Credit Default Models

- 1. Credit Default Models Swati Mital swati.mital@maths.ox.ac.uk Professional Risk Managers’ International Association May 4, 2016 Mital, Swati (PRMIA) Credit Default Models May 4, 2016 1 / 31

- 2. Credit Risk What is Credit Risk? Credit Risk is the risk that the value of the portfolio changes due to changes in the credit quality of the ”obligors” due to defaults or rating downgrade. Products: Loans, Sovereign Bonds, Corporate Bonds and Credit Derivatives. Ignore Equity. We focus on corporate credit models not retail scoring models. Why model Credit Risk? Measure Risk in porfolio of credit risky instruments Compute Regulatory Capital Compute Economic Capital Perform Risk Adjusted comparison of different porfolios Mital, Swati (PRMIA) Credit Default Models May 4, 2016 2 / 31

- 3. Agenda Focus on, broadly speaking, four types of Credit Default Models Merton’s Structural Model Extension to Merton’s Model (KMV Model) Ratings based Model Multivariate Factor Models We also have a brief section on Reduced Form Model (Bernoulli Mixture Model) Finally, we cover Copulas and how they are used for Default Modelling Default Modelling with Copulas Mital, Swati (PRMIA) Credit Default Models May 4, 2016 3 / 31

- 4. Notations Let the time interval be fixed [0, T]. Let τi be time to default for obligor i. Let Yi = 1τi ≤T be the default indicator. Then, we can represent the probability of default for obligor i as, PDi = P(Yi = 1) = 1 − P(Yi = 0) = P(τi ≤ T) (1) Let EADi be the exposure at default and LGDi be the loss given default. Then the default loss on a porfolio is, Default Loss = n i=1 EADi × Yi × LGDi (2) Since Yi is a Bernoulli r.v., E[Yi ] = PDi . This gives us the Expected value of the default loss. However, we are interested in different quantiles of the loss distribution function. Mital, Swati (PRMIA) Credit Default Models May 4, 2016 4 / 31

- 5. Structural Models In 1974, Merton showed how the Black Scholes Option Pricing theory can be used to estimate a firm’s probability of default and credit spreads. Assumptions in Merton’s structural Credit Risk Model: Firm value, Vt, is financed by equity, St, and, debt, Bt Vt = St + Bt, 0 ≤ t ≤ T (3) Debt is a single zero coupon bond with face value B and time to maturity T Default occurs when the value of the firm, VT , goes below the outstanding debt, B. This can be determined from the firm’s balance sheet. Mital, Swati (PRMIA) Credit Default Models May 4, 2016 5 / 31

- 6. Structural Models Hence, at time T if VT ≥ B, then the shareholders receive ST = VT − B and there is no default. But if VT < B, then a default event occurs and shareholders receive nothing, i.e., ST = 0. The equity of a firm is a call option on it’s assets with Strike, B. The debt of a firm is long a risk-free asset, B, and short a put (to the equity holders) on the firm. In Option Analogy terms, this can be expressed as, ST = (VT − B)+ BT = B − (B − VT )+ (4) Mital, Swati (PRMIA) Credit Default Models May 4, 2016 6 / 31

- 7. Default Probability under Structural Model We assume that the firm’s asset value, Vt, follows Geometric Brownian Motion, Vt = V0exp (µv − σ2 v 2 )t + σv Wt . We can compute the probability of default, P(VT < B), also known as, ”Distance to Default”, as P(VT < B) = P V0exp (µv − σ2 v 2 )T + σv WT < B = P WT < ln B V0 − (µv − σ2 v 2 )T σv = Φ ln B V0 − (µv − σ2 v 2 )T σv √ T = δT (5) Mital, Swati (PRMIA) Credit Default Models May 4, 2016 7 / 31

- 8. Diagrammatic Representation Figure: Merton Structural Model (source: Crouhy et al., A comparative analysis of current credit risk models, Journal of Banking and Finance, 2000 [59-117]) Mital, Swati (PRMIA) Credit Default Models May 4, 2016 8 / 31

- 9. Variables in the Structural Model In Merton’s model, we link the firm’s equity value, St, which is observed in the market, and equity volatility, σe, to the otherwise unobservable asset value, Vt and asset volatility, σv . The price of equity can be computed using the Black-Scholes price of a call option on Vt with strike B. St = CBS (t, Vt, σv , r, T, B) = VtΦ(d1) − B exp−r(T−t) Φ(d2) d1 = ln Vt B + (r + σ2 v 2 )(T − t) σv (T − t) d2 = d1 − σv (T − t) σe = Vt St Φ(d1)σv (6) Hence, given, St, σe, r, and B we can solve for the Distance to Default, δT . Mital, Swati (PRMIA) Credit Default Models May 4, 2016 9 / 31

- 10. Credit Spreads in Merton’s Model Merton’s model can also be used to compute the credit spread above the yield of a risk-free bond. Let Pr (t, T) be the price of a risk-free zero coupon bond maturing at time T. Let Pd (t, T) be the price of a corporate risky bond maturing at time T. Then, we can define the credit spread on their yields, assuming continuous compounding, as, spread(t, T) = 1 T − t ln Pd (t, T) Pr (t, T) (7) In Merton’s model the price of firm’s debt can be computed as a discounted value of default-free debt, B, and a Black-Scholes price of a short put option on Vt with strike, B. This gives, Pd (t, T) = Pr (t, T)Φ(d2) + Vt B Φ(d1) (8) Plugging this back into Equation 7 gives us the formula for the credit spread. Mital, Swati (PRMIA) Credit Default Models May 4, 2016 10 / 31

- 11. Evaluation of Merton’s Model Advantages Credit Risk of a firm is connected to underlying structural variables. Intuitive Economic Explanation and Endogenous explanation of credit defaults. Option Analogy allows for easy implementation. Disadvantages Too Simplistic: Equity as Call option, Debt matures at same time. Only applicable if a firm has tradable equity and a good estimate of debt level. Not extendable for private firms or sovereigns. Assumes that two equally leveraged firms with identical market capitalization and asset volatility are of equal risk. Underestimate credit spreads for short time to maturity that is empirically difficult to explain. Mital, Swati (PRMIA) Credit Default Models May 4, 2016 11 / 31

- 12. KMV Extension of Merton’s Model KMV (now Moody’s KMV) model was developed in 1990s and it focused on modelling defaults by extending the Merton Model. Mapped Distance to Default to historical default rates using proprietary database. Removed the need to model credit risk using Option Theory. KMV model is only focused on modelling default and not the credit spreads. Mital, Swati (PRMIA) Credit Default Models May 4, 2016 12 / 31

- 13. Dynamics of the KMV Model - EDF One of the central ideas in the KMV model is the Expected Default Frequency (EDF). This is the one-year probability of default of an obligor. Going back to Merton’s model the EDF would be, EDFMerton = 1 − Φ ln V0 B + (µv − σ2 v 2 ) σv (9) In KMV model, the EDF has similar structure to the Merton model but the function 1 − Φ is replaced with an estimated KMV function. The variable µv is ignored and the V0 and σv are backed out from the observable value of equity of the firm. The default boundary, B, is 1 2 of short-term debt (< 1 year) and 100% of long-term debt. Floor on the Estimated 1 year default probability of 40% and a ceiling of 0.01%. Mital, Swati (PRMIA) Credit Default Models May 4, 2016 13 / 31

- 14. Dynamics of the KMV Model - DD The other central idea in the KMV model is the Distance to Default (DD). To put it simply, a higher DD means a firm is less likely to default than a lower DD. The DD is mapped to EDF using empirical proprietary KMV database. Firms with equal DD have equal EDF. DD in the KMV model can be expressed by the following equation, DD = (V0 − F) σv V0 (10) where F is the default threshold. Relationship between EDF and DD. (Source: Moody’s/KMV) Mital, Swati (PRMIA) Credit Default Models May 4, 2016 14 / 31

- 15. Ratings Based Models Credit Rating measures the credit quality of a firm at any given point in time. The Ratings based model computes the probabilities of this rating changing. These migration probabilities are supplied by Rating Agencies (for e.g., Moody’s, Standard and Poor’s). JP Morgan CreditMetrics is a popular ratings based credit risk model. In the KMV model the fundamental state variable was DD, in the Ratings Migration approach the state variable is the Credit Rating. Firms with equal Credit Rating have equal migration probabilities. Rating agencies have huge database that cover a wide range of firms including sovereigns. Rating agencies focus on ”through the cycle” credit ratings causing less fluctuations as opposed to KMV which is ”point in time”. Rating agencies are slow to react to credit events leading to a lag from the market spreads. Mital, Swati (PRMIA) Credit Default Models May 4, 2016 15 / 31

- 16. An Example Ratings Migration Matrix One year Transition Probability Matrix taken from Moody’s. (Source: Elton E, Gruber M, Agrawal D, Explaining the Rate Spread on Corporate Bonds, Journal of Finance 2001) Mital, Swati (PRMIA) Credit Default Models May 4, 2016 16 / 31

- 17. Migration Model in Firm Value Model Popular way to embed a migration model inside a firm value model. Suppose we are given transition probabilities by the rating agencies for n rating classes. Denote pj where 0 ≤ j ≤ n as the probability for a given firm to be in rating class j. We then select rating migration thresholds −∞ = d0 < d1 < .... < dn < dn+1 = ∞ such that P(dj−1 < Vt < dj ) = pj ∀j. If we assume that the asset process, Vt, has log normal distribution (Merton’s assumption), then we can compute the thresholds using standard normal distribution as, d1 = ZCCC = Φ−1 (pdef ) d2 = ZB = Φ−1 (pdef + pCCC ) d3 = ZBB = Φ−1 (pdef + pCCC + pB) ... (11) Mital, Swati (PRMIA) Credit Default Models May 4, 2016 17 / 31

- 18. Multivariate Firm Value Model Here we extend Merton’s ideas into something that can be used on a large portfolio by using factors for modelling dependence. Consider a portfolio of n firms over a time period [0, T]. Assume T = 1. Let Yi denote default indicator. So, Yi = 1 indicates that a default event has taken place and Yi = 0 means there is no default. The default of the company is driven by some latent variable Xi , generally assumed to be normally distributed, which if it lies below a threshold di , a default occurs. Therefore, we can write the default probability as, P(Yi = 1) = P(Xi ≤ di ) = F(di ) (12) Model default dependence between the different firms in the portfolio by making the Xi correlated, i.e., to make the asset values dependent. Mital, Swati (PRMIA) Credit Default Models May 4, 2016 18 / 31

- 19. Generic Factor Model Let X = (X1 X2... Xn)T , then the random vector X is driven by a set of (p << n) factors to reduce the dimensionality of the correlation matrix. A generic factor model can be expressed as, X = α + βT F + (13) α ∈ Rn is a vector of constants that can be thought of as the global factor affecting all firms. F ∈ Rp is a random vector of (systematic or economic) factors. βT ∈ Rn×p is the factor loading on the p factors since each Xi load differently on each factor. ∈ Rn is a random vector of (idiosyncratic) terms and are hence uncorrelated with mean zero. cov(F, ) = 0 Mital, Swati (PRMIA) Credit Default Models May 4, 2016 19 / 31

- 20. Gaussian Linear Factor Model Since the firm value model descends from Merton model, we assume that X has a multivariate normal distribution. Let F ∼ N(0, Ω) Let ∼ N(0, Γ) Then, X ∼ N(α, βT Ωβ + Γ) cov(Xi , Xj ) = βT i Ωβj For majority of credit risk models, since actual asset values of the company are unobservable, the factors are derived by observing the equity returns. Mital, Swati (PRMIA) Credit Default Models May 4, 2016 20 / 31

- 21. One Factor Vasicek Model This is a special case where, Xi = βi F + 1 − β2 i i , and F, i have standard normal distribution. Therefore, X ∼ N(0, 1). If all the factor loadings are identical then we get a homogeneous model, Xi = √ ρF + 1 − ρ i (14) where ρ = var(βi F) = β2 i ∀i is the systematic variance but also the asset correlation parameter since it is the correlation of the critical variables. corr(Xj , Xk) = βj T Ωβk βj T Ωβj + Γjj βk T Ωβk + Γkk = βj 2 βj 2 + (1 − β2 j ) βk 2 + (1 − β2 k) = ρ (15) Mital, Swati (PRMIA) Credit Default Models May 4, 2016 21 / 31

- 22. Bernoulli Mixture Model We start with a portfolio of n firms and a p-dimensional factor vector Θ = (θ1, θ2, ..., θp). In a Bernoulli Mixture Model, the probability of default conditional on these factors is given by, P(Yi = 1|Θ = Θ) = pi (Θ) (16) such that the joint probability of the default indicators conditional on the factors is given by, P(Y1 = y1, Y2 = y2, ..., Yn = yn|Θ = Θ) = n i=1 pi (Θ)yi (1 − pi (Θ))1−yi (17) And, hence, the default indicators of the n firms are independent conditional on the factor vector with their joint default probability given by, P(Y1 = 1, Y2 = 1, ..., Yn = 1|Θ) = n i=1 pi (Θ) (18) Mital, Swati (PRMIA) Credit Default Models May 4, 2016 22 / 31

- 23. Gaussian Firm Value Model as a Mixture Model We now see that the Gaussian Firm Value Model is, in fact, also a Bernoulli Mixture Model with Θ = F. And the conditional probability of the default for a firm is given as, P(Yi = 1|F) = P(Xi < di |F) = P(αi + βi T F + i < di |F) = P( i < di − βi T F − αi ) = Φ di − βi T F − αi σ i = Φ Φ−1(pi ) − βi T F − αi σ i (19) Mital, Swati (PRMIA) Credit Default Models May 4, 2016 23 / 31

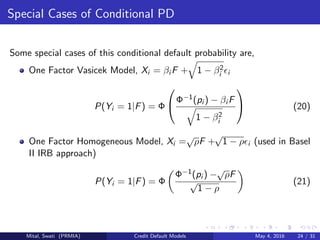

- 24. Special Cases of Conditional PD Some special cases of this conditional default probability are, One Factor Vasicek Model, Xi = βi F + 1 − β2 i i P(Yi = 1|F) = Φ Φ−1(pi ) − βi F 1 − β2 i (20) One Factor Homogeneous Model, Xi = √ ρF + √ 1 − ρ i (used in Basel II IRB approach) P(Yi = 1|F) = Φ Φ−1(pi ) − √ ρF √ 1 − ρ (21) Mital, Swati (PRMIA) Credit Default Models May 4, 2016 24 / 31

- 25. Copulas Definition Let C be a copula function. Then C : [0, 1]n → [0, 1] such that there are random variables U1, U2, ..., Un that take values on [0, 1] whose joint cumulative distribution function is C. C(u1, u2, ..., un) = P(U1 ≤ u1, U2 ≤ u2, ..., Un ≤ un) (22) Multivariate Distribution using Copula Consider a vector of random variables (X1, X2, ..., Xn) such that their univariate marginal distribution functions are (F1(x1), F2(x2), ..., Fn(xn)). Then the Copula function results in their multivariate joint distribution, C(F1(x1), F2(x2), ..., Fn(xn)) = F(x1, x2, ..., xn) (23) Sklar’s Theorem established that any multivariate distribution F can be written in this form using a Copula Function. Mital, Swati (PRMIA) Credit Default Models May 4, 2016 25 / 31

- 26. Copula Functions Gaussian and t-copula are two of the most common Copula functions used in Credit Default Models. We define them as follows, Gaussian Copula Let Φn be Multivariate Normal Distribution, then we can define the Gaussian Copula as, C(u1, u2, ..., un) = Φn(Φ−1 (u1), Φ−1 (u2), ..., Φ−1 (un), ρ) (24) Student’s t Copula Let Tν and tν be the multivariate and univariate Student’s t distribution with ν degrees of freedom.Then, we define the Student’s t Copula as, C(u1, u2, ..., un) = Tν(t−1 ν (u1), t−1 ν (u2), ..., t−1 ν (un), ρ) (25) Mital, Swati (PRMIA) Credit Default Models May 4, 2016 26 / 31

- 27. Default Correlation Models Modelling default dependence for credit portfolios using Copulas was popularized by Li in [2]. We build our framework with the following assumptions. We have n firms and we want to model their default correlations over a fixed time period [0, T]. We have the marginal distribution of survival times, Si , for each of these firms. Denote this by Fi (s) = P(Si ≤ s). Then Copulas are one of the ways to model the joint distribution function of the survival times, F(s1, s2, ..., sn) = C(F1(s1), F2(s2), ..., Fn(sn), ρ) (26) Therefore, for C = Φn, the joint default probability is given by, P(S1 < T, ..., Sn < T) = Φn(Φ−1 (F1(S1)), ..., Φ−1 (Fn(Sn)), ρ) (27) For C = Tν, the joint default probability is, P(S1 < T, ..., Sn < T) = Tν(t−1 ν (F1(S1)), ..., t−1 ν (Fn(Sn)), ρ) (28) Mital, Swati (PRMIA) Credit Default Models May 4, 2016 27 / 31

- 28. Factor Model with Gaussian Copula Let us look again at the One-Factor Vasicek Model covered earlier. We know that the default probability is given by Fi (Si ) = P(Si < T) = pi and the joint default probability distribution is given as, P(Y1 = 1, ..., Yn = 1) = Φn(Φ−1 (p1), ..., Φ−1 (pn), ρ) (29) In the factor model, the defaults are conditionally independent on the systematic factors, Q, and therefore the latent variables, Xi = √ βi Q + 1 − β2 i i , have conditional joint default probability given by the copula function, C(p1, p2, ..., pn) = +∞ −∞ n i=1 Φ Φ−1(pi ) − βi Q 1 − β2 i φ(y)dy (30) Mital, Swati (PRMIA) Credit Default Models May 4, 2016 28 / 31

- 29. Conclusions We have looked at the dynamics of different credit default models starting from Firm Value models to Multivariate Factor Models. All sophisticated banks have advanced IRB models for computing Default Risk on credit portfolios. Generally, multifactor model with copula dependence structure is well understood and widely implemented. We discussed the dynamics of different credit risk models. One of the other big challenges is in the calibration of these models. For example: factor selection, factor weights, correlation structure etc. In order to compute the distribution of default loss, Monte Carlo techniques are typically used. There are many computational challenges in a Monte Carlo simulation especially for non-linear products that require full revaluation. Mital, Swati (PRMIA) Credit Default Models May 4, 2016 29 / 31

- 30. Reference (1/2) McNeil AJ, Frey R and Embrechts P: Quantitative Risk Management: Concepts, Techniques and Tools (Revised Edition). Princeton University Press., 2015 Crouhy M., Galai D., Mark R: A Comparative analysis of current credit risk models, 2000 Crosbie, P: Modeling Default Risk, Moody’s KMV Technical Document, 2002 Kealhofer, S. and Bohn, J.: Portfolio management of default risk, Moody’s KMV Technical Document, 2001 Mital, Swati (PRMIA) Credit Default Models May 4, 2016 30 / 31

- 31. Reference (2/2) Rutkowski, M. and Tarca, S., Regulatory Capital Modelling for Credit Risk, University of Sydney, 2014 Li, D. X. On default correlation: A copula function approach. Journal of Fixed In- come 9(4), 43–54., 2000. Tarashev N. and Zhu H., Specification and Calibration Errors in Measures of Portfolio Credit Risk: The Case of the ASRF Model, Bank of International Settlements Mital, Swati (PRMIA) Credit Default Models May 4, 2016 31 / 31

![Notations

Let the time interval be fixed [0, T]. Let τi be time to default for obligor i.

Let Yi = 1τi ≤T be the default indicator.

Then, we can represent the probability of default for obligor i as,

PDi = P(Yi = 1) = 1 − P(Yi = 0) = P(τi ≤ T) (1)

Let EADi be the exposure at default and LGDi be the loss given default.

Then the default loss on a porfolio is,

Default Loss =

n

i=1

EADi × Yi × LGDi (2)

Since Yi is a Bernoulli r.v., E[Yi ] = PDi . This gives us the Expected value

of the default loss. However, we are interested in different quantiles of the

loss distribution function.

Mital, Swati (PRMIA) Credit Default Models May 4, 2016 4 / 31](https://image.slidesharecdn.com/creditdefaultmodelsexternal-160504190001/85/Credit-Default-Models-4-320.jpg)

![Diagrammatic Representation

Figure: Merton Structural Model (source: Crouhy et al., A comparative analysis

of current credit risk models, Journal of Banking and Finance, 2000 [59-117])

Mital, Swati (PRMIA) Credit Default Models May 4, 2016 8 / 31](https://image.slidesharecdn.com/creditdefaultmodelsexternal-160504190001/85/Credit-Default-Models-8-320.jpg)

![Multivariate Firm Value Model

Here we extend Merton’s ideas into something that can be used on a large

portfolio by using factors for modelling dependence.

Consider a portfolio of n firms over a time period [0, T]. Assume

T = 1.

Let Yi denote default indicator. So, Yi = 1 indicates that a default

event has taken place and Yi = 0 means there is no default.

The default of the company is driven by some latent variable Xi ,

generally assumed to be normally distributed, which if it lies below a

threshold di , a default occurs. Therefore, we can write the default

probability as,

P(Yi = 1) = P(Xi ≤ di ) = F(di ) (12)

Model default dependence between the different firms in the portfolio

by making the Xi correlated, i.e., to make the asset values dependent.

Mital, Swati (PRMIA) Credit Default Models May 4, 2016 18 / 31](https://image.slidesharecdn.com/creditdefaultmodelsexternal-160504190001/85/Credit-Default-Models-18-320.jpg)

![Copulas

Definition

Let C be a copula function. Then C : [0, 1]n → [0, 1] such that there are

random variables U1, U2, ..., Un that take values on [0, 1] whose joint

cumulative distribution function is C.

C(u1, u2, ..., un) = P(U1 ≤ u1, U2 ≤ u2, ..., Un ≤ un) (22)

Multivariate Distribution using Copula

Consider a vector of random variables (X1, X2, ..., Xn) such that their

univariate marginal distribution functions are (F1(x1), F2(x2), ..., Fn(xn)).

Then the Copula function results in their multivariate joint distribution,

C(F1(x1), F2(x2), ..., Fn(xn)) = F(x1, x2, ..., xn) (23)

Sklar’s Theorem established that any multivariate distribution F can be

written in this form using a Copula Function.

Mital, Swati (PRMIA) Credit Default Models May 4, 2016 25 / 31](https://image.slidesharecdn.com/creditdefaultmodelsexternal-160504190001/85/Credit-Default-Models-25-320.jpg)

![Default Correlation Models

Modelling default dependence for credit portfolios using Copulas was

popularized by Li in [2]. We build our framework with the following

assumptions.

We have n firms and we want to model their default correlations over

a fixed time period [0, T].

We have the marginal distribution of survival times, Si , for each of

these firms. Denote this by Fi (s) = P(Si ≤ s).

Then Copulas are one of the ways to model the joint distribution

function of the survival times,

F(s1, s2, ..., sn) = C(F1(s1), F2(s2), ..., Fn(sn), ρ) (26)

Therefore, for C = Φn, the joint default probability is given by,

P(S1 < T, ..., Sn < T) = Φn(Φ−1

(F1(S1)), ..., Φ−1

(Fn(Sn)), ρ) (27)

For C = Tν, the joint default probability is,

P(S1 < T, ..., Sn < T) = Tν(t−1

ν (F1(S1)), ..., t−1

ν (Fn(Sn)), ρ) (28)

Mital, Swati (PRMIA) Credit Default Models May 4, 2016 27 / 31](https://image.slidesharecdn.com/creditdefaultmodelsexternal-160504190001/85/Credit-Default-Models-27-320.jpg)