Functional Workflow and Related Queries regarding GST System

- 1. Functional Workflow and Related Queries regarding GST System Presented by Shashi Bhushan Singh VP, GSTN New Delhi Date:7 /02/2017

- 2. Outline • New Features in revised Model GST Law • GSTR 1 – Happy Path – Invoice, Invoice Upload – Amendment – Credit Note – Advance received and liability without invoice declaration – Unhappy Path • GSTR 2A – Before submission – After Submission • GSTR 2 – Acceptance – Rejection – Modification – Addition – Keep Pending • GSTR 1A • GSTR 3 • Mismatch Report and addition of Output Tax – ITC Credit – Reduction in Output Liability – Mismatched supplies with E-Commerce Vendor • Scenarios • Challan • Invoice Reference Number 2 Plan of Presentation

- 3. Outline • Communication of changes and additions in GSTR 2 to the Supplier • Credit Note for Goods returned • TCS on Net Value by E-Commerce Operators • Procedure for Job Work • Reversal of ITC on non payment of consideration within three months • Separate registration for TDS/ISD • Receipt for Advance • Tax Invoice for Inward supply from unregistered persons 3 New features in Revised Model Law

- 4. INTERACTIVE RETURNS GSTR-1 • Upload of Invoice Data • Upload of other data GSTR-2A • Autodrafted from all suppliers/ISD/ TDSand TCS • Download GSTR-2 • Accept / Reject • Modify / Add • Upload of remaining data GSTR-1A • Audto-drafted on the basis of submitted GSTR 2 • Accept/Reject if GSTR 1 filed and GSTR3 not filed GSTR-1 • Auto Amended GSTR 1 if GSTR 3 not filed • Acceptance/rejection/addi tion if GSTR 1 not filed or next period GSTR1 if GSTR 3 filed

- 5. Tax Invoice Details Name,Address and GSTIN of Supplier Consecutive serial no.(unique for a FY) Date of Issuance of Invoice Place of supply(state name & code Accounting code of services HSN code of goods Description of goods/ services Quantity in case of goods and unit Taxable value of goods/ services Rate ofTax Amount of tax charged Total value of goods/ services • Details in maroon boxes need to be uploaded

- 6. Tax I oice Details …….. co ti ued.. Place of Delivery Indication if tax payable under reverse charge The word ‘Revised Invoice/ Supplementary Invoice’- where applicable Signature/Digital Signature of the supplier Recipient Details- B2B: Name,Address & GSTIN B2C: Name, Address(State name & code) • Details in maroon need to be uploaded • Other information • E-commerce GSTIN if applicable • provisional assessment flag and details if applicable

- 7. GSTR – 1 Tables Table No. Detail Table – 5 Taxable outward supplies to a registered person Table – 5A Amendments to details of Outward Supplies to a registered person of earlier tax periods. Table – 6 Taxable outward supplies to a consumer where Place of Supply (State Code) is other than the State where supplier is located (Inter-state supplies) and Invoice value is more than Rs 2.5 lakh Table – 6A Amendment to taxable outward supplies to a consumer of earlier tax periods where Place of Supply (State Code) is other than the State where supplier is located (Inter-state supplies) and Invoice value is more than Rs 2.5 lakh.

- 8. GSTR - 1 Table No. Detail Table – 7 Taxable outward supplies to consumer (Other than 6 above) Table – 7A Amendment to Taxable outward supplies to consumer of earlier tax periods (original supplies covered under 7 above in earlier tax period (s)). Table – 8 Details of Credit/Debit Notes. Table – 8A Amendment to Details of Credit/Debit Notes of earlier tax periods Table – 9 Nil rated, Exempted and Non GST outward supplies Table – 10 Supplies Exported (including deemed exports)

- 9. GSTR - 1 Table No. Detail Table – 11 Tax liability arising on account of Time of Supply without issuance of Invoice in the same period. Table – 11A Amendment to Tax liability arising on account of Time of Supply without issuance of Invoice in the same tax period. Table – 12 Tax already paid (on advance receipt/ on account of time of supply) on invoices issued in the current period

- 10. Table No. Detail Table – 13 Supplies made through e-commerce portals of other companies Part – 1 - Supplies made through e-commerce portals of other companies to Registered Taxable Persons Part – 2 - Supplies made through e-commerce portals of other companies to Unregistered Persons Part – 2 A - Amendment to Supplies made through e- commerce portals of other companies to Unregistered Taxable Persons Table – 14 Invoices issued during the tax period including invoices issued in case of inward supplies received from unregistered persons liable for reverse charge GSTR - 1

- 11. GSTR 1 Happy Path • Invoice and Invoice Upload: • Invoice Details Upload to Start from the 1st of the Tax Period • Invoice of related tax period and earlier tax period can be uploaded • All item level details of one invoice to be uploaded as a unit. • Uploaded Invoice Details of the concerned tax period can be modified/overwritten without any system limit till the submission/filing of the GSTR 1 of the tax period • Modified details to be uploaded for all invoice line items even if modification is only in one line item 11

- 12. Invoice and Invoice Upload • Uploaded invoice details summary in WIP GSTR 1 can be downloaded showing receiver GSTIN wise summary • All Individual invoice details can be downloaded for one recipient GSTIN • Download of filtered individual invoice details not proposed at present. • Invoices cannot be submitted/filed individually. The whole GSTR1 has to be submitted and filed. • The invoice details can be uploaded but would not get frozen till the GSTR 1 is submitted . • The whole GSTR 1 will get frozen when it is submitted/filed 12

- 13. Invoice and Invoice Upload contd. • One GSTR1 for all branches of a GSTIN in a State. – If the invoices relate to two different units the mapping has to be kept by the taxpayer. Invoices for IGST, CGST/SGST will be issued separately o e i oice ca ’t ha e IGST as ell as SGST/CGST i.e one POS in one invoice). Separate invoices for reverse charge Rounding off of liability in respect of a particular head(IGST/SGST/CGST/Cess) will be done at a the return level(i.e. GSTR3) At invoice level normal practice of declaration with two decimals can be expected. 13

- 14. Amendment • Uploaded Invoices/credit/debit notes details which are not yet accepted or rejected by the recipient may be amended • All fields can be amended including POS, reverse charge, GSTIN, invoice number etc. • Amendment can only be accepted and rejected. • In case of amendment of POS no interest will be charged on the IGST or CGST/SGST paid. • The exact procedure for refund/adjustment of wrongly paid tax in case of change in POS is to be specified in law/rules • Only the differential impact of tax will be included in the month in which amendment is furnished. 14

- 15. Credit Notes and Debit Notes • Only the Credit/Debit notes issued by registered supplier has to be declared • the taxable value and/or tax charged in that tax invoice is found to exceed the taxable value and/or tax payable in respect of such supply, or • goods supplied are returned by the recipient, or • services supplied are found to be deficient, • Has to be linked to an invoice and amounts related to each invoice has to be apportioned • Output tax will be reduced in the month of reporting of credit note. 15

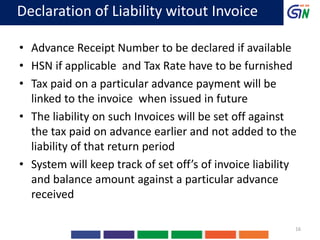

- 16. Declaration of Liability witout Invoice • Advance Receipt Number to be declared if available • HSN if applicable and Tax Rate have to be furnished • Tax paid on a particular advance payment will be linked to the invoice when issued in future • The liability on such Invoices will be set off against the tax paid on advance earlier and not added to the liability of that return period • System will keep track of set off’s of invoice liability and balance amount against a particular advance received 16

- 17. Export Declaration • In case of Goods Export Shipping Bill No has to be declared • So far only export invoice details are expected to be declared in case of Services • Provisions of Declaration of deemed exports not very clear 17

- 18. GSTR 1 Unhappy Path • Recipient's GSTR2 filed before filing of GSTR 1 • Supplier has to accept/reject the downloaded auto- drafted invoices of IA in his GSTR1 and upload and submit • Supplier will not be able to add invoices already present in GSTR 1A. (only accept/reject) • Supplier can add invoices not auto drafted in GSTR1A 18

- 19. GSTR 2 A • The suppliers invoice details will be visible in GSTR 2A Part A immediately after upload • These can be downloaded at any time • The invoices of suppliers have filed their returns in the available GSTR 2A , has to be mandatorily included in GSTR 2 with status of accepted/ rejected/ modified/ pending. • Auto drafted TDS credit/TCS Credit/ISD credit 19

- 20. FORM GSTR-2A: specifics Part A Part B Part C Part D Inward supplies received from registered taxable persons and amendments thereof ISD Credit received TDS Credit received TCS Credit received Details of credit and debit notes and amendments thereof FORM GSTR-1 FORM GSTR-6 FORM GSTR-7 FORM GSTR-8

- 21. GSTR 2 – INWARD SUPPLIES FORM GSTR-2 To be prepared on the basis of details contained in FORM GSTR-2A. Inclusions- 1. Modifications in relation to unmatched details 2. Specification of ineligible input tax credit determinable at invoice level. 3. Quantum of ineligible input tax credit in relation to non-taxable supplies or for non-business purposes undeterminable at invoice level. 4. Details of invoice furnished by an ISD in FORM GSTR-6. 5. Details of TDS in FORM GSTR-7. 6. Details of TCS by an e-commerce operator in FORM GSTR-8

- 22. GSTR 2 • Uploaded GSTR 2 will include all the auto-drafted invoices for which supplier has submitted return with the status of acceptance/ rejection/ modification/ keep pending along with the additional columns/ fields related to ITC availment. • New invoices can be added which are not present in GSTR 2A or whose suppliers have not yet filed their return • In case of new invoices the recipient has to declare the information as per the supplier invoice with him. • Summary of GSTR 2 to include details related to accepted/modified/added invoices • TDS/TCS credits can only be accepted or rejected • Whether ISD credit can only be accepted/rejected or the process will be similar to that of invoice not yet clear 22

- 23. GSTR 2 Contd. • Reverse charge liabilities in respect of –purchase from unregistered persons, –import of services, –advance payment for purchase from unregistered persons • Declaration of import of goods and Input tax credit on IGST paid to custom authorities on bill of entry 23

- 24. GSTR 1A • Modifications/rejections/additions in GSTR 2 will be compiled and communicated in GSTR 1A • Shall take action till 17th before filing his GSTR 3 • if accepted before GSTR 3 then GSTR 1 will be auto amended • Otherwise will form part of GSTR 1 of next tax period • The action of acceptance has to be communicated to the GST system i.e requires submission/filing 24

- 25. GSTR 3 – Monthly return FORM GSTR-3 PART A * Electronically generated based on FORM GSTR-1, GSTR-2, electronic credit/cash ledger and electronic tax liability register. * Details of Turnover, outward/inward supplies, export/import, input tax, output tax. PART B *Details of tax, interest, fees or any amount paid. (Electronically generated from cash and ITC ledger) *Refund of any balance in the electronic cash ledger

- 26. GSTR 3 • Will be generated on the basis of submitted GSTR 1, 1A and GSTR 2 • payment details from ITC ledger and Cash ledger (debit entry numbers) has to be mentioned. • If the tax liability is not fully discharged return invalid • Subsequent valid return cannot be filed till the earlier return is valid 26

- 27. Valid Return • Unless tax is paid, the return does not go for matching – ITC for invoices that have been uploaded but tax not paid will get reversed • ITC claimed in a return that is not valid available only for utilization for liability in that return • No tax payer can file a valid monthly return unless he has filed a valid return for previous o th’s retur 27

- 28. Mismatch reports • Mismatch reports – Input Tax credit claimed by recipients – Output tax reduction on credit notes claimed by supplier – Supplies through an Ecommerce Operator • Can be resolved by filing corrections/ amendments in the next tax period return • Will be communicated on the Dashboards of both the counterparties to a Mismatch • If unresolved in the return of the next tax period, output tax along with interest added to GSTR 3 • In case of ITC mismatch and Output Tax reduction Mismatch if the counterparty resolves the discrepancy afterwards the output tax added along with interest will be reduced. 28

- 29. Input Tax Credit Mismatch • Input Tax credit claimed is more than the tax paid by the supplier on an invoice/debit note . • Supplier has not filed a valid return • Recipient has modified the auto drafted invoice/debit note and increased the tax paid amount and claimed more credit and the Supplier does not accept the upward change in his GSTR 1A • Recipient has claimed credit on a added invoice/debit note and the supplier does not accept the added invoice in his GSTR 1A • In case ITC claimed is more than input tax paid whether full ITC will be reversed or only the differential has to be reversed is still an open issue 29

- 30. Output Tax Reduction Mismatch • Credit note furnished by the supplier is rejected by the recipient or kept pending whereas ITC was claimed on the related invoice. • Credit note furnished by the supplier is accepted by the recipient but input tax credit claimed on it earlier is not reduced. 30

- 31. Ecommerce Mismatch • Supplies of a registered supplier declared by an Ecommerce operator in his return(GSTR 8) is more that the supplies declared through that Ecommerce operator in his GSTR 1 31

- 32. ITC Ledger • Provisional ITC : ITC claimed by a recipient in his return before matching is done . – Can be used for the discharge of the related months liability • Matched ITC: The ITC which gets identified as matched after the matching process – Can be used for payment of other months liabilities in later period returns. • Mismatched ITC: The ITC which gets identified as mismatched after the matching process – Will get added as output tax if not resolved in the next tax period return – Cannot be used for payment of other months liabilities in later period returns. • All the three components will be shown in the GST ITC -1 form available on a taxpayers dashboard. The mismatched report will be readily available in detailed form. 32

- 33. Scenarios 1. Supplier uploads an Invoice No. 123 wrongly against Party A which was originally meant for Party B. Party A accepts the invoice and takes input credit. How will the supplier make the corrections to Invoice No. 123? (Since the invoice is accepted it cannot be amended. Supplier also cannot re-upload since it will be rejected as duplicate). If supplier uploads credit note buyer may reject it, so how will he reduce his liability?

- 34. Scenarios 2. Supplier uploads an invoice wrongly against Party A instead of Party B. Party A rejects and Party B claims in the GSTR-2. Now in Supplier’s GSTR-1A both Party A rejection and Party B claim will appear. And as per the supplier both are right so he accepted both. Clarification needed: In this scenario, can buyer upload a claim against an invoice number which supplier has already uploaded but against a different receiver? Or will it throw duplicate error? Will the liability of supplier gets doubled??

- 35. Challan • Once CPIN is generated the details in the Challan cannot be amended • In E-payment the bank has to selected after the Challan is generated and hence can be changed • In OTC the Bank cannot be changed. Payment can be made in any Branch. • In NEFT/ RTGS the Bank cannot be changed. The taxpayer can make payment in any branch of the bank • No limit on the number of challans one can generate to make payment • In OTC no limit on number of challan but amount limited to Rs 10000 per tax period. 35

- 37. Thank You