QuantConnect - Using Options for Risk Control with Python

- 1. Risk Control with Trailing Stops and Options Systematic Evaluation of Popular Risk Control Techniques www.quantconnect.com Jared Broad Founder & CEO

- 2. November-2017 QuantConnect – Risk Control with Trailing Stops and Options Page 2 Outline ▪ Introduction to QuantConnect ▪ Algorithm Development Process ▪ Creating Our Investigation Thesis ▪ Developing a Control ▪ Testing and Researching ▪ Experiment 1: Adding Trailing Stop ▪ Experiment 2: Adding Option Hedge ▪ Experiment 3: Covered Calls ▪ Summary

- 3. What is QuantConnect? We empower investors with powerful investment tools and connect the brightest minds from around the world with capital they need. November-2017 QuantConnect – Risk Control with Trailing Stops and Options Page 3

- 4. What is QuantConnect? QuantConnect is a community of 44,000 Engineers, Data Scientists, Programmers From 6,100 Cities and 173 Countries November-2017 QuantConnect – Risk Control with Trailing Stops and Options Page 4

- 5. Building Thousands of Algorithms Every Day November-2017 QuantConnect – Risk Control with Trailing Stops and Options Page 5

- 6. We’ve built a web algorithm lab where thousands of people test their ideas on financial data we provide; for free. LEAN ALGO TECHNOLOGY FINANCIAL DATA POWER COMPUTING How do we do it? November-2017 QuantConnect – Risk Control with Trailing Stops and Options Page 6 EQUITIES OPTIONS FUTURES FOREX CRYPTO

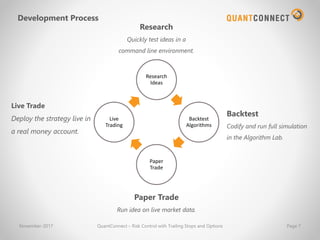

- 7. Development Process Live Trade Deploy the strategy live in a real money account. Research Ideas Backtest Algorithms Paper Trade Live Trading Research Quickly test ideas in a command line environment. Backtest Codify and run full simulation in the Algorithm Lab. Paper Trade Run idea on live market data. November-2017 QuantConnect – Risk Control with Trailing Stops and Options Page 7

- 8. Creating Our Investment Hypothesis First we define our null hypothesis, something we setout to disprove: The market is completely efficient and attempts at risk control are futile. November-2017 QuantConnect – Risk Control with Trailing Stops and Options Page 8 We are testing this theory by evaluating popular risk control methods; (e.g. Trailing Stops and Option Hedging), and comparing the performance.

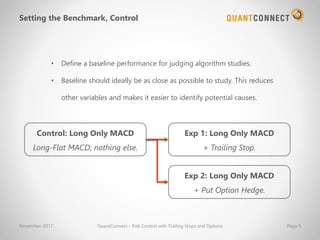

- 9. Setting the Benchmark, Control November-2017 QuantConnect – Risk Control with Trailing Stops and Options Page 9 • Define a baseline performance for judging algorithm studies. • Baseline should ideally be as close as possible to study. This reduces other variables and makes it easier to identify potential causes. Control: Long Only MACD Long-Flat MACD; nothing else. Exp 1: Long Only MACD + Trailing Stop. Exp 2: Long Only MACD + Put Option Hedge.

- 10. Exploratory Research November-2017 QuantConnect – Risk Control with Trailing Stops and Options Page 10 Quantbook Research

- 11. November-2017 QuantConnect – Risk Control with Trailing Stops and Options Page 11 Control Implementation SPY Backtest IBM Backtest

- 12. Trailing Stop Hypothesis November-2017 QuantConnect – Risk Control with Trailing Stops and Options Page 12 Place Stop Move Up

- 13. November-2017 QuantConnect – Risk Control with Trailing Stops and Options Page 13 Experiment 1: Adding Trailing Stop SPY Backtest IBM Backtest

- 14. Option Hedge Hypothesis November-2017 QuantConnect – Risk Control with Trailing Stops and Options Page 14 Buy Put Insure Dip

- 15. November-2017 QuantConnect – Risk Control with Trailing Stops and Options Page 15 Experiment 2: Buying Put Hedge SPY Backtest IBM Backtest

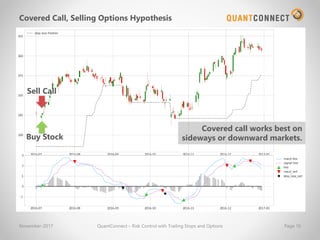

- 16. Covered Call, Selling Options Hypothesis November-2017 QuantConnect – Risk Control with Trailing Stops and Options Page 16 Buy Stock Sell Call Covered call works best on sideways or downward markets.

- 17. November-2017 QuantConnect – Risk Control with Trailing Stops and Options Page 17 Experiment 3: Selling Covered Call Not strictly “risk control” SPY Backtest IBM Backtest

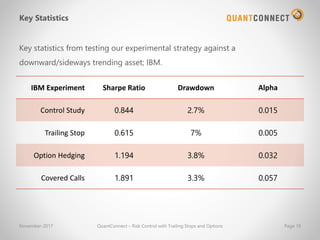

- 18. Key Statistics IBM Experiment Sharpe Ratio Drawdown Alpha Control Study 0.844 2.7% 0.015 Trailing Stop 0.615 7% 0.005 Option Hedging 1.194 3.8% 0.032 Covered Calls 1.891 3.3% 0.057 November-2017 QuantConnect – Risk Control with Trailing Stops and Options Page 18 Key statistics from testing our experimental strategy against a downward/sideways trending asset; IBM.

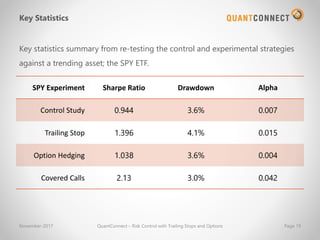

- 19. Key Statistics SPY Experiment Sharpe Ratio Drawdown Alpha Control Study 0.944 3.6% 0.007 Trailing Stop 1.396 4.1% 0.015 Option Hedging 1.038 3.6% 0.004 Covered Calls 2.13 3.0% 0.042 November-2017 QuantConnect – Risk Control with Trailing Stops and Options Page 19 Key statistics summary from re-testing the control and experimental strategies against a trending asset; the SPY ETF.

- 21. Appendix

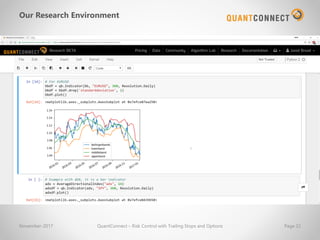

- 22. Our Research Environment November-2017 QuantConnect – Risk Control with Trailing Stops and Options Page 22

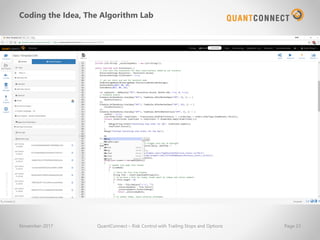

- 23. Coding the Idea, The Algorithm Lab November-2017 QuantConnect – Risk Control with Trailing Stops and Options Page 23

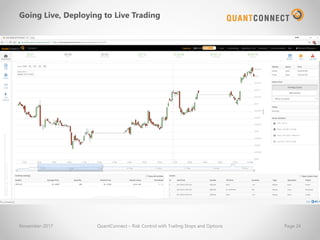

- 24. Going Live, Deploying to Live Trading November-2017 QuantConnect – Risk Control with Trailing Stops and Options Page 24