Retirement

- 1. Article 287, Title II, Book 6, Labor Code Retirement from the Service Report by: Maam Lumanglas IR 207.2, UP-SOLAIR, 6 October 2007

- 2. Article 287 -- Original “ Any employee may be retired upon reaching the retirement age established in the collective bargaining agreement or other applicable employment contract In case of retirement, the employee shall be entitled to receive such retirement benefits as he may have earned under existing laws and any CBA or other agreements”

- 3. Article 287 -- Original This old provision had to be amended because the Supreme Court had interpreted it as not a source of retire- ment benefit if there was no collective bargaining agreement or voluntary company policy granting such benefit (Llora Motors, Inc. vs. Drilon, Nov. 7, 1989) RA 7641 (Sen. Ernesto Herrera) amended Art. 287 to overturn the effect of the Llora Motors ruling Took effect on January 7 1993 Further amendments came through RA 8558 regarding underground mine workers Approved on February 26, 1998

- 4. Article 287 -- Amended “ Any employee may be retired upon reaching the retirement age established in the collective bargaining agreement or other applicable employment contract In case of retirement, the employee shall be entitled to receive such retirement benefits as he may have earned under existing laws and any CBA and other agreements… Provided, however, that an employee’s retirement benefits under any collective bargaining and other agreements shall not be less than those provided herein.”

- 5. Article 287 -- Amended “ In the absence of a retirement plan or agreement providing for retirement benefits of employees in the establishment, an employee upon reaching the age of 60 years or more, but not beyond 65 years which is hereby declared the compulsory retirement age, who has served at least 5 years in the said establishment, may retire and shall be entitled to retirement pay equivalent to at least one-half (1/2) month salary for every year of service , a fraction of at least six (6) months being considered as one whole year.”

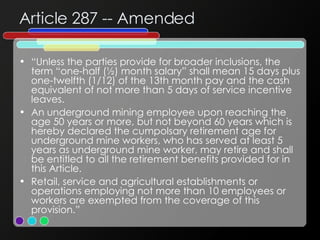

- 6. Article 287 -- Amended “ Unless the parties provide for broader inclusions, the term “one-half (½) month salary” shall mean 15 days plus one-twelfth (1/12) of the 13th month pay and the cash equivalent of not more than 5 days of service incentive leaves. An underground mining employee upon reaching the age 50 years or more, but not beyond 60 years which is hereby declared the cumpolsary retirement age for underground mine workers, who has served at least 5 years as underground mine worker, may retire and shall be entitled to all the retirement benefits provided for in this Article. Retail, service and agricultural establishments or operations employing not more than 10 employees or workers are exempted from the coverage of this provision.”

- 7. Coverage Applies to private sector employees Full-time, part-time, regular or non-regular Retiree must have served the establishment for at least 5 years Retiree must have reached the age of 60 (for optional retirement) or 65 (for compulsary retirement)

- 9. Definition of Retirement Retirement has been defined as a withdrawal from office, public station, business, occupation, or public duty It is the result of a bilateral act of the parties, a voluntary agreement between the employer and the employee whereby the latter, after reaching a certain age, agrees and/or consents to sever his employment with the former

- 10. Definition of Retirement Pension schemes, while initially humanitarian in nature , now concomitantly serve to secure loyalty and efficiency on the part of employees, and to increase continuity of service and decrease the labor turnover , by giving to the employees some assurance of security as they approach and reach the age at which earning ability and earnings are materially impaired or at an end It must be noted, however, that the nature of the rights conferred by a retirement or pension plan depends in large measure upon the provisions of such particular plan

- 11. Clarifications In the absence of of any provision on optional retirement in a CBA or any other employment contract or employer’s retirement plan, an employee may optionally retire upon reaching the age of 60 years or more, but not beyond 65 years, provided he has served at least 5 years in the establishment concerned This prerogative is exclusively lodged in the employee

- 12. Clarifications Where the CBA itself gives the option to retire either to the employer or the employee , such provision is valid An employer’s act of retiring an employee who is of retirable age as defined in the CBA is valid If the CBA does not so require, the employer does not have to consult the employee before retiring him

- 13. Clarifications Is a CBA provision allowing compulsary retirement before age 60 but after 25 years of service legal and enforceable? Art.287 of the labor Code as worded permits employers and employees to fix the applicable retirement age below 60 years

- 14. THANK YOU!