Presentation - Touchtech Payments

- 1. US Market Entry Strategy forTouchtech Payments UCD Michael Smurfit Graduate Business School Full-time Master of Business Administration

- 2. Agenda Introduction Project Scope Industry Analysis Customer Segmentation Market Entry Strategy Challenges to Internationalisation Recommendations

- 3. Introduction International market entry strategy for Touchtech Academic frameworks to frame understanding Segmented a market of 12,000+ institutions We produced a shortlist institutions Gained first-hand information from key decision makers in US financial institutions. 12,000+ Financial Institutions

- 4. ProjectScope Phase 1: Business Model Analysis Understanding howTouchtech compete in the market Phase 2: Market Analysis Detailed analysis of US market Phase 3: Academic Literature Review Focused literature review on best practice for start-ups, internationalisation, and growing & scaling an organisation

- 5. ProjectScope Phase 4: Researching Potential Customers Starting at a high level with 12,000+ institutions Complete list of high level potential targets Deep dive and shortlisting of the highest potential customers Phase 5: Market Entry Strategy A guideline forTouchtech Outline the risks involved, key contacts, and estimated required resources

- 6. IndustryAnalysis US Market Entry Strategy forTouchtech Payments

- 7. Industry Analysis High degree of competition Authentication market No preference of end-users Access to distribution network Reliance on partnerships Intricate selling process

- 8. Industry Analysis 12000+ Banks and CUs Role of new government Geographical distance Credit Union v/s Banks US Market Analysis

- 9. Industry Analysis MobileWallets3D Secure ShoppingTransactions Large scale identity management solutions Competitor Categories

- 10. Industry Analysis Product offeringLow High Maturityofproduct/BrandEquityLowHigh Competitor Diversity

- 11. Customer Segmentation US Market Entry Strategy forTouchtech Payments

- 12. Customer Segmentation US Banks & Credit Unions

- 13. Customer Segmentation US Banks & Credit Unions

- 15. Customer Segmentation Banks: Segmentation Method US Banks Group 1 Group 2 Group 3 Asset Size > $100 bn < $100 bn, > $2bn < $2 bn 1. Assets:

- 16. Customer Segmentation Banks: Segmentation Method US Banks Group 1 Group 2 Group 3 Asset Size > $100 bn < $100 bn, > $2bn < $2 bn 1. Assets: 2. Demographics: US Banks Group 1 Group 2 Group 3 Population Under 18 18 – 35 yr Over 35 yr

- 17. Customer Segmentation Banks: Segmentation Method US Banks Group 1 Group 2 Group 3 Asset Size > $100 bn < $100 bn, > $2bn < $2 bn 1. Assets: 2. Demographics: 3. Geographical: Identified banking clusters US Banks Group 1 Group 2 Group 3 Population Under 18 18 – 35 yr Over 35 yr

- 18. Customer Segmentation Banks: $2b - $100b Assets

- 19. Customer Segmentation Banks: Assets & Demographics (18-35)

- 20. Customer Segmentation Banks: Assets, Demos & Clusters

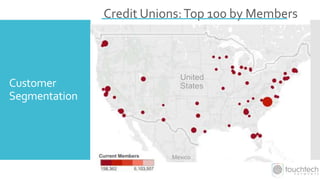

- 22. Customer Segmentation Credit Unions: Segmentation Method US Credit Unions Group 1 Group 2 Asset Size > $2bn < $2 bn 1. Assets:Top 100

- 23. Customer Segmentation Credit Unions: Segmentation Method US Credit Unions Group 1 Group 2 Asset Size > $2bn < $2 bn 1. Assets:Top 100 2. Members:Top 100 3. Branches:Top 100 US Credit Unions Group 1 Group 2 No. of Members > 150,000 < 150,000 US Credit Unions Group 1 Group 2 No. of Branches > 20 < 20

- 24. Customer Segmentation Credit Unions:Top 100 by Assets

- 25. Customer Segmentation Credit Unions:Top 100 by Members

- 26. Customer Segmentation Credit Unions:Top 100 by Branches

- 28. Customer Segmentation 1. Strong retail / personal banking section? 2. Technology focused strategy? 3. Online banking capability? 4. Mobile banking capability? 5. Active on social media? 6. Decreased its number of branches over the past five years? 7. Customer focused strategy? 8. Customer complaints re login / payment systems? 9. Has new management / CEO been appointed? Banks & Credit Unions: Shallow Dive

- 29. Customer Segmentation 1. How user friendly is their login platform? 2. How bad are the reviews of their payment / login systems? 3. Do they currently offerApple Pay / Android Pay / mobile wallet or any other payment system? 4. Do they currently use aTouch ID technology or any other biometric technology? 5. What is the reason for the % change in branch numbers (if any) over the past 5 years? 6. Do they have a digital development program in place? Banks & Credit Unions: Deep Dive

- 30. Customer Segmentation Final List : Banks & Credit Unions

- 31. Market EntryStrategy US Market Entry Strategy forTouchtech Payments

- 32. EntryStrategy Touchtech US Market Entry None of which can be viewed in isolation Entry Strategy comprises of four elements -

- 33. Formulate a clear mission and vision statement prior to entering the USAStrategy Mission: Why we exist? Vision: What future we want to create? Mission andVision

- 34. Strategy Where to locate? - NewYork Which market to tackle? - East coast Banks - Nationwide Credit Unions What isTouchtech’s product offering? - Explore and establish quickly Structure, Geography and Focus

- 35. Finance Ensure sufficient resources for market entry 2+ years Establish and affirm cost structure prior to internationalisation. Understanding costs means you understand your product’s price point Costs and Financing

- 36. Operations Don’t get spread too thin? Increased risk of failure by entering multiple geographies simultaneously Personnel Establish the right team Senior US marketing and sales personnel with strong network connections Junior US personnel Original / founding Irish personnel Desired founding culture is embedded from initiation Original / founding Irish personnel continuity of desired standards and expectations – mission and vision Senior management support is imperative during entry phase strongest team members must be available to support market entry Leverage Enterprise Ireland’s industry networks as part of the marketing plan Resources Critical for Success

- 37. Operations Things to know Human resources - critical differentiators between success and failure. A key reason cited for market entry failure was shortcomings in personnel and support structures for the market entry programme. Human resources management costs are high and can be a barrier to entry. Structural barriers, bureaucratic barriers and cost barriers are low e.g. US company ex-Delaware can be established in three days Post establishment professional service costs are considerably higher than that of Europe e.g. accountancy, legal services Resources Critical for Success

- 38. Operations Understand the procurement processes of your clients Procurement processes for some tier 2 banks and large credit unions will be well-defined, involving multiple business units evaluating the new technologies. Example: Mountain America FCU’s Chief Risk Officer. (Information acquired through interview at recent CU conference, Belfast) CUSO’s (Credit Union Service Organisations) IT Dept. Risk Officer Procure ment Team Finance Officer Legal Officer CEO Procurement Process

- 39. Marketing Crucial to attend industry trade shows to gather first hand data No amount of secondary research can replace primary, in-person research! Attending tradeshows needs to be a disciplined process. Establishing contact and pre-arranging meetings Information gathered and managed in a dedicated report format Accessible and visible to all marketing and sales personnel UtiliseCRM software to manage process – make it a discipline Develop marketing materials based on customer feedback Exhibiting at trade shows Expensive - $10,000 to $40,000 Marketing Process for the US

- 40. Challenges of Internationalisation US Market Entry Strategy forTouchtech Payments

- 41. Challenges Lucrative returns possible but face an uphill challenge Attitude to risk from Organisation Previously un-encountered Barriers- 1. Knowledge 2. Resources 3. Regulations Challenges of Internationalisation

- 42. Challenges 1) Lack of Information Barriers to information Limited information Unreliable information Ability to identify opportunities 2) New norms of doing business 3) “Outsidership” Breaking into new markets Resistance Liability of Smallness Challenge 1: Knowledge

- 43. Challenges 1. Not just …..Although it is Essential 2. Scaling and the experience curve 3. Personnel 4. Networks $$$ Challenge 2: Resources

- 44. Challenges 1. Dodd Frank Act 2010 2. Regulation driving Institution consolidation 3. Regulation compliance driving IT uptake 4. Regulation fear of jumping ahead of the curve Challenge 3: Regulation

- 45. Recommendations US Market Entry Strategy forTouchtech Payments

- 46. Recommendations Strategy Finance Operations Marketing • Mission andVision • Geography • Focus • Funding • Costs • Logistics • Human Resources • Procurement • Customer Database and Learn! • Banks AND Credit unions • Trade Shows Roadmap forward for Touchtech

- 47. The Sky is the Limit