EFT Guide

1 like757 views

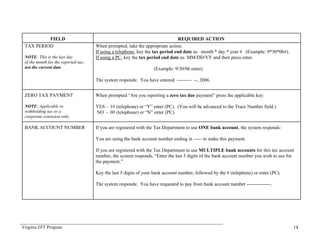

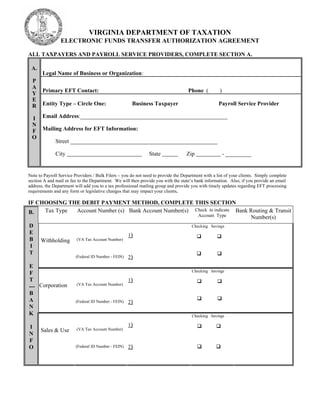

This document provides an overview of Virginia's Electronic Funds Transfer (EFT) program for remitting tax payments. It describes the two EFT payment methods - ACH Debit and ACH Credit - and outlines requirements for mandatory EFT filers. Key details include: - Taxpayers with average monthly tax liabilities over $20,000 must pay by EFT, as must those who act on behalf of 100+ taxpayers. - ACH Debit involves initiating payments through a Data Collection Center by phone or computer. ACH Credit involves working with one's bank to transfer funds. - Mandatory EFT filers are notified and provided payment reconciliation forms to file each quarter and year-end.

1 of 33

Downloaded 18 times

More Related Content

What's hot (16)

Ad

Viewers also liked (7)

Ad