Consumption function

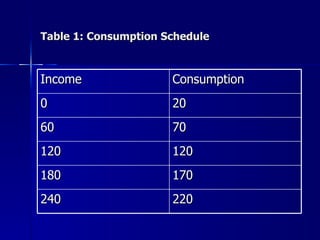

- 1. Consumption Function It is a functional relationship between two aggregates i.e., total consumption and National Income. Consumption is an increasing function of income Symbolically C= f (Y) Consumption Schedule It is the tabular representation of various amounts of consumption expenditure corresponding to different levels of income.

- 2. Table 1: Consumption Schedule Income Consumption 0 20 60 70 120 120 180 170 240 220

- 3. Properties of the Consumption Function The Average Propensity to Consume: The average propensity to consume may be defined as the ratio of consumption expenditure to any particular level of income. Expressed as percentage or proportion of income consumed. APC= C/Y APC declines as income increases because the proportion of income spent on consumption decreases. APS = 1- APC

- 4. Marginal Propensity to Consume It is defined as the ratio of change in consumption to the change in income. It is the rate of change in APC. MPC= ∆C/ ∆Y. MPS=1-MPC Significance of MPC Over the long run APC and MPC are equal and approximate 0.9. MPC is assumed to be positive and less than unity which means that consumption is an increasing function of income and it increases by less than the increase of income. Economic significance of the MPC lies in filling the gap between income and consumption through planned investment to maintain the desired level of income.

- 5. Keynes’s Psychological law of Consumption This law says “that men are disposed as a rule and on the average to increase their consumption as their income increases but not by as much as the increase in their income”. Three related Propositions When Income increases, consumption expenditure also increases but by a smaller amount. Thus, it increases less than proportionately. The increased income will be divided in some proportion between consumption expenditure and saving. Increase in income always leads to increase in both consumption and saving.

- 6. Table: 2 Income( Y) Consumption( C) Savings (S) 0 20 -20 60 70 -10 120 120 0 180 170 10 240 220 20 300 270 30

- 7. Assumptions It assumes a constant Psychological and Institutional complex which means that income distribution, tastes, habits, social customs, price movements, population growth,etc remain constant and consumption depends on income. It assumes the existence of normal conditions. The law does not operate in abnormal conditions like war, revolution or hyperinflation. It assumes the existence of lassiez-Fare Capitalist economies and is in operative in case of socialist economies.

- 8. Determinants of Consumption Function Subjective factors ( endogenous or internal to the economic system). Psychological characteristics of human nature. Social practices. Behaviour Pattern of Business concerns Social arrangements affecting distribution of income. On the basis of above characteristics there can be individual as well as Business Motives.

- 9. Objective Factors Changes in wage level. Windfall Gains or losses. Changes in the Fiscal Policy. Change in Expectations. Change in Rate of interest Financial policies of Corporations. Distribution of Income Attitude towards Saving Duesenberry Hypothesis

- 10. Measures to raise the Propensity to Consume Income Redistribution Increased Wages Social Security Measures Credit Facilities Advertisement Development of the Means of Transport Urbanisation

- 11. Theories of consumption Function Relative Income Hypothesis is given by James Duesenberry. Based on two assumptions: A) Consumption behaviour of an individual is not independent but interdependent on other individual. B) Consumption Relations are irreversible and not reversible in time.

- 12. According to Duesenberry human beings not only try to keep up with joneses but try to surpass the joneses which shows that consumers’ preferences are interdependent. Rich people will have a lower APC and poor people will have higher APC but in long run APC will remain constant. According to Duesenberry it is harder for a family to reduce its expenditure from a higher level than for a family to refrain from making high expenditures in the first place.

- 13. The outcome of this statement is that as income falls consumption declines but proportionately less than decrease in the income because the consumer dissaves to sustain consumption. Duesenberry combines his two related hypothesis in the following form C t / Y t = a-b Y t /Y o Where C --- Consumption Y--- Income t ----Current time period o ---- Previous Peak a ---- positive autonomous consumption b---- Consumption Function

- 14. In this equation, the consumption income ratio in the current period is regarded as function of ratio of current income to the previous peak income. Ratchet effect is a peculiar phenomenon observed in this case. The short run consumption function ratchet upwards when income increases in the long run but it does not shift down to earlier level when income declines.

- 15. Criticism Proportional relationship between consumption and income is not always true. It neglects other factors that influence , consumer spending such as asset holdings, urbanisation, appearance of new products, etc. Expectations and level of aspirations also play an important role in consumer spending.