e-cheque

- 1. WELCOME

- 2. E-CHEQUE

- 3. E-CHEQUE Recent years have seen a tremendous increase in e-commerce transactions. The success of e-commerce relies on developing adequate payment technologies. One such technology is e-Cheque. An e- Cheque is an electronic document which substitutes the paper check for online transactions. Digital signatures (based on public key cryptography) replace handwritten signatures.

- 4. Definition of 'Electronic Cheque' A form of payment made via the internet that is designed to perform the same function as a conventional paper cheque. Because the cheque is in an electronic format, it can be processed in fewer steps and has more security features than a standard paper cheque. Security features provided by electronic cheque include authentication, public key cryptography, digital signatures and encryption, among others.

- 7. The e-Cheque is compatible with interactive web transactions or with email and does not depend on real-time interactions or on third party authorizations. It is designed to work with paper cheque practices and systems, with minimum impact on payers, payees, banks and the financial system. Payers and payees can be individuals, businesses, or financial institutions such as banks. E- Cheques are transferred directly from the payer to the payee, so that the timing and the purpose of the payment are clear to the payee

- 8. The payer writes an e-Cheque by structuring an electronic document with the information legally required to be in a cheque and digitally signs it. The payee receives the e-Cheque over email or web, verifies the payer's digital signature, writes out a deposit and digitally signs it.

- 9. The payee's bank verifies the payer's and payee's digital signatures, and then forwards the cheque for clearing and settlement The payer's bank verifies the payer's digital signature and debits the payer's account

- 10. PAYER PROCESS In order to send a cheque, the client simply fills out a standard e-cheque. The system allows clients to define common payees in order to speed the e-cheque creation process. When the cheque has been written it can be easily transferred from the payer to the payee over a secure e-cheque channel.

- 11. This secure channel will be established between the payer and the payee before the transaction begins. The e-cheque is automatically signed by the user using his private key based on RSA algorithm and SHA-128; this ensures the authenticity and the integrity of the e-cheque

- 12. PAYEE PROCESS When the payee receives the e-cheque he can open and view it using the e-cheque system. In order to deposit the cheque, the payee simply connects to the bank (which is expected to provide e-cheque services) and uploads the e-cheque to his bank account.

- 13. Once the bank receives the e-cheque, it will decrypt it using the e-cheque system. After clearing (i.e. verifying both the cheque signature and account balance) with the payer’s bank, the payee’s account will be credited accordingly.

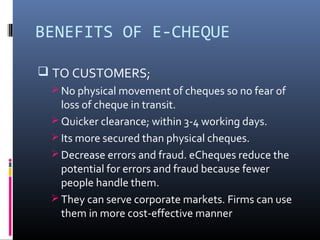

- 15. BENEFITS OF E-CHEQUE TO CUSTOMERS; No physical movement of cheques so no fear of loss of cheque in transit. Quicker clearance; within 3-4 working days. Its more secured than physical cheques. Decrease errors and fraud. eCheques reduce the potential for errors and fraud because fewer people handle them. They can serve corporate markets. Firms can use them in more cost-effective manner

- 16. Benefits to Bank Reduce the risk associated with paper clearing Superior verification and reconciliation process No geographical restrictions No physical movement of cheques- it saves cost and time for banks. No chance of cheque dishonor- The risk is taken care of by the accounting server, which will guarantee that the cheque would be honoured.

- 17. Well suited for clearing micro payments Reduce processing costs by up to 60%. E-cheques require less manpower to process and don’t come with any deposit or transaction fees. As a result, processing an e-cheque is generally much cheaper than processing a paper check or credit card transaction.

- 18. Work smarter and greener.; Electronic check conversion is easy to set up. It relies on the trusted ACH Network. And eChecks help reduce the more than 67.4 million gallons of fuel used and 3.6 million tons of greenhouse gas emissions created by transporting paper checks ACH – Automated Clearing House.

- 19. DRAW BACKS Customer education Chances of misuse, hacking etc Need a different infrastructure Unauthorized transactions becomes challenge for banks

- 20. Problem could be when there is more than one signer or endorser. Transactions based on internet- network failure may lead to delay in payment. Both payer and payee should have e-cheque facility.

- 21. In India the e-cheque facility is now replaced by CTS- Cheque Truncation System 2o1o. Where there will be a physical cheque which will be converted into e-cheque by scanning and transferred for clearance. And the time taken for clearance is 24hrs.