Contract Costing

- 4. Definition: ICMA defines, "Contract costing is that form of specific order costing which applies where work is undertaken to customer's special requirements and each order is of long-term duration.“ Contract costing is applicable in: Building construction Road construction Bridge construction Ship building, etc.

- 5. Features of Contract Costing: 1. Contracts are generally of large size and, therefore, a contractor usually carries out a small number of contracts at a particular point of time. 2. A contract generally takes more than one year to complete, 3. Work on contracts is carried out at the site of contracts and not in factory premises. 4. Each contract undertaken is treated as a cost unit. 5. A separate contract account is prepared for each contract. 6. Nearly all labor cost will be direct. 7. Most expenses (e.g. electricity, telephone, insurance, etc.) are also direct.

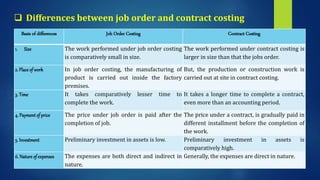

- 6. Basis of differences Job Order Costing Contract Costing 1. Size The work performed under job order costing is comparatively small in size. The work performed under contract costing is larger in size than that the jobs order. 2. Place of work In job order costing, the manufacturing of product is carried out inside the factory premises. But, the production or construction work is carried out at site in contract costing. 3. Time It takes comparatively lesser time to complete the work. It takes a longer time to complete a contract, even more than an accounting period. 4. Payment of price The price under job order is paid after the completion of job. The price under a contract, is gradually paid in different installment before the completion of the work. 5. Investment Preliminary investment in assets is low. Preliminary investment in assets is comparatively high. 6. Nature of expenses The expenses are both direct and indirect in nature. Generally, the expenses are direct in nature. Differences between job order and contract costing

- 7. Contract Costing Procedure: 1. Contract Account: Each contract is allotted a distinct number and a separate account is opened for each contract. 2. Direct costs: Most of the costs of a contract are direct cost and are debited to the contract account. Such direct costs are- 1. Materials, 2. Labour and supervision, 3. Direct expenses, 4. Depreciation of plant and machinery, 5. Subcontract costs, etc. 3. Indirect costs: Contract account is also debited with overheads which tend to be small in relation to direct costs.

- 8. 4. Transfers of materials or plant: When materials, plant or other items are transferred from the contract, the contract account is credited by the amount. 5. Contract price: The contract account is also credited with the contract price. 6. Profit or loss on contract: The balance of contract account represents profit or loss which is transferred to Profit and Loss Account. However, when contract is not completed within the financial year, only a part of the profit is taken into account and the remaining profit is kept as reserve to meet any contingent loss on the incomplete portion of the contract.

- 9. Types of contracts: There are three types of contract which are mentioned below: 1. Fixed price contract: The contract that is executed with the fixed price which is agreed by the contractor and the contractee is called the fixed price contract. 2. Fixed price contract with escalation and de-escalation clauses: Escalation clause is often provided in contracts to cover any likely changes in the price or utilization of materials and labour. An escalation clause safeguards the interest of the contractor by upward revision of the contract price, a de-escalation clause may be interested to look after the interest of the contractee by providing downward revision of the contract price.

- 10. 3. Cost-Plus Contracts: The contract in which the contract price is determined by adding a certain percentage of profit on cost is known as cost plus contract. The cost plus contract is adopted to overcome with problem of fixing the contract price caused due to nature of contract, duration of completion of contract, uncertainty of material, change in the price level, new technology etc. This type of contract is mostly followed by the government for production of special articles not usually manufactured, urgent repairs of vehicles, roads, bridges etc.

- 11. PROFIT ON INCOMPLETE CONTRACTS There are two aspects of profit computation. They are- 1. Computation of notional profit or estimated profit. 2. Computation of the portion of such profit to be transferred to Profit & Loss Account. Notional Profit: Difference between the value of WIP certified and the value of WIP not certified. It is computed as follows- Value of work certified 10,00,000 Add: Cost of work not yet certified 2,00,000 12,00,000 Less: Cost of work to date 9,00,000 Notional Profit 3,00,000

- 12. Estimated Profit: Excess of the contract price over the estimated total cost of the contract. It is computed as follows- Contract Price 15,00,000 Less: Total cost already incurred 11,00,000 4,00,000 Less: Estimated additional cost required to 1,00,000 complete the contract Estimated Profit 3,00,000

- 13. Portion of Notional Profit or Estimated Profit to be transferred to Profit & Loss Account There are some generally followed rules. They are - (a) When work certified is less than 25% complete No profit or Loss be accounted for (b) When work certified is 25 % or more but less than 50% Notional Profit Cash received Work Certified 1 3

- 14. (c) When work certified is the 50% or more but less than 90% Notional Profit 2 3 Cash received Work Certified (d) When the contractor estimates the profit: Work Certified Contract Price Estimated Profit

- 15. THANK YOU