Vatraining

- 2. OVERVIEW – VA LOANS VA guaranteed loans are made by private lenders and mortgage companies to eligible veterans for the purchase of a home that must be for their own personal occupancy. To get a loan, a veteran must apply to a lender. If the loan is approved, VA will guarantee a portion of it to the lender. If the veteran has never used his/her entitlement before, or, previously used it for a home which has been sold and the loan paid in full, then he/she has full entitlement available and can apply for maximum VA financing. Based on secondary market requirements, lenders generally limit VA purchase loans to $417,000 (including the funding fee), which is equal to the conventional conforming loan limit for 2008. In December 2004, VA guidelines were modified so the maximum entitlement will index and increase accordingly with conforming loan limits, therefore always equaling 25% of the current conforming limit. Requirements For VA Loan Approval To obtain a VA loan, the law requires that: The applicant must be an eligible veteran who has available entitlement. The veteran must occupy the property as a home. Eligible Loan Purpose Eligible veterans and service personnel may obtain loans for the following purposes: To buy a home up to 4 family units for one veteran, including townhouses or condominium unit in a VA approved project. To build a home. To refinance an existing home loan. Cash-out refinance Reduce the interest rate (Interest Rate Reduction Refinance Loan – “IRRRL”). Convert an adjustable rate mortgage (ARM) to a fixed rate mortgage. FAMC does not allow VA Manufactured homes. (Reference: Chapter 3, Section 2a, VA Lender’s Handbook Change 4, September 15, 2004, http://www.warms.vba.va.gov/pam26_7.html ) Advantages of VA Home Loans 100% Financing/No Down Payment One Ratio Calculated – Back Ratio 41% No Cash Reserves Required VA Funding Fee Can Be Financed More Leniency on Derogatory Credit Seller Contribution 4% Including Prepaids No Monthly Mortgage Insurance Maximum Loan Amount equal to the Conforming Loan Limit

- 3. VA FORMS & DISCLOSURES – Now Hyperlinked Up Front Disclosures In addition to the required RESPA disclosures the following additional up front disclosures are required. Interest Rate and Discount Disclosure Veteran must sign and broker includes in loan submission package. VA Form 26-0592 (6/95) – Counseling Checklist for Military Homebuyers ACTIVE DUTY MILITARY ONLY: Veteran and broker must sign and include in loan submission package. Franklin American Mortgage VA Benefit Questionnaire (FORM 1) and Statement of Active Duty Status (FORM 2) 1/19/05 Veteran and spouse (if applicable) complete and sign Part 1. All applicants with qualifying income complete and sign Part Broker signs and includes in loan submission package. VA LENDER ID NUMBER To become an Agent of a Sponsoring Lender (FAMC) you must submit a $100 check (payable to Veteran’s Administration) to FAMC. This fee must be paid annually to maintain your VA Agent status. You should receive your VA lender ID # in 6 to 8 weeks. In certain cases the VA does not provide the VA lender ID # to FAMC and in those cases it will be the responsibility of the Agent (broker) to contact the local VA office and request the VA Lender ID #. TIP: Log on to VA website at http://homeloans.va.gov/ls.htm to access Forms, Lenders Handbook (underwriting guidelines), Eligibility Centers, Training Information and much more.

- 7. WHO IS ELIGIBILE? SERVICE ERA DATES MINIMUM SERVICE WW II 9/16/40 – 7/25/47 90 continuous days Post WWII 7/26/47 – 6/26/50 181 days Korean 6/27/50 – 1/31/55 90 days Post Korean 2/01/55 – 8/04/64 181 days Vietnam 8/05/64 – 5/07/75 90 days Post Vietnam (Enlisted) 5/08/75 – 9/07/80 181 days Post Vietnam (Officer) 5/08/75 – 10/16/81 181 days Post Vietnam (Enlisted) 09/08/80 – 08/01/90 2 years * Post Vietnam (Officer) 10/17/81 – 08/01/90 2 years * Persian Gulf 08/02/90 – present 2 years The veteran must have served 2 years or the full period which called or ordered to active duty (at least 90 days during wartime and 181 during peacetime). OTHER ELIGIBLE PERSONS MINIMUM SERVICE Active Duty Member (1) 90 days (181 during peacetime) Reserve/Guard 6 years in Selected Reserves Disabled Veteran As determined by VA IRRRL Following Veteran’s Death Surviving spouse must be on original loan. Unmarried Surviving Spouse(2) No time requirement. Veteran must have died on active duty or from a service connected disability. POW/MIA Spouse Veteran must have been POW or MIA 90 days. Limited to one-time use. Certificate valid only while veteran remains on active duty. A surviving spouse that does not qualify for VA entitlement may still be eligible for an Interest Rate Reduction Refinance Loan (IRRRL). If the spouse previously purchased property with the veteran (who is now deceased) under a VA loan and now wishes to take advantage of a lower interest rate, he/she can reuse the veteran’s entitlement to obtain an IRRRL. NOTE: This chart is only a general guide as to who may be eligible to receive a VA-guaranteed loan. Eligibility and available entitlement must always be determined and reported by VA on Form 26-8320, “Certificate of Eligibility for Loan Guaranty Benefits”, or Form 26-8320a, “Certificate of Eligibility for Loan Guaranty Benefits (Reserves/National Guard)”. A veteran who has served less than the minimum required period of service or was discharged because of a service-connected disability, may be eligible for home loan benefits. (Reference: Chapter 2, Exhibit 2-A, VA Lender’s Handbook Change 4, September 15, 2004)

- 8. CERTIFICATE OF ELIGIBILITY (COE) Establishing the veteran’s eligibility is the first and most important step in processing a VA loan. If the Veteran does not have an original COE at the time of loan application, the broker must immediately take steps to obtain VA’s determination of the veteran’s eligibility. 1. Requesting an Automated Certificate of Eligibility (ACE) using VA’s WebLGY System Log on to the VA Information Portal at https://vip.vba.va.gov/portal/userprofiling/login.jsp . Select “User Registration” if your company does not already have a User ID and password. After signing on, select the “webLGY” link under Applications. Under “Eligibility” select “Automated Certificate of Eligibility”. Complete the required information and submit. If eligibility is approved: Select “View Certificate of Eligibility”. Print a paper copy and include it in the loan submission package. If the WebLGY system is NOT able to determine the veteran’s eligibility: Apply online by selecting “Electronic Application”. In many cases you will be able to upload the required proof of service to expedite receipt of an electronic COE. If unable to complete the Electronic Application: Follow instructions below to request a Certificate of Eligibility (COE) by mail. COEs that cannot be processed by WebLGY (must request the COE by mail): Persons whose service was or is in the Reserves/National Guard Persons who may have had prior VA loan(s) that went to foreclosure Persons who did not serve the minimum required length of service and were not discharged for an authorized exception Persons who were discharged under conditions other than honorable Persons for which VA has insufficient data to make the determination Persons seeking restoration of previously used entitlement 2. Requesting a Certificate of Eligibility by Mail Have the veteran complete, sign and date VA Form 26-1880, “Request for a Certificate of Eligibility” . Have the veteran provide the appropriate proof of service (i.e. DD-214). Mail documents to the VA eligibility center (address on next page). Incomplete submissions will result in processing delays. CAUTION: It may take 3 to 4 weeks to receive a hard-copy COE. FAMC requires the original COE Prior to Docs so please be sure to allow adequate processing time. The current lead time for hard-copy COEs is usually posted on the VA Information Portal at: https://vip.vba.va.gov/portal/VBAH/Home

- 9. CERTIFICATE OF ELIGIBILITY (COE) (cont’d) 3. Requesting Restoration (Updated Certificate of Eligibility) Have the veteran fully complete, sign and date VA Form 26-1880, “Request for a Certificate of Eligibility” . Include evidence of payment in full of any prior loans (HUD-1 settlement statement). Include any previous COE’s. Mail documents to the VA eligibility center (address below). 4. Concurrent Restoration and Guaranty (“Back-to-Back” Closings) When a veteran is selling their current home and purchasing a new home within a short period of time (10 business days)*, the following information may be submitted in lieu of mailing a request for restoration to the VA eligibility center: Evidence of the presently-used entitlement, showing VA loan number of the property being sold (original paper COE, or automated COE from the WebLGY system). VA Form 26-1880, “Request for a Certificate of Eligibility” , fully completed and containing veteran’s original signature . Copy of HUD-1 on sale of existing property. * Must close on new home within 10 business days of sale of existing home 5. Requesting a Certificate of Eligibility for an IRRRL using VA’s WebGIL System Log on to the VA Information Portal at https://vip.vba.va.gov/portal/userprofiling/login.jsp . Select “User Registration” if your company does not already have a User ID and password. After signing on, select the “webGIL” link under “Applications”. Under “All Users” select “Search LIN”. Complete the required information and submit. If the LIN Search returns information showing the active loan to be refinanced, print the output and use in lieu of a COE. VA ELIGIBILITY CENTER As of January 1, 2006, the Winston-Salem Eligibility Center became the sole center for processing hard-copy COE requests. The center is experiencing serious backlogs. It may take 3 to 4 weeks to receive a hard-copy COE, therefore, brokers should obtain an electronic COE (as detailed on the previous page) whenever possible. Winston-Salem VA Eligibility Center Mail Service Courier Service Department of Veteran Affairs Department of Veteran Affairs Eligibility Center Eligibility Center PO Box 20729 251 N. Main St. Winston-Salem, NC 27120 Winston-Salem, NC 27155 Telephone: 888-244-6711 - Toll Free E-Mail: [email_address]

- 15. VA FUNDING FEE The VA Funding Fee is a one-time, up-front charge applied as a percentage to the “Base Loan Amount”. The Funding Fee may be financed into the loan provided the entire loan amount including the Funding Fee does not exceed the current conforming loan limit ($417,000 for 2008). The fee is remitted by the Lender to VA after loan closing. The fee is fully earned by VA upon loan closing and is not available as a pro-rated refund to the veteran, even if the veteran refinances to another VA loan at a later date. Funding Fee Tables PURCHASE AND CONSTRUCTION PAYOFF LOANS REGULAR REFINANCE LOANS (CASH-OUT) ** ** All VA refinance loans are considered “cash-out” except IRRRLs and loans to payoff (1) construction loans, (2) installment land contracts, and (3) loans assumed by veterans at interest rates higher than the proposed refinance. All other VA refinance loans are considered “cash-out” whether or not the veteran actually receives cash. 1 The higher subsequent use fee does not apply if the veteran’s only prior use of entitlement was for a manufactured home loan not titled as real estate . IRRRLS Type of Veteran Down Payment Percentage for First Time Use Percentage for Subsequent Use Regular Military None ( closed 10/1/06 thru 9/30/07 ) None ( closed 10/1/07 and after ) 5% or more (up to 10%) 10% or more 2.15% 2.15% 1.50% 1.25% 3.35% 3.3% 1.50% 1.25% Reserves/ National Guard None ( closed 10/1/06 thru 9/30/07 ) None ( closed 10/1/07 and after ) 5% or more (up to 10%) 10% or more 2.4% 2.4% 1.75% 1.5% 3.35% 3.3% 1.75% 1.5% Type of Veteran Dates Percentage for First Time Use Percentage for Subsequent Use Regular Military closed 10/1/06 thru 9/30/07 closed 10/1/07 and after 2.15% 2.15% 3.35% 3.3% Reserves/ National Guard closed 10/1/06 thru 9/30/07 closed 10/1/07 and after 2.4% 2.4% 3.35% 3.3% Type of Loan Percentage for all Veterans Whether First Time or Subsequent Use Interest Rate Reduction Refinancing Loans .50%

- 16. VA FUNDING FEE (cont’d) Funding Fee Exemption In certain cases, a veteran may be “ exempt” from the funding fee. Immediately upon receipt of a loan application, VA requires the broker to ask these four specific questions of the veteran or surviving spouse applicant: Are you currently receiving VA disability benefits? Have you (or your deceased veteran spouse) ever received VA disability benefits? Have you (or your deceased veteran spouse) ever been rated disabled or incompetent by VA, regardless of whether or not benefits were ever received? Are you the surviving spouse of a veteran who died on active duty or as a result of a service-connected disability? If the answer to any of the questions is “yes”, the veteran is “exempt”, the funding fee is not charged, and the broker must obtain from VA, a completed VA Form 26-8937, Verification of VA Benefits . This form must be included in the underwriting package any time the funding fee is not charged . If the answer to all four questions is “no”, the funding fee is charged, the VA-completed form 26-8937 is not required, and evidence that all required questions were answered as “no” may be included in the underwriting package in lieu of Form 26-8937. As a convenience to our wholesale brokers, FAMC provides a dual form, “ VA Benefit Questionnaire and Statement of Active Duty Status ” that can be completed at application to cover these four required questions along with the VA-required Statement of Active Duty Status. Any forms that are equivalent to these two sections are acceptable. Every veteran, including active duty, must answer Part 1 of the dual form (or equivalent), and every applicant whose income is used to qualify (including non-military applicants) must answer Part 2 of the dual form (or equivalent). Ref VA Handbook Chapter 4, Section 6.a. TIP: The 26-8937 should be submitted to the VA Regional Loan Center with jurisdiction over the property's state. There are 11 RLCs that cover the entire the U.S., listed here along with the states they cover: http://homeloans.va.gov/rlcweb.htm . This list is reproduced on page 26 of this handbook for your convenience.

- 18. ENTITLEMENT, GUARANTY, AND MAXIMUM LOAN AMOUNTS VA does not establish maximum loan amounts. However, the secondary market requires VA loans (other than IRRRLs) to have a 25% guaranty, which can be met with a combination of VA entitlement, plus the veteran’s down payment and/or equity in the property. The maximum amount of VA guaranteed loan that can be made to a veteran and sold in the secondary market is, therefore, determined by the type of loan, the amount of the funding fee, the value of the property, the veteran’s down payment and/or equity in the property, and the veteran’s available entitlement. For 2008, the maximum loan that can be made to a veteran with full entitlement is $417,000 including the funding fee. The Two Types of Entitlement – Basic and Bonus Eligible veterans have two types of entitlement, “basic” and “bonus”. Basic entitlement is $36,000 . This is the maximum that can be shown on the COE unless changed by Federal legislation. Bonus entitlement is never show in the COE, and varies year-to-year based on the conforming loan limit. For 2008, bonus entitlement is $68,250 . Bonus entitlement is available ONLY for these types of loans that exceed $144,000: Purchase transactions Refinance transactions that pay off construction loans and installment land contracts Bonus entitlement is not available for rate and term or cash-out refinance transactions , therefore, those loans are limited to $144,000 unless the veteran as sufficient equity in the property to equal 25% of the appraised value when combined with the veteran’s available basic entitlement.

- 19. VA ENTITLEMENT EXERCISES For 2008, every eligible veteran has 36,000 basic entitlement and $68,250 bonus entitlement. This brings the total entitlement up to $104,250 for 2008. The bonus entitlement kicks in automatically when the dollar amount of the loan for purchase of a home exceeds $144,000. Calculating Bonus Entitlement 2008 Conforming Loan Limit: $417,000 Less Maximum Loan w/ Full Basic Entitlement ($36,000 x 4): - $144,000 $273,000 x 25% 2008 Bonus Entitlement: $ 68,250 Exercise #1 Purchase with Full Entitlement Assumptions COE entitlement used -0- COE remaining entitlement $36,000 Lesser of sales price or value $231,500 Down payment funds $-0- $ available entitlement from COE + $ bonus entitlement = ___________ (total entitlement) $ X 4 = $_______________loan amount maximum for this veteran (total entitlement) (further limited by the sales price/value of the home)

- 20. VA LOAN AMOUNT EXERCISES Total Loan Amount Exercise #2 Assumptions: Regular Military 1 st time use Lesser of sales price or value $220,000 COE entitlement used -0- COE entitlement available $36,000 Down payment -0- $ available entitlement + $ bonus entitlement = $_______________ (total entitlement) $ X 4 = $ loan amount maximum (total entitlement) % funding fee X lesser of sales price or value = $ funding fee amount $ funding fee amount + $ lesser of sales price or value = $ total loan amount

- 21. VA LOAN AMOUNT EXERCISES Total Loan Amount Exercise #3 Assumptions: Regular Military (used eligibility to purchase a previous single family home which has been paid in full) Lesser of sales price or value $199,000 COE entitlement used -0- COE entitlement available $36,000 Down payment 5% $ available entitlement + $ bonus entitlement = $________________ (total entitlement) $ X 4 = $ loan amount maximum (total entitlement) $ lesser of sales price or value - $ down payment = $___________________(a) proposed loan amount (providing entitlement covers) % funding fee X proposed loan amount = $ funding fee amount $ funding fee amount + $ (a) proposed loan amount= $ total loan amount

- 22. Veteran may pay the following closing costs in addition to a 1% Origination Fee Veteran may pay the following closing costs IN LIEU OF a 1% Origination Fee (1) YES YES YES YES YES YES YES YES YES YES YES YES YES ** NO ** (2) YES YES YES YES YES Provided the total of itemized fees paid in lieu of the 1% Origination Fee does not exceed 1%. The veteran may never under any circumstances pay a termite inspection fee on a purchase transaction. CLOSING COST SUMMARY - The following is a closing cost summary for a VA Purchase Transaction: Summary of Closing Costs Appraisal Fee VA Compliance Inspection for new construction Recording & Endorsement Fees MERS Registration Fee Credit Report Fee Prepaid Items Flood Certification Survey Fee Title Exam & Insurance Overnight Courier Fee VA Funding Fee Home Inspection if desired by veteran Notary Fees Termite Inspection Fee Tax Service Fee Underwriting Fee Document Prep Fee Discount Points (reasonable) Septic Inspection YES YES YES YES YES YES YES YES YES NO YES YES NO NO NO NO NO YES NO

- 23. FEES AND CHARGES Allowable Fees & Charges The veteran can pay a maximum of: Reasonable and customary amounts for any or all of the “ Itemized Fees and Charges” designated by VA, plus A 1% flat charge (typically called an “Origination Fee”), plus Reasonable discount points used to buy down the interest rate. The veteran may pay any or all of the following itemized fees and charges, in amounts that are reasonable and customary. It is VA’s intention for the 1% Origination Fee to cover all other fees and charges that are not listed. The veteran can pay for the credit report obtained by the lender. For Automated Underwriting cases, the veteran may pay the AUS fee in lieu of the charge for a credit report. For “Refer” cases, the veteran may also pay the charge for a merged credit report, if required. Credit Report The veteran can pay the reasonable and customary fee (currently $3.95, $4.95 effective ) for registration of the loan with the Mortgage Electronic Registration System. MERS Registration Fee The veteran can pay for recording fee and recording taxes or other charges incident to recordation. Recording Fees The veteran can pay the fee of a VA appraiser and VA compliance inspectors. The veteran can also pay for a second appraisal if he or she is requesting reconsideration of value. The veteran cannot pay for an appraisal requested by the lender or seller for reconsideration of value The veteran cannot pay for appraisals requested by parties other than the veteran or lender. Appraisal and Compliance Inspections Description Allowable Fee

- 24. FEES AND CHARGES (cont’d) Allowable Fee Description Prepaid Items The veteran can pay for the credit report obtained by the lender. For Automated Underwriting cases, the veteran may pay the AUS fee in lieu of the charge for a credit report. For “Refer” cases, the veteran may also pay the charge for a merged credit report, if required. Hazard Insurance The veteran can pay the required hazard insurance premium. This includes flood insurance, if required. Flood Zone Determination The veteran can pay the actual amount charged for a determination of whether a property is in a special flood hazard area, if made by a third party who guarantees the accuracy of the determination. The veteran can pay a charge for a life-of-the-loan flood determination service purchased at the time of loan origination. A fee may not be charged for a flood zone determination made by the lender or a VA appraiser. Survey The veteran can pay a charge for a survey, if required by the lender or veteran. Many charge for a survey in connection with a condominium loan must have the prior approval of VA. Title Examination and Title Insurance The veteran can pay a fee for title examination and title insurance. Of the lender decides that an environmental protection lien endorsement to a title policy is needed, the cost of the endorsement may be charged to the veteran. Special Mailing Fees for Refinancing Loans For refinancing loans only, the veteran can pay charges for Federal Express, Express Mail, or a similar service when the saved per diem interest cost to the veteran will exceed the cost of the special handling. VA Funding Fee Unless exempt from the fee, each veteran must pay a funding fee to VA.

- 25. FEES AND CHARGES (cont’d) Unallowable Fees & Charges The following are examples of fees and charges that cannot be charged to the veteran when a 1% Origination Fee is paid. If no Origination Fee is paid, the veteran may pay fees and charges that would otherwise be unallowable, provided the total does not exceed 1%. The veteran may never under any circumstances pay a termite inspection fee on a purchase transaction!! attorney’s fees loan broker fees, real estate broker fees, finder fees prepayment penalties HUD/FHA inspection fees (for proposed construction constructed under HUD supervision) notary fees commitment fees, marketing fees preparation or recording of assignment due to a secondary loan sale trustee’s fees or charges loan application or processing fees fees for preparation of truth-in-lending or other disclosure statement fees charged by loan brokers, finders or other third parties whether affiliated with the lender or not, and tax service fees. Seller Contributions (Reference: Chapter 8, Section 5, VA Lender’s Handbook Change 4 - September 15, 2004) Seller contributions may not exceed 4% of the sales price. The 4% seller contribution may include prepaid expenses, discount points and the VA funding fee. Seller may also pay closing costs over and above the 4% which are reasonable and customary for the area in which the property is located and typically include the following: Origination Fee Title Examination Fee Appraisal Fee Recording Fee Credit Report Fee Flood Determination Fee Survey Fee

- 26. DOCUMENTATION STANDARDS Age: All verification documents (credit, employment, income, assets, etc.) must be dated within 120 days of the note ( 180 days for new construction). Source: V erification documents may not be handled or transmitted by or through any interested third party or their equipment (e.g. real estate agent, builder, seller). Copied Documentation: Documents should be originals or certified true copies. Blanket “True-Copy” Certifications: Subject to the limitations below, FAMC will accept in lieu of individually stamped documents, a signed “blanket certification” that states all documents are true and correct copies of the original. Individual “True-Copy” Certifications: If included in a loan package, collateral documents must be individually true-certified, including but not limited to the following: Security Instrument (Deed of Trust/Mortgage) Riders to the Security Instrument All assignments Other documents related to the Note and/or the Security Instrument (for example, Power of Attorney) Faxed and Internet Documentation: Acceptable in lieu of an original/true-certified document provided it: clearly identifies the source of information, contains a fax header consistent with the information source, identifies the name and telephone number of a person who can verify faxed information, indicates the date and time printed and includes the Internet Uniform Resource Locator (URL) to identify the downloaded webpage(s), was not handled or transmitted by, from or through interested third parties or their equipment, including but not limited to real estate agents, builders, and sellers, is clear, completely legible and contains no cut off text.

- 27. DOCUMENTATION STANDARDS (cont’d) Non-Purchasing Spouse Issues When the spouse is not an applicant (not contractually obligated, does not complete the application or sign the note), ECOA prohibits inquiring about the spouse’s income, debt, and credit history, or a divorce situation unless: Veteran is relying on the spouse’s income to qualify – verify and treat the spouse’s income the same as the veteran’s income, (require the spouse to sign the application and the note). Veteran reveals or evidence suggests that the veteran is obligated to pay alimony, child support or maintenance to a spouse or former spouse – obtain documentation to sufficiently verify the monthly payment due to the spouse/former spouse and count as a debt of the veteran. Veteran is relying on alimony, child support or maintenance payments from the spouse or former spouse – sufficiently verify the past and future income stream from the spouse/former spouse to the veteran. The subject property is located in a community property state – obtain a credit report on the non-purchasing spouse and treat their debts and credit history just like those of the veteran, regardless of whether or not the veteran and spouse choose to have the spouse’s income considered and verified as qualifying income. If a married veteran wants to obtain the loan in his or her name only, the veteran may do so without regard to the spouse’s credit only in a non-community property state. Community Property States as of date of publication: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington and Wisconsin . Refer to the Income and Debt sections for further details on required documentation.

- 28. INCOME SUMMARY (Reference: Chapter 4, Section 2, VA Lender’s Handbook Change 4 - September 15, 2004) Employment History Verify a two-year employment history (including past employers if needed). Applicants with less than 12 months of civilian employment history will be evaluated for acceptability as provided in Chapter 4, Section 2.f. of the VA Handbook, taking into consideration documented experience, training, and education related to the present position. Standard Documentation Written Verification of Employment/VOE (VA Form 26-8497 or equivalent), plus Most recent single pay stub. Alternative Documentation Verbal VOE (identifying the person contacted, their position, phone number, date contacted and probability of continued employment). Pay stub(s) covering the most recent 30 day period. W-2 forms for the previous 2 years and explanation of all gaps in employment. Alternative documentation may be combined with standard documentation to meet the two year requirement. Employment Verification Services VA has approved the following Employment Verification Services in lieu of a standard VOE: “ The Work Number for Everyone” (TALX Corporation). No pay stub is needed with the TALX verification.

- 29. INCOME SUMMARY (cont’d) (Reference: Chapter 4, Section 2, VA Lender’s Handbook Change 4 - September 15, 2004) Active Duty & Reservists, National Guard Applicants A certified copy or original Leave and Earnings Statement (LES) is required to verify military employment and substitutes for the VOE. Veterans who have less than one year remaining time in service (ETS date) must certify that they are going to re-enlist, along with their commander certifying they are eligible to re-enlist. If the applicant does not plan to continue with the military, he/she must provide a firm job commitment or contract from the new employer verifying the job position, rate of pay, starting date, hours scheduled per week, and probability of continued employment. Acceptability of the newly-acquired civilian employment as qualifying income will be evaluated on a case-by-case basis as provided in Chapter 4, Section 2.k. of the VA Handbook. Factors to be considered include LTV, cash reserves, how the veteran’s military experience, training, and education relate to the new position, and for married veterans – ability of the loan to qualify using the spouse’s income only vs. how much income from the veteran’s new job is needed to qualify. Self-employment Income Income from self-employment may be used when the applicant has been self-employed for at least two years. Provide copies of the past two years individual tax returns. If the business is a partnership or corporation , a credit report on the business plus two years of business tax returns are required. The current year-to-date profit and loss statement and balance sheet are required. These exhibits can be prepared by the business or the veteran, however the underwriter may request financials prepared by an accountant if needed for clarity or consistency. Normal business expenses that can be “added-back” to the net profit or bottom line figures include depreciation. Business debts listing the name of a Sole-proprietor on a Schedule C must be counted against the veteran on the loan analysis. The same applies to partnerships filed on IRS Form 1065. Only corporate debts are exempt from the veteran’s loan analysis. On partnerships and corporations , furnish a list of the primary owners and their percentage in the business. This can usually be found on the K-1 Forms for partnerships and sub-chapter S corporations or on the 1120 Form, Schedule E for standard corporations. Taxable Income listed on the bottom of a corporate tax return (IRS Form 1120) may be divided by the veteran’s percentage of ownership and then used as additional income (subject to tax).

- 30. INCOME SUMMARY (cont’d) Commission Income When all or a major portion of an applicant’s income is from commissions, verification documents must show the year-to-date commissions, the basis for computing commission, and how frequently commissions are paid to the applicant. Generally commission income can be considered stable after the applicant has received it for two years. The prior two years income tax returns (additional periods if needed) must be provided with W-2s and 1099-MISC Forms. Rental Income Multi-Unit Property Securing the VA Loan – If the veteran is purchasing owner-occupied multi-unit housing, the documentation required would include two years tax returns to verify prior landlord experience , copies of leases (if available), and evidence of cash reserves equaling six months PITI. If all of these conditions are met rental funds may be included in effective income as follows: Existing Property – 75% of the verified prior rent. Proposed Construction – 75% of the appraiser’s estimate of the property’s fair monthly rental. Rental of Veteran’s Previous Residence – If the veteran will be renting out his/her former residence, prospective rental income may be used to offset the mortgage payment if there is a positive cash-flow, and no indication that the property will be difficult to rent. A copy of the lease must be furnished. The mortgage debt should be listed on the loan analysis and shown as “rental offset.” This rental income may only be used to offset the mortgage payment and may not be included in effective income. Other Rental Property – If the veteran has other rental property, required documentation includes two years tax returns to verify rental income and prior landlord experience , evidence of continued ownership (open mortgage or other proof of ownership), copies of leases (if available), and evidence of cash reserves equaling three months PITI. If all of these conditions are met, positive cash flow may be added as effective income or used to offset the mortgage debt.

- 31. INCOME SUMMARY (cont’d) Stability & Use of Other Income Generally, 2nd job income should only be used after the applicant has 24 months experience of working two jobs. The ability to withstand the physical and emotional stress of working two jobs must be demonstrated before income can be included. Generally, income from overtime or part-time work is NOT considered reliable unless the applicant has received this income for 2 years. Income from Worker’s Compensation, Foster Care, Public Assistance, Social Security, Alimony and Child Support may be considered if they have been verified as consistently paid and are likely to continue. Public assistance programs and Social Security must continue for a minimum of 3 years from the date of closing to be counted.

- 32. CREDIT SUMMARY General Rule A borrower who has made satisfactory payments on traditional credit accounts for 12 months since the date of the last derogatory credit item can generally be considered to have acceptable credit. Exceptions are: Bankruptcy Outstanding judgments Unresolved Federal debts No Credit, Non-Traditional Credit Lack of credit is not generally considered an adverse factor. Obtain three non-traditional sources of credit and document a 12 month history. Sources in order of preference: rental history, utilities, auto insurance, cable TV, cellular telephone, other credit accounts. Non-traditional credit may not be used to compensate for collection accounts, judgments, or adverse traditional credit accounts that are less than two years old. Collection Accounts Payment of collection accounts at or near the time of loan application does not improve creditworthiness of the borrower. A borrower with an unacceptable credit history does not become acceptable simply by paying collection accounts. Conversely, a borrower with an overall favorable history might be considered acceptable with isolated unpaid collection accounts. In the strictest sense, unpaid collection accounts are considered derogatory items the entire time they remain unpaid. Under the “General Rule” above, the 12 months of clean credit would start the date collection accounts are satisfied. Judgments/Tax Lien A loan cannot be approved with an unpaid judgment or tax lien. If the veteran is on acceptable repayment plan of at least 12 months predating the application and has strong compensating factors the loan may be considered for approval. Consumer Credit Counseling Need 12 months of acceptable history predating the application and the approval of counselor. Bankruptcy Chapter 7: 2-year "Waiting Period" from discharge date (with 2 years clean credit). Chapter 13: 1-year into the pay-out period, satisfactory payments, and Court approval. Need a satisfactory history for 12 months on payment plan and approval of the court. Foreclosures or “Deed-in-Lieu” 2 year "waiting period" from the date the deed was surrendered or the claim was paid by VA. Divorce Situations Adverse credit due to divorce is not generally given consideration as a “circumstance beyond the borrower’s control.” However, delinquent payments made after documented assignment of responsibility to an ex-spouse may be disregarded. Refer to the non-purchasing spouse section on page 14 for further information on divorces

- 33. CHECKING “CAIVRS” For all VA loans including Interest Rate Reduction Refinancing Loans (IRRRLs), lenders must screen all borrowers using HUD's: "Credit Alert Interactive Voice Response System” (CAIVRS) If CAIVRS indicates the borrower is presently delinquent or has had a claim paid within the previous three years on a Government-insured loan made on his/her behalf, the borrower is not eligible. Exceptions to this may be granted under the following situations: Assumptions. If the Borrower sold the property, with or without a release of liability, to a mortgagor who subsequently defaulted and it can be established that the loan was not in default at the time of assumption, the borrower is eligible. Divorce. A borrower may be eligible if the divorcee decree or legal separation agreement awarded the property and responsibility for payment to the former spouse. However if a claim was paid on a mortgage in default at the time of divorce, the borrower is not eligible. Bankruptcy. When the property was included in a bankruptcy that was caused by circumstances beyond the borrower's control (such as the death of the principal wage earner; loss of employment due to factory closings, reductions-in-force, etc., or serious long-term uninsured illness), the borrower may be eligible. If the processor has reason to believe the CAIVRS message is erroneous or must establish the date of claim payment, the lender must contact the local VA Regional Office for instructions or provide documentation to support the borrower's eligibility. Using the Credit Alert Interactive Voice Response System - "CAIVRS" FHA Approved Lenders : While logged-in to The FHA Connection , https://entp.hud.gov/clas/ select Single Family FHA / Single Family Origination / Case Processing / CAIVRS Authorization. In the drop-down for SSN/TIN Indicator select SSN. Enter the SSN for the first borrower. Continue until you have selected the SSN indicator and entered the SSN for each borrower on the loan. Enter your company’s 10-digit VA ID Number in the Lender ID box. In the Agency drop-down box select Veterans’ Affairs. SEND. If successfully completed, a CAIVRS authorization number beginning with an “A” will be returned and should be entered on the VA Loan Analysis Worksheet or the IRRRL Worksheet . HUD’s CAIVRS website: https://entp.hud.gov/caivrs/public/home.html . Contact your Account Executive if you need help with registration. Telephone Inquiry: Call: 304-744-4073 Monday-Saturday, 9 am to 9 pm EST Information needed: VA Lender's ID # Borrower's social security number Record "Code number" for each borrower on the VA Loan Analysis Worksheet or the IRRRL Worksheet as applicable .

- 34. DEBTS & OBLIGATIONS Debts & Obligations Debts and obligations of the applicant must be rated and a tri-merge credit report must be obtained. When a pay stub or leave-and-earnings statement indicates an allotment, the lender must investigate the nature of the allotment and determine if it is related to a debt. Include significant debts and obligations in the borrower’s debt ratio when determining ability to meet mortgage payments. Significant debts and obligations include: debts and obligations with a remaining term of 10 months or more (long-term) accounts with a term less than 10 months that require payments so large as to cause a severe impact on the family’s resources for any period of time Community Property States If the property is located in a community property state (currently AZ, CA, ID, LA, NV, NM, TX, WA and WI), the broker must obtain a credit report on the spouse and treat their debts and credit history just like those of the veteran, regardless of whether or not the veteran and spouse choose to have the spouse’s income considered as qualifying income . Refer to the non-purchasing spouse section for further information. Joint Loans A joint loan is any loan where title to the property will be held by the veteran and another person who is not the veteran’s spouse. Rule of Thumb for all VA loans except IRRRLs: The VA guaranty plus the Veteran’s down payment or equity must equal 25% of the total loan amount (25% of the appraised value for refis) including the funding fee. Since VA will only guarantee the portion of the loan belonging to the veteran, joint loans require a down payment (or equity) and must be underwritten and approved by VA. Before submitting a joint loan to FAMC, p lease confirm current availability with the FAMC commitment desk and allow an additional 10 to 12 days underwriting time . Examples of Joint Loans : Veteran/non-veteran joint loan: A loan involving at least one veteran using their entitlement, plus at least one non-veteran who is not the veteran’s spouse. 2 veteran joint loan: A loan involving at least two veterans who are not married to each other, with each using their own entitlement. This loan will require prior approval from VA but will not require downpayment/equity if each veteran has sufficient entitlement to provide a full 25% guaranty of their portion of the loan. A loan to a veteran and a fiancé/fiancée who intend to marry prior to a loan closing and take title as veteran and spouse will be treated as a loan to a veteran and spouse (conditioned upon their (Reference: Chapter 7, Section 1, VA Lender’s Handbook Change 4 - September 15, 2004)

- 35. COMPENSATING FACTORS A valid compensating factor is an unusual factor to strengthen the loan, not mere satisfaction of a program requirement. For example, significant liquid assets might compensate for a residual income shortfall whereas long-term employment would not. Compensating factors cannot be used to compensate for unsatisfactory credit. Compensating factors include, but are not limited to the following: Excellent long-term credit Conservative use of consumer credit Minimal consumer debt Long-term employment Significant liquid assets Down payment or the existence of equity in refinancing loans Little or no increase in housing expense Military benefits Satisfactory home ownership experience High residual income Low debt-to-income ratio

- 36. TABLE OF RESIDUAL INCOMES BY REGION (Reference: Chapter 4, Section 9e, VA Lender’s Handbook Change 4 - September 15, 2004)

- 37. TABLE OF RESIDUAL INCOMES BY REGION (Reference: Chapter 4, Section 9e, VA Lender’s Handbook Change 4 - September 15, 2004) MAINTENANCE & UTILITIES Use 14¢ per square foot. Add $75.00 if the home has a pool.

- 38. VA QUALIFYING EXERCISE Use the following assumptions to complete these sections on the attached Loan Analysis Worksheet: SECTION “C” Estimated Monthly Shelter Expenses SECTION “D” Debts & Obligations SECTION “E” Monthly Income & Deductions Items 41 through 45 Loan Type 30 year fixed Interest Rate 6.25% Purchase Price $199,000 Funding Fee 2.15% Down Payment -0- Size of Home 1450 sq ft Maintenance Costs $0.14 / sq ft Property Taxes $200 / month Hazard Insurance $52 / month Revolving Debt $20 / month Child Care Expense $585 / month Number of Children 2 Property Location Kansas City, Missouri Veteran is salaried, employed for 4 years with same company with monthly income of $2,800. Federal Income Tax = $251 State Income Tax = $86 Veteran’s spouse is hourly, with same company for 2 years, 40 hours/wk with an hourly income of $12.80. Federal Income Tax = $237 State Income Tax = $69 They have 2 children with child care expenses of $135.00 per week

- 40. THE VA CASE NUMBER & APPRAISAL Ordering VA Case Number & Appraisal A VA case number must be ordered for every VA loan using VA TAS (The Appraisal System). You may register for TAS in the Veterans Information Portal at https://vip.vba.va.gov/portal/userprofiling/html/reglinks.jsp . Brokers should register as User Type “Lender”. You will need the following information: Your company’s VA Lender ID # Your company’s VA PIN # (the last 4 digits of your VA Lender ID#) Franklin American’s VA Sponsor ID# 8753180000 When registration is complete, proceed to the log-in function. From the menu at far left under “Applications”, select “TAS”. First page will be blank with a few options. Select “Requester”, then “Assignments”. Purchase or non-IRRRL refi – select “Single Property” IRRRL – select “Loan Number Only” Complete subsequent screens and click “Submit”. Print the TAS-generated VA Form 26-1805-1 “VA Request for Determination of Reasonable Value” for your records. Include a copy with your loan submission to FAMC. E-mail, fax or mail the VA Form 26-1805-1, the sales contract, and any other required documentation (see section 10.04 of the VA handbook) to the assigned appraiser on the same day the case number is assigned. For more details and training on the VA TAS System please access the FAMC website, Wholesale Lending section, https://www.franklinamerican.com/ext/general?npage=whol . If you do not have access to the VA TAS System you may access the “ Forms” section of our website and select “VA Case Number Request Form” . Complete the necessary information and fax to the number listed on the bottom and FAMC will order the VA case number for you. It will be the broker’s responsibility to order their own VA case numbers after VA has issued their VA Lender ID#. IMPORTANT NOTE: With the exception of IRRRLs, when you order a case number you are automatically ordering an appraisal . When you click “submit” to generate the case number, you are placing the order for an appraisal and making the following certification to VA, “we agree to forward to the appraiser the approved fee which we are holding for this purpose.” Even if the loan does not close , you are responsible to pay the appraiser unless you cancel the order before the appraisal has been performed.

- 41. THE VA CASE NUMBER & APPRAISAL cont’d) Canceling a VA Appraisal Order E-mail the assigned appraiser and the appropriate VA Regional Loan Center (RLC) with the case number, property address and request to cancel. The appraiser’s e-mail address can be found on the VA Form 26-1805-1. E-mail links to the RLCs are located at http://homeloans.va.gov/rlcmap.htm . For RLC fax and phone information see http://homeloans.va.gov/rlcweb.htm or page 24 of this manual. Be sure to confirm the appraisal order has been cancelled. If the request to cancel is not received and processed by VA before the appraisal is performed, then the broker will be liable for the cost of the appraisal. (Reference: Chapter 10, VA Lender’s Handbook)

- 42. PROPERTY ELIGIBILITY Existing Construction 1-4 family owner-occupied dwelling that at the time of appraisal: Has been previously owner-occupied, or Fully completed for 12 months or more. New Construction 1-4 family owner-occupied dwelling that at the time of appraisal: Has been fully completed for less than 12 months, or Is fully completed EXCEPT for “Customer Preference” items (interior wall finishes, floor covering, appliances, fixtures and equipment, etc.). The broker and builder should work closely together to determine when the property has reached this stage and when the appraisal should be ordered. One of the following is required: 1-yr VA Builder’s Warranty (VA Form 26-1859, “Warranty of Completion of Construction”) AND Builder VA ID # or 10-yr Warranty Acceptance Letter AND Builder VA ID # Proposed or Under Construction 1-4 family owner-occupied dwelling that at the time of appraisal: Is not completed to the “Customer Preference” stage (see above) The following are required: 1 year VA Builder’s Warranty (VA Form 26-1859, “Warranty of Completion of Construction”) – always Builders VA ID# One of the following Certificate of Occupancy or equivalent issued by the local building authority 10 year Warranty Acceptance Letter AND Final Inspection by a VA Fee Inspector, VA Appraiser, or the local building authority. From this final inspection, FAMC must be able to confirm that the property is 100% complete and meets VA’s minimum Property Requirements for existing construction.

- 43. PROPERTY ELIGIBILITY (cont’d) 1 set of construction exhibits (see Section 10.10 VA Lenders handbook). Send to the Appraiser with the TAS-generated VA Form 26-1805-1) Fully completed Builder’s Certification (HUD Form 92541) OR A certification identifying the property, signed and dated by technically qualified and properly identified individual (such as, builder, architect, engineer, etc.) which states “I certify that the construction exhibits meet all local code requirements and are in substantial conformity with VA Minimum Property Requirements, including the energy conservation standards of the 1992 Council of American Building Officials’ Model Energy Code and the requirement for lead-free water piping.” Veteran must sign “Description of Materials” Documentation Update : VA will now accept a Certificate of Occupancy (CO), or equivalent, issued by the local building authority in lieu of inspections that were formerly required to be performed by a VA Fee Inspector. Those changes are reflected above. Ineligible Properties Located in Flood hazard area where flood insurance is not available. Located in the Coastal Barrier Resource System. Located in certain airport noise zones (see Section 11.12 VA Lenders Handbook). Located in non-approved Condo. Leasehold condos. Cooperatives. Residential structures within a transmission line easement (see Section 12.07 VA Lenders Handbook). Ownership other than “fee simple” unless previously approved by VA. Properties that are not primarily residential in nature and use. FAMC does not lend on manufactured housing. Remember: VA guarantees the loan, not the condition of the property. It is the purchaser’s responsibility to see that all components (i.e. heating, cooling, plumbing, etc.) of the house are in proper working condition.

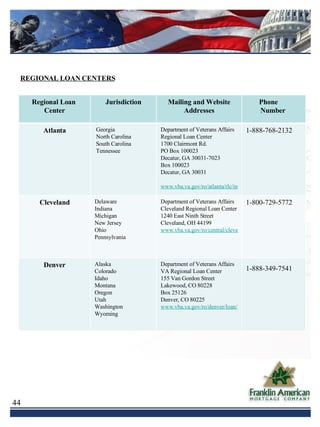

- 44. REGIONAL LOAN CENTERS Regional Loan Center Jurisdiction Mailing and Website Addresses Phone Number Atlanta Georgia North Carolina South Carolina Tennessee Department of Veterans Affairs Regional Loan Center 1700 Clairmont Rd. PO Box 100023 Decatur, GA 30031-7023 Box 100023 Decatur, GA 30031 www.vba.va.gov/ro/atlanta/rlc/index.htm 1-888-768-2132 Cleveland Delaware Indiana Michigan New Jersey Ohio Pennsylvania Department of Veterans Affairs Cleveland Regional Loan Center 1240 East Ninth Street Cleveland, OH 44199 www.vba.va.gov/ro/central/cleve/index1.htm 1-800-729-5772 Denver Alaska Colorado Idaho Montana Oregon Utah Washington Wyoming Department of Veterans Affairs VA Regional Loan Center 155 Van Gordon Street Lakewood, CO 80228 Box 25126 Denver, CO 80225 www.vba.va.gov/ro/denver/loan/lgy.htm 1-888-349-7541

- 45. REGIONAL LOAN CENTERS Regional Loan Center Jurisdiction Mailing and Website Addresses Phone Number Honolulu Hawaii Guam American Samoa Commonwealth of the Northern Marianas Department of Veterans Affairs VA Regional Office Loan Guaranty Division (26) 459 Patterson Road Honolulu, HI 96819 * Although not an RLC, this office is a fully functioning Loan Guaranty operation for Hawaii. 1-808-433-0481 Houston Arkansas Louisiana Oklahoma Texas Department of Veterans Affairs VA Regional Loan Center 6900 Almeda Road Houston, TX 77030-4200 www.vba.va.gov/ro/central/houston/lgy/home.html 1-888-232-2571 Manchester Connecticut Massachusetts Maine New Hampshire New York Rhode Island Vermont Department of Veterans Affairs VA Regional Loan Center 275 Chestnut Street Manchester, NH 03101 www.vba.va.gov/ro/manchester/lgymain/loans.html 1-800-827-6311 1-800-827-0336

- 46. REGIONAL LOAN CENTERS 1-800-933-5499 Department of Veterans Affairs VA Regional Loan Center 210 Franklin Road, SW Roanoke, VA 24011 http://www.vba.va.gov/ro/roanoke/rlc District of Columbia Kentucky Maryland Virginia West Virginia Roanoke Regional Loan Center Jurisdiction Mailing and Website Addresses Phone Number Phoenix Arizona California New Mexico Nevada Department of Veterans Affairs VA Regional Loan Center 3333 N. Central Avenue Phoenix, AZ 85012-2402 http://www.vba.va.gov/ro/phoenixlgy 1-888-869-0194 St. Paul Illinois Iowa Kansas Minnesota Missouri Nebraska North Dakota South Dakota Wisconsin Department of Veterans Affairs VA Regional Loan Center 1 Federal Drive Fort Snelling St. Paul, MN 55111-4050 http://www.vba.va.gov/ro/central/stpau/pages/homeloans.html 1-800-827-0611 St. Petersburg Alabama Florida Mississippi Puerto Rico U.S. Virgin Islands Department of Veterans Affairs VA Regional Loan Center 9500 Bay Pines Road St. Petersburg, FL 33708 PO Box 1437 St. Petersburg, FL 33731-1437 http://www.vba.va.gov/ro/south/spete/rlc/index.htm 1-888-611-5916 (out of state) 1-800-827-1000 (in FL)

- 47. USEFUL VA WEBSITES Veterans Information Portal https://vip.vba.va.gov/portal/userprofiling/login.jsp INCLUDING: webLGY (Certificate of Eligibility Online) TAS (The Appraisal System) e-Appraisal Circulars / News http://www.homeloans.va.gov/new.htm Condos, PUDS, Builder IDs http://condopudbuilder.vba.va.gov/2.2/frames.html Construction & Valuation http://www.homeloans.va.gov/cav.htm Forms http://www.va.gov/vaforms/ Frequently Asked Questions http://www.homeloans.va.gov/lgyfaq.htm Handbook http://www.warms.vba.va.gov/pam26_7.html IRRRL Worksheet (fillable) http://www.vba.va.gov/pubs/forms/26-8923fill.pdf Lenders Homepage http://www.homeloans.va.gov/ls.htm Loan Guaranty Homepage http://www.homeloans.va.gov/ Local Requirements http://www.homeloans.va.gov/cav_approved_local_conditions.htm Military Pay Charts http://www.dod.mil/dfas/militarypay/2006militarypaytables.html Regional Loan Centers http://www.homeloans.va.gov/RLCWEB.htm Training Homepage http://www.homeloans.va.gov/train.htm

![CERTIFICATE OF ELIGIBILITY (COE) (cont’d) 3. Requesting Restoration (Updated Certificate of Eligibility) Have the veteran fully complete, sign and date VA Form 26-1880, “Request for a Certificate of Eligibility” . Include evidence of payment in full of any prior loans (HUD-1 settlement statement). Include any previous COE’s. Mail documents to the VA eligibility center (address below). 4. Concurrent Restoration and Guaranty (“Back-to-Back” Closings) When a veteran is selling their current home and purchasing a new home within a short period of time (10 business days)*, the following information may be submitted in lieu of mailing a request for restoration to the VA eligibility center: Evidence of the presently-used entitlement, showing VA loan number of the property being sold (original paper COE, or automated COE from the WebLGY system). VA Form 26-1880, “Request for a Certificate of Eligibility” , fully completed and containing veteran’s original signature . Copy of HUD-1 on sale of existing property. * Must close on new home within 10 business days of sale of existing home 5. Requesting a Certificate of Eligibility for an IRRRL using VA’s WebGIL System Log on to the VA Information Portal at https://vip.vba.va.gov/portal/userprofiling/login.jsp . Select “User Registration” if your company does not already have a User ID and password. After signing on, select the “webGIL” link under “Applications”. Under “All Users” select “Search LIN”. Complete the required information and submit. If the LIN Search returns information showing the active loan to be refinanced, print the output and use in lieu of a COE. VA ELIGIBILITY CENTER As of January 1, 2006, the Winston-Salem Eligibility Center became the sole center for processing hard-copy COE requests. The center is experiencing serious backlogs. It may take 3 to 4 weeks to receive a hard-copy COE, therefore, brokers should obtain an electronic COE (as detailed on the previous page) whenever possible. Winston-Salem VA Eligibility Center Mail Service Courier Service Department of Veteran Affairs Department of Veteran Affairs Eligibility Center Eligibility Center PO Box 20729 251 N. Main St. Winston-Salem, NC 27120 Winston-Salem, NC 27155 Telephone: 888-244-6711 - Toll Free E-Mail: [email_address]](https://image.slidesharecdn.com/vatraining-1226605683777708-9/85/Vatraining-9-320.jpg)