SCM

- 2. Role of Intermediaries • Greater efficiency in making goods available to target markets. • Intermediaries provide – Contacts – Experience – Specialization – Scale of operation • Match supply and demand.

- 3. Functions of a Distribution Channel • Information:Gathering and distributing market research and intelligence - important for marketing planning • PromotionDeveloping and spreading communications about offers • ContactFinding and communicating with prospective buyers • MatchingAdjusting the offer to fit a buyer's needs, including grading, assembling and packaging • NegotiationReaching agreement on price and other terms of the offer • Physical distributionTransporting and storing goods • FinancingAcquiring and using funds to cover the costs of the distribution channel • Risk takingAssuming some commercial risks by operating the channel (e.g. holding stock) (ISPE CHUNA MANA PFIR)

- 4. Meaning: Supply chain: Network of organizations and business process for procuring materials, transforming raw materials into the finished products and distributing the finished products to the customers. Supply chain management : Integration of suppliers , distributors and customer logistics into one cohesive process. Supply chain management process: information system that automate the flow information between a firm and its suppliers in order to optimize the planning , sourcing , manufacturing and delivering of products and services.

- 5. INTRODUCTION • Supply Chain Management (SCM), the management of the flow of goods and services, involves the movement and storage of raw materials, of work-in-process inventory, and of finished goods from point of origin to point of consumption. • Supply Chain Management flows can be divided into three main flows: Product Flow FinanceFlow Information Flow

- 6. Supplier Management Schedule / Resources Conversion Stock Deployment Delivery Customer Management Leads to Business Process Integration Material Flow Flow Information Flow It is the strategic management of activities involved in the acquisition & conversion of materials to finished products delivered to customer

- 7. SUPPLY CHAIN DRIVERS • Why sudden interest? – Demanding customers – Shrinking product life cycles – Growing retailer power in some cases – Emergence of specialized logistics providers – Globalization – Information technology

- 8. SCM objectives: SCM outcomes: What? Establish policies , objectives and operating footprints. How much? Deploy resources to match supply with demand . When ? Where? Schedule , monitor , control and adjust production. Do: Build and transport. Objectives. Supply policies(service levels). Network design. Demand forecast Production ,procurement &logistic plan Inventory target. Work center scheduling Order/inventory tracking Order cycle Material movement. Strategic Tactical Operational Execution

- 9. upstream downstream eg. of supply chain. supplier supplier supplier supplier supplier supplier manufacturer distributer retailer customer

- 10. Supply Chain Management - Introduction • Supply chains and vertical integration – For any organization vertical integration involves either taking on more of the supplier activities (backward) and/or taking on more of the distribution activities (forward) – Eg. backward vertical integration would be a ricebran oil manufacturer decides to start rice milling rather than buying rice bran from a rice mills / supplier – Eg. forward vertical integration would be a rice bran oil manufacturer decides to start marketing their rice bran oil directly to market / stockists. – In supply chains, some of the supplying and some of the distribution might be performed by the manufacturer. E.g: Tasty Treat/ Karmiq/Premia / Select Eg. Raymonds getting into garments / Tea Estates getting into tea selling Could be Honda getting into scooter tyre mfg, Kilosksrs getting into refrigerators / Yarn manufacturing getting into Fabric & garment unit

- 11. Supply Chain Elements Strategic Tactical Operational Production /Distribution planning Resource Allocation Medium Term Planning(Qtrly/Monthly) •Supply Chain Design • Resource Acquisition Long Term •Long Planning (Yrly/ Qtrly) •Shipment Scheduling •Resource Scheduling •Short term Planning ( weekly/Daily)

- 12. Supply Chain Management - Introduction • Strategic, tactical and operating issues – Strategic - long term and dealing with supply chain design • Determining the number, location and capacity of facilities • Make or buy decisions • Forming strategic alliances – Tactical - intermediate term • Determining inventory levels • Quality-related decisions • Logistics decisions – Operating - near term • Production planning and control decisions • Goods and service delivery scheduling • Some make or buy decisions

- 13. Supply Chain Management - Benefits • Key issues in supply chain management include – Distribution network configuration • How many warehouses do we need? • Where should these warehouses be located? • What should the production levels be at each of plants? • What should the transportation flows be between plants and warehouses? – Inventory control • Why are we holding inventory? Uncertainty in customer demand? Uncertainty in the supply process? Some other reason? • If the problem is uncertainty, how can we reduce it? • How good is our forecasting method?

- 14. Supply Chain Management - Benefits – Distribution strategies • Direct shipping to customers? • Classical distribution in which inventory is held in warehouses and then shipped as needed? • Cross-docking in which transshipment points are used to take stock from suppliers’ deliveries and immediately distribute to point of usage? – Supply chain integration and strategic partnering • Should information be shared with supply chain partners? • What information should be shared? • With what partners should information be shared? • What are the benefits to be gained?

- 15. Supply Chain Management - Benefits – Product design • Should products be redesigned to reduce logistics costs? • Should products be redesigned to reduce lead times? • Would delayed differentiation be helpful? – Information technology and decision-support systems • What data should be shared (transferred) • How should the data be analyzed and used? • What infrastructure is needed between supply chain members? • Should e-commerce play a role? – Customer value • How is customer value created by the supply chain? • What determines customer value? How do we measure it? • How is information technology used to enhance customer value in the supply chain?

- 17. What is the value chain? Porter’s definition includes all activities to design, produce, market, deliver, and support the product/service. The value chain is concentrating on the activities starting with raw materials till the conversion into final goods or services. Two categories: Primary Activities (operations, distribution, sales) Support Activities (R&D, Human Resources)

- 18. TYPES OF VALUE CHAIN: • Value Chain is categorized into types based on the type of organizations. • Manufacturing based. • Service based. • Both manufacturing and service based.

- 19. VALUE CHAIN SYSTEM the series of activities and process as well as the supply of raw materials or needed inputs involved in producing a product or delivering a service. Backward channel Forward channel Business Organization Rawmaterials Supply Chain Distribution chain C U S T O M E R S Value chain system

- 20. What is value chain Analysis? • Used to identify sources of competitive advantage • Specifically: – Opportunities to secure cost advantages – Opportunities to create product/service differentiation • Includes the value-creating activities of all industry participants Eg.a) 5 ltr pouch/jar b)Handwash bottle to pouch c) Beverages Eg.a) ID fresh b) Indulekha c)Emirates

- 21. Porter’sValueChain Model • Introduced by Michael E. Porter in his influential book “Competitive Advantage” in 1985. • Can be used by companies to examine all of their activities in the process of converting inputs to outputs. • How value chain activities are carried out determines costs and affects profits. • The value that's created and captured by a company is the profit margin (Value Created and Captured – Cost of Creating thatValue = Margin). • The activities conducted can be divided into primary activities and support activities.

- 22. TYPES OF FIRM ACTIVITIES • Primary activities: • Those that are involved in the creation, sale and transfer of products (including after-sales service) Inbound logistics Operations Outbound logistics Sales and marketing Service and support • Support Activities: Those that merely support the primary activities Human resources (general and admin.) Tech. development Procurement

- 23. Value Chain Model from Michael E. Porter’s Competitive Advantage Firm Infrastructure (General Management) Human Resource Management Technology Development Procurement Inbound Logistics Operation Outbound s Logistics Sales & Service and Marketing Support PRIMARY ACTIVITIES SUPPORT ACTIVITIES

- 24. PRIMARY ACTIVITIES 1.INBOUND LOGISTICS - CONCERNED WITH RECEIVING, STORING, DISTRIBUTING INPUTS (e.g. HANDLING OF RAW MATERIALS, WAREHOUSING, INVENTORY CONTROL) 2. OPERATIONS - COMPRISE THE TRANSFORMATION OF THE INPUTS INTO THE FINAL PRODUCT FORM (E.G. PRODUCTION, ASSEMBLY, AND PACKAGING) 3. OUTBOUND LOGISTICS -INVOLVE THE COLLECTING, STORING, AND DISTRIBUTING THE PRODUCT TO THE BUYERS (e.g. PROCESSING OF ORDERS, WAREHOUSING OF FINISHED GOODS, AND DELIVERY) Involve the purchase of materials, the processing of materials into products, and delivery of products to customers.

- 25. PRIMARY ACTIVITIES 4. MARKETING AND SALES -Identification of customer needs and generation of sales. (e.g. ADVERTISING, PROMOTION, DISTRIBUTION) 5. SERVICE -INVOLVES HOW TO MAINTAIN THE VALUE OF THE PRODUCT AFTER IT IS PURCHASED.(e.g. INSTALLATION, REPAIR, MAINTENANCE, AND TRAINING)

- 26. Value Chain Model from Michael E. Porter’s Competitive Advantage Firm Infrastructure (General Management) Human Resource Management Technology Development Procurem ent Inbound Logistics Ops. Outbound Logistics Sales & Marketing Service and Support PRIMARY ACTIVITIES SUPPORT ACTIVITIES

- 27. SUPPORT ACTIVITIES 1.FIRM INFRASTRUCTURE The activities such as Organization structure, control system, company culture are categorized under firm infrastructure. 2.HUMAN RESOURCE MANAGEMENT Involved in recruiting, hiring, training, development and compensation. 3.TECHNOLOGY DEVELOPMENT These activities are intended to improve the product and the process, can occur in many parts of the firm. 4.PROCUREMENT Concerned with the tasks of purchasing inputs such as raw materials, equipment, and even labor. Support primary activities & can play a role in each primary activity. It may also support each other within support activities. Those that merely support the primary activities

- 28. USES OF VALUE CHAIN ANALYSIS: • The sources of the competitive advantage of a firm can be seen from its discrete activities and how they interact with one another. • The value chain is a tool for systematically examining the activities of a firm and how they interact with one another and affect each other’s cost and performance. • A firm gains a competitive advantage by performing these activities better or at lower cost than competitors. • Helps you to stay out of the “No Profit Zone” • Presents opportunities for integration • Aligns spending with value processes

- 29. IMPORTANCE OF VALUE CHAIN Backward channel Composed of the companies or organization providing raw materials or other forms of inputs for the company to undertake its value creation process. Suppliers of the business concern Forward channel Distribution side of the business or parties involved beyond the production and storage line. This group includes organizations acting as distributors, dealers, agents, indentors, importers, transport/delivery firms and other organizations closing in to the ultimate users

- 30. VALUE CHAIN IN THE E-COMMERCE ERA Allows the so called seamless chain scenario or one that electronically connects various organization either in the supply or distribution chain side thereby ensuring timely information sharing and efficient logistical operations both at the supply and distribution aspects of the business. Expediency and efficiency both in the backward and forward channel of the business

- 31. CUSTOMER-ORIENTED VALUE CHAIN It takes the form of a circular model to emphasize the philosophy that the customer – and not the business organization itself- is the focus to which all the other activities are directed to. Central to this kind of value chain model is that there exists an information system directly connecting the various functional unit thereby allowing a scheme somehow assuring that customer’s needs and wants are addressed by all functional units and in a way, competitiveness is assured.

- 32. Supply Chain Management • How can you assess how well your supply chain is performing? – The SCOR model - Supply Chain Operations Reference Model - can be used to assess performance – SCOR model metrics include: • On-time delivery performance • Lead time for order fulfillment • Fill rate - proportion of demand met from on-hand inventory • Supply chain management cost • Warranty cost as a percentage of revenue • Total inventory days of supply • Net asset turns

- 33. SCM - Inventory Management Issues • Manufacturers would like to produce in large lot sizes because it is more cost effective to do so. The problem, however, is that producing in large lots does not allow for flexibility in terms of product mix. • Retailers find benefits in ordering large lots such as quantity discounts and more than enough safety stock. • The downside is that ordering/producing large lots can result in large inventories of products that are currently not in demand while being out of stock for items that are in demand.

- 34. SCM - Inventory Management Issues • Ordering/producing in large lots can also increase the safety stock of suppliers and its corresponding carrying cost. It can also create what’s called the bullwhip effect. • The bullwhip effect is the phenomenon of orders and inventories getting progressively larger (more variable) moving backwards through the supply chain.

- 35. 10-35 Bullwhip Effect Occurs when slight demand variability is magnified as information moves back upstream

- 36. The Bullwhip Phenomenon • Volatility amplification along the network • Increase in demand variability as we move upstream away from the market • Mainly because of lack of communication and coordination • Delays in information and material flows Bullwhip effect occurs because of various reasons: • Order Batching - Accumulate orders • Shortage gaming- Ask for more than what is needed • Demand forecast updating

- 37. SCM - Inventory Management Issues • Some of the causes of variability that leads to the bullwhip effect includes: – Demand forecasting Many firms use the min-max inventory policy. This means that when the inventory level falls to the reorder point (min) an order is placed to bring the level back to the max , or the order-up-to-level. As more data are observed, estimates of the mean and standard deviation of customer demand are updated. This leads to changes in the safety stock and order-up-to level, and hence, the order quantity. This leads to variability. – Lead time As lead time increases, safety stocks are increased, and order quantities are increased. More variability.

- 38. SCM - Inventory Management Issues – Batch ordering. Many firms use batch ordering such as with a min- max inventory policy. Their suppliers then see a large order followed by periods of no orders followed by another large order. This pattern is repeated such that suppliers see a highly variable pattern of orders. – Price fluctuation. If prices to retailers fluctuate, then they may try to stock up when prices are lower, again leading to variability. – Inflated orders. When retailers expect that a product will be in short supply, they will tend to inflate orders to insure that they will have ample supply to meet customer demand. When the shortage period comes to an end, the retailer goes back to the smaller orders, thus causing more variability.

- 39. SCM - Inventory Management Issues • Techniques for improving inventory management include: – Cross-docking. This involves unloading goods arriving from a supplier and immediately loading these goods onto outbound trucks bound for various retailer locations. This eliminates storage at the retailer’s inbound warehouse, cuts the lead time, and has been used very successfully by WalMart and among others. – Delayed differentiation. This involves adding differentiating features to standard products late in the process. For Eg. Pringle decided to make all of their wool sweaters in undyed yarn and then dye the sweaters when they had more accurate demand data. – Direct shipping. This allows a firm to ship directly to customers rather than through retailers. This approach eliminates steps in the supply chain and reduces lead time. Reducing one or more steps in the supply chain is known as disintermediation. Companies such as Zodiac , Cipla use this approach.

- 40. SCM - Strategic Partnering • Strategic partnering (SP) is when two or more firms that have complementary products or services join such that each may realize a strategic benefit. Types of strategic partnering include: – Quick response, – Continuous replenishment, – Advanced continuous replenishment, and – Vendor managed inventory (VMI) Eg. Hero :HUL-Glaxo , Indian Post-Kotak Mahindra /Tata: Jaguar/ Maruti-Suzuki/Bajaj:Kawasaki

- 41. SCM - Strategic Partnering • Requirements for an effective SP include: – Advanced information systems, – Top management commitment, and – Mutual trust • Steps in SP implementation include: – Contractual negotiations • Ownership • Credit terms • Ordering decisions • Performance measures • Third party logistics (3PL) involves the use of an outside company to perform part or all of a firm’s materials management and product distribution function. – Eg. Mcdonalds.

- 42. SCM - Strategic Partnering • Advantages of SP include: – Fully utilize system knowledge – Decrease required inventory levels – Improve service levels – Decrease work duplication – Improve forecasts • Disadvantages of SP include: – Expensive technology is required – Must develop supplier/retailer trust – Supplier responsibility increases – Expenses at the supplier also often increase

- 43. Measuring Supply Chain Performance • Key performance indicators – inventory turnover • cost of annual sales per inventory unit – inventory days of supply • total value of all items being held in inventory – fulfillment rate • fraction of orders filled by a distribution center within a specific time period

- 44. Measures of Supply Chain Performance • Process Control – used to monitor and control any process in supply chain • Supply Chain Operations Reference (SCOR) – establish targets to achieve “best in class” performance

- 45. SCOR Model Processes Plan Develop a course of action that best meets sourcing, production and delivery requirements Source Procure goods and services to meet planned or actual demand Make Transform product to finished state to meet planned or actual demand Deliver Provide products to meet demand, including order management, transportation and distribution Return Return products, post-delivery customer support

- 46. Number of days to achieve an unplanned 20% change in orders without a cost penalty Production flexibility Number of days for supply chain to respond to an unplanned significant change in demand without a cost penalty Supply chain response time Supply Chain Flexibility Number of days from order receipt to customer delivery Order fulfillment lead time Supply Chain Responsiveness Percentage of orders delivered on time and in full, perfectly matched with order with no errors Perfect order fulfillment Percentage of orders shipped within24 hours of order receipt Fulill rate Percentage of orders delivered on time and in full to the customer Delivery performance Supply Chain Delivery Reliability DefinitionPerformance Metric Performance Attribute SCOR: Customer Facing

- 47. DefinitionPerformance Metric Performance Attribute SCOR: Internal Facing Revenue divided by total assets including working capital and fixed assets Asset turns Number of days that cash is tied up as inventory Inventory days of supply Number of days that cash is tied up as working capital Cash-to-cash cycle time Supply Chain Asset Management Efficiency Direct and indirect costs associated with returns including defective, planned maintenance and excess inventory Warranty/return s processing cost Direct material cost subtracted from revenue and divided by the number of employees, similar to sales per employee Value-added productivity Direct cost of material and labor to produce a product or service Cost of goods sold Direct and indirect cost to plan, source and deliver products and services Supply chain management cost Supply Chain Cost

- 48. ISSUE CONSIDERATIONS Network Planning •Warehouse locations and capacities • Plant locations and production levels • Transportation flows between facilities to minimize cost and time Inventory Control • How should inventory be managed? • Why does inventory fluctuate and what strategies minimize this? Supply Contracts • Impact of volume discount and revenue sharing • Pricing strategies to reduce order-shipment variability Distribution Strategies • Selection of distribution strategies (e.g., direct ship vs. cross-docking) • How many cross-dock points are needed? • Cost/Benefits of different strategies Integration and Strategic Partnering • How can integration with partners be achieved? • What level of integration is best? • What information and processes can be shared? • What partnerships should be implemented and in which situations? Outsourcing & Procurement Strategies • What are our core supply chain capabilities and which are not? SCM-Key Issues

- 49. SCM-Operations Model Strategy When To Choose Benefits Make to Stock standardized products, relatively predictable demand eg. fmcg Low manufacturing costs; meet customer demands quickly Make to Order customized products, many variations Eg. Furniture, jewellery Customization; reduced inventory; improved service levels Configure to Order many variations on finished product; infrequent demand Eg. apparel Low inventory levels; wide range of product offerings; simplified planning Engineer to Order complex products, unique customer specifications Industrial equipments Enables response to specific customer requirements

- 50. Inventory • Where do we hold inventory? – Suppliers and manufacturers – warehouses and distribution centers – retailers • Types of Inventory – WIP – raw materials – finished goods • Why do we hold inventory? – Economies of scale – Uncertainty in supply and demand – Lead Time, Capacity limitations

- 51. Functions of Inventory • To meet anticipated demand • To smooth production requirements • To decouple operations • To protect against stock-outs • To take advantage of order cycles • To help hedge against price increases • To take advantage of quantity discounts

- 52. Objectives of Inventory Control • To meet unforeseen future demand due to variation in forecast figures and actual figures. • To average out demand fluctuations due to seasonal or cyclic variations. • To meet the customer requirement timely, effectively, efficiently, smoothly and satisfactorily. • To smoothen the production process. • To facilitate intermittent production of several products on the same facility. • To gain economy of production or purchase in lots.

- 53. • To reduce loss due to changes in prices of inventory items. • To meet the time lag for transportation of goods. • To meet the technological constraints of production/process. • To balance various costs of inventory such as order cost or set up cost and inventory carrying cost. • To balance the stock out cost/opportunity cost due to loss of sales against the costs of inventory. • To minimize losses due to deterioration, obsolescence, damage, pilferage etc.

- 54. Importance of Inventory One of the most expensive assets of many companies representing as much as 50% of total invested capital Operations managers must balance inventory investment and customer service.

- 55. Factors Affecting Inventory Control • Type of product • Type of manufacture • Volume of production

- 56. Benefits of Inventory Control • Ensures an adequate supply of materials • Minimizes inventory costs • Facilitates purchasing economies • Eliminates duplication in ordering • Better utilization of available stocks • Provides a check against the loss of materials • Facilitates cost accounting activities • Enables management in cost comparison • Locates & disposes inactive & obsolete store items • Consistent & reliable basis for financial statements

- 57. Requirements for purchase systems • procurement involves sourcing items: – At the right price. – Delivered at the right time. – Of the right quality. – Of the right quantity. – From the right source.

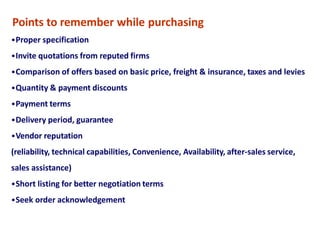

- 58. Points to remember while purchasing •Proper specification •Invite quotations from reputed firms •Comparison of offers based on basic price, freight & insurance, taxes and levies •Quantity & payment discounts •Payment terms •Delivery period, guarantee •Vendor reputation (reliability, technical capabilities, Convenience, Availability, after-sales service, sales assistance) •Short listing for better negotiation terms •Seek order acknowledgement

- 59. Objectives of Purchasing Obtain goods and services: of the required quantity and quality at the lowest possible cost at the best possible service and delivery while maintaining and developing suppliers

- 60. CPFR • By the mid 1990s, Retail Link had emerged into an Internet-enabled SCM system whose functions were not confined to inventory management alone, but also covered collaborative planning, forecasting and replenishment (CPFR).

- 61. CPFR: Hard to implement • Though CPFR was a promising supply chain initiative aimed at a mutually beneficial collaboration between Wal-Mart and its suppliers, its actual implementation required huge investments in time and money. • A few suppliers with whom Wal-Mart tried to implement CPFR complained that a significant amount of time had to be spent on developing forecasts and analyzing sales data.

- 62. RFID Technology (Radio Frequency Identification) • In efforts to implement new technologies to reduce costs and increase the efficiency, in July 2003, Wal- Mart asked its top 100 suppliers to be RFID compliant by January, 2005. • Wal-Mart planned to replace bar-code technology with RFID technology. • The company believed that this replacement would reduce its supply chain management costs and enhance efficiency.

- 63. RFID Technology (Radio Frequency Identification) • Because of the implementation of RFID, employees were no longer required to physically scan the bar codes of goods entering the stores and distribution centers, saving labor cost and time. • Wal-Mart expected that RFID would reduce the instances of stock-outs at the stores.

- 64. RFID Technology (Radio Frequency Identification) • Although Wal-Mart was optimistic about the benefits of RFID, analysts felt that it would impose a heavy burden on its suppliers. • To make themselves RFID compliant, the suppliers needed to incur an estimated $20 Million. • Of this, an estimated %50 would be spent on integrating the system and making modifications in the supply chain software.

- 65. Demand Management • Demand Management is based on “forecast” and plans. • In DM, forecasts of the quantities and timing of customer demand are developed & • What is actually planned to deliver to customers each period is the output of the process.

- 66. Demand Management is • The process of ensuring that market demand and the company’s capabilities are in synchronization. • Recognizing all demands for products and services to support the marketplace. • Doing what is required to help make the demand happen • Prioritizing demand when supply is lacking. • Planning and using resources for profitable business results

- 67. Demand Management Components • Goal Customer Service Levels • New Product Introductions • Distribution Resource Planning • Customer Order Entry and Promising • Sales And Marketing Plans • Inventory Targets • Product Commitments • Interplant Shipments • Demand Forecasting At Item And Aggregate Levels

- 68. Four phases of Demand Management

- 69. BENEFITS OF DEMAND MANAGEMENT… • Control over product availability • Confidence of Sales Force in ability to deliver product. • Smoother product introductions. • Improved ability to respond to change. • A single game plan, based on the same set of numbers Streamline: Make (an organization or system) more efficient and effective by employing faster or simpler working methods Priority: a thing that is regarded as more important than another

- 70. BENEFITS OF DEMAND MANAGEMENT… • With the Demand Management, organizations can streamline approval processes, while ensuring that Information Technologies (IT) priorities are aligned with the broader business objectives and that approved initiatives will deliver maximum business value. Streamline: Make (an organization or system) more efficient and effective by employing faster or simpler working methods Priority: a thing that is regarded as more important than another

- 71. What is the Nature of Demand Relative to Supply? Extent of demand fluctuations over time Extent to which supply is constrained Wide Narrow Peak demand can usually be met without a major delay 1 Electricity Natural gas Telephone Hospital maternity unit Police and fire emergencies 2 Insurance Legal services Banking Laundry and dry cleaning Peak demand regularly exceeds capacity 4 Accounting and tax preparation Passenger transportation Hotels and motels Restaurants Theaters 3 Services similar to those in 2 but which have insufficient capacity for their base level of business

- 72. ABC ANALYSIS (ABC = Always Better Control) This is based on cost criteria. It helps to exercise selective control when confronted with large number of items it rationalizes the number of orders, number of items & reduce the inventory. About 10 % of materials consume 70 % of resources About 20 % of materials consume 20 % of resources About 70 % of materials consume 10 % of resources

- 73. ‘A’ ITEMS Small in number, but consume large amount of resources Must have: •Tight control •Rigid estimate of requirements •Strict & closer watch •Low safety stocks •Managed by top management

- 74. ‘B’ ITEM Intermediate Must have: •Moderate control •Purchase based on rigid requirements •Reasonably strict watch & control •Moderate safety stocks •Managed by middle level management

- 75. Spend Analysis Spend Analysis Spend Analysis is the process of collecting, cleansing, classifying and analysing expenditure data with the purpose of decreasing procurement costs, improving efficiency, and monitoring controls and compliance.

- 76. Analysing Spend • 12 triliion $ is total spend through global 2000 companies in 2014. • Enterprises are loosing $260 billion per year due to inability to organise & analyse spend data. • To date only 40% of global companies have good visibility on their spending. • 60 % of firms that analyse spend still rely on paper & spread sheets.

- 77. Spending Clarity Starts With Asking Right Questions • How can I get more detailed information on suppliers • How much I am spending with suppliers at corporate family level? • How diverse is my supply base?How can I locate more diverse suppliers? • Where are the greatest risk in my supply chain?

- 78. Stay Ahead Of Curve Advantage:Get a sense of potential interuption before it can impact Bottom Line: Through Stock out Top Line: Through idling manufacturing line Brand:Through damage to quality & product availability Results: Source from Financial stable suppliers Get advance notice to reduce risk & protect supply chain continuty Deliver consistent ,objective treatment of suppliers

- 79. Spend Strategy Three Step Process to Spend Strategy 1) Identify Spends By Category/ Sub Category:Determine which spends are procurement influenced vs Non procurement influence 2) Align Sub categories into Segmentation Quadrant Important factors are Y-axis & X-axis 3)Develop Sub categories strategies to Source key elements that must be understood & will drive sourcing strategy

- 80. Spend Analysis Benefits • Baseline for strategic sourcing initiatives • Enabler for process improvement • Measurement device for cost reduction programs • Comprehensive spend visibility across direct and indirect commodities and services • Significant cost-savings opportunities through supplier and commodity consolidation • Enhanced compliance through effective spend and supplier monitoring

- 81. Cost per unit weight Analysis Cost per unit weight is performed to compare the similar parts. The inherent assumption is that these parts are similar, and their cost/unit weight shouldbe similar. This helps to identify the outliers which contributes to differentcosts. Part Price History Analysis Plot the trend of a part’s price over 2 years and identify opportunities tore- negotiate lower price in cases of unjustified price increases in thepast. Pricing Brackets/ EOQ Analysis Analysis identifies the optimum bracket quantity for cost reduction within the available brackets. Can only be done on parts that have contracts thatinclude pricing brackets. Indexed Pricing Analysis This type of analysis helps identify the relationship between material prices and part cost and helps us identify opportunities for index-based pricingand re-negotiation. Currency Opportunity Analysis The analysis identifies the cost reduction opportunity by switching prices between currencies. The assumption is that the manufacturer should be paid in the currency of manufacturingcountry. Common Types ofAnalysis

- 82. Freight Analysis Analysis identifies a way to obtain visibility into freight costs associatedwith procuring parts from suppliers. It helps in selecting a best approach to optimize freight costs. VAT/GST Analysis VAT/GSTis a tax that is assessed at each phase of the process where value is added to components or services by different suppliers. It is usually recovered when a supplier sells his product to the next supplier in thechain. Leakage can sometimes occur when trying to recover the VAT from foreign governments. Warranty Cost Recovery Warranty cost incurred due to defective supplier parts. This could include both labor and part cost. Payment Terms Analysis Analysis identifies deviation to standard payment terms. The intent is to negotiate with the suppliers to pay them on Standard Terms so that werealize savings from holding the cash (Cost of Money) Part Family Analysis Analysis identifies the optimum way of categorizing parts into a family and then identifying potential parts for cost reduction which do not belong to the part family due to different processes or alternate processes that could be used. It also helps in identifying cost outliers within the same family ofparts Common Types ofAnalysis

- 83. Suppliers Selection/Evaluation • In today’s competitive environment, progressive firms must be able to produce quality products at reasonable prices. Product quality is a direct result of the production workforce and the suppliers. • Buying firms select suppliers based on their capabilities, and not purely on the competitive process. The current trend in sourcing is to reduce the supplier base. • In order to select suppliers who continually outperform the competition, suppliers must be carefully analyzed and evaluated.

- 84. 8-5 Make Versus Buy • The use of outsourcing has quickly become a competitive weapon for an increasing number of businesses. • It is no easy task for management to decide to make ,lease or buy • component parts and services. The decision to outsource has led to a need for strategic partnerships.

- 85. The Make or Buy Decision • When a firm has answered the make-or-buy question with a decision to buy , the question then becomes to whom to “delegate” this responsibility. • Thus, the firm must select a supplier or suppliers for the part (s) in question. • The buying firm must be highly skilled at (1) specifying product attributes, (2) forecasting expected requirements, (3) ensuring the right quality at a reasonable price.

- 86. Strategic Selection • Each business unit and department should have a clear understanding of the strategy of the whole firm and have a departmental strategy that complements and aids the overall strategy execution of the firm. • Purchasing, logistics, inventory management, and production control are all linked tightly together under the materials management umbrella.

- 87. Supplier Relationship Management (SRM) Buyer and supplier relationships have become increasingly important for a number of reasons. 1. There is a trend toward specialization away from manufacturing an entire product and to more contract manufacturing and purchasing. 2. In some market segments, it is estimated that 80 percent or more of total product revenue often passes directly to suppliers as payment for labor, materials, and equipment. 3. This significant transfer of value downstream emphasizes the importance and significance of supply chain relationship management. 4. For any buying organization to stay competitive in today’s aggressive market sectors, it is essential that they maintain strong relationships with their best contract manufacturers and suppliers.

- 88. 5. Buying firms experience a great deal of pressure from customers and competitors to keep their edge and stay in business by reducing costs, improving product, improving service quality and enacting continuous improvement. 6. With the decreasing number of suppliers used by buying firms, it is more important than ever to maintain strong buyer-supplier relationships. Supplier Relationship Management (SRM)

- 89. Four Pure Supply Management Relationships • One model that explains supply chain relationship management includes four behavioral dimensions— the four Cs: 1. counterproductive (lose-lose) 2. competitive (win-lose), 3. cooperative (win-win), 4. collaborative (win-win) relationships.

- 90. Counterproductive Relationships • Counterproductive relationships are those in which each organization (buying and supplying) is so focused on getting what is best for it that each puts the other at a disadvantage. • This type of relationship is undesirable because: – it does not promote a positive rapport between buying and supplying firms involved and – neither organization achieves its goals. • Counterproductive buyer-supplier relationships are not recommended.

- 91. Transactional Relationships • Transactional or competitive relationships are those relationships in which both buying and supplying firms strive to get the very best arrangement possible in their negotiations and fail to see the benefits of both organizations obtaining their goals and objectives. • In transactional relationships, the buying and supplying firms will stop at nothing to make sure that they come out on top and do not care about the other organization’s well-being. It does not matter if the relationship is not strong enough to last because by definition, transactional suppliers can be easily replaced at any time.

- 92. Cooperative Relationships • Cooperative relationships recognize the potential value of both organizations getting what they want and maximize the potential of having a long-term relationship. • Although it is a strong relationship, a cooperative alliance lacks the teamwork that is needed between the various buying and supplying firms in order to optimize the benefits for all of the members of the supply chain. • Cooperative relationships are commonly found within a buying organization’s preferred/tier- two service providers and suppliers list

- 93. Collaborative Relationships • Collaboration or collaborative relationships, usually found with the buying firm’s strategic/tier- one suppliers, include the team component that is missing in a cooperative relationship. • In collaboration, the two organizations truly realize the benefits of working together to optimize outcomes for both organizations. • The two firms work together to develop a strategy to deliver a high-quality product or service on time and under budget.

- 94. Three Categories of Suppliers 1. Strategic suppliers are those that are most important to the buying firm. They supply the buying firm with essential materials and capabilities that are not easily replaced. 2. Preferred suppliers are those that are important to the buying firm, but alternative suppliers could be found with some effort. 3. Transactional suppliers are those that can be easily replaced in a short time.

- 95. Benefits Of SRM • Eliminates waste & barriers to effective service. • Contracts set out what has been agreed between buyer & seller in terms of what will be delivered & for what price. • In practice waste can be created due to inefficiencies in how the processes systems & ways of working of two sides come together. • SRM programme can identify these sources of waste & eliminate them creating lower costs & improved service.

- 96. Benefits Of SRM • Builds mutual dependency • If both side value benefits they get from the relationship they created by SRM programme then they acquire an expectation that the relationship will be long lasting. • It means in times of scarcity your organisation is unlikely to be affected by any need for the supplier to rate their output.

- 97. Benefits Of SRM • Encourages Investment • If critical & strategic supplies in SRM programme see that it creates value for them & that business relations value for them & business relationship is likely to be a long one then they are more likely to make more investments that increase their capacity & capability to deliver what you need.

- 98. Benefits Of SRM • Motivate Suppliers to go the extra mile. • Arms length & adversarial supplier relationship in which every problem seem If critical & strategic supplies in which every problem is seen to belong to the supplier create disillusionment & disinterest for them & result in a lack of motivation. • SRM programme create a shared responsibility & this fairness translates into motivated suppliers who go out of their way to help you.

- 99. Tech Assessment Needs Analysis Demos/Due Diligence Bid Evaluation/Finalists RFP Vendor Selection Contract Negotiation

- 100. Category Explanation FUNCTIONALITY The current features and benefits of the system and the ability of these features to allow the client employees to do their jobs better The users’ perception of future systems migration and the impact it will have on the client The ability of the system to support the sales and service goals set by the client VENDOR STRENGTH The ability of the vendor to support and enable the strategic goals of theclient The ability of the vendor to deliver promised systems and programs on timeand with consistent high quality The track record of the vendor in supporting other utilities The perception of client management that the vendor understands the client andits unique strategy and will proactively aid in its realization The financial strength of the vendor and the ability to continually invest in system upgrades and enhancements PRICE The base unit prices that will be charged The structure of price increases over five years in various growth scenarios The additional products and services that are included as part of the baseprice The value the client will receive in products and services for the money paid

- 107. Criteria for Supplier Evaluation • There are two main categories of supplier evaluations: process-based evaluations and performance-based evaluations. • The process-based evaluation is an assessment of the supplier’s production or service process. • Performance- based evaluations are based on objective measures of performance. • Typically, the buyer will conduct an audit at the supplier’s site to assess the level of capability in the supplier’s systems. • In addition, large buying organizations increasingly are demanding that their suppliers become certified through third-party organizations, such as ISO 9001- 2008 certification or Malcolm Baldrige National Quality Awards.

- 108. Three Common Supplier Performance Based Evaluation Systems • The three general types of supplier evaluation systems in use today are: – the categorical method, – the cost-ratio method, and – the linear averaging method. • In general, the guiding factors in determining which system is best are ease of implementation and overall reliability of the system. • It must be pointed out the interpretation of the results from any of these three systems is a matter of the buyer’s judgment.

- 109. Categorical Method • The categorical method involves categorizing each supplier’s performance in specific areas defined by a list of relevant performance variables. • The buyer develops a list of performance factors for each supplier and keeps track of each area by assigning a “grade” in simple terms, such as “good,” “neutral,” and “unsatisfactory.” • At frequent meetings between the buying organization and the supplier, the buyer will then inform the supplier of its performance.

- 110. Cost-Ratio Method • The cost-ratio method evaluates supplier performance by using standard cost analysis. • The total cost of each purchase is calculated as its selling price plus the buyer’s internal operating costs associated with the quality, delivery, and service elements of the purchase. • Calculations involve a four-step approach • A hybrid of the cost-ratio method is the “total cost-of- ownership rating,” developed by the director of corporate purchasing of Sun Microsystems.

- 111. Cost-Ratio Method • It includes five performance factors: quality (maximum of 30 points), delivery (25), technology (20), price (15), and service (10). A perfect supplier would receive a score of 100. • This is calculated by deducting the amount of points received (100 if perfect) from 100, dividing by 100, and adding 1. • The idea is to give a simple numeric rating to the so-called hidden cost of ownership—the additional product-lifetime cost to Sun. • A score of 1.20, for instance, means that for every dollar Sun spends with that supplier, it spends another 20 cents on everything from line downtime to added service costs.

- 112. Linear Averaging • The linear averaging method is probably the most commonly used evaluation method. • Specific quantitative performance factors are used to evaluate supplier performance. • The most commonly used factors in goods purchases are quality, service (delivery), and price, although any one of the factors named may be given more weight than the others.

- 113. Linear Averaging Method 1. The first step is to assign appropriate weights to each performance factor, such that the total weights of each factor add up to 100. • For example, quality might be assigned a weight of 50, service a weight of 35, and price a weight of 15. • The assignment of these weights is a matter of judgment and top management preferences. • The weights are subsequently used as multipliers for individual ratings on each of the three performance factors.

- 114. Single versus Multiple Sources • Much debate has taken place concerning the number of suppliers a firm should use. One side of the debate is the multiple-sources side. This involves the use of two or more suppliers. The other side of the debate is the single-source policy, in which only one supplier is used to supply a particular part.

- 115. Advantages of Multiple Sourcing • The main arguments for multiple sourcing are competition and assured supply. – It is commonly believed that competition between suppliers for a similar part will drive costs lower as suppliers compete against each other for more of the OEM’s business. • This sense of competition is in the very root of American thought as competition is the basis for capitalism and is the backbone of Western economic theory. • Multiple sources also can guarantee an undisrupted supply of parts. – If something should go wrong with one supplier, such as a strike or a major breakdown or natural disaster, the other supplier (s) can pick up the slack to deliver all the needed parts without a disruption.

- 116. Advantages of Single Sourcing • The major arguments in favor of single sourcing are that with the certainty of large volumes that the supplier can enjoy lower costs per unit and increased cooperation and communication to produce win-win relationships between buyer and seller. • Naming a certain supplier as the single source and providing it with a long-term contract (three to five years) greatly reduces the uncertainty that the supplier will lose business to another competitor.

- 117. Advantages of Single Sourcing • With this contract guarantee, the supplier is more willing to invest in new equipment, or change its business/operating methods to accommodate the buyer. • Single sources should be able to provide lower costs per unit compared to multiple sources by reducing the duplication of operations in areas such as setup. • Spreading fixed costs across a larger volume should also result in an accelerated learning curve.

- 118. Cross-Sourcing • Cross-sourcing works this way. If supplier A can produce parts 1, 2, 3, 4, and 5 and so can supplier B, the advantages of both single and multiple sourcing can be achieved if supplier A produces all of parts 1, 3, and 5 and supplier B produces all of 2 and 4. If anything would happen to supplier A, supplier B can pick up the slack as it has the capability to produce 1, 3, and 5 as well. • In sum, neither supplier suffers because overall volume remains the same. The reverse also can be done if a buyer wants to increase competition among the suppliers.

- 119. Supplier Reduction • Regardless of one’s final analysis of the single/multiple debate, it is recommended to reduce the supply base. • If the perceived benefits outweigh the risks, and after careful analysis of both short-term and long-term needs, a single source may be appropriate. • However, for operations that would be financially damaged when a supply stoppage occurs, then the use or development of a second source is wise. • Assume that it is desirable to reduce the number of suppliers. The question now is which one (s)? The grade and hurdle methods are used to guide the supplier reduction analysis.

- 120. Grade • “Grade” methods are those that are based on a score or grade given to the supplier by the buyer for some attribute. • The most common attributes are quality, price, and delivery. • The supplier’s performances in the past are kept on record and the suppliers receive a “report card” as to how well they are doing compared to other suppliers. • Many additional attributes an be added to the most common three such as frequency of delivery, but the method remains the same—for each attribute and purchase transaction, the supplier is given a grade.

- 121. Key Performance Indicators Dickson’s Supplier evaluation criteria Weber’s Supplier evaluation criteria

- 122. Key Performance Criteria Dickson’s Supplier evaluation criteria Average importance Slight importance Delivery Performance History Warranties and claim policies Production facilities Net Price Technical capability Financial position Procedural compliance Communication system Reputation and position in the industry Desire to do business Management and organization Operating controls Repair services Attitude Impression Packaging ability Labor relations record Geographical location Amount of past business Training aid Reciprocal arrangements 1. Quality 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. Evaluation Extreme importance Considerable importance Rank Criteria

- 123. Key Performance Criteria 1. Net Price 2. Delivery Extreme Importance Weber’s supplier evaluation criteria 3. Quality 4. Production facilities & cap. 5. Geographical location 6. Technical capabilities 7. Management & organization 8. Reputation & industry position 9. Financial Position 10. Performance History Rank Criteria Evaluation

- 124. Approaches to Evaluate Suppliers Total Cost of Ownership (TCO) Models Very complicated approach Requires from the buyer to indicate which are the imperative costs It entail more than price in a purchasing situation Focuses on the costs related to the chain and created by the suppliers The approach can be practiced in every kind of purchase, depending on the type of product or service

- 125. 3.3 Approaches to Evaluate Suppliers Mathematical programming Models Select a variety of suppliers by analyzing mostly multi criteria. Utilizes a mixed program integer that can reduce the number of items not received, delivery and unit price Hyper LINDO is an integer linear program solve Data envelop analysis is also known mathematical programming method

- 126. Statistical Models The least used model for suppliers’ evaluation Emphasizes on uncertainty and its time consuming It of great importance to employ it as assessment of buyer-supplier relationship to dictate their performance

- 127. Approaches to Evaluate Suppliers Artificial Intelligence (AI) based Models It’s a computer system that provides data information from historical data Employs Neural Network method Can cope with difficult and uncertain situations AI models are difficult to use

- 129. Payment s (A/P) Dual control of master record Simultaneous updating of subsidiary ledger and general ledger (minimize reconciliation activities) Instant access to details of account balances per Vendor Drill down facility down to the original document Full audit trail Manual or automatic processing of payment transactions Check information on payment transactions

- 130. Reorder Points EOQ answers the “how much” question The reorder point tells “when” to order Reorder Point = Lead time for a new order in days Demand per day = d x L d = D Number of working days in a year

- 131. Reorder Point Curve Q* ROP (units) Inventorylevel(units) Time (days) Lead time = L Slope = units/day = d Resupply takes place as order arrives

- 132. Reorder Point Eg. Demand = 8,000 iPods per year 250 working day year Lead time for orders is 3 working days Reorder Point = d x L d = D Number of working days in a year = 8,000/250 = 32 units = 32 units per day x 3 days = 96 units

- 133. Order Quantity Model Used when inventory builds up over a period of time after an order is placed Used when units are produced and sold simultaneously

- 134. Production Order Quantity Model Q = Number of pieces per order p = Daily production rate H = Holding cost per unit per year d = Daily demand/usage rate D = Annual demand Q2 = 2DS H[1 - (d/p)] Q* = 2DS H[1 - (d/p)]p Setup cost = (D/Q)S Holding cost = HQ [1 - (d/p)]1 2 (D/Q)S = HQ [ 1 - (d/p)]1 2

- 135. Production Order Quantity Eg. D = 1,000 units p = 8 units per day S = Re.10 d = 4 units per day H = Re. 0.50 per unit per year Q* = 2DS H[1 - (d/p)] = 282.8 or 283 units Q* = = 80,0002(1,000)(10) 0.50[1 - (4/8)]

- 136. Quantity Discount Models Reduced prices are often available when larger quantities are purchased Trade-off is between reduced product cost and increased holding cost Total cost = Setup cost + Holding cost + Product cost TC = S + H + PD D Q Q 2

- 137. Quantity Discount Models Discount Number Discount Quantity Discount (%) Discount Price (P) 1 0 to 999 no discount Re. 5.00 2 1,000 to 1,999 4 Re. 4.80 3 2,000 and over 5 Re. 4.75 A typical quantity discount schedule

- 138. Quantity Discount Example Calculate Q* for every discount Q* = 2DS IP Q1* = = 700 units/order 2(5,000)(49) (.2)(5.00) Q2* = = 714 units/order 2(5,000)(49) (.2)(4.80) Q3* = = 718 units/order 2(5,000)(49) (.2)(4.75)

- 139. Quantity Discount Eg. Calculate Q* for every discount Q* = 2DS IP Q1* = = 700 units/order 2(5,000)(49) (.2)(5.00) Q2* = = 714 units/order 2(5,000)(49) (.2)(4.80) Q3* = = 718 units/order 2(5,000)(49) (.2)(4.75) 1,000 — adjusted 2,000 — adjusted

- 140. Quantity Discount Example Discount Number Unit Price Order Quantit y Annual Product Cost Annual Ordering Cost Annual Holding Cost Total 1 R.5.00 700 R.25,000 R.350 R.350 R.25,700 2 R.4.80 1,000 R.24,000 R. 245 R.480 R.24,725 3 R.4.75 2,000 R.23.750 R.122.50 R.950 R.24,822.50 Choose the price and quantity that gives the lowest total cost Buy 1,000 units at Re 4.80 per unit

- 141. Importance of demand forecasting Crucial tosupplier, manufacturerorretailer Businessdecisions Planning for future finishedgoods accurate demand forecasts lead to efficientoperations and high levels of customerservice Improve quality & effectiveness ofproduct

- 142. Levels of Demand Forecasting 1) Micro Level- Demand forecasting by individuals business firm for forecasting the demand for its product. 2) Industrial Level- Demand estimate for the product of the industry 3) Macro Level- Aggregate demand forecasting for industrial outputat the national level- it is based on the national income/ aggregate expenditure of the company.

- 143. Factors determining demand forecasting Time factor Level of forecasting General or Specificforecasting Problems & methods of forecasting Classification of goods Knowledge of different marketconditions Otherfactors

- 144. Qualitative Forecasting approach I. Judgmental approach Surveys Consensus methods Delphi method II. Experimental approach Test marketing Customer buyingdatabase Customerpanels

- 145. Advantages & Disadvantages of Qualitative Forecasting Advantages :- o Ability to predictchanges o Flexibility o Ambiguity Disadvantages :- o Accurate forecast is notpossible o Judgmental approach o False/ inadequate information

- 146. Quantitative Forecasting Approach Relationshipapproach Econometric models Life cyclemodels Input-outputmodels Time seriesapproach Static models Adaptive models

- 147. WHAT IS A CROSS FUNCTIONAL TEAM? A cross-functional team is defined as a group of peoplewith different expertise and backgrounds working toward common goals. The team may include representatives from operations, engineering, R&D, marketing, supply base, quality and team members from outside the organization such as customers, or suppliers could be involved as well.

- 148. ● Improved speed of delivery ● Reduction in cycle times ● Increase in speed of feedback ● Improved product stability ● Risk reduction Key Benefits ● More Accurate estimates ● Avoiding the “last mile” ● Mainline dev puts product managers in charge ● Better release planning ● True agility ● Expand team skillsets ● Reduce the “bus factor” Other Benefits

- 149. MAIN CHALLENGES FOR GLOBAL TEAMS • Team meetings - Arranging a common time • Clarity on expectations and deliverables and how do they align • Language barriers • Understanding and empathy towards cultural differences

- 150. POTENTIAL PITFALLS AND ROADBLOACKS AND HOW TO AVOID THEM• Avoid gaps on communication Rules of engagement during kick off meeting Be able to organize your meetings so you can reach the entire team with the same message Have agreement between the team Rephrasing as necessary to understand each other until is clear • Align the goals of all the team members Understand the goals of each team member Clarify expectations and deliverables and how do they align • Gain cultural competence to avoid surprises Start with an open attitude and self awareness Share experiences and ask others to share

- 151. CONCLUSI ONS • The creation of a strong plan based on the business needs is the foundation of success • Lead with example and gain trust from your team • Cultural differences should not be seen as a barrier to achieve your goals. Know your team and create a strong MOS • Cultural competence is the outcome of a continuous learning process; you will always learn more from each of your global projects • Teamwork is the answer to your most difficult problems

- 152. •Barcodesprovideasimpleandinexpensivemethodofencoding text informationthat iseasilyreadbyinexpensiveelectronic readers. • Barcodingalsoallowsdata to becollectedrapidlyandwith extreme accuracy. •Barcodescanbethoughtofasaprintedtype oftheMorse code with narrowbars(andspaces)representingdots, andwide bars representingdashes. • Dueto thedesignofmostbarcodeit doesnotmakeanydifference Barcode Basics

- 153. Universal product code (UPC): The Universal Product Code (UPC) is a barcode symbology (i.e., a specific type of barcode), thatis widely used in Canada and the U.S for tracking trade items in stores. European article number (EAN): An EAN-13 barcode (original European Article Number) is a bar coding standard which is a superset of the original 12-digit Universal Product Code(UPC) system developed in the United States. A UPC barcode is also an EAN-13 barcode with the first digit set to zero.

- 154. ADVANTAGES OF BARCODE Fast-selling items can be identified quickly. Build-up of unwanted stock of slow-selling items can be stopped. Repositioning of item in a store can be monitored. Packing by manufacturers. A relational database is created like order number, items packed, quantity packed, final destination, etc.

- 155. DISADVANTAGES OF BARCODE • data is coded in the barcode. This can be an additional cost. • A scanner system is required eachtime to see the details encoded. • Complete system setup is needed to encode and decode data. • A slight defect in barcode can cause decoding problems.

- 156. APPLICATIONS OF BARCODE Bar Code is essentially used for 100% accurate & speedy data entry. The major applications are – Retail. Manufacturing. Quantity & Quality control. Packing. Ware housing. Service industry such as Courier Industry, Hospital and Library Management. Export Industry.

- 157. Definition Import:- The term import is derived from the conceptual meaning as to bring in the goods and services into the port of a country. The buyer of such goods and services is referred to an "importer" Export:- This term export is derived from the conceptual meaning as to ship the goods and services out of the port of a country. The seller of such goods and services is referred to as an "exporter"

- 158. Reduce dependence on existing markets Exploit international trade technology Extend sales potential of existing products Maintain cost competitiveness in your domestic market Advantages of Import

- 159. Disadvantages Of Import Importation of items from other countries can increase the risk of getting them which is no more common in the warm weather. it leads to excessive competition It also increases risks of other diseases from which the country is exporting the goods.

- 160. Advantages Of Export Exporting is one way of increasing your sales potential Increasing sale& profits Reducing risk and balancing growth Sell Excess Production Capacity. Gain New Knowledge and Experience

- 161. Disadvantages Of Export tation Extra Costs Financial Risk Export Licenses and Documen Market Information

- 162. EXIM Bank

- 163. EXIM Bank Export-Import Bank of India is the premier export finance institution of the country, established in 1982 under the Export-Import Bank of India Act 1981 Government of India launched the institution with a mandate, not just to enhance exports from India, but to integrate the country’s foreign trade and investment with the overall economic growth. like other Export Credit Agencies in the world, Exim Bank of India has, over the period, evolved into an institution that plays a major role in partnering Indian industries, particularly the Small and Medium Enterprises, in their globalisation efforts, through a wide range of products and services offered at all stages of the business cycle, starting from import of technology and export product development to export production, export marketing, pre-shipment and post- shipment and overseas investment.

- 164. EXIM Bank Exim Bank of India has been the prime mover in encouraging project exports from India. The Bank extends lines of credit to overseas financial institutions, foreign governments and their agencies, enabling them to finance imports of goods and services from India on deferred credit terms. The Bank provides financial assistance by way of term loans in Indian rupees/foreign currencies for setting up new production facility, expansion/modernization/upgradation of existing facilities and for acquisition of production equipment/technology. Such facilities Such facilities particularly help export oriented Small and Medium Enterprises for creation of export capabilities and enhancement of international competitiveness. The Bank has launched the Rural Initiatives Programme with the objective of linking Indian rural industry to the global market. The programme is intended to benefit rural poor through creation of export capability in rural enterprises.

- 165. ECGC The Export Credit Guarantee Corporation of India Limited(ECGC) is a company wholly owned by the Government of India based in Mumbai, Maharashtra. It provides export credit insurance support to Indian exporters and is controlled by the Ministry of Commerce. Government of India had initially set up Export Risks Insurance Corporation (ERIC) in July 1957.

- 166. ECGC • What does ECGC do? Provides a range of credit risk insurance covers to exporters against loss in export of goods and services. Offers guarantees to banks and financial institutions to enable exporters to obtain better facilities from them. Provides Overseas Investment Insurance to Indian c investing in joint ventures abroad in the form of equity Information on different countries with its own credit Assists the exporters in recovering bad debts ompanies or loan. rating

- 167. INCO TERMS

- 168. OriginTerms EXW • Ex-Works, named place where shipment is available to the buyer, not loaded. • The sellerwill notcontract forany transportation. •This term thus represents the minimum obligation for the seller, and the buyer has to bear all costs and risks involved in taking the goods from the seller’spremises. International Carriage NOT Paid bySeller FCA •Free Carrier, unloaded at the seller's dock OR a named place where shipment is available to the international carrier or agent, not loaded. This term can be used for any mode of transport.

- 169. FAS •Free Alongside Ship, named ocean port of shipment. The seller delivers when the goods are placed alongside the vessel at the named port of shipment. • The FAS term requires the seller toclear thegoods forexport. FOB •Free On Board vessel, named ocean port of shipment. The seller delivers when the goods pass the ship’s rail at the named port of shipment. •This term is used for ocean shipments only where it is important that the goods pass the ship'srail.

- 170. International Carriage Paid by theSeller CFR • Cost and Freight, named ocean port ofdestination. •The seller delivers when the goods pass the ship’s rail in the port of shipment. •The seller must pay the costs and freight necessary to bring the goods to the named port ofdestination •But the risk of loss of or any damage to the goods, as well as any additional costs due to events occurring after the time of delivery, are transferred from theseller tothe buyer. CIF • Cost, Insurance and Freight, named ocean port ofdestination. •The seller delivers when the goods pass the ship’s rail in the port of shipment. •The seller must pay the costs and freight necessary to bring the goods to the named port of destination BUT the risk of loss or damage to the goods, as well as any additional costs due to the events occurring after the time of delivery, are transferred from the seller tothe buyer.

- 171. •Seller also has to procure marine insurance against the buyer’s risk of loss of ordamage tothegoodsduring thecarriage. •Under the CIF term the seller is required to obtain insurance only on minimumcover. • Buyerto make his ownextra insurancearrangements. • This term is used forocean shipments. CPT •Carriage Paid To, named place or port of destination. This term is used forairorocean consignments. •The seller delivers the goods to the carrier nominated by him but the seller must in addition pay the cost of carriage necessary to bring the goods to the nameddestination. • This means that the buyer bears all risks and any other costs occurring afterthegoods have been sodelivered.

- 172. CIP • Carriageand Insurance Paid To, named place orportof destination. •The seller delivers the goods to the carrier nominated by him but the seller must in addition pay the cost of carriage necessary to bring the goods to the nameddestination. • The buyer bears all risks and any additional costs occurring after the goods have been sodelivered. •The seller also has to procure insurance against the buyer’s risk of loss of or damage tothegoodsduring carriage. • This term is used forairorocean consignments.

- 173. place of destination, by land, not Arrival At StatedDestination DAF • Delivered At Frontier, named unloaded. •The seller delivers when the goods are placed at the disposal of the buyer on the means of transport not unloaded, cleared for export, but not cleared for import at the named point and place at the frontier, but before thecustoms borderof theadjoining country. •The term “frontier” may be used for any frontier including that of the country of export. • This term is used forany modeof transportation butdelivered by land.

- 174. DES • Delivered Ex-Ship, named port of destination, notunloaded. • The seller delivers when the goods are placed at the disposal of the buyer on board the ship not cleared for import at the named port of destination. •The seller has to bear all the costs and risks involved in bringing the goods to the named port of destination beforedischarging. • This term is used for ocean shipmentsonly. DEQ • Delivered Ex-Quay, named port of destination, unloaded, notcleared. •The seller delivers when the goods are placed at the disposal of the buyer not cleared for import on the quay (wharf) at the named port of destination. •The seller has to bear costs and risks involved in bringing the goods to the named port of destination and discharging thegoods on thequay (wharf). •The DEQ term requires the buyer to clear the goods for import and to pay for all formalities, duties, taxes and othercharges upon import. • This term is used for ocean shipmentsonly.

- 175. DDU • Delivered Duty Unpaid, named place of destination, not unloaded, not cleared. •Duty has to be borne by the buyer as well as any costs and risks caused by his failure toclearthegoods for import in time. • This term is used forany modeof transportation. DDP - Delivered Duty Paid, named place of destination, not unloaded, cleared. This term is used forany modeof transportation.

- 176. Import means bring (goods or services) into a country from abroad for sale. The buyer of such goods and services is referred to an importer who is based in the country of import whereas the overseas based seller is referred to as an exporter. Thus an import is any good (e.g.garments) orservice brought in from one country to another country in a legitimate fashion, typically for use in trade

- 177. Documents Required For IMOPRT of an Item:- 1. Bill of Lading / Airway bill : Bill of lading under sea shipment or Airway bill under air shipment is carrier’s document required to be submitted with customs for import customs clearance purpose. Bill of lading or Airway bill issued by carrier provides the details of cargo with terms of delivery. 2. Invoice: Invoice is required for import customs clearance for value appraisal by concerned customs official. Assessable value is calculated on the basis of terms of delivery of goods mentioned in commercial invoice. The concerned officer verifies the value mentioned in commercial invoice matches with the actual market value of same goods. This method of inspection by officer of customs prevents fraudulent activities of importer or exporter by over invoicing or under invoicing.

- 178. 3. Bill of Entry: Bill of entry is one of the major import document for import customs clearance. As explained previously, Bill of Entry is the legal document to be filed by CHA or Importer duly signed. Bill of Entry is one of the indicators of ‘total outward remittance of country’ regulated by Reserve Bank and Customs department. Bill of entry must be filed within thirty days of arrival of goods at a customs location. 4. Import License Import license may be required as one of the documents for import customs clearance procedures and formalities under specific products. This license may be mandatory for importing specific goods as per guide lines provided by government. Import of such specific products may have been being regulated by government time to time. So government insist an import license as one of the documents required for import customs clearance to bring those materials from foreign countries.

- 179. 5. Insurance certificate Insurance certificate is a supporting document against importer’s declaration on terms of delivery. Insurance certificate under import shipment helps customs authorities to verify, whether selling price includes insurance or not. This is required to find assessable value which determines import duty amount. 6. Purchase order/Letter of Credit A purchase order reflects almost all terms and conditions of sale contract which enables the customs official to confirm on value assessment. If an import consignment is under letter of credit basis, the importer can submit a copy of Letter of Credit along with the documents for import clearance.

- 180. 7. Industrial License if any An industrial license copy may be required under specific goods importing. If Importer claims any import benefit as per guidelines of government, such Industrial License can be produced to avail the benefit. In such case, Industrial license copy can be submitted with customs authorities as one of the import clearance documents. 8. DEEC/DEPB /ECGC or any other documents for duty benefits If importer avails any duty exemptions against imported goods under different schemes like DEEC/DEPB/ECGC etc., such license is produced along with other import clearance documents. .

- 181. 9. Central excise document if any If importer avails any central excise benefit under imported goods, the documents pertaining to the same need to be produced along with other import customs clearance documents 10. GATT/DGFT declaration. As per the guidelines of Government of India, every importer needs to file GATT declaration and DGFT declaration along with other import customs clearance documents with customs. GATT declaration has to be filed by Importer as per the terms of General Agreement on Tariff and Trade.

- 182. Anti Dumping Duty on dumped articles • • • • • Often, large manufacturer from abroad may export goods at very low prices compared to prices in his domestic market. Such dumping may be with intention to cripple domestic industry or to dispose of their excess stock. This is called 'dumping'. In order to avoid such dumping, Central Government can impose, under section 9A of Customs Tariff Act, anti-dumping duty up to margin of dumping on such articles, if the goods are being sold at less than its normal value. Levy of such anti-dumping duty is permissible as per WTO agreement. Anti dumping action can be taken only when there is an Indian industry producing 'like articles'.

- 183. Safeguard Duty • • • Central Government is empowered to impose 'safeguard duty' on specified imported goods if Central Government is satisfied that the goods are being imported in large quantities and under such conditions that they are causing or threatening to cause serious injury to domestic industry. Such duty is permissible under WTO agreement. Safeguard duty is a step in providing a need-based protection to domestic industry for a limited period, with ultimate objective of restoring free and fair competition

- 184. National Calamity Contingent Duty • • • A National Calamity Contingent Duty (NCCD) of customs has been imposed vide section 129 of Finance Act, 2001. This duty is imposed on pan masala , chewing tobacco and cigarettes. It varies from 10% to 45%. - NCCD of customs of 1% was imposed on motor cars, multi utility vehicles and two wheelers and NCCD of Rs 50 per ton was imposed on domestic crude oil -section 134 of Finance Act. There are different rates of duty for different goods there are different rates of duty for goods imported from certain countries in terms of bilateral or other agreement with such countries which are called preferential rate of duties the duty may be percentage of the value of the goods or at specified rate.

- 185. PURCHASINGPRINCIPLES 5R’s OF BUYING RIGHTSOURCE RIGHTTIME RIGHTQUALITY RIGHT QUANTITYRIGHTPRICE

- 186. 1. RightQuality:- Rightqualitydoesnot meanthebestquality.Anyqualitythatis suitableforthepurposeisknownas rightquality. 2. RightQuantity:- Purchaseorganisation isalsoresponsibletomaintainregular flowof materialsforproductionactivity. Forthisrightquantityof materialsisto bepurchased.Excesspurchaseshould beavoidedbecauseCapitalis unnecessarily blocked.

- 187. (3)RightTime– Righttimemeanstheminimum level. Thislevel indicates thestockhas reachedtominimum andnowtheordermust beplaced.Atthislevel, purchasedepartment willnotdelayinplacingorder. If thegoodsarearrangedearlierthanthe required time,itwillcauseover-stockand blockingof money On the otherhand,delayindeliverymeans lossof production. (4)RightSource:- Therightsourceisthat supplierwhocansupplythematerialof the rightquality,intherightquantity,at therighttime andattheagreedorright price. Thesuppliershouldhavesufficient financial resourcesandmanpowerto handlethe order.

- 188. Right source aspects requires decisions as to what items should be purchased directly from the manufacturers,which itemsfrom dealers & whichitems fromopenmarket. Asfaraspossible, thefirmshouldbelocated nearthe buyers plant.This will avoid delivery delay and high transportationcost. (5)RightPrice:- Rightpricedoesnotmeansthelowestpricebuttheprice whichminimisetheoverallcost.

- 189. WHAT IS SUBCONTRACTING? Subcontracting refers to the process of entering a contractual agreement with an outside person or company to perform a certain amount of work. The outside person or company in this arrangement is known as a subcontractor. Many small businesses hire subcontractors to assist with a wide variety of functions. Example: A small business may use an outside firm to prepare itspayroll.

- 190. SUBCONTRACTING IS ALSO KNOWN AS OUTSOURCING Outsource means to send part of a company’s work to outside providers to simplify or reduce cost.