How to Create a l10n Payroll Structure

- 1. • Software Engineer, RD4HR Team Leader EXPERIENCE 2019

- 4. ● It has been largely improved ○ Functionally: ■ Easier structures definition ■ New dashboards ■ Less complexity (removed parent/children hierarchy) ■ New employee scheduler (Work Entries) ■ More tools for payroll management ■ New versioning mechanism

- 5. ● It has been largely improved ○ Technically: The models have been refactored to: ■ Ease the accounting entries generation ■ Batch all the payslip computation and validation ■ Ease the structures definition ■ Allow easy methods inheritance for both rules computation methods and evaluation context

- 17. ● Attachment of salary ● Meal Vouchers Management ● Expense Reimbursement ● SEPA payment generation ● 281.10, 245.10, DMFA export ● Paid Time Off Allocation ● Company cars management ● Salary configurator ● Credit Time Management ● ... l10n_be only

- 19. ● Define the global parameters for the structures: ○ The scheduled pay (daily, monthly, …) ○ The default working hours (38h/week, …) ○ The wage type (Hours/month-based). ○ The default structure to use as regular pay

- 21. ● Define some parameters to compute a payslip: ○ The rules to be computed on the payslip lines ○ The payslip name ○ Take the worked days into account or not ○ The unpaid work entry types ○ Other specific inputs

- 25. ● Define some parameters to compute the payslip line: ○ The code ○ The name ○ The category ○ Displayed on the payslip or not ○ The applicability/amount rules ○ The journal on which to post the accounting entries ○ The contributor (ONSS, Fédéral State, …)

- 26. ● Define the way a payslip line is computed: ○ A condition to apply it or not: ■ Always ■ Based on a field and a particular range (min/max) ■ Based on a python code NB: Bold means that the element is evaluated in python (using safe_eval). This will be explained later.

- 27. ● Define the way a payslip line in computed: ○ The amount, based on: ■ A fixed amount ■ A fixed percentage based on a field ■ On a python code ○ The quantity NB: Bold means that the element is evaluated in python (using safe_eval). This will be explained later.

- 29. ● Some parameters are evaluated with safe_eval ● The evaluation context ? ○ localdict try: safe_eval( self.amount_python_compute or 0.0, localdict, mode='exec', nocopy=True) return float( localdict['result']), localdict.get('result_qty', 1.0), localdict.get('result_rate', 100.0) except Exception as e: raise UserError(_('Wrong python code defined for salary rule %s (%s).nError: %s') % (self.name, self.code, e))

- 30. localdict = { **self._get_base_local_dict(), **{ 'categories': BrowsableObject(employee.id, {}, self.env), 'rules': BrowsableObject(employee.id, {}, self.env), 'payslip': Payslips(employee.id, self, self.env), 'worked_days': WorkedDays(employee.id, worked_days_dict, self.env), 'inputs': InputLine(employee.id, inputs_dict, self.env), 'employee': employee, 'contract': contract }, **{ 'result': None, 'result_qty': 1.0, 'result_rate': 100 } } 1 3 2

- 31. def _get_base_local_dict(self): return { 'float_round': float_round } ● The first block is quite simple… ● It only contains a pointer to a classic Odoo method

- 32. ● But can be overridden in your own module! def _get_base_local_dict(self): res = super()._get_base_local_dict() res.update({ 'compute_withholding_taxes': compute_withholding_taxes, }) return res def compute_withholding_taxes(payslip, categories, worked_days, inputs): # Do smart stuff return smart_amount

- 33. localdict = { **self._get_base_local_dict(), **{ 'categories': BrowsableObject(employee.id, {}, self.env), 'rules': BrowsableObject(employee.id, {}, self.env), 'payslip': Payslips(employee.id, self, self.env), 'worked_days': WorkedDays(employee.id, worked_days_dict, self.env), 'inputs': InputLine(employee.id, inputs_dict, self.env), 'employee': employee, 'contract': contract }, **{ 'result': None, 'result_qty': 1.0, 'result_rate': 100 } } 1 3 2

- 34. ● BrowsableObject ? Vasistasse ? ● So ? It’s mostly the same thing than a browsed record or a dictionary ? class BrowsableObject(object): def __init__(self, employee_id, dict, env): self.employee_id = employee_id self.dict = dict self.env = env def __getattr__(self, attr): return attr in self.dict and self.dict.__getitem__(attr) or 0.0

- 35. ● So ? It’s mostly the same thing than a browsed record ? ○ NO ! Because we can define more local information on it ! ○ Example: categories is initially empty. 'categories': BrowsableObject(employee.id, {}, self.env)

- 36. ● So ? It’s mostly the same thing than a browsed record ? ○ But on each computed payslip line, the sum for each rule category is recomputed def _sum_salary_rule_category(localdict, category, amount): if category.parent_id: localdict = _sum_salary_rule_category( localdict, category.parent_id, amount) old_value = localdict['categories'].dict.get(category.code, 0) localdict['categories'].dict[category.code] = old_value + amount return localdict

- 37. ● So ? It’s mostly the same thing than a browsed record ? ○ Then, in a salary rule, you can use a shortcut like: ○ In that case, you get the sum of all the payslip lines amount that belong to the categories ‘BASIC’ and ‘ALW’. result = categories.BASIC + categories.ALW

- 38. ● Same for rules, which is also initially empty ● But, is updated each time a payslip line is computed ● You can then access to all the evaluated rules 'rules': BrowsableObject(employee.id, rules_dict, self.env) rules_dict[rule.code] = rule result = 20 if 'CHILD' in rules else 10

- 39. ● For payslip, it’s a little more complicated ● You could do something like: class Payslips(BrowsableObject): def sum(self, code, from_date, to_date=None): self.env.cr.execute("""SMART SQL QUERY""") res = self.env.cr.fetchone() return res and res[0] or 0.0 def sum_category(self, code, from_date, to_date=None): self.env.cr.execute("""SMART SQL QUERY""") res = self.env.cr.fetchone() return res and res[0] or 0.0 result = payslip.sum('NET', '2018-01-01', '2018-12-31')

- 40. ● For payslip, it’s a little more complicated class Payslips(BrowsableObject): def rule_parameter(self, code): return self.env['hr.rule.parameter']._get_parameter_from_code( code, self.dict.date_to)

- 41. ● What is a hr.rule.parameter ? ○ It’s a constant used in a salary rule, that may have different values over the time. (Example: the Child Allowances)

- 42. result = categories.BRUT <= payslip.rule_parameter('work_bonus_reference_wage_high') ● What is a hr.rule.parameter ? ○ So, we could retrieve the current value for a given parameter, for example in a applicability condition like the following:

- 43. ● For payslip, it’s a little more complicated ● By default, we retrieve the basic salary (wage - unpaid amount) like this: class Payslips(BrowsableObject): @property def paid_amount(self): return self.dict._get_paid_amount() result = payslip.paid_amount

- 44. ● worked_days and inputs also are BrowsableObjects, with sum and sum_hours methods, as for payslip ● They are defined as: 'worked_days': WorkedDays(employee.id, worked_days_dict, self.env), 'inputs': InputLine(employee.id, inputs_dict, self.env), worked_days_dict = {line.code: line for line in self.worked_days_line_ids if line.code} inputs_dict = {line.code: line for line in self.input_line_ids if line.code}

- 45. ● It is thus possible to retrieve the number of worked days on a payslip like: ● Or retrieve the value for an additional payslip line from an input like: worked_days.WORK100.number_of_days result = inputs.YEAREND_BONUS.amount if inputs.YEAREND_BONUS else 0

- 46. ● employee and contract are simple browsed records, and can be used in a classical way result = 100 if employee.children == 1 else 200 result = contract.car_atn

- 47. localdict = { **self._get_base_local_dict(), **{ 'categories': BrowsableObject(employee.id, {}, self.env), 'rules': BrowsableObject(employee.id, {}, self.env), 'payslip': Payslips(employee.id, self, self.env), 'worked_days': WorkedDays(employee.id, worked_days_dict, self.env), 'inputs': InputLine(employee.id, inputs_dict, self.env), 'employee': employee, 'contract': contract }, **{ 'result': None, 'result_qty': 1.0, 'result_rate': 100 } } 1 3 2

- 48. ● You probably noticed, that we often set a variable result on the rules computation formulae ● In fact, for each payslip line, the default value is: ● The python rule can set all those 3 variables for a payslip line: { 'result': None, 'result_qty': 1.0, 'result_rate': 100 } result = categories.TERMINAISON_DOUBLE result_rate = -13.07 result_qty = 6.8/7.67

- 50. <record id="structure_type_employee_cp200" model="hr.payroll.structure.type"> <field name="name">CP200: Belgian Employee</field> <field name="default_resource_calendar_id" ref="resource.resource_calendar_std_38h"/> <field name="country_id" ref="base.be"/> </record>

- 51. <record id="hr_payroll_structure_cp200_employee_salary" model="hr.payroll.structure"> <field name="name">CP200: Employees Monthly Pay</field> <field name="country_id" ref="base.be"/> <field name="type_id" ref="l10n_be_hr_payroll.structure_type_employee_cp200"/> <field name="regular_pay" eval="True"/> <field name="unpaid_work_entry_type_ids" eval="[ (4, ref('hr_payroll.work_entry_type_unpaid_leave')), (4, ref('l10n_be_hr_payroll.work_entry_type_unpredictable')), (4, ref('l10n_be_hr_payroll.work_entry_type_long_sick')), (4, ref('l10n_be_hr_payroll.work_entry_type_part_sick')), (4, ref('l10n_be_hr_payroll.work_entry_type_maternity')), (4, ref('l10n_be_hr_payroll.work_entry_type_breast_feeding')), ]"/> </record>

- 52. <record id="cp200_employees_salary_atn_internet" model="hr.salary.rule"> <field name="category_id" ref="hr_payroll_head_div_impos"/> <field name="name">ATN Internet</field> <field name="code">ATN.INT</field> <field name="sequence">16</field> <field name="condition_select">python</field> <field name="condition_python">result = bool(contract.internet)</field> <field name="amount_select">code</field> <field name="amount_python_compute">result = 5.0</field> <field name="struct_id" ref="hr_payroll_structure_cp200_employee_salary"/> </record>

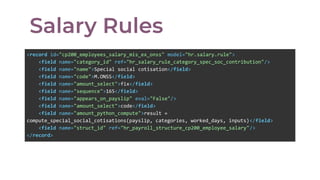

- 53. <record id="cp200_employees_salary_mis_ex_onss" model="hr.salary.rule"> <field name="category_id" ref="hr_salary_rule_category_spec_soc_contribution"/> <field name="name">Special social cotisation</field> <field name="code">M.ONSS</field> <field name="amount_select">fix</field> <field name="sequence">165</field> <field name="appears_on_payslip" eval="False"/> <field name="amount_select">code</field> <field name="amount_python_compute">result = compute_special_social_cotisations(payslip, categories, worked_days, inputs)</field> <field name="struct_id" ref="hr_payroll_structure_cp200_employee_salary"/> </record>

- 54. ● Be careful! By default, a structure has already 3 default rules. ○ BASIC { 'name': 'Basic Salary', 'sequence': 1, 'code': 'BASIC', 'category_id': self.env.ref('hr_payroll.BASIC').id, 'condition_select': 'none', 'amount_select': 'code', 'amount_python_compute': 'result = payslip.paid_amount', }

- 55. ● Be careful! By default, a structure has already 3 default rules. ○ GROSS { 'name': 'Gross', 'sequence': 100, 'code': 'GROSS', 'category_id': self.env.ref('hr_payroll.GROSS').id, 'condition_select': 'none', 'amount_select': 'code', 'amount_python_compute': 'result = categories.BASIC + categories.ALW', }

- 56. ● Be careful! By default, a structure has already 3 default rules. ○ NET { 'name': 'Net Salary', 'sequence': 200, 'code': 'NET', 'category_id': self.env.ref('hr_payroll.NET').id, 'condition_select': 'none', 'amount_select': 'code', 'amount_python_compute': 'result = categories.BASIC + categories.ALW + categories.DED', }

- 57. ● Don’t recreate those lines, override them ;) <function model="hr.salary.rule" name="write"> <value model="hr.salary.rule" search="[ ('struct_id', '=', ref('l10n_be_hr_payroll.hr_payroll_structure_cp200_double_holiday')), ('code', '=', 'NET')]"/> <value eval="{'amount_python_compute': 'result = categories.DP + categories.ALW + categories.DED', 'sequence': '201'}"/> </function>

- 59. ● Benefits : Your module is under our responsibility concerning the maintenance + less customizations for your customers. ● Contact yti@odoo.com, and open a PR with your modifications. ● It should be included in a l10_CODE_hr_payroll module. ● Try to be generic (Only data for the salary structures, or new computation methods) ● You may propose new features as well (reports, ...), that will be validated internally with the product owner. ⇒ THANK YOU FOR YOUR HELP !

![● Some parameters are evaluated with safe_eval

● The evaluation context ?

○ localdict

try:

safe_eval(

self.amount_python_compute or 0.0,

localdict, mode='exec', nocopy=True)

return float(

localdict['result']),

localdict.get('result_qty', 1.0),

localdict.get('result_rate', 100.0)

except Exception as e:

raise UserError(_('Wrong python code defined for salary rule %s (%s).nError: %s') %

(self.name, self.code, e))](https://image.slidesharecdn.com/howtocreateal10npayrollstructures-191029150044/85/How-to-Create-a-l10n-Payroll-Structure-29-320.jpg)

![● So ? It’s mostly the same thing than a browsed record ?

○ But on each computed payslip line, the sum for each rule

category is recomputed

def _sum_salary_rule_category(localdict, category, amount):

if category.parent_id:

localdict = _sum_salary_rule_category(

localdict,

category.parent_id,

amount)

old_value = localdict['categories'].dict.get(category.code, 0)

localdict['categories'].dict[category.code] = old_value + amount

return localdict](https://image.slidesharecdn.com/howtocreateal10npayrollstructures-191029150044/85/How-to-Create-a-l10n-Payroll-Structure-36-320.jpg)

![● Same for rules, which is also initially empty

● But, is updated each time a payslip line is computed

● You can then access to all the evaluated rules

'rules': BrowsableObject(employee.id, rules_dict, self.env)

rules_dict[rule.code] = rule

result = 20 if 'CHILD' in rules else 10](https://image.slidesharecdn.com/howtocreateal10npayrollstructures-191029150044/85/How-to-Create-a-l10n-Payroll-Structure-38-320.jpg)

![● For payslip, it’s a little more complicated

● You could do something like:

class Payslips(BrowsableObject):

def sum(self, code, from_date, to_date=None):

self.env.cr.execute("""SMART SQL QUERY""")

res = self.env.cr.fetchone()

return res and res[0] or 0.0

def sum_category(self, code, from_date, to_date=None):

self.env.cr.execute("""SMART SQL QUERY""")

res = self.env.cr.fetchone()

return res and res[0] or 0.0

result = payslip.sum('NET', '2018-01-01', '2018-12-31')](https://image.slidesharecdn.com/howtocreateal10npayrollstructures-191029150044/85/How-to-Create-a-l10n-Payroll-Structure-39-320.jpg)

![● For payslip, it’s a little more complicated

class Payslips(BrowsableObject):

def rule_parameter(self, code):

return self.env['hr.rule.parameter']._get_parameter_from_code(

code, self.dict.date_to)](https://image.slidesharecdn.com/howtocreateal10npayrollstructures-191029150044/85/How-to-Create-a-l10n-Payroll-Structure-40-320.jpg)

![<record id="hr_payroll_structure_cp200_employee_salary" model="hr.payroll.structure">

<field name="name">CP200: Employees Monthly Pay</field>

<field name="country_id" ref="base.be"/>

<field name="type_id" ref="l10n_be_hr_payroll.structure_type_employee_cp200"/>

<field name="regular_pay" eval="True"/>

<field name="unpaid_work_entry_type_ids" eval="[

(4, ref('hr_payroll.work_entry_type_unpaid_leave')),

(4, ref('l10n_be_hr_payroll.work_entry_type_unpredictable')),

(4, ref('l10n_be_hr_payroll.work_entry_type_long_sick')),

(4, ref('l10n_be_hr_payroll.work_entry_type_part_sick')),

(4, ref('l10n_be_hr_payroll.work_entry_type_maternity')),

(4, ref('l10n_be_hr_payroll.work_entry_type_breast_feeding')),

]"/>

</record>](https://image.slidesharecdn.com/howtocreateal10npayrollstructures-191029150044/85/How-to-Create-a-l10n-Payroll-Structure-51-320.jpg)

![● Don’t recreate those lines, override them ;)

<function model="hr.salary.rule" name="write">

<value model="hr.salary.rule" search="[

('struct_id', '=', ref('l10n_be_hr_payroll.hr_payroll_structure_cp200_double_holiday')),

('code', '=', 'NET')]"/>

<value eval="{'amount_python_compute': 'result = categories.DP + categories.ALW +

categories.DED', 'sequence': '201'}"/>

</function>](https://image.slidesharecdn.com/howtocreateal10npayrollstructures-191029150044/85/How-to-Create-a-l10n-Payroll-Structure-57-320.jpg)