GRESB Infrastructure Results | New York

- 3. GRESB assesses and benchmarks the ESG performance of real asset investments, providing standardized and validated data to capital markets.

- 4. GRESB ASSESSMENTS ESG Performance Data ESG Analytics ESG Analytics Investor perspective A Collaborative ESG Data Platform

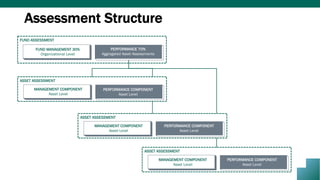

- 5. FUND ASSESSMENT ASSET ASSESSMENT WEIGHTED ASSET SCORE FUND ASSESSMENT SCORE GRESB FUND SCORE Funds with ≥25% asset participation 30% 70% Two Complimentary Assessments

- 6. 10 Years of GRESB

- 7. 2009 Assesses the ESG performance of property companies, fund managers and developers Combined, GRESB represents over US$4 trillion in real asset value GRESB Reporting Framework Annual ESG Disclosure for Real Asset Portfolios 2016 Assesses the ESG performance of infrastructure assets and portfolios 2019

- 8. 10 years of impact # PARTICIPANTS# INVESTORS 107 FUNDS 393 ASSETS

- 9. GRESB Infrastructure Membership Investor Members >100 Institutional Investor Members, representing >$22 trillion Pension funds, insurance companies, sovereign wealth funds

- 10. 2019 Results

- 15. Sustainable Investment Strategies From Negative Screening to Positive Selection

- 16. Fund Commitments

- 17. Assets

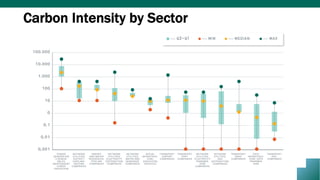

- 22. Intensity Reporting (per Output)

- 23. Carbon Intensity by Sector

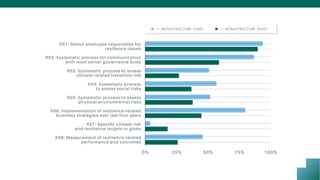

- 24. Resilience

- 30. Assessment Structure MANAGEMENT COMPONENT Asset Level PERFORMANCE COMPONENT Asset Level ASSET ASSESSMENT MANAGEMENT COMPONENT Asset Level PERFORMANCE COMPONENT Asset Level ASSET ASSESSMENT ASSET ASSESSMENT MANAGEMENT COMPONENT Asset Level PERFORMANCE COMPONENT Asset Level FUND MANAGEMENT 30% Organizational Level FUND ASSESSMENT PERFORMANCE 70% Aggregated Asset Assessments

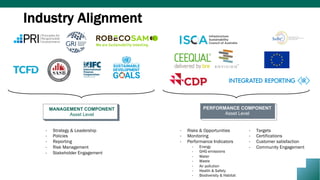

- 31. Industry Alignment - Strategy & Leadership - Policies - Reporting - Risk Management - Stakeholder Engagement - Risks & Opportunities - Monitoring - Performance Indicators - Energy - GHG emissions - Water - Waste - Air pollution - Health & Safety - Biodiversity & Habitat - Targets - Certifications - Customer satisfaction - Community Engagement MANAGEMENT COMPONENT Asset Level PERFORMANCE COMPONENT Asset Level

- 32. SECTOR LEADERS - FUNDS Oceania Focused Sector Diversified Europe Focused Renewable Power America Focused Globally Diversified Asia Focused

- 33. SECTOR LEADERS - ASSETS UDICITE Gestión Integral de Hospitales de Zumpango, S.A.P.I. de C.V. Operadora de Infraestructura Especializada de Guanajuato, S.A.P.I. de C.V. Associated British Airports Port Companies Airport Companies Data Infrastructure Health & Social Care Transport Other Social Infrastructure Network Utilities Energy and Water Resources Diversified and Other Environmental Services Solar Power Education Services Renewable Power Power Generation

- 34. Panel Discussion 2019 GRESB Results • Anmay Dittman, Director of Real Assets at BlackRock • Jessica Elengical, Head of ESG Strategy, Alternatives, DWS Group • Francisca Quinn, Founder and Managing Partner, Quinn and Partners • Josh Nothwang, AVP, Sustainability, Energy and Climate Change, WSP USA Panel discussion moderated by Dan Winters, Head of Americas, GRESB

- 36. SECTOR LEADERS Gestión Integral de Hospitales de Zumpango, S.A.P.I. de C.V. Associated British Airports Operadora de Infraestructura Especializada de Guanajuato UDICITE

- 37. Investment Lifecyle Management (ILM) Ali Mamujee Director of Product & ESG GRESB Infrastructure Results – New York – 2019

- 38. © Mercatus, Inc. Proprietary and Confidential. – Slide 2 Mercatus Platform Overview: Investment Lifecycle Management (ILM) Valuation / Scenarios Asset/Portfolio Mgmt. Data Centralization Origination Mgmt. TM Investor Reporting ESG Reporting Forecasting, Reporting and Compliance Single Source of Truth and System of Record Full Data Transparency and Traceability with LPs Merging ESG, Financial and Operational Datasets Systematize investment process, approval and financial modeling Fast / Easy sensitivity analysis & forward-looking scenarios

- 39. © Mercatus, Inc. Proprietary and Confidential. – Slide 3 Solving Critical Data Challenges for Top Asset Owners, Investors Countries where investments are developed and managed118 Assets tracked and managed14,000 Assets Under Management (AUM)$546B Mercatus Platform Statistics Reference Customers MWs of renewable energy assets managed273,000 Assets managed in emerging markets42% MWh annual renewable production tracked9,287,000

- 40. © Mercatus, Inc. Proprietary and Confidential. – Slide 4 Critical Business Issue: We cannot deliver timely, high quality ESG data for our current and potential LPs Common ESG challenges we hear…. Specific Capabilities: • A centralized system that facilitates ESG collaboration between deal teams, asset managers, and portfolio companies at the asset level • Created automated templates to significantly reduce reporting to GRESB and other ESG frameworks • Ability to integrate ESG data with traditional financial and operational KPIs Problems • Relevant datasets are spread across Excel spreadsheets, multiple third-party software platforms, and PDF reports • Data quality, data quality, data quality • ESG metrics are ever-changing and our current ESG platform is too rigid • We spend weeks manually reporting to multiple frameworks (GRESB, CDP, GRI) • Our team spends over 100 painful hours to create our annual corporate sustainability report (CSR)

- 41. © Mercatus, Inc. Proprietary and Confidential. – Slide 5

- 42. © Mercatus, Inc. Proprietary and Confidential. – Slide 6

- 43. © Mercatus, Inc. Proprietary and Confidential. – Slide 7

- 44. © 2016 Mercatus, Inc. Proprietary and Confidential.

- 45. © Mercatus, Inc. Proprietary and Confidential. – Slide 9 Key Risk: Lack of ESG Roadmap to Repeatable Insight Clear opportunity to evolve into an ESG data driven business Systems Spreadsheets Workforce Assets Portfolio Companies High Low Competitive Advantage Engagement Systemization Data Driven Insights Management and Investor Value Low High 1 2 3 4 5 6 7 8 9 10 Engagement 1. Identify ESG objectives 2. Identify clear owners 3. Draft policies Systemization 4. Finalize ESG data metrics 5. Identify people and processes to facilitate data collection 6. Report manually to ESG industry frameworks 7. Implement technology to streamline ESG processes Data Driven Insights 8. Streamline ESG reporting 9. Integrating financial, operational and ESG data 10. ESG data à consistent improvement in financial performance

- 46. Ali Mamujee Director of Product & ESG amamujee@gomercatus.com 832-630-6241 Contact 400 Concar Drive, 4th Floor San Mateo, CA 94403 www.gomercatus.com Headquarters Thank you!