Fema - Quick Guide For NRIs [Compatibility Mode]

- 1. Foreign Exchange Management Act Quick Guide for NRIs CA Vinit V Deo Chartered Accountant

- 2. Overview • Overview of Opportunities in FEMA • Definition of NRI • Possession & Surrender of Foreign Exchange • Bank Accounts • Loans to NRIs • Loans by NRIs • Investment in Immoveable Property • Investments in India • Starting a Business • Insurance Policies • Derivative Contracts • Remittance of Assets • Special Cases of Residents

- 3. Person Resident Outside India • Means a Person who is not a Resident in India Vinit V Deo Chartered Accountant

- 4. Definitions - NRI • Means a person resident outside India who is a citizen of India or a person of Indian Origin Exception: Applicable only under the Foreign Exchange Management (Remittance of Assets) Regulations • Means a person resident outside India who is a citizen of India Vinit V Deo Chartered Accountant

- 5. Case Study • Mr Kulkarni, a Senior Citizen, goes to USA for medical treatment in March 2007. The Doctors advise him that the medical treatment will last for 10 months and he decides to stay with his son in California. He comes back in Jan 07. What his residential status for: – FY 2006-07 – FY 2007-08 – FY 2008-09 Vinit V Deo Chartered Accountant

- 6. Case Study • Pravin Shah, a software engineer is deputed by his Company for an overseas assignment in Australia for a period of 200 months starting 1st Jan 2007. What is his residential status for: – FY 2007-08 – FY 2008-09 • Would it make a difference if he was not deputed by his company but went on his own accord to work for the Company in Australia? Vinit V Deo Chartered Accountant

- 7. Not Permanantly Resident Means a Person resident in India: • For employment of a specified duration (irrespective of the length), OR • for a specific job or assignment of a duration not exceeding 3 years Special Feature: • Can retain currency without limit travellers cheques etc acquired/owned when he was a resident outside India and brought into India Vinit V Deo Chartered Accountant

- 8. Definitions - PIO • Means a citizen of any country other than of a Prohibited Country,if a) He at any time held Indian Passport: or b) He or either of his parents or any of his grand- parents were a citizen of India by virtue of the Constitution of India or the Citizenship Act,1955.or c) The person is a spouse of an Indian citizen or a person referred to in sub-clause (a) or (b). Vinit V Deo Chartered Accountant

- 9. Prohibited Countries • Indian Citizens who are now taken citizenship / carry passport of the following countries are not considered as PIOs i.e. they get the same treatment as Foreigners under FEMA. Regulation Prohibited Countries Borrowing or Lending in Rupees Bangladesh,Pakistan Remittance of Assets Bangladesh,Pakistan Non Resident Accounts Bangladesh,Pakistan Investment in Shares Bangladesh,Pakistan, Sri Lanka Acquisition and Transfer of Bangladesh,Pakistan, Sri Lanka, Immoveable Property Afghanistan, China,Iran,Nepal, Bhutan Vinit V Deo Chartered Accountant

- 10. PIO Card • Privileges – No Visa Required to come to India – No separate Student / Employment Visa – Exempt from registration requirement if single stay in India does not exceed 180 days – Parity with NRIs in facilities in Economic, Social and Financial field • Validity – 15 Years from the date of issue • How to Apply – Submit the prescribed Form accompanied by documentary evidence that person is PIO – Form to be submitted to the Indian Embassy where the person is a Resident – Fee is Rs 15,000 for (Rs 7,500 for children upto 18 years of age) Vinit V Deo Chartered Accountant

- 11. Possession & Surrender of Foreign Exchange Vinit V Deo Chartered Accountant

- 12. Brining and Retention of Foreign Exchange in India • Brining Foreign Exchange ANY PERSON can at ONE TIME get the following amounts to India: – USD 5,000 of foreign currency – USD 10,000 in currency and travellers cheques including the currency mentioned above (Amounts in excess of above: Currency Declaration Form) • Retention of Foreign Exchange PERSON RESIDENT IN INDIA can AT ANY GIVEN TIME retain upto USD 2,000 only if the same are acquired are as follows: – Unspent amount out of foreign exchange purchase for foreign travel – Payment for services outside India, if the services are not arising from any business or anything done in India – Gift, Honorarium, payment for services or settlement received from a Person Resident Outside India visiting India – Gift or Honorarium while on a visit outside India Vinit V Deo Chartered Accountant

- 13. Surrender of Foreign Exchange • Periods of Surrender • 180 days from: • In case of Receipt – Date of Receipt • In case of any amount is unused – Date of Purchase • In case of unspent – Date of return to traveller • Exchange brought back can be utilised for next visit • Unspent exchange can also be deposited in RFC (D) Account Vinit V Deo Chartered Accountant

- 14. Bank Accounts Vinit V Deo Chartered Accountant

- 15. Bank Accounts – Which One? NRE NRO Used for international Used for local receipts receipts and payments and payments Fully Repatriable Non-Repatriable (Now repatriation allowed for certain types of payments upto USD 1 Mn per year) Vinit V Deo Chartered Accountant

- 16. Permissible Credits NRE/FCNR (B) NRO -Remittances from abroad - Remittances from Abroad -Cheques, travellers cheques, - Legitimate dues in India of the currency etc. deposited during Account holder temporary visit to India -Transfer from other NRE/FCNR Account -Interest on funds in the Account -Interest and maturity of Govt securities and units of MFs if they were bought in Foreign Currency -Refund of share/debenture subscription if original payment made from NRE -Refund of amount paid for flat booking if paid in foreign currency

- 17. Permissible Debits NRE / FCNR (B) NRO -Local disbursements -Payment of local expenses -Remittances outside India -Investments -Transfer to NRE / FCNR Account -Remittance of current income out of self or any other person of India net of taxes -Investment in shares,securities, commercial paper of Indian company -Purchase of immoveable property Vinit V Deo Chartered Accountant

- 18. Bank Accounts - I Non-Resident Foreign Non Resident (External) Currency (Non Ordinary Rupee Account Resident) Bank Account Account Popularly known NRE Account FCNR (B) NRO Account as Account Currency in Rupees Rupees Pound Sterling, which the US Dollar, Account can be Deutsche Mark, Japanese Yen, maintained Euro Who Can Open NRI / PIO NRI / PIO Any Person Resident outside India (i.e. even Foreigners) Vinit V Deo Chartered Accountant

- 19. Bank Accounts - II Non-Resident Foreign Non Resident (External) Currency (Non Ordinary Rupee Account Resident) Bank Account Account Type of Account Current Account, Term (Fixed) Current Account, Savings Account, Deposit Savings Account, Recurring Recurring Period of Fixed Deposit, Fixed Deposit, Fixed Deposit Deposit is Deposit between 1 and 3 years only Joint Accounts Only Between Only Between Account be held NRIs / PIOs NRIs / PIOs jointly with Residents Vinit V Deo Chartered Accountant

- 20. Bank Accounts - III Non-Resident Foreign Non Resident (External) Currency (Non Ordinary Rupee Account Resident) Bank Account Account When the Non - Account to be NRI can ask for Account to be Resident redesignated as redemption of the redesignated as becomes a Resident Account deposit, or Resident Account i.e. normal bank Resident i.e. normal bank Deposit is allowed account in India account in India, to continue till its or due date and then - Funds in the redeemed Account can be Deposit is transferred to converted into Resident Foreign resident Foreign Currency Account Currency Account on maturity Vinit V Deo Chartered Accountant

- 21. Issues – Bank Accounts • What happens to the Savings Bank Accounts when a resident becomes a Non-Resident? • What happens to the NRE/NRO/FCNR Accounts when a non- resident becomes a resident? • Can one open more than one Accounts: – With different branches of the same Bank – With different banks • Is money freely transferable between: – NRE to NRO and vice versa – NRE to FCNR and vice versa – NRO to FCNR and vice versa • Can the Accounts be opened and operated by a Power of Attorney (POA) holder? Are there any restrictions on the transactions that a POA holder can undertake? Vinit V Deo Chartered Accountant

- 22. Remitting Money to India Q:Are there restrictions / limits on sending money to India? A:No. They can send money in any form without limit. Exception: Loans to relatives in India (Maximum Amount is USD 250,000) Vinit V Deo Chartered Accountant

- 23. Loans to NRIs Vinit V Deo Chartered Accountant

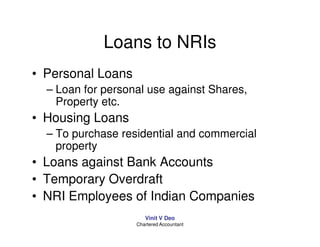

- 24. Loans to NRIs • Personal Loans – Loan for personal use against Shares, Property etc. • Housing Loans – To purchase residential and commercial property • Loans against Bank Accounts • Temporary Overdraft • NRI Employees of Indian Companies Vinit V Deo Chartered Accountant

- 25. Personal Loans - I • Types: – Against Security • Security of shares or securities • Security of immoveable property other than agricultural land, plantation or farm house – Other Loans Vinit V Deo Chartered Accountant

- 26. Personal Loans – Against Security • Purpose – Own personal requirements or for own business purpose – Not to be utilised for business of chit fund, nidhi company, trading in TDR, agricultural or real estate business • Loan amount not to be credited to NRE Account • Loan amount not to be remitted outside India • Repayment from – Remittance from outside India – Debit to NRE / FCNR / NRO Account of borrower – Sale of property against which loan is availed Vinit V Deo Chartered Accountant

- 27. Other Loans – I • Purpose – Any purpose as per the Loan Policy laid down by the Board of Directors of the Authorised Dealer except: • Chit Fund, Nidhi Company • Agricultural Loans, Plantation, Real Estate, Farm House • Trading in TDR • Investment in Capital Market including margin trading and derivatives Vinit V Deo Chartered Accountant

- 28. Other Loans – II • Other Conditions – Amount not to be credited to NRE / FCNR Accounts – Loan amount not to be remitted outside India • Repayment: – Remittance from outside India – Debit to NRE / FCNR / NRO Account of borrower – Sale of property against which loan is availed Vinit V Deo Chartered Accountant

- 29. Housing Loans • Purpose: Purchase of Residential Property • No. of Properties: No Limit • Amount of Loan: No Limit • From Whom Can they Loans be availed – Banks (SBI, ICICI etc) or Financial Institutions (HDFC) • Bank Account in India: Not Required • Mortgage: Compulsory. In addition, Bank can also take lien of borrowers other assets Vinit V Deo Chartered Accountant

- 30. Housing Loans – II • Repayment: The loan can be repaid in any of the following 4 ways: – Transferring the amounts from your Bank account outside India – Making the payments out of funds in NRE / FCNR / NRNR / NRO Accounts in India – Rental Income of property which you have acquired – Asking a relative in India to make the payment on your behalf Vinit V Deo Chartered Accountant

- 31. Housing Loans - III • Can Banks keep different terms and conditions for NRI? • No. The quantum, repayment period and margin money have to be same for Residents and NRIs • Exception: Rate of Interest can be different Vinit V Deo Chartered Accountant

- 32. Loans Against Bank Accounts NRE / FCNR (B) NRO To Account Holder / Third Allowed Allowed Parties in India (Against security of FD (Against security of FD and for specified and for specified Purposes as given in Purposes as given in next slide) next slide) Foreign Currency Loan to Allowed (Against Not Allowed Account Holder / Third security of funds held in Party outside India Account for any bonafide purpose) All the above loans are now restricted to Rs 20 Lacs Vinit V Deo Chartered Accountant

- 33. General Features of Loans in India General Features of Loans in India • Purpose of Loan – Personal or Business purposes – Investment in firms and companies on non-repatriation basis – Purchase of residential house for own use • Loan cannot be used for Relending, Agricultural / plantation activities, Real estate business • Third Party can be Individual, Firms or Companies • No consideration e.g. commission can be paid to NRI for agreeing to pledge his deposits Vinit V Deo Chartered Accountant

- 34. Temporary Overdraft NRE / FCNR (B) NRO Maximum Amount Rs 50,000 As per Bank’s judgement Period Maximum 2 Weeks As per Bank’s judgement Vinit V Deo Chartered Accountant

- 35. NRI Employees of Indian Companies • A Body Corporate registered in India or Indian Company can grant loans to employees who are NRI / PIO • Loan to be accordance with the Staff Welfare Scheme / Staff Housing Loan Scheme ie conditions to be same • Amount to be credited to NRO Account • Repayment to be made by borrower himself through remittance outside India or debit to NRE / FCNR / NRO Account • Loans can be also given for buying ESOP subject to: – Maximum of Rs 20 Lacs – Loan amount not to exceed 90% of purchase price of shares Vinit V Deo Chartered Accountant

- 36. Questions • What happens to the Loan / Overdraft given by the Bank to a Resident if he become a Non-Resident? • How does one repay a Loan if the Lender becomes a Non-Resident? • What happens when the borrower becomes a Non-Resident Vinit V Deo Chartered Accountant

- 37. Solutions • An Authorised Dealer may allow continuance of the loan subject to: – Period of the loan cannot exceed the period originally granted – Repayment is made by inward remittances or from NRE/FCNR/NRO Accounts • If the Lender becomes Non-Resident, amount should be paid to his NRO A/c • If the Borrower becomes Non-Resident, he can repay out of NRO / NRE Account Vinit V Deo Chartered Accountant

- 38. Loans by NRIs

- 39. Loans by NRIs • Loans to Individuals • Loans to Relatives • Loans to Companies • Loans against Bank Accounts – As discussed in the Bank Accounts section

- 40. Loans to Individuals • NRI can given loan to any Resident • Principal is not repatriable • Loan to be given out of remittance outside India or from NRE/NRO/FCNR Account • Maximum Period of Loan: 3 Years • Interest: 2% over the Bank Rate Vinit V Deo Chartered Accountant

- 41. Loans to Relatives • Indian Resident can borrow only from ‘Close Relatives’ • Minimum maturity is 1 Year • Maximum Amount is USD 250,000 • Loan is Free of Interest • Loan received from remittance outside India or debit to NRE / FCNR Account • Loan amount if fully repatriable Vinit V Deo Chartered Accountant

- 42. Loans to Companies • Company must be incorporated in India • Repatriation and Non Repatriation basis • Company is borrowing by way of Non-Convertible Debentures issued by way of Public Offer • Rate of Interest :SBI PLR + 3% • Borrowing Company does not carry out activities of agriculture, real estate, chit fund, nidhi fund • Period: Not less than 3 years • Additional Conditions – Non-Repatriation basis: Remittance from outside India / NRE / FCNR / NRO Account – Repatriation Basis • NRO Account not allowed for investment • Percent holding by all NRIs should be within FDI Limit Vinit V Deo Chartered Accountant

- 44. Immoveable Property - Eligibility • Definition of Person of Indian origin excludes citizens of: – Pakistan – Bangladesh – Sri Lanka – Afghanistan – China – Iran – Nepal Vinit V Deo Chartered Accountant

- 45. Non-Resident India What can be Acquired Any immoveable property other than Agricultural property, plantation or farm house Payment Mode Remittance from outside India or debit to non-resident account Transfer of Agricultural Land, Only to person resident in India Plantation or Farm House Transfer of Any Other Property To:Person Resident in India i.e. Indian Citizen, NRI, PIO, Foreigner Vinit V Deo Chartered Accountant

- 46. PIO – Acquisition of Property Type of Property Mode of Status of Transferor Acquisition Any immoveable property Any Mode other Resident (Indian and other than Agricultural than Gift and Foreign Citizen) property, plantation or farm Inheritance NRI house PIO Any immoveable property Gift Resident (Only Indian other than Agricultural Citizen) property, plantation or farm NRI house PIO Any Property Inheritance Resident (Indian and Foreign Citizen) NRI PIO Vinit V Deo Chartered Accountant

- 47. PIO – Transfer of Property Type of Property Mode of Status of Transferee Transfer Any immoveable property Sale Person Resident in other than Agricultural India ie. Resident. PIO property, plantation or farm Foreign Citizen house Resident in India Agricultural property, Gift, Sale Indian Citizen plantation or farm house Resident in India Residential or Commercial Gift Resident Property NRI PIO resident outside India Foreign Citizen Resident in India Vinit V Deo Chartered Accountant

- 48. Remittance of Sale Proceeds • Purchase in Foreign Currency – Amount cannot exceed the remittance originally made to acquire the property – In case of residential property, the remittance is restricted to 2 such properties • Purchased out of Rupee Funds – Entire amount, subject to a maximum of USD 1 Mn can be remitted Vinit V Deo Chartered Accountant

- 50. Definition of Securities • Shares, Stocks • Bonds • Debentures • Units of Mutual Fund • Government Securities • Savings Certificates Vinit V Deo Chartered Accountant

- 51. Investment in Listed Cos. • Share / Convertible Debentures of an Indian Company • Through Registered Broker on a recognised Stock Exchange • Single NRI can invest upto 5% of Total Paid up value of shares / debentures • Aggregate investment by all NRIs not to exceed 10% of Total Paid up Value – This limit can be increased to 24% by the Company by passing a Special Resolution in General Meeting • NRI has to take delivery of shares • Repatriation Basis: Payment must be made out of foreign remittance, NRE, FCNR Account • Non-Repatriation Basis: Payment can be made out of NRO Account Vinit V Deo Chartered Accountant

- 52. Investment in Listed or Unlisted Cos. • Shares / Convertible Shares of listed or unlisted company • Shares can be issued by Public Issue or Private Placement • Company cannot be chit fund, nidhi fund, real estate, agriculture or plantation business • No limit on % of holding and amount of investment • Payment must be made out of foreign remittance,NRE,FCNR, NRO Account • Amount of sale consideration, net of taxes to be credited to NRO Account • Principal and gains are not repatriable Vinit V Deo Chartered Accountant

- 53. Housing & Real Estate • Only NRIs are allowed to invest upto 100% in the following: – Development of serviced plots and construction of residential premises – Development of townships – City & Regional level Infrastructure facilities including roads and bridges – Manufacture of building materials Vinit V Deo Chartered Accountant

- 54. Investment in Other Securities • NRI can without limit on Repatriation or Non-Repatriation basis invest in: – Government dated securities, Treasury Bills, Units of Mutual Fund – Bonds issued by PSU – Shares in PSU disinvestment • NRI can invest without limit on Non- Repatriation basis: – National Plan / Certificates Vinit V Deo Chartered Accountant

- 55. Transfer of Shares • NRI can transfer shares or convertible debentures only to other NRI by way of Sale or Gift – If the Transferee has other venture or tie up or collaboration etc in India in the same, prior permission of Central Government required – The above permission is not required for companies in IT sector • NRIs need prior permission of RBI to transfer shares to person resident in India Vinit V Deo Chartered Accountant

- 56. Starting a Business in India

- 57. Proprietary Concern / Firm • NRI / PIO can invest in the capital of Proprietary Concern / Firm on the following conditions: – Amount received by inward remittance or though non-resident Bank Account – Firm is not in the agricultural or plantation activity or in real estate or Print Media – Amount invested is not eligible for repatriation Vinit V Deo Chartered Accountant

- 59. Insurance Policies • General / Life Insurance Policies taken by a Person when he was a Non-Resident can continue after he becomes a Resident • If the premium has been paid by remittance from India, the maturity proceeds have to be brought back to India through Banking channel within 7 days of receipt Vinit V Deo Chartered Accountant

- 61. Derivative Contracts • NRI can enter into Rupee Forward Contract to hedge: – Dividend due on shares held in Indian Company – Balances held in FCNR and NRE Accounts – Investment made under the Portfolio Investment Scheme • Cross currency exposure in FCNR Account • Investment made in India since 1st Jan 93 • Proposed Foreign Investment in India Vinit V Deo Chartered Accountant

- 63. Remittance of Assets • Which assets can be remitted: – Deposit with Bank, Firm or Company – Provident Funds, Superannuation benefits – Maturity proceeds / claims from insurance company – Sale proceeds of shares or securities – Sale proceeds of immoveable property – Sale proceeds of any other assets held in accordance with FEMA Regulations Vinit V Deo Chartered Accountant

- 64. Normal Remittance – NRI / PIO • Upto USD 1 Million (Approx Rs 4 Crs) can be remitted out of: – Balance in NRO Account – Sale proceeds of Assets – Assets acquired by way of legacy or inheritance • If remittance is made in multiple installments, all of them to be made through the same Authorised Dealer Vinit V Deo Chartered Accountant

- 65. Some Provisions Applicable to Residents

- 66. Special Case:Indians going out • Amounts that can be freely taken out: – Immigration : USD 100,000 of the limit prescribed by the destination country – Employment: USD 100,000 – Education: USD 100,000 per academic year or estimate from the Educational Institution, whichever is higher Vinit V Deo Chartered Accountant

- 67. Resident Foreign Currency A/c • Who can Open: A person Resident in India (ie all categories including Firms, Companies etc.) • Type: Current or Term Deposit • Permissible Credits Foreign Exchange Received: – As pension/any superannuation/other monetary benefits – On realised on conversion of assets referred in sub-section 6(4) & repatriated to India – FE received as gift or inheritance – FE received as proceeds of Life Insurance claims / maturity / surrender values • Permissible Debits: This A/c is free from all the restrictions regarding utilisation of FC balance including any restriction on investment in any form, by whatever name called outside India Vinit V Deo Chartered Accountant

- 68. Resident Foreign Currency (Domestic) – Who can Open: Resident Individual (ie No Firms, Companies etc.) – Currency : Any foreign currency – Type: Current Account without interest – Permissible Credits Only in the form of currency notes or travellers cheques received by way of: • While on a visit abroad, payment for services not arising from any business in India • Payment received as honorarium,gift or settlement of lawful obligation from a person on a visit to India • Hororarium or Gift received on a visit outside India • Unspent amount of foreign exchange taken for foreign travel • Gift from a close relative • Earning from Export of Goods or Services, Honorarium, Royalty or any other lawful means • Disinvestment proceeds from sponsored ADR/GDR issue • Insurance claim or maturity value of life insurance policy – Permissible Debits • All Current and Capital Account transactions – No ceiling on amount of balance in the Account Vinit V Deo Chartered Accountant

- 69. USD 200,000 Scheme • A Resident Individual can freely remit abroad upto USD 200,000 per financial year • Purpose can be any capital or current account transaction • Resident can open a Bank Account with a foreign bank for this purpose Vinit V Deo Chartered Accountant

- 70. Thank You Vinit Deo Chartered Accountant +91 9822088313 vinitdeo@gmail.com