Cost accounting intrudoction by akbari.ppt

- 1. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Management and Cost accounting Seventh Edition Chapter 4 Process costing

- 2. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Introduction • In many industries, products are mass produced, that is, relatively homogeneous products are processed in a very similar manner. • Companies in these industries use process costing. • This chapter presents process-costing systems.

- 3. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Key Differences Between Job Costing and Process Costing BASIS FOR COMPARISON JOB COSTING PROCESS COSTING Meaning Job costing refers to calculating the cost of a special contract, work order where work is performed as per client's or customer's instructions. A costing method, in which the costs which are charged to various processes and operations is ascertained, is known as Process Costing. Nature Customized production Standardized production Assignment of cost Calculating cost of each job. First of all, cost is determined for the process, thereafter spread over the produced units. Cost Center Job Process Scope of cost reduction Less High Transfer of Cost No transfer Cost is transferred from one process to another Identity Each job is different from another. Products are manufactured consecutively and so they lose their identity. Cost Ascertainment Completion of the job. End of the cost period. Industry type Job costing is suitable for the industries which manufactures products as per customer's order Process costing is perfect for the industry where mass production is done. Losses Losses are usually not segregated. Normal losses are carefully ascertained and abnormal losses are bifurcated. Work-in-progress (WIP) WIP may or may not exist at the beginning or at the end of the financial year. WIP will always be present in the beginning or at the end of the accounting period.

- 4. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Key Differences Between Job Costing and Process Costing • The costing method which is used for the ascertainment of the cost of each job is known as Job Costing. Conversely, by process costing, we mean the costing technique used to determine the cost of each process. • Job Costing is performed where the products produced of a specialized nature, whereas Process Costing is used where standardized products are produced. • In Job Costing, the cost is calculated for each job, but in Process Costing first of all the cost of each process is calculated which is then dispersed over the number of units produced. • In job costing the cost center is the job itself while the process is the cost center in case of process costing. • In job costing each job requires special treatment. On the other hand, no such special treatment is required for each process in process costing. • There is no transfer of cost in job costing, from one job to another. However, the cost of the last process is transferred to the next process in the process costing. • The possibility of cost reduction is very less in Job Costing. In contrast to Process Costing, the scope of cost reduction is comparatively high. • In Job Costing, the cost is ascertained after the completion of the job, but in Process Costing, the cost of each job is determined. • In job costing, losses are not bifurcated. On the contrary, in process costing normal losses are ascertained carefully, while the abnormal losses are bifurcated. • In job costing, WIP may or may not be present at the end of the financial year. As against this, WIP will always be present, irrespective of the quantity, in the beginning, or at the end of the accounting period, in process costing.

- 5. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Learning objectives 1 Recognise when process-costing systems are appropriate 2 Describe key steps in process costing 3 Calculate and use equivalent units

- 6. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Learning objectives (Continued) 4 Demonstrate the weighted-average and first- in, first-out (FIFO) method of process costing 5 Show how standard costs simplify process costing 6 Apply process-costing methods to cases with transferred-in costs

- 7. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Process costing • In a process-costing system, the unit cost of a product or service is obtained by assigning total costs to many identical or similar units. • In a manufacturing setting, each unit is assumed to receive the same amount of direct material costs, direct manufacturing labour costs and indirect manufacturing costs.

- 8. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Process costing (Continued) • The principal difference between process costing and job costing is the extent of averaging used to compute unit costs of products or services. • In a job-costing system, individual jobs use different quantities of production resources. • Thus, it would be incorrect to cost each job at the same average production cost.

- 9. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Process costing (Continued) • In contrast, when similar or identical units of products or services are mass produced and not processed as individual jobs, process costing averages production costs over all units produced.

- 10. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Process costing (Continued) Direct materials Direct labour Department Department Indirect manu- A B facturing costs Finished goods Cost of goods sold

- 11. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Learning objective 2 Describe key steps in process costing

- 12. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Five steps in process costing • Step 1: Summarise the flow of physical units of output. • Step 2: Compute output in terms of equivalent units. • Step 3: Compute equivalent unit costs.

- 13. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved three cases in process costing 1) Process costing with zero opening and zero closing work-in-progress stock 2) Process costing with zero opening work-in-progress stock but some closing work-in-progress stock 3) Process costing with both some opening and some closing work-in- progress stock

- 14. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Five steps in process costing (Continued) • Step 4: Summarise total costs to account for. • Step 5: Assign total costs to units completed and to units in ending work-in- progress stock.

- 15. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Learning objective 3 Calculate and use equivalent units

- 16. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Equivalent units • Equivalent units is a derived amount of output units that takes the quantity of each input in units completed or in work-in-progress and converts it into the amount of completed output units that could be made with that quantity of input. • Equivalent unit calculations are necessary when all physical units of output are not uniformly completed during the period.

- 17. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Equivalent units (Continued) • The following information relates to Snowdon Ltd, a manufacturer of skiing accessories. • Ending work-in-progress stock is 100% complete for materials and 20% complete for conversion.

- 18. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Physical units (Step 1) Physical Flow of production units Work-in-progress, opening 0 Started during current period 35,000 To account for 35,000 Completed and transferred out during current period 30,000 Work-in-progress, closing (100%/20%) 5,000 Accounted for 35,000

- 19. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Compute equivalent units (Step 2) Equivalent units Direct Conversion Flow of production materials costs Completed and transferred out 30,000 30,000 Work-in-progress, closing 5,000 (100%) 1,000 (20%) Current period work 35,000 31,000

- 20. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Compute equivalent unit costs (Step 3) Total production costs are £146,050. Direct Conversion materials costs £84,050 £62,000 Equivalent units 35,000 31,000 Cost per equivalent unit £2.4014 £2.00

- 21. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Summarise and assign total costs (Steps 4 and 5) • Step 4: Total costs to account for: £146,050 • Step 5: Assign total costs: Completed and transferred out 30,000 × £4.4014 = £132,043 Work-in- progress closing (5,000 units) • Direct materials 5,000 × £2.4014 = 12,007 Conversion costs 1,000 × £2.00 = 2,000 Total £146,050

- 22. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Journal entries • Journal entries in process-costing systems are basically like those made in job-costing systems with respect to direct materials and conversion costs. • The main difference is that in a process-costing system, there is a separate work-in-progress account for each department rather than for each job.

- 23. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Journal entries (Continued) • Assume that Snowdon Ltd has two processing departments – Assembly and Finishing. • Snowdon Ltd purchases direct materials as needed. • What is the journal entry for materials? Work-in-progress, Assembly 84,050 Accounts payable control 84,050 To record direct materials purchased and used.

- 24. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Journal entries (Continued) • What is the journal entry for conversion costs? Work-in-progress, Assembly 62,000 Various accounts 62,000 To record Assembly Department conversion costs. • What is the journal entry to transfer completed goods from Assembly to Finishing?

- 25. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Journal entries (Continued) Work-in-progress, Finishing 132,043 Work-in-progress, Assembly 132,043 To record cost of goods completed and transferred from Assembly to Finishing during the period.

- 26. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Flow of costs Accounts Payable Various Accounts WIP Assembly WIP Finishing Finished Goods 84,050 62,000 84,050 62,000 132,043 14,007 132,043 Cost of Goods Sold

- 27. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Learning objective 4 Demonstrate the weighted-average and first-in, first-out (FIFO) method of process costing

- 28. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Weighted-average method • The weighted-average process-costing method calculates the average equivalent unit cost of the work done to date (regardless of the period in which it was done). • It assigns this cost to equivalent units completed and transferred out, and to equivalent units in closing work-in-progress stock.

- 29. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Weighted-average method (Continued) • The weighted-average cost is the total of all costs entering the work-in-progress account (regardless of whether it is from opening work- in-progress or from work started during the period) divided by total equivalent units of work done to date.

- 30. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Weighted-average method (Continued) • Assume that Snowdon Ltd had 1,000 units in the Assembly Department opening work-in-progress stock. • These units were 100% complete for materials (£2,350) and 60% complete for conversion (£5,200). • Closing work-in-progress stock consisted of 5,000 units (100% materials) and (20% conversion).

- 31. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Physical units (Step 1) • Work-in-progress, opening: 100% material 60% conversion costs 1,000 Units in progress 35,000 36,000 • Units transferred out: 31,000 Units in closing stock: 100% Material 20% Conversion costs 5,000 36,000

- 32. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Compute equivalent units (Step 2) • Partially completed units are converted into equivalent units. • Closing stock is only 20% complete for conversion which equals 1,000 equivalent units (5,000 × 20%).

- 33. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Compute equivalent units (Step 2) (Continued) Materials Conversion Completed and transferred 31,000 31,000 Closing stock 5,000 1,000 Equivalent units 36,000 32,000 100% 20%

- 34. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Compute equivalent unit costs (Step 3) Materials Conversion Opening stock £2,350 £5,200 Current costs 84,050 62,000 Total £86,400 £67,200 Equivalent units 36,000 32,000 Cost per unit £2.40 £2.10

- 35. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Summarise and assign total costs (Steps 4 and 5) • Work-in-progress opening stock: Materials £2,350 Conversion 5,200 Total opening stock £7,550 + Current costs in Assembly Department: Materials £84,050 Conversion 62,000 Costs to account for £153,600

- 36. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved • This step distributes the department’s costs to units transferred out: 31,000 units × £4.50 = £139,500 • And to units in closing work-in-progress stock: £12,000 + £2,100 = £14,100 Summarise and assign total costs (Steps 4 and 5) (Continued)

- 37. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved • Costs transferred out: 31,000 × (£2.40 + £2.10) £139,500 • Costs in closing stock: Materials 5,000 × £2.40 12,000 Conversion 1,000 × £2.10 2,100 • Total costs accounted for: £153,600 Summarise and assign total costs (Steps 4 and 5) (Continued)

- 38. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Journalising: weighted-average • What are the journal entries in the Assembly Department? • Work-in-progress, Assembly 84,050 Accounts payable control 84,050 To record direct materials purchased and used. • Work-in-progress, Assembly 62,000 Various accounts 62,000 • To record Assembly Department conversion costs.

- 39. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Journalising: weighted-average (Continued) Work-in-progress, Finishing 139,500 Work-in-progress, Assembly 139,500 • To record cost of goods completed and transferred from Assembly to Finishing during the period.

- 40. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Key T-account: weighted-average Work-in-progress stock, Assembly Opening stock 7,550 Transferred Materials 84,050 to finishing 139,000 Conversion 62,000 Balance 14,600

- 41. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved First-in, first-out method • FIFO process-costing method assigns the cost of the prior accounting period’s equivalent units in opening work-in-progress stock to the first units completed and transferred out.

- 42. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved First-in, first-out method (Continued) • FIFO assigns the cost of equivalent units worked on during the current period first to complete opening stock, then to start and complete new units and finally to units in closing work-in- progress stock. • This method assumes that the earliest equivalent units in the work-in-progress, Assembly account are completed first.

- 43. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved • A distinctive feature of the FIFO process- costing method is that work done on opening stock before the current period is kept separate from work done in the current period. First-in, first-out method (Continued)

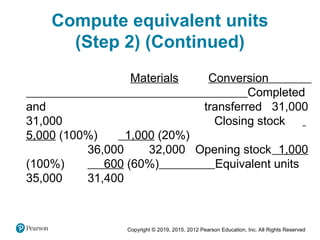

- 44. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved • Assume that Snowdon Ltd uses FIFO. • How many units will be in the quantity schedule (Step 1)? 36,000 (same as weighted-average method). • What are the equivalent units (Step 2)? First-in, first-out method (Continued)

- 45. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Compute equivalent units (Step 2) Materials Conversion Completed and transferred: From opening stock 0 400 Started and completed 30,000 30,000 Closing stock 5,000 1,000 35,000 31,400

- 46. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Compute equivalent units (Step 2) (Continued) Materials Conversion Completed and transferred 31,000 31,000 Closing stock 5,000 (100%) 1,000 (20%) 36,000 32,000 Opening stock 1,000 (100%) 600 (60%) Equivalent units 35,000 31,400

- 47. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Compute equivalent unit costs (Step 3) Materials Conversion Current costs £84,050 £62,000 Equivalent units 35,000 31,400 Cost per unit £2.40 £1.975

- 48. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Summarise and assign total costs (Steps 4 and 5) Work-in-progress opening stock £7,550 Current costs: Material 84,050 Conversion 62,000 Total £153,600 • Same as using weighted-average.

- 49. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Costs transferred out: From opening stock: £7,550 Conversion costs added: 1,000 × 40% × £1.975 790 £8,340 From current production: 30,000 × £4.375 131,250 Total £139,590 Summarise and assign total costs (Steps 4 and 5) (Continued)

- 50. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Work-in-progress closing stock: Materials: 5,000 × £2.40 £12,000 Conversion: 5,000 × 20% × £1.975 1,975 Total £13,975 Summarise and assign total costs (Steps 4 and 5) (Continued)

- 51. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Costs transferred out £139,590 + Costs in closing stock £13,975 = £153,565 (£35 rounding error) • An alternative approach: Costs to account for £153,600 – Cost in closing stock £13,975 = Costs transferred out £139,625 Summarise and assign total costs (Steps 4 and 5) (Continued)

- 52. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Key T-account: FIFO Work-in-progress stock, Assembly Opening stock 7,550 Transferred Materials 84,050 to finishing 139,625 Conversion 62,000 Balance 13,975

- 53. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Comparison of weighted-average and FIFO methods Weighted average FIFO Difference Costs of units completed and transferred out £139,500 £139,625 +£125 Work- in-progress, closing 14,100 13,975 −£125 Total costs accounted for £153,600 £153,600 0

- 54. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved • The weighted-average closing stock is higher than the FIFO closing stock by £125. • This results in a lower cost of goods sold and hence higher operating income and higher income taxes than does from the FIFO method. Comparison of weighted-average and FIFO methods (Continued)

- 55. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved • Differences in equivalent unit costs of opening stock and work done during the current period account for the differences in weighted-average and FIFO costs. Comparison of weighted-average and FIFO methods (Continued)

- 56. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Learning objective 5 Show how standard costs simplify process costing

- 57. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Standard-costing method of process costing • Setting standards for quantities of inputs needed to produce output in companies that use process costing is often relatively straightforward. • Standard costs per input unit may then be assigned to these physical standards to develop standard costs per output unit.

- 58. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved • Assume that Snowdon Ltd uses the standard- costing method of process costing. • Steps 1 and 2 are identical to the steps described for the FIFO method. • Step 3 is easier than that under weighted- average and FIFO methods. • Why? Standard-costing method of process costing (Continued)

- 59. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved • Because the cost per equivalent unit does not have to be computed, as was done for the weighted-average and FIFO methods. • The cost per equivalent unit is the standard costs. • The entries to the work-in-progress account are at standard costs rather than actual. Standard-costing method of process costing (Continued)

- 60. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved • Process-costing systems using standard costs usually accumulate actual costs incurred separately from the stock accounts. • Assume that actual materials cost is £84,050 and standard materials cost is £84,250. • What are the journal entries in the Assembly Department? Standard-costing method of process costing (Continued)

- 61. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved • Direct materials control 84,050 Accounts payable control 84,050 Work-in-progress 84,250 Direct material variances 200 Direct materials control 84,050 • To record direct materials purchased and used in production during the period and variances. Standard-costing method of process costing (Continued)

- 62. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Learning objective 6 Apply process-costing methods to cases with transferred-in costs

- 63. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Transferred-in costs weighted average • Assume that the Finishing Department of Snowdon Ltd had 4,000 units in opening work- in-progress stock and 2,000 in closing work-in- progress stock. • 31,000 units were transferred from the Assembly Department to the Finishing Department during this period.

- 64. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved • The opening work-in-progress stock was 60% complete for materials and 25% for conversion. • The closing work-in-progress stock was 100% complete for materials and 40% for conversion. Transferred-in costs weighted average (Continued)

- 65. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved • There are three equivalent unit computations for the Finishing Department: 1 Transferred-in 2 Direct materials 3 Conversion. Transferred-in costs weighted average (Continued)

- 66. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Physical units (Step 1) • Opening stock 4,000 Work-in-progress31,000 35,000 • Units completed and transferred to finished goods 33,000 Closing stock 2,000 35,000

- 67. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Compute equivalent units (Step 2) • Equivalent units for transferred-in costs: Transferred to finished goods 33,000 Closing stock 2,000 35,000 • Stock is 100% complete for the work performed in the Assembly Department.

- 68. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Compute equivalent units (Step 2) (Continued) • Equivalent units for direct materials costs: Transferred to finished goods 33,000 Closing stock (100%) 2,000 35,000

- 69. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved • Equivalent units for conversion costs (closing stock 2,000): Transferred to finished goods 33,000 Closing stock (40%) 800 33,800 Compute equivalent units (Step 2) (Continued)

- 70. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Compute equivalent unit costs (Step 3) • Assume the following costs in the Finishing Department: • Work-in-progress opening stock from: Assembly Department £30,200 Direct materials 9,400 Conversion costs 8,000 Total cost in opening stock £47,600

- 71. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved • Current costs in Finishing Department are as follows: Costs received from the Assembly Department £139,500 Direct materials 9,780 Conversion 42,640 Total £191,920 Compute equivalent unit costs (Step 3) (Continued)

- 72. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved (Transferred-in costs £30,200 + Costs transferred-in from the Assembly Department £139,500) ÷ 35,000 units = £4.85 (Direct materials £9,400 + £9,780) ÷ 35,000 = £0.55 (Conversion costs £8,000 + £42,640) ÷ 33,800 = £1.50 Total unit cost = £6.90 Compute equivalent unit costs (Step 3) (Continued)

- 73. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Summarise and assign total costs (Steps 4 and 5) Total costs in opening stock £47,600 Current costs in Finishing Department 191,920 £239,520 Costs to account for: £47,600 + £ 191,920 = £239,520

- 74. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved • Costs in work-in-progress closing stock: Transferred-in costs: 2,000 × £4.85 £9,700 Direct materials: 2,000 × £0.55 1,100 Conversion: 2,000 × 40% × £1.50 1,200 Total cost in closing stock £12,000 Summarise and assign total costs (Steps 4 and 5) (Continued)

- 75. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved • Costs to account for: £239,520 Costs transferred to finished goods stock: 33,000 × £6.90 £227,700 Costs in closing work-in- progress stock: £12,000 − £180 rounding error 11,820 Total £239,520 Summarise and assign total costs (Steps 4 and 5) (Continued)

- 76. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved T-account finishing department Work-in-progress stock – Finishing Opening stock 47,600 Transferred Transferred-in 139,500 to Finished Materials 9,780 Goods 227,700 Conversion 42,640 Balance 11,820

- 77. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Transferred-in costs FIFO method • The physical units (Step 1) is the same as in weighted-average. • Opening stock 4,000 Units Work-in-progress31,000 35,000 • Units transferred to finished goods 33,000 Closing stock 2,000 35,000

- 78. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Compute equivalent units FIFO (Step 2) Equivalent units for transferred-in costs: From Opening work-in-progress 0 Started and completed 29,000 Work-in-progress, closing (100%) 2,000 Total equivalent units 31,000

- 79. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Equivalent units for transferred-in costs: Transferred to finished goods 33,000 Closing work-in-progress stock 2,000 Total 35,000 Opening work-in-progress stock 4,000 Equivalent units 31,000 • Stocks are 100% complete for the work performed in the Assembly Department. Compute equivalent units FIFO (Step 2) (Continued)

- 80. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Equivalent units for materials costs: From opening work-in-progress 1,600 Started and completed 29,000 Work-in-progress, closing (100%) 2,000 Total equivalent units 32,600 Compute equivalent units FIFO (Step 2) (Continued)

- 81. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Equivalent units for material costs (opening stock 4,000): Transferred to finished goods 33,000 Closing stock (100%) 2,000 Total 35,000 Opening stock (60%) 2,400 Equivalent units 32,600 Compute equivalent units FIFO (Step 2) (Continued)

- 82. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Equivalent units for conversion costs: From opening work-in-progress 3,000 Started and completed 29,000 Work- in-progress, closing (40%) 800 Total equivalent units 32,800 Compute equivalent units FIFO (Step 2) (Continued)

- 83. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Equivalent units for conversion costs (opening stock 4,000, closing stock 2,000): Transferred to finished goods 33,000 Closing stock (40%) 800 Total 33,800 Opening stock (25%) 1,000 Equivalent units 32,800 Compute equivalent units FIFO (Step 2) (Continued)

- 84. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Compute equivalent unit costs FIFO (Step 3) • Cost per equivalent unit: Transferred-in: £139,590 ÷ 31,000 £4.50 Direct materials: £9,780 ÷ 32,600 0.30 Conversion: £42,640 ÷ 32,800 1.30 Total unit cost £6.10

- 85. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Summarise and assign total costs FIFO (Steps 4 and 5) Current costs in Finishing Department £192,010 Work-in-progress opening stock 47,600 Costs to account for £239,610 • Same as weighted-average.

- 86. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Work-in-progress closing stock: Transferred-in: 2,000 × £4.50 £9,000 Direct materials: 2,000 × £0.30 600 Conversion: 800 × £1.30 1,040 Total £10,640 Summarise and assign total costs FIFO (Steps 4 and 5) (Continued)

- 87. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved • Costs transferred out: From opening stock: £47,600 Direct materials added: 4,000 × 40% × £0.30 480 Conversion costs added: 4,000 × 75% × £1.30 3,900 Total £51,980 Summarise and assign total costs FIFO (Steps 4 and 5) (Continued)

- 88. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved • Total costs transferred out: From opening stock £51,980 From current production: 29,000 × £6.10 176,900 Total £228,880 Summarise and assign total costs FIFO (Steps 4 and 5) (Continued)

- 89. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved • Total costs accounted for: Transferred to finished goods: £176,900 + £51,980 £228,880 Work-in-progress closing stock 10,640 Rounding 90 Total £239,610 Summarise and assign total costs FIFO (Steps 4 and 5) (Continued)

- 90. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved Costs to account for £239,610 Work-in-progress closing stock −10,640 Transferred to finished goods £228,970 Summarise and assign total costs FIFO (Steps 4 and 5) (Continued)

- 91. Copyright © 2019, 2015, 2012 Pearson Education, Inc. All Rights Reserved End of Chapter 4