Servicing Oversight A Presentation

- 1. Servicing Oversight – Recommending a Strategy Ideas for Today and Tomorrow Presented by Debra Gaveglio

- 2. Vision Statement The Servicing Oversight role is an essential function to support the adherence to the uniform national mortgage-servicing and loss mitigation standards that would apply to all servicers. A comprehensive Servicing Oversight process protects the interests of the servicer of record, the investor, the insurers, the regulators and the borrowers.

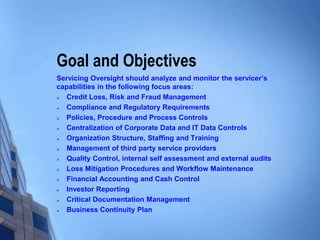

- 3. Goal and Objectives Servicing Oversight should analyze and monitor the servicer’s capabilities in the following focus areas: Credit Loss, Risk and Fraud Management Compliance and Regulatory Requirements Policies, Procedure and Process Controls Centralization of Corporate Data and IT Data Controls Organization Structure, Staffing and Training Management of third party service providers Quality Control, internal self assessment and external audits Loss Mitigation Procedures and Workflow Maintenance Financial Accounting and Cash Control Investor Reporting Critical Documentation Management Business Continuity Plan

- 4. Today’s Situation Servicing Oversight plays an important role in insuring the implementation of clearly defined governing rules for industry standard prudent Mortgage Servicing, Loss Mitigation and Investor Reporting Contractual Agreements should outline applicable Obligations, Fees, Costs, Benefits, Breach Events, Representations, Warranties and Remedies • Servicing and Subservicing • Custodial/Collateral • Vendor Management • Trustees Monthly Remittance and Investor Reporting Package including income fees and costs, credit loss, loss mitigation workouts and delinquency data and Management Dashboard Summary Reports

- 5. How Do We Get Here? Servicing Oversight analyzes and monitors the Servicer, Third Party and Vendor Activities to insure the appropriate controls are maintained. Some of these include: • Taxes and Insurance • Outsourced Servicing Functions • Payment Processing • Escrow and Cash Control • Collections • Legal Document Custodians • MERS • Credit Bureaus • Legal firms • Loss Mitigation • Liquidations • Flood, Force Placed Hazard and Mortgage Insurers

- 6. Opportunities Servicing Oversight monitors Servicing, Collections and Loss Mitigation Governance • Industry Comparative Data for Trending default Statistical Analysis • Dual Tracking of borrower workouts occurring simultaneously • Borrower Communication Procedures including solicitations • Quality Control and Due Diligence Processes Staffing • Capacity Modeling • Workload Management • File to Representative ratio • Training Programs

- 7. Recommended Servicing Oversight Approach Relationship Management - Dedicated Servicing Oversight Point of Contact Monthly Remittance Package Receipt and Review Schedule Business Intelligence Dashboard & Management Summary Reports Loan level Loss Analysis with applicable Remedy and Recourse Plan Access to Servicer Workflow Management System (SharePoint; CRM platforms) Contingency Plan for Ongoing Regulatory Changes Reasonable access to Books/Records Fraud and Risk Management Plan