BCG Matrix presentation

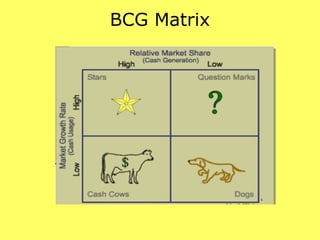

- 1. BCG Matrix

- 2. Company's Portfolio Portfolio : A business portfolio is a company’s set of investments, holdings, products, businesses and brands. A product portfolio is the product’s mix of market segments. Marketing managers attempt to make a product appeal to specific groups of people, called segments. Examples of segments may be college graduates, infant babies, men only , women only. Strategic business units : The items in a business’s portfolio may be called strategic business units, or SBU's. Having identified the business units that result from the analysis, the company’s next task is to determine what objectives, strategy and budget to assign to each business unit.

- 3. MODELS FOR PORTFOLIO ANALYSIS Several models have been developed for use when evaluating a company’s portfolio.Such include : Market share model, the Growth share Matrix and the multifactor portfoliomatrix.

- 4. Introduction The Boston Consulting Group (BCG) is a global management consulting firm with 82 offices in 46 countries founded in 1963. The firm advises clients in the private, public, and not-for-profit sectors around the world. In the early 1970’s the Boston Consulting Group (BCG) developed a model for managing a portfolio of different strategic business units (SBUs) or major product lines.

- 5. Bruce Henderson, CEO BCG (1915 - 1992)

- 6. Why Need a model or BCG Matrix ? The chart is a graphical planning tool, where the company’s products and services can be plotted to help make key business decisions. These decisions include whether to keep a particular business unit, sell it or to invest more in it. The y-axis of the graph represents rate of market growth while the x-axis represents market share. A portfolio management tool based on product life cycle theory.

- 7. BCG Growth Share Matrix

- 8. Structure The BCG GrowthShare Matrix is a four cell (2 by 2) matrix used to perform business portfolio analysis as a step in the strategic planning process. The BCG Growth Share Matrix positions the various SBUs/product lines based on Market Growth Rate and Market Share relative to the most important competitor.

- 9. FOUR CATEGORIES OF SBU’S

- 10. Market share ( X-axis ) Market share is the percentage of either revenue or volume of sales that your organization has of the total market. In other words, the higher your market share, the bigger the proportion of the market you control and influence. Relative market share is the firm’s or brands market share is an index of its largest competitor. In this way, relative market share becomes a measure of competitive strength. The formula for calculating relative market share is as follows:

- 11. Market Growth ( Y- axis ) Market growth is the percentage growth compared to the previous year. It is used as a measure of how attractive a market is to existing providers and potential new entrants. High market growth creates an environment in which it is relatively easy for organizations to grow their profits, even if their market share remains the same. In contrast, if your product is in a low growth market you will face intense competitive activity and your organization will need to employ significant effort just to retain its market share, even if it is an established provider.

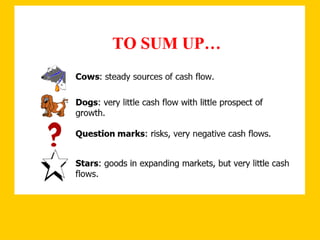

- 12. Cash Cows (high share, low growth) Cash cows: Cash cows are the leaders in the marketplace and generate more cash than they consume. These are business units or products that have a high market share, but low growth prospects. Cash cows provide the cash required to turn question marks into market leaders, to cover the administrative costs of the company, to fund research and development, to service the corporate debt, and to pay dividends to shareholders. Companies are advised to invest in cash cows to maintain the current level of productivity, or to "milk" the gains passively. So …...Cash Cows are

- 13. More Facts … Cash cows are products or services that have achieved market leader status, provide positive cash flows and a return on assets (ROA) that exceeds the market growth rate. The return on assets (ROA) shows the percentage of how profitable a company's assets are in generating revenue. The return on assets ratio, often called the return on total assets, is a profitability ratio that measures the net income produced by total assets during a period by comparing net income to the average total assets. ROA can be computed as:

- 14. Stars ( High growth, High Market Share) Stars are leaders in business. They also require heavy investment, to maintain its large market share. It leads to large amount cash consumption and cash generation. Attempts should be made to hold the market share otherwise the star will become a CASH COW.

- 15. Problem Child Or Question Mark (low share, high growth) A Question Mark has a low market share in a fast-growing market. Whilst this type of product is likely to generate some revenue it may not be enough to sustain rapid growth and it may become a net consumer of cash as it struggles to retain its market share. Identifying those Question Marks that have the potential to gain sufficient market share to become a Star and eventually a Cash Cow is critically important to the future of any organization. It is essential to define how much investment the organization is prepared to allocate to a Question Mark product in order to gain market

- 16. More facts ... So the Question marks are products which may give high returns but at the same time may also flop and may have to be taken out of the market. This uncertainty gives the quadrant the name “Question Mark”. The major problem associated with having Question marks is the amount of investment which it might need and whether the investment will give returns in the end or whether it will be completely wasted. Strategies for Question marks – As they are new entry products with high growth rate, the growth rate needs to be capitalized in such a manner that question marks turn into high

- 17. Dogs (low share, low growth) Product classified as dogs always have a weak market share in a low growth market. These products are very likely making a loss or a very low profit at best. These products can be a big drain on management time and resources. The question for managers are whether the investment currently being spent on keeping these products alive, could be spent on making something that would be more profitable. The answer to this question is usually yes.

- 18. More facts ... Strategies for Dogs – Depending on the amount of cash which is already invested in this quadrant, the company can either divest the product altogether or it can revamp the product through rebranding / innovation / adding features etc. However, moving a dog towards a star or a cash cow is very difficult. It can be moved only to the question mark region where again the future of the product is unknown. Thus in cases of Dog products, divestment strategy is used.

- 19. In General ..

- 20. Colgate since 1873 BCG Matrix

- 22. Final Cases ..

- 23. Sequences Success Sequence in BCG Matrix – The Success sequence of BCG matrix happens when a question mark becomes a Star and finally it becomes a cash cow. This is the best sequence which really give a boost to the companies profits and growth. The success sequence unlike the disaster sequence is entirely dependent on the right decision making. Disaster sequence in BCG Matrix – Disaster sequence of BCG matrix happens when a product which is a cash cow, due to competitive pressure might be moved to a star. It fails out

- 26. THE AIM IS …. • to keep the cows, • sell the dogs to finance the question marks • and work to turn the cows into stars • before they turn into dogs

- 27. Thanks ...