Fundamental concepts, principle of economics

- 1. Fundamental Concepts of Managerial Economics Prof. Shampa Nandi

- 2. Fundamental Concepts/Principles in Managerial Economics Economic theory provides a number of concepts and analytical tools which can be of considerable and immense help to a manager in taking many decisions and business planning. The contribution of economics to managerial economics lies in certain principles which are basic to managerial economics. There are six basic principles of managerial economics. They are: 1. The Incremental Principle 2. The Principle of Time Perspective 3. The Opportunity Cost Principle 4. The Discounting Principle 5. The Equimarginal Principle 6. Risk and Uncertainty

- 3. The Incremental Principle Incremental concept is closely related to the marginal cost and marginal revenues of economic theory. The two major concepts in this analysis are incremental cost and incremental revenue. a) Incremental Cost: Incremental cost may be defined as the change in total cost resulting from a particular decision. b) Incremental Revenue: Incremental revenue is the change in total revenue resulting from a particular decision. According to incremental principle, a decision is profitable if: (i) It increases revenue more than costs. (ii) It decreases some cost to a greater extent than it increases others. (iii) It increases some revenues more than it decreases others. (iv) It reduces costs more than revenues.

- 4. Example of Incremental Principle Some businessmen hold the view that to make an overall profit, they must make a profit on every job. The result is that they refuse orders that do not cover full costs plus a provision of profit. This will lead to rejection of an order which prevents short run profit. Suppose a new order is estimated to bring in an additional revenue of Rs. 10,000. The costs are estimated as under: Labour Rs. 3,000 Materials Rs. 4,000 Overhead charges Rs. 3,600 Selling and administrative expenses Rs. 1,400 Full Cost Rs.12, 000 The order appears to be unprofitable. For it results in a loss of Rs. 2,000.

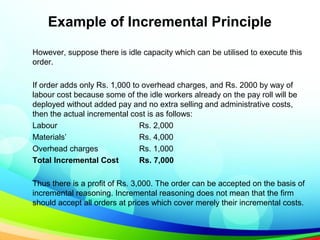

- 5. Example of Incremental Principle However, suppose there is idle capacity which can be utilised to execute this order. If order adds only Rs. 1,000 to overhead charges, and Rs. 2000 by way of labour cost because some of the idle workers already on the pay roll will be deployed without added pay and no extra selling and administrative costs, then the actual incremental cost is as follows: Labour Rs. 2,000 Materials’ Rs. 4,000 Overhead charges Rs. 1,000 Total Incremental Cost Rs. 7,000 Thus there is a profit of Rs. 3,000. The order can be accepted on the basis of incremental reasoning. Incremental reasoning does not mean that the firm should accept all orders at prices which cover merely their incremental costs.

- 6. Principle of Time Perspective The time perspective concept states that the decision maker must give due consideration both to the short run and long run effects of his decisions. He must give due emphasis to the various time periods. It was Marshall who introduced time element in economic theory. By Short run they mean that period within which some of the inputs (called fixed inputs) cannot be altered, while in the long run all the inputs can be changed. In the short period, the firm can change its output without changing its size. In the long period, the firm can change its output by changing its size. In the short period, the output of the industry is fixed because the firms cannot change their size of operation and they can vary only variable factors. In the long period, the output of the industry is likely to be more because the firms have enough time to increase their sizes and also use both variable and fixed factors. A decision may be made on the basis of short run considerations, but may as time elapses have long run repercussions which make it more or less profitable than it at first appeared.

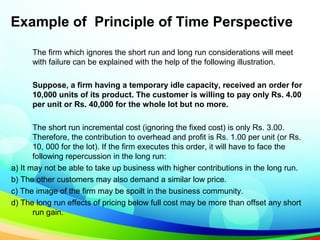

- 7. Example of Principle of Time Perspective The firm which ignores the short run and long run considerations will meet with failure can be explained with the help of the following illustration. Suppose, a firm having a temporary idle capacity, received an order for 10,000 units of its product. The customer is willing to pay only Rs. 4.00 per unit or Rs. 40,000 for the whole lot but no more. The short run incremental cost (ignoring the fixed cost) is only Rs. 3.00. Therefore, the contribution to overhead and profit is Rs. 1.00 per unit (or Rs. 10, 000 for the lot). If the firm executes this order, it will have to face the following repercussion in the long run: a) It may not be able to take up business with higher contributions in the long run. b) The other customers may also demand a similar low price. c) The image of the firm may be spoilt in the business community. d) The long run effects of pricing below full cost may be more than offset any short run gain.

- 8. Example of Principle of Time Perspective In one of the case studies Haynes, Mote and Paul refer to the example of a printing company which never quotes prices below full cost due to the following reasons: (1) The management realized that the long run repercussions of pricing below full cost would more than offset any short run gain. (2) Reduction in rates for some customers will bring undesirable effect on customer goodwill. Therefore, the managerial economist should take into account both the short run and long run effects as revenues and costs, giving appropriate weight to most relevant time periods.

- 9. Opportunity Cost Resources are scarce, we cannot produce all the commodities. For the production of one commodity, we have to forego the production of another commodity. We cannot have everything we want. We are, therefore, forced to make a choice. Opportunity cost of a decision is the sacrifice of alternatives required by that decision. Sacrifice of alternatives is involved when carrying out a decision requires using a resource that is limited in supply with the firm. Opportunity cost, therefore, represents the benefits or revenue forgone by pursuing one course of action rather than another. The concept of opportunity cost implies three things: 1. The calculation of opportunity cost involves the measurement of sacrifices. 2. Sacrifices may be monetary or real. 3. The opportunity cost is termed as the cost of sacrificed alternatives.

- 11. Opportunity Cost In managerial decision making, the concept of opportunity cost occupies an important place. The economic significance of opportunity cost is as follows: 1. It helps in determining relative prices of different goods: For Example : If a given amount of factors can produce 1 table or 3 chairs, then the price of one table will tend to be equal to three times that on one chair. 2. It helps in determining normal remuneration to a factor of production: For Example: Let us assume that the alternative employment of a college professor is to work as an office in a bank at a salary of Rs. 40000 per month. In such a case he has to be paid at least Rs.40000 to continue to retain him in the college. 3. It helps in proper allocation of factor resources: For Example: Opportunity cost of 1 table is 3 chairs and price of a chair is Rs.100, while the price of a table is Rs.400. Under such conditions it is beneficial to produce 1 table rather than 3 chairs. Because, if he produce 3 chairs, he will get only Rs.300, whereas a table fetches him Rs. 400.

- 12. Equi-Marginal Principle The principle states that an input should be allocated so that value added by the last unit is the same in all cases. This generalisation is popularly called the equi-marginal. Let us assume a case in which the firm has 100 unit of labour at its disposal. And the firm is involved in five activities viz., А, В, C, D and E. The firm can increase any one of these activities by employing more labour but only at the cost i.e., sacrifice of other activities. An optimum allocation cannot be achieved if the value of the marginal product is greater in one activity than in another.

- 13. Equi-Marginal Principle For example, the value of the marginal product of labour in activity A is Rs. 50 while that in activity В is Rs. 70 then it is possible and profitable to shift labour from activity A to activity B. The optimum is reached when the values of the marginal product is equal to all activities. This can be expressed symbolically as follows: VMPLA = VMPLB = VMPLC = VMPLD = VMPLE Where VMP = Value of Marginal Product. L = Labour For a consumer, this concept implies that money may be allocated over various commodities such that marginal utility derived from the use of each commodity is the same. Similarly, for a producer this concept implies that resources be allocated in such a manner that the marginal product of the inputs is the same in all uses.

- 14. Equi-Marginal Principle The principle states that an input should be allocated so that value added by the last unit is the same in all cases. This generalisation is popularly called the equi-marginal. Let us assume a case in which the firm has 100 unit of labour at its disposal. And the firm is involved in five activities viz., А, В, C, D and E. The firm can increase any one of these activities by employing more labour but only at the cost i.e., sacrifice of other activities. An optimum allocation cannot be achieved if the value of the marginal product is greater in one activity than in another.

- 15. Discounting Principle / Time Value of Money This concept is an extension of the concept of time perspective. Since future is unknown and incalculable, there is lot of risk and uncertainty in future. Everyone knows that a rupee today is worth more than a rupee will be two years from now. This judgment is made not on account of the uncertainty surrounding the future or the risk of inflation. It is simply that in the intervening period a sum of money can earn a return which is ruled out if the same sum is available only at the end of the period.

- 16. Example of Discounting Principle The value of Rs.100000 after one year is not equal to Rs. 100000 today, but less than that. But then how much money today is equal to Rs.100000 after one year? To find out this we will have to take into account relevant rate of interest. Then, we will discount Rs.100000 at that rate of interest to ascertain the value of Rs.100000 after one year.

- 17. Risk And Uncertainty Managerial decisions are actions of today which bear fruits in future which is unforeseen. Future is uncertain and involves risk. The uncertainty is due to unpredictable changes in the business cycle, structure of the economy and government policies. Economic theory generally assumes that the firm has perfect knowledge of its costs and demand relationships and of its environment. Uncertainty is not allowed to affect the decisions. Uncertainty arises because producers simply cannot foresee the dynamic changes in the economy and hence, cost and revenue data of their firms with reasonable accuracy. The managerial economists have tried to take account of uncertainty with the help of subjective probability. The probabilistic treatment of uncertainty requires formulation of definite subjective expectations about cost, revenue and the environment.