What's new with EU Energy 4th Package?

- 1. After the World CupAfter the World Cup What’s new with EU energyWhat’s new with EU energy 44thth Package?Package? Dublin, IIEA, 16Dublin, IIEA, 16thth July 2018July 2018 Jean-Michel GlachantJean-Michel Glachant Director Florence School of Regulation European University Institute (Florence, Italy)

- 2. EU I know, You know 2

- 3. Overview • 1/ What’s a Package in the EU? • 2/ What did first 3 Packages bring to EU? 1996-2009 • 3/ What’s new since 3d EU Package, ~10 years ago ? • 4/ What did lead to 4th Package? Juncker Commission’s “Energy Union” • 5/ The two parts of the 4th Package: *the markets **the policies 3

- 4. 1/ What’s a Package in the EU? (slides 5-6)

- 5. What’s a Package? 5 It is... a Package... •1.1 It packs various areas… as: Gas & Elec; Renewables & Energy Efficiency •1.2 It packs different types of EU laws... Directives: EU Targets, becoming national rules AFTER being transposed into each country legal frame (Ex: Creation of TSOs & Unbundling) Regulations: EU rules, becoming immediatly applicable in each country, without any ‘’national Transposition’’ (Ex: EU TSOs ‘’Ten Year Network Development Plan’’; EU Generation Adequacy Assessment)

- 6. What’s a Package? 6 •1.3 Are different types of EU law implemented the same?… Impossible: EU Laws being transposed > become national laws; implemented by national administrations, special entities (as TSOs & NRAs), players (as companies & consumers). Plus National Decrees of application. EU Laws being not transposed > are ‘only’ EU Laws; having NO EU administrations, NO EU entities (as TSOs & NRAs), NO EU players (as companies & consumers). They have to be implemented by same 28 national frames like ‘’national laws’’. NO European decrees of application. Asymetry of implementation… or… …’’European Regulatory Gap’’…

- 7. 2/ What did first 3 Packages bring to EU? 1996-2009 (slides 8-12)

- 8. Grid Level: Member States or EU? 1996 1st Package: negociated or regulated at MS level 2003 2nd Package: Regulator at MS level + EU crossborder 2009 3d Package: Indep Regulator at MS + EU EN.TSO & ACER + Grid Codes & Ten Year Development Plans & Gen. Adequacy Grid Channel: Regulator or Compet. Authority? 2007 Sector Enquiry + “smoking guns” policy by DG COMP °Eon, RWE disinvest from grids °2009 Swedish TSO reviews congestion management scheme (priority national vis à vis Foreigners)> more bidding zones EU frame building 8

- 9. EU frame building Market Level: Member States or EU? 2003 2nd Package: open at MS level + EU crossborder ‘fair’ rules 2009 3d Package: more EU EN.TSO + ACER + Codes (Congestion; Capacity allocation; Balancing energy ) + Regional Initiatives + ‘Market Target Model’ being market coupling with open balancing Market Channel: Energy Reg. or Compet. Authority? °2005 EU Court suppress LT priority access to elec interco °Basic market rules: free Merchant PX vs reg. Market Coupling °Loose market monitoring from financial regulation capped by REMIT 2010 specific energy monitoring (ACER+ NRAs) 9

- 10. Energy Mix Level: Member States or EU? °In EU “Energy Mix” sovereign right of Member States (See Nuclear – prohibited in Austria / 80% in France; coal in Germany vs UK) °big caveat: RES directives + EU ETS as “voluntarily” constraints for MS’s Energy Mix Energy Mix Channel: Energy Regulator or Compet. Authority? ° EU Court ruling: RES support “Environmental Public Policy” not market- based BUT support to be notified to DG COMP as “State Aid” (14 Billion in 2010) > DG Comp Guidelines 2014 °Support Schemes (Gov. MS) + Dispatch priority (Ener. Reg) °Regulators involved (Connections; Congestion; Balancing; TSO planning & incentives; Distribution grid regulation) EU frame building 10

- 11. Grids: EU vs US °much more EU rules; but still enforced by MS regulators (no federal regulator FERC) °grid regulation entirely submitted to “market opening”; but still state operated (no regional RTOs - ISOs) °EU mutualisation TSOs&Regulators: EN.TSOs &ACER since 3d Package but NO RTO/FERC proxies °Independence DG COMP vis-à-vis Energy regulators & TSOs Markets: EU vs US °EU general Target Model + °Regional Initiatives + °ACER + °EN.TSOs + °REMIT: larger frame in the EU; but less depth & strengh EU frame vs US 11

- 12. Energy Mix: EU vs US °EU RES scheme + °EU ETS = more comprehensive scheme in EU Institutions: EU vs US °Strong US energy federal regulator in a smaller area; °No role for US Competition opposite to DG COMP; °US State regulators independent from federal as opposite to EU “ruling” MS regulators; °Strong US Environmental federal Regulator vs EU stronger directives >> US implementation stronger but Scope smaller (except for Competition; embedded into US FERC or PUCs) EU frame vs US 12

- 13. 3/ What’s new since 3d EU Package ~10 years ago ? (slides 14-26)

- 14. 3d Package key novelties • 1- The Third Package creates EU Bodies >mutualisation of NRAs at EU level (ACER) >mutualisation of TSOs at EU level (ENTSOs) • 2- The Third Package gives legal duties to these EU Bodies >ACER managing cross-border conflicts between NRAs; issuing Framework Guidelines for ENTSOs codes rules & methodologies >ENTSOs TenYearsNDPlan; Generation Adequacy; Network Codes rules & methodologies 14

- 15. 3d Package key novelties • 3- The Third Package gives Commission power in process of Codes & Guidelines proposals >EU will have a common set of European market & network rules IF: 1-ACER defines Framework Guidelines 2-ENTSOs define Codes or Guidelines (i.e plus further metholdologies) 3- ACER agrees ENTSOs compliant Framework Guidelines 4-Commission agrees with results, proposes to Council (Member States) experts to vote (‘’Comitology’’) And 5-Parliament does not veto IF all of this works > Network Codes become “Commission Regulation” What you & me can call a proper “European regulation” > detailed rules mandatory in all EU, with no transposition by countries 15

- 16. 3d Package key novelties • 4- This Third Package ‘’EU Market & Network Codes & Guidelines’’: implemented; by whom? >NO big novelties under the sun: ¤ The National regulators (NRAs) and ¤ The National TSOs still have the de facto monopoly of implementation of the new EU regulation (NO EU regulator; no EU or regional TSO) > ¤ + New small brother: NEMOS – ‘Nominated Electricity Markets Operators’ (from ComReg2015) to perform Market Coupling (Day Ahead or Intraday) 16

- 17. Network Codes (Table from 2015) 17

- 18. Requirements for Generators Comitology Process (entered 2013) • Size-dependent, technical requirements for Power Generating Modules • Common framework of obligations for Network Operators to appropriately make use of the Power Generating Facilities’ capabilities Demand Connection Comitology Process (entered 2014) • European rules on how demand interacts with the transmission system • Ensure effective contribution to the stability of the power system by all distribution networks and demand facilities • Clarify the role that demand response will play in contributing to the deployment of RES HVDC Connection ACER recommendation submitted (2014) Manage HVDC lines and connections: •Determine contribution to system security •Promote coordinated development of the infrastructure Operational Security ACER recommendation submitted (2013) Framework for maintaining a secure interconnected European electricity transmission system: common, legally binding principles and rules for operating electricity transmission networks Operational Security requirements and principles; Data exchange; provisions for training of System Operator Employees Network Codes (Content Overview 2015) 18

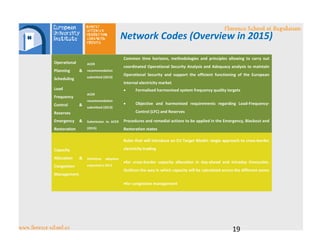

- 19. Network Codes (Overview in 2015) Operational Planning & Scheduling ACER recommendation submitted (2013) Common time horizons, methodologies and principles allowing to carry out coordinated Operational Security Analysis and Adequacy analysis to maintain Operational Security and support the efficient functioning of the European internal electricity market Load Frequency Control & Reserves ACER recommendation submitted (2013) • Formalised harmonised system frequency quality targets • Objective and harmonised requirements regarding Load-Frequency- Control (LFC) and Reserves Emergency & Restoration Submission to ACER (2015) Procedures and remedial actions to be applied in the Emergency, Blackout and Restoration states Capacity Allocation & Congestion Management Definitive adoption expected in 2015 Rules that will introduce an EU Target Model: single approach to cross-border electricity trading •for cross-border capacity allocation in day-ahead and intraday timescales. Outlines the way in which capacity will be calculated across the different zones •for congestion management 19

- 20. Network Codes (Overview in 2015) Forward Capacity Allocation ACER recommendation submitted (2014) Design and operation of the markets in which the right to use cross-border capacity is sold in advance Electricity Balancing Resubmission to ACER (2014) Steps for transforming balancing markets to a set of regional markets and later a pan-European market 20

- 21. EU regulatory framework "REGULATION" SECONDARY LEGISLATION PRIMARY LEGISLATION Treaty (Art. 194) Decisions Regulation (EC) 714/2009 Guidelines Network Codes Directive 2009/72/EC 21

- 22. More on Network Codes >Network “Codes” [Connection] 3 Codes >>Network “Guidelines” [Market] 3 Guidelines > with Methodologies to be added (special process for methodologies; can be regional, pan-EU; stakeholder consultation + NRAs approval with ACER if not). Difficulty but flexibility [Operation] both: 1 Code: Emergency & Restoration 1 GL: System Operation with Regional Security Coordinators (5 mandatory tasks as security assessment; capacity calculation; links with 10 Capacity Calculation Regions ] 22

- 23. More on Market GL Day Ahead & Intraday Markets {CACM GL July 2015} >[Nemos] Nominated Electricity Market Operators to perform Market Coupling; can be a private company or a public entity >[Day Ahead] 2 side blind auction; temporal (def. products) & spatial granularity (bidding zones); min & max prices >[Intra Day] continuous trading; regional auctions if approved NRAs; Gate Closure at least 1h >[Remedial Actions] within Bidding Zones? Between Bidding Zones? Preventive or Curative? What Price? >[LongTerm] Grid investment: within zone? Between Zones? Or Zones review? 23

- 24. More on Market GL Balancing Market {EB GL Nov 2017} >[Reserves] SO GL defines 4 reserves (FCR / aFFR, mFFR / RR); also defines reserves sizing >[Bid Format] duration of Bal. offer; upward / downward joint or separated; minimum bid volume; pay-as-bid or marginal price (EB GL) but FFR & RR cannot be regulated price Standard products; but specific if… Gate Closure should be harmonized >[Reactive vs Proactive EB] Reactive: Belgium, German, Austria, in real time (relying on BRPs); Proactive: France, UK, Nordics before RT, according to forecast (less incentives to BRPs) – both SO GL & EB GL neutral 24

- 25. EU Gaps by J. Vasconcelos (April 2017) > From our FSR research report Spring 2017 ‘First-order gap: Lack of Coordination’ • 1- Lack of comprehensive coordination of system planning, further to the TYNDP • 2- Lack of comprehensive coordination of cross-border investments • 3- Lack of comprehensive coordination of system operation • 4- Lack of a common redispatching approach • 5- Lack of common reserve contracting and cost allocation • 6- Lack of intraday cross-border allocation with auction • 7- Lack of load shedding coordination • 8- Lack of comprehensive coordination for solidarity 25

- 26. ‘Second-order gap: Lack of Harmonisation’ • 9- No harmonisation of common congestion rent allocation scheme •10- No harmonisation of capacity remuneration mechanisms •11- No harmonisation of transmission tariffs across countries and TSO zones •12- No harmonisation of ‘state aid’ to big energy consumers (through reduced network tariffs) (From) “Fig. XX The EU regulatory roadblocks” Florence School research report (April 2017) 26 EU Gaps by J. Vasconcelos (April 2017)

- 27. 4/ What did push for EU 4th Package: Juncker Commission’s “Energy Union” (slides 28-29)

- 29. Energy Union is / isn’t… •Is’nt new Institution for EU energy policy: NO institution created •is political “novelty” Commission Juncker deal made with new Council Pdt Donald Tusk (Former PM Poland) & backed by Chairman Parliament Industry & Energy Committee Jerzy Buzek (Former PM Poland, former Pdt EU Parliament) •~ Content unveiled 25th Feb. 2015 Hardly foreseen @Barroso Commission (2013-14) // EnerUnion = about 25 proposals of action •~ in touch with EU Council March 2015 EU Council (Heads of State & Gov.) agreed EC go ahead with EnerUnion •~ nevertheless a gamble No institution created: Council of ministers &Parliament have to agree each legislative proposal… •February 2015 Ener.Union Manifesto don’t strictly tie anybody: even Commission can change having seen what blocks / what goes 29

- 30. 5/ The two parts of the 4th Package: *the markets ** the policies (slide 31-45)

- 31. In practice: “EU 4th Package” is a pack… of packages Market Design Pack is made of four proposals: 1- Directive for Internal Market (Retail & Consumers) 2- Regulation for Wholesale Market 3- Regulation for ACER 4- Regulation for electricity risk preparedness 1 Directive & 3 Regulations Energy Policy Pack has four proposals too: 1- Renewables Energy Package incl. Bioenergy (Directive) > Target RES 2- Energy Union Governance (Regulation) 3- Energy Efficiency (Directive) Performance Buildings (Directive)> Target EE 4- ETS revision 2021-2030 (Directive) > Target GHG Emissions 4 Directives & 1 Regulation 31

- 32. More on Market Design proposals Market Pack is made of 1 Directive & 3 Regulations 1- Directive for Internal Market (Retail & Consumers) 2- Regulation for Wholesale Market 3- Regulation for ACER 4- Regulation for electricity risk preparedness 32

- 33. More on Market Proposals >[Technologies level-playing field] End of ‘must-run’ & ‘dispatch priority’; balancing responsibility for all; entry for ‘demand response’ >[More on short horizon] markets closer to real time; harmonization of balancing reserves & larger balancing zones >[LT Capacity Markets] framed by EU-Wide or regional ENTSO-e assessment; coordinated among neighbors; with harmonised X-B cooperation >[Crisis Preparation] National & Regional plans for elec. Crisis; Crisis scenarios defined by Regional Centers ROCs >[old Retail] Phase out retail price regulation; EU definition of energy poverty >[new Retail] Role for aggregators; right to dynamic pricing; to demand response; to self-generation & self-consumption; + legal framework for Energy Communities; 33

- 34. More on Grids & Acer Proposals >[DSOs] new roles for DSOs as hosting key generation resources & demand response >[TSOs] °New entity for Tr.S.op: the ROCS; °Harmonisation of tariff methodology & rent congestion use >>[ACER] °Final role (before Commission) vis-à-vis ENTSO for Network Codes & Guidelines °Say on regionalisation of NRAs decisions °Coordination of ROCs °Supervision of NEMOs °°°BUT NRAs keep full control of ACER decisions (voting rules among NRAs can change) 34

- 35. But ONLY proposals from Commission 1- Commission has no majority at Parliament, at Council; even within Commissionners.. All to come from deals & opportunity 2- However PPE is strong: Juncker, Spizenkandidat (Head of list), Canete Commissioner, Tusk Pdt Council, Tajani Pdt Parliament, J. Buzek (former Pdt) current Ind Comm + Secretary-General Commission Martin Selmayr 3- At Parliament (Coalition parties: PPE – ALDE- SD – Greens) do common deals avoiding votes in plenary >> Common Position Parliament 4- Similar deals at higher EU level After first vote (Parliament – Council); if both in opposition It goes to ‘’Trilogue’’: a tripartite Deal (Commission – Council – Parliament) 35

- 36. More on the Four Energy Policy Blocks 1- Renewables Energy Package incl. Bioenergy (Directive) -14th June 2018 Target 2030 RES 32% (Revision 2023) 2- Energy Union Governance (Regulation) – 20th June National E&C Plans 2021-2030 –5D - Comments EC 3- Performance Buildings (Directive) – 14th May Energy Efficiency (Directive) – 18th June Target 2030 EE 32.5% (revision 2023) 4- ETS revision 2021-2030 (Directive) 2021-30 with annual reduction -28 Feb Target 2030 GHG Emissions 40% [Covered 43% - non covered 30%] (21 June: ~45%) 4 Directives & 1 Regulation 36

- 37. Tweet Commissioner Canete, 14th June 37

- 38. 38 At what time? 14th June - 3.38 am…

- 39. Whom shaking hands to whom? • Jerzy Buzek (Chairman Industry & Energy EU Parliament; PPE; Poland) > Bulgarian Presidency (of the Council) • Miguel Canete (Commissioner; PPE; Spain) > Claude Turmes (Green; Parliament) 39

- 40. 40

- 41. Whom made the deal possible? • Pepe Blanco S-D Spanish • Bas Eickhout Green Belgian • Federley ALDE Danish • Sean Kelley PPE Irish • Tamburrano 5 Star italian 41

- 42. What’s in the deal? • 32% RES at EU level At country level? • Right to self-consume RES What trade rules? What grid access & tariff rules? • Ban on palm oil Whom to pay for? 42

- 43. 43 13th June: no deal Energy Efficiency

- 44. Five general conclusions 1# Union Governance EU has 32% RES target; but no ‘burden sharing’ among Member States… 2# Regionalization of TSOs tasks How to get a really ‘European’ market if each TSO does what if wants with ‘remedial actions’ within its borders, & for ‘borders capacity’ investments? 3# DSOs Europeanization How to get a really ‘European’ market if most generation investments are at DSO level, but the thousands of DSOs free to define connection rules, tariffs, congestion management, etc.? 44

- 45. Four conclusions as questions 4# ACER governance What to do if national regulators (NRAs), national TSOs, & DSOs do not agree on same rules or same implementation of rules? 5# Regionalization for ‘’More Advanced Market Digitalization’’ (more realistic to go ahead? Closer reality; higher willigness) But: which ‘regulatory oversight’? What regional regulatory decision making & monitoring? 45

- 46. How to conclude? #I don’t know! # To be seen in 2020-22… 46

- 47. www.florence-school.eu 47 Thank you for your attention Email contact: jean-michel.glachant@eui.eu Follow me on Twitter: @JMGlachant already 42 000+ tweets My web site: http://www.florence-school.eu

![More on Network Codes

>Network “Codes”

[Connection] 3 Codes

>>Network “Guidelines”

[Market] 3 Guidelines > with Methodologies to be added (special process for

methodologies; can be regional, pan-EU; stakeholder consultation + NRAs

approval with ACER if not). Difficulty but flexibility

[Operation] both:

1 Code: Emergency & Restoration

1 GL: System Operation with Regional Security Coordinators

(5 mandatory tasks as security assessment; capacity calculation; links with 10

Capacity Calculation Regions ]

22](https://image.slidesharecdn.com/dublinglachantiiea16july2018-180717091817/85/What-s-new-with-EU-Energy-4th-Package-22-320.jpg)

![More on Market GL

Day Ahead & Intraday Markets {CACM GL July 2015}

>[Nemos] Nominated Electricity Market Operators to perform Market

Coupling; can be a private company or a public entity

>[Day Ahead] 2 side blind auction; temporal (def. products) & spatial

granularity (bidding zones); min & max prices

>[Intra Day] continuous trading; regional auctions if approved NRAs; Gate

Closure at least 1h

>[Remedial Actions] within Bidding Zones? Between Bidding Zones?

Preventive or Curative? What Price?

>[LongTerm] Grid investment: within zone? Between Zones? Or Zones

review?

23](https://image.slidesharecdn.com/dublinglachantiiea16july2018-180717091817/85/What-s-new-with-EU-Energy-4th-Package-23-320.jpg)

![More on Market GL

Balancing Market {EB GL Nov 2017}

>[Reserves] SO GL defines 4 reserves (FCR / aFFR, mFFR / RR); also defines

reserves sizing

>[Bid Format] duration of Bal. offer; upward / downward joint or separated;

minimum bid volume;

pay-as-bid or marginal price (EB GL) but FFR & RR cannot be regulated price

Standard products; but specific if…

Gate Closure should be harmonized

>[Reactive vs Proactive EB] Reactive: Belgium, German, Austria, in real time

(relying on BRPs); Proactive: France, UK, Nordics before RT, according to

forecast (less incentives to BRPs) – both SO GL & EB GL neutral

24](https://image.slidesharecdn.com/dublinglachantiiea16july2018-180717091817/85/What-s-new-with-EU-Energy-4th-Package-24-320.jpg)

![More on Market Proposals

>[Technologies level-playing field] End of ‘must-run’ & ‘dispatch priority’;

balancing responsibility for all; entry for ‘demand response’

>[More on short horizon] markets closer to real time; harmonization of

balancing reserves & larger balancing zones

>[LT Capacity Markets] framed by EU-Wide or regional ENTSO-e assessment;

coordinated among neighbors; with harmonised X-B cooperation

>[Crisis Preparation] National & Regional plans for elec. Crisis; Crisis

scenarios defined by Regional Centers ROCs

>[old Retail] Phase out retail price regulation; EU definition of energy poverty

>[new Retail] Role for aggregators; right to dynamic pricing; to demand

response; to self-generation & self-consumption; + legal framework for

Energy Communities;

33](https://image.slidesharecdn.com/dublinglachantiiea16july2018-180717091817/85/What-s-new-with-EU-Energy-4th-Package-33-320.jpg)

![More on Grids & Acer Proposals

>[DSOs]

new roles for DSOs as hosting key generation resources & demand response

>[TSOs]

°New entity for Tr.S.op: the ROCS;

°Harmonisation of tariff methodology & rent congestion use

>>[ACER]

°Final role (before Commission) vis-à-vis ENTSO for Network Codes &

Guidelines

°Say on regionalisation of NRAs decisions

°Coordination of ROCs

°Supervision of NEMOs

°°°BUT NRAs keep full control of ACER decisions (voting rules among NRAs

can change)

34](https://image.slidesharecdn.com/dublinglachantiiea16july2018-180717091817/85/What-s-new-with-EU-Energy-4th-Package-34-320.jpg)

![More on the Four Energy Policy Blocks

1- Renewables Energy Package incl. Bioenergy (Directive) -14th June 2018

Target 2030 RES 32% (Revision 2023)

2- Energy Union Governance (Regulation) – 20th June

National E&C Plans 2021-2030 –5D - Comments EC

3- Performance Buildings (Directive) – 14th May

Energy Efficiency (Directive) – 18th June

Target 2030 EE 32.5% (revision 2023)

4- ETS revision 2021-2030 (Directive) 2021-30 with annual reduction -28 Feb

Target 2030 GHG Emissions 40% [Covered 43% - non covered 30%]

(21 June: ~45%)

4 Directives & 1 Regulation

36](https://image.slidesharecdn.com/dublinglachantiiea16july2018-180717091817/85/What-s-new-with-EU-Energy-4th-Package-36-320.jpg)