Retirement 2007

- 1. CMW Financial, Inc. Financial Representative of and Advisory Services and Securities Offered through Lincoln Investment Planning, Inc., Registered Investment Advisor, Member NASD/SIPC. CMW Financial, Inc. and Lincoln Investment Planning, Inc. are independently owned and each is responsible for its own business. 09/07 Don’t Retire – Rewire! What’s Your Next Chapter?

- 2. What is Retirement? Pay Off Bills Pay Off House Buy Retirement Car

- 3. What Retirement Is… Opportunity The Next Chapter Hobbies Family Working at Something You Love

- 4. The Reality Life as Usual with a Different Slant

- 5. How Long Should I Plan For? Individual Life Expectancy Couple Age 62 Today Joint Life Expectancy 89 92

- 6. How Should I Plan for One-Third of My Life?

- 7. The Pyramid of Financial Independence © RETURN RISK

- 8. Goals Travel Family College Later Years Where to Live Elderly Parents

- 12. Risk Management

- 13. Inflation Hedge

- 14. Modern Portfolio Theory (MPT) The 1952 publication "The Modern Portfolio Theory" by Harry M. Markowitz revolutionized portfolio development. An approach to choosing investments allowing investors to quantify and control the amount of risk they accept and amount of return they achieve in their portfolios. It shifts the emphasis away from analyzing the specific security in the portfolio and towards determining the relationship between risk and reward in the total portfolio.

- 15. What You See… May Not Be What You Get S&P 500 Index Average Mutual Fund Investor 3.7% 13.2% Average Annual total Returns 1984-2004 Source: Dalbar, Inc.

- 17. High Risk

- 18. How Much Income Will I Need… … in 5 years … in 10 years … in 15 years … in 20 years from now?

- 19. Your Retirement Income Should Support Your Needs & Goals Travel Family College Later Years Where to Live Elderly Parents

- 20. ORP Do I leave my money where it is? The accumulation period requires a different investment platform than distribution. Paycheck Retirement Paycheck $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $

- 21. What are my other options?

- 22. ORP How do I safely develop a spending plan so my money lasts? Divide your assets according to risk tolerance to afford current income through immediate annuities, treasury bills or bonds. Position monies in various investments to provide an inflation hedge.

- 23. How Standard Annuity Calculated Average of Highest 3 or 5 Annual Salaries May also visit http://www.trs.state.tx.us/Benefits/RetEst.html for an online Retirement Estimate Worksheet. Grandfathered Option Annual Annuity / 12 = Monthly Standard Annuity Total % Average Salary x = Annual Annuity Total Years of Service Credit x Total % = 2.3% (.023)

- 24. Grandfathered Provision Continue Rule of 80 but with a 5% reduction for each year below age 60 Change from 3 to 5 years highest salary to determine benefit payment Eliminate subsidy for early retirement for individuals with 20 + years of service Require rule of 90 to be eligible for PLSO Age 50 or meet the rule of 70 or have 25 years of service at 08/31/2005 if not covered by one of above, then the following will apply beginning 9/1/05

- 25. Increase Your Income in the Last 3/5 Years You Work Saturday School Tutoring Summer School Increase your income for the rest of your life!

- 26. Buy Back Years to Increase Retirement Income 1. TRS members who have service credit in another state before 01/01/2006 can purchase TRS out of state service at the current subsidized cost. Purchase of out-of state service credits accrued after 1/1/06 will be charged at the full actuarial cost. Unlimited Substitute 5 Military 15 Out of State 1 Unlimited Texas 1 50 State Days 2 Career

- 29. These payment are not tax-sheltered.

- 30. How Do I Finance? Out of Savings Finance Through State at 9% Roll TSA - Rolling takes 2 - 3 months

- 31. Eligibility for TRS-Care 1 Must have at least 10 years of actual Texas public school service. Must be age 65 or older or must meet a rule of 80 where age and years of service credit for actual Texas public school service equal 80. Can satisfy a portion (up to 5 years) of any requirement for “actual Texas public school service” through the purchase of military service credit. Out-of state service, can no longer be used toward health insurance eligibility. 1. Increase active member contribution to TRS Care from .5% to .65%

- 32. Vesting Five (5) years to vest TRS Ten (10) years to vest TRS Care Years of Service* + Age = 80 to vest full retirement benefits * Even if you meet rule of 80, you must be 60 to get full benefits

- 33. Here’s the Math Average of 3 Years: $50,000 30 years x 2.3%: x 69% $ 34,500 12 = $2,875 per month $ 34,500

- 34. Out of State Years 10 Years = $50,000 Cost of Buying Out of State Years

- 35. Buying Back Years is Essential $50,000 x 92% (40 x 2.3) = $46,000 $46,000 12 = $3,833 per month $ 3,833 - $2,875 = $958 more per month

- 36. Buying Back Years is Essential Cost: $50,000 Annual Gain: $11,496 Years to Recover: 4.4

- 37. Investment Decisions $50,000 x 4% = $2,000 $166 per month Not Guaranteed

- 38. Buying Back Military Cost of Three Military Years = $17,000 $50,000 x 6.9% (2.3 x 3) = $3,450 Annual Gain $287.50 Extra Per Month Years to Recover: 4.9

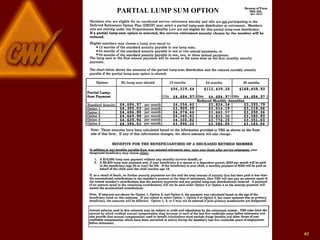

- 40. PARTIAL LUMP SUM OPTION

- 42. Partial Lump Sum ...fix up my house …buy a car …pay off bills I want to have the money to...

- 43. The Tax Implications of Taking PLSO in Cash Partial Lump Sum: $150,000 Federal Taxes (36%): - $ 54,000 Under Age 59-½ Federal Penalty (10%): - $ 15,000 ____________ Net To You: $ 81,000

- 44. Tax Implication of Taking Just Part of Your PLSO in Cash Partial Lump Sum: $50,000 Federal Taxes (30%) -$15,000 Under Age 59-½ Federal Penalty (10%): -$ 5,000 __________ Net To You $30,000

- 45. The Alternative Roll it into a 403(b) and you can borrow up to $50,000 at net cost of 2.5% Payback loan in five (5)* years or thirty (30) years for principal residence *approximately $20 per month per $1,000 borrowed

- 46. TERRP* District Matching Bonus 403(b) / 457 Started automatically in 2002-2003 school year. You are vested 25% per year. The district will contribute to the plan the greater of the following: * Teacher/Employee Recruitment and Retention Program Annual Cap $360 100% of employee contributions up to 2% of pay Perfect Attendance $270 75% of employee contributions up to 1.5% of pay Excellent Attendance (absent fewer than 3 days) $180 50% of employee contributions up to 1% of pay Basic Matching

- 47. TRS-Care The changes that effect retirees are: Office visit co-payment increases from $15 to $25 Introducing a 3-tiered program on prescription drugs

- 48. TRS and Social Security Your personal Social Security is discounted whether you work at a district that offers Social Security or not. You can collect half of spousal Social Security by working at a district that pays into both TRS and Social Security for five years prior to retiring.

- 49. Ages Increase to Receive Benefit 67 1960 and later 66 and 10 months 1959 66 and 8 months 1958 66 and 6 months 1957 66 and 4 months 1956 66 and 2 months 1955 66 1943-54 65 and 10 months 1942 65 and 8 months 1941 65 and 6 months 1940 65 and 4 months 1939 65 and 2 months 1938 65 1937 and prior Full Retirement Age Year of Birth

- 50. Questions?