Financial Management Group Presentation Slides

- 2. 1.Financial Management QSB3413/QSB3414/FIN60203 ABOUT THE COMPANY Sycal Venture Berhad (Group) Established since 1980 Public Limited Liability Company Listed on the main board of Bursa Malaysia on the 29th March 1995 Core Businesses Construction and Infrastructure Property Development Hotels and Resorts

- 3. 2.Financial Management QSB3413/QSB3414/FIN60203 PRINCIPAL ACTIVITIES Name of subsidiary companies Principal Activities Sycal Kulai Sdn Bhd Property development Cygal Construction Sdn Bhd Dormant Sycal Plant & Machinery Sdn Bhd Contractor for management and operator of plant and machinery Cygal Industries Sdn Bhd Dormant Cygal Hotel Management Services Sdn Bhd Dormant Cygal Entertainment Sdn Bhd Dormant Sycal Concrete Sdn Bhd Manufacturing and trading in ready mix concrete Sycal Geotechniecs Sdn Bhd Dormant United Golden Mile Aviation Ltd Leasing of aircraft parts and equipment and provision of related services Sycal ICC Properties Sdn Bhd Property development Sycal Properties Management Sdn Bhd Property development, investment holding and operator of theme park

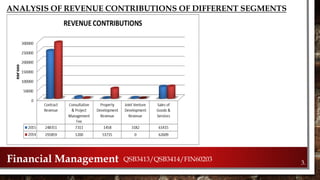

- 4. ANALYSIS OF REVENUE CONTRIBUTIONS OF DIFFERENT SEGMENTS 3.Financial Management QSB3413/QSB3414/FIN60203

- 5. REVENUE CONTRIBUTION OF DIFFERENT SEGMENTS IN 2014 & 2015 REVENUE GROUP VARIANCE 2015 2014 RM’000 RM’000 RM’000 % Revenue comprises: Contract revenue 248,351 291,859 (43,508) (15)% Consultation and project management fee 7,311 1,200 6,111 509% Property development revenue 1,458 51,715 (50,257) (97%) Joint venture development revenue 3,182 - 3,182 100% Sales of goods and services 61,415 62,609 (1,194) (2%) TOTAL 321,717 407,383 (85,666) (21%) 4.Financial Management QSB3413/QSB3414/FIN60203

- 6. CURRENT STATE OF MAJOR INDUSTRY OF SYCAL BERHAD CURRENTLY FACING THE CHALLENGES OF ECONOMIC SLOWDOWN. ECONOMIC GROWTH IS EXPECTED TO SLUGGISH FROM 4.7% TO 4.5% IN ONE YEAR PERIOD. THE HOUSING MARKET ECONOMIST PREDICTED THE NUMBER OF SALES FOR HOUSING MARKET WILL ATTAIN BETWEEN 190,000 AND 210,000. HOUSE PRICE INDEX- RISE IN BETWEEN 3.5% & 5.5%. GDV- GROW BY 2% IN 2016. OVERALL, SYCAL BERHAD IS COMPETENT TO KEEP PROFITABLE. 5.Financial Management QSB3413/QSB3414/FIN60203

- 7. 6.Financial Management QSB3413/QSB3414/FIN60203 STRENGTHS Awarded the Bureau Veritas Certification, ISO 9001:2008 Requirements of the management system standards Handful of Completed Projects Segmentations of Services Services by different subsidiaries WEAKNESSES Diversification Into Hotels & Resorts Affects by Economic Downturn

- 8. 7.Financial Management QSB3413/QSB3414/FIN60203 STRATEGIC PLANS TO SEIZE OPPORTUNITIES Planned Developments in developing areas Potential GDV of RM 1.2 billion Expand one of their core business Hotels & Resorts segment CHALLENGES Global financial crisis Goods and Service Tax issue Comply with stringent regulations Threats of increased interest rates Stringent lending policies by bank Ability to fund its projects

- 9. 8.Financial Management QSB3413/QSB3414/FIN60203 MAJOR CAPITALS Last three years Year 2013 • Purchased RM 7,245,000 of property, plant and equipment • As well as RM 63,000 in other investments Year 2014 • Purchased RM 15,371,000 of property, plant and equipment • As well as RM 63,000 in other investments Year 2015 • Purchased RM 16,882,000 of property, plant and equipment • As well as RM 63,000 in other investments SOURCE OF FUNDINGS Bank borrowings of RM 62,578,000 and RM 60,345,000 in the year 2014 and 2015 respectively

- 10. EVALUATING THE COMPANY’S CASH FLOW 9.Financial Management QSB3413/QSB3414/FIN60203 Company’s Cash Flow Statement Year 2011 2012 2013 2014 2015 Total of Cash and Cash Equivalents (RM) 611,000 485,000 2,270,000 8,340,000 (4,260,000) Differences (RM) - (126,000) 1,785,000 6,070,000 (12,600,000)

- 11. THE COMPANY’S MAJOR CASH FLOW 10.Financial Management QSB3413/QSB3414/FIN60203

- 12. THE COMPANY’S MAJOR CASH FLOW (CONT’D) 11.Financial Management QSB3413/QSB3414/FIN60203

- 13. Net cash decrease by RM 4,260,000 in 2015 while in 2014 the net cash increase is RM 8,340,000 which is higher than net cash in 2015 THE COMPANY’S CASH AND CASH EQUIVALENT 12.Financial Management QSB3413/QSB3414/FIN60203

- 14. THE COMPANY’S FREE CASH FLOW WHAT IS FCF (FREE CASH FLOW)? A MEASUREMENT OF FINANCE PERFORMANCE HOW TO CALCULATES FCF? USING THE COMPANY’S OCF – CAPEX = FCF Financial Management QSB3413/QSB3414/FIN60203 13.

- 15. Year 2011 RM Net Operating Activities 1,436,000 Total Investment (908,000) Total FCF 528,000 Year 2012 RM Net Operating Activities 21,420,000 Total Investment (40,000) Total FCF 21,380,000 Year 2013 RM Net Operating Activities (14,148,000) Total Investment (407,000) Total FCF (14,555,000) Year 2014 RM Net Operating Activities (41,770,000) Total Investment (1,401,000) Total FCF (43,171,000) Year 2015 RM Net Operating Activities (426,000) Total Investment (1,473,000) Total FCF (1,473,000) THE COMPANY’S FREE CASH FLOW Financial Management QSB3413/QSB3414/FIN60203 14.

- 16. Year of Company’s Free Cash Flow (FCF) Total in RM 31st of March 2011 528,000 31st of March 2012 21,380,000 31st of March 2013 (14,555,000) 31st of March 2014 (43,171,000) 31st of March 2015 (1,473,000) Total Free Cash Flow in 5 Years (34,291) Financial Management QSB3413/QSB3414/FIN60203 THE COMPANY’S FREE CASH FLOW 15.

- 17. COMPANY’S FINANCIAL PERFORMANCE Financial Management QSB3413/QSB3414/FIN60203 2015 2014 2013 2012 2011 a. Current Ratio current assets current liabilities 434,729,000 225,848,000 = 1.92 443,676,000 224,002,000 = 1.98 328,261,000 211,296,000 = 1.55 192,754,000 132,343,000 = 1.46 190,409,000 113,703,000 = 1.67 b. Quick Ratio cash+accounts receivable current liabilities 5,205,000+ 173,076,000 225,848,000 = 0.79 9,720,000+ 172,333,000 224,002,000 = 0.81 3,529,000+ 160,551,000 211,296,000 = 0.78 2,425,000+ 36,812,000 132,343,000 = 0.30 1,199,000+ 51,329,000 113,703,000 = 0.46 i. Liquidity 16.

- 18. Financial Management QSB3413/QSB3414/FIN60203 17. COMPANY’S FINANCIAL PERFORMANCE ii. Activity 2015 2014 2013 2012 2011 a. Inventory turnover Cost of goods sold Inventory 280,540,000 19,932,000 =14.07x 363,933,000 19,811,000 =18.37x 260,573,000 6,589,000 =39.55x 148,907,000 8,161,000 =18.25x 83,241,000 7,789,000 =10.69x b. Average collection period Accounts receivables Daily credit sales 189,939,000 297,652,000 x 365 =233.6 days 176,130,000 384,514,000 x 365 =167.4 days 112,942,000 272,125,000 x 365 =151.5 days 51,522,000 157,327,000 x 365 =119.5 days 48,676,000 89,006,000 x 365 =199.6 days c. Total asset turnover Sales Total assets 321,717,000 434,729,000 =0.74x 407,383,000 443,676,000 =0.92x 292,327,000 328,261,000 =0.89x 169,406,000 192,754,000 =0.88x 100,131,000 190,409,000 =0.53x

- 19. COMPANY’S FINANCIAL PERFORMANCE iii. Debt Financial Management QSB3413/QSB3414/FIN60203 18. 2015 2014 2013 2012 2011 a. Debt Ratio Total liabilities Total assets 286,193,000 528,225,000 =0.54 286,580,000 511,862,000 =0.56 215,311,000 405,161,000 =0.53 142,879,000 315,140,000 =0.45 128,539,000 291,673,000 =0.44 b. Debt to Equity Total liabilities Common stock equity 286,193,000 242,032,000 =1.18 286,580,000 225,282,000 =1.27 215,311,000 189,850,000 =1.13 142,879,000 172,261,000 =0.83 128,539,000 163,134,000 =0.79 c. Interest cover ratio Operating profits Interest expense 24,603,000 1,593,000 =15.44 29,195,000 1,480,000 =19.73 20,427,000 228,000 =89.59 12,748,000 917,000 =13.90 6,927,000 1,876,000 =3.69

- 20. COMPANY’S FINANCIAL PERFORMANCE iv. Profitability Financial Management QSB3413/QSB3414/FIN60203 19. 2015 2014 2013 2012 2011 a. Gross Profit Margin Gross profit Revenue 41,177,000 321,717,000 =0.13 43,450,000 407,383,000 =0.11 31,754,000 292,327,000 =0.11 20,499,000 169,406,000 =0.12 16,890,000 87,322,000 =0.19 b. Return on Assets Net income Total assets x 100% 18,452,000 528,225,000 x 100% =3.49% 35,804,000 511,862,000 x 100% =6.99% 17,977,000 405,161,000 x 100% 4.44% 8,936,000 315,140,000 x 100% =2.84% 5,200,000 291,673,000 x 100% =1.78% c. Return on Equity Net income Shareholders’ equity x 100% 18,452,000 238,203,000 x 100% =7.75% 35,804,000 222,312,000 x 100% =16.11% 17,977,000 187,685,000 x 100% 9.58% 8,936,000 170,641,000 x 100% =5.24% 5,200,000 161,543,000 x 100% =3.22%

- 21. COMPANY’S FINANCIAL PERFORMANCE v. Market Performance Financial Management QSB3413/QSB3414/FIN60203 20. 2015 2014 2013 2012 2011 a. Earnings per Share Net income Total outstanding common shares 17,293,000 320,250,000 =0.05 34,999,000 320,250,000 =0.11 17,432,000 320,250,000 =0.06 8,907,000 288,256,000 =0.03 5,056,000 251,959,000 =0.02 b. Price / Earnings Market value per share Earnings per share 0.41 0.05 =8.20 0.33 0.11 =3.00 0.28 0.06 =4.67 0.18 0.03 =6.00 0.20 0.02 =10.00 c. Price / Book Ratio Market value per share Equity book value / share 0.41 0.74 =0.55 0.33 0.69 =0.48 0.28 0.59 =0.47 0.18 0.59 =0.31 0.20 0.64 =0.31

- 22. Financial Management QSB3413/QSB3414/FIN60203 FORECAST REVENUE GROWTH 2015 2016 RM'000 % of Revenue RM'000 Revenue 321,717 100.0% 341,020 Cost of Sales (280,540) -87.2% (297,372) Gross Profit 41,177 12.8% 43,648 Other Operation Income 6,426 2.0% 6,812 47,603 14.8% 50,459 Administration Expenses (10,854) -3.4% (11,505) Other Operating Expenses (13,211) -4.1% (14,004) Profit/(Loss) From Operations 23,538 7.3% 24,950 Finance Costs (1,727) -0.5% (1,831) Profit/(Loss) Before Taxation 21,811 6.8% 23,120 Taxation (3,359) -1.0% (3,561) Profit/(Loss) For the Year 18,452 5.7% 19,559 Other Comprehensive Income (1,402) -0.4% (1,486) Total Comprehensive Income/(Loss) for the Year 17,050 5.3% 18,073 21.

- 23. Financial Management QSB3413/QSB3414/FIN60203 REQUIRED NEW FUNDS )1()()( 2 11 DPSS S L S S A RNF - This shows that the company does not require any new funds to achieve this sales growth A/S = Percentage relationship of variable assets to sales S = Change in sales L/S = Percentage relationship of variables liabilities to sales P = Profit margin S2 = New sales level D = Dividend payout ratio 22.

- 24. CONCLUSIONS & RECOMMENDATIONS 23.Financial Management QSB3413/QSB3414/FIN60203 Worsening performance in the year ended 2015 Attributed to the downturn in economy Diversify its revenue streams or investments Utilisation of assets

- 25. Financial Management QSB3413/QSB3414/FIN60203 “Enjoy little things in life, because one day you will look back, and realize they were the big things.” – Barrack Obama