Dr.tk gst-ppt

- 1. GST in India : An Insight Dr. K. THULASI KRISHNA, Ph.D. Assistant Professor, Dept. of Management Studies, Madanapalle Institute of Technology & Science, Madanapalle, A.P., India 06.07.2017

- 2. GST in India : An Insight Dr. K. THULASI KRISHNA, Ph.D. Assistant Professor, Dept. of Management Studies, Madanapalle Institute of Technology & Science, Madanapalle, A.P., India 06.07.2017

- 3. Contents • History of Tax • Taxation in India • Classification of Taxes • GST : An Indirect Tax • History of GST • GST Rates: Goods & Services • Earlier Tax Framework • GST Framework – With Illustrations • GST rates in other countries • GST Registration • Comparison of Taxes Before and After GST • Impact of GST on Common Man

- 4. "It was only for the good of his subjects that he collected taxes from them, just as the Sun draws moisture from the Earth to give it back a thousand fold" – Kalidas in Raghuvansh praising KING DILIP.

- 5. History of Tax • Income tax today is an important source of revenue for government in all the countries. • More than 3,000 years ago, the inhabitants of ancient Egypt and Greece used to pay income tax, consumption taxes and custom duties.

- 6. • The origin of the word "Tax" is from "Taxation" which means an estimate. These were levied either on the sale and purchase of merchandise or livestock and were collected in a haphazard manner from time to time.

- 7. Taxation in India • In India, the system of direct taxation as it is known today, has been in force in one form or another even from ancient times. • There are references both in Manu Smriti and Arthasastra to a variety of tax measures. • Manu, the ancient sage and law-giver stated that the king could levy taxes, according to Sastras. The wise sage advised that taxes should be related to the income and expenditure of the subject. • According to him, the king should arrange the collection of taxes in such a manner that the subjects did not feel the pinch of paying taxes. • He laid down that traders and artisans should pay 1/5th of their profits in silver and gold, while the agriculturists were to pay 1/6th, 1/8th and 1/10th of their produce depending upon their circumstances.

- 8. • Kautilya's Arthasastra, deals with the system of taxation in a real elaborate and planned manner. • The land revenue was fixed at 1/6th share of the produce and import and export duties were determined on advalorem basis (according to value). • The import duties on foreign goods were roughly 20 per cent of their value. Similarly, tolls, road cess, ferry charges (merchant vehicle) and other levies were all fixed. • Kautilya's concept of taxation is more or less akin to the modern system of taxation. His overall emphasis was on equity and justice in taxation.

- 9. Direct Taxes Indirect Taxes Meaning It is a tax where incidence as well as impact of tax is on one and the same person. In other words, it is borne by the assessee and cannot be passed on to the customer. It is a tax where the incidence is on one person but the impact is on the customer. In other words, the person on whom tax is levied passes on the tax burden to the customer. Example Income Tax (Gift Tax Act was abolished in the FY 1997 and Wealth Tax Act was abolished in the FY 2015) a) Sales tax b) VAT c) Excise duty d) Customs duty e) Service tax Burden Burden not felt by all persons Burden shouldered by all persons Classification of Taxes

- 10. GST – An Indirect Tax • Goods and Services Tax (GST) is a uniform tax system which allows seamless transfer of goods and services. • This is the most simplified tax which facilitates multiple benefits such as increase in Gross Domestic Product (GDP), increase in tax collections, no differences between State’s taxes, strengthening of the economy and more importantly eliminates all complications in indirect taxes.

- 11. • GST is a single tax on the supply of goods and services, right from the manufacturer to the consumer. • Credits of input taxes paid at each stage will be available in the subsequent stage of value addition, which makes GST essentially a tax only on value addition at each stage. • The final consumer will thus bear only the GST charged by the last dealer in the supply chain, with set-off benefits at all the previous stages. • The GST is a destination based tax, not the origin one. • GST, now is accepted and adopted by all the states in India including Jammu & Kashmir.

- 12. History of GST • It was first announced in 2006 by the then Finance Minister, P. Chidambaram in his Union Budget speech that India would introduce GST by April 1st, 2010. • Since then, many discussions went on the complexities involved in the implementation of GST in view of the prevailing Central and State Taxes. • Further, due to lack of consensus between Central and State Governments and a few other practical issues, the implementation of GST is delayed. • Finally, it came into force w.e.f. 01.07.2017

- 13. Taxes to be subsumed GST would replace most indirect taxes currently in place such as: Central Taxes State Taxes o Central Excise Duty o Service tax o Additional Customs Duty (CVD) o Special Additional Duty of Customs (SAD) o Central Sales Tax ( levied by the Centre and collected by the States) o Central surcharges and cesses ( relating to supply of goods and services) o State Value Added Tax/Sales Tax o Entry Tax o Purchase Tax o Luxury Tax o Taxes on lottery, betting & gambling o State cesses and surcharges o Entertainment tax (other than the tax levied by the local bodies) o Central Sales Tax ( levied by the Centre and collected by the States)

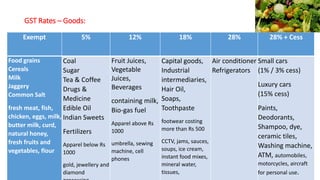

- 14. GST Rates – Goods: Exempt 5% 12% 18% 28% 28% + Cess Food grains Cereals Milk Jaggery Common Salt fresh meat, fish, chicken, eggs, milk, butter milk, curd, natural honey, fresh fruits and vegetables, flour Coal Sugar Tea & Coffee Drugs & Medicine Edible Oil Indian Sweets Fertilizers Apparel below Rs 1000 gold, jewellery and diamond Fruit Juices, Vegetable Juices, Beverages containing milk, Bio-gas fuel Apparel above Rs 1000 umbrella, sewing machine, cell phones Capital goods, Industrial intermediaries, Hair Oil, Soaps, Toothpaste footwear costing more than Rs 500 CCTV, jams, sauces, soups, ice cream, instant food mixes, mineral water, tissues, Air conditioner Refrigerators Small cars (1% / 3% cess) Luxury cars (15% cess) Paints, Deodorants, Shampoo, dye, ceramic tiles, Washing machine, ATM, automobiles, motorcycles, aircraft for personal use.

- 15. GST Rates – Services: Exempt 5% 12%-18% 28% o Education o Healthcare o Residential accommodation o Hotel/ Lodges with tariff below INR 1000 o Goods transport o Rail tickets (other than sleeper class) o Economy class air tickets o Cab aggregators o Selling space for advertisements in print media o Works contract o Business Class air travel o Telecom services o Financial services o Restaurant services o Hotel/ Lodges with tariff between INR 1000 and 5000, o IT services, branded garments and financial services o Cinema tickets o Betting o Gambling o Hotel/ Lodges with tariff above INR

- 16. How earlier tax framework was?

- 17. GST Framework : How GST operates? - Case 1: Sale in one state, resale in the same state

- 18. How GST operates? - Case 2: Sale in one state, resale in another state

- 19. Illustration 1 • Rajesh, a dealer in Maharashtra sold goods to Anand in Maharashtra worth Rs. 10,000. The GST rate is 18% comprising of CGST rate of 9% and SGST rate of 9%. In such case the dealer collects Rs. 1800 and Rs. 900 will go to the central government and Rs. 900 will go to the Maharashtra government.

- 20. GST

- 21. Illustration 2 • If Rajesh in Maharashtra had sold goods to Anand in Gujarat worth Rs. 1,00,000. The GST rate is 18% comprising of CGST rate of 9% and SGST rate of 9%. In such case the dealer has to charge Rs. 18,000 as IGST. This IGST will go to the Centre.

- 22. GST

- 23. GST Rates in Different Countries

- 24. GST Registration Mandatory: • To every person who supplies goods and/or services of value exceeding Rs 20 lakh in a financial year. (Limit is Rs. 10 lakh for some special category states). • And GST must be paid when turnover exceeds Rs 20 lakh (Rs 10 lakh for some special category states). • To any person making inter-state taxable supply of goods and/or services • Every e-commerce operator

- 25. . • Every person who supplies goods and/or services, other than branded services, through e-commerce operator • Casual Taxable Person • Input Service Distributor • Person supplying online information and database access or retrieval services from a place outside India to a person in India, other than a registered taxable person. • Person supplying the goods on behalf of other taxable person (eg. Agent) • GST does NOT apply to Agriculturists • GST does not apply to any person engaged exclusively in the business of supplying goods and/or services that are not liable to tax or are wholly exempt from tax under this Act

- 26. Comparison of Taxes Before and After GST Items Earlier Rate (%) GST (%) Perfume 17.5 - 27 18 Cosmetics 28 Cheese 5-14.5 12 Butter 12 Glucometers 11-20.5 12 Tableware - Metal 11 18 Revised 12% for spoons, forks, ladles, skimmers, cake servers, fish knives, tongs

- 27. Tableware - Ceramic 17.5 18 Tableware - Wood 18 and 28 Tableware - Plastic 18 Kitchenware - Metal 11-20.5 18 Revised 12% for Spoons, forks, ladles, skimmers, cake servers, fish knives, tongs Kitchenware-Ceramic 17.5 - 27 18

- 28. X-Ray Apparatus (for medical, dental & veterinary) 17.5-27 12 X-Ray Apparatus 28 Footwear (below Rs. 500) 14.41 5 Footwear(above Rs. 500) 14.41 18 Readymade garments (below Rs. 1000) 5-6 5 Readymade garments (above Rs. 1000) 18.5 12 Biscuits( Less than Rs. 100/kg) 11.89 18 Biscuits(Above Rs. 100/kg) 16.09 18 Corn-flakes 9.86 18 Wrist watch 20.64 28 Jam 5.66 18

- 29. Baby food (sold in unit containers) 7.06 18 Small Cars (<4m <1200 cc petrol) 25-27 28+1 (cess) Small Cars (<4m <1500 cc diesel) 25-27 28+3 (cess) Mid-segment (<1500 cc) 36-40 28+15 (cess) Cars with 1500 cc & larger engines 41.5-44.5 28+15 (cess) Vehicles for transport with 10 to 13 passenger capacity (cannot be considered as bus) 39-41 28+15 Motorcycles 25-35 28 Motorcycles Engine >350 25-35 28+3 (cess) Television 25-27 28

- 30. Renewable energy devices 17-18 5 Iron Ore 17-18 5 Digital Cameras 25-27 28 Luxury items like yacht (Ship) 25-27 28+3 (cess) Music Instruments (Handmade) 0-12.5 0 Music Instruments (Other than Handmade) 25-27 28

- 31. Impact of GST on Common Man • Tax on personal care products like soaps, hair oil, detergent, kajal, tissue paper and toothpaste has been brought down from 24-28% to 18% which certainly help you save a lot of amount. • While silk and jute have been exempted from taxes, cotton and natural fibre will be taxed at 5%, man-made fibres at 18%, and apparel costing below Rs 1,000 at 5%. Apart from this, GST rate of 5% will be imposed on footwear below Rs 500.

- 32. • Mobile phones will also get cheaper as the tax levied on them will be reduced to 12% from 13.5%. • The automobile industry will get a major boost as the prices of entry-level cars are expected to drop significantly. Two- wheelers with engine capacity below 350 cc, SUVs and three-wheeler commercial vehicles will now be cheaper.

- 33. How to Avoid GST? • While going out side take bottle of water with you...Avoid buying water bottle outside. • While starting journey, avoid buying food out side…Home made food recommended. • Buy groceries from near by shops. Avoid buying in malls and super markets…Prefer to rythubazaars. • Avoid shopping on weekends…please visit friends/relatives house..you can build relations • If you go to a tour, please stay in relatives house rather than staying in hotels. • Cash in hand is the best way to avoid un necessary charges from bank

- 34. Conclusion • The successful implementation of GST depends on the understanding and co-operation between Central and State Governments. • Further, there are many hurdles to be crossed in its implementation. Whether, the GST makes life easy or more comfortable, future remains to be unseen. • But it is certain that the monthly budget of people if goes beyond the essential consumer goods, will impact their overall expenses and creates more complications. • In addition to this, the impact of inflation is always unpredictable. Even there is no guarantee that the manufacturer will pass on the tax benefit to the end user. Keeping these issues aside, one can say that GST will be a welcome change for the development of the economy since it is expected to simplify the indirect tax structure in India.

- 35. •THANK YOU