Credit Review

- 2. Terms The person or company who loans money or extends credit to you. CREDITOR DEBTOR The person who borrows money or uses credit. CREDIT – obtaining the use of money that you do not have

- 3. Annual Fee The yearly fee some companies charge for using their card APR – annual percentage rate The interest rate you pay in a single year on the money you borrow Grace period The time you have to pay the credit card balance owed without being charge interest Credit limit The maximum amount you can charge

- 4. Principal The original amount of the loan Interest Fee charged for the use of money

- 5. The 3 C’s of Credit C haracter - responsible attitude toward living up to agreements Will the applicant be responsible and repay the loan? C apacity – financial ability to replay with present income Does the applicant have enough discretionary income to comfortably make the payments on the loan amount requested? C ollateral – property pledged to assure repayment of loan Will the loan be secured, or guaranteed, by collateral that can be used to repay the debt in case the borrower defaults on the loan?

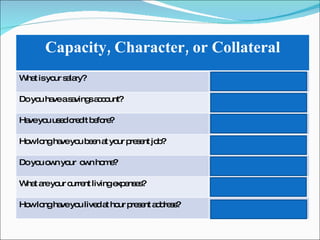

- 6. Capacity, Character, or Collateral What is your salary? Capacity Do you have a savings account? Collateral Have you used credit before? Character How long have you been at your present job? Character Do you own your own home? Collateral What are your current living expenses? Capacity How long have you lived at hour present address? Character

- 7. Common Forms of Credit Home Mortgage Car Loans College Loans Personal Loans Credit Cards

- 8. Credit Advantages Disadvantages Helps people acquire valuable assets Helps people lead happier lives Helps people in emergency situations People may use too much credit in relation to their income Misuse of credit can lead to paying more to obtain credit in the future Misuse of credit can hurt the ability of people to obtain credit in the future

- 9. Credit Scores Credit rating - Measure of creditworthiness based on analysis of financial history. Scores range from 300 – 850 700 – 850 Excellent 650 – 700 Average Below 650 Needs Work Range may vary from lender to lender

- 10. What’s in a Credit Score? Identifying information – Name, address, date of birth, social security number, employment information used to identify you (Not part of your credit score) Trade lines – Your credit accounts. Type of account Date opened Credit limit or loan amount Account balance Payment history

- 11. Credit inquiries - Everyone who accessed your credit within the last two years. Voluntary inquiries – inquiries you authorize Involuntary inquiries – when financial institutions access your information in order to offer “Pre-approved” credit offers Public Records and Collection Items Public information from state and county courts Public information such as bankruptcies, foreclosures, suits, liens, garnishments

- 12. Credit Bureaus Company that gathers, stores, and sells credit information to business subscribers Three larges credit bureaus Equifax Experian TransUnion Under Fair Credit Reporting Act, individuals have the right to get a copy of their credit report from each credit bureau free of charge each year . www.annualcreditreport.com

- 13. How to Establish a Good Credit History Always pay bills on time. Never borrow more than you can comfortably pay back. Borrow only amount you need. Contact lenders immediately if you expect to have a payment problem. Develop good savings habits to handle financial emergencies. Report lost or stolen cards Do not apply for too many credit cards.

- 14. Kinds of Credit Open-ended credit Agreement to lend the borrower an amount up to a stated limit and to allow borrowing up to that limit again, whenever the balance falls below the limit Borrower usually has choice of repaying the entire bill or making smaller payments over a period of time Examples: Credit Cards

- 15. Open 30-Day Accounts Consumer promises to pay the full balance owed each month. Examples: American Express, Diner’s Club

- 16. Revolving Credit Accounts Consumer has option each month of paying in full or making payments at least as high as the stated minimum. Examples: VISA, MasterCard, Discover, department stores, gas company cards

- 17. Closed-End Credit A loan for a specific amount that must be repaid, in full, including all finance charges, by a stated due date. Loan is repaid with fixed payments, or installments , that include principal and interest. Down payment is usually required. Product purchased usually becomes collateral. Examples: loans for cars, furniture, major appliances

- 18. Service Credit Agreement to have a service performed now and pay for it later. Terms are set by individual businesses. Some may impose finance charges on unpaid account balances, but do expect regular payments be made until the bill is paid in full. Examples: utility & telephone companies, lawyers, doctors, hospitals

- 19. Methods of calculating interest on credit cards Average daily balance – the interest rate is calculated each day on the average of each day’s balance for the billing cycle. This is the most frequently used method. Adjusted balance – The interest rate is calculated on the opening balance after subtracting the payments made during the month. Previous balance – Interest is calculated on the opening balance regardless of payments made during the month

- 20. Interest = principal x rate x time I = PRT Finance Charge = Total Price Paid – Cash Price APR = 2 x n x f P (N+1) Where: n = number of payment periods in one year F = finance charge P = principal or amount borrowed N - total number of payments to pay off amount borrowed

- 21. Federal Consumer Credit Protection Truth in Lending Act Fair Credit Reporting Act Equal Credit Opportunity Act Fair Credit Billing Act Electronic Fund Transfer Act Fair Debt Collection Practices Act

- 22. Truth in Lending Act Requires creditors to disclose the cost of credit in simple terms. Lender must State percentage cost of borrowing in terms of the annual percentage rate (APR) Disclose total finance charges for the loan Protects against unauthorized use of credit cards. If card is lost or stolen, you are liable for no more than $50 of charges made by someone else. Not responsible for any charges after notifying the issuer.

- 23. Fair Credit Reporting Act Governs the activities of credit bureaus and creditors Requires creditors to furnish accurate and complete information If you are refused credit, you have right to see your credit report file Requires credit bureaus to investigate if you disagree with information on your report. If claim is valid, information must be corrected Requires that only people with a legitimate business purpose can obtain a copy of your report

- 24. Equal Credit Opportunity Act Requires that all consumers will be given an equal chance to receive credit. States it is illegal to discriminate against applicants on the basis of sex, marital status, race, national origin, religion, age, or because they receive public assistance income.

- 25. Fair Credit Billing Act Requires creditor to mail your bill at least 14 days before payment is due Establishes procedures for correcting billing errors

- 26. Electronic Fund Transfer Act Provides consumer protection to people who use ATM and debit cards. Limits your liability when card is lost or stolen. How quickly you report the loss determines the amount for which you are held responsible. If reported lost or stolen within two days of discovering the loss or theft, your losses are limited to $50. If you wait up to 60 days, you are liable for up to $500. If you wait more than 60 days, you could lose all the money that was taken from your account.

- 27. Fair Debt Collection Practices Forbids collection agencies from using threats, harassment, or abuse to collect debts. Does not apply to creditors who are collecting their own debts.

- 28. Extra Credit Question: In 1958, what two banks began issuing bank credit cards? Bank of America and Chase Manhattan Bank of New York