POLA_QUANT.IT_2016_v5

- 1. QUANTITATIVE AND ASSET MANAGEMENT WORKSHOP 2016 Combining F-atoms with A-atoms to exploit investment opportunities around global economies Gianni POLA,PhD Senior Portfolio Manager– Head of Quantitative Research Multiasset& MultimanagerDivision ANIMA SGR 25-26 Febbraio - Marittima Centro Congressi Terminal 103 - Venezia

- 2. ANIMA - highlights Source: ANIMA; as ofDec31st, 2015 AuM 66.9 € bn #1 Largest independent asset manager inItaly €67 bn of Assets under management and 1 million customers Anima Holding: a public company, listed on Borsa Italiana (ANIM:IM) Distinctiveinvestmentexpertise Over 50 professionals in portfolio managementand productengineering based in Milan and Dublin Excellent track record both on relative and absolute return products Highly effectivedistributionnetwork Long term strategic partnerships with 4 banking groups Long term commercial agreement with Poste Italiane Over 130 distribution agreements with banks and FA networks Unique business model An integrated platformof tools and services for distribution partners/networks Over 50 professionals dedicated to supportand services 2

- 3. ANIMA - highlights 2011 35.0 2012 40.7 2013 46.6 2014 57.1 Source: ANIMA -Total AuM, including assets delegatedto Third parties Assets under Management (€bn) 2015 66.9 3

- 4. ANIMA - highlights * Includes institutional andretaildiscretionary mandates Source: ANIMA Products Clients Mutual funds/SICAV Asset under Management, December 31st, 2015 100% = 66.9 €bn Retail Institutional Asset under Management,December 31st, 2015 100% = 66.9 €bn Individualportfolio management* 4 75% 25% 59% 41%

- 5. ANIMA – Multiasset & Multimanager Division 5 Investment philosophy Investment solutions & financial services Capital appreciation with low bias towards macro environments to overcome adverse market conditions to catch up the risk-premia available in the market Beta investment on strategic horizon to get exposure to risk premia Alpha strategies to tactically adapt the asset allocation to changing regime in the macro space Flagship product: multi-asset flexible unconstrainedapproach exposure to non-traditionalassets style: quant + discretionary risk profile:KIID 4 (vol.5% - 10%) Traditional (long-only) multiasset products Advisory to institutional clients measuringimplicit macro diversification enhancingdiversificationin asset idiosyncraticriskby means of entropy metrics

- 6. 6 A new paradigmfor asset allocation Assets are like molecules that can be broken down in atoms of different nature F-atoms refer to global and local macro factors A-atoms refer to asset specific risk

- 7. 7 Are we risk-parity? we like the idea of balancingrisk BUT risk is not volatility,macro risk is more relevant moreover traditionalrisk-parity suffers from estimationrisk(Pola, 2014) This work develops further some ideas previously published on research papers by introducingthe local F-atoms enrichingthe investment opportunity set with A-atoms

- 8. 8 Unexpected returns The recent crises have brought increasing uncertainty in the exercise of forecastingexpected returns due to: some market variables (interestrates)are in uncharted territory non-conventionalmonetarypolicies ofCentral Banks recent fallingoil prices & China slowdown The uniquenessof the level reached by many financial variablesshould at least convince us to lower our confidence on predictabilityof asset risk premia (see de Laguiche & Pola,2012) 0 2 4 6 8 10 12 14 16 1790 1800 1810 1820 1830 1840 1850 1860 1870 1880 1890 1900 1910 1920 1930 1940 1950 1960 1970 1980 1990 2000 2010 US 10 yrs bond yield Source: GLOBALFINANCIAL DATA

- 9. 9 Academia & Research Industry Bayesian approaches (e.g. Black & Litterman, 1990) Robust Allocations (Tütüncü & Koenig, 2004) Robust Bayesian Allocations (Meucci, 2011) Forecast-free investment solutions (minimum variance, maximum diversification, and risk-parity; Russo, 2013) Entropy-based diversified portfolios (Meucci, 2009; Pola, 2013c; Pola, 2014; Pola, 2016) Factor Investing (Fama & French, 1992; Webster 2015) Global Macro Approach (Pola & Facchinato, 2016) How to handle uncertainty in portfolio management?

- 10. 10 Most of asset dynamics can be captured by variations of levels of macro variables (growth and inflation) and the risk-premia available in the market “Markets move based on shifts in conditions relative to the conditions that are priced in” (Bridgewater)

- 11. 11 Practical implications on Asset Allocation … Robust Asset Allocationto navigateuncertainmarket conditions Efficient investing on globaland localmacro themes Hedging against the fallingoil prices or recent China slowdown New insights in crisis management Portfolio diagnosis for advisory activity Deepening our understandingof asset correlation

- 12. 12 Macro scenarios, and their quasi-ortogonality rising growth falling growth rising inflation falling inflation rising risk premia falling risk premia As variations of levels are more relevant than levels themselves we define rising and falling scenarios . )()( ),( log),()()(||),( 21, 21 21 212121 ff fPfP ffP ffPfPfPffPD * Analysis based on a non-parametric statisticaltest (Bootstrap-based) ontheKL pseudo-distance. We measured the “orthogonality” of factors via the Kullback-Leibler pseudo distance: Factors are not strictly-orthogonal*, however we prefer to work with quasi- orthogonal axes that are stable over time and easily related to macroeconomic dynamics

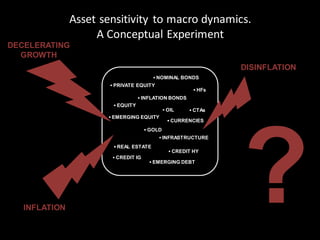

- 13. 13 Asset sensitivity to macro dynamics. A Conceptual Experiment ▪ NOMINAL BONDS ▪ INFLATION BONDS ▪ EQUITY ▪ GOLD ▪ OIL ▪ INFRASTRUCTURE ▪ CREDIT IG ▪ CREDIT HY ▪ EMERGING EQUITY ▪ EMERGING DEBT ▪ CURRENCIES ▪ HFs ▪ CTAs ▪ PRIVATE EQUITY ▪ REAL ESTATE DECELERATING GROWTH INFLATION DISINFLATION

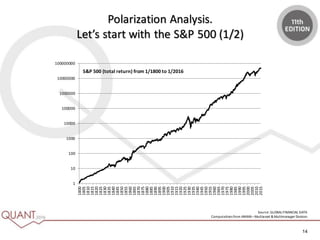

- 14. 14 Polarization Analysis. Let’s start with the S&P 500 (1/2) 1 10 100 1000 10000 100000 1000000 10000000 100000000 1800 1805 1810 1815 1820 1825 1830 1835 1840 1845 1850 1855 1860 1865 1870 1875 1880 1885 1890 1895 1900 1905 1910 1915 1920 1925 1930 1935 1940 1945 1950 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 2015 S&P 500 (total return) from 1/1800 to 1/2016 Source: GLOBALFINANCIAL DATA Computationsfrom ANIMA–Multiasset &Multimanager Division

- 15. 15 Polarization Analysis. Let’s start with the S&P 500 (2/2) 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% whole sample rising growth falling growth rising inflation falling inflation Averagequarterly excess returnof S&P500 overrisk-free conditional tomacro scenarios G I Source: GLOBALFINANCIAL DATA & Fama-French Website Computationsfrom ANIMA–Multiasset &Multimanager Division

- 16. 16 Polarization Analysis. An indicator to measure asset sensitivity Is the result statistically robust? The polarization coefficient P (parametric and non-parametric approaches) to evaluate asset sensitivity to macro factors Main properties are: P is in-between -1 and +1 sign(P) indicates preference for rising or falling scenario abs(P) quantifies the probability to polarize The polarization coefficients for the S&P 500 are: growth +99.27% inflation -81.10% Source: GLOBALFINANCIAL DATA & Fama-French Website Computationsfrom ANIMA–Multiasset &Multimanager Division Looking intrasectors

- 17. 17 Asset Segmentation (1/2) 119 assets inthe US including traditional and alternativeassetclasses Nominal bonds Inflation-linked bonds Credit market (IG, HY, EMDH, EMDL) Zero-duration Creditmarket Equity sectors & styles Equity sectors & styles – beta-neutral Currencies Volatility Commodity Hedge-fund strategies & trend followers Clustering AnalysisonMacroSimilarity Source: Bloomberg,Datastream, GLOBAL FINANCIAL DATA, Fama &Frenchwebsite Computations from ANIMA – Multiasset & Multimanager Division. The dendrogram is a tree diagram illustrating the clusters produced by a metric quantifying the “distance”among assets. It has been obtained with standard algorithm provided by MathWorks. In particular the hierarchy between asset classes has been derived according to a Minkowski metric with p=1 in the bi- dimensional space spanned by the polarization coefficients on growth and inflation, and the clustering protocol ofun-weighted averagedistance. INFLATION-LINKEDBOND NOMINALBOND EQUITY COMMODITY

- 18. 18 Asset Segmentation (2/2) Clustering AnalysisonMacroSimilarity G+ I- Equity Equity Financials, Utilities, Industrials … G+ I+ OIL Industrial Metals Equity Energy, Material Emerging Debt Local currency Commodity currencies … G- I- Nominal Bonds Credit IG CTAs VIX … G- I+ Inflation linked bonds G I

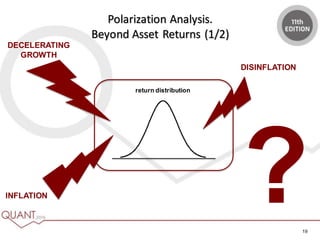

- 19. 19 Polarization Analysis. Beyond Asset Returns (1/2) DECELERATING GROWTH INFLATION DISINFLATION return distribution

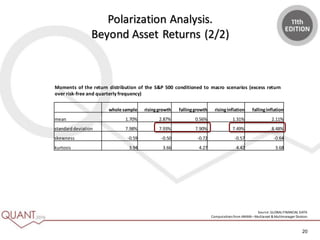

- 20. 20 Polarization Analysis. Beyond Asset Returns (2/2) Moments of the return distribution of the S&P 500 conditioned to macro scenarios (excess return over risk-free and quarterly frequency) whole sample risinggrowth fallinggrowth risinginflation fallinginflation mean 1.70% 2.87% 0.56% 1.31% 2.11% standarddeviation 7.98% 7.93% 7.90% 7.49% 8.48% skewness -0.59 -0.50 -0.72 -0.57 -0.64 kurtosis 3.94 3.66 4.27 4.42 3.68 Source: GLOBALFINANCIAL DATA Computationsfrom ANIMA–Multiasset &Multimanager Division

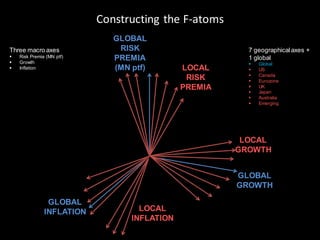

- 21. 21 Constructing the F-atoms GLOBAL INFLATION GLOBAL RISK PREMIA (MN ptf) GLOBAL GROWTH Three macro axes Risk Premia (MN ptf) Growth Inflation LOCAL INFLATION LOCAL RISK PREMIA LOCAL GROWTH 7 geographical axes + 1 global Global US Canada Eurozone UK Japan Australia Emerging

- 22. 22 F-atoms, 2011 Focus on Global, US and Eurozone Risk Premia (MN ptf) Source: Bloomberg Computationsfrom ANIMA–Multiasset &Multimanager Division

- 23. 23 F-atoms, 2015 Focus on Global, US and Eurozone Risk Premia (MN ptf) Source: Bloomberg Computationsfrom ANIMA–Multiasset &Multimanager Division

- 24. 24 F-atoms, YtD as of February 3rd, 2016 -8.00% -3.00% 2.00% GLOBAL US CANADA EURO UK JAPAN AUSTRALIA Risk Premia (MN ptf) -8.00% -3.00% 2.00% GLOBAL US CANADA EURO UK JAPAN AUSTRALIA Growth -8.00% -3.00% 2.00% GLOBAL US CANADA EURO UK JAPAN AUSTRALIA Inflation Source: Bloomberg Computationsfrom ANIMA–Multiasset &Multimanager Division

- 25. 25 F-atoms, Draghi speech on December 3rd, 2015 -3.50% -1.50% GLOBAL US CANADA EURO UK JAPAN AUSTRALIA Risk Premia (MN ptf) -3.50% -1.50% 0.50% GLOBAL US CANADA EURO UK JAPAN AUSTRALIA Growth -3.50% -1.50% 0.50% GLOBAL US CANADA EURO UK JAPAN AUSTRALIA Inflation Source: Bloomberg Computationsfrom ANIMA–Multiasset &Multimanager Division

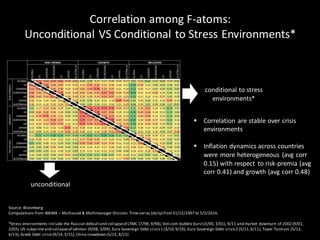

- 26. 26 Correlation among F-atoms: Unconditional VS Conditional to Stress Environments* Source: Bloomberg Computations from ANIMA – Multiasset& Multimanager Division.Time-series (daily) from31/12/1997 to 5/2/2016. *Stress environments include:the Russian defaultand collapseof LTMC (7/98, 9/98), Dot-com bubble burst(3/00, 3/01), 9/11 and market downturn of 2002 (9/01, 2/03), US subprimeand collapseof Lehman (9/08, 3/09), Euro Sovereign Debt crisis 1 (3/10,9/10), Euro Sovereign Debt crisis 2 (5/11,6/11), Taper Tantrum (5/13, 6/13), Greek Debt crisis (9/14,5/15),China slowdown (5/15, 8/15) conditional to stress environments* unconditional Correlation are stable over crisis environments Inflation dynamics across countries were more heterogeneous (avg corr 0.15) with respect to risk-premia (avg corr 0.41) and growth (avg corr 0.48)

- 27. 27 Why introducing the A-atoms component? Main investment motivations are to include specific investment themes (e.g. robotics, automobile sectors, …) sometimes and in specific market conditions idiosyncratic risk plays a central role (e.g. CHF, Volkswagen, Italian Banks, …) Main benefits: it diversifies the model risk embedded in the F-atoms construction it makes our approach more flexible to generate decorrelated alpha A-atoms construction is based on entropy metrics that balance high convinction bets with market uncertainty

- 28. 28 Factor analysis Macro- Neutral portfolio Risk premium Macro outlook Alpha generation Macro-diversified active portfolio Understanding the key global and local macro factors Growth, Inflation, Risk Premium Diversifying macro factors and idiosyncratic risk Embracing macro dynamics Managing risk premiumexposure A C D B E Anima Global Macro Diversified. The investment process

- 29. Portfolio diagnosis: the 60/40 29 Capital Allocation A 60/40 allocation with a euro bias (50% euro + 50% global) Portfolio diagnosis Globalfactors explain 83%of theportfolio variance, adding localadjstumentswereach 87% 87% can bebroken down as follows: 5% 29% 15% Bond Euro (20%) Bond Global (20%) Equity Euro (30%) Equity Global (30%) GLOBAL RISK-PREMIA (47%) LOCAL (ADJ) RISK-PREMIA (4%) GLOBAL GROWTH (27%) LOCAL (ADJ) GROWTH (15%) GLOBAL INFLATION (7%) LOCAL (ADJ) INFLATION (0.1%) Source: Bloomberg Computations from ANIMA –Multiasset &Multimanager Division Portfolio allocatedin jpmgemlc,jhucgbig, msdlemu, mxwo. Timeseries from31/12/1997to 31/12/2015(monthly obs).

- 30. Conclusions F-atoms and A-atoms are the building blocks of asset returns, they are complementary as they diversify the investment opportunityset the model risk The ANIMA Global Macro approach is able to decipher complex patternsof many assets in terms of few factors to capture the market risk premium without being exposed to macroeconomic dynamicsand asset idiosyncraticrisk 30

- 31. Main references 31 .. GLOBAL MACRO APPROACH 1.Pola,G.,& Facchinato,S.,2016.«CombiningF-atomswithA-atomsto exploitinvestmentopportunitiesaround global economies”,in preparation2016 2.Pola,G.,2013a.“Rethinking Strategic AssetAllocation interms of DiversificationAcross MacroeconomicScenarios”,Amundi Cross AssetSpecialFocus May 2013 3.Pola,G.,2013b.“Managinguncertaintywith DAMS.Assetsegmentation in responseto macroeconomic changes”,Amundi Working PaperWP-034-2013 4. Pola, G., & Facchinato, S., 2014. “Managing uncertainty with DAMS: from Asset Segmentation to Portfolio Management”, AMUNDI Discussion Paper DP-06- 2014 5. Pola, G., & Facchinato, S., 2015. “Factor investing through DAMS: from Asset Segmentation to Portfolio Management”, AMUNDI Cross Asset Special Focus, January 2015 6. Pola, G.,& Taze-bernard, E., 2015. . “Assetallocation in a context of falling oil prices: the case of institutions in commodity-exporting countries”, AMUNDI Cross AssetSpecial Focus,January 2015 DIVERSIFICATION MEASURES &ESTIMATION RISK 7.Pola,G.,2016.“On entropy and portfolio diversification”,accepted forpublicationto Journal of AssetManagement,2016 8.Pola,G.,Zerrad,A.,Massoli,G.,Barucci,.E.,2016.“Theroleof estimationrisk inportfolio diversification”,in preparation2016 9.Pola,G.,& Nastaj,M.,2016. “On assetdependency and portfoliodiversification”, in preparation 2016 10.Pola,G.,& Gianni,M,2016. “Asset-basedAllocation vs.FactorInvesting:a differentperspective”, in preparation 2016 11. Pola, G., 2013c. “Diversification Measures for Portfolio Selection”, book chapter in "Stock Markets: Emergence, Macroeconomic Factors and Recent Developments”,NOVA publisher(NewYork),2013 12.Pola,G.,2014.“Isyourportfolio effectivelydiversified? Various perspectives on portfoliodiversification”,Amundi Working PaperWP-040-2014 13.Pola,G.,& Zerrad,A.,2014.“Diversification,EntropyandtheInefficientFrontier”,Amundi Cross AssetSpecialFocus,April 2014 EXPECTEDRETURNS 14. de Laguiche, S., Pola, G., & Taze-bernard, E., 2013. . “Forecasting returns on assets in an environment of uncertainty”, AMUNDI Cross Asset Special Focus, January 2013 15. de Laguiche, S., & G. Pola, 2012. “Unexpected Returns. Methodological Considerations on Expected Returns in Uncertainty”, Amundi Working Paper WP-032- 2012 16.deLaguiche,2014.“« Risk-free» assets:whatlong-termnormalized return? “,Amundi Discussion PaperDP-02-2014

- 32. Il presente materiale non può in nessun caso essere interpretato come consulenza, invito all’investimento, offerta o raccomandazione per l’acquisto o la vendita di strumenti finanziari, né costituisce sollecitazione al pubblico risparmio. ANIMA è esonerata da qualsiasi responsabilità derivante da un uso improprio del presente materiale al pubblico, effettuato in violazione delle disposizioni degli Organi di Vigilanza anche in materia di pubblicità. I rendimenti passati non sono indicativi di quelli futuri. Prima di aderire leggere il Prospetto, disponibile presso la sede della società, i collocatori e sul sito www.animasgr.it. This document is not intended to be an offer or solicitation, investment advice or recommendation for the purchase or sell any financial instruments and it cannot be disclosed to third parties and/or distributed to the public.This is an informative report and its content is not intended and cannot be used improperly, also as advertising, for the placement of any fund managed by ANIMA Sgr, accordingly to Italian law. The Company assumes the hereby given information as accurate and reliable, but it does not guarantee its precision and it shaIlnot therefore be liable for its use by the addressees. Past performance is not indicative of future returns. For detailed information, please consult the sales prospectusavailable at ANIMAHeadquarter, third partiesdistributorsand on our corporate website www.animasgr.it.