Intro To Shariah Compliant Structures Mohammed Haris

- 1. Introduction to Shariah Compliant Structures and Business Applications Mohammad Haris Deputy General Manager, Corporate Banking, Structured Finance & Product Development April 28, 2009 1 St East and Central Africa Conference on Islamic Banking

- 2. Presentation Outline Part I: Shariah compliant structures Murabaha Ijarah Musharaka Mudarabah Part II: Business solution Financing Requirements Working Capital Asset/Project /BMR Financing Trade Requirements Imports Exports Fx 1 St East and Central Africa Conference on Islamic Banking

- 3. Shariah Compliant Structures Murabaha 1 St East and Central Africa Conference on Islamic Banking

- 4. Murabaha Murabaha is a particular kind of sale where the transaction is done on a “cost plus profit” basis i.e. the seller discloses the cost to the buyer and adds a certain profit to it to arrive at the final selling price The distinguishing feature of Murabaha from ordinary sale is - The seller discloses the cost to the buyer - And a known profit is added 1 St East and Central Africa Conference on Islamic Banking

- 5. Murabaha Since Murabaha is a sale transaction - rules of Shariah regarding sale should be understood to judge if a Murabaha transaction is valid 1 St East and Central Africa Conference on Islamic Banking

- 6. Basic Rule for Murabaha Asset to be sold: must exist. should be in ownership of the seller at the time of sale. should be in physical or constructive possession of the seller. should not be used for un-Islamic purpose. Sale price should be determined. Forward sale is not allowed. 1 St East and Central Africa Conference on Islamic Banking

- 7. Process Flow 1 St East and Central Africa Conference on Islamic Banking Bank Customer Supplier Agreement for Murabaha (1) Payment (2) Asset (3) Offer to Purchase (4) Acceptance + Transfer of Title (5) Payment of Sale Price (6)

- 8. Shariah Compliant Structures Ijarah 1 St East and Central Africa Conference on Islamic Banking

- 9. Ijarah Ijarah is a term which means “To give something on rent” The term “Ijarah” is used in two situations: It means ‘To employ the services of a person on wages’ e.g. “A” hires a porter at the airport to carry his luggage Another type of Ijarah relates to paying rent for use of an asset or property 1 St East and Central Africa Conference on Islamic Banking

- 10. Ijarah Ijarah is an Islamic alternative of Leasing. Leasing backed by an acceptable contract is an acceptable transaction under Shariah. The question of whether or not the transaction of leasing is Shariah compliant depends on the terms and conditions of the contract. Several characteristics of conventional agreements may not conform to Shariah thus making the transaction un-Islamic and thereby invoking a prohibition. 1 St East and Central Africa Conference on Islamic Banking

- 11. Process Flow 1 St East and Central Africa Conference on Islamic Banking Vendor Bank Customer Undertaking to Lease (1) Payment to Purchase Assets (2) Transfer of title (3) Lease Agreement (4) Rental Payment (5) At the end of Contract period client purchase the assets And Transfer of Title (6)

- 12. Rules of Ijarah Ownership of the leased asset remains with the Lessor All rights and liabilities relating to ownership are borne by the Lessor. Subject matter of Lease should be Valuable, Identified and Quantified. The period of Lease must be determined in clear terms. The Lessor cannot increase the rent unilateral 1 St East and Central Africa Conference on Islamic Banking

- 13. Rules of Ijarah The Lessee is responsible for damage to the asset caused by fraud or negligence. Normal maintenance is Lessee’s responsibility If the leased asset is destroyed, the lease will terminate. Lease rentals for the entire lease period must be fixed; 1 St East and Central Africa Conference on Islamic Banking

- 14. Shariah Compliant Structures Musharaka 1 St East and Central Africa Conference on Islamic Banking

- 15. Definition “ Musharakah ” means “Sharing”. The word Musharakah has been derived from “Shirkah” which means being a partner Musharakah is basically a kind of partnership in which the partners join together with different contributions, work or obligation for the common objective of undertaking business and trade in accordance with the principles of Shariah. 1 St East and Central Africa Conference on Islamic Banking

- 16. Types of Musharakah Shirkat-ul-Milk It means joint ownership of two or more persons in a particular property. Shirkat-ul-’Aqd This is the second type of Shirkah which means: A partnership effected by a mutual contract in which the partners join together with different contributions, work or obligation for the purpose of earning profit. 1 St East and Central Africa Conference on Islamic Banking

- 17. Rules of Musharaka Management of Musharaka Each partner has a right to take part in Musharaka management. The partners may appoint a managing partner by mutual consent One or more of the partners may decide not to work for the Musharaka and work as a sleeping partner. 1 St East and Central Africa Conference on Islamic Banking

- 18. Rules Of Musharaka Rules for Profit Distribution The ratio of profit distribution must be agreed at the time of execution of the contract The ratio must be determined as a proportion of the actual profit earned by the enterprise Not as percentage of partner’s investment Not in lump sum amount A sleeping partner cannot share the profit more than the percentage of his capital. 1 St East and Central Africa Conference on Islamic Banking

- 19. Rules Of Musharaka Illustration for Profit Distribution If A and B enter into a partnership and it is agreed between them that A shall be given Rs. 10,000/- per month as his share in the profit, and the rest will go to B, the partnership is invalid. Similarly, if it is agreed between them that A will get 15% of his investment, the contract is not valid. The correct basis for distribution would be an agreed percentages of the actual profit accrued to the business. 1 St East and Central Africa Conference on Islamic Banking

- 20. Rules Of Musharaka Rules for Loss In the case of a loss, each partner shall suffer the loss exactly according to the ratio of investment. Profit is based on the agreement of the parties, but loss is always subject to the ratio of investment. 1 St East and Central Africa Conference on Islamic Banking

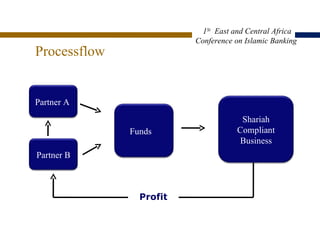

- 21. Processflow Profit 1 St East and Central Africa Conference on Islamic Banking Partner A Partner B Funds Shariah Compliant Business

- 22. Shariah Compliant Structures Mudarabah 1 St East and Central Africa Conference on Islamic Banking

- 23. Mudarabah This is a kind of partnership where one partner gives money to another for investing in a commercial enterprise. The investment comes from the first partner who is called “ Rabb-ul-Maal ” (Investor) The management and work is an exclusive responsibility of the other, who is called “ Mudarib ” (Manager) Profit is shared as per agreed ratio All losses are borne by Investor 1 St East and Central Africa Conference on Islamic Banking

- 24. Types of Mudarabah Un-restricted Mudarabah No restriction from the Rabb-ul-Mal (Investor) regarding the business. Restricted Mudarabah Some restrictions implemented from the Rabb-ul-Mal (Investor) 1 St East and Central Africa Conference on Islamic Banking

- 25. Processflow Profit 1 St East and Central Africa Conference on Islamic Banking Depositors Asset Manager Funds Shariah Compliant Assets, Financing Expertise

- 26. Diff b/w Musharaka & Mudarabah Musharakah In Musharaka all partners invest Both parties can work Loss is shared according to contribution Mudarabah In Mudarabah one party invests (Investor) and other party works (Manager) Profit is shared as per agreed ratio All losses are borne by Investor 1 St East and Central Africa Conference on Islamic Banking

- 27. Business Solution - Financing Requirement Working Capital Financing Using Murabaha (Sale) Mode of Financing 1 St East and Central Africa Conference on Islamic Banking

- 28. Murabaha Murabaha is a particular kind of sale where the transaction is done on a “cost plus profit” basis 1 St East and Central Africa Conference on Islamic Banking

- 29. Murabaha – Illustration The Customer and the bank sign Master Financing Agreement along with Agency Agreement. Customer identifies and finalizes a purchase deal for cotton with a supplier. Customer makes a written request to the bank for the purchase of Raw Cotton. The bank disburses funds amounting to KES. 100 million to the supplier. 1 St East and Central Africa Conference on Islamic Banking

- 30. Murabaha – Illustration Agent/Bank purchases and takes possession of the Cotton. The Customer then makes an offer to purchase it at KES 106 million to be paid after six months by signing the Offer. The bank accepts the offer and the sale is concluded whereby ownership as well as risk is transferred to the Customer. 1 St East and Central Africa Conference on Islamic Banking

- 31. Process Flow 1 St East and Central Africa Conference on Islamic Banking Bank Customer Cotton Supplier Agreement for Murabaha (1) Agency Agreement to source cotton supplier (2) Payment of Kes 100 Mio (3) Delivery of Cotton (4) Offer to Purchase cotton at Kes 106 Mio in 6 months (5) Acceptance of Sale + Transfer of Title (6) Differed payment of Kes 106 Mio (7)

- 32. Issues in Murabaha Rollover in Murabaha Rebate on early payments Penalty for late payments 1 St East and Central Africa Conference on Islamic Banking

- 33. Business Solution - Financing Requirement Asset/Project Financing Using Ijarah (Leasing) Mode of Financing 1 St East and Central Africa Conference on Islamic Banking

- 34. Ijarah Ijarah is a term which means “To give something on rent” Ijarah is an Islamic alternative of Leasing. 1 St East and Central Africa Conference on Islamic Banking

- 35. Illustration Customer request financing for a truck costing Kes. 10 million. Islamic Bank agrees to finance the cost. Undertaking to lease is signed. Bank makes payment to truck supplier and take possession. Bank and customer sign the lease agreement for 3 years. The customer uses the truck and pays regular rent for 3 years. At the end of 3 rd year, the customer buys the truck from the bank at nominal value and ownership is transferred. 1 St East and Central Africa Conference on Islamic Banking

- 36. Process Flow 1 St East and Central Africa Conference on Islamic Banking Vendor Bank Customer Undertaking to Lease (1) ksh10m (2) Truck Title (3) Lease Agreement (4) Rental Payment (5) (At the end of Lease period) Truck Title (6)

- 37. Risk and rewards of ownership lies with the owner Once and if the asset is destroyed, the lease agreement is terminated Late payment penalty cannot be booked as income by the Lessor. Lease and Sale agreement should be separate and non contingent. Difference b/w Conventional Lease & Ijarah 1 St East and Central Africa Conference on Islamic Banking

- 38. The Lessor cannot increase the rent unilaterally Expenses to be borne by the parties: Lessor - expenses relating to the corpus of the asset Lessee - actual operating/overhead expenses related to running the asset Rent is charged after delivery of the asset to the Lessee. Difference b/w Conventional Lease & Ijarah 1 St East and Central Africa Conference on Islamic Banking

- 39. Business Solution- Financing Requirement Asset/Project Financing Using Diminishing Musharaka (Partnership) Mode of Financing 1 St East and Central Africa Conference on Islamic Banking

- 40. Diminishing Musharaka It involves taking share in the ownership of a specific asset and then gradually transferring complete ownership to the other partner. This concept is based on Declining ownership of the financier Three components Joint ownership of the Bank and customer Customer as a lessee uses the share of the bank Redemption of the share of the Bank by the customer 1 St East and Central Africa Conference on Islamic Banking

- 41. Illustration Customer request financing for a property costing Kes. 10 million. Islamic Bank agrees to provide financing up to 60% of the cost. Joint Ownership Agreement is executed between the bank and the Customer. Bank will purchase 60% share in the property by paying Kes. 6 million to supplier. Customers pays its share of Kes. 4million. 1 St East and Central Africa Conference on Islamic Banking

- 42. Illustration Bank’s share is divided into sixty units. Customer agrees to buyout Bank’s share (units) on monthly basis and the Undertaking is executed by the customer. Customer pays the rent for the usage of the Bank’s units. Rental reduces after purchase of each unit by the customer. After five years ownership of the asset is completely transferred to the customer. 1 St East and Central Africa Conference on Islamic Banking

- 43. Joint Partnership Musharaka Payment of Rental and Purchase of Unit Gradual Transfer of Ownership Process Flow Kes 6m Kes 4m 1 St East and Central Africa Conference on Islamic Banking Bank Customer Supplier

- 44. Business Solution - Trade Requirement Trade Finance Products 1 St East and Central Africa Conference on Islamic Banking

- 45. Trade Finance Products Sight & Usance LCs Import Financing through “Import Murabaha” & “Musharaka” Export Financing through “Musawamah & Agency” & “Musharaka” Forex transactions: Spot and forward Collaterally Managed Assets financing through “Murabaha” 1 St East and Central Africa Conference on Islamic Banking

- 46. Letter of Credit Shariah allows that the bank may charge service charges for providing various services in the course of issuing LCs. However, these service charges should be developed keeping in view the reasonable cost estimates. For example if the importer extends the LC, less service charges should be collected as less services would be required for extension in the period of the LC. 1 St East and Central Africa Conference on Islamic Banking

- 47. Business Solution - Trade Finance Requirement Import Financing Using Murabaha (Sale), Ijarah (Leasing) and Musharaka (Partnership) Mode of Financing 1 St East and Central Africa Conference on Islamic Banking

- 48. Import Murabaha The customer opens the LC from the Bank as an agent of the Bank. The bank assumes ownership of the goods until they arrive at the port and are sold to the customer. Upon receipt of documents Bank makes payment to the foreign supplier. The Bank sells the goods to the customer on Murabaha (i.e. cost plus profit basis. ) 1 St East and Central Africa Conference on Islamic Banking

- 49. Import Ijarah The Importer places order with the foreign supplier on behalf of Islamic Bank. The importer signs undertaking to lease. The Importer opens the LC from Islamic Bank as an agent of the Bank. Upon receipt of documents Islamic Bank makes payment to the foreign supplier. The bank will enter into an Ijarah agreement with the customer. After the term of Ijarah agreement is completed, the bank may sell the asset to the importer at an agreed price. 1 St East and Central Africa Conference on Islamic Banking

- 50. Import Musharaka The bank and the importer will sign Musharaka Agreement. The bank and the importer may agree on any profit sharing ratio. The bank will make payment to the exporter after receiving the documents. Importer will sell the commodity in local market. The bank and the importer will share the profit as per the agreed ratio. 1 St East and Central Africa Conference on Islamic Banking

- 51. CM Murabaha Bank and the customer sign master murabaha agreement and agency agreement Customer finalizes terms with CM company. Customer opens the LC thru the bank as its agent to import commodity. Bank makes payment upon arrival of documents Upon arrival of shipment, bank will release import documents to CM. Customer will request bank to release commodity in tranches Bank will release the commodity in tranches after signing offer and acceptance. Bank will calculate murabaha price after adding all costs incurred to date and applying profit rate. The transaction will complete once the customer has paid for the entire consignment for its release. 1 St East and Central Africa Conference on Islamic Banking

- 52. Business Solution - Trade Finance Requirement Export Financing Using Musharaka (Partnership) and Wakala (Agency) Mode of Financing 1 St East and Central Africa Conference on Islamic Banking

- 53. Export Musharaka The exporter has a confirmed order to export commodity backed by LC The bank and the exporter will sign Musharaka Agreement. The bank and the importer may agree on any profit sharing ratio. The bank and the exporter will contribute their share of funds. The exporter will ship the commodity through the bank in accordance with LC terms. The documents will be couriered to the importer The bank will receive export proceeds and will share it with the exporter as per agreed ratio. 1 St East and Central Africa Conference on Islamic Banking

- 54. Purchase and Agency The exporter has a confirmed export order backed by LC The exporter has already procured the commodity and is ready for shipment. The bank will buy the commodity prior to shipment. The bank will arrange to ship the commodity. The documents will be couriered to the importer. The bank will receive export proceeds and will settle the o/s exposure along with booking profit. 1 St East and Central Africa Conference on Islamic Banking

- 55. Business Solution - Trade Requirement FX Deals 1 St East and Central Africa Conference on Islamic Banking

- 56. Spot Fx Deals Trading of currency with another currency is allowed so far as the delivery of one or both is not deferred. The counter values of the same currency must be of equal amount. 1 St East and Central Africa Conference on Islamic Banking

- 57. Forward Cover A bilateral promise to buy or sell currency on a future date is not allowed However, a promise from one party is permissible. 1 St East and Central Africa Conference on Islamic Banking

- 58. Thank you 1 St East and Central Africa Conference on Islamic Banking

- 59. Q & A 1 St East and Central Africa Conference on Islamic Banking

Editor's Notes

- #5: Murabaha Murabaha is a particular kind of sale where the transaction is done on a “cost plus profit” basis The distinguishing feature of Murabaha from ordinary sale is - The seller discloses the cost to the buyer - And a known profit is added Since Murabaha is a sale transaction, rules of Shariah regarding sale should be applied.

- #7: Basic Rule for Murabaha sale/finance Asset to be sold must exist. Sale price should be determined. Sale must be unconditional. Assets to be sold:- should not be used for un-Islamic purpose. should be in ownership of the seller at the time of sale. should be in physical or constructive possession of the seller.

- #29: Murabaha Murabaha is a particular kind of sale where the transaction is done on a “cost plus profit” basis The distinguishing feature of Murabaha from ordinary sale is - The seller discloses the cost to the buyer - And a known profit is added Since Murabaha is a sale transaction, rules of Shariah regarding sale should be applied.

- #33: ISSUES IN MURABAHA Following are some of the issues in murabaha financing: 1. Securities against Murabaha Payments coming from the sale are a receivable and for this the client may be asked to furnish a security. It can be in the form of a mortgage or hypothecation or some kind of lien or charge. 2 . Guaranteeing the Murabaha The seller can ask the client to furnish a 3 rd party guarantee. In case of default on payment the seller may have recourse to the guarantor who will be liable to pay the amount guaranteed to him. There are 2 issues relating to this: a) The guarantor cannot charge a fee from the original client. The reason being that a person charging a fee for advancing a loan comes under the definition of riba. b) However the guarantor can charge for any documentation expenses. 3. Penalty of default Another issue with murabaha is that if the client defaults in payment of the price at the due date, the price cannot be changed nor can penalty fees be charged.

- #49: In order to deal with dishonest clients who default in payment deliberately they should be made liable to pay compensation to the Islamic Bank for the loss suffered on account of default. However these should be made subject to the following conditions: a) The defaulter should be given a grace period of at-least one-month. b) If it is proved beyond doubt that the client is defaulting without valid excuse then compensation can be demanded. 4. Rollover in Murabaha Murabaha transaction cannot be rolled over for a further period as the old contract ends. It should be understood that murabaha is not a loan rather the sale of a commodity which is deferred to a specific date. Once this commodity is sold its ownership transfers from the bank to the client it is therefore no more a property of the seller. Now what the seller can claim is only the agreed price and therefore there is no question of effecting another sale on the same commodity between the same parties. 5. Rebate on earlier payments Sometimes the debtors want to pay early to get discounts. However in Islam majority of muslim scholars including the major schools of thought consider this to be un-Islamic. However if the Islamic bank or financial institution gives somebody a rebate on its own it is not objectionable, especially if the client is needy.

- #52: In order to deal with dishonest clients who default in payment deliberately they should be made liable to pay compensation to the Islamic Bank for the loss suffered on account of default. However these should be made subject to the following conditions: a) The defaulter should be given a grace period of at-least one-month. b) If it is proved beyond doubt that the client is defaulting without valid excuse then compensation can be demanded. 4. Rollover in Murabaha Murabaha transaction cannot be rolled over for a further period as the old contract ends. It should be understood that murabaha is not a loan rather the sale of a commodity which is deferred to a specific date. Once this commodity is sold its ownership transfers from the bank to the client it is therefore no more a property of the seller. Now what the seller can claim is only the agreed price and therefore there is no question of effecting another sale on the same commodity between the same parties. 5. Rebate on earlier payments Sometimes the debtors want to pay early to get discounts. However in Islam majority of muslim scholars including the major schools of thought consider this to be un-Islamic. However if the Islamic bank or financial institution gives somebody a rebate on its own it is not objectionable, especially if the client is needy.