Advance Tally Erp With Accounts By SK Singh

- 1. Tally Erp.9 1 | P a g e IASAM ACADEMY - 011-22043114 Quick Shiksha A UNIT OF IASAM Sharpen Your Skills with us and get an ‘Edge’ in Interview and Job Certificate Course in ‘Financial Analysis’ 1st April 2012 Tally Erp.9 MODULE - 2 Santosh Kr.Singh A-123, Street N0-02, (Opp. Metro Pillar No. 36), Vikas Marg, Shakarpur, Delhi – 110092, 011 22043114, 09268972567 I&II

- 2. Tally Erp.9 2 | P a g e IASAM ACADEMY - 011-22043114 Basic Accounting Concepts Owner Business Other Person Capital Liabilities Transactions/Events ( Received ( Payment ( Received but due ( Payment but not due ( Payment but due Received but not due ( Expenses Assets Income Liabilities

- 3. Tally Erp.9 3 | P a g e IASAM ACADEMY - 011-22043114 Debits and Credits vs. Account Types Account Type Debit Credit Assets Increases (Dr.) Decreases (Cr.) Liabilities Decreases (Dr.) Increases (Cr.) Income Decreases (Dr.) Increases (Cr.) Expenses Increases (Dr.) Decreases (Cr.) FUNDAMENTAL OF ACCOUNTING (Accounting means processing) Book - Keeping Book Keeping (Books of Account) Journal Ledger Subsidiary book etc System of Book – Keeping 1. Single entry system 2. Double entry system 3. Indian System 4. Cash System 1) Single Entry System :- Only transaction recorded at One place Some transaction are omitted from Book Accounts Renown Dispute 2) Double Entry System :- All transaction are recorded on two places. All transaction must be recorded 3) Indian System :- Under this system transaction are recorded on regional language

- 4. Tally Erp.9 4 | P a g e IASAM ACADEMY - 011-22043114 4) Cash system :- Under this system transaction are recorded on cash basis system. Double Entry System :- ____________ (Itli,venus city) 1494 Lucas Pecioli Under this system all transaction recorded at two places which are named as debit and credit this system sported by a set of rules which are called as Golden rules or rules of Journalizing. Accounting Cycle:- Transaction arises -> Not, Allusions -> Not Transaction recorded If yes/ of Business _____________. P 1) Memorandum/ waste book/Raugh Book. R Journalizing O 2) Journal/ Journal book C Posting E 3) Ledger/ Ledger book S 4) T.B. S I N G Final Accounts (Reporting) Trail Balance Profit & loss Balance sheet Journalizing: - It is a procedure trough which the business transaction are recorded from memorandum book these procedure we sported by a set of rules calls rules of Journalizing.

- 5. Tally Erp.9 5 | P a g e IASAM ACADEMY - 011-22043114 Rules of Double Entry Systems The transaction are to be recorded at two places or and cr. The transaction is to be recorded at each place of equal Amount. Accounts (Categories) Personal Impersonal Real Nominal 1) Personal Accounts :- i. Natural ii. Artificial iii. Representative (i) Natural : - Made by nature/God. (ii) Artificial :- Made by Human (iii) Representative: - represent to human/human related, example, capital Accounts, Drawing Accounts, Outstanding, and Prepaid etc. 2) Real Account :- All Assets (1) Tangible or Intangible Example: - Cash, cash at Bank, Machine etc. 3) Nominal Accounts :- All Incomes All Expenses All gains All Profit All Losses Note: - Expenses is losses Income is gain

- 6. Tally Erp.9 6 | P a g e IASAM ACADEMY - 011-22043114 Profit is _______ etc. # Expenses : - Behalf of Something retimed # Losses : - Behalf of not something return # Income : - Income is certain/Constraint it is not trading purpose. # Gains :- Gains is uncertain/unlimited it is not trading purpose. # Profit :- Margainal means Sales – Marginal purpose = Profit it is trading Purpose/business purpose. Rules of Debit/Credit/Journalizing 1) Personal Accounts :- Debit the receiver. Credit the giver. 2) Real Accounts :- Debit what comes in. Credit what goes out. 3) Nominal Accounts :- Debit all expenses and Losses are Credit All Income and gains are # Entry transaction must be two aspect # Which that aspect here that aspect recorded. Example : - Cash received from manoj Rs. 5000 Step 01 for Journalizing:- (i) Ideality the Emolument of Accounts in particular transaction. (ii) Apply the rules of relevant Accounts i) Cash – Real A/c -> Dr. What Comes in ii) Manoj – Personal A/c -> Cr the giver.

- 7. Tally Erp.9 7 | P a g e IASAM ACADEMY - 011-22043114 According to business:- Cash A/c – Dr. 5000 To Manoj A/c Cr. 500 (Being cash rescued from Manoj) # According to Party/means Debtor (Company) Party A/c – Dr. 500 To cash A/c – 500 (Being cash paid to Business) # Postage stamps purchases worth Rs.500 and out of which only Rs.3000 has been used for the Reporting the Private letters. Step 01 i) Postage stamps – Naminal A/c ii) Drawing - Repre. Personal A/c iii) Cash - Real A/c Step 02 (Rules) i) All expenses & losses are Dr. ii) Dr the receiver iii) Cr what goes out Postage stamps A/c - Dr. 2000 Drawing A/c - Dr. 3000 To cash A/c - 5000 (Being purchase postage stamp) # Postage Stamp purchases for personal used and payment made by his personal A/c – 5000 Rs. Transaction arises No Entry If Business if not business transaction transude Entry No it is not Business ____________ so not recorded is business.

- 8. Tally Erp.9 8 | P a g e IASAM ACADEMY - 011-22043114 # Furniture sold to many which home have been purchases for household compartment and mode from Business – 2000 No entry required here become it is personal/private used. # Classification of goods. Two types of goods. 1) Trading Goods 2) Non- Trading Goods (Goods/Purchases) (Particulars/Used specified name) # Classification of Goods A/c:- 1) Purchaser A/c 2) Sales A/c 3) Purchase Returns A/c 4) Sale Returns A/c 1. Business Transaction: The terms „Business Transaction‟ means a financial transaction or event entered into by the parties and recorded in the books of accounts. It is a financial event, which can be expressed in terms of money and brings change in the financial position of an enterprise. It is concerned with two parties (i.e. 2. (Accounts) involving the transfer of exchange of goods, receipts from debtors, payment made to creditors, purchase or sale of fixed assets, payment of dividend, etc. Characteristics of a business transaction: 1. It is concerned with money or money‟s worth of goods or services. 2. It arises out of the transfer of exchange of goods or services. 3. It brings about a change in the financial position (assets and liabilities) of a business concern. 4. It has an effect on the accounting equation of any business firm.

- 9. Tally Erp.9 9 | P a g e IASAM ACADEMY - 011-22043114 5. It has dual aspects or sides –„receiving‟ (Debit) and „giving‟ (Credit) of the benefit. In other words, every transaction has two sides- one side is –„receiving‟ and the other side is‟ giving‟ the benefit. Transaction Relationship with the accounting units Mode of settlement of value internal transaction or accounting External Transaction Cash Transaction Credit Transaction Transaction,e.g. Depreciation on or fixed Assets Business Transaction A transaction may be a cash transaction or a credit transaction. When the amount is transacted immediately on entering into a transaction it is a cash transaction and promise to pay later, it is a credit transaction. Transaction maybe external (between a business entity and a second party, for example, goods sold on credit to Z) or internal (does not involve second party, e.g., depreciation charged on machinery). 3. Account: Account is a summarized record of transactions relating to a particular head at one place. It records not only the amount of transactions but also their effect and direction.

- 10. Tally Erp.9 10 | P a g e IASAM ACADEMY - 011-22043114 4. Capital: Capital is the amount invested by the proprietor or partner in the business. It may be in the form of money or assets having money value. It is a liability of the business towards the proprietor of partner. It is so because under” Business Entity Concept”, business is considered to be a separate and distinct entity from its owners. Capital is also known as Owner‟s Equity or Net Worth. It is always equal to assets less liabilities. This can be expressed as: 5. Drawings: it is the amount withdrawn or goods taken by the proprietor for this personal use. Goods so taken by the proprietor for his personal use Drawings reduce the investment (or Capital) of the owners. 6. Liabilities: Liabilities mean the amount owed (Payable) by the business to outsiders and to the proprietors. Various kinds of liabilities are: (i) Internal Liability: Internal Liability is the amount owned by the business to the proprietor of the business. It is so because under the Business Entity Concept, transactions are recorded taking business to be an entity distinct and separate from its owners. (ii) External Liability: External Liability is a liability that is payable to outsiders, i.e., other than the proprietors. External liability arises because of credit transactions or loans raised. Examples of external liabilities are creditors, bank overdraft, bills payable, outstanding liabilities. Liabilities can be further classified into: (iii) Long-Term liabilities: Long-Term Liabilities are those liabilities which are payable after a longer period, (more than a year). Examples of Long-Term Liabilities are Long- Term loans, debenture, etc. (iv) Current Liabilities: These are those liabilities which are payable within a year. Examples of Current Liabilities are creditors, bills payable, short –term loans, etc. (v) Contingent Liabilities: Contingent Liabilities are those liabilities which may or may not arise in future depending on the happening of an event. For example: Bills Receivable discounted. It will become a liability if it is dishonored on the due date. These are shown as a foot note of the Balance Sheet. 7. Assets: Assets are property or legal rights owned by an individual or business to which money value can attached. In other words, anything which will enable the firm to get cash or a benefit in the future is an asset. Examples of assets are land, building, machinery, furniture, stock, debtors, cash and bank balances, etc. “Assets are property or legal right owned by an individual or company to which money cost.” --R. Brockington “Assets are future economic benefits, the rights, which are owned or controlled by an organization or individual.” --Finney and Miller Capital=Assets-Liabilities

- 11. Tally Erp.9 11 | P a g e IASAM ACADEMY - 011-22043114 “Assets are valuable resources owned by a business which are acquired at a measurable money cost” --Prof. R.N. Anthony What emerges from the above definitions is that an asset should have the following characteristics: 1. It should be owned (i.e., property) by an individual or an organization (business or non-business). 2. It may be in the tangible (Physical) form or intangible form. 3. It should have some value attached to it. 4. It should be capable of being measured in money terms. Assets can be classified into: (i) Tangible Assets: - Tangible Assets are those assets which have physical existence, i.e., they can be seen and touched. Examples of Tangible Assets are land, building, machinery, computer, furniture, good, etc. (ii) Intangible Assets: - Intangible Assets are those assets which do not have physical existence, i.e., they can not be seen and touched. Examples of Intangible Assets are patents, goodwill, trade-mark, etc. (iii) Fixed Assets: - Fixed assets are those assets which are acquired not with the purpose of resell but to facilitate business operations and increase the earning capacity of the business by employing them. Examples of Fixed Assets are land, building, machinery, computers, vehicles, furniture, etc. Fixed Assets are usually shown as the first item in the Balance sheet. (iv) Current Assets: - Current assets are those assets which are retained in the business with the purpose to convert them into cash within short periods say, one year. For example, goods are purchased with a purpose to resell and earn profit, debtors exist to convert them into cash, i.e., receive the amount from them, bills receivable exist again for receiving cash against it, etc. Prepaid expenses are also classified as Current Assets although they can not be converted into cash .They are so classified because benefit from such expenses when paid has not fully exhausted,i.e., it will be available in the next accounting year also. (v) Liquid Assets: - Liquid assets are those which are either in the form of cash or can be converted into cash within a very short period. Examples of liquid assets are: cash, bills receivable and debtors, etc . (vi) Fictitious Assets: - Fictitious Assets are those assets which are neither tangible assets or intangible assets but represent loss or expenses yet to be written off. Examples are: Debit balance of Profit and Loss Account and Deferred Revenue Expenditure, etc. 8. Receipts: Receipts is the amount received or receivable for selling assets, goods or services.

- 12. Tally Erp.9 12 | P a g e IASAM ACADEMY - 011-22043114 Capital Receipts: - It is the amount received or receivable for selling assets. Examples are: sales of machinery, Building, furniture, etc. Revenue Receipts:- It is the amount received or receivable against sale of goods or services. In other words, it is a receipt on account of business transactions. 8. Expenditure:- . Expenditure is the amount spent or liability incurred for acquiring assets, goods or services. Expenditure may be categorized into: (i) Capital Expenditure:- It is the Expenditure incurred to acquire assets or improving the existing assets which will increase the earning capacity of the business, i.e., will give benefit to the business in more than one accounting year. Examples are purchase of machinery to manufacture foods, purchase of furniture or computers to carry on business. Capital Expenditure is shown on the assets side of the Balance Sheet. (ii) Revenue Expenditure:- Revenue Expenditure is the amount spent to purchase goods and services that are consumed during the accounting period. Revenue Expenditure does not increase the earning capacity but it maintains the earning capacity in the current year. Revenue Expenditure is shown on the debit side of the Profit and Loss Account. (iii) Deferred Revenue Expenditure: Deferred Revenue Expenditure is revenue expenditure in nature but is written off (Charged) to profit and loss account in more than one accounting period. For Example, Large advertisement expenditure that will give benefit for more than one accounting period is a Deferred Revenue Expenditure. Revenue: Revenue means the amount , which as a result of operations, i.e., sale of goods or services, is added to the capital. “Revenue Is an inflow of assets, which results in an increase in the owner‟s equity. “Examples of revenue are receipts from sale of goods, rent, commission, etc. Revenue differs from income. Sale of goods and services is revenue and cost of sale of goods and services is expense. The difference between revenue and expense in income. Income = Revenue - Expense 9. Expense: Expense is a value which has expired during the accounting period. It may be (i) Cash payment such as salaries, Wages, rent, etc. (ii) Writing off a part of fixed assets (depreciation). (iii) An amount written off out of current assets (say bad debts). (iv) Decline in the value of assets (say investments). (v) Cost of goods sold.

- 13. Tally Erp.9 13 | P a g e IASAM ACADEMY - 011-22043114 An expense is charged (debited) to Profit and Loss Account. Prepaid Expense: It is an expense that has been paid in advance and the benefit of which will be available in the following year or years. For example, insurance premium of Rs. 10,000 has been paid for one year beginning 1st October, 2010. The financial year ends on 31st March, 2011. It means premium for six months, i.e., 1st April, 2011 to 30th September, 2011 amounting to Rs.5, 000 has been paid in advance. Thus, the amount of premium paid in advance (Rs.5, 000) is prepaid expense. Similarly, if advance rent paid is to be adjusted over 3 years, advance rent relating to following accounting years yet to be adjusted shall be prepaid expense. It is termed as outstanding Expense. It is debited to the Profit and Loss Account and also shown under the head current Liabilities in the Balance Sheet. Outstanding Expense: It is an expense that has not been paid but the benefit thereof has already been availed. For example, an audit has been conducted by a chartered accountant firm against which audit fee of Rs.20,000 is to be paid. It mains a liability of Rs.20, 000 has been incurred, which is yet to be paid. It is termed as Outstanding Expense. It is debited to the Profit and Loss Account and also shown under the head Current Liabilities in the Balance 10. Income: Income is the profit earned during a period of time. In other words, the difference between revenue and expense is termed as Income. For example, goods costing Rs.15, 000 are sold for Rs.21, 000 is revenue and the difference, i.e., Rs.6,000 and is income. It can, therefore, be expressed as: Income= Revenue-Expense 11. Profit: It is the excess of revenue of a business over its costs. Profit is normally categorized into gross profit and net profit. Gross Profit: Gross Profit is the difference between sales revenue for the proceeds of goods sold and/or services rendered over its direct cost. Net Profit: Net Profit is the profit made after allowing for all expenses. In case expenses are more than the revenue, it is Net Loss. 12. Gain: Gain is a profit of irregular or non-recurrent nature. For examples, profit on sale of fixed asset or investment. 13. Loss: A loss is excess of expenses of a period over its related revenue which may arise from normal business activities. It decreases the owner‟s equity. It also refers to money or money‟s worth lost (or cost incurred) against which the firm receives no benefit, e.g., cash or goods lost in theft. It is also arises from events of non-recurring nature, e.g., loss on sale of fixed assets. 14. Purchases: The term „Purchases‟ is associated with or used for purchase of goods. Goods are articles purchased for resale or for producing the finished products which are also too sold. The term

- 14. Tally Erp.9 14 | P a g e IASAM ACADEMY - 011-22043114 „purchases‟ includes both cash and credit purchases of goods. Goods purchased for cash are termed as Cash Purchases and goods purchased on credit are termed as Credit Purchases. Purchase Return: Goods purchased may be returned due to any reason, say, they are not as per specifications or are defective. Goods returned are known as Purchases Return or Return Outward. 15. Sales: This term „Sales‟ is associated with or used for sale of goods that are dealt with by the firm. The term „sale‟ includes both cash and credit sales. When goods are sold for cash, they are termed as Cash Sales and who sold on credit, they are termed as Credit Sales. Sales Return: Goods sold when returned by the purchaser are termed as Sales Return or Returns Inward. 16. Stock: Stock is the tangible asset held by an enterprise for the purpose of sale in ordinary course of business or for the purpose of using it in the production of goods meant for sale. Stock may be: (1) Opening stock or (ii) Closing Stock. (i) Opening stock is the stock-in-hand in the beginning of the accounting year. In other words, it is stock-in-hand at the end of the previous accounting year. (ii) Closing stock is the stock-in-hand at the end of the accounting periods. Stock may be of the following kinds: (i) Stock of Goods: Stock of goods in the case of a trading concern comprises of stock of goods remaining unsold. In the case of manufacturing concern, it comprises of processed goods manufactured for the purpose of sale. It is valued at cost or net realizable value, whichever is lower. (ii) Stock of Raw Material: It comprises the stock of raw material used for manufacturing of goods lying unused. For example, stock of cloth to be used for stitching shirts. It is valued at cost or net realizable value, whichever is lower. (iii) Work-in-progress: It is a stock that is in the process of being finished, i.e., they are partly finished goods. It is valued at an aggregate of cost of raw material used, cost of labor, other production cost, i.e., power, fuel, etc. Stock is classified in the Balance Sheet as a Current Asset. The stock is valued on the basis of “cost or market prices whichever is lower” principle. 17. Debtor: A person who owes amount to the enterprise on account of credit sales of goods or services is called a Debtor. For example, when goods are sold to a person on credit the person is called a Debtor because he owes the amount to the enterprise. The amount due is known as debt. 18. Bill Receivable: Bill Receivable means a bill of exchange accepted by a debtor the amount of which will be received on the specified date. 19. Creditor: A person to whom an enterprise owes amount on account of credit purchases of goods or services is called a Creditor. For example, Mohan is a creditor of a firm when goods are purchased on credit from him.

- 15. Tally Erp.9 15 | P a g e IASAM ACADEMY - 011-22043114 20. Bill Payable: Bill Payable means a Bill of Exchange, the amount of which will be payable on the specified date. 21. Goods: Goods are the physical items of trade. It is a term that applies to all the items making up the sales or purchases of business. They are thus Stock-in-Trade of an enterprise, which are purchased or manufactured with a purpose of selling. For an enterprise dealing in home appliances such as T.V., fridge, A.C., etc., are goods. Similarly, for a stationer, stationery is goods. 22. Cost: It is the amount of expenditure incurred on or attributable to a specified article, product of activity. 23. Voucher: Voucher is an evidence of a business transaction. Example of voucher is Cash Memo, Invoice or Bill, Receipt, Debit/Credit notes, etc. 24. Discount: When customers are allowed any type of reduction in the prices of goods by the business, it is known as a Discount. Trade discount: Trade Discount is the rebate allowed by the seller on the basis of sales. Sales is recorded at net value, i.e., sales-Trade Discount. Similarrly purchases are recorded by the purchaser at net value, i.e., Purchases –Trade Discount. Cash Discount: Cash Discount is the rebate allowed for timely payment of due amount. It is and expense for the party allowing the discount and income for the party receiving cash discount. The accounting terms discussed above, have been prescribed in the syllabus. We are discussing below some other important terms as will. 25. Books of Accounts: Books of Accounts means Journal and Ledger in which transactions are recorded. 26. Entry: A transaction and event when recorded in the books of accounts is known as an Entry. 27. Debit: An account has two parts, i.e., debit and credit. The left side is the debit side while the right side is the credit side. If an account is to be debited, then the entry Is posted to the debit side of the account. In such an event, it is said that the account is debited. It has been derived from an Italian word „Debito‟. 28. Credit: Credit is the right side of an account. If an account is to be credited, then the entry is posted to the credit side of the account. In such an event, it is said that the account is credited; it has been derived from an Italian word „Credito‟. 29. Proprietor: The person who makes the investment and bears all the risks connected with the business is called the Proprietor 30. Receivable: The term „Receivables‟ includes the outstanding amount due from others. Sometimes, a debtor may accept a Bill of Exchange, which Is payable after a given period. Such a bill is known as Bill Receivable. Sometimes, a debtor promises to pay the specific amount in writing after a specified period. Such a promise is known as a Promissory Note and is recorded as note Receivable. The term – accounts receivable includes trade debtors as well as bills receivable and promissory notes receivable. The term receivable includes all the amounts due from others.

- 16. Tally Erp.9 16 | P a g e IASAM ACADEMY - 011-22043114 31. Payables: The term „Payables‟ include the amounts due to others. Accounts payable included trade creditors as well as bills payable and promissory notes payable. The term payable includes all the amounts due to others. 32. Depreciation: Depreciation is a fall in the value of an assets because of usage or with passage of time or obsolescence or accident. 33. Cost of Goods Sold: Cost of Goods Sold is the direct costs of the goods or services sold. 34. Bad Debts: Bad Debts are the amount that has become irrecoverable. It is a business loss and is debited to Profit and Loss Account. 35. Insolvent: Insolvent is a person or enterprise which is not in a position to pay its debts. 36. Solvent: Solvent is a person or enterprise which is in a position to pay its debts. 37. Book Value: This is the amount at which an item appears in the books of accounts or financial statements. 38. Balance Sheet: It is a statement of the financial position of an individual or enterprise as at a given date, which exhibits its assets, liabilities, Capital, reserves and other account balances at their respective book values. 39. Entity: An Entity means an economic unit which performs economic activities (e.g., Reliance Industries, Bajaj Auto, Maruti, TISCO). Business entity means a specifically identifiable business enterprise like ITC Ltd., Hira Jewelers, etc. An accounting system is always devised for a specific business entity (also called Accounting Entity). HEAD OF ACCOUNTS (1) Salary: - Amount paid to permanent employee is called salary. (2) Staff welfare: - Expenses incurred on the welfare of the staff is called staff welfare Example –tea bill, etc. (3) Medical expenses:-the expenses incurred for the treatment of the employee of called the medical expenses i.e. medicines, doctor fee, regular checkup etc. (4) Printing & stationary: - All type of stationary and printing. I.e. pen, file cover, cash book, etc. (5)Telephone expenses: - telephone bill, fax, STD and any other expenses related to telephone is called telephone expenses. (6) Postage and stamp/Telegram Expenses: - The expenses the expenses incurred on stamps, Airmail, Postcard, courier goes to postage and telegram expense. (7)Tour and travelling expenses:-The expenses incurred for tour for official purpose i.e. for collecting payment outstation or for attending some meeting or conference the road faire, train fare, air fare, and boarding and lording expenses go to tour and traveling expenses.

- 17. Tally Erp.9 17 | P a g e IASAM ACADEMY - 011-22043114 (8)Insurance:- the expenses incurred for the insurance of vehicle, building, machinery and other assets goes to insurance expenses. (9) Advertisement & publicity expenses: - any type of expenses incurred for broadcasting, advertising, either on sign board or news pappeer, ads or hording board, radio, TV, is called Advertisement &publicity expenses. (10) Sales promotion: - any expenses incurred for the promotion of sales goes to sales foes to sales promotion expenses according to. I.e. hold or restaurant bill or conference whit supplier and dealers and delegates goes to sates promotion according to. (11) Conveyance A/C:- Any expenses incurred or travelling on place to another locally i.e. auto fare, D T C pass for employees go to conveyance accordingly. (12) Freight & cartage accounts: - the amount which is spent on the transportation of goods Goes to freight and cartage accounts. (13) Consumable goods /Items Accounts: - any expenses incurred for office use are called consumable items for example soap payment duster and towel. Flower etc. (14) Entertainment expenses accounts: - any expenses incurred for the entertainment of staff goes to entertainment expenses accounts. For the example – any picnic or party or gathering or trade fare or seminar etc. (15) Fire extinguishing expenses accounts: - expenses incurred for the prevention of fire goes to fire extinguishing expenses. (16)Vehicle maintenance: - amount spends for the maintenance of vehicle such as car, bus , tempo and trunk which is used for official purpose. For example- petrol, type, repairs. (17) Audit fee: - the amount given for the services rendered by C.A. for the auditing of accounts books goes to audit fee accounts. (18) Donation a subscription accounts:- any amounts paid to society s charitable trust primeminister (19) News paper & periodical: - accounts: - any amount spends on news paper, book and magazines. Goes to News paper & periodical accounts. (20) Rent account: - The amount that is given as rent office, building, godown and staff, residence goes to rent accounts. (21) Mislenious expenses: - all types of uncountable expenses or minor expenses goes to mislenious expenses such as amount paid to sweeper, lock etc. (22) Bank charges &interest accounts :-The interest another charges lived by the bank charges &interest accounts for example- cheques charges, cheques returned charges, discounted charges, over draft interest etc. (23) Bonus accounts: - any amount given to staff except salary goes to bonus accounts. (24)Discount accounts :-any discount gives or received against bill is goes to discounts. (25) Repair &maintenance: - amount spend on the repairing and maintenance office, building, godown goes to repair &maintenance account for example wllpaper, flooring,, addition,alteration or renovation. (26) Accuntancy charges:-the amounts paid to casual other than a regular or permanent accountant goes to accountancy charges account.

- 18. Tally Erp.9 18 | P a g e IASAM ACADEMY - 011-22043114 (27) Parking expenses: - the expenses done for parking of goods are recorded ib parking expenses i.e. cartoons, boxes etc. (28)Manufacturing expenses:-all manufacturing expenses such as factory i.e. fuel, oil, power, coal gas &lighter is kept on manufacturing expenses. (29) Wages: - the amount paid to casual labour or temporary or daily wages go to wages expenses accounts. (30) Loss &damage account: - all types of loss such as good destroted by the fire, accident and good stolen etc. go to loss damage accounts. (31) Production incentives: - the profile distribution among works in the business against production is kept on production incentive accounts. 1.1 INTRODUCTION TO ACCOUNTING 1.1.1 What is Accounting? Accounting, in simplest, is keeping track of our Income, Expenses, Assets and Liabilities. This is true for business, for a household or for an individual. In the case of a business Accounting can be defined as: “… the art of systematic recording, classifying, summarizing in a significant manner and in terms of money, transactions and events which are, in part at least, of financial character, and interpreting the results thereof.” From the above definition, we note the following features of accounting: Only financial aspects are considered in Accounting. A financial transaction is one which brings some change in the financial position of business. For example, we buy raw material or sell our goods. Thereby, we spend money and earn money. These are financial transactions. But when we place an order to a supplier for a particular machinery, it does not alter the financial position of the business. Thus, it is not a financial transaction and cannot be included in Accounts Books. The transactions are to be recorded primarily in some documents. Later they are to be grouped and summarized. This leads to different steps in Accounts Compilation. The process at different steps in the Compilation of Accounts should be performed on some basic rules, which are common for all business organizations, be it Manufacturing, Trading or the Service industry. The entire organized, grouped and summarized data should reveal some information for executives at different levels in the organization. We prepare reports of standard formats for interpretation purposes. 1.1.2 Process of Financial Accounting System The basic document used in the Financial Accounting System are: Voucher Where transactions are entered first Journal Where transactions are entered chronologically and denote which accounts will be affected. Ledger Where the transactions of particular accounts are segregated and balance for each account

- 19. Tally Erp.9 19 | P a g e IASAM ACADEMY - 011-22043114 Using the above documents, the main reports prepared in the Financial Accounting System are stated below: Trial balance:- It gives the consolidated list of various Accounts and their balances. Brings out any error, procedural or airthmetical, in Journalising or posting ogf transactions. This is the source point for preparing other reports. Profit & loss report:- This statement is prepared to find the operating profit in the business for a given period. The net profit is the basis of calculating the tax. The final net profit will be transferred to the Balance Sheet. The P&L statement shows the efficiency of performing operations in the business for given period. Balance sheet:- The Balance sheet shows the financial status of the business as at a particular date. The effectiveness of managing the business is depicted here. The P&L Account and the Balance Sheet together form the basis for different analysis. The results of such analysis will be used by different groups of people such as the Income Tax Department, Banks for providing Working Capital Loans, existing and potential investors for investing in the business, and so on. 1.2 DOUBLE ENTRY SYSTEM OF ACCOUNTING 1.2.1 What is Double Entry System of Book-Keeping? Every financial transaction in an organization has two aspects. There will always be inflow of cash or kind on one side and outflow on the other. For example, purchase material from the supplier on credit. Our stocks of material increases. At the same time our liability towards the supplier (which is outflow of cash) also increases. The double entry system of Book-keeping allows us to keep track of both these aspects. Thus, as per this system at least two accounts are affected when a transaction is recorded. In the example above, the accounts affected are the Material Purchase account and the supplier account. Debit and Credit Entries in the Double Entry System How do we account for the two sides of a transaction? The respective accounts, which get changed by a transactions, get any of the two entries – Debit or Credit. In other words, one account will be debited and the other account will be credited. Passing of the Debit and Credit entries is the basic, but crucial process in Accounting. Any error in this process will have a ripple effect and will affect the final reports. 1.3 ACCOUNTS AND RULES FOR ACCOUNTING 1.3.1 Accounts Type:- Accounts can be any of four types: Assets What the business owns and what is due to be business. Liability What the business owes to other Expense A source of expenditure for running the business pertaining to a Period. Income A source of earning money in the business pertaining to a period. Exercise : Identify the following types of Accounts : Debentures Bank of India

- 20. Tally Erp.9 20 | P a g e IASAM ACADEMY - 011-22043114 Factory Shed Furniture and Fittings Taxes Payable Interest received Sales Electricity charges 1.3.2 Rules for recording Transactions Classification of Accounts by the Nature of Account and the Golden rules of Accounting: 1. Personal Account All accounts which are in the name of any Individual, Firm or Company such as Ram &Co., Shyam Gupta, Metro Transport, and so on. Rule: Debit the receiver and Credit the giver 2. Real Accounts Accounts which relate to the Assets or liabilities of the business, such as Cash A/C, Goods A/C, Furniture A/C, and so on. Rule: Debit what comes in and Credit what goes out 3. Revenue or Nominal Accounts Accounts which relate to income or expense, such as Purchase, Sales, Interest received, Salary & Wages, and so on. Rule: Debit all expenses and Credit all income Let us suppose we have a transaction “purchase of goods worth Rs. 7000/- on credit from Mahesh Traders” What accounts will be affected by this transaction? What accounts will be Debited and which will be credited? To find answers for the above questions, take the help of some basic rules of recording transactions. The rules are given below. Account Type Debit Credit Personal receiver Giver Assets/liability/capital what comes in What goes out (real) (in cash or kind) (in cash or kind) Revenue (income and Expenses and losses Income or gains Expenses) Also Known as Nominal Let us understand the rules with some examples. Consider the same transaction : (i) Purchase of goods worth Rs. 7000/- on credit from Mahesh Traders Accounts affected Purchase Mahesh Traders Type Expenses Personal Status Money paid/to be paid Giver

- 21. Tally Erp.9 21 | P a g e IASAM ACADEMY - 011-22043114 Rule Debit Expenses Credit the giver Entry Debit purchase A/C Credit Mahesh Traders A/C Amount 7000/- 7000/- Purchase A/c Dr. 7000/- (Debit all expenses) To Mahesh Traders A/c Cr. 7000/- (Credit the giver) (ii) Cash drawn from United Bank Rs. 5500/- Accounts affected cash United bank Type Assets Asset Status Money comes in Money goes out Rule Debit what comes in What goes out Entry Debit Cash A/c Credit United Bank A/c Amount 5500/- 5500/- Cash A/c Dr. 5500/- (Debit what comes in) To United Bank A/c Cr. 5500/- (Credit what goes out) 1.4 ACCOUNTING COMPILATION & REPORTS 1.4.1 Basic steps in Account Compilations, documents used and reports In this section, let us learn how to go through the different steps of Accounts compilation and see what document is used and created/ updated at each stage. The steps are as indicates below: Step 1 Recording Step 2 Classifying Step 3 Summarizing Step 4 Interpreting (by preparing reports) The sequence is best represented in the flow diagram below:

- 22. Tally Erp.9 22 | P a g e IASAM ACADEMY - 011-22043114 FIGURE-1 -Let us start with a payment transaction for example: Paid cash Rs. 700 for local Conveyance (i) Voucher or entry Document: The first document where the transaction is entered is called a Voucher. A voucher can exist in the form of an Expenses Bill, Sales Bill, Receipt, Payment, and so on. (ii) Journal entry: The second step is the stage where we classify the transaction that is, to find out which are the accountints to be debited or credited. The transaction is now entered in the form of a journal entry in a book called a journal Proper. A paper journal entry has a typical format. Given below is the journal entry for the cash payment transaction above: 25.04.2012 Electricity Charges Dr. 1000 To cash A/c 1000 The process of passing a journal entry such as the one above is based on the rules for recording transactions, discussed in the earlier section. (iii) Ledger Posting and Balancing: Ledger posting and balancing is done to findout the payment receipt, income or expenses through any Account. For example, in the Cash A/c the Electricity Charges are posted to the Debit side of Electricity Charges Ledger and the Cash A/c Credited. Thus the process of posting is transfer of individual transaction amounts from the journal to the debit or credit side in a given Account. A simple Cash Account is shown in next page with posting entries. CASH ACCOUNT TRANSACTON VOUCHER TRIAL BALANCE LEDGER ACCOUNTS JOURNAL ENTRY P&L ACCOUNTS BALANCE SHEET

- 23. Tally Erp.9 23 | P a g e IASAM ACADEMY - 011-22043114 RECEIPTS PAYMENTS DATE PARTICULARS AMT DATE PARTICULARS AMT 01.03.02 05.03.02 26.03.02 31.03.02 To Bal B/d To Bank A/c To Tour Advance A/c (Amount Refunded) Total 2500 500 1500 5000 02.03.02 04.03.02 06.03.02 07.03.02 05.03.02 31.03.02 31.03.02 By Electricity charges By Printing A/c By stationery A/c By Tour Advance A/c By other Expenses A/c By Bal C/f Total 50 35 55 460 100 4400 5000 From the above we see that the total of payment (credit total, omitting the last entry) is different from the total of receipts on the left side. But in the manual system the total of both sides are matched. To get them matched, a new entry is passed on the right side (if the debit Total is more than the credit total) or on the debit side (if the debit total is less than the credit side). This new entry is known as balancing entry and it will have the difference between the totals in the amount column. In the above cash account, the balancing entry is “By Balance Carried Forward” and the balance amount is 4400. This is the actual cash availability as at the end of March 2002. In other words, it is the closing balance as on March 31,2002. The ledger accounts are usually posted every month. (iv) Consolidating in Trial Balance : Once we get the closing balance of all accounts for the last month of the fiscal year (March), we are ready to prepare the reports. But first we get the consolidated list of such balances. The list is called the Trial Balance. The Trial Balance has three columns, namely Account Name, Debit Column and Credit Column. When an account appears in the debit column, otherwise in the credit column. A sample Trial Balance is shown below:

- 24. Tally Erp.9 24 | P a g e IASAM ACADEMY - 011-22043114 ACCOUNT NAME Capital General reserve Surplus in P&L Account Tax deducted at source Expenses payable Sales tax payable Furniture Land & building Plant & machinery State bank of india Cash in hand Fixed deposits Opening stock Material purchased Stores consumed Labour charges Factory electricity Salary & Wages Travelling expenses Other expenses Sales Interest received Other income Accounts payable Accounts receivable Total DR 227500 242500 355000 413000 3500 250000 140000 382500 55500 6300 11750 55000 131500 211500 285500 2771050 CR 500000 150000 132500 21000 49000 10000 1417500 43000 126000 322050 2771050 TYPEOF ACCOUNT Liability Liability Liability Liability Liability Liability Assets Assets Assets Assets Assets Assets Expense Expense Expense Expense Expense Expense Expense Expense Assets The Trial Balance is a source for preparing the reports. As per double entry system, every transaction has debit and credit entries of equal sum in different accounts. Hence, the total of debit balances and credit balances should be equal in the trial balance. Preparation of these consolidated reports reveals any manual or procedural errors in the earlier steps of accounts compilation. There is one more input require before we go for preparing the P&L report and the balance sheet. That is the closing entry. Closing entry is given for stock value at the end of the year. Closing stock is the value of stock available at the end of the year. The closing stock can be valued by any method such as LIFO, FIFO, Weighted Average and Moving Average. The value of stock is shown as a current assets in the Balance sheet. The closing stock of finished goods is treated as an income in the Profit & Loss (P&L) statement. 1.5 PREPARING FINAL REPORTS 1.5.1 Profit & Loss Statement: This report depicts the operating profit/ loss for given period. In many organizations, this report is prepared in two steps – trading Account and P&L Account. The trading account is a list of all direct production – related expenses on one side and the direct source of income (usually income through sales and services) on the other side . The difference between their total is the Gross Profit or Gross Loss. Given below is a sample Trading Account showing the balances in the Trial balance above. The closing stock of Finished goods is assumed as Rs. 25000 and the depreciation for the year is assumed as Rs. 37000.

- 25. Tally Erp.9 25 | P a g e IASAM ACADEMY - 011-22043114 Trading Account of ABC Company for the year ending 31 March, 2001 Expense Amount Income Amount Opening stock Add: Material purchased Labour charges Factory Power Gross profit transferred to P&L Account Total 140000 382500 1045000 6300 11750 901950 1442500 Sales Turnover Closing stock Total 1417500 25000 1442500 The P&L Account is prepared by listing all other expenses, which were not included in the Trading Account , on one side and all other incomes on the other. Additionally , the Depriciation is included in the expenses list. The first entry on the income side is the Gross Profit taken from the Trading Account. The Profit & Loss Account using the balances from the Trial Balance and Closing Entries above is given below. Profit & Loss Statement for ABC Co. For the year ending 31 March, 2001 Expenses Amount Income Amount Stores Consumed Salary & Wages Travelling Expenses Other Expenses Depreciation for the year Net operating profit Total 55500 55000 131500 211500 37000 580450 1070950 Gross profit from trading A/c Interest earned of fixed deposits Other income Total 901950 43000 126000 1070950 1.5.2 Balance Sheet The P&L statement depicts the operating profit earned or loss suffered by doing the business for the one year. But the Balance sheet provides information about the financial status of the company as on a particular date. The balance sheet is prepared taking the assets and liability type accounts from the Trial balance. The balance sheet of ABC Co. as at March 31,2002 is given in next page. The values are taken from the trial Balance and the Closing entries for Depreciation and Closing Stock.

- 26. Tally Erp.9 26 | P a g e IASAM ACADEMY - 011-22043114 Liabilities Amount Assets Amount Share capital General reserve Surplus in P&L account Tax deducted at source Expenses payable Sales tax payable Accounts payable Net profit from P&L A/c Total Liabilities 500000 150000 132500 21000 49000 10000 322050 580450 1765000 Furniture Land & Building Plant & Machinery Less Depreciation Net Fixed Assets Bank balance Cash in hand Fixed Deposits Accounting receivable Closing stock Total Assets 227500 242500 355000 37000 788000 413000 3500 250000 285500 25000 1765000 1.6 USE OF DAY BOOKS IN ACCOUNTING We learnt that all the transactions are entered from vouchers to the journal in a chronological order. Using this method, the journal becomes a voluminous book and extracting entries for posting in Ledger becomes a time-consuming job. Moreover, the debit and credit entries are written in the journal and ledger. This is a duplication of effort. To avoid these disadvantages, the day books are used. Day books are specialized books, where transactions relating to a particular type, say Sales or Purchase, are entered directly from the voucher. They are not written into the journal. At intervals, say every month, the totals from these books are carried forward and used for posting in the Ledger. When the ledger is posted from the day books, there is only one entry written. Thereby, we can get the details such as total sales or total purchase at a glance from the ledger. If we want to know the details, we have to refer to the Day books using a reference number usually the folio number of the respective Day book. These books are also called Books of Original Entry. 1.7 ACCOUNTS RECEIVABLE AND ACCOUNTS PAYABLE Accounts receivable, also known as Bills Receivable, gives he details of the dues from the Customers. The details are maintained in a sub-ledger (called Debtors Ledger or Sundry Debtors). As the sum due from customers is our money blocked, we have to monitor the receivable closely. This also helps us keep a watch on our customers‟ credit worthiness and reliability. Many statements are prepared to monitor the Accounts receivable. Some of them are Analysis Statement, Ageing analysis Statement, Business summary (month-wise or item- wise) and so on. Account payable, also known as Bills Payable, gives details of yours dues to suppliers. The details are maintained in a sub ledger (called Creditors Ledger of Sundry Creditors). A close monitoring of Accounts payable is also essential, because it helps us in our cash flow

- 27. Tally Erp.9 27 | P a g e IASAM ACADEMY - 011-22043114 planning and knowing the cash requirement at any time. Further, our credit worthiness towards our suppliers is also enhanced, which is again important. 1.8 BANK RECONCILIATION STATEMENT When we maintain a bank account, we prepare a bank book. The bank gives us one book, which is called the pass book. The entries in the bank book are made by us. The Pass book entries are made by the bank authorities. At any point of time, the final balance shown as per the Bank and the Pass book should be the same. But most of the times it will not be so. This happen because of the following reasons : When we make a cheque payment, we make the Bank book posting immediately, whereas our account will be adjusted only when the cheque is presented and honoured. When we deposit a cheque from the cutomer, we post the same in our bank book. But our account with the bank is actually adjusted only when the amount is realized. For any outstation cheque receipts or for overdrafts, the bank will deduct the service charges. This will be automatically debited to our account. But we will get the statement only after some time. But to be sure that everything goes fine and no errors are committed, a statement is regularly prepared. This statement is called the Bank Reconciliation Statement. Suppose we have the following entries in our Bank Book and Pass Book for one month ending 30.9.02 Bank Book Dr. Cr. Pass Book Dr. Cr. Opening balance Payment by cheque No. 489882 Cheque deposited No. 2345 Arvind by cheque No. 22328 Cheque deposited No. 2434 Total Balance as on 30.9.02 20000 3500 3000 26500 21800 1500 3200 4700 Opening balance Withdrawal as per Cheque No.2482 Cheque presented and realized Cheque No. 48945 Purchase of demand Draft by cheque No. 22343 service charges Total Balance as on 30.9.02 20000 3500 23500 18700 1500 3200 100 4800 Now comparing the entries in both of the books, we prepare a Bank Reconciliation Statement which looks like the one below:

- 28. Tally Erp.9 28 | P a g e IASAM ACADEMY - 011-22043114 Bank Reconciliation Statement as on 30.9.02 Dr. Cr. Balance as per Bank Book Add: Cheques issued but not presented Less: Cheques deposited but not presented Chque No. 2434. Amount – Rs.3000 21800 0 3000 Service charges 100 Total Balance as per pass Book (Bank Statement) 21800 3100 18700 Dr. Groups

- 29. Tally Erp.9 29 | P a g e IASAM ACADEMY - 011-22043114 Name Of The Accounts Groups 1. Stock A/c Stock in hand 2. Purchase A/c Purchase 3. Sales A/c Sales 4. Carriage A/c 5. Wages A/c 6. Octorio A/c 7. Import duties A/c Direct expenses 8. Duck charges A/c 9. Royalty A/c 10. Boxel & label A/c 11. Factory expenses A/c 12. Salary A/c 13. Rent A/c 14. Printing & stationery A/c 15. Audit free A/c 16. Repair & maintenance 17. Rent A/c 18. Printing & stationery A/c 19. Audit fee A/c 20. Repair & maintenance A/c 21. Interest A/c 22. Miscellaneous expense A/c 23. Donation A/c 24. Conveyance A/c 25. Vehicle maintenance A/c 26. Depreciation A/c 27. Medical expense A/c 28. Fire extension A/c 29. Accountancy charges Indirect expenses 30. Staff welfare A/c 31. Establishment A/c 32. license fee A/c 33. Brokage A/c 34. Electronic charges 35. Commission A/c 36. Advertisement A/c 37. Packing charges 38. Tours & Travelling A/c 39. Bad debts A/c 40. Telephone Charges A/c 41. Postage & telephone A/c 42. Entertainment expenses A/c 43. Legal charges 44. Incidental expenses A/c 45. Freight & carriage (outward) A/c

- 30. Tally Erp.9 30 | P a g e IASAM ACADEMY - 011-22043114 46. Business promotion 47. News & paper A/c 48. periodical A/c Indirect expenses 49. Loss & Damages A/c 50. Insurance A/c 51. Discount A/c 52. Commission received A/c 53. Interest received A/c 54. Discount received A/c 55. Rent received A/c Indirect incomes 56. Bad-debts A/c 57. Mis. Receipts A/c 58. Dividend A/c 59. Furniture A/c 60. Loan & Building A/c 61. Loose and tools A/c 62. Plant & machinery A/c Fixed assets 63. Vehicle A/c 64. Freehold land A/c 65. Patents & trade mark 66. Goodwill A/c 67. B/R A/c 68. Accrued income A/c Current Assets 69. Cash A/c Cash in hand 70. Bank A/c (SBI) Bank 71. Party dob. (sales) A/c Sundary depts 72. Investment A/c 73. F&R A/c 74. Advance A/c 75. Loan A/c 76. Drawing A/c Capital A/c 77. Reserve & fund A/c Resreve & surplus 78. Outstanding expenses Current liabilities 79. Bills payable A/c Current liabilities 80. Sales tax/ VAT A/c Duties & Taxes 81. Loan A/c Loan Liability Party Cr. Purchase from party A/c Sundry Creditors Double Entry Book Keeping I. Simple Entry II. Compound Entry The transaction affects three accounts as follows: Cash A/c Real A/c: Cash A/c (Rs4, 850) to be debited because cash is coming into business. Discount allowed A/c Nominal A/c: Discount Allowed A/c (Rs150) to be debited because it is an

- 31. Tally Erp.9 31 | P a g e IASAM ACADEMY - 011-22043114 Expense or loss for business. Satish Personal A/c: Satish‟s A/c (Rs5,000) to be credited because he is the giver of the amount The entry for the transaction is a Compound Entry as follows:- cash A/c ……..Dr. 4,850 To Satish ……...Dr. 150 (Being the amount received from satish and allowed him discount) Let us take another example of a Compound Entry. Salaries of Rs.5,000 and trade expenses of Rs.3,000 are payable for the year ended 31st March, 2010. These expenses can be recorded in the books of accounts with the following compound entry. Salary A/c …………Dr. 5,000 Trade expenses A/c ………….Dr. 3,000 To expenses payable A/c (Being the salary and trade expenses payable provided) Entries of some specific Transactions 1. Bad Debts:- (i) when the amount is irrecoverable: Bad Debts A/c ………Dr. To Debtor‟s personal A/c (Being the amount not recoverable written off as bad Debt) (ii) when a part of the debt is recoverable:- cash or Bank A/c ……….Dr. Bad Debts A/c ………Dr. To Debtor‟s personal A/c (Being the amount received and balance written off as bad debt being not recoverable) 2. Bad Debt Recovered:- cash or Bank A/c ……….Dr. To Bad Debt Recovered A/c (Being the amount earlier written off as bad debt, now recovered) 3. Cash withdrawn for personal use:- Drawing A/c ……….Dr. To cash A/c

- 32. Tally Erp.9 32 | P a g e IASAM ACADEMY - 011-22043114 (Being the cash withdrawn for personal use) 4. Banking Transactions: 5. Discount (i) Trade Discount (ii) Cash Discount 6. Goods taken for personal use: Drawing A/c ……….Dr. To purchase A/c (Being the goods taken for personal use) Note: The cost of goods withdrawn is debited to the Drawings Account and credited to purchases Account. It is not considered as a sale but as a sale but as a decrease in purchases as no profit is earned on such goods. 7. Goods given as charity:- Charity A/c ……….Dr. To purchase A/c (Being the goods given as charity, hence credited to purchases account) 8. Distributed of goods as free samples:- Advertisement A/c/Sample A/c …….Dr. To purchase A/c (Being the goods distributed as free samples) 9. Loss by Theft or Fire:- Loss by Theft or Fire A/c ……Dr. To purchase A/c (Being the loss of goods by theft or fire) Note: Loss by Theft or Fire Account is debited because the loss is a nominal account and the purchase Account is credited because the purchase decrease. The loss will be treated in accounts as follows: (i) When goods (Stock) are fully insured, loss is to be borne by the insurance company. The entry passed is: Insurance Co. or Insurance claim A/c. …………Dr. To loss by theft or fire A/c (Being the Loss of goods recoverable from the insurance company) Insurance claim is an asset and will be shown as an asset in the Balance sheet until actually received in cash. (ii) When the goods are partly insured:- Insurance Co. A/c ………….Dr.

- 33. Tally Erp.9 33 | P a g e IASAM ACADEMY - 011-22043114 Profit and Loss A/c ………….Dr. To Loss by Theft Or Fire A/c (Being the insurance claim partially admitted. Balance amount transferred to Profit and Loss A/c) (iii) When the claim is received from the insurance company: Bank A/c …………Dr. To Insurance Co. (Being the insurance claim received) (iv) When the stock is not insured, whole of the loss will be borne by the firm. At the end of the year balance in loss by Theft or Fire Account is transferred to Profit and Loss Account Profit and Loss A/c …………..Dr. To Loss by Theft Or Fire A/c (Being the loss transferred to profit and Loss Account) 10. Goods used to make an asset:- Asset A/c ……….Dr. To purchase A/c (Being the loss transferred to profit and Loss Account) 11. Purchase and sale of fixed assets:- (i) On purchase of asset for Cash: Asset A/c …………Dr. To cash or Bank A/c (Being the asset purchased against cash) (ii) On sale of asset for cash: cash or Bank A/c ……….Dr. To Asset A/c (Being the asset sold against cash) (iii) On purchase of asset on Credit:- asset A/c …….Dr. To supplier A/c (Being the asset purchased on credit) (iv) On Saele of Aset on Credit: Purchaser‟s A/c ………Dr.

- 34. Tally Erp.9 34 | P a g e IASAM ACADEMY - 011-22043114 To assets A/c (Being the asset sold on credit) 12. Expenditure on the instillation of Machinery and on the Construction of Building: 13. Central Sales Tax: (i) cash or Debtors A/c ……….Dr. To sales A/c To central sales Tax A/c (Being the sales made and central sales Tax Collectd) (ii) At the time of depositing sales Tax in the Government Account, the entry passed is: central sales Tax A/c …………..Dr. To cash or Bank A/c (Being the central sales tax collected and deposited in Government Account) 14. Value Added Tax (VAT): (i) When VAT is paid at the time of purchases: Purchases A/c ……………Dr. VAT paid A/c …………….Dr. To cash sales Tax A/c (Being the purchase made and VAT paid recorded) (ii) When VAT is collected at the time of sales:- Cash or Bank or Debtor‟s A/c ………..Dr. To sales A/c To VAT collected A/c (Being the sales madder and VAT collected rerecorded as liability) (iii)When VAT is paid to the Government: (a) VAT collected A/c ……….Dr. To VAT paid A/c (Being the balance in VAT paid A/c transferred to VAT collected A/c) (b) VAT collected A/c ………..Dr. To cash or Bank A/c.

- 35. Tally Erp.9 35 | P a g e IASAM ACADEMY - 011-22043114 (Being the balance in VAT collected A/c after transfer of balance in VAT paid A/c deposited) 15. Sundry or Miscellaneous Expenses:- Sundry Expenses A/c ……….Dr. To Cash A/c (Being the miscellaneous expenses incurred) 16. Income Tax:- (i) When Income tax is paid:- income Tax A/c ……..Dr. To cash or Bank A/c. (Being the income tax paid) (iii) For treating it as drawings of the proprietor: Drawing A/c …….Dr. To income Tax A/c (Being the income tax paid transferred to drawings) 17. closing Stock: Closing stock A/c …………Dr. To Trading A/c. (Being the closing stock recorded) Remember: Closing stock is to be valued at cost or net realizable value (market price) whichever is lower. 18. Outstanding Expenses:- Wages A/c …………….Dr. 500 To Outstanding Wages A/c 500 (Being the outstanding wages accounted) 19. Prepaid Expenses: Prepaid Expenses A/c (Prepaid insurance premium A/c in the above example) To insurance premium A/c (Being the amount transferred to prepaid expenses A/c of insurance for the period)

- 36. Tally Erp.9 36 | P a g e IASAM ACADEMY - 011-22043114 1st April, 2011 to 30th June, 2011 Note: prepaid Insurance premium A/c is an asset. 20. Depreciation:- Depreciation A/c To asset A/c (Being the depreciation on asset provided) 21. Interest on capital: Interest on capital A/c ……………Dr. To capital A/c (Being the interest on capital allowed @....%) 22. Interest on Drawings: Drawing A/c ………….Dr. To Interest on Drawings (Being the interest on drawings charged @.......%) (ii) Posting an Account Credited in a Journal entry: Furniture A/c …………Dr. To modern Furniture A/c (Being the furniture purchased) Tally ERP. Tally is the no. 1 financial accounting package which allows used to create a company a company , create an accounts, create a voucher and print report or more…..(used in India and abroad also) Creating a company:- For first time to start working which tally a company is to be created a company, first time typing the company name & addresses etc. Method of manufacturing account in tally 1) Accounts only 2) Account with inventory Starting date of company/transaction 1) Financial year 2) Books being from

- 37. Tally Erp.9 37 | P a g e IASAM ACADEMY - 011-22043114 When the company created in tally automatically to create two accounts. 1) Cash 2) Profit& Loss A/ To Create a company :- Got Alt+ F3 Create company As your requirement OK To edit the company :- GOT Alt + F3 Alter edit OK To delete the company GOT Alt F3 Alter Alt + D Yes yesOK To select the company:- GOT Alt + F3 Select the requirement company OK To change the financial period:- GOT Alt + F2 Change financial period OK To change the voucher date:- GOT Accounting voucher F2 Give the voucher date Ok To save the voucher/Ledger etc. Ctrl + A To create online ledger:- Alt (when your cursor/ selection on ledger place) To create online calculator:- Alt + C (when your cursor/ selection on value/ number column) To display any ledger/Day book/ Inventory/ etc. GOT Display Check & See the effect OK. To create a ledger/Opening Balance:- GOT Account info Ledger Create as your requirement ledger OK (Ctrl + A) To open the voucher entry:- GOT Accounting voucher as your requirement OK (Ctrl+A). Some Voucher name 1) Contra ------------------------------------F4 Only for this situation:- Bank to Bank -----For example-------------------SBIUTI Bank to Cash------For example-------------------SBICASH Cash to Cash------For example------------------ CASHPETTY CASH Suppose cash deposit to SBI Rs 100,000 by P.V. Ltd. SBI A/C-------------------------Dr. To Cash A/C

- 38. Tally Erp.9 38 | P a g e IASAM ACADEMY - 011-22043114 (Under contra entry after pressing F4) 2) Payment ............................................................................... F5 Expenses/Purchase /Assets etc. For example:- Salary paid to Ram RS 20,000 Salary A/C -----------------------Dr. 20,000 To Cash A/C 20,000 (under payment entry after pressing F5) 3) Receipt/ Received (Received any amount)------------F6 For example:- RS 20,000 Received from Ram & Sons Cash A/C -----------------------Dr. 20,000 To Ram & Sons. A/C 20,000 (under receipt after pressing F6) 4) Journal---------------------------------------------------------F7 5) Purchase ------------------------------------------------------F9 (purchase any trading goods normally) For example:- Purchase goods RS 10,000 from ABC Ltd. In cash V.V.I. Shortcut key for Tally Function key Description F1 _______________________________________________ Select the company F2 __________________________________________ Change the voucher date F3 _______________________________________________Create the company F4 _____________________________________________________Contra entry F5 ___________________________________________________ Payment entry F6 ____________________________________________________ Receipt entry F7 ____________________________________________________ Journal entry

- 39. Tally Erp.9 39 | P a g e IASAM ACADEMY - 011-22043114 F8 ______________________________________________________ Sales entry F9 __________________________________________________ Purchases entry F10 _______________________________________________ Reversing journal F11 ________________________________________________________ Feature F12 ___________________________________________________Configuration Alt+F1 ____________________________________________ Shut the company Alt+F2 ____________________________________________ Change the Period Alt+F3 ____________________________ Select the company, Create comp.etc. Alt+F4 _______________________________________________Purchase order Alt+F5 __________________________________________________ Sales order Alt+F6 ________________________________________________ Rejection out Alt+F7 _______________________________________________ Stock Journal Alt+F8 ________________________________________________ Delivery note Alt+F9 ________________________________________________Receipt Notes. Alt+F10 ______________________________________________ Physical Stock Ctrl+F6_________________________________________________ Rejection in Ctrl+F8__________________________________________________ Debit notes Ctrl+F9_________________________________________________ Credit notes Ctrl+F10______________________________________________ Memorandum Ctrl+V _________________________________ Voucher mode/Inventory mode Ctrl+L _________________________________________________Option mode

- 40. Tally Erp.9 40 | P a g e IASAM ACADEMY - 011-22043114 New Features - Tally.ERP 9 Some of the new features in Tally.ERP 9 include, Remote Access Tally.NET (to be read as Tally.NET) Simplified Installation process New Licensing Mechanism Control Centre Support Centre Enhanced Look & Feel Enhanced Payroll Compliance Excise for Manufacturers Auditors� Edition of Tally.ERP 9 (Auditing Capabilities for Auditors�) Enhanced Tax Deducted at Source Remote Access Tally.ERP 9 provides remote capabilities to its users to access data from anywhere. Using Tally.NET features, the user can create remote users (ids), authorize & authenticate them to access company remotely. Currently, the remote connectivity allows the user to view/display the required information on his system instantly. The process for remote access is as follows: Start Tally.ERP 9, load the required company and connect to Tally.NET Enter the remote user ID at the remote login location to access company data from Tally.ERP 9 Licensed / Educational.

- 41. Tally Erp.9 41 | P a g e IASAM ACADEMY - 011-22043114 Requirements for Remote Connectivity: At the Customer�s Location: A valid Internet connection A valid Tally.ERP 9 License with a Tally.NET subscription Create and authorise remote users for a Company that has to be accessed remotely Load & Connect the Company to Tally.NET for remote access Note: For the company to be accessed by the Remote User the computer has to be kept on and Tally.ERP 9 with company loaded. At the Remote Location: A valid Internet connection Tally.ERP 9 (Licensed/Education) A valid remote User ID and Password Benefits of Remote Access: Provides anytime, anywhere access to required information Allows you to access Reports & Statements on the move to keep yourself updated with the latest Business happenings. Enhances response time to customers (For e.g., Sales staff can access Customer�s Outstanding Statement for immediate reference / discussion) Easy access to financial information for faster & timely decision making. Data Security: The Remote connectivity is initiated with a secured Handshake between two computers using Tally.NET environment. Customer can allow / disallow access to the Company Data for remote users at any point of time. Data resides on the Customer�s Computer only. Encrypted Data is transferred between two computers on request. The customer can assign Security controls to remote users depending upon what access to be given. For the Remote user(s) Back up / Restore options will not be available in the remote location.

- 42. Tally Erp.9 42 | P a g e IASAM ACADEMY - 011-22043114 Remote TDL�s During Remote Access, the additional TDL�s running at the customer�s place will also be available to the Remote User at the remote Location. The user experience remains the same either working locally on Customer�s Computer or from a Remote Location. It is recommended to use Broadband connections to enjoy the best Remote experience. Tally.NET Tally.NET is an enabling environment which works behind the scenes to facilitate various Internet based services in Tally.ERP 9. Each Tally.ERP 9 is enabled for Tally.NET Services by default. Tally.NET provides the following services/capabilities in this release of Tally.ERP 9: Tally.NET Features Create and maintain Remote Users Remote Access Control Centre Support Centre Synchronization of data (via Tally.NET) Product updates & upgrades The following services will be available in the forthcoming releases: Online help capability in the form of reference Manuals, Articles and FAQ�s Access information from Tally.ERP 9 via SMS from mobile Employer Recruitment Test Simplified Installation Process Tally.ERP 9 comes with a new enhanced installer, which allows the user to configure different settings from a single screen, as per requirements. New Tally.ERP 9 Installer The new installer allows the user to install Tally.ERP 9 application as well as License Server, however you may choose to install either of them one after the other. Using the new Installer, the user can install Tally.ERP 9 and License Server separately on different Computers/folders or same folder.

- 43. Tally Erp.9 43 | P a g e IASAM ACADEMY - 011-22043114 While installing Tally.ERP 9, the user can specify the path for Application, Data, Configuration and Language files to be stored. While Installing Tally.ERP 9 on the Client machine in a multiuser environment, the user is required to provide the Computer Name / IP Address and Port Number of the computer, where the License Server is installed & running. Uninstaller: The Uninstaller wizard similar to the Installer, also provides flexibility to uninstall either Tally.ERP 9 application or License Server separately or both together. If only License Server is uninstalled, then Tally.ERP 9 will switch to Education mode on the Client Computer. Tally Admin Tool The TallyAdmin tool is a new component that has been introduced with Tally.ERP 9 which enables the user to perform the following activities without starting Tally.ERP 9 Initiate License Service operations. Display the active Tally.ERP 9 License Servers in a LAN. Administer Site License for different products from Tally.ERP 9. Check network connections between the computers designated as Client and Server. Convert TCP and TSF files of Tally 9 to the format compatible with Tally.ERP 9. The Tally Admin Tool is available in the Tally.ERP 9 application folder, on installation. Introduction to TDL Server DLL Component Tally.ERP 9 onwards, a new component TDLServer.DLL has been introduced, which gets copied to the folder in which Tally.ERP 9 has been installed. All the default TDL files of Tally have been integrated in this component. On invoking Tally.ERP 9, these TDL�s will be loaded. The user TDL�s will be subsequently loaded as usual from Tally.ini. The componentization will result in a more robust application. The benefits of this componentization are as follows- In case of any updates/ changes in TDL, only TDLServer.dll file needs to be downloaded and not the entire Tally application which enables faster downloads.

- 44. Tally Erp.9 44 | P a g e IASAM ACADEMY - 011-22043114 This will help in dynamic loading and unloading of TDL Files while Tally application is running Forthcoming Tally Developer will be directly using this component, thus eliminating the need for a separate DefTDL.dat file. Unified File Format for Tally.ERP 9 The Tally.ERP 9 application folder contains files other than the data files. These are referred to as secondary files. From this release onwards the file format of all the secondary files have been standardized. TCP Files All the TDL files which were compiled for previous versions of Tally as .tcp have to be converted to a new format. Mentioned below are the ways in which this can be done. Note: The TDL files in txt format does not require this conversion. Conversion of Tally 7.2 tcp files to Tally.ERP 9 Format Tally7.2 tcp files can be migrated to Tally.ERP 9 format using the Tally72Migration tool available in the Tally.ERP 9 folder. Migration process is the same as earlier. Conversion of Tally 9 tcp files to Tally.ERP 9 Format Automatic Conversion Process: When Tally.ERP 9 is installed in the existing Tally 9 folder then all the files with .tcp extension included in the �tally.ini� file are automatically converted to the Tally.ERP 9 compatible format. The original �.tcp� file is renamed as �<filename>.tcp.BAK�. The name of the file which is converted to new format is same as the original filename. The original TCP file is retained as a backup file. Manual Conversion Process: To manually convert the files in the new format use the Conversion tab of Tally Admin Tool. It is mandatory to specify the File Type. The file Type can be TSF or TCP. TSF: Converts tally configuration file from old format to new format e.g. tallysav.tsf to tallycfg.tsf TCP: Converts TCP file from old format to new format. In the Source File box specify the name of file to be converted. In Destination File box provide the name for the converted file. Note: Start Tally.ERP 9 and check the status of your TDL file. [Go to Gateway of Tally, click F12:Configuration > Functions and Features] If the status is Active, then the tdl is compatible to Tally.ERP 9 format. If the status is Error, then scroll down to the line and press enter to know the details. Then make the TDL syntactically compatible as per the Tally.ERP 9 standards. Configuration File Manually the file �Tallysav.tsf� can be converted to the new standardized format by selecting �TSF� as the file type in the Conversion tab of Tally Admin Tool. Ensure that the destination file name is �Tallycfg.tsf� Licensing in Tally.ERP 9 Tally.ERP 9 launches a new Licensing mechanism which is simple, user-friendly and addresses all the licensing activities from a single screen for users across segments of business. Besides, allowing activation of Single User (Silver) and Multi User (Gold) license, it also extends the feature to Multi-Site Licensing. The salient features of Licensing are: License Activation is simple and easy two step process. Introducing the concept of an Account for better management & administration of Licenses through the Control Centre. Provide your Account ID and Password to reactivate license The flexibility and compatibility to centrally manage multiple licenses across locations in a secured environment Removes all licensing data from your computer for a particular instance of license. Site Licensing A new concept of Site Licensing is introduced from Tally.ERP 9. A site refers to activation of Tally.ERP 9 Single or Multi User license. The site licensing is broadly classified into two categories namely Single Site and Multi-Site.

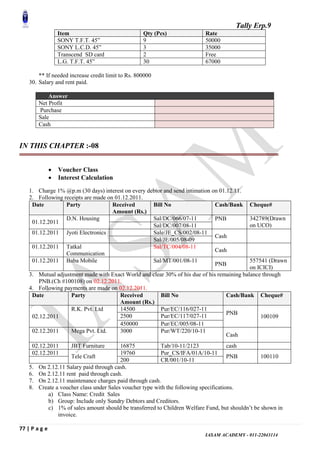

- 45. Tally Erp.9 45 | P a g e IASAM ACADEMY - 011-22043114 Single Site: A single instance of Tally.ERP 9 Silver or Gold license is active at a time under an Account. Multi Site: Is more than one active Tally.ERP 9 Silver or Gold licenses on different machines under a single account comprising of same or different Serial numbers. Advantages: Centrally configure Sites / License across locations. An Account is created using your E-Mail ID provided in the activation form. All the serial numbers are assigned to the Account. User can split an Account or merge two or more Accounts. The Account information is accessible using the Account ID and Password. Licensing Mechanism Provide the required details and your E-Mail ID in the activation form. On processing the request an encrypted (not in readable format) license file is generated and needs to be decrypted using a set of character and numbers called key. Control Centre Control Centre is a new feature being introduced with Tally.ERP 9. This utilises Tally.NET as an interface between the end user and Tally.ERP 9 installed at different locations. With the help of Control Centre, you will able to: Create users with predefined Security levels Centrally Configure & manage your Tally.ERP 9 Surrender, Confirm or Reject activation of a Site Maintain Account related information Following are brief descriptions of the features of the Control Center: Create users with predefined Security levels Using the Control Centre feature, the Account Administrator can create users and map them to a predefined security level and authorise them to access a Site/Location linked to that Account. Further, the system administrator can also create Remote users (Tally.NET Users & Tally.NET Auditors) and allow / disallow them to remotely access the data. The predefined security levels in Tally.ERP 9 are: Owner - This security level refers to the ownership for the complete Account. The Owner can create Standard Users or Owners with required permissions. Standard User - Created by the Owner with required permissions. Centrally Configure and manage your Tally.ERP 9 The Control Centre provides the flexibility to create (or change) the master configurations set for an Account and apply them to one or more sites (all sites) belonging to that Account. The following master configurations set can be made from the Control Centre: Add/Modify the Tally.ini parameters Assign TDL�s to a site or all the sites under an Account Permit or Deny changes to the local configurations The master configurations set created, is applied initially to the Account centrally, which is then inherited by the site(s) on updation of license, based on the site level permissions defined by the Account Administrator. Surrender, Confirm or Reject activation of a Site The Account Administrator is authorised to surrender, confirm a site license or Reject the request received on activation from another site. Maintain Account related information Allows you to maintain information about the organisation. Based on the requirements, the Account Administrator can merge multiple accounts into one or split an account into multiple accounts for easy and better management. Support Centre Tally.ERP 9 provides a new capability known as Support Centre, wherein a user can directly post his support queries on the functional and technical aspects of the Product. Using Support Centre feature, the