CRIF Products Fraud Model

- 1. BANKING FRAUD ISSUES STATS AND SOLUTIONS

- 2. The Fraud Challenge Globally over 1 Billion records have been exposed through the use of Fraud Even the big data handlers have experienced huge issues and negative branding – Equifax – Linkedin – Target stores – ebay – yahoo – dating sites Customers are quite clear that they are reluctant to engage with companies / banks who have experienced a data breech Example of data breeches globally Preventing fraud whilst maintaining profitable customers

- 4. GCC Specifics Why is Credit Application Fraud prevalent in the region? Transient Expat Population Limited Data Sources Validation of Information Constant churn of individuals, new to country and maybe new to credit Population is dominated by economic migrants that are commercially aware No single data source available to search individuals relevant data Access to national data repositories are restrictive and expensive Data validation can not always be confirmed or relied upon Constant changes in economic situation can impact on standard predictive models.

- 5. Business Challenge: Typical Fraud Hidden audit trail External Agents Digital Application Location Location doesn’t match Applicant home / office Abnormal Behavior Payment Types Application Speed Inconsistent answers Bad Data Usage Mis-match data Generic answers Known phone numbers

- 6. Business Challenge: SME Fraud In the UAE there are specific Credit Risk issues that concentrate around SME credit application fraud. Challenge Issue Easy to establish new entity in multiple free zones. Company startup requires little or no investment and can be established in a short timeframe. Multiple company ownership or complex relationship between entities is not monitored A network of customers and suppliers can all be related to a small group of individuals Access to validated documentation or information from external providers is difficult Trade documentation, invoices and payments can be altered or manipulated. Bank statements and financial statements are also open to misuse Limited collateral required for finance. Expat business owners have few assets in UAE. There is less commitment from business owners to make loan repayments if the business starts to fail

- 7. SME Fraud: Statistics Using market knowledge and data analysis CRIF can share the following snippets Some Interesting Statistics Age of company established in country – Recent changes in ownership Audited Financial Company Accounts – Rapid changes in P&L Visibility of additional borrowing from other banking providers Company demographics and payment history within your bank Changes in application data within a 3 month period

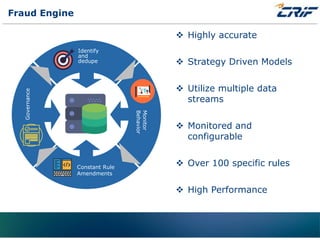

- 9. Fraud Engine Governance Monitor Behavior Identify and dedupe Constant Rule Amendments InitiativeRoot-Cause Highly accurate Strategy Driven Models Utilize multiple data streams Monitored and configurable Over 100 specific rules High Performance

- 10. CRIF Fraud ID Output Results Analytics Input data Behavioural data Third Party Bureau data Registry data Client level risk score Affordable limit by product Customer Value Collection scoring Churn models IRB / IFRS9 Probability of Fraud or Skip Fraud ID The CRIF Fraud ID engine utilizes multiple data sources and complex analytics to provide a Fraud Score