GROUP-6-66666-FINAL-HS.ppt

- 1. Presentation on InsurTech in Microinsurance Group- 06

- 3. Agenda • Overview of InsurTech • Importance of InsurTech • Technologies Used in InsurTech • InsurTech Platforms • Factors Impacting InsurTech Platforms • InsurTech and Microinsurance • Role of Insurtech • InsurTech in Premium Collection • InsurTech in Claim Settlement • The Reason for Which InsurTech Needs to be Formalized • Benefits of InsurTech • Risks of InsurTech in Microinsurance • Findings • Recommendations • Conclusion

- 4. Overview of InsurTech Designed to find cost savings and efficiency. Combination of the words insurance and technology. Used to more effectively process claims, evaluate risk, process contracts, or underwrite policies. Leverages modern solutions. Allows products to be priced more more competitively.

- 5. In Bangladesh, • Technology is growing • Subscriptions to mobile telephone have increased • Total number of mobile phone subscribers has reached 180.87 million • Falling prices of mobile broadband and the increasing availability of 4G networks

- 6. Importance of Insurtech 1. Increases the customer experience 2. Promotes efficiency 3. Emphasizes individuality 4. Improves flexibility 5. Reduces operating costs 6. Decrease fraud

- 7. Technologies used in InsurTech • Acquire risk information and evaluate loss. • Offer considerably more specific and granular information concerning risk or loss. • Used to offer customized products. • Automate or improve claims handling or customer service. • Enable automated or more granular underwriting. • Include product offerings, risk selection, pricing, • As a tool for information coordination among numerous participants. • Allows automated transactions and are especially well-suited for parametric covers. • Offers the fundamental digitization. • Designed to be used by insurance consumers directly or • As support for the back- or front-end operations of an insurance provider. Digital/Mo bile Platforms Distribute d Ledger Technolog y/ Blockchai n Satellites and Remote Sensing Artificial Intelligen ce/Big Data

- 8. Insurtect Platforms •Used to improve the effectiveness of the insurance •Enable consumers to get insurance in a matter of minutes

- 9. 9 Factors Impacting Insurtech Platforms Customer Experience Security and Privacy It enhance the customer experience and promote client interaction Insurance companies must conduct background checks and guarantee that claims are legitimate Digital Solution The combination of various technologies in digital solutions is driving the growth of digital insurance platforms for deployment and management.

- 10. 10 Platforms Next Insurance •Supplier of insurance for small companies •Headquarters in Palo Alto, California •Applications in 10 minutes and provide 24/7 access Policy Bazaar •Online insurance broker in India •Employs 14 digital tools and services •Receives a commission from insurers for each policy Bimafy •First insurtech platform in Bangladesh •Website and Mobile app

- 12. 12 Role of Insurtech Insurer incur high transaction costs in servicing low income people Innovative technology (Mobile network, M-Health) can mitigate the obstacles Also provide greater understanding about customer behaviors and risk Make it quick, convenient, relatively low cost payment of premium and claim payment

- 13. 13 1. Go to the MetLife Bangladesh website- www.metlife.com.bd. 2. From the pay premium button, select payment channel and submit 3. Provide the policy number and date of birth and click submit 4. Choose the Payment Type 5. Go through the “Terms and Conditions” 6. A copy of which will automatically be sent to insured’s e- InsurTech in Premium Collection

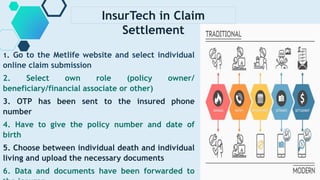

- 14. 14 InsurTech in Claim Settlement 1. Go to the Metlife website and select individual online claim submission 2. Select own role (policy owner/ beneficiary/financial associate or other) 3. OTP has been sent to the insured phone number 4. Have to give the policy number and date of birth 5. Choose between individual death and individual living and upload the necessary documents 6. Data and documents have been forwarded to

- 15. The reasons for which InsurTech needs to be formalized To bring about a paradigm shift in the insurance sectors Higher market penetration with different products To work together for developing and modifying the products

- 16. Findings:- Fraud prevention Billing efficiency Cut down on manual process Increase profits by growing their margin Secure customer data Improve the customer experience Benefits of InsurTech

- 17. Risk of InsurTech in Microinsurance 17 — Focus risk — Digital assets — Cyber risk — Investment risk — Lack of proper knowledge — Climate and environment risk

- 18. Findings 18 — Quick claim settlement — Frequent use of same data — Reduce documentation — Helping on reducing fraud — Low data security — Unorganized law — High cost

- 19. Recommendations 19 — Knowledge sharing criteria — Part of digitalization — Proper training — Specific and structured law — Part time responsibility sharing with tech based company

- 20. Conclusion Microinsuran ce Emerging sector and part of financial inclusion Problems Cyber risk, Investment risk, lack of knowledge, high cost Solutions Training, proper education, part time responsibility sharing, structured law

- 21. Thanks! 21