f 1040n inst

1 like392 views

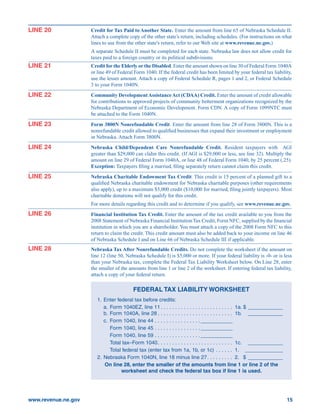

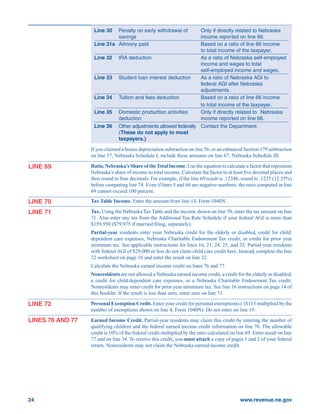

This document provides instructions and information for filing 2008 individual income tax returns in Nebraska. It discusses electronic filing options, payment options, extensions, estimated tax payments, and other topics. Key points include: - Taxpayers are encouraged to file electronically using the free NebFile system or hiring a tax preparer. - The deadline to file 2008 returns was April 15, 2009. Extensions could be obtained by attaching a federal extension form. - Taxpayers may owe penalties for underpaying estimated taxes if payments were less than 90% of the 2008 tax or 100% of the 2007 tax. Exceptions include low income or farmers/ranchers.

1 of 24

Download to read offline

More Related Content

What's hot (16)

Ad

Similar to f 1040n inst (20)

Ad