Merger Synergies

- 2. Meaning of Synergy The value of a combined firm is greater than the value of sum of individual firms. 1 + 1 > 2 2Dr Raju Indukoori

- 3. Synergy Value • It is the excess of the merged value over the sum of individual firms. • It is the ability of a business combination to be more profitable than the sum of the profits of individual firms • Acquiring companies look at target firm for synergy value. • Acquiring firm also considers expenses while acquiring the target firm. 3Dr Raju Indukoori

- 4. Synergy Value Equation EP)PV(PVPVVS TBAAA incurredExpensesE paidPremiumP firmTargetofValuePresentPV nacquisitiobeforefirmAcquiringofValuePresentPV nacquisitioafterfirmAcquiringofValuePresentPV Where T BA AA 4Dr Raju Indukoori

- 5. Synergy Value – An example An acquiring company with a present value of Rs 1,000 Cr is contemplating to acquire a target company worth Rs 680 Cr with an expenses of Rs 20 Cr. The post merger value is expected by the analysts as Rs 1750 Cr. What was the synergy value in this combination 5Dr Raju Indukoori EP)PV(PVPVVS TBAAA

- 6. Synergy Value – An example An acquiring company with a present value of Rs 1,000 Cr is contemplating to acquire a target company worth Rs 680 Cr with an expenses of Rs 20 Cr. The post merger value is expected by the analysts as Rs 1750 Cr. What was the synergy value in this combination EP)PV(PVPVVS TAA Cr50Rs 20Rs680)Rs1,000(Rs1,750RsVS 6Dr Raju Indukoori

- 7. Types of Synergy • Growth Synergy • Efficiency Synergy • Financial synergy • Operation synergy • Technological synergy • Competitive synergy 7Dr Raju Indukoori

- 8. Sources of Synergy • Revenue Growth. • Cost Reduction. • Tax Benefits. • Surplus funds. • Unused debt capacity. • Asset Write ups. • Reduced Competition. • Increase in concentration. 8Dr Raju Indukoori

- 9. Sources of Synergy Revenue Growth • Strengthened product • Integration of channels of distribution 9Dr Raju Indukoori

- 10. Sources of Synergy Cost Reduction • Reduce overlapping costs • Economies of scale • Increased bargaining power with suppliers. • Usage of common assets. • R&D 10Dr Raju Indukoori

- 11. Factors Destroying the synergy sources • Target company employees resistance. • Poor product quality. • Change in perception of the customers. • Environmental issues • Product liabilities • Unresolved lawsuit 11Dr Raju Indukoori

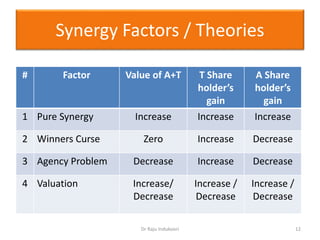

- 12. Synergy Factors / Theories # Factor Value of A+T T Share holder’s gain A Share holder’s gain 1 Pure Synergy Increase Increase Increase 2 Winners Curse Zero Increase Decrease 3 Agency Problem Decrease Increase Decrease 4 Valuation Increase/ Decrease Increase / Decrease Increase / Decrease 12Dr Raju Indukoori

- 13. Synergy & Value Creation • Acquiring poorly managed firm. • Acquiring undervalued firm. • Acquiring stressed company. • Acquiring company with poor IR. 13Dr Raju Indukoori

- 14. Synergy and Success of a Merger • Revenue Growth • Cost Reduction • Enhanced Efficiency: Managerial, operational, financial and technological. • Meeting strategic objectives. 14Dr Raju Indukoori

- 15. Synergy Value and Swap Ratio – Problem 1 A company with a market price of Rs 128 is contemplating to acquire a target company trading at Rs 89. If the acquiring company offers 0.90 of its share for every one share of the target company, Is that justified? If yes to whom? 15Dr Raju Indukoori • Swap ratio based on market price = Rs 89/ Rs 128 = 0.70 • Any proportion greater than 0.70 would benefit the share holders of the target company • Target company would generate synergy value of the swap ratio is less than 0.70

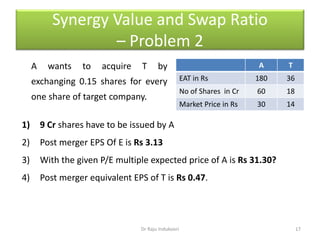

- 16. Synergy Value and Swap Ratio – Problem 2 A wants to acquire T by exchanging 0.15 shares for every one share of target company. 16Dr Raju Indukoori 1) ___ Cr shares have to be issued by A ? 2) Post merger EPS of A is Rs _________. 3) With the given P/E multiple expected price of A is Rs ________. 4) Post merger equivalent EPS of T is Rs______. A T EAT in Rs 180 36 No of Shares in Cr 60 18 Market Price in Rs 30 14

- 17. Synergy Value and Swap Ratio – Problem 2 A wants to acquire T by exchanging 0.15 shares for every one share of target company. 17Dr Raju Indukoori 1) 9 Cr shares have to be issued by A 2) Post merger EPS Of E is Rs 3.13 3) With the given P/E multiple expected price of A is Rs 31.30? 4) Post merger equivalent EPS of T is Rs 0.47. A T EAT in Rs 180 36 No of Shares in Cr 60 18 Market Price in Rs 30 14

- 18. Synergy Value and Swap Ratio – Problem 2 18Dr Raju Indukoori A T A Post Merger EAT in Rs Cr 180 36 216 No of Shares in Cr 60 18 69 Market Price in Rs 30 14 31.30 EPS in Rs 3 2 3.13 P/E 10 7 10

- 19. Synergy and Success of a Merger • Revenue Growth • Cost Reduction • Enhanced Efficiency: Managerial, operational, financial and technological. • Meeting strategic objectives. 19Dr Raju Indukoori

- 20. Any Questions…. 20Dr Raju Indukoori

- 21. Thank You 21Dr Raju Indukoori