Jubilant food works capstone project

- 1. Jubilant Food works Capstone Project

- 2. Group detail:- SAMAR SAHA (37459) NITIN KUMAR PODDAR (37450) BHOJARAJ PATEL (37439) ALOK SINGH (37436)

- 3. History of Jubilant Food Works Ltd. Jubilant FoodWorks Limited (the Company) is a Jubilant Bhartia Group Company. The Company was incorporated in 1995 and initiated operations in 1996. The Company got listed on the Indian stock exchange in February 2010. Mr. Shyam S. Bhartia, Mr. Hari S. Bhartia and Jubilant Enpro Private Ltd. are the Promoters of the Company. The Company & its subsidiary operates Domino’s Pizza brand with the exclusive rights for India, Nepal, Bangladesh and Sri Lanka.

- 4. Introduction The Company is India’s largest and fastest growing food service company, with a network of 844 Domino’s Pizza restaurants (as of February 05, 2015). The Company launched Dunkin’ Donuts in India in April 2012 in Delhi. The Company has 50 Dunkin’ Donuts restaurants in India (as of February 05, 2015).

- 5. JUBILIANT BHARTIA GROUP Pharmaceuticals and Life Sciences Agri Products, Performance Polymers & Retail Retail Food Oil and Gas Exploration and Production Services Auto Jubilant Bhartia Group

- 6. SWOT Analysis STRENGTHS barriers of market entry domestic market monetary assistance provided WEAKNESSES competitive market OPPORTUNITIES new products and services new markets growing demand THREATS Global economy Government regulations Increase in labor costs Increasing costs Growing competition and lower profitability tax changes Increasing rates of interest

- 8. Porter’s Five Competitive Forces Force Intensity Comments Degree of Rivalry High Domino’s Pizza has high competition from other pizza brands like Pizza Hut, Smokin Joe, Gracia etc. However, it has created a unique position of “guaranteed delivery in 30 minutes” which helps to wither the competition to some extent. It commands a market share of 65% in the delivery market in which it was the first mover and enjoys sizable brand recall. Also, it has positioned itself on the affordability platform which the lowest pizza priced at Rs 39. The competitive intensity still stands high. Threat of Entry High There are not many barriers to entry apart from introducing products that suits the Indian palate. KFC was the first MNC brand to enter India in 1995 which was followed by influx of other QSR brands such as Domino's and McDonald's (which entered only after researching the market since 1990). Threat of Substitutes High Right from road size eateries to sophisticate dine ins and other national lower-priced fast-food chains such as McDonalds, KFC all pose as strong substitutes for pizzas. Buyer Power Medium Bargaining power of buyers is medium to low in case of pizzas. Supplier Power Low JFL centrally sources all its raw material requirements, thus commanding significant bargaining power over its suppliers. Economies of scale come into play as bulk orders are placed with various suppliers.

- 9. Strategic Group Map Analysis

- 10. Management Team Chairmen Mr. Shyam S. Bhartia Mr. Hari S. Bhartia Board of Directors Mr. Ajay Kaul Mrs. Rami Nirula Mr. Vijay Marwaha

- 12. Major Players in Fast Food Domino’s Pizza Pizza Hut Smokin Joe’s Garcias Pizza KFC Subway

- 13. Market Share in delivery system DOMINOS PIZZA HUT SMOKIN JOES GARCIAS 65 % 20% 7% 2%

- 15. Top Line Analysis 0 200 400 600 800 1000 1200 FY 08-09 FY 09-10 FY 10-11 FY 11-12 FY 12-13 236.03 313.91 475.52 765.24 1017.36 Net Sales AmountinRsCr.

- 16. Highlights of F.Y 2012-2013 Particulars 2012-2013 (₹ in Cr) 2011-2012 (₹ in Cr) Total Income 1018.52 767.05 Less :- Expenditure 826.29 644.95 Operating Profit 192.85 120.54 Less :- Depreciation 37.57 29.34 Less :- Interest 0 0.34 Profit Before Tax 154.66 92.42 Less :- Tax 49.79 20.43 Profit After Tax (Net Profit) 105.64 72

- 17. Operating Profit Margin Profit Margin 0 50 100 150 200 FY 08-09 FY 09-10 FY 10-11 FY 11-12 FY 12-13 26.85 34.19 66.94 120.54 192.85 Profit Margin AmountinRsCr.

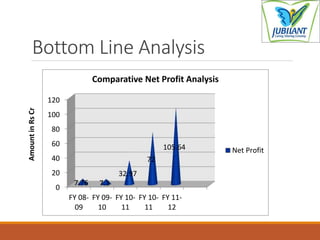

- 18. Bottom Line Analysis 0 20 40 60 80 100 120 FY 08- 09 FY 09- 10 FY 10- 11 FY 10- 11 FY 11- 12 7.76 7.3 32.97 72 105.64 Comparative Net Profit Analysis Net Profit AmountinRsCr

- 19. Book Value Per Share 0 5 10 15 20 25 30 35 40 45 50 FY 08-09 FY 09-10 FY 10-11 FY 11-12 FY 12-13 Amountin₹/share.

- 20. Competitive Analysis Brand No. of Stores Cities Format Dominos 439 100 Own stores Pizza Hut 180 56 Franchisee Smokin’ Joe’s 42 23 Franchisee Garcia’s Pizza 20 1 Own+Franchise e

- 21. Future Prospects Plans to diversify into non food business Aims to add 100 more stores and hike the price by 3 % Plans to open 100 new stores of Dunkin donuts across the country this financial year

- 22. Things Jubilant must watch out for... Till now no nation wide competitor, only city wise Competition from New Entrants as market is untapped Substitution effect (like restaurants, other food joints) Suppliers growing bargaining power

- 23. Dominos on the Industry Life Cycle

- 24. Conclusion Business Model ◦ Relatively inelasticity of Demand Advantage. Future growth depends on how well retailers are able to innovate, provide value for money, and keep up and surpass competitors. The fast-food industry is becoming more global and it seems that will continue The growth of the fast-food industry is expected to generally stay the same over the next few year.

- 25. THANK YOU !