The EU Productivity Gap - Open Session

- 1. The EU Productivity Gap Matilde Mas Universitat de València and Ivie Open Session Round Table: The Future of Europe from an International Perspective Madrid May 24th, 2016 This project has received funding from the European Union’s Seventh Framework Programme for research, technological development and demonstration under grant agreement No. 612774

- 2. Labour Productivity growth is key for per capita income growth “Productivity isn’t everything, but in the long run it is almost everything”.- Paul Krugman y = 1,01x + 0,21 R² = 0,90 -1 0 1 2 3 4 5 6 -1 0 1 2 3 4 5 6 Percapitaincomegrowth(percentage),1950-2014 Labour productivity growth (percentage), 1950-2014 Labour productivity andper capita income, 1950-2014Figure 1. Labour productivity and per capita income, 1950-2014 Source: Total Economy Database, May 2015 (TCB)

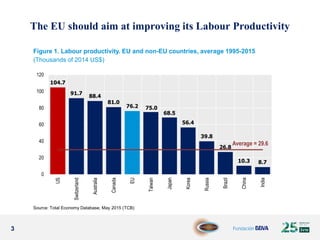

- 3. 3 The EU should aim at improving its Labour Productivity Figure 1. Labour productivity. EU and non-EU countries, average 1995-2015 (Thousands of 2014 US$) 104.7 91.7 88.4 81.0 76.2 75.0 68.5 56.4 39.8 26.8 10.3 8.7 0 20 40 60 80 100 120 US Switzerland Australia Canada EU Taiwan Japan Korea Russia Brazil China India Average = 29.6 Source: Total Economy Database, May 2015 (TCB)

- 4. 4 Figure 2. Labour productivity growth. EU and Non-EU countries, 1995-2015 (annual rates in percentages) Source: Total Economy Database, May 2015 (TCB) 5.80 5.00 3.07 2.87 2.45 1.59 1.27 1.12 0.96 0.92 0.82 0.67 0 2 4 6 8 China India Korea Taiwan Russia US Australia EU Canada Japan Switzerland Brazil Average = 1.9% The rate of growth of labour productivity (LP) in the EU has been…modest

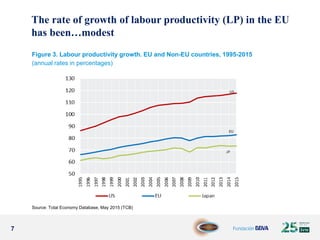

- 5. 5 Figure 3. Labour productivity growth. EU and Non-EU countries, 1995-2015 (annual rates in percentages) The rate of growth of labour productivity (LP) in the EU has been…modest Source: Total Economy Database, May 2015 (TCB)

- 6. 6 Figure 3. Labour productivity growth. EU and Non-EU countries, 1995-2015 (annual rates in percentages) Source: Total Economy Database, May 2015 (TCB) The rate of growth of labour productivity (LP) in the EU has been…modest

- 7. 7 Figure 3. Labour productivity growth. EU and Non-EU countries, 1995-2015 (annual rates in percentages) The rate of growth of labour productivity (LP) in the EU has been…modest Source: Total Economy Database, May 2015 (TCB)

- 8. 8 Figure 3. Labour productivity growth. EU and Non-EU countries, 1995-2015 (annual rates in percentages) The rate of growth of labour productivity (LP) in the EU has been…modest Source: Total Economy Database, May 2015 (TCB)

- 9. LP growth have been lower in the EU than in other leading countries… Figure 2: Productivity. Dynamics of other economies’ differences vs the EU28 average. 2006 and 2013. (Thousands of 2010 euros PPS) a) Total economy Note: EU28 aggregated labour productivity in 2006 = 56.4; in 2013 = 57.8. EU28 manufacturing labour productivity in 2006 = 52.4; in 2013 = 57.7. EU28 services labour productivity in 2006 = 52; in 2013 = 52.9. Latest available data for Canada and Japan corresponds to 2012. Source: PREDICT database elaborated by Ivie and JRC-IPTS Lower than EU28 average & Converging II Higher than EU28 average & Diverging IV -80 -60 -40 -20 0 20 40 60 80 100 120 India China Russia Korea Japan Canada Taiwan Australia United States 20132006 DifferenceOthereconomies-EUaverage(thousandsof2010eurosPPS) Higher than EU28 average & Converging II

- 10. In Manufacturing the gap decreased with respect to 3 countries… Figure 2 (cont.): Productivity. Dynamics of other economies’ differences vs the EU28 average. 2006 and 2013. (Thousands of 2010 euros PPS) b) Manufacturing Note: EU28 aggregated labour productivity in 2006 = 56.4; in 2013 = 57.8. EU28 manufacturing labour productivity in 2006 = 52.4; in 2013 = 57.7. EU28 services labour productivity in 2006 = 52; in 2013 = 52.9. Latest available data for Canada and Japan corresponds to 2012. Source: PREDICT database elaborated by Ivie and JRC-IPTS Lower than EU28 average & Converging II Higher than EU28 average & Diverging IV -80 -60 -40 -20 0 20 40 60 80 100 120 India Australia China Russia Canada Japan Taiwan Korea United States 20132006 DifferenceOthereconomies-EUaverage(thousandsof2010eurosPPS) Lower than EU28 average & Diverging I Higher than EU28 average & Converging III

- 11. …but in Services, all countries have performed better Figure 2 (cont.): Productivity. Dynamics of other economies’ differences vs the EU28 average. 2006 and 2013. (Thousands of 2010 euros PPS) c) Services Note: EU28 aggregated labour productivity in 2006 = 56.4; in 2013 = 57.8. EU28 manufacturing labour productivity in 2006 = 52.4; in 2013 = 57.7. EU28 services labour productivity in 2006 = 52; in 2013 = 52.9. Latest available data for Canada and Japan corresponds to 2012. Source: PREDICT database elaborated by Ivie and JRC-IPTS Lower than EU28 average & Converging II Higher than EU28 average & Diverging IV 20132006 DifferenceOthereconomies-EUaverage(thousandsof2010eurosPPS) -80 -60 -40 -20 0 20 40 60 80 100 120 India China Russia Korea Canada Japan Australia Taiwan United States Higher than EU28 average & Converging III

- 12. 12 The leadership of the US in LP with respect to the EU has widened during the 2006-2013 period in all industries but two ICT industries 1 Manufacture of electronic components and boards [261] 2 Manufacture of computers and peripheral equipment [262] 3 Manufacture of communication equipment [263] 4 Manufacture of consumer electronics [264] 5 Telecommunications [61] 6 Computer and related activities [5820, 62, 631, 951] Non-ICT industries 7 Manufacture of chemicals and chemical products [20] 8 Manufacture of pharmaceuticals, medicinal chemical and botanical products [21] 9 Manufacture of machinery and equipment [27-28] 10 Manufacture of motor vehicles, trailers and semi-trailers [29] 11 Manufacture of other transport equipment [30] 12 Transportation and storage [49-53] 13 Information and communication [58-63, except Computer and related activities] 14 Financial and insurance activities [64-63] 15 Professional, scientific and technical activities [69-75] 16 Administration and support service activities [76-82] 17 Education [85] 18 Human health and social work activities [86- 88] Figure 4. Productivity. Dynamics of US-EU differences by industry. 2006 and 2013 (Thousands of 2010 euros PPS) 0 50 100 150 200 250 20132006 12 2 17 16 9 15 14 10 6 11 4 5 13 1 7 3 8 DifferencebyindustryUS-EUaverage(thousandsof2010eurosPPS) 18 Higher thanEU average & Diverging IV Higher than EU average & Converging III (Thousands of 2010 euros PPS) Note: ICT sectors marked inbold. The codificationofindustries canbe foundinthe box to the left (NACERev. 2 codes inbrackets ). Source: PREDICTdatabase elaborated byIvie and JRC-IPTS

- 13. 13 MFP contribution was negative in the 5 big EU countries. Figure 6. Contributions to GDP growth, 2007-2012 (Percentages) -3 -2 -1 0 1 2 France Germany Italy Spain UK US ICT capital Non-ICT capital Hours worked Labour composition TFP GDP Source: APO, EU KLEMS, Jorgenson and Vu (2016), TCB and own elaboration

- 14. 14 Warning: There is not an homogenous EU There are several potential factors - Lack of flexibility of the EU labour markets long-term uneployment; temporary employment;… - Accumulation of capital during the boom years (excess capacity affecting productivity of capital) - Regulations (some of them under discussion with TTIP) - Lack of competition (roaming; collusive agreements; …) - Size and flexibility (in and out) of firms - Directive on Services in the internal market and its trasposition - Endowments of Intangible Assets o R&D o Other Intangible Assets: Organizational Capital and Training What might be the sources of EU disappointing performance?

- 15. 15 Intangibles and Growth • Empirical evidence shows a strong correlation between intangibles and LP growth (Corrado, Haskel, Jona-Lasinio and Iommi (2013)). Fernández de Guevera and Mas (2016) making use of the Spanish data disaggregated by industries. • Corrado, Haskel and Jona-Lasinio (2014) also find: I. a complementary relation between ICT and intangible capital. II. significant spillovers of intangible capital. • These results are not confirmed (at least not yet) for the Spanish disaggregated data.

- 16. 16 US outperforms the EU in both, market and non-market GFCF in intangibles. Marked heterogeneity of EU15 countries. Sweden and UK in the first positions. The four peripheral countries at the low end. Figure 7. Share of GFCF on intangible assets over total GDP. EU15 and US. Average 2006- 2010 (percentages) Source: Eurostat, INTAN-Invest, SPINTAN and own elaboration. a) Market sector b) Non-market sector 10.8 8.4 8.3 7.5 7.4 7.3 7.1 6.9 6.8 6.3 6.3 6.2 6.1 6.0 5.2 4.5 4.5 4.3 2.1 0 2 4 6 8 10 12 UnitedStates Sweden UnitedKingdom Belgium Denmark France Finland Slovenia Netherlands EU15 CzechRepublic Germany Austria Luxembourg Ireland Spain Portugal Italy Greece EU15 average = 6.3% 2.5 1.6 1.3 1.1 1.1 0.9 0.9 0.9 0.9 0.9 0.8 0.8 0.7 0.7 0.7 0.6 0.4 0.2 0.2 0.0 0.5 1.0 1.5 2.0 2.5 3.0 UnitedStates Sweden UnitedKingdom Italy Netherlands Austria Portugal Finland EU15 Belgium CzechRepublic Germany Ireland France Denmark Slovenia Spain Greece Luxembourg EU15 average = 0.9%

- 17. 17 Figure 8. BERD intensity (BERD/GDP) and GBAORD/GDP. EU and Non-EU countries, average 2006-2013 (Percentages) The US presents higher BERD (business) and GBAORD (public) intensity than the EU28 Source: PREDICT database elaborated by Ivie and JRC-IPTS a) BERD/GDP b) GBAORD/GDP

- 18. 18 The gap with the US is higher in the non-market sector Figure 8. Share of GFCF on R&D over total GDP. EU15 and US. Average 2006-2010 (percentages) Source: Eurostat, INTAN-Invest, SPINTAN and own elaboration. a) Market sector b) Non-market sector 2.212.15 1.97 1.631.59 1.45 1.131.121.091.061.00 0.83 0.750.75 0.630.610.540.51 0.14 0.0 0.5 1.0 1.5 2.0 2.5 Sweden Finland UnitedStates Germany Austria Denmark France Luxembourg Belgium EU15 Slovenia UnitedKingdom CzechRepublic Netherlands Ireland Spain Italy Portugal Greece EU15 average = 1.06% 0.94 0.80 0.61 0.52 0.46 0.40 0.37 0.37 0.31 0.29 0.26 0.22 0.19 0.18 0.16 0.11 0.0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1.0 UnitedStates Sweden Austria Portugal Italy CzechRepublic Denmark Finland Germany EU15 Belgium Netherlands UnitedKingdom France Spain Slovenia EU15 average = 0.29%

- 19. 19 UK leads the ranking of GFCF on organisational capital over GDP in the market sector and the US in the non-market. Figure 9. Share of GFCF on organisational capital over total GDP. EU-15 and US. Average 2006-2010 (percentages) Source: Eurostat, Intan-INVEST, SPINTAN and own elaboration. a) Market sector b) Non-market sector 2.9 2.4 2.3 2.1 1.9 1.8 1.6 1.6 1.5 1.5 1.4 1.4 1.3 1.3 1.0 1.0 0.9 0.7 0.0 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 UnitedKingdom UnitedStates Belgium Netherlands France Sweden Slovenia EU15 Austria Portugal Finland Ireland CzechRepublic Germany Luxembourg Italy Denmark Spain Greece EU15 average = 1.6% 0.4 0.3 0.2 0.2 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.1 0.1 0.2 0.2 0.3 0.3 0.4 0.4 0.5 UnitedStates Belgium Italy Netherlands France Sweden Greece EU15 Ireland Finland Austria UnitedKingdom Denmark Portugal Slovenia CzechRepublic Germany Spain Luxembourg EU15 average = 0.1%

- 20. 20 In training GFCF Denmark (followed by the US) takes the leading role in the market sector and the UK in non-market. US is above the EU15 average. Figure 10. Share of GFCF on training over total GDP. EU-15 and US. Average 2006-2010 (percentages) Source: Eurostat, INTAN-Invest, SPINTAN and own elaboration. 1.3 1.1 1.0 0.9 0.9 0.8 0.8 0.8 0.8 0.7 0.7 0.6 0.5 0.5 0.5 0.5 0.4 0.4 0.0 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 Denmark UnitedStates UnitedKingdom France Germany Netherlands Luxembourg EU15 Austria Ireland Sweden Slovenia CzechRepublic Italy Belgium Finland Portugal Spain Greece EU15 average = 0.8% 0.8 0.5 0.4 0.3 0.3 0.2 0.2 0.2 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 UnitedKingdom Ireland UnitedStates Germany EU15 CzechRepublic Belgium Finland Sweden Netherlands Slovenia Italy France Portugal Greece Luxembourg Austria Denmark Spain EU15 average = 0.3% a) Market sector b) Non-market sector

- 21. 21 • The EU has a serious productivity problem. The gap with respect to the US has increased, specially since 2009. The Asian countries are rapidly closing the gap with the EU. In fact Taiwan has already surpassed it. • All nine leading countries considered had a higher LP growth than the EU during the period 2006-2013 at the aggregate level, and even more so in the services industries. • In all 18 sectors analized, labour productivity in the US is higher than in the EU. And the gap has increased in almost (16) all of them. • From the various potential explanations, we have concentrated in intangible assets endowments • Total Intangible capital, as well as in three of its main components: R&D; organizational capital; and on-the-job training, the superiority of the US is overhelming both for the market and non- market economy. Greece, Italy and Spain are lagging behind also in all of them. Concluding Remarks

- 22. The EU Productivity Gap Matilde Mas Universitat de València and Ivie Open Session Round Table: The Future of Europe from an International Perspective Madrid May 24th, 2016 This project has received funding from the European Union’s Seventh Framework Programme for research, technological development and demonstration under grant agreement No. 612774

![12

The leadership of the US in LP with respect to the EU has

widened during the 2006-2013 period in all industries but two

ICT industries

1 Manufacture of electronic components and

boards [261]

2 Manufacture of computers and peripheral

equipment [262]

3 Manufacture of communication equipment

[263]

4 Manufacture of consumer electronics [264]

5 Telecommunications [61]

6 Computer and related activities [5820, 62,

631, 951]

Non-ICT industries

7 Manufacture of chemicals and chemical

products [20]

8 Manufacture of pharmaceuticals, medicinal

chemical and botanical products [21]

9 Manufacture of machinery and equipment

[27-28]

10 Manufacture of motor vehicles, trailers and

semi-trailers [29]

11 Manufacture of other transport equipment

[30]

12 Transportation and storage [49-53]

13 Information and communication [58-63,

except Computer and related activities]

14 Financial and insurance activities [64-63]

15 Professional, scientific and technical

activities [69-75]

16 Administration and support service

activities [76-82]

17 Education [85]

18 Human health and social work activities [86-

88]

Figure 4. Productivity. Dynamics of US-EU differences by industry. 2006 and 2013

(Thousands of 2010 euros PPS)

0

50

100

150

200

250

20132006

12 2 17 16 9 15 14 10 6 11 4 5 13 1 7 3 8

DifferencebyindustryUS-EUaverage(thousandsof2010eurosPPS)

18

Higher thanEU average

& Diverging

IV

Higher than EU average

& Converging

III

(Thousands of 2010 euros PPS)

Note: ICT sectors marked inbold. The codificationofindustries canbe foundinthe box to the left (NACERev. 2 codes inbrackets ).

Source: PREDICTdatabase elaborated byIvie and JRC-IPTS](https://image.slidesharecdn.com/opensessionmay242016matildemas-160704124958/85/The-EU-Productivity-Gap-Open-Session-12-320.jpg)