READ KNOW.docx

- 1. Q1. How many types of business transactions are there in accounting? Ans. There are two types of business transactions in accounting – revenue and capital. Q2. Explain real and nominal accounts with examples. Ans. A real account is an account of assets and liabilities. E.g. land account, building account, etc. A nominal account is an account of income and expenses. E.g. salary account, wages account, etc. Q3. Which accounting platforms have you worked on? Which one do you prefer the most? Ans. Describe the accounting platforms (QuickBooks, Microsoft Dynamic GP, etc.) that you have worked with and which one you liked the most. Q4. What is double-entry bookkeeping? What are the rules associated with it? Ans. Double-entry bookkeeping is an accounting principle where every debit has a corresponding credit. Thus, the total debit is always

- 2. equal to the total credit. In this system, when one account is debited then another account gets credited at the same time. Q5. What is working capital? Ans. Working capital is calculated as current assets minus current liabilities, which is used in day-to-day trading. Q6. How do you maintain accounting accuracy? Ans. Maintaining the accuracy of an organisation’s accounting is an important activity as it can result in a huge loss. There are various tools and resources which can be used to limit the potential for errors to creep in and address quickly if any errors do arise. Q7. What is TDS? Where do you show TDS on a balance sheet? Ans. TDS (Tax Deducted at Source) is a concept aimed at collecting tax at every source of income. In a balance sheet, it is shown in the assets section, right after the head current asset. Q8. What is the difference between ‘accounts payable (AP)’ and ‘accounts receivable (AR)’? Ans.

- 3. Accounts Payable Accounts Receivable The amount a company owes because it purchased goods or services on credit from a vendor or supplier. The amount a company has righ because it sold goods or services a customer. Accounts payable are liabilities. Accounts receivable are assets. Q9. What is the difference between a trial balance and a balance sheet? Ans. A trial balance is the list of all balances in a ledger account and is used to check the arithmetical accuracy in recording and posting. A balance sheet, on the other hand, is a statement which shows the assets, liabilities and equity of a company and is used to ascertain its financial position on a particular date. Q10. Is it possible for a company to show positive cash flows and still be in grave trouble? Ans. Yes, if it shows an unsustainable improvement in working capital and involves lack of revenue going forward in the pipeline. Q11. What are the common errors in accounting?

- 4. Ans. The common errors in accounting are – errors of omission, errors of commission, errors of principle and compensating error. Q12. What is the difference between inactive and dormant accounts? Ans. Inactive accounts are which that are closed and will not be used in the future. Dormant accounts are not currently functional but may be used in the future. Q13. Are you familiar with the Accounting Standards? How many accounting standards are there in India? Ans. There are currently 41 Accounting Standards which are usually issued by the Accounting Standards Board (ASB). Q14. Why do you think Accounting Standards are mandatory? Ans. Accounting Standards play an important role in preparing a good and accurate financial report. It ensures reliability and relevance in financial reports. Also Read>> IFRS vs GAAP: Which is suited for you?

- 5. Q15. Have you ever helped your company to save money or use their available financial resources effectively? Ans. Explain if you have proposed an idea which has affected the company’s finances positively. Tell how you have optimised the process and how you came to such a decision through historical data reviewing. Q16. If our organisation has three bank accounts for processing payments, what is the minimum number of ledgers it needs? Ans.Three ledgers for each account for proper accounting and reconciliation processes. Q17. What are some of the ways to estimate bad debts? Ans. Some of the popular ways of estimating bad debts are – percentage of outstanding accounts, aging analysis and percentage of credit sales. Q18. What is a deferred tax liability?

- 6. Ans. Deferred tax liability signifies that a company may pay more tax in the future due to current transactions. Q19. What is a deferred tax asset and how is the value created? Ans. A deferred tax asset is when the tax amount has been paid or has been carried forward but has still not been recognized in the income statement. The value is created by taking the difference between the book income and the taxable income Q20. What is the equation for Acid-Test Ratio in accounting? Ans. The equation for Acid-Test Ratio in accounting Acid-Test Ratio = (Current assets – Inventory) / Current Liabilities LEA R N A C C O U N T I N G N O W> > Q21. What are the popular accounting applications? Ans. I am familiar with accounting apps like CGram Software, Financial Force, Microsoft Accounting Professional, Microsoft Dynamics AX and Microsoft Small Business Financials. Q22. Which accounting application you like the most and why?

- 7. Ans. I find Microsoft Accounting Professional the best as it offers reliable and fast processing of accounting transactions, thereby saving time and increasing proficiency. Q23. Tell me something about GST. Ans. GST is the acronym for Goods and Service Tax and it is an indirect tax other than the income tax. The seller charges it to the customer on the value of the service or product sold. The seller then deposits the GST to the government. Q24. What is bank reconciliation statement? Ans. A bank reconciliation statement or BRS is a form that allows individuals to compare their personal bank account records to that of the bank. BRS is prepared when the passbook balance differs from the cashbook balance. Q25. What is tally accounting? Ans. It is an accounting software used by small business and shops to manage routine accounting transactions. Q26. What are fictitious assets? Ans. Fictitious assets are intangible assets and their benefit is derived over a longer period, for example good will, rights, deferred revenue expenditure, miscellaneous expenses, preliminary expenses, and accumulated loss, among others.

- 8. Q27. Can you explain the basic accounting equation? Ans. Yes, since we know that accounting is all about assets, liabilities and capital. Hence, its equation can be summarized as: Assets = Liabilities + Owners Equity. Q28. What are the different branches of accounting? Ans. There are three branches of accounting – Financial Accounting Management Accounting Cost Accounting Q29. What is the meaning of purchase return in accounting? Ans. As the name suggests, purchase return is a transaction where the buyer of merchandise, inventory or fixed assets returns these defective or unsatisfactory products back to the seller. Q30. What is retail banking? Ans. Retail banking or consumer banking involves a retail client, where individual customers use local branches of larger commercial banks.

- 9. Q31. What is offset accounting? Ans. Offset accounting is a process of canceling an accounting entry with an equal but opposite entry. It decreases the net amount of another account to create a net balance. Q32. What are trade bills? Ans. These are the bills generated against each transaction. It is a part of documentation procedure for all types of transactions. Q33. What is fair value accounting? Ans. As per fair value accounting, a company has to show the value of all of its assets in terms of price on balance sheet on which that asset can be sold. Q34. What happens to the cash, which is collected from the customers but not recorded as revenue? Ans. It goes into “Deferred Revenue” on the balance sheet as a liability if no revenue has been earned yet. Q35. Why did you choose accounting as your profession?

- 10. Ans. I was good at numbers and accounting since my school days, but it was during my 10+2; I decided to adopt this field as a profession and did Bachelor’s and then Master’s in Accounting. Q36. What is a MIS report, have you prepared any? Ans. Yes, I have prepared MIS reports. It is an acronym for Management Information System, and this report is generated to identify the efficiency of any department of a company. Q37. What is a company’s payable cycle? Ans. It is the time required by the company to pay all its account payables. Q38. What is Scrap Value in accounting? Ans. Scrap Value is the residual value of an asset that any asset holds after its estimated lifetime. Q39. Which account is responsible for interest payable? Ans. Current liability account is responsible for interest payable. Also Read>> Top Financial Analyst Interview Questions

- 11. Q40. What is departmental accounting system? Ans. It is a type of accounting information system that records all the financial information and activities of the department. This financial information can be used to check profitability and efficiency of every department. Q41. What is a perpetual inventory system? Ans. Perpetual inventory is a methodology that involves recording the sale or purchase of inventory immediately using enterprise asset management software and computerized point-of-sale systems. Q42. What do you mean when you say that you have negative working capital? When a company’s current liabilities exceed its current assets, it is named as negative working capital. It is a common terminology in certain industries like retail and restaurant businesses. Q43. What are the major constraints that can hamper relevant and reliable financial statements? Ans.

- 12. 1. Delay, which leads to irrelevant information 2. No balance between costs and benefits 3. No balance between the qualitative characteristics 4. No clarity in true and fair view presentation Q44. Tell me the golden rules of accounting, just mention the statements. Ans. There are three golden rules of accounting – Debit the receiver, credit the giver Debit what comes in, credit what goes out Debit all expenses and losses, credit all incomes and gains Q45. Please elaborate, what this statement means – “Debit the Receiver, Credit the Giver”. Ans. So, this is among the most frequently asked accounting interview questions. Your reply should be – This principle is used in the case of personal accounts. If a person is giving any amount either in cash or by cheque to an organization, it becomes an inflow and thus that person must be credited in the books of accounts. Therefore, when an organization received the money or cheque, it needs to credit the person who is paying and debit the organization. Q46. Any idea what is ICAI?

- 13. Ans. Of course, it is the abbreviation of Institute of Chartered Accountants in India. Q47. What do you mean by premises? Ans. Premises refer to fixed assets presented on a balance sheet. Q48. What is Executive Accounting? Ans. Executive Accounting is specifically designed for the service- based businesses. This term is popular in finance, advertising and public relations businesses. Q49. What are bills receivable? Ans. Bills receivable are the proceeds or payments, which a merchant or a company will be receiving from its customers. When replying to accounting interview questions, be very specific and don’t speak up generic stuff. Q50. Define Balancing. Ans. Balancing means equating or balancing both debit and credit sides of a T-account. Q51. What is Marginal Cost?

- 14. Ans. If there is any increase in the number of units produced, the total cost of output is changed. Marginal cost is that change in the cost of an additional unit of output. Q52. What are Trade Bills? Ans. Every transaction is documented and the trade bills are those documents, generated against each transaction. Q53. Can you define the term Material Facts? Ans. Yes, these are the documents such as vouchers, bills, debit and credit notes, or receipts, etc. They serve as the base of every account book. Q54. What are the different stages of Double Entry System? Ans. There are three different stages of double entry system, which are – Recording transactions in the accounting systems Preparing a trial balance in respective ledger accounts Preparing final documents and closing the books of accounts Q55. What are the disadvantages of a Double Entry System? Ans.

- 15. Difficult to find the errors, especially when transactions are recorded in the books In case of any error, extensive clerical labor is required You can’t disclose all the information of a transaction, which is not properly recorded in the journal Q56. What is Assets Minus Liabilities? Ans. It stands for an owner’s or a stockholder’s equity. Q57. What is GAAP? Ans. GAAP is the abbreviation for Generally Accepted Accounting Principles (GAAP) issued by the Institute of Chartered Accountants of India (ICAI) and the provisions of the Companies Act, 1956. It is a cluster of accounting standards and common industry usage, and it is used by organizations to: Record their financial information properly Summarize accounting records into financial statements Disclose information whenever required Q58. Can you tell me some examples for liability accounts? Ans. Some popular examples of liability accounts are – Accounts Payable Accrued Expenses Bonds Payable Customer Deposits

- 16. Income Taxes Payable Installment Loans Payable Interest Payable Lawsuits Payable Mortgage Loans Payable Notes Payable Salaries Payable Warranty Liability Q59. What is the difference between accounts receivable and deferred revenue? Ans. Accounts receivable is yet-to be received cash from products or services that are already sold/delivered to customers, whereas, deferred revenue is the cash received from customers for services or goods not yet delivered. Q60. Where should you record a cash discount in journal entry? Ans. A cash discount should be recorded as a reduction of expense in cash account. Q 61. What is compound journal entry? Ans. A compound journal entry is just like other accounting entry; the only difference is that it affects more than two account heads. The compound journal entry has one debit, more than one credits, or more than one of both debits and credits.

- 17. Q 62. What is the dual aspect term? Ans. The dual aspect suggests that every business transaction requires double entry bookkeeping. This can be understood with the example- If you purchase anything, you give the cash and receive the stuff, and when you sell anything, you lose the stuff and earn the money. This defines the aspects of every transaction. Q 63. What is retail banking? Ans. Retain banking is also known as consumer banking, where individuals use the local branches of larger commercial banks. Q 64. Define depreciation. Ans. Depreciation refers to decreasing value of any asset that is in use. Q 65. What are the different types of depreciation? Ans. Depreciation is of two types – 1. Straight Line Method 2. Written Down Value Method Q 66. What is the difference between the consignor and consignee? Ans. Consigner – S/he is the shipper of the goods

- 18. Ans. Consignee – S/he is the recipient of the goods. Q 67. Define Partitioning. Ans. Partitioning refers to the division/subdivision/grouping/regrouping of financial transactions in a given financial year. Q 68. Differentiate between Provision and Reserve. Ans. Provisions – This refers to keeping the money for a given liability. In short, EXPENSES. Reserves – Refers to retaining some amount from the profit for future use. In short, PROFITS. Q 69. What is an over accrual? Ans. It is a situation where the estimate for accrual journal entry is very high, and this may apply to an accrual of revenue or expense. Q 70. What is reversing journal entries? Ans. Reversing entries refer to the journal entries that are made when an accounting period starts. These entries reverse or cancel the adjusting journal entries that were made at the end of the previous accounting period.

- 19. Q 71. Name some intangible assets. Ans. Intangible assets include – Patents Copyrights Trademarks Brand names Domain names Q 72. What is Bad debt expense? Ans. Bad debts expense is asset accounts receivable of a company and is considered to be uncollectible accounts expense or doubtful accounts expense. Q 73. When do you capitalize rather than expense a purchase? Ans. An item’s cost is capitalized is it is expected to be consumed by the company over a long period. This way their economic value does not depreciate. Q 74. When does goodwill increase? Ans. Goodwill can be increased through the acquisition of another company as a subsidiary, by paying more than the fair value of its tangible and intangible assets.

- 20. Q 75. What are Revenue Recognition and Matching Principles? Ans. Revenue Recognition Principle – This principle suggests that the revenue should be recognized and recorded when it is realized and earned, no matter when the amount has been paid. Matching Principle – This principle dictates the companies to report an expense on its income statement the time the related revenues are earned. It is associated with the accrual basis of accounting. Q 76. Name different accounting concepts. Ans. The most popular accounting concepts are – Accounting Period Concept Business Entity Concept Cost Concept Dual Aspect Concept Going Concern Concept Matching Concept Money Measurement Concept Q 77. What is the owner’s equity? Ans. The owner’s equity is a business owner’s claim against the assets of the business. It is also called the capital of the business and is calculated by subtracting equity of creditors from the total equity.

- 21. Q 78. What is a debit note? Ans. Debit note or debit memorandum is a commercial document sent to a seller, by a buyer, formally requesting a credit note. The original document is sent to the party to whom the goods are being returned and the duplicate copy is kept for office record. Q 79. What is a credit note? Ans. Credit note is a receipt given to buyer who has returned a product, by the seller/shop. This intimation suggests that the buyer’s account is being credited for the purpose indicated. Q 80. Explain Contingent Liabilities. Ans. Contingent Liabilities are potential obligations that may or may not become an actual liability. They may or may not be incurred by an entity, based on the outcome of an uncertain future event, e.g. – If an ex-employee of an ABC company sues it for gender discrimination for any particular sum, the company has a contingent liability. In case the company is found guilty, it will have a liability, and if it is not found guilty, the company will not have an actual liability. Q 81. What is GST? Ans. GST or Goods and Service Tax is an indirect tax charged on the value of the service or product sold to a customer. Here the consumers pay the tax to the seller, who thereby deposits the GST to the government.

- 22. Q 82. Can you name some common errors in accounting? Ans. Some common accounting errors are – Error of omission Error of commission Error of original entry Error of accounting principle Compensating error Error of entry reversal Error of duplication Q 83. What is project implementation? Ans. Project implementation is a phase when the plans and visions come into reality. This includes carrying out the tasks to deliver the outputs and monitor the related progress. Q 84. What are the various stages of project implementation? Ans. There are six steps involved in project implementation, which are – Identifying need Generating and screening ideas Conducting a feasibility study Developing the project Implementing the project

- 23. Controlling the project Q 85. Are you in favor of having accounting standards? Ans. I believe that accounting standards contribute to high quality and accurate reporting and ensure reliable financial statements. Q86. What do you mean by Amortization and also mention its journal entry? Ans. Amortization is an accounting concept that is used to gradually write off the cost. Through amortization, over a period of time, one can allocate the cost of any intangible asset. Also, it can be done to repay any loan principal. However, those assets which have an indefinite life like Goodwill can not be amortized. Below is the journal entry for amortization: Debit Credit Amortization expense x~xx Accumulated amortization xxx The concept of amortization in accounting is different from depreciation. The major point of difference between amortization and depreciation is their usage. Amortization works for intangible assets whereas depreciation works for tangible assets. Also, unlike depreciation, amortization has no salvage value. Another key

- 24. difference between both is that depreciation can be implemented using both the straight-line method and accelerated method but amortization is implemented through the straight-line method. Using the below transactions solve the practical accounting questions: Firm’s Name – ABC Ltd. which is 10 years old firm on December 31, 2018. As on January 01, 2019, below are the trial balance entries Transactions/entries Amount in INR Accounts Payable 50,000 Accounts Receivable 20,000 Cash 4,50,000 Merchandise inventory 6,620 Land 60,000 Unearned revenue 10,000 Salaries payable 32,000 Common Stocks 15,000 Prepaid Rent for Office 15,000

- 25. Supplies 20,000 Retained Earnings 25,000 Later other transactions which took place in 2019 are: 1. Paid salaries payable from 2018. 2. As of March 2019, the petty cash expense made was Rs 10,000. 3. Advanced payment made for the company’s car which was on lease Rs, 1,00,000 on May 1, 2019. 4. Paid office rent in advance Rs. 25,000 on May 3, 2019. 5. Supplies purchased for Rs. 10,000 on the account. 6. During the year, purchased 20 CCTV cameras for Rs. 20,000 for cash. 7. Sold 103 CCTV cameras for Rs. 42,000 (calculate the cost of goods sold using FIFO method) 8. Accounts payable was Rs. 30,000 9. Petty cash replenished and the receipts included office supply expenses – Rs. 2,000, miscellaneous Rs. 7,000. Currency left Rs.1000 10. Billed Fixing services for Rs 10,000 for the year. 11. The salaries paid were Rs. 30,000 in cash 12. Accounts receivable were Rs. 60,000 13. Ad and marketing expense Rs. 6,000 14. Utility expense paid Rs. 5,000 15. The dividend paid to the shareholders was Rs. 15,000. Q87.What is the total value of cash in the above transactions? Ans. Here is the total calculation of cash

- 26. All Cash Transactions and balances: Actual Cash = 4,50,000 Salaries payable = 32,000 Company’s car lease = 1,00,000 Office rent = 25,000 CCTV purchase = 20,000 Accounts payable = 30,000 Petty cash = 10,000 Petty cash replenished = 7,000 + 2000 Balance petty cash = 1000 Salaries paid = 30,000 Accounts receivable = 60,000 Ad and marketing expense = 6,000 Utility expense = 5,000 Dividend paid = 15,000 Hence as per the nature, here is the actual calculation of cash: 4,50,000 – 32,000 – 1,00,000 – 25,000 – 20,000 – 30,000 – (10,000 – 1,000) – 1,000 + 60,000 – 5,000 – 15,000 = 2,73,000

- 27. Q88. What is the total value of accounts receivable in the above transactions? Ans. All entries related to accounts receivable: Accounts receivable = 20,000 Income from selling CCTV camera = 42,000 Billed Fixing services = 10,000 Accounts receivable = 60,000 Hence, here is the total calculation of accounts receivable: 20,000 + 42,000 + 10,000 + 60,000 = 1,32,000 Q89. What is the value of the total fixed assets? Ans. As no other assets apart from land is mentioned we will consider Land as the only fixed assets: Value of Fixed Asset: Land = 60,000 Q90. What will all be included in current assets?

- 28. Ans. We will include the following things: Closing inventory Bank and cash value Supplies Account Receivables Q91. What will be included in the Owner’s equity? Ans. We will include the following things in owners equity: Capital (Common Stocks) Retained earnings (balance at the beginning of the year, profits for the current year, less dividend paid, capital contributed during the year if any) Q92. What will be included in the Current Liabilities? Ans. Under the current liabilities, we will include the amount for creditors/payables which is 10,000 in the above case. Q93. What do you mean by Days Payable Outstanding (DPO)? Ans. DPO or Days Payable Outstanding refers to the average number of days which ideally a company takes to clear its credit purchase in regards to the outstanding suppliers. Most of the time, DPO is a monthly task for a business, however, each month the day of clearing

- 29. the outstanding payment might differ, hence the average is taken out to estimate the payment period. Below is the formula for calculating DPO: Closing accounts payable / Purchase per day Or (Average accounts payable / COGS) X Number of days Q94. Find out the DPO in the below query. Ans. Average accounts payable in June 50,000 Cost of Goods sold in June 5,00,000 As the month of June has 30 days the DPO will be: (50,000/5,00,000)*30 = 3 days Hence, the DPO in the above situation is 3 days. This states that a company takes 3 days on average to clear all its pending invoices. Q95. What are the different types of liquidity ratios in accounting?

- 30. Ans. Basically, there are five different types of ratios in accounting: 1. Current Ratio Current ratio = Current Asset/ Current Liabilities The higher the company has a current ratio, the better is the company’s strength to handle short term financial issues. 2. Net-Working Capital Ratio It articulates that whether or not a company has sufficient funds to carry out short term operations. It is calculated by Current Asset – Current Liabilities 3. Quick ratio The quick ratio is also known as the acid test ratio or liquid ratio which illustrates the company’s short term liquidity to meet any short term obligations. If the quick ratio is below 1:1, the company is not in a good state to handle short term debts. Quick ratio = Liquid Assets / Current Liabilities 4. Super-Quick Ratio Super Quick Ratio = (Cash + Marketable Securities) / Current Liabilities 5. The operating Cash Flow ratio It is calculated by dividing cash flow from operations with current liabilities. It is observed that a sound operating cash flow ratio makes the firm’s liquidity position better. Here cash flow from operations will generally include:

- 31. All revenues from operations + Non-cash based expenses – Non-cash based revenue Whereas Current Liabilities will include: Balance payments, creditors, provisions, short term loans, etc. Going through the above accounting interview questions will probably have given you an idea of the type of accounting interview questions that are asked during an accounting interview. These will also help you to freshen up your accounting knowledge. Naukri Learning offers a variety of professional online accounting certifications and courses, which will make you an expert and improve your chances of acing any accounting interview that you go for. Accounting is an important activity to understand the financial health of an organisation and determines the business activities. The two most common accounting standards are IFRS and GAAP. If you are thinking about doing a certification course and have to choose one of the two, this article will help you to make the right decision. Accounting standards are usually guidelines for accounting,usually set by a governing body, to help firms to present its income, expenses, assets and liabilities in a set standard method.Let’s discuss the IFRS and GAAP differences. Let’s Jump in: 1. What is IFRS? 2. What is GAAP? 3. IFRS vs GAAP What is IFRS IFRS (International Financial Reporting Standards)is a set of accounting standards developed by the independent, not-for-profit organisation, International Accounting Standards Board (IASB). It was done with a goal to provide a global framework for the preparation of financial statements rather than industries or organisations adopting their own methods. Currently, this method is used by organisations in more than 100 countries. C H EC K O U T O U R I F R S C O U R SES> >

- 32. What is GAAP Generally Accepted Accounting Principles (GAAP) is anotherset of accounting standards and unlike IFRS, there is no universal GAAP standard.It varies from one geographical location or industry to another.Though GAAP is used in some of the countries, IFRS is being adopted increasingly. C H EC K O U T O U R G A A P C O U R SES> > IFRS vs GAAP Though IFRS and GAAP are two of the widely used standards in accounting, there are a number of differences that you need to understand to find out which one is perfect for you: Conceptual Approach – The major difference between the two approaches lies in the conceptual approach. The GAAP standard is based on rule, where the focus is more on the literature. IFRS, on the other hand, is principle-based and review of the facts pattern is more thorough. Geographical dominance in terms of usage – The GAAP standard is popular in the USA; though there is a shift towards IFRS in the recent years. The IFRS standard is the most popular standard globally and is used across more than 110 countries, including the European Union. Inventory – Under IFRS standard, the LIFO method cannot be used whereas under the GAAP standard, there is the choice between LIFO and FIFO. FIFO (first in, first out) means that the goods first added to an inventory are assumed to be the first goods removed from inventory for sale. LIFO (last in, first out) means that the goods last added to the inventory are assumed to be the first goods removed from the inventory for sale. Objectives of financial statements – GAAP provides separate objectives for business and non-business entities. IFRS provides the same set of objectives for business and non-business entities. Development costs – The development costs can be capitalised under IFRS, whereas it is considered as expenses under GAAP. Inventory reversal – Under IFRS, if an inventory is written down, the write down can be reversed in future periods if specific criteria are met but in GAAP, once inventory has been written down, any reversal is prohibited. Which one is best-suited for you? Choosing to do a certification course in one of the two accounting standards is a simple decision. It all depends on your geographical location and the industry you are in. If you are looking to work in the US or working for US- based organisations,GAAP is going to be the best one for you.Otherwise, IFRS is perfect as it is widely accepted across the world and a greater percentage of the organisations globally are adopting the IFRS standard.

- 33. Be it a bank, an institution, or any well-known corporation, most of the time, financial analyst job interview questions are tricky and challenging. That’s why they require thorough preparation, professional financial knowledge, and practical exposure to financial modelling and other analytical skills. The job role of financial analysts is to gather, organise, analyse, and present data and information which forms the basis of recommending financial decisions to all the stakeholders. Since the role directly affects the financial management of any organization, the recruiters take extra efforts to hire a skilled financial analyst who matches the company’s requirements and roll on worthy business decisions. But before you scroll down to questions, we have a piece of advice “Though there are a lot of opportunities for financial analysts in the industry, the chances of getting into one of the top financial companies can be boosted if you are a Chartered Financial Analyst (CFA).” Here are the answers to some of the most frequently asked Financial Analyst interview questions for the position of a financial analyst: Q1. Explain ‘financial modelling’. Ans. Financial modelling is a quantitative analysis commonly used for either asset pricing or general corporate finance. Basically, it is the process wherein a company’s expenses and earnings are taken into consideration (commonly into spreadsheets) to anticipate the impact of today’s decisions in the future. The financial model also turns out to be a very impactful tool for the following tasks:

- 34. Estimate the valuation of any business Compare competition Strategic planning Testing different scenarios Budget planning and allocation Measure the impacts of any changes in economic policies Since financial modelling is one of the most primary key skills, you can also share your experience about using different financial models including discounted cash flow (DCF) model, initial public offering (IPO) model, leveraged buyout (LBO) model, consolidation model, etc. Q2. Walk me through a ‘cash flow statement.’ Ans. Being one of the essential financial statements, you’ll have to be well-prepared for this question as a day in and day out you have to use cash flow statements to successfully build a three model statement. When a recruiter shoots this question during your interview, you can start by explaining the three main categories of cash flow statement: Operating activities Investing activities Financing activities After calculating the total cash from all the above-listed categories, adding opening cash balance, and further explaining all significant adjustments, you will arrive at the total change in cash. Mention all the necessary parts that are associated with it.

- 35. However, during the interview, the interviewer will also be looking out for something more beyond the bookish knowledge about cash flow statements. S/He must be interested in how the statement of cash flow is useful to a financial analyst. Now, this could turn into your bonus point as you can walk through the intent of using the cash flow statement, which is listed below: Provides data and information about a firm’s liquidity status, Helps in outlining the firm’s ability to alter cash flows status in future Highlights the changes in account balances on the balance sheet Helps in depicting the company’s ability to meet expansion requirements in future Gives the estimation of available free cash flow Q3. Is it possible for a company to have positive cash flow but still be in serious financial trouble? Ans. Yes. There are two examples – (i) a company that is selling off inventory but delaying payables will show positive cash flow for a while even though it is in trouble (ii) A company has strong revenues for the period, but future forecasts show that revenues will decline When you define such situations, it proves that you are not plainly looking at the cash flow statements; instead, you care about where the cash is coming from or going to and mark all the points highlighting how the company is making or losing money.

- 36. Q4. What do you think is the best evaluation metric for analysing a company’s stock? Ans. There is no specific metric. It depends on how you put the answer and make the interviewers understand the value of the specific parameter that you mention. The main intention of this question is to check your critical thinking abilities and logical skills. This question also gives you a chance to prove your capabilities of identifying potential pros and cons related to the available investment options. Generally, technical analysts use some of the following types of charts to check the stock price, which forms the basics of picking the right one: Line charts (helps in tracking daily movements) Bar charts (helps in tracking periodic highs and lows of stock price) Point chart (helps in determining stock momentums) Q5. What is ‘working capital, and which are the different types of working capital’? Ans. The working capital formula is best defined as current assets minus current liabilities.

- 37. The primary function of working capital is to analyze the total amount of money which you have readily available to meet the demand of all the current expenses. Since financial analysts play a major role in being an information mediator in capital markets, getting a true understanding of working capital needs is very essential. Also, an analyst must stay on toes to forecast the actual working capital requirements, especially in the case when the company is constantly growing or expanding. Also, you can highlight a few prior incidents when your existing company felt the need for additional working capital, and you can even back your answer with the ways you used to boost the working capital. Another example of proving your abilities is to suggest the times when you and your team used the working capital data to operate current and future needs smoothly. Q6. Explain quarterly forecasting and expense models? Ans. The analysis of expenses and revenue which is predicted to be produced or incurred in future is called quarterly forecasting. For this, referring to an income statement along with a complete financial model works well. However, making a realistic model is a challenge, and thus the role of a financial analyst comes here. As an expert, you need to model revenues with high degrees of detail and precision.

- 38. An expense model tells what expense categories are allowed on a particular type of work order, which forms the foundation of building a budget. Also, to make this model functional, an expense projection model is created, which helps in identifying variable and fixed cost which forms a basis of accurately forecasting the company’s expected profit or loss. Q7. What is the difference between a journal and a ledger? Ans. The journal is a book where all the financial transactions are recorded for the first time. The ledger is one which has particular accounts taken from the original journal. So in a lay man’s terms, journals are the raw books that play a pivotal role in preparing ledger. This gives us a second conclusion that if you wrongly prepare a journal, your ledger will also be faulty. However, here the question which the recruiter will ask is to understand your foundational knowledge as this, directly or indirectly relates to the Financial Analyst job role, which is mentioned below: Reviewing journal entries (to ensure the data is correct) Checking the distribution work area in order to manage journal entries for ledgers Ensuring that all accounting standards are met Verifying set of subsidiaries or management segment values Managing sub-ledger source transaction Recurring general ledger journal entries Reviewing financial statements and other transactions Also Check out >> Top Financial Management Courses

- 39. Q8. Mention one difference between a P&L statement and a balance sheet? Ans. The balance sheet summarises the financial position of a company for a specific point in time. The P&L (profit and loss) statement shows revenues and expenses during a set period of time. Q9. What is ‘cost accountancy’? Ans. This is an important question which nowadays a lot of employers ask since they look for a financial analyst who has some basic understanding of cost accounting. Cost accountancy is the application of costing and cost accounting principles, methods and techniques to the science, art and practice of cost control and the ascertainment of profitability as well as the presentation of information for the purpose of managerial decision making. Q10. What is NPV? Where is it used? Ans. Net Present Value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows. NPV is used in capital budgeting to analyse the profitability of a projected investment or project. Also Read>> How Finance Learning can be Made More Interesting

- 40. Q11. How many financial statements are there? Name them Ans. There are four main financial statements – 1) Balance sheets 2) Income statements 3) Cash flow statement 4) Statements of shareholders’ equity Q12. What are ‘adjustment entries’? Ans. Adjustment entries are accounting journal entries that convert a company’s accounting records to the accrual basis of accounting. Q13. Do you follow the stock market? Which stocks in particular? Ans. You need to be very careful in answering this question. As a financial analyst, following the stock market proves to be beneficial. Also, always be up-to-date with the stocks. Also Read>>Business Analytics – A Must Have Skill in a World Drowning in Data

- 41. Q15. What is a ‘composite cost of capital’? Ans. Also known as the weighted average cost of capital (WACC), a composite cost of capital is a company’s cost to borrow money given the proportional amounts of each type of debt and equity a company has taken on. WACC= Wd (cost of debt) + Ws (cost of stock/RE) + Wp (cost of pf. Stock) Q16. What is ‘capital structure’? Ans. The capital structure is how a firm finances its overall operations and growth by using different sources of funds. Also Check out IFRS Course Q17. What is ‘goodwill’? Ans. Goodwill is an asset that captures excess of the purchase price over the fair market value of an acquired business. Q18. What do you know about valuation techniques? Ans. For calculating the valuation of a business or stocks, generally, the following three types of valuation techniques are used:

- 42. 1. 1. DCF analysis – helps in forecasting future cash flows 2. Comparable company analysis – helps in comparing the current worth of one business when compared to other similar businesses using P/E, EBITDA 3. Precedent transactions – helps in identifying the transactional values of a company by comparing a business with other business which has been sold recently Q19. What do you mean by ratio analysis? Ans. The ratio analysis approach is frequently used by the financial analyst to get deeper insights into a company’s overall equity analysis by using financial statements. Analysis of different ratios helps stakeholders in measuring a company’s profitability, liquidity, operational efficiency, and solvency status. And when these ratios are paired with other essential financial metrics, it results in a deeper view of the financial health of the company. Analyzing ratios help in: Examining the current performance of your company with past performance Avoiding potential financial risks and problems Comparing your organization with other Making stronger and data-driven decisions Some of the most frequently analyzed financial ratios are: Liquidity ratios

- 43. Solvency ratios Efficiency ratios P/E and dividend ratios Q20. What do you think are the common elements of financial analysis? Ans. Some of the common elements of financial analysis include: Revenue & revenue growth and income statement Profits and net profit margin Accounts receivables and inventory turnovers Capital efficiency (Return on equity, debt to equity ratio) Firm’s liquidity Q21. How is Cash Flow different from Free Cash Flow (FCF)? Ans. Free cash flows (FCF) refers to remaining cash available for investors after considering cash operating and investing expenditure and it is used to find a business’s current value. However, cash flow is used to find net cash inflow from the business’s basic activities like operating, investing, and financing. Free cash flow helps in defining business valuation which is required by investors as it includes capital expenditure and changes in Net Working Capital. Q22. As a financial analyst which factors do you constantly analyse?

- 44. Ans. It is essential to keep data handy for the following essential factors (depending on the business type, the metrics can change) Risk exposure and how the business will affect the current working capital How to streamline finance requirements and make business processes effective? Identifying the right opportunities on the basis of capital and/or revenue How will financial decisions affect key value drivers? Which product/ customer segment/ target audience largely affects profit margins and what will be the future impact on margins affected by today’s choices, financial strategies, and decisions? Which decisions can affect our stock price Q23. Which tools do you use for advanced financial modelling? Ans. Some of the essential business intelligence tool (BI tool) helpful ar: Quantrix Oracle BI GIDE Maplesoft Also Check out Top Excel and Analytics Courses

- 45. Q24. What will you use to gauge the company’s liquidity – cash flow or income? Ans. Measuring the firm’s liquidity means finding the company’s ability to pay its current debt with its current assets. Here is a basic process to measure the company’s liquidity: Calculate the current ratio of the company (Current Assets/Current Liabilities) Calculate the quick ratio (Current Assets-Inventory/Current Liabilities) Find the Net Working Capital of the company (Current Assets – Current Liabilities) However, if to choose between cash flow or income, the better idea is to gauge the company’s liquidity on the basis of cash flow, since using earning is a more reliable approach. The Parting Note The above questions and answers will help you in your preparation for the next interview for the position of a financial analyst. It will provide you with an idea of the type of questions that are generally asked. Apart from this, you also need to be prepared to answer all types of questions — technical skills, interpersonal, leadership or methodology. If you are looking to be successful in the financial industry, enrol yourself for a financial analyst certification course to understand the techniques and skills required to be an expert.

- 46. What is the Percentage of Completion Method? The percentage of completion method of revenue recognition is a concept in accounting that refers to a method by which a business recognizes revenue on an ongoing basis depending on the stages of a project’s completion. In other words, the percentage of completion method is used for longer-term projects and recognizes revenue and expenses as a percentage of the project’s completion during the period. Understanding the Percentage of Completion Method The percentage of completion method falls in-line with IFRS 15, which indicates that revenue from performance obligations recognized over a period of time should be based on the percentage of completion. The method recognizes revenues and expenses in proportion to the completeness of the contracted project. It is commonly measured through the cost-to-cost method.

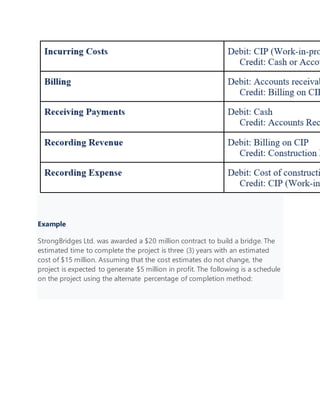

- 47. There are two conditions to use the percentage of completion method: 1. Collections by the company must be reasonably assured. 2. Costs and project completion must be reasonably estimated. Journal Entries: Percentage of Completion Method Journal entries for the percentage of completion method are as follows:

- 48. Cost-To-Cost Approach In the cost-to-cost approach, the percentage of completion is based on the costs incurred to the estimated total cost to complete the project. Therefore, the equation for the cost-to-cost estimate of percentage completion is: Percentage complete: Revenue recognized: An example is provided below to clarify the cost-to-cost approach. Example of the Cost-To-Cost Approach

- 49. StrongBridges Ltd. was awarded a $20 million contract to build a bridge. The estimated time to complete the project is three (3) years, with an estimated cost of $15 million. Assuming that the cost estimates do not change, the project is expected to generate $5 million in profit. The following is a schedule on the project: Notes: Costs Incurred is the costs incurred to build the bridge as estimated by the company’s engineer. Billings are the amount of money StrongBridges Ltd. billed for the construction of the bridge. Billings amount is set by the company. Cash Collected is the amount of money StrongBridges Ltd. received for the construction of the bridge. The variation in billings and cash collected is due to timing differences. % Completed is determined by the percentage complete formula.

- 50. For the schedule above, revenues under the percentage of completion method: Year 2008: 33% completed. Revenue recognized = 33% x $20 million (contract price) = $6,600,000 Year 2009: 47% completed. Revenue recognized = 47% x $20 million (contract price) – $6.6 million (previously recognized) = $2,800,000 Year 2010: 100% completed. Revenue recognized = 100% x $20 million (contract price) – $6.6 million – $2.8 million (previously recognized) = $10,600,000 Total Revenue = $20,000,000 Costs under the percentage of completion method: Year 2008: $5,000,000 Year 2009: $2,000,000 Year 2010: $8,000,000 Total Cost = $15,000,000 Profit under the percentage of completion method: Year 2008: $6,600,000 – $5,000,000 = $1,600,000 Year 2009: $2,800,000 – $2,000,000 = $800,000 Year 2010: $10,600,000 – $8,000,000 = $2,600,000 Gross Profit = $5,000,000 Journal entries for the example above would be as follows:

- 51. What is the Completed Contract Method? The completed contract method of revenue recognition is a concept in accounting that refers to a method in which all of the revenue and profit associated with a project is recognized only after the completion of the project.

- 52. In addition to the completed contract method, another way to recognize revenue for a long-term contract is the percentage of completion method. The two revenue recognition methods are commonly seen in construction companies, engineering companies, and other businesses that mainly generate revenue on long-term contracts for projects. Understanding the Completed Contract Method The completed contract method defers all revenue and expense recognition until the contract is completed. The method is used when there is unpredictability in the collection of funds from the customer. It is simple to use, as it is easy to determine when a contract is complete. In addition, under the completed contract method, there is no need to estimate costs to complete a project – all costs are known at the completion of the project. Journal Entries Journal entries for the completed contract method are as follows:

- 53. Example StrongBridges Ltd. was awarded a $20 million contract to build a bridge. The estimated time to complete the project is three (3) years with an estimated cost of $15 million. Assuming that the cost estimates do not change, the project is expected to generate $5 million in profit. The following is a schedule on the project using the alternate percentage of completion method:

- 54. Notes: Costs Incurred is the costs incurred to build the bridge as estimated by the company’s engineer. Billings is the amount of money StrongBridges Ltd. billed for the construction of the bridge. Billing amounts are set by the company. Cash Collected is the amount of money StrongBridges Ltd. received for the construction of the bridge. The variation in billings and cash collected is due to timing differences. % Completed is determined as costs incurred divided by estimated total costs. For the completed contract method, revenue and expense are only recognized at the end of the contract. The journal entries are as follows:

- 55. Using Procurement Card to Simplify Invoice Processing By Lie Dharma Putra Accounts Payable (A/P) accountants very well know how the supplier invoice processing sucks most of their working hour. Consider the following common routines carried on daily basis:

- 56. Registering and setting up new vendors on the system and physical filing folders; Receiving work papers (PO, receiving slip, invoice); 3-way matching the work papers; Routing invoices for approvals; Entering data into the system; Separating and expediting invoices that have discounts; Creating month-end accruals; Processing checks; Obtaining check signatures; Mailing payments to vendors; and Filing the check copies. The routines leave the accounts with no time for analytic works. Not to mention the important expenses audit that are often left behind. Such situation is especially common in the small and medium business environment. Adv ertisement “So, Putra, what is the easy way to speed up the invoice processing without imposing the company to any risks?” a client once asked. The answer is unfortunately “there is no easy way”. All of the above listed tasks are must done in that way to ensure sufficient control. EXCEPT, small purchases that the cost of carrying all those tasks exceeds the amount of the invoice, often referred to as “low-risk purchase” or “low-risk invoice.” The good news is that, in many instances, up to 1/3 of all payment transactions fall into the category, including my client’s. A company can change the approach on how to handle low-risk purchases to speed up the process thus results in lower cost of invoice processing in the company-wide level. “How?” You may ask. As far as I know, using “procurement card”—instead of issuing PO and write a check— is the most effective way to process such small purchases. What is a Procurement Card? A “procurement card,” also known as a “purchasing card” (abbreviated as “P-Card), is simply like a consumer credit card but numbers of extra features on it. So, instead of using a purchase order or check to purchase something (which demands the traditional long-listed tasks above), purchasers instead use a procurement card for small and frequent purchases. The procurement card is issued to those people who make frequent purchases, with instructions to keep on making the same purchases, but to do so with the card. This

- 57. eliminates the plethora supplier invoices by consolidating them all into a single monthly credit card statement. According to Bizdoz, the use of procurement cards has seen a dramatic rise in recent years with many government organizations now using them to reduce costs. For example In 2001 the Department of Defense (DOD) had 230,000 card holders with an annual spend of $6.1 Billion. Another report titled “2005 Purchasing Card Benchmark Survey” by Palmer and Gupta (2007) notes: 2003 procurement card spend = $80 billion 2005 procurement card spend = $110 billion 43% of e-procurement transactions are paid via check By 2008 over 70% of all organizations will have a procurement card program, up from 60% in 2005. The study also highlights that, “although these cards currently are not in widespread use, their popularity is growing.” Traditional purchasing card transactions below $2000, the report reveals, grew 1.4% from 2003 to 2005. The most dynamic growth was in transactions from $2000 – $10,000 representing a 6.1% growth. A/P transactions fall within this range and can extend into the hundreds of thousands of dollars. An organizations can use procurement card as a strategic form of payment in its accounts payable (A/P), instead of issuing PO and write a check for low risk purchase. Using the approach, the company can cut the cost of invoice processing in the company-wide level. Why Using Procurement Card? The use of procurement card is for sure attractive. Here are why: 1. It decreases numbers of purchasing transaction – A whole range of purchasing activities are reduced in volume, including contacting suppliers for quotes, creating and mailing purchase orders, resolving invoicing differences, and closing out orders. 2. It results in fewer invoice reviews and signatures – Managers no longer have to review a considerable number of invoices for payment approval, nor do they have to sign so many checks addressed to suppliers. 3. It minimizes petty-cash transactions – If employees have procurement cards, they will—somehow—no longer feel compelled to buy items with their own cash and then ask for a reimbursement from the company’s petty-cash fund. So, the use of procurement card reduces such tendency.

- 58. 4. It results in less frequent cash advances – Employees often request cash advances and the accounting staff must create a manual check for that person, record it in the accounting records, and ensure that it is paid back by the employee. This can be a very time-consuming process. A credit card can avoid this entire process, because employees can go to an automated teller machine and withdraw cash, which will appear in the next monthly card statement from the issuing bank—no check issuances required. 5. It reduces supplier list – The number of active vendors in the purchasing database can be greatly reduced, which allows the buying staff to focus on better relations with the remaining ones on the list. 6. A/P staff is available for other tasks – Having fewer A/P transactions, when start using procurement card, some of the staffs may be redirected to other tasks— particularly analytical works. 7. It reduces mailroom volume – Even the mailroom will experience a drop in volume, since there will be far fewer incoming supplier invoices and outgoing company checks. In addition, the payable staffs can contact a supplier, just before an invoice is due for payment, and see whether the supplier will accept payment of the invoice with a procurement card. By doing so, the company has just extended its payment interval (depending on the cutoff period for the procurement card), since it can now wait an additional period until the monthly procurement card statement arrives before making a payment. Knowing the ProcurementCard’s Features A worth questioning on the use of procurement card probably is the possibility of getting misused by bad purchasers. As there is always a risk of having bad purchasers purchase personal items (for personal use) with a cash advances or excessively expensive purchases by using credit card, the procurement card adds a few features to control precisely what is purchased. Here are two built-in controls a procurement card offers: Purchase Limitations – For example, it can have a limitation on the total daily amount purchased, the total amount purchased per transaction, or the total purchased per month. It may also limit purchases to a specific store or to only those stores that fall into a specific Standard Industry Classification (SIC code) category, such as a plumbing supply store and nothing else. These built-in controls effectively reduce the risk that procurement cards will be misused. Expenses Statement – Once the card statement arrives, it may be too jumbled, with hundreds of purchases, to determine the expense accounts to which all the items are to be charged. To help matters, a company can specify how the credit card statement is to be sorted by the credit card processing company. For example, it can list expenses by the location of each purchase, by Standard Industrial Classification (SIC) code, or by dollar

- 59. amount, as well as by date. It is even possible to receive an electronic transmission of the credit card statement so that a company can do its own sorting of expenses. Note: The purchasing limitations and expense statement changes are the key differences between a regular credit card and a procurement card. In addition to the basic features, certain procurement card providers (issuers) even offer more detail data through which the company is able to do control activities on the transaction using the card, such as followings: Vendors’ Status Data – Certain procurement card providers (issuers) even provide what is called “Level II” data; this includes a supplier’s minority supplier status, incorporated status, and its tax identification number. Transaction Details – Another features to look into when reviewing the procurement card option is the existence of “Level III” reporting, which includes such line-item details as quantities, product codes, product descriptions, and freight and duty costs—in short, the bulk of the information needed to maintain a detailed knowledge of exactly what is being bought with a company’s procurement cards. Though the use of procurement card is so much convincing to many organizations, but Thich Nhat Hanh ever said that, “good-and-bad, is an inter-are” which means, in this context, the benefit of using procurement card comes with the issues that require solution. Overcoming the Challenge of Using Procurement Card Susan Avery, in 2005, has stated that according to the Aberdeen Group purchasing card benchmark report, best practice purchasing card programs “do not confine” purchasing to the traditional spending of low-dollar, high-transaction goods and services, due to numbers of reason. One hurdle in the A/P procurement card payment conversion is in the area of what is called “supplier enablement”—often referred as to “purchasing card supplier enablement” or “p-card supplier enablement”—on which every supplier must be contacted and informed of the payment change from check to the procurement card, even if the supplier is already a purchasing card supplier. A collaborative research study by the First Annapolis Consulting and the National Association of Purchasing Card Professionals (NAPCP), in 2010, suggests: “In terms of impeding an organization’s cardprogram growth, 61% of end-user respondents reported that suppliers’ resistanceto (or non- acceptance of) card paymentsis, at a minimum, somewhat of a problem. Not surprising, the transaction acceptance fee factor is overwhelminglythe number-one reasonsuppliers give end-users for resisting or not acceptingcard payments. Further, nearly 50% of respondents stated theysometimesor frequently encounter suppliers that impose a surchargein conjunctionwith card acceptance. End- users employ varying approaches in response to the challenges; for

- 60. example, educating suppliers on the benefits of card payments—a task that is often completedby program management and/or procurement staff.” As of today, in 2013, banks offer help in the procurement card supplier enablement and many other software companies provide technology to make the conversion efficient and easy for the users. The procurement card supplier enablement is mostly solved but, in a controller (like me) sight, the following issues must be carefully considered by the business owner in order to ensure that the procurement card program operates as it is expected: 1. Overcoming Procurement Card Misuse – When procurement cards are handed out to a large number of employees, there is always the risk that someone will abuse the privilege and use up valuable company funds on incorrect or excessive purchases. There are several ways to prevent this problem and reduce its impact. One approach is to hand out the procurement cards only to the purchasing staff, who can use them to pay for items for which they would otherwise issue a purchase order. However, this does not address the large quantity of very small purchases that other employees may make, so a better approach is a gradual rollout of procurement cards to those employees who have shown a continuing pattern of making small purchases. Also, the features of the procurement card itself can be set up either by limiting the dollar amount of purchases per transaction, per time period, or even per department. 2. Purchasing on Capital and Special Inventory Items – Capital purchases typically have to go through a detailed review and approval process before they are acquired; since a procurement card offers an easy way to buy smaller capital items, it represents a simple way to bypass the approval process. Thus, procurement card are not a good choice for capital purchases. The use of a procurement card can actually interfere with existing internal procedures for the purchase of some items, rendering those systems less efficient. For example, the use of an automated system linked to the inventory system that does not allow manual intervention, such as an automated materials planning system—adding inventory items to this situation that were purchased through a different methodology can interfere with the integrity of the database, requiring more manual reconciliation of inventory quantities. Thus, the use of procurement cards is not a good idea when buying inventory items. 3. Summarizing General Ledger Accounts – The summary statements that are received from the procurement card processor will not contain as many expense line items as are probably already contained within a company’s general ledger. For example, the card statements may only categorize by shop supplies, office supplies, and shipping supplies. If so, then it is best to alter the general ledger accounts to match the categories being reported through the procurement cards. This may also require changes to the budgeting system, which probably mirrors the accounts used in the general ledger. 4. Purchases from Unapproved Suppliers – A company may have negotiated favorable prices from a few select suppliers in exchange for making all of its purchases

- 61. for certain items from them. It is a simple matter to ensure that purchases are made through these suppliers when the purchasing department is placed in direct control of the buying process. However, once purchases are put in the hands of anyone with a procurement card, it is much less likely that the same level of discipline will occur. Instead, purchases will be made from a much larger group of suppliers. Though not an easy issue to control, the holders of procurement cards can at least be issued a “preferred supplier yellow pages,” which lists those suppliers from whom they should be buying. Their adherence to this list can be tracked by comparing actual purchases to the yellow pages list and giving them feedback about the issue. 5. Paying Sales and Use Taxes – Occasionally, a state sales tax auditor will arrive on a company’s doorstep, demanding to see documentation that proves it has paid a sales tax on all items purchased. The requirement becomes a serious issue when procurement cards are used, because the sales tax noted on a procurement card payment slip shows only the grand total sales tax paid, rather than the sales tax for each item purchased. Please take a note. This is an important issue, for some items are exempt from taxation, which will result in a total sales tax that appears to be too low in comparison to the total dollar amount of items purchased. One way to address this issue is to obtain sales tax exemption certificates from all states with which a company does business; employees then present the sales tax exemption number whenever they make purchases so that there is no doubt at all—no sales taxes have been paid. Then the accounting staff can calculate the grand total for the use tax (which is the same thing as the sales tax, except that the purchaser pays it to the state, rather than to the seller) to pay, and forward this to the appropriate taxing authority. 6. Overcoming the Reluctance on the Banker Side – If one think that a procurement card is easy to implement (just hand it out to employees), she might be wrong. It is better to keep a significant difficulty in mind. In fact, the banks that issue credit cards must expend extra labor to set up a procurement card for a company, since each one must be custom designed. Consequently, they prefer to issue procurement cards only to those companies that can show a significant volume of credit card business—usually at least $1 million per year. This volume limitation makes it difficult for a smaller company to use procurement cards. This problem can be partially avoided by using a group of supplier-specific procurement cards. For example, a company can sign up for a credit card with its office supply store, another with its building materials store, and another with its electrical supplies store. This results in a somewhat larger number of credit card statements per month, but they are already sorted by supplier, so they are essentially a “poor man’s procurement card.” 7. Negotiating Procurement Card Rebates – Last but not least. If a company has shifted a large part of its purchases to procurement cards, then this represents a significant revenue source for procurement card companies. Once a company has built up a sufficient volume of procurement card business, it is in a position to negotiate for better terms with its procurement card supplier. One of the best such deals is to obtain a rebate percentage that is tied to the volume of payments made with a specific procurement card. Such opportunity is particularly available for a company that can surpass about $5 million per year in procurement card purchases. If so, then such company can bargain for a small rebate percentage that can increase as its purchases increase.

- 62. Although the problems are minor in relation to the possible benefits of using procurement card, they can lead into a failure. Therefore, realizing and then preparing the company to overcome the issue is the best. Financial Statements Disclosures Required Under IFRS By Lie Dharma Putra Though I have posted about balance sheet’s disclosures required under the US’s accounting standard codification, in the past. This post discusses financial statements disclosures required under IFRS, dedicated for those who implement IFRS. As it is required under the US-GAAP, a supplemental disclosure for financial statements is also required under the IFRS—generally shown as notes to the accounts. Adv ertisement To help users to understand the financial statements and to compare them with financial statements of other entities, an entity normally should present notes in the following order: 1. Statement of compliance with IFRS 2. Summary of significant accounting policies applied 3. Supporting information for items presented in the financial statements 4. Other disclosures More detailed explanations are presented below. Read on… 1. Statement of Compliance with IFRS

- 63. An entity might refer to IFRS in describing the basis on which its financial statements are prepared without making this explicit and unreserved statement of compliance with IFRS. Financial statements, however, should not be described as complying with IFRS unless they comply with all the requirements of IFRS. A reporting entity may only claim to follow IFRS if it complies with every single IFRS in force as of the reporting date. IAS 1 requires an entity whose financial statements comply with IFRS to make an explicit statement of such compliance in the notes. 2. Accounting PolicyDisclosures Basically, entities should make financial statement users become aware of the accounting policies used by reporting entities—so that they can better understand the financial statements and make comparisons with the financial statements of others. Financial statements should include clear and concise disclosure of all significant accounting policies that have been used in the preparation of those financial statements. The policy disclosures should identify and describe the accounting principles followed by the entity and methods of applying those principles that materially affect the determination of financial position, results of operations, or changes in cash flows. IAS 1 requires that disclosure of these policies be an integral part of the financial statements. IAS 8 provides criteria for making accounting policy choices. Policies should be relevant to the needs of users and should be reliable (representationally faithful, reflecting economic substance, neutral, prudent, and complete). The policy note should begin with a clear statement on the nature of the comprehensive basis of accounting used. Management must also indicate the judgments that it has made in the process of applying the accounting policies that have the most significant effect on the amounts recognized. The entity must also disclose the key assumptions about the future and any other sources of estimation uncertainty that have a significant risk of causing a material adjustment to later be made to the carrying amounts of assets and liabilities. IAS 1 also requires an entity to disclose in the summary of significant accounting policies: The measurement basis (or bases) used in preparing the financial statements; and The other accounting policies applied that are relevant to an understanding of the financial statements.

- 64. [box type=”note” ] Note: Measurement bases may include historical cost, current cost, net realizable value, fair value or recoverable amount. [/box] Other accounting policies should be disclosed if they could assist users in understanding how transactions, other events and conditions are reported in the financial statements. 3. Supporting Informationfor FinancialStatement’s Items Basically, supporting information is required for nearly all items presented on the financial statements. There is, though, a degree of fluidity between showing information “on the face of the accounts” (=directly in the statement of financial position or income statement) and in the notes (= the main categories have to be preserved, but the detail underlying the reported amounts may be shown in the notes). The two basic techniques, for the purpose, are: 1. Parenthetical explanations – Supplemental information is disclosed by means of parenthetical explanations following the appropriate statement of financial position items. For example: “Equity share capital ($10 par value, 150,000shares authorized, 100,000 issued) = $1,000,000” Parenthetical explanations have an advantage over both footnotes and supporting schedules, as they place the disclosure in the body of the statement, where their importance cannot be overlooked by users of the financial statements. 2. Footnotes – If the additional information cannot be disclosed in a relatively short and concise parenthetical explanation, a footnote should be used, with a cross- reference shown in the statement of financial position. In accordance with IAS 1 the notes should: present information about the basis of preparation of the financial statements and the specific accounting policies used; disclose the information required by IFRS that is not presented elsewhere in the financial statements; and provide information that is not presented elsewhere in the financial statements, but is relevant to an understanding of any of them. An entity should present notes in a systematic manner and should cross-reference each item in the statements of financial position and of comprehensive income, in the

- 65. separate income statement (if presented), and in the statements of changes in equity and of cash flows to any related information in the notes. For example: “Inventories (seeNote 2) = $2,550,000” The notes to the financial statements would then contain the following: “Note 2: Inventories are stated at the lower of cost or market. Cost is determined by the first-in, first-out method, and market is determined on the basis of estimated net realizable value. As of the date of the statement of financial position, the market valueof the inventory is $2,620,000.” To present adequate detail regarding certain statement of financial position items, or move complex detail from the face of the accounts, a supporting schedule may be provided in the notes. For example: Current receivables may be a single line item in the statement of financial position, as follows: “Current receivables (see Note 3) = $2,300,000” A separate schedule for current receivables would then be presented as follows: Valuation accounts are another form of schedule used to keep detail off the balance sheet. For example, accumulated depreciation reduces the book value for property, plant, and equipment, and a bond premium (discount) increases (decreases) the face value of a bond payable as shown in the following illustrations. The net amount is shown in the statement of financial position, and the detail in the notes. In addition, an entity should disclose the judgments that management has made in the process of applying the entity’s accounting policies and that have the most significant

- 66. effect on the amounts recognized in the financial statements. For example: when making decisions whether investments in securities should be classified as trading, available for sale or held to maturity, or whether lease transactions transfer substantially all the significant risks and rewards of ownership of financial assets to another party. Determining the carrying amounts of some assets and liabilities requires estimating the effects of uncertain future events on those assets and liabilities at the end of the reporting period in measuring, for example, the recoverable values of different classes of property, plant, and equipment, or future outcome of litigation in progress. The reporting entity should disclose information about the assumptions it makes about the future and other major sources of estimation uncertainty at the end of the reporting period—which have a significant risk of resulting in a material adjustment to the carrying amount of assets and liabilities within the next financial year. The notes to the financial statements should include the nature and the carrying amount of those assets and liabilities at the end of the period. 4. Other Required Disclosures IFRS also requires entities to include other disclosures such as related party, contingent liabilities and unrecognized contractual commitments; and nonfinancial disclosures (e.g., the entity’s financial risk management objectives and policies). a. Related-party Disclosures A related party is essentially any party that controls or can significantly influence the financial or operating decisions of the company to the extent that the company may be prevented from fully pursuing its own interests. Such groups would include: Associates Investees accounted for by the equity method Trusts for the benefit of employees Principal owners Key management personnel Family members of owners or management According to IAS 24, financial statements should include disclosure of material related- party transactions that are defined by the standard as “transfer of resources or obligations between related parties,