Tms

- 1. Treasury Management System as easy as 1-2-3

- 2. Effective TMS Automatic pooling/zerobalancing Fast notional settlement – hundreds of transactions just in a few minutes for cleanup of intercompany balances Cross border payments with automatic recognition Management of intercompany loans Audit function for critical transactions

- 3. The central piece of a good TMS is the interest bearing account The account should have: An easy to comprehend layout A drill down functionality for complex transactions Nostro and vostro interest calculations The possibility of frequent interest changes Interest calculations with different bases (e.g. 360 and 365 days) Withholding taxes calculations taken into account Two dates: transaction or input date and value date Provisions for various currencies Automatic updates of the account The possibility to be posted on the intranet Interest capitalization in any period required

- 4. Nostro vostro calculation selection Interest base Interest base Interest changes weekly Drill down for IC-Settlement and Payment orders

- 5. Pooling enables multinational corporations to manage liquidity globally when more than 1 legal entity per jurisdiction is required Transactions should be recorded automatically based on the information provided by the banks. User should be notified when any corrections/input is required. User should be notified if he/she tries to process the same transaction for the second time. System should differentiate input and value dates.

- 6. Pooling is executed automatically based on swift data provided by the bank

- 7. When computer cannot assign automatically the MMA, the user is made aware of necessary manual corrections.

- 8. Intercompany settlement has the highest savings potential for a multinational company The system should be able to handle notional settlement and facilitate actual net payments through banking system, if required. Data in various formats should be accepted as the input. Data should be automatically verified against possible errors. The system should provide drill down functionality. The system should enable posting to the Intranet. The system should facilitate the use mid rates or bid and offer rates as conversion rates Processing time should be very short to enable daily settlement.

- 9. Netting cycle Participants notify the center of intercompany obligations Center checks integrity of the data With indicative rates center can calculate net payable or receivable amount for each participants in local currency or functional currency of the group and advise participants of their approximate position Applying notional netting the center calculates using market rates the ultimate credit and debits into interest bearing accounts Applying actual net payments through banking system the center contacts banks and buys and sells its currency shortfall or surplus. The center then uses rates obtained in place of indicative rates to calculate obligations of each participant

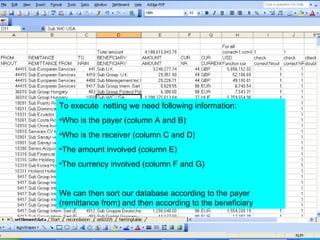

- 10. To execute netting we need following information: Who is the payer (column A and B) Who is the receiver (column C and D) The amount involved (column E) The currency involved (column F and G) We can then sort our database according to the payer (remittance from) and then according to the beneficiary

- 11. After the database has been sorted according to the payer (remittance from) we can easily see what each company has to “pay”. The amount can be charged in the functional currency of the group or in the local currency of the subsidiary. When we sort the database according to the beneficiary, we will see, what each company will receive from other companies. This amount can be calculated in the functional currency of the group or in the local currency of the subsidiary. The above process applies correspondingly whether we apply notional netting or pay net amounts through the banking system.

- 13. Double payment Wrong NROUT Wrong NRIN The settlement program for notional settlement is an automatic process to cleanup intercompany balances. It can use data from many sources and checks the correctness of data. User can correct the data or leave the corrections to the program. The settlement orders are booked with drill down functionality into MMA’s. Because the program can settle hundreds of accounts within a few minutes, it can be used on a daily basis.

- 14. The settlement program also updates the MMA with settlement transactions and stores the individual information about settlement orders with drill down functionality. When Pressing IC-Settlement on the MMA we obtain all necessary information about the settlement order.

- 15. We now see all relevant data for a confirmation of receivables or payables. When we click Back to MMA we go back to MMA.

- 16. The program creates also intranet confirmations for settlement of account payables and account receivables.

- 17. Cross border payments should be managed globally The corporate treasury is executing and receiving all cross border payments on behalf of whole group. The executed payments / received payments are automatically recognized and booked. The automatic identification should be easy to adjust and handle. Data which cannot be automatically assigned should be easily to adjust manually. Program should provide drill down capabilities. Program should enable posting on the Intranet. Processing time should very short.

- 18. The program to manage cross border payments and receipts uses swift data to populate automatically MMAs with payment data. It can identify not only agreed identification for each payer or receiver but also use any string to identify appropriate intercompany account (MMA). There can be many different identification strings for each MMA. The program uses this table to assign automatically MMA. Users are able to update this table any time. String and assigned MMA

- 19. The program assigns most of the data from the swift messages automatically but when any payment cannot be recognized the user gets an error message and is able to adjust data manually.

- 20. The payment order is also booked into the MMA with a hyperlink. The hyperlink offers drill down functionality.

- 21. Here you see detailed information about the payment order. If you click BACK to MMA you will be brought back to the MMA.

- 22. The program creates a payment order in htm-format for posting on the company intranet. Htm -file

- 23. Easy handling of intercompany loans The required input should be very low and all standard information should be populated automatically. If interest bearing accounts are involved they should be automatically updated at the inception and maturity of the loan. If necessary, hedging instruments should be created automatically as well.

- 24. One program handles all loans requirements, updates the MMAs and creates hedging contracts

- 25. Handling of foreign exchange and other activities Input form for foreign exchange transactions should be easy to handle and the required input for intercompany foreign exchange transactions should be further reduced. Program should automatically populate “known” fields for swap and offsetting transactions. Audit function for important information – all changes of database with foreign exchange transactions should be monitored. The required payments to settle foreign exchange transactions should be created automatically based on the information in the database.

- 26. When you check buy or sell swap the longer lag will be automatically populated Foreign exchange transactions are inputted into system using the Input form and MMA’s are then automatically updated. Based on the maturing forward contracts the data for offsetting spot contracts is automatically populated into the input form reducing the user input requirements.

- 27. The database of foreign exchange contracts is monitored and any corrections of records in the database and any “visits” to the cell are recorded as comment to the cell and in the log file. Corrections are monitored in the comments field and in the logfile

- 28. The logfile.txt provides the complete audit trail for all changes in the database, which were executed after the deals were inputted to the database. This event driven procedure could also be used to monitor other critical ranges, where changes should be registered.

- 29. No direct input into MMAs In order to assure that always 2 MMA’s are updated simultaneously the user should not enter any data into MMAs directly. The utility program should be used. Any data entered into this program should be also used for other purposes for example creation of electronic payments.

- 30. When you press the credit or debit button / menu command then at first you see the screen where you have to make a selection. When you want to initiate a transfer without passing any information to accounting then you just need to press OK -button

- 31. The program is driven by 3 macros and is organized in 4 worksheets. Sheet EUR- creates the payment in CSV-format, cell G36 the sheet is normally hidden Sheet SPOT4 – contains macro buttons, FX- Transactions etc. Sheet Counterparty Delivery – database for delivery instructions Sheet oldpayments –database for created e-payments Sheet delete – to reduce number of fx-deals

- 32. Information on this sheet are used to credit the beneficiary account. With help of the vlookup-function the program finds the right beneficiary account according to the information in column A, which consists of bank number and currency code. The changes about delivery instructions can be entered or pasted to this sheet Presently the database has 432 records. New records cannot be appended below the present database but have to be inserted somewhere between row 2 and 433. When you insert new rows the vlookup formulas will adjust automatically.

- 33. All programs should be easily accessed from one screen

- 34. This program should help users to access various programs and view individual MMAs