BCG_Meta Report

- 1. March 2023 Harnessing digital to drive M&E growth Seeing the BIG Picture

- 2. Boston Consulting Group partners with leaders in business and society to tackle their most important challenges and capture their greatest opportunities. BCG was the pioneer in business strategy when it was founded in 1963. Today, we work closely with clients to embrace a transformational approach aimed at benefiting all stakeholders — empowering organizations to grow, build sustainable competitive advantage, and drive positive societal impact. Our diverse, global teams bring deep industry and functional expertise and a range of perspectives that question the status quo and spark change. BCG delivers solutions through leading-edge management consulting, technology and design, and corporate and digital ventures. We work in a uniquely collaborative model across the firm and throughout all levels of the client organization, fueled by the goal of helping our clients thrive and enabling them to make the world a better place. Meta builds technologies that help people connect, find communities, and grow businesses. When Facebook launched in 2004, it changed the way people connect. Apps like Messenger, Instagram and WhatsApp further empowered billions around the world. Now, Meta is moving beyond 2D screens toward immersive experiences like augmented and virtual reality to help build the next evolution in social technology.

- 3. Shaveen Garg THE ORIGINS OF THE STUDY Media & Entertainment (M&E) players around the world have embraced digital-forward practices to become future-ready. They recognize the power of digital to influence every stage of the consumer’s media consumption journey, from discovery to interest to engagement. Yet Indian players have been hesitant to embrace digital. BCG and Meta have come together to present a view on how digital can drive growth for M&E organizations in India. We connected with 30+ industry leaders from LTV, OTT and Movie Studios to get the complete industry perspective. We complemented this with a quantitative survey of ~2,600 consumers and in-depth discussions with 50+ viewers, for a holistic customer perspective. We are grateful to these industry leaders and consumers for their invaluable contributions.

- 4. THE TRAILER High consumer involvement post content discovery Digital plays a critical role across the content consumption journey Think full funnel 50–60% of consumers actively research and engage with content Of these, 50%+ are digitally influenced Deploy digital as a complementary medium Significant consumer involvement on digital channels beyond LTV/OTT network Ideate, create and share digital-forward content ~50% off-network activity happens on digital 3 digital touchpoints between content discovery and consumption Ramp up digital engagement Word of Mouth (WoM) increases appointment viewing and reduces churn Design and execute targeted campaigns to nudge WoM Up to 40% higher watch times for digitally engaged audiences 40%+ viewers discover content on digital via WoM

- 5. Identify pockets of innovation Urgent need to re-think and formulate business, content and marketing strategies to accelerate growth Nurture Test and learn culture with agile teaming Re-allocate marketing spends basis incremental returns Tailor digital activations basis digital maturity Build capabilities to match global peers Best-in-class companies build an ecosystem to design and execute digital activations Technology and data Content factory Measurement toolkit Organizational Flywheel for user engagement Unlock significant value with digital Strategic digital activations expand the viewer base and drive top-line growth 2.5–3x higher active user base 1.5–2x higher time spent 30–40% sales uplift for LTV and Movie Studios 35–40% marketing spends efficiency for OTT

- 6. SHOOTING SCHEDULE 01 02 LIGHTS Understanding the power of digital and evolving consumer behavior CAMERA Attracting and engaging the viewer P a g e 0 8 P a g e 2 4

- 7. 03 04 ACTION Building a digital-ready organization P a g e 4 4 P a g e 5 4 BEHIND THE SCENES Key research data points and glossary of terms

- 8. 8 8 LIGHTS Understanding the power of digital and evolving consumer behavior 01

- 9. 9 9

- 10. CAGR 19–22 CAGR 19–22 SEEING THE BIG PICTURE : HARNESSING DIGITAL TO DRIVE M&E GROWTH 10 11% 17% 51% India is an entertainment-hungry nation – and growth in digital is driving new content consumption 1. TV: ages 18+ who use at least once per month; includes live, DVR, and other prerecorded video (such as video downloaded from the internet but saved locally); includes all time spent watching TV, regardless of multitasking. If all population with age 18+ is considered, average hours per day is 3.28 hours as of 2022; 2. Digital: ages 18+ who use at least once per month; includes all time spent with online video activities, regardless of multitasking; includes viewing via desktop/laptop computers, mobile (smartphones and tablets) and other connected devices (game consoles, connected TVs or OTT devices); 3. Includes gaming, print and radio 4. Estimated Source: Media consumption in India 2022 from E-marketer; Industry Reports; BCG Analysis Growth in digital consumption outpacing all other segments PayTV households in India continue a growing trend while the US and China are static or declining… Number of hours of consumption/day/viewer 2019 2022E4 2.8–3.0 2.1–2.2 3.8–3.9 8.7–9.1 10.6–11.2 4.3–4.5 3.0–3.3 3.3–3.4 Digital video2 Television1 Others3 …and the number of OTT SVoD subscribers is growing 3–4x faster than in US and China India India US US China China 2% 0% -7%

- 11. +5% +12% CAGR 22–25 ~600Mn online video viewers in India (50% up vs. 2019) 50%+ of all time spent on OTT by 2025 will be on vernacular content Original content on OTT to reach 4,000 hours by 2024 (2x vs. 2019) Faster growth in post-pandemic period 3% 34% 17% 11 2016 2019 14 2022E2 18-20 2025F3 LTV Digital Video (OTT, SFV) Movie Studios 20% 3% 77% 13 19% 8% 73% 13% 20% 67% 15% 33% 52% LIGHTS : UNDERSTANDING THE POWER OF DIGITAL & EVOLVING CONSUMER BEHAVIOR 11 Video verticals are catering to this appetite and expected to grow at 12%+ CAGR for next 3 years In USD Bn Video-based media and entertainment market size in India This report is focused on the LTV, OTT and Movie Studios sectors 1. Short form video apps 2. Estimated 3. Forecasted Source: India Media Market Size, 2022 from Magna Global; Tuning Into Consumer, March 2022 by EY & FICCI; Press Articles; BCG Analysis Pre-pandemic Post-pandemic

- 12. 6% CAGR 13% CAGR SEEING THE BIG PICTURE : HARNESSING DIGITAL TO DRIVE M&E GROWTH 12 1. Users using internet for more than 4 years 2. Estimated 3. Forecasted Source: BCG analysis Digitally active users are growing and expected to be 85% of internet users 2030F 2020 2022E2 2025F3 Internet users aged 18+ 894 515 624 Digitally active users1 224 Share of digitally aged populations among internet users 43% 59% 73% 85% In Mn In Mn In Mn In Mn 757 366 743 545

- 13. Digital 67% Relative size of M&E Industry 33% 46% 54% 42% 58% 10% 90% 28% 72% LIGHTS : UNDERSTANDING THE POWER OF DIGITAL & EVOLVING CONSUMER BEHAVIOR 13 1. For 2021 2. Average of 11 countries other than India Source: Media Market & Advertising Overview, 2021 from Magna Global; Industry Expert Interviews; BCG Analysis However, Indian media companies are under-indexed on marketing spends and digital capabilities Indian M&E industry spends lower than international peers Even domestically, digital spends lower than other B2C industries Urgent need to invest in internal digital capabilities Marketing spends as % of industry revenue1 Share of digital in marketing spends1 In USD Mn Offline Average2 3.7% UK France Australia United States Japan Canada Brazil India China Italy South Korea Germany Average 57% 100 60 20 80 40 0 0 1 2 3 4 5 10 1,650 Retail 680 BFSI 370 Telecom 1,400 FMCG 600 M&E Industry speak "Majority of our efforts are on own network, digital is seen as a secondary driver of reach" "Digital is growing but our LTV network still has majority of the eyeballs" "Lack of clarity on the impact of digital activations puts a lot of resistance in executing these"

- 14. DISCOVERY SEEING THE BIG PICTURE : HARNESSING DIGITAL TO DRIVE M&E GROWTH 14 Gender Income Language Digital maturity Male Large town Small town Female Less than 35 years Less than INR 10 lacs1 More than 35 years More than INR 10 lacs Hindi 57% Regional 41% English 2% High: Typical app usage: SVoD OTT, app-based cab booking, internet/mobile banking Low to moderate: Typical app usage: social media, search, e-com shoppers, AVoD OTT, mobile wallets We looked at consumers across demographics… Consumer lens 1. Per annum 2. Large towns – metros and tier-1 cities and small town – tier 2 and 3 cities Source: BCG Consumer Content Consumption Survey, October 2022, N = 2,615 53% 53% 47% 47% 57% 45% 43% 55% 56% 44% • Getting to know about a new/existing piece of content on that respective channel/studio/OTT platform Age groups City tier2 Business objectives Drive awareness among customers who are • Not aware about the platform • Not aware about the content • Dormant/churned Consumer voice "Top 10 trending are a great way to discover good content pieces" "I came across a meme from a recent release and decided to watch its trailer"

- 15. INTEREST ENGAGEMENT LIGHTS : UNDERSTANDING THE POWER OF DIGITAL & EVOLVING CONSUMER BEHAVIOR 15 ...to understand their content consumption journey and the key drivers • Gathering information actively to make a conscious decision to watch/not watch a piece of content • Actively following the content episode after episode, season after season (incl. catchup) • Sharing of related info (view, feedback, recommendation) while consuming the content • Involved with the content beyond watching it (fandom, discussions on characters / plot etc.) • Maximizing subscriptions • Generating interest about the content Engaging with audiences by various marketing initiatives • Maximizing time spent • Maximizing frequency of visits • Reducing churn rate Social listening to gauge reaction to content "We have a group where we review and discuss new shows and movies" "I search for information about the content online and check out reviews by influencers" "Whenever I am watching something, I usually take a picture of my laptop screen and post it online" "I follow official handles of my favorite celebs; at times they have shared my posts on their handles as well" "I usually watch sports highlights on my phone when I am having a meal"

- 16. SEEING THE BIG PICTURE : HARNESSING DIGITAL TO DRIVE M&E GROWTH 16 CORE OBJECTIVE OF THE STUDY WAS TO UNDERSTAND… How media companies can catalyze growth through digital...

- 17. LIGHTS : UNDERSTANDING THE POWER OF DIGITAL & EVOLVING CONSUMER BEHAVIOR 17

- 18. SEEING THE BIG PICTURE : HARNESSING DIGITAL TO DRIVE M&E GROWTH 18 Activations to be designed keeping in mind… High overlap in content consumption across verticals – blurring boundaries in consumers' mind Similar digital influence for Hindi and Regional content content viewers; however, important nuances in the choice of channels and activities within them Significant digital influence observed even for cohorts generally considered to be digitally passive (over – 35 years, women, small- town residents)

- 19. LIGHTS : UNDERSTANDING THE POWER OF DIGITAL & EVOLVING CONSUMER BEHAVIOR 19 Consumers seamlessly transition across LTV and OTT 43% respondents consume content across verticals Content consumption is vertical agnostic for 40%+ respondents… Share of respondents …rather, consumers’ choice of platform to watch content depends on external factors Source: BCG qualitative research, October 2022, N=50; BCG Consumer Content Consumption Survey, October 2022, N = 2,615 38% 11% 38% 3% 1% 1% 8% LTV OTT Movie Studios Priyanka, Patiala, 34 years Jugal, Mumbai, 25 years "I love watching a particular serial on TV because I like the way the lead acts and dresses" "I never skip the episodes and have been watching it since the last 2–3 years" "Sometimes, when I miss an episode on TV, I watch it online the next day" "I am a sports lover and sports means Cricket and Kabaddi for me" "I usually watch them on TV. But, if my family wants to watch something else, I switch to OTT apps on my phone or laptop" "Whenever I am in office, I watch live cricket matches on streaming platforms on my laptop"

- 20. SEEING THE BIG PICTURE : HARNESSING DIGITAL TO DRIVE M&E GROWTH 20 Age Gender Annual income City-tier <35 years 35 years+ Male Female <INR 10 lacs INR 10 lacs+ Large towns Small towns PRE WATCHING1 LTV 40% 28% 26% 34% 33% 35% 31% 39% OTT 78 71% 70% 66% 76% 76% 74% 81% Movie Studios 62% 54% 45% 55% 63% 56% 55% 68% POST WATCHING2 LTV 68% 60% 67% 65% 64% 64% 64% 65% OTT 72% 70% 78% 77% 72% 71% 72% 72% Movie Studios 69% 70% 68% 74% 69% 69% 70% 69% Contrary to industry belief, even cohorts like over–35 years, women and small-town residents have significant digital influence 1. Includes digital influence in the “pre-watching” stage of media content journey (i.e., discovery and interest) 2. Includes digital influence in the “post-watching” stage of media content journey (i.e., engagement) Source: BCG Consumer Content Consumption Survey, October 2022, N = 2,615 <25% 25-50% <75% 50-75% Digital efforts should be planned to target audiences across demographics % respondents digitally influenced at each journey stage Digital influence and interaction is age, gender, income & city-tier agnostic

- 21. Similar levels of digital influence in Hindi and Regional LIGHTS : UNDERSTANDING THE POWER OF DIGITAL & EVOLVING CONSUMER BEHAVIOR 21 40% 69% 64% 70% 78% 70% 25% 73% 46% 58% 72% 73% Hindi content Regional content Important for media houses to have customized approach for marketing Regional content Digital influence similar for Hindi and Regional, but driven by different channels and activities 1. Sample size of 1,493 for Hindi and 1,082 for Regional content Source: BCG Consumer Content Consumption Survey, October 2022, N = 2,615 LTV Movie Studios LTV Movie Studios % respondents digitally influenced at each journey stage1 OTT Regional influencers build better connect and, therefore, have high credibility Pain points for Regional are mainly driven by limited availability of industry-generated content like BTS OTT Regional content Top ranked Source for digital discovery In- app Short- and long- form videos across platforms Research topic Information on release dates/launch Information on storyline Source of research activity Influencers Official page/ account Engagement activity Following interviews/ official accounts of related celebs Discussion on websites/ forums Hindi content However, the most influential digital channels for both differ considerably Language <25% 25-50% <75% 50-75%

- 22. SEEING THE BIG PICTURE : HARNESSING DIGITAL TO DRIVE M&E GROWTH 22 M&E companies must actively and consciously understand evolving consumer behavior and design strategies covering E2E consumer journey to accelerate growth

- 23. LIGHTS : UNDERSTANDING THE POWER OF DIGITAL & EVOLVING CONSUMER BEHAVIOR 23

- 24. DISCOVERY INTEREST ENGAGEMENT 24 CAMERA Attracting and engaging the viewer 02

- 25. 25

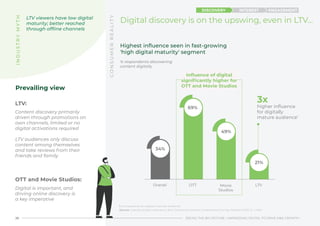

- 26. Overall OTT Movie Studios LTV 34% 69% 49% 21% ENGAGEMENT INTEREST DISCOVERY OTT and Movie Studios: Digital is important, and driving online discovery is a key imperative 26 SEEING THE BIG PICTURE : HARNESSING DIGITAL TO DRIVE M&E GROWTH I N D U S T R Y M Y T H 1. Compared to low digital maturity audience Source: Industry Expert Interviews; BCG Consumer Content Consumption Survey, October 2022, N = 2,615 3x higher influence for digitally mature audience1 Digital discovery is on the upswing, even in LTV... % respondents discovering content digitally Influence of digital significantly higher for OTT and Movie Studios C O N S U M E R R E A L I T Y LTV: Content discovery primarily driven through promotions on own channels, limited or no digital activations required LTV audiences only discuss content among themselves and take reviews from their friends and family Highest influence seen in fast-growing 'high digital maturity' segment LTV viewers have low digital maturity; better reached through offline channels Prevailing view

- 27. 46% 32% 19% Source: BCG Consumer Content Consumption Survey, October 2022, N = 2,615 LTV players should invest in ideating, creating and sharing digital- forward content to tap into this existing demand ENGAGEMENT INTEREST DISCOVERY Supply driven challenges …viewers are influenced by digital, but supply is a constraint C O N S U M E R R E A L I T Y CAMERA : ATTRACTING AND ENGAGING THE VIEWER 27 Lack of digital content is a pain point for ~80% of non-digitally influenced LTV viewers % of non-digitally influenced LTV viewers facing the respective issue Limited info about upcoming content on online platforms Too many ads of irrelevant products/ services Incomplete info in ads, or promos shown are not for desired content

- 28. I N D U S T R Y M Y T H LTV: Discovery mainly driven by own network and offline channels Digital activation not critical since TG is not digitally active Recognize the power of non-network digital platforms to drive discovery Source of discovery OTT 62% discovery happens off the app – and half of it is on digital LTV 40% of discovery happens outside TV, and more than 60% of that is on digital 62% 38% 60% Outside network In-app/Own Network 40% 63% 37% 50% 50% ENGAGEMENT INTEREST DISCOVERY Off-network discovery is hugely underestimated – and 50–60% of it is on digital channels Source: Industry Expert Interviews; BCG Consumer Content Consumption Survey, October 2022, N = 2,615 % respondents influenced by respective sources OTT: CRM channels sufficient to promote content discovery once viewers are onboarded Recommendation engine, top listings are significant drivers 28 SEEING THE BIG PICTURE : HARNESSING DIGITAL TO DRIVE M&E GROWTH No pressing need for digital interventions beyond own networks/channels to drive content discovery Digital Offline Digital Offline C O N S U M E R R E A L I T Y Prevailing view

- 29. ENGAGEMENT INTEREST DISCOVERY CAMERA : ATTRACTING AND ENGAGING THE VIEWER 29 The drivers of digital content discovery Organic chatter – conversations with friends, family and peers are a powerful engine of discovery Fan following – online channels like studio/celebrity's official handles etc. can be harnessed to drive discovery Video nudges – short- and long-form videos across platforms exert strong influence on discovery Influence of influencers – key emerging channel to build connect and hook viewers to content

- 30. ENGAGEMENT INTEREST DISCOVERY 30 SEEING THE BIG PICTURE : HARNESSING DIGITAL TO DRIVE M&E GROWTH LTV: Interest can be generated by having higher frequency of touchpoints on own network 60%+ consumers seek out information about content before deciding to watch Source: Industry Expert Interviews; BCG Consumer Content Consumption Survey, October 2022, N = 2,615 Up to 80% of research occurs online, across verticals On average, 3 digital consumer touchpoints between content discovery and consumption OTT and Movie Studios: Decisions are often shaped by multiple online interventions Leverage digital to nudge viewer decision-making % respondents who research content to decide whether to watch No of digital touchpoints % respondents who research content online to help them make a viewing decision 2.7 3.1 3.2 LTV 42% Movie Studios 68% 62% OTT 83% Prevailing view

- 31. 1. Includes radio, newspaper, OHH and TV (for Movie Studios and OTT) Source: BCG Consumer Content Consumption Survey, October 2022, N = 2,615 CAMERA : ATTRACTING AND ENGAGING THE VIEWER 31 29% 20% 7% 12% 5% 27% OTT 21% 16% 5% 9% 7% 42% LTV 32% 19% 10% 26% 13% NA Movie Studios Within digital, videos have the greatest influence on viewer decision-making across verticals % respondents doing respective research activity Digital outside network Short- and long- form videos Text-based (incl recommendations from peers) Posts/banners/ rich media Offline ads1 Offline recommendations In-app/own network ENGAGEMENT INTEREST DISCOVERY

- 32. LTV Movie Studios OTT 32 SEEING THE BIG PICTURE : HARNESSING DIGITAL TO DRIVE M&E GROWTH % respondents ranking information area as top 15% Reviews and ratings 14% Reviews and ratings 15% Reviews and ratings 17% Ad promos for the content 15% Ad promos for the content 13% Info about where the movie is screening 15% Info about related stars/celebs/players 17% Info about related stars/celebs/players 12% Info on storyline Trailers/teasers related to content Trailers/teasers related to content 24% 28% 27% Trailers/teasers related to content Note: Comparison shown for OTT Movies, TV Movies and Cinema Source: BCG Consumer Content Consumption Survey, October 2022, N = 2,615 Content trailers/teasers are most sought-after across verticals Consumers seek similar information across verticals, but priorities vary Develop content across high-preference information areas to nudge decision-making ENGAGEMENT INTEREST DISCOVERY

- 33. CAMERA : ATTRACTING AND ENGAGING THE VIEWER 33 Case study: Indian LTV player Leveraging external channels in a 360º marketing campaign for a dance reality show Source: Industry & Press Reports; BCG Analysis ENGAGEMENT INTEREST DISCOVERY 2nd highest rated reality show in India and among top 20 shows within a week of launch Driving online mentions through the metaverse Enabled audience to choose their avatar and dance on virtual stage Engaging activities like photo booth, dance master- class, game zone and BTS Harnessed AR to let people dance to the title track with a celebrity judge Video snippets released for participants to share on their online handles Publicizing title track using AR dance classes Top influencers danced with the judges/anchors, performing the hook step to the title track Snippets uploaded and promoted as short videos for easy sharing Dance challenges for influencers Flash mob organized in Mumbai with children dancing to the title track Talent show for select dance troupes in various cities Hashtag led challenges across cities

- 34. I N D U S T R Y M Y T H 47% 34% 35% 34 SEEING THE BIG PICTURE : HARNESSING DIGITAL TO DRIVE M&E GROWTH LTV: Passive consumer involvement after watching content Limited scope for digital influence as engagement mainly driven by offline discussion with friends/family ~50% viewers engage with content – and 35–50% of this occurs digitally across verticals… OTT and Movie Studios: Audiences engage online with user- generated content, as well as content shared on official handles Source: Industry Expert Interviews; BCG Consumer Content Consumption Survey, October 2022, N = 2,615 Digital engagement significant even for LTV OTT Movie Studios LTV % respondents actively engaged and digitally influenced % respondents who engage with content 48% ENGAGEMENT INTEREST DISCOVERY C O N S U M E R R E A L I T Y Limited online post-watch engagement for LTV content Prevailing view

- 35. Industry-generated content (Interviews of celebs, BTS, memes, updates, contests…)` User-generated content (Online discussions, sharing reels, recommendations, stories…) Sources of digital engagement activities OTT GEC fiction Movie Studios LTV GEC fiction CAMERA : ATTRACTING AND ENGAGING THE VIEWER 35 Source: Industry Expert Interviews; BCG Consumer Content Consumption Survey, October 2022, N = 2,615 Propagate engagement-driving content and foster online communities for user-generated content Important to re-engage with audiences and explore scope to monetize content through publishers C O N S U M E R R E A L I T Y …though digital engagement in LTV is driven by user-generated content LTV under-indexed on industry-generated digital engagement activities Within digital engagement, 85%+ consumers consume short clips of watched shows ENGAGEMENT INTEREST DISCOVERY “I actively seek out short clips of my watched shows” 55% respondents “I watch short clips of my watched shows whenever I come across them” 32% respondents 73% 64% 54% 27% 36% 46%

- 36. I N D U S T R Y M Y T H 36 SEEING THE BIG PICTURE : HARNESSING DIGITAL TO DRIVE M&E GROWTH Higher digital engagement correlated with higher watch times on both LTV… Industry pain point LTV: OTT: Limited digital activations due to difficulty in measuring and attributing the impact High consumer churn rate for content pieces with a long gap between seasons High churn rate (up to 4%/ month vs 2–2.5% for BIC) eating into profits, despite concerted efforts towards customer acquisition Watch time/week (in minutes) 1. Refers to Reality/Talent hunt/Game shows 2. Includes digital influence in the “post-watching” stage of media content journey (i.e. engagement) Source: Industry Expert Interviews; BCG Consumer Content Consumption Survey, October 2022, N = 2,615 LTV | Watch time depends entirely on content – if the quality is good, users will watch for longer OTT | High churn rates are inevitable, focus should be on countering them through customer acquisition LTV: Digital engagement shown to increase watch time by up to 35% Not engaged digitally Digitally engaged2 +18% 374 440 GEC fiction 233 317 GEC non-fiction1 193 234 Sports +36% +21% ENGAGEMENT INTEREST DISCOVERY C O N S U M E R R E A L I T Y Focus on digital engagement to boost appointment viewing and reduce churn; deploy sophisticated measurement tools, incremental lift tests Prevailing view

- 37. Consumers' voice "I saw a friend's post raving about the movie, we discussed the plot and I decided to buy the tickets" "I spoke to a friend who’d recently watched the movie and she recommended it to me" "My friends kept sharing memes about the movie and that sparked my curiosity" CAMERA : ATTRACTING AND ENGAGING THE VIEWER 37 Not engaged digitally Digitally engaged2 Watch time/week (in minutes) of the respondents who discovered a movie via digital, did so through WoM Optimize campaigns for deep funnel metrics and deploy 1PD-led churn prediction models Level up on digital engagement to encourage movie viewing …and OTT; drives churn reduction and subsequent content consumption OTT: Digital engagement linked to higher watch times across genre; highest among sports viewers Movie Studios: Digital engagement can drive Word of Mouth (WoM) and entice audiences to watch 1. Refers to Reality/Talent hunt/Game shows 2. Includes digital influence in the “post-watching” stage of media content journey (i.e. engagement and digital advocacy) Source: Industry Expert Interviews; BCG Consumer Content Consumption Survey, October 2022, N = 2,615 +20% 263 316 GEC non-fiction1 +16% 328 381 Movies +40% 229 322 Sports ~45% ENGAGEMENT INTEREST DISCOVERY C O N S U M E R R E A L I T Y

- 38. I N D U S T R Y M Y T H 38 SEEING THE BIG PICTURE : HARNESSING DIGITAL TO DRIVE M&E GROWTH Trailer launched one month before release Lead actress shared posters on her official handles Offline activations evoking the theme of the series Amplified the online buzz through multiple interventions Blooper reel released online Reel of deleted scenes released 3 weeks after launch 5 statues of sisters overshadowed by their brothers, placed across cities 2nd most watched title in UK within a month of release Rely on organic WoM driven by fans, digital followers of show leads ‘Spray & pray’ approach to audience engagement, with mixed results Source: Industry Expert Interviews; Press Reports; BCG Analysis Industry pain point Difficult to measure and attribute impact of activations with top influencers ENGAGEMENT INTEREST DISCOVERY Word of mouth (WoM) happens organically – it is entirely consumer-led and driven by content quality Pre-launch Post-launch Case study – Leading OTT player Piggybacking on a social issue to nudge WoM via offline and online activations WoM not exclusively organic – OTT ahead of LTV and Movie Studios in nudging conversation Design and execute marketing activations to nudge WoM Prevailing view

- 39. CAMERA : ATTRACTING AND ENGAGING THE VIEWER 39 Case study – Global OTT in India Leveraging digital platforms to engage audiences for Season 2 launch of fiction show Protagonist-led content marketing Clips on pertinent moments and plot teasers to create online buzz Shared memorable dialogues combining humor and intrigue to spark interest ‘Find the protagonist’ campaign to drive engagement Online job hunt with industry influencers Excuse generator chatbot Source: Press Reports; BCG Analysis The call was answered by the 'protagonist' who says he is busy The caller then receives a link to the show’s official handle via SMS Released a telephone number for audiences to dial Social campaign seeking job recommendations for the protagonist Videos released showing protagonist's job interviews with industry leaders Chat bot with hundreds of excuses inspired by the protagonist’s tactics in the show Multiple GIF reactions to link the conversation to the show Always-on 'Stream Now' button linked to website ENGAGEMENT INTEREST DISCOVERY 4th most popular show worldwide on IMDb by user ratings within 3 weeks of release

- 40. Monitor the performance of content through organic views, mentions etc. 40 SEEING THE BIG PICTURE : HARNESSING DIGITAL TO DRIVE M&E GROWTH • Somber, dark and violent setting • Focus on troubled backstories of characters and how they work together • Showed mix of abusive and loving relationships • Reoriented the plot to lighten the feel and create a more carefree atmosphere • Enhanced the logo to project a sense of fun • Edited the trailer to highlight the quirkiness of the characters • Further lightened the tone and changed the background music • Added even more color to the logo • Further amplified the quirky characters and amusing scenes Source: Industry Expert Interviews; Press Reports; BCG Analysis Trailer 1 Trailer 2 Trailer 3 Box office collections worldwide in the first week of release $365+Mn Industry pain point Limited scope to analyze the social mood and generate relevant insights Re-shooting scenes or making last-minute edits is impractical Invest in social listening capabilities to adapt content to user tastes ENGAGEMENT INTEREST DISCOVERY Digital provides an opportunity to generate actionable feedback from online chatter Case study – Leading global movie studio Implementing social listening to change movie tone based on reaction to trailer Prevailing view

- 42. SUMMARY OF KEY INSIGHTS • Videos across platforms and WoM (both online and offline) are critical drivers for discovery • New channels/platforms to distribute content online (studio and celeb handles, influencers etc.) gaining prominence • 50–60% of out-of-network discovery for LTV and OTT happens on digital • ~80% of LTV consumers point to supply- related challenges for online discovery LTV Movie Studios OTT Drive more organic traffic (through own and artists' handles, SEO, CRM…) Increase the scope and efficiency of external, paid initiatives Vertical specific insights 42 SEEING THE BIG PICTURE : HARNESSING DIGITAL TO DRIVE M&E GROWTH DISCOVERY

- 43. • 60%+ consumers conduct research before viewed content • 3 digital touchpoints, between discovery and watching • ~30% viewers prefer digital videos for decision-making • 25-30% viewers say trailers/teasers are the most important factors to drive interest • Reviews and ratings and information about screening venues are among the most sought-after info for Movie Studios • 85%+ viewers watch short clips of already watched content • ~50% audiences engage with content post- watching, significant even for LTV • Generate actionable feedback from online chatter before release • WoM can be nudged by marketing activations • Up to 40% higher watch times for digitally engaged audiences for both OTT and LTV • ~45% viewers discovered new movie through WoM Refine personalized communication via test and learn (ad copies, digital assets and channels) Build engagement ecosystem (On and off platform activations, with paid and organic initiatives) Leverage 1PD churn prediction models (higher lifetime value and reduced churn) CAMERA : ATTRACTING AND ENGAGING THE VIEWER 43 INTEREST ENGAGEMENT

- 44. 44 ACTION Building a digital–ready organization 03

- 45. 45

- 46. 46 SEEING THE BIG PICTURE : HARNESSING DIGITAL TO DRIVE M&E GROWTH The way forward for M&E leaders Navigating the new digital landscape Blurring boundaries between media verticals in consumers’ minds Companies should not define themselves as LTV/OTT/Movie Studios, and reimagine themselves as content creators not chained to a delivery medium Digital activations are multidimensional Players should use a wide array of levers, including communities, influencers, personalized reach- outs, short videos... Focus on E2E media consumption journey Companies need to make dedicated efforts to generate interest and fuel engagement to maximize watch time One size does not fit all Digital marketing effective across demographics, genres and languages, but it must be cognizant of the respective nuances Digital is a complementary medium, supplementing own network Digital marketing is a game- changing addition to existing marketing efforts, at every step of the consumption journey Build capabilities to maximize value generation Develop in-house muscle - content factory, user engagement flywheel, measurement strategy and impact attribution, organizational capabilities and MADTech1 stack 1. Marketing, advertising, data and technical stack

- 47. ACTION : BUILDING A DIGITAL-READY ORGANIZATION 47 Content Factory Difficult to create quality, multi-format content, at high velocity, and refresh it across platforms and languages Flywheel for user engagement Inability to nudge WoM with marketing activations, both digital and offline Organizational capabilities Lack of organizational skills to create and execute new-age digital activations Optimal MADTech stack Lack of advanced technologies and data capabilities Measurement toolkit Difficult to measure the true business impact of marketing activations – especially engagement and branding campaigns Critical new capabilities are needed to maximize revenue generation 1 2 3 4 5

- 48. 48 SEEING THE BIG PICTURE : HARNESSING DIGITAL TO DRIVE M&E GROWTH Content agency Design and execution of the campaigns Coordination with influencers/celebs Creative agency Create digital forward creatives Adopt creatives for platforms 3P tech platforms Content management systems, automated workflows with partners… Develop a 'content factory’ to generate high-quality content at speed Create content across multiple themes with varied formats Content strategists Identify focus topics and formats basis customer preference Content marketers Ideate with and guide content creation agencies Social listening team Identify trending topics/ templates and recommend relevant content VIDEO NON-VIDEO Trailers Teasers/promos Short clips highlighting important scenes/dialogues Behind the scenes Challenges Interviews… Posts Memes Updates Contests Interactive quizzes Blogs/articles Audio podcasts… Robust in-house talent to leverage digital opportunities Strategic partnerships with agencies and service providers 1

- 49. ACTION : BUILDING A DIGITAL-READY ORGANIZATION 49 Non-exhaustive Build a flywheel for user engagement, leveled up with paid activations Combine on-platform activations … … with both organic and paid activations off-platform to engage users Organic Paid Via app notifications, top listings, current trending Develop BTS videos, best moments, exclusive interviews Ask for user voting/polls while streaming Promote interactivity via fan corners and hashtag-led activations Run contests with lucky winner announced during streaming Run deep-funnel campaigns to improve consumer lifetime value Leverage engaging influencer-led campaigns (challenges, meet-ups…) Empower precision targeting capabilities with 1PD and programmatic DSPs Deploy innovative digital ad-tech enabling AR/VR, gamification… Increase activity on own and artists’ handles via posts, news and updates Re-share user posts from official handles Build online communities/fan clubs to facilitate discussions and run contests Create shareable and snackable content via memes, BTS videos, short clips 2

- 50. 50 SEEING THE BIG PICTURE : HARNESSING DIGITAL TO DRIVE ME GROWTH Sharpen focus on digital-forward organizational, … ORGANIZATIONAL CAPABILITIES Build full-stack digital growth team with new-age skills • Data scientists, Content specialists, Audience strategist, MarTech specialists Develop test and learn culture • Test innovative use cases, advanced targeting options, CRO pilots • Agile operating model followed across teams Align metrics/KPIs across functional teams • Promote data-driven decision-making 3

- 51. ACTION : BUILDING A DIGITAL-READY ORGANIZATION 51 …technological and data capabilities TECHNOLOGICAL CAPABILITIES DATA CAPABILITIES Identify and invest in future-ready media capabilities • Server-side Ad Integration (SSAI), video analytics, dynamic product placements… Visibility of end-to-end customer journey • Digital and offline, across devices/geos • Real-time data capture and updation Deploy best-in-class campaign planning, execution and measurement tools • Creative automation, audience segmentation, personalization… Clearly defined roadmap for near- and long-term tech requirements • Based on growth aspirations and global BIC practices Build signal loss-resilient data deployment capabilities • Browser-independent solutions • 1P data collection and usage Advanced data analytics' tools • Build 1PD based churn prediction models • Regression/statistical modeling 4

- 52. 52 SEEING THE BIG PICTURE : HARNESSING DIGITAL TO DRIVE ME GROWTH Deploy measurement tool-kit with a mix of methodologies to attribute impact Measure and track incremental metrics Interest • Incremental mentions • Incremental visits • Cost/incremental subscription Engagement • Incremental revenue • Incremental ROAS • Incremental time spent per visit • Cost/incremental streamer Metrics that measure incremental impact from a campaign; i.e. impact that would not have happened but for the marketing intervention Customized measurement approach for strategic and operational decisions Discovery • Incremental reach/frequency • Cost/Incremental reach • Cost/incremental install Decision type Strategic decisions Operational decisions Source: BCG-Meta 'Measure to grow', Nov-21 Key decisions Media mix, channels, geographies e.g., ROAS for engagement campaigns, media-mix for reducing churn… Campaign, channel and creatives optimization e.g., optimal campaign settings, best creative, ad copy etc. Measurement approach Define media mix based on incrementality Deploy statistical, non- cookie dependent measurement solutions – e.g., Marketing Mix Models Calibrate output of measurement solutions with Incremental lift tests Calibrate touch-based attribution with incremental lift tests Explore new age, 3rd party token-based, measurement solutions 5

- 53. ACTION : BUILDING A DIGITAL-READY ORGANIZATION 53 Poised for growth | Digital can empower the ME industry 1. For LTV and OTT; 2. For focus content Note: LTV metrics for GEC channels; Higher Time spent on specific content pieces Source: Expert discussions; App Annie data (Mar, Jun, Sep 2022); BARC data (Jan-Mar and Oct-Nov 2022); Talkwalker (2022); BCG Analysis INDUSTRY DATA-LED 2.5–3X Higher active users1 1.2Bn Digitally influenced viewers (cumulative) 1.5–2X Higher time spent1 1.3Bn+ View hours from digitally engaged customers ~11Bn+ Annual revenues (USD) from digitally influenced viewers 30–40% Sales uplift for LTV2 and Movie Studios 35–40% Marketing spends efficiencies (OTTs) RESEARCH DATA-LED

- 54. 54 BEHIND THE SCENES Key research data points and Glossary of terms 04

- 55. 55

- 56. 56 SEEING THE BIG PICTURE : HARNESSING DIGITAL TO DRIVE ME GROWTH Insights generated by qualitative discussions with industry leaders and consumers along with a quantitative survey covering ~2,600 consumers Tested industry beliefs against consumer consumption patterns to identify growth opportunities for ME players Spoken to 50+ consumers across 6 FGDs and 13 IDIs spread across metros, tier-1s and tier 2/3s to understand consumers' media consumption journey Surveyed 2,615 respondents across India to map the level of digital influence along the media consumption journey Consumer research Studied and analyzed best-in- class practices across global ME industry via industry reports and press releases to understand and benchmark the current landscape of India's ME industry Secondary Research Connected with 30+ industry experts to develop an understanding of the lay of the land and industry beliefs regarding digital Industry connects

- 57. BEHIND THE SCENES : KEY RESEARCH DATA POINTS AND GLOSSARY OF TERMS 57 Movie Studios 70% 71% 45% OTT 83% 78% 59% High overall consumer involvement across the media consumption journey % of respondents who are active across respective journey stage Source: BCG Consumer Content Consumption Survey, October 2022, N=2,615 LTV 84% 59% 46% Discovery Interest Engagement Overall 82% 62% 48%

- 58. 58 SEEING THE BIG PICTURE : HARNESSING DIGITAL TO DRIVE ME GROWTH GLOSSARY Advanced video analytics Use cases like analysing scrubbing behavior, watch times, drop-off points etc. Consumer involvement Active discovery of content, gathering information to decide whether to watch, following content and sharing content-related information. FGDs Focus group discussions among 8-10 consumers to generate insights. LTV A platform that is used for appointment viewing i.e. only a scheduled program can be viewed. OTT Means of providing content over the internet as per viewer's requirements for any-time and/or catch-up viewing. A A C C L L Word of mouth(WoM) Sharing information with other individuals/ groups via online or offline modes. W W F F AVoD and SVoD AVoD is advertising- based video on demand which allows viewers to watch the content for free, while SVoD stands for Subscription Video on Demand which means a user has to pay/ subscribe to watch content. Digital influence Level of activities that happen on digital platforms across the consumption journey. IDIs In-depth interviews of the content consumption journey of a particular individual. Own and off- network Own network refers to a player's own inventory on LTV and/or OTT app. Any inventory apart from this is off- network. D D Media verticals Type of platform through which the content is consumed by viewers. M M Organic and paid activations Organic activations refer to any activation that does not involve paid ads, while paid activations involve usage of paid ads. O O I I BIC Organizations that have implemented best-in-class practices. Digital maturity A measure of the consumer's usage of digital apps. Defined on the basis of app usage for socializing, cab booking, mobile/ internet banking, e-payments and subscription to OTT platforms. Influencer An individual who has credibility and followership (both national and regional) among the target audience. Movie Studios A company owning the studio facility used to make movies. MADTech Term used to define AdTech and MarTech. B B Server-side ad integration Seamless delivery of video ads on content streamed on internet- enabled devices. SFV Applications that typically offer videos with less than 60 seconds duration. S S

- 59. Saket Jha Saurabh Director and Head – Media Partnerships, Meta Mumbai Shweta Bajpai Vertical Head, India – FS, Media, Travel and Professional Services, Meta Delhi AUTHORS Shaveen Garg Managing Director and Partner, BCG Delhi garg.shaveen@bcg.com Pallavi Malani Managing Director and Partner, BCG Mumbai malani.pallavi@bcg.com Nimisha Jain Managing Director and Senior Partner, BCG Delhi jain.nimisha@bcg.com Kanika Sanghi Partner and Director, BCG Mumbai sanghi.kanika@bcg.com Sidharth Madaan Partner, BCG Delhi madaan.sidharth@bcg.com Nivedita Balaji Partner and Associate Director, BCG Mumbai balaji.nivedita@bcg.com Alpi Chaudhari Lead SPM, TV, OTT Digital Publisher partnerships, Meta Mumbai Kaumudi Mahajan Head, Entertainment Partnerships, Meta Mumbai Aditya Fialok Project Leader, BCG Delhi fialok.aditya@bcg.com Shashi Udyavar Client Partner, Media Meta Mumbai ACKNOWLEDGMENT This study was undertaken by Boston Consulting Group (BCG) in association with Meta. We are thankful to Ankit Shrivastava, Mayank Kalia, Prashant Srivash, Raghav Sally, Roshni Lamba and Varuni Shukla for their assistance in writing this report. We are also thankful to Jasmin Pithawala for managing the marketing process as well as Jamshed Daruwalla, Saroj Singh, Sujatha Moraes, Seshachalam Marella, Subhradeep Basu, Vijay Kathiresan, Pavithran NS and Saanchi Chatwal for their contribution towards design and production of this report. For information or permission to reprint, please contact BCG at permissions@bcg.com. To find the latest BCG content and register to receive e-alerts on this topic or others, please visit bcg.com. Follow Boston Consulting Group on Facebook and Twitter. © Boston Consulting Group 2023. All rights reserved.