Lecture 7 Income Statement Rw

- 1. Reporting PerformanceIncome Statement and Statement of Cash Flow

- 2. Balance Sheet shows where I am nowBalance Sheet shows where I wasCash Flow explains how cash changedAssetsLiabilities&EquityCashCash Flow StatementAssetsLiabilities&EquityCashIncome Statement shows how I got thereIncome Statement

- 3. Income StatementIncome Statement: measures performance over a certain period of timeCompares inflows (“Revenue” or “Sales”) with outflows (“Costs” or “Expenses”)Revenue – Expenses = Net Income

- 6. Business Income StatementA business income statement reports on operating and non-operating activities. It lists amounts for revenues less expenses over a period of time. Sales less expenses yield the “bottom-line” net income amount.

- 7. Income Statement ComponentsRevenues: value received from the exchange of goods or services to customersExpenses: cost of doing business; assets and resources used to provide those revenuesNet income: revenues less the expenses associated with getting those revenues

- 8. 80

- 9. Income Statement is on Accrual BasisThe Accrual Income Statement reflects the economics of the tradewith the customer

- 10. Revenue is the value of what the company gives to the customer, regardless of when it gets paid. Customer gives back Cash or Accounts Receivable (cash later)Expenses are the value of the resources used to produce whatever it is that was traded

- 11. Might be paid for before used, when used or paid laterThe Income StatementEvery company is different but follows same general format…Sales / Revenue (“top-line”) -Cost of Sales = Gross Profit -SGA, R&D, Marketing Expenses = Income From Operations +/- Interest Expense / Income = Income before Taxes - Tax = Net Income (“bottom line”)Direct cost of goods provided to customers

- 12. 80

- 13. 80EBITDAEarnings before Interest, Taxes, Depreciation & AmortizationMeasures operating results before costs of capital structure and taxes

- 14. EBITDA ExampleTwo Companies exactly the same:RevenueProductsCustomersIndustryEmployeesNet Income:Company A $200Company B $ 20

- 15. EBITDA ExampleABRevenue 1000 1000Expenses 980 780Net Income 20 220Interest 120 10Tax 60 10Depreciation /Amortization 50 10EBITDA 250 25014

- 17. Accrual AccountingAssets, liabilities, revenues, and expenses are put on the financial statements when the transaction that causes them occurs, not when cash is paid or received.Cash may be paid or received at same time, but this has NOTHING to do with when the info goes on the financial statementsRequired by GAAP.

- 18. Accrual Basis Revenues are earned and recorded when goods or services are provided to customersExpenses are incurred and recorded when the resources are used to create the goods and services provided to the customerThe matching principle requires that expenses be recorded in the same period as the associated revenue, NOT the period in which they are paid

- 19. ExerciseBig and Rich Hats LLC - 2008Buys hats from suppliers: value of $175k$25k paid in 2008, balance on creditSells goods to customers: invoice value of $200kReceived $150k in cashRemainder to be paid in 2009

- 20. Big and Rich Performance19

- 21. Big and Rich Performance20

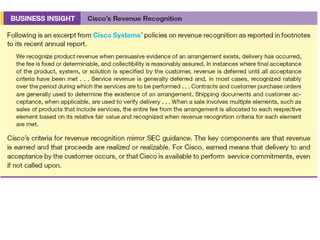

- 22. Revenue Recognition Rules in GAAP…often lots of judgment in determining revenueRevenue is recognized when all conditions are met:Persuasive evidence of an arrangement existsDelivery of products or services has occurredPrice is fixed and determinableCollection is reasonably assured

- 23. Revenue Recognition Rules in GAAP…often lots of judgment in determining revenueRevenue is recognized when all conditions are met:Persuasive evidence of an arrangement existsDelivery of products or services has occurredPrice is fixed and determinableCollection is reasonably assured

- 25. 2485 – 88

- 26. 2587

- 27. Revenue Games ExerciseBlue Train Computer Corp.List Price: Hardware $20 Software License $1 / month Full Maintenance $2 / monthMingus Inc. purchases system for $20; includes 3 months of software license and 1 month warranty“Irrevocable” contract signed Nov 24. 2009: $5 non refundable deposit with contract$5 per month Jan 2010 – Mar 2010If no pay, only recourse is take back hardwareDec 31, 2009: ½ hardware deliveredJan 31, 2010: ½ hardware deliveredFeb 28, 2010: software deliveredMar 31, 2010: system up and running26

- 28. Percentage-of-CompletionFor certain industries requiring long-term contacts, revenue is by determining the costs incurred to date compared with the project’s total expected costs. Percentage-of-completion method requires an estimate of total anticipated costs. This estimate is made at the beginning of the contract and is used to initially bid the contract.

- 29. Percentage-of-Completion2005 10-K report footnotes of Raytheon Company:

- 30. Unearned RevenueDeposits from customers are liability until service obligation is fulfilled

- 31. Expense Rules in GAAP Once revenue is determined, then expenses are recorded The matching principle requires that expenses be recorded in the period in which they are incurred to generate the revenue

- 32. Expense Rules in GAAP Once revenue is determined, then expenses are recorded The matching principle requires that expenses be recorded in the period in which they are incurred to generate the revenue…even more judgment in expenses

- 33. Accrual-Based Measurement of ExpensesIf benefit is for current period, report the cost as… ExpenseAs the benefits are used up, reduce the asset and report this cost as…If benefit extends to future periods, initially report the cost as…AssetA capitalized cost is the cost that is reported as an asset on the balance sheet.Company incurs a cost.

- 34. 80

- 35. 3495

- 37. 36102 – 103