Chapter 3 forecasting operations management 3

- 1. Forecasting Chapter 3 McGraw-Hill/Irwin Copyright © 2012 by The McGraw-Hill Companies, Inc. All rights reserved.

- 2. Forecast Forecast – a statement about the future value of a variable of interest We make forecasts about such things as weather, demand, and resource availability Forecasts are an important element in making informed decisions Instructor Slides 3-2

- 3. Two Important Aspects of Forecasts Expected level of demand The level of demand may be a function of some structural variation such as trend or seasonal variation Accuracy Related to the potential size of forecast error Instructor Slides 3-3

- 4. Elements of a Good Forecast The forecast should be timely should be accurate should be reliable should be expressed in meaningful units should be in writing technique should be simple to understand and use should be cost effective

- 5. Steps in the Forecasting Process 1. Determine the purpose of the forecast 2. Establish a time horizon 3. Select a forecasting technique 4. Obtain, clean, and analyze appropriate data 5. Make the forecast 6. Monitor the forecast

- 6. Features Common to All Forecasts 1. Techniques assume some underlying causal system that existed in the past will persist into the future 2. Forecasts are not perfect 3. Forecasts for groups of items are more accurate than those for individual items 4. Forecast accuracy decreases as the forecasting horizon increases Instructor Slides 3-6

- 7. Forecast Accuracy and Control Forecast errors should be monitored Error = Actual – Forecast If errors fall beyond acceptable bounds, corrective action may be necessary

- 8. Forecast Accuracy Metrics n t t Forecast Actual MAD 2 t t 1 Forecast Actual MSE n 100 Actual Forecast Actual MAPE t t t n MAD weights all errors evenly MSE weights errors according to their squared values MAPE weights errors according to relative error

- 9. Forecast Error Calculation Period Actual (A) Forecast (F) (A-F) Error |Error| Error2 1 107 110 -3 3 9 2 125 121 4 4 16 3 115 112 3 3 9 4 118 120 -2 2 4 5 108 109 -1 1 1 AVG(A) 114.6 Sum 13 39 n = 5 n-1 = 4 MAD MSE MAPE=MAD / AVG(A) = 2.6 = 9.75 =2.6/114.6= 2.27%

- 10. Forecasting Approaches Qualitative Forecasting Qualitative techniques permit the inclusion of soft information such as: Human factors Personal opinions Hunches These factors are difficult, or impossible, to quantify Quantitative Forecasting Quantitative techniques involve either the projection of historical data or the development of associative methods that attempt to use causal variables to make a forecast These techniques rely on hard data

- 11. Judgmental Forecasts Forecasts that use subjective inputs such as opinions from consumer surveys, sales staff, managers, executives, and experts Executive opinions Sales force opinions Consumer surveys Delphi method

- 12. Time-Series Forecasts Forecasts that project patterns identified in recent time-series observations Time-series - a time-ordered sequence of observations taken at regular time intervals Assume that future values of the time-series can be estimated from past values of the time- series

- 13. Time-Series Behaviors Trend Seasonality Cycles Irregular variations Random variation

- 14. Historical Monthly Product Demand Consisting of a Growth Trend, Cyclical Factor, and Seasonal Demand Exhibit 9.4

- 15. Common Types of Trends Exhibit 9.5a

- 16. Common Types of Trends (cont’d) Exhibit 9.5b

- 17. Trends and Seasonality Trend A long-term upward or downward movement in data Population shifts Changing income Seasonality Short-term, fairly regular variations related to the calendar or time of day Restaurants, service call centers, and theaters all experience seasonal demand

- 18. Trend, Cyclical, with Variations

- 19. Cycles and Variations Cycle Wavelike variations lasting more than one year These are often related to a variety of economic, political, or even agricultural conditions Random Variation Residual variation that remains after all other behaviors have been accounted for Irregular variation Due to unusual circumstances that do not reflect typical behavior Labor strike Weather event

- 20. Time-Series Forecasting - Naïve Forecast Naïve Forecast Uses a single previous value of a time series as the basis for a forecast The forecast for a time period is equal to the previous time period’s value Can be used when The time series is stable There is a trend There is seasonality

- 21. Time-Series Forecasting - Averaging These Techniques work best when a series tends to vary about an average Averaging techniques smooth variations in the data They can handle step changes or gradual changes in the level of a series Techniques Moving average Weighted moving average Exponential smoothing

- 22. Moving Average Technique that averages a number of the most recent actual values in generating a forecast average moving in the periods of Number 1 period in value Actual average moving period MA period for time Forecast where MA 1 1 t n t A n t F n A F t t t n i i t t

- 23. Forecast Demand Based on aThree- and Five-Week Simple MovingAverage Week Demand Forecast Forecast (3-week) (5-week) 1 800 2 1400 3 1000 4 1500 (1000+1400+800)/3 =1067 5 1500 (1500+1000+1400)/3 = 1300 6 1300 (1500+1500+1000)/3 = 1333 (1500+1500+1000+1400+ 800)/5 =1240 7 1800 (1300+1500+1500)/3 = 1433 (1300+1500+1500+1000+1400)/5 =1340 8 1700 (1800+1300+1500)/3 = 1533 (1800+1300+1500+1500+1000)/5 =1420 9 1300 1600 (1700+1800+1300+1500+1500)/5 =1560 10 1700 1600 (1300+1700+1800+1300+1500)/5 =1520 11 1700 1567 (1700+1300+1700+1800+1300)/5 =1560

- 24. Moving Average As new data become available, the forecast is updated by adding the newest value and dropping the oldest and then recomputing the the average The number of data points included in the average determines the model’s sensitivity Fewer data points used-- more responsive More data points used-- less responsive

- 25. Forecast Demand Based on a Three- and Nine-Week Simple Moving Average Exhibit 9.6

- 26. MovingAverage Forecast ofThree- and Nine-Week Periods versusActual Demand Exhibit 9.7

- 27. Weighted Moving Average The most recent values in a time series are given more weight in computing a forecast The choice of weights, w, is somewhat arbitrary and involves some trial and error Ft wn At n wn 1At (n 1) ... w1At 1 where wt weight for period t, wt 1 weight for period t 1, etc. At the actual value for period t, At 1 the actual value for period t 1, etc.

- 28. Exponential Smoothing A weighted averaging method that is based on the previous forecast plus a percentage of the forecast error 1 1 1 1 1 ( ) where Forecast for period Forecast for the previous period =Smoothing constant Actual demand or sales from the previous period t t t t t t t F F A F F t F A

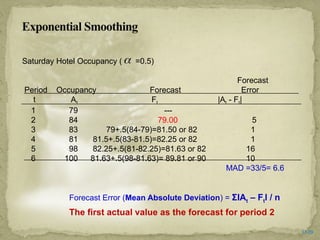

- 29. Exponential Smoothing Saturday Hotel Occupancy ( =0.5) Forecast Period Occupancy Forecast Error t At Ft |At - Ft| 1 79 --- 2 84 79.00 5 3 83 79+.5(84-79)=81.50 or 82 1 4 81 81.5+.5(83-81.5)=82.25 or 82 1 5 98 82.25+.5(81-82.25)=81.63 or 82 16 6 100 81.63+.5(98-81.63)= 89.81 or 90 10 MAD =33/5= 6.6 Forecast Error (Mean Absolute Deviation) = ΣlAt – Ftl / n The first actual value as the forecast for period 2 17-29

- 30. Linear Trend A simple data plot can reveal the existence and nature of a trend Linear trend equation Ft a bt where Ft Forecast for period t a Value of Ft at t 0 b Slope of the line t Specified number of time periods from t 0

- 31. Estimating slope and intercept Slope and intercept can be estimated from historical data 2 2 or where Number of periods Value of the time series n ty t y b n t t y b t a y bt n n y

- 32. Figure 3-9 3-32

- 33. Linear Trend Example Week (t) Sales (y) t2 ty 1 150 1 150 2 157 4 314 3 162 9 486 4 166 16 664 5 177 25 885 t= 15 y= 812 t2 =55 (ty)=2499

- 34. Linear Trend Example 2 2 5(2499) 15(812) 5(55) 225 12495 12180 6.3 275 225 812-6.3(15) = 143.5 5 143.5 6.3 n ty t y b n t t y b t a n y t

- 35. Linear Trend Example Substituting values of t into this equation, the forecast for next 2 periods are: F6= 143.5+6.3 (6) = 181.3 F7= 143.5+6.3 (7) = 187.6

- 36. Techniques for Seasonality Seasonality – regularly repeating movements in series values that can be tied to recurring events Expressed in terms of the amount that actual values deviate from the average value of a series Models of seasonality Additive Seasonality is expressed as a quantity that gets added to or subtracted from the time-series average in order to incorporate seasonality Multiplicative Seasonality is expressed as a percentage of the average (or trend) amount which is then used to multiply the value of a series in order to incorporate seasonality Instructor Slides 3-36

- 37. Models of Seasonality Instructor Slides 3-37

- 38. Computing Seasonal Relatives Using SimpleAverage (SA) Method Example 8A, page 150 Manager of a Call center recorded the volume of calls received between 9 and 10 a.m. for 21 days and wants to obtain a seasonal index for each day for that hour. Volume Season Overall Day Week 1 Week 2 Week 3 Average ÷ Average = SA Index Tues 67 60 64 63.667 ÷ 71.571 = 0.8896 Wed 75 73 76 74.667 ÷ 71.571 = 1.0432 Thurs 82 85 87 84.667 ÷ 71.571 = 1.1830 Fri 98 99 96 97.667 ÷ 71.571 = 1.3646 Sat 90 86 88 88.000 ÷ 71.571 = 1.2295 Sun 36 40 44 40.000 ÷ 71.571 = 0.5589 Mon 55 52 50 52.333 ÷ 71.571 = 0.7312 Overall Avg 71.571 7.0000

- 39. Seasonal Relatives Seasonal relatives The seasonal percentage used in the multiplicative seasonally adjusted forecasting model Using seasonal relatives To deseasonalize data Done in order to get a clearer picture of the nonseasonal components of the data series Divide each data point by its seasonal relative To incorporate seasonality in a forecast Obtain trend estimates for desired periods using a trend equation Add seasonality by multiplying these trend estimates by the corresponding seasonal relative

- 40. Seasonal Relatives Example Example 7, page 149 A coffee shop owner wants to predict quarterly demand for hot chocolate for periods 9 and 10, which happen to be the 1st and 2nd quarters of a particular year. The sales data consist of both trend and seasonality. The trend portion of demand is projected using the equation Ft = 124 + 7.5 t. Quarter relatives are Q1 = 1.20, Q2 = 1.10, Q3 = 0.75, Q4 = 0.95,

- 41. Seasonal Relatives Example (Con’d) Example 7, page 149 Use this information to deseasonalize sales for Q1 through Q8. Period Quarter Sales ÷ Quarter Relative = Deseasonalized sales 1 1 158.4 ÷ 1.20 = 132.0 2 2 153.0 ÷ 1.10 = 139.1 3 3 110.0 ÷ 0.75 = 146.7 4 4 146.3 ÷ 0.95 = 154.0 5 1 192.0 ÷ 1.20 = 160.0 6 2 187.0 ÷ 1.10 = 170.0 7 3 132.0 ÷ 0.75 = 176.0 8 4 173.8 ÷ 0.95 = 182.9

- 42. Seasonal Relatives Example (Con’d) Example 7, page 149 Use this information to predict for periods 9 and 10. F9 = 124 +7.5( 9) = 191.5 F10= 124 +7.5(10) = 199.0 Multiplying the trend value by the appropriate quarter relative yields a forecast that includes both trend and seasonality. Given that t =9 is a 1st quarter and t = 10 is a 2nd quarter. The forecast demand for period 9 = 191.5(1.20) = 229.8 The forecast demand for period 10 = 199.0(1.10) = 218.9