENGES IN 2006 Understand consumer behavior and preferences related to sportswear and the Olympics. Challenges Health concerns and changing consumer preferences toward healthier options like bottled water and sports drinks posed a significant threat to the CSD market. Declining Demand for CSD While Coke and Pepsi had significant global footprints, they faced challenges from local competitors in international markets, along with regulatory issues. Globalization Increased input costs, including raw materials like aluminum and sugar, impacted profitability. Pricing Pressure Growing concerns about the environmental impact of plastic packaging, water usage, and other sustainability issues started to emerge, leading both companies to explore greener practices. Environmental Concerns

- 11. 1 Pepsi Challenge The Pepsi Challenge started in 1975 with blind taste tests of two unmarked colas. A BLIND TASTE TEST CAMPAIGN BY PEPSI 2 The main goal of the Pepsi Challenge was to show that people preferred the taste of Pepsi over Coca-Cola in a straightforward manner. The majority of participants preferred Pepsi over Coca-Cola in blind taste tests, leading Pepsi to promote its cola as superior in taste. After downplaying the results, Coca-Cola reformulated its recipe in 1985 to create "New Coke" in response to the taste test results. The Pepsi Challenge had a big impact on the soda industry and changed how companies approach competitive marketing. 3 4 5

- 12. COCA-COLA LEADERSHIP PEPSI LEADERSHIP Leadership Strategies Strong focus on global expansion and brand differentiation. Used nostalgia and heritage marketing to keep the brand's image timeless. Leadership under Neville Isdell emphasized reinvigorating growth and efficiency. Aimed for a younger, edgier image through bold advertising campaigns. Leadership Strategies Emphasized product diversification into non- CSD products such as Tropicana & Gatorade. Leadership under Indra Nooyi emphasized sustainability, product innovation, and healthier alternatives.

- 13. Launches Continued to introduce variations like Diet Coke Coke Zero The company also explored bottled water (Dasani) and energy drinks. Coca-Cola Expanded its non-CSD portfolio with products like Tropicana Aquafina, and Gatorade. Pepsi also introduced product lines tailored to specific markets, like Pepsi Blue and Pepsi Twist. Pepsi PRODUCT LAUNCHES AND INNOVATIONS Understand consumer behavior and preferences related to sportswear and the Olympics.

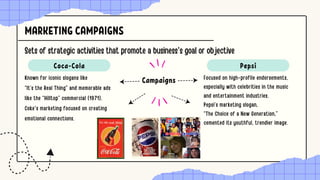

- 14. Campaigns Known for iconic slogans like “It’s the Real Thing” and memorable ads like the “Hilltop” commercial (1971). Coke's marketing focused on creating emotional connections. Coca-Cola Focused on high-profile endorsements, especially with celebrities in the music and entertainment industries. Pepsi’s marketing slogan, “The Choice of a New Generation,” cemented its youthful, trendier image. Pepsi MARKETING CAMPAIGNS Sets of strategic activities that promote a business's goal or objective

- 15. FACTS Market Share Coca Cola 48% Pepsi 21% Others 31% Coca-Cola had a significantly higher market share globally in CSDs, nearly double that of PepsiCo. The remaining market share was held by regional & smaller competitors such as Dr Pepper Snapple Group. PepsiCo held a stronger position in non-carbonated beverages (NCB), primarily driven by its Gatorade and Tropicana brands. Coca-Cola spent more on advertising overall, with a higher allocation to CSDs, reflecting its core focus on carbonated beverages. PepsiCo’s advertising expenditure was more evenly split between CSDs and NCBs, supporting its diversified product strategy.

- 16. COCA-COLA SWOT ANALYSIS STRENGTHS Global market leader in CSDs & High profitability Strong brand loyalty and extensive distribution networks WEAKNESSES Heavily reliant on CSDs Slower to adapt to the health-conscious trend compared to Pepsi OPPORTUNITIES Expansion in emerging markets Product diversification into non-carbonated beverages THREATS Rising health concerns over sugar & carbonated beverages Increased competition from Pepsi & other brands

- 17. PEPSICO SWOT ANALYSIS STRENGTHS Strong presence in both CSD and non-carbonated beverage markets Ownership of leading brands like Gatorade & Tropicana WEAKNESSES Lagging behind Coca-Cola in the global CSD market Lower brand recognition internationally compared to Coca-Cola OPPORTUNITIES Capitalizing on growing demand for health and wellness beverages Expanding into under-penetrated emerging markets THREATS Decreasing CSD consumption, particularly in North America Growing competition from private labels and health-focused brands

- 18. BRAND BRAND Value derived from consumer perception of a brand. Coke vs. Pepsi: Coca-Cola's iconic status vs. Pepsi's pop-culture connections. Brand Equity Consumer Loyalty: How emotional attachment influences repeat purchases. Sponsorships, advertising, product placement. Brand Attachment Coke's Advantage: Global reach, brand equity, bottling system. Pepsi's Advantage: Youth appeal, diversification into snacks. Competitive Advantage Primarily youth, but expanding to health-conscious consumers. Demographics: Urban vs. rural, age groups, income levels. Environmental Concerns Differentiation: Product variety, advertising strategies. Cost Leadership: Economies of scale in production and distribution. Key Aspects

- 19. REVENUE Company 2005 Revenue (in billions) 2006 Revenue (in billions) Revenue Growth (YoY) $23 billion $24 billion 4.3% $32.6 billion $35 billion 7.4% In Billions Revenue Growth (2005-2006) Coca-Cola's growth was slower due to its reliance on carbonated soft drinks (CSDs), which were facing challenges in mature markets such as North America and Europe due to health concerns. PepsiCo experienced higher revenue growth compared to Coca-Cola. PepsiCo’s diversified portfolio in snacks and non-carbonated beverages (NCBs) helped it achieve greater growth, especially in the non-CSD categories.

- 20. GROWTH Company 2005 Market Share 2006 Market Share Change in Market Share 47% 48% +1% 20% 21% +1% Market Share Growth (2005-2006) Company 2005 Market Share 2006 Market Share Change in Market Share 42% 42% 0% 31% 31% 0% Global CSD Market Share Growth: Global CSD Market Share Growth:

- 21. ANALYSIS Metric Coca-Cola PepsiCo Product Diversification Focus on core CSD brands, slow expansion into NCBs (Dasani, Minute Maid). Significant diversification into NCBs (Gatorade, Tropicana) and snack foods (Frito-Lay). Emerging Market Focus Aggressive expansion in Latin America, Africa, and Asia-Pacific. Expansion into emerging markets, but focused more on North America for NCBs and snacks. Health and Wellness Slow to adapt, still focused on traditional sugary beverages like Coke and Sprite. Strong adaptation, focusing on healthier beverages and snacks (Gatorade, Tropicana). Advertising Spend Focused heavily on CSD products and global brand campaigns (e.g., Coca-Cola Classic). Balanced spend between CSDs and NCBs with a focus on youth marketing (Gatorade, Pepsi Max). Innovation Limited innovation in product lines; new CSD variants like Diet Coke and Coke Zero. More innovative product offerings in NCBs and snacks, launching new flavors and health-focused options. Comparative Analysis: Strategic Initiatives (2006)

- 22. REVENUE Company Operating Margin Net Profit Margin Return on Equity (ROE) 26.5% 20.2% 30% 23% 15.5% 27% Profitability Analysis (2006) Coca-Cola had higher profitability in terms of net profit margin and ROE, reflecting its efficiency and dominance in the CSD market. PepsiCo’s lower margins were partly due to its diversified portfolio, which included lower-margin NCBs and snacks, although this also helped reduce risk and volatility.

- 23. REVENUE Company 2006 Advertising Spend Primary Focus $4 billion Focus on brand loyalty and core CSDs (Coke, Sprite). $3.7 billion Focus on youth marketing, non-CSDs, and sports marketing (Gatorade, Pepsi Max). Comparative Advertising and Marketing Efforts (2006) Coca-Cola’s advertising was largely focused on maintaining its global dominance in CSDs, with campaigns emphasizing brand loyalty and tradition (e.g., Coca-Cola Classic). PepsiCo directed a significant portion of its marketing budget towards non-CSD products like Gatorade and Pepsi Max, aiming to capture the growing health-conscious consumer segment.

- 24. Year Company Market Share Revenue Key Product Launches Key Strategy/Steps Taken 1960s 60% $1 billion (1969) Fanta, Sprite Significant diversification into NCBs (Gatorade, Tropican 26% $1 billion (1969) Pepsi Generation Campaign Targeted youth with aggressive marketing (Pepsi Generation campaign). 1970s 52% $5.9 billion (1979) Tab (diet soda) Global presence, diversification into diet beverages. 32% $3.3 billion (1979) Mountain Dew, Diet Pepsi Pepsi Challenge (blind taste test), aggressive marketing. 1980s 40% $7.2 billion (1985) New Coke, Coca-Cola Classic Reintroduced Coca-Cola Classic after New Coke’s failure. 30% $5.5 billion (1985) Acquisition of Frito-Lay Diversified into snacks, Pepsi Generation, capitalized on New Coke debacle. 1990s 48% $18 billion (1999) Coca-Cola Zero Focus on global expansion, especially in emerging markets. 31% $16 billion (1999) Aquafina Focus on non-CSDs (bottled water), snacks, and healthy beverages. 2000s 45% $21.7 billion (2006) Minute Maid Premium, Vitaminwater (acquisition) Health-focused product portfolio, expansion into functional drinks. 30% $25 billion (2006) Pepsi Max, Tropicana expansion Diversification into non-CSDs, strong performance in snacks and NCBs. REVENUE Who has been Winning the War?

- 25. Year Company Market Share Revenue Key Product Launches Key Strategy/Steps Taken 2010s 44% $35.1 billion (2019) Coca-Cola Life, AHA Sparkling Water Focus on sugar-free and low-calorie beverages, sustainability efforts. 29% $67 billion (2019) Bubly, Gatorade G2 Focus on non-CSDs, expanding snack and health-focused product lines. 2020s 43% $41.3 billion (2022) AHA Sparkling Water, Costa Coffee (acquisition) Expanding into health-conscious and premium coffee segments. 27% $86 billion (2022) Bubly, Plant-based beverages Focus on wellness products, non-CSDs, and snack diversification. REVENUE Who has been Winning the War? While Coca-Cola remains dominant in the CSD segment, PepsiCo’s diversified portfolio in snacks and non- CSD beverages has led to overall revenue dominance. PepsiCo's ability to adapt to changing consumer trends (health and wellness) and its innovation in new products makes it a formidable competitor.

- 26. KEY INSIGHTS Key Insights from the 1960s - 2020s 1960s-1980s: Coca-Cola was the clear market leader, but PepsiCo started gaining market share through aggressive marketing and product diversification, particularly in the 1980s. 1990s-2000s: Coca-Cola continued to dominate the CSD market, but PepsiCo's focus on non-carbonated beverages (NCBs) and snacks allowed it to increase its revenue, especially by the 2000s. 2010s-2020s: PepsiCo surpassed Coca-Cola in total revenue due to its diversification strategy, with a major focus on health-conscious beverages and snacks.

- 27. Summary: Coca-Cola has consistently maintained its global leadership in carbonated soft drinks (CSDs), but PepsiCo's diversification into snacks and non-carbonated beverages has allowed it to surpass Coca-Cola in overall revenue. Outlook: PepsiCo's focus on non-CSD products, including acquisitions like Gatorade, Tropicana, and Frito-Lay, has allowed it to capitalize on health and wellness trends, while Coca-Cola's strategy has been slower in adapting to this shift. CONCLUSIONS