yehisb kne16.doc

- 1. CHAPTER 18 REVENUE RECOGNITION IFRS questions are available at the end of this chapter. TRUE-FALSE—Conceptual Answer No. Description F 1. Recognition of revenue. T 2. Realization of revenue. T 3. Delayed recognition of revenue. F 4. Recognizing revenue when right of return exists. T 5. Recognizing revenue prior to product completion. F 6. Use of percentage-of-completion method. T 7. Input measure for contract progress. T 8. Reporting Construction in Process and Billings on Construction in Process. F 9. Construction in Process account balance. F 10. Recognition of revenue under completed-contract method. T 11. Principal advantage of completed-contract method. F 12. Recognizing loss on an unprofitable contract. F 13. Recognizing current period loss on a profitable contract. T 14. Recognizing revenue under completion-of-production basis. F 15. Recording a loss on an unprofitable contract. F 16. Deferring revenue under installment-sales method. T 17. Deferring gross profit under installment-sales method. T 18. Classification of deferred gross profit. F 19. Recognizing revenue under cost-recovery method. T 20. Recognizing profit under cost-recovery method. MULTIPLE CHOICE—Conceptual Answer No. Description c 21. Revenue recognition principle. b 22. Definition of "realized." a 23. Definition of "earned." b S 24. Revenue recognition representations. d P 25. Definition of recognition. b P 26. Revenue recognition principle. d 27. Recognizing revenue at point of sale. d 28. Recording sales when right of return exists. c 29. Revenue recognition when right of return exists. d 30. Revenue recognition when right of return exists. b 31. Appropriate accounting method for long-term contracts. c 32. Percentage-of-completion method. b 33. Percentage-of-completion method. c 34. Classification of progress billings and construction in process. b 35. Calculation of gross profit using percentage-of-completion. a 36. Disclosure of earned but unbilled revenues. b 37. Disadvantage of using percentage-of-completion. d S 38. Percentage-of-completion input measures.

- 2. Test Bank for Intermediate Accounting, Thirteenth Edition 18 - 2 MULTIPLE CHOICE—Conceptual (cont.) Answer No. Description a S 39. Advantage of completed-contract method c 40. Revenue, cost, and gross profit under the completed-contract method. a 41. Loss recognition on a long-term contract. c 42. Accounting for long-term contract losses. d 43. Criteria for revenue recognition of completion of production. a 44. Completion-of-production basis. d S 45. Revenue recognition of completion of production. b S 46. Treatment of estimated contract cost increase. c 47. Presentation of deferred gross profit. c 48. Appropriate use of the installment-sales method. b 49. Valuing repossessed assets. b 50. Gross profit deferred under the installment-sales method. c S 51. Income realization on installment sales. d P 52. Conservative revenue recognition method. b 53. Income recognition under the cost-recovery method. b 54. Income recognition under the cost-recovery method. d 55. Cost recovery basis of revenue recognition. b 56. Deposit method of revenue recognition. d 57. Cost recovery method. b *58. Types of franchising arrangements. d *59. Accounting for consignment sales. d *60. Allocation of initial franchise fee. a *61. Recognition of continuing franchise fees. b *62. Future bargain purchase option. a *63. Option to purchase franchisee's business agreement. d *64. Revenue recognition by the consignor. P These questions also appear in the Problem-Solving Survival Guide. S These questions also appear in the Study Guide. *This topic is dealt with in an Appendix to the chapter. MULTIPLE CHOICE—Computational Answer No. Description c 65. Computation of total revenue and accounts receivable. d 66. Computation of total construction expenses. b 67. Computation of costs and profits in excess of billings balance. c 68. Computation of total revenue and construction expenses. b 69. Gross profit recognized under percentage-of-completion. c 70. Computation of construction in process amount. c 71. Percentage-of-completion method. c 72. Percentage-of-completion method. b 73. Determine cash collected on long-term construction contract. d 74. Determine gross profit using percentage-of-completion. c 75. Gross profit to be recognized using percentage-of-completion. b 76. Gross profit to be recognized using percentage-of-completion. c 77. Profit to be recognized using completed-contract method. a 78. Gross profit to be recognized using percentage-of-completion.

- 3. Revenue Recognition 18 - 3 MULTIPLE CHOICE—Computational (cont.) Answer No. Description b 79. Profit to be recognized using completed-contract method. a 80. Gross profit to be recognized using percentage-of-completion. c 81. Gross profit to be recognized using completed-contract method. b 82. Computation of construction costs incurred. c 83. Gross profit recognized under percentage-of-completion. a 84. Computation of construction in process amount. b 85. Loss recognized using completed-contract method. c 86. Revenue recognition using completed-contract method. c 87. Reporting a current liability with completed-contract-method. a 88. Reporting inventory under completed-contract method. d 89. Gain recognized on repossession—installment sale. b 90. Calculate loss on repossessed merchandise. a 91. Calculate loss on repossessed merchandise. b 92. Interest recognized on installment sales. b 93. Calculation of deferred gross profit amount. b 94. Computation of realized gross profit amount. d 95. Computation of loss on repossession. d 96. Calculation of gross profit rate. a 97. Computation of net income from installment sales. d 98. Computation of realized and deferred gross profit. a 99. Calculation of gross profit rate. d 100. Computation of net income from installment sales. a 101. Computation of realized and deferred gross profit. c 102. Computation of realized gross profit amount. b 103. Computation of realized gross profit-cost recovery method. a 104. Revenue recognized under the cost-recovery method. d *105. Cancellation of franchise agreement. c *106. Accounting for initial and annual continuing franchise fees. b *107. Franchise fee with a bargain purchase option. d *108. Sales on consignment. a *109. Reporting inventory on consignment. MULTIPLE CHOICE—CPA Adapted Answer No. Description a 110. FASB's definition of "recognition." b 111. Determine contract costs incurred during year. d 112. Gross profit to be recognized using percentage-of-completion. d 113. Profit to be recognized using completed-contract method. c 114. Revenue recognized under completed-production method. b 115. Determine balance of installment accounts receivable. c 116. Calculate deferred gross profit—installment sales. c 117. Calculate deferred gross profit—installment sales. c 118. Balance of deferred gross profit—installment sales. c 119. Reporting deferred gross profit—installment sales. a 120. Effect of collections received on service contracts.

- 4. Test Bank for Intermediate Accounting, Thirteenth Edition 18 - 4 EXERCISES Item Description E18-121 Revenue recognition (essay). E18-122 Revenue recognition (essay). E18-123 Long-term contracts (essay). E18-124 Journal entries—percentage-of-completion. E18-125 Percentage-of-completion method. E18-126 Percentage-of-completion method. E18-127 Percentage-of-completion and completed-contract methods. E18-128 Installment sales. E18-129 Installment sales. E18-130 Installment sales. *E18-131 Franchises. PROBLEMS Item Description P18-132 Long-term construction project accounting. P18-133 Accounting for long-term construction contracts. P18-134 Long-term contract accounting—completed-contract. P18-135 Installment sales. CHAPTER LEARNING OBJECTIVES 1. Apply the revenue recognition principle. 2. Describe accounting issues for revenue recognition at point of sale. 3. Apply the percentage-of-completion method for long-term contracts. 4. Apply the completed-contract method for long-term contracts. 5. Identify the proper accounting for losses on long-term contracts. 6. Describe the installment-sales method of accounting. 7. Explain the cost-recovery method of accounting. *8. Explain revenue recognition for franchises and consignment sales.

- 5. Revenue Recognition 18 - 5 SUMMARY OF LEARNING OBJECTIVES BY QUESTIONS Item Type Item Type Item Type Item Type Item Type Item Type Item Type Learning Objective 1 1. TF 3. TF 22. MC S 24. MC P 26. MC 121. E 2. TF 21. MC 23. MC P 25. MC 110. MC 122. E Learning Objective 2 4. TF 6. TF 28. MC 30. MC 5. TF 27. MC 29. MC 122. E Learning Objective 3 7. TF 34. MC 66. MC 72. MC 80. MC 123. E 133. P 8. TF 35. MC 67. MC 73. MC 82. MC 124. E 9. TF 36. MC 68. MC 74. MC 83. MC 125. E 31. MC 37. MC 69. MC 75. MC 84. MC 126. E 32. MC S 38. MC 70. MC 76. MC 111. MC 127. E 33. MC 65. MC 71. MC 78. MC 112. MC 132. P Learning Objective 4 10. TF 40. MC 81. MC 87. MC 123. E 134. P 11. TF 77. MC 85. MC 88. MC 127. E S 39. MC 79. MC 86. MC 113. MC 133. P Learning Objective 5 12. TF 14. TF 41. MC 43. MC S 45. MC 114. MC 133. P 13. TF 15. TF 42. MC 44. MC S 46. MC 132. P Learning Objective 6 16. TF 49. MC 91. MC 96. MC 101. MC 118. MC 130. E 17. TF 50. MC 92. MC 97. MC 102. MC 119. MC 135. P 18. TF S 51. MC 93. MC 98. MC 115. MC 120. MC 47. MC 89. MC 94. MC 99. MC 116. MC 128. E 48. MC 90. MC 95. MC 100. MC 117. MC 129. E Learning Objective 7 19. TF P 52. MC 54. MC 56. MC 103. MC 20. TF 53. MC 55. MC 57. MC 104. MC Learning Objective 8* 58. MC 60. MC 62. MC 64. MC 106. MC 108. MC 131. E 59. MC 61. MC 63. MC 105. MC 107. MC 109. MC Note: TF = True-False MC = Multiple Choice E = Exercise P = Problem

- 6. Test Bank for Intermediate Accounting, Thirteenth Edition 18 - 6 TRUE-FALSE—Conceptual 1. Companies should recognize revenue when it is realized and when cash is received. 2. Revenues are realized when a company exchanges goods and services for cash or claims to cash. 3. Delayed recognition of revenue is appropriate if the sale does not represent substantial completion of the earnings process. 4. If a company sells its product but gives the buyer the right to return it, the company should not recognize revenue until the sale is collected. 5. Companies can recognize revenue prior to completion and delivery of the product under certain circumstances. 6. Companies must use the percentage-of-completion method when estimates of progress toward completion are reasonably dependable. 7. The most popular input measure used to determine the progress toward completion is the cost-to-cost basis. 8. If the difference between the Construction in Process and the Billings on Construction in Process account balances is a debit, the difference is reported as a current asset. 9. The Construction in Process account includes only construction costs under the percentage-of-completion method. 10. Under the completed-contract method, companies recognize revenue and costs only when the contract is completed. 11. The principal advantage of the completed-contract method is that reported revenue reflects final results rather than estimates. 12. Companies must recognize a loss on an unprofitable contract under the percentage-of- completion method but not the completed-contract method. 13. A loss in the current period on a profitable contract must be recognized under both the percentage-of-completion and completed-contract method. 14. Under the completion-of-production basis, companies recognize revenue when agricul- tural crops are harvested since the sales price is reasonably assured and no significant costs are involved in product distribution. 15. The provision for a loss on an unprofitable contract may be combined with the Construction in Process account balance under percentage-of-completion but not completed-contract. 16. Under the installment-sales method, companies defer revenue and income recognition until the period of cash collection.

- 7. Revenue Recognition 18 - 7 17. The installment-sales method defers only the gross profit instead of both the sales price and cost of goods sold. 18. Deferred gross profit is generally treated as an unearned revenue and classified as a current liability. 19. Under the cost-recovery method, a company recognizes no revenue or profit until cash payments by the buyer exceed the cost of the merchandise sold. 20. Companies recognize profit under the cost-recovery method only when cash collections exceed the total cost of the goods sold. True-False Answers—Conceptual Item Ans. Item Ans. Item Ans. Item Ans. 1. F 6. F 11. T 16. F 2. T 7. T 12. F 17. T 3. T 8. T 13. F 18. T 4. F 9. F 14. T 19. F 5. T 10. F 15. F 20. T MULTIPLE CHOICE—Conceptual 21. The revenue recognition principle provides that revenue is recognized when a. it is realized. b. it is realizable. c. it is realized or realizable and it is earned. d. none of these. 22. When goods or services are exchanged for cash or claims to cash (receivables), revenues are a. earned. b. realized. c. recognized. d. all of these. 23. When the entity has substantially accomplished what it must do to be entitled to the benefits represented by the revenues, revenues are a. earned. b. realized. c. recognized. d. all of these.

- 8. Test Bank for Intermediate Accounting, Thirteenth Edition 18 - 8 S 24. Which of the following is not an accurate representation concerning revenue recognition? a. Revenue from selling products is recognized at the date of sale, usually interpreted to mean the date of delivery to customers. b. Revenue from services rendered is recognized when cash is received or when services have been performed. c. Revenue from permitting others to use enterprise assets is recognized as time passes or as the assets are used. d. Revenue from disposing of assets other than products is recognized at the date of sale. P 25. The process of formally recording or incorporating an item in the financial statements of an entity is a. allocation. b. articulation. c. realization. d. recognition. P 26. Dot Point, Inc. is a retailer of washers and dryers and offers a three-year service contract on each appliance sold. Although Dot Point sells the appliances on an installment basis, all service contracts are cash sales at the time of purchase by the buyer. Collections received for service contracts should be recorded as a. service revenue. b. deferred service revenue. c. a reduction in installment accounts receivable. d. a direct addition to retained earnings. 27. Which of the following is not a reason why revenue is recognized at time of sale? a. Realization has occurred. b. The sale is the critical event. c. Title legally passes from seller to buyer. d. All of these are reasons to recognize revenue at time of sale. 28. An alternative available when the seller is exposed to continued risks of ownership through return of the product is a. recording the sale, and accounting for returns as they occur in future periods. b. not recording a sale until all return privileges have expired. c. recording the sale, but reducing sales by an estimate of future returns. d. all of these. 29. A sale should not be recognized as revenue by the seller at the time of sale if a. payment was made by check. b. the selling price is less than the normal selling price. c. the buyer has a right to return the product and the amount of future returns cannot be reasonably estimated. d. none of these.

- 9. Revenue Recognition 18 - 9 30. The FASB concluded that if a company sells its product but gives the buyer the right to return the product, revenue from the sales transaction shall be recognized at the time of sale only if all of six conditions have been met. Which of the following is not one of these six conditions? a. The amount of future returns can be reasonably estimated. b. The seller's price is substantially fixed or determinable at time of sale. c. The buyer's obligation to the seller would not be changed in the event of theft or damage of the product. d. The buyer is obligated to pay the seller upon resale of the product. 31. In selecting an accounting method for a newly contracted long-term construction project, the principal factor to be considered should be a. the terms of payment in the contract. b. the degree to which a reliable estimate of the costs to complete and extent of progress toward completion is practicable. c. the method commonly used by the contractor to account for other long-term construc- tion contracts. d. the inherent nature of the contractor's technical facilities used in construction. 32. The percentage-of-completion method must be used when certain conditions exist. Which of the following is not one of those necessary conditions? a. Estimates of progress toward completion, revenues, and costs are reasonably dependable. b. The contractor can be expected to perform the contractual obligation. c. The buyer can be expected to satisfy some of the obligations under the contract. d. The contract clearly specifies the enforceable rights of the parties, the consideration to be exchanged, and the manner and terms of settlement. 33. When work to be done and costs to be incurred on a long-term contract can be estimated dependably, which of the following methods of revenue recognition is preferable? a. Installment-sales method b. Percentage-of-completion method c. Completed-contract method d. None of these 34. How should the balances of progress billings and construction in process be shown at reporting dates prior to the completion of a long-term contract? a. Progress billings as deferred income, construction in progress as a deferred expense. b. Progress billings as income, construction in process as inventory. c. Net, as a current asset if debit balance, and current liability if credit balance. d. Net, as income from construction if credit balance, and loss from construction if debit balance. 35. In accounting for a long-term construction-type contract using the percentage-of- completion method, the gross profit recognized during the first year would be the estimated total gross profit from the contract, multiplied by the percentage of the costs incurred during the year to the a. total costs incurred to date. b. total estimated cost. c. unbilled portion of the contract price. d. total contract price.

- 10. Test Bank for Intermediate Accounting, Thirteenth Edition 18 - 10 36. How should earned but unbilled revenues at the balance sheet date on a long-term construction contract be disclosed if the percentage-of-completion method of revenue recognition is used? a. As construction in process in the current asset section of the balance sheet. b. As construction in process in the noncurrent asset section of the balance sheet. c. As a receivable in the noncurrent asset section of the balance sheet. d. In a note to the financial statements until the customer is formally billed for the portion of work completed. 37. The principal disadvantage of using the percentage-of-completion method of recognizing revenue from long-term contracts is that it a. is unacceptable for income tax purposes. b. gives results based upon estimates which may be subject to considerable uncertainty. c. is likely to assign a small amount of revenue to a period during which much revenue was actually earned. d. none of these. S 38. One of the more popular input measures used to determine the progress toward completion in the percentage-of-completion method is a. revenue-percentage basis. b. cost-percentage basis. c. progress completion basis. d. cost-to-cost basis. S 39. The principal advantage of the completed-contract method is that a. reported revenue is based on final results rather than estimates of unperformed work. b. it reflects current performance when the period of a contract extends into more than one accounting period. c. it is not necessary to recognize revenue at the point of sale. d. a greater amount of gross profit and net income is reported than is the case when the percentage-of-completion method is used. 40. Under the completed-contract method a. revenue, cost, and gross profit are recognized during the production cycle. b. revenue and cost are recognized during the production cycle, but gross profit recognition is deferred until the contract is completed. c. revenue, cost, and gross profit are recognized at the time the contract is completed. d. none of these. 41. Cost estimates on a long-term contract may indicate that a loss will result on completion of the entire contract. In this case, the entire expected loss should be a. recognized in the current period, regardless of whether the percentage-of-completion or completed-contract method is employed. b. recognized in the current period under the percentage-of-completion method, but the completed-contract method should defer recognition of the loss to the time when the contract is completed. c. recognized in the current period under the completed-contract method, but the percentage-of-completion method should defer the loss until the contract is completed. d. deferred and recognized when the contract is completed, regardless of whether the percentage-of-completion or completed-contract method is employed.

- 11. Revenue Recognition 18 - 11 42. Cost estimates at the end of the second year indicate a loss will result on completion of the entire contract. Which of the following statements is correct? a. Under the completed-contract method, the loss is not recognized until the year the construction is completed. b. Under the percentage-of-completion method, the gross profit recognized in the first year must not be changed. c. Under the completed-contract method, when the billings exceed the accumulated costs, the amount of the estimated loss is reported as a current liability. d. Under the completed-contract method, when the Construction in Process balance exceeds the billings, the estimated loss is added to the accumulated costs. 43. The criteria for recognition of revenue at the completion of production of precious metals and farm products include a. an established market with quoted prices. b. low additional costs of completion and selling. c. units are interchangeable. d. all of these. 44. In certain cases, revenue is recognized at the completion of production even though no sale has been made. Which of the following statements is not true? a. Examples involve precious metals or farm equipment. b. The products possess immediate marketability at quoted prices. c. No significant costs are involved in selling the product. d. All of these statements are true. S 45. For which of the following products is it appropriate to recognize revenue at the completion of production even though no sale has been made? a. Automobiles b. Large appliances c. Single family residential units d. Precious metals S 46. When there is a significant increase in the estimated total contract costs but the increase does not eliminate all profit on the contract, which of the following is correct? a. Under both the percentage-of-completion and the completed-contract methods, the estimated cost increase requires a current period adjustment of excess gross profit recognized on the project in prior periods. b. Under the percentage-of-completion method only, the estimated cost increase requires a current period adjustment of excess gross profit recognized on the project in prior periods. c. Under the completed-contract method only, the estimated cost increase requires a current period adjustment of excess gross profit recognized on the project in prior periods. d. No current period adjustment is required. 47. Deferred gross profit on installment sales is generally treated as a(n) a. deduction from installment accounts receivable. b. deduction from installment sales. c. unearned revenue and classified as a current liability. d. deduction from gross profit on sales.

- 12. Test Bank for Intermediate Accounting, Thirteenth Edition 18 - 12 48. The installment-sales method of recognizing profit for accounting purposes is acceptable if a. collections in the year of sale do not exceed 30% of the total sales price. b. an unrealized profit account is credited. c. collection of the sales price is not reasonably assured. d. the method is consistently used for all sales of similar merchandise. 49. The method most commonly used to report defaults and repossessions is a. provide no basis for the repossessed asset thereby recognizing a loss. b. record the repossessedmerchandise at fair value, recording a gain or loss if appropriate. c. record the repossessed merchandise at book value, recording no gain or loss. d. none of these. 50. Under the installment-sales method, a. revenue, costs, and gross profit are recognized proportionate to the cash that is received from the sale of the product. b. gross profit is deferred proportionate to cash uncollected from sale of the product, but total revenues and costs are recognized at the point of sale. c. gross profit is not recognized until the amount of cash received exceeds the cost of the item sold. d. revenues and costs are recognized proportionate to the cash received from the sale of the product, but gross profit is deferred until all cash is received. S 51. The realization of income on installment sales transactions involves a. recognition of the difference between the cash collected on installment sales and the cash expenses incurred. b. deferring the net income related to installment sales and recognizing the income as cash is collected. c. deferring gross profit while recognizing operating or financial expenses in the period incurred. d. deferring gross profit and all additional expenses related to installment sales until cash is ultimately collected. P 52. A manufacturer of large equipment sells on an installment basis to customers with questionable credit ratings. Which of the following methods of revenue recognition is least likely to overstate the amount of gross profit reported? a. At the time of completion of the equipment (completion of production method) b. At the date of delivery (sales method) c. The installment-sales method d. The cost–recovery method 53. A seller is properly using the cost-recovery method for a sale. Interest will be earned on the future payments. Which of the following statements is not correct? a. After all costs have been recovered, any additional cash collections are included in income. b. Interest revenue may be recognized before all costs have been recovered. c. The deferred gross profit is offset against the related receivable on the balance sheet. d. Subsequent income statements report the gross profit as a separate item of revenue when it is recognized as earned.

- 13. Revenue Recognition 18 - 13 54. Under the cost-recovery method of revenue recognition, a. income is recognized on a proportionate basis as the cash is received on the sale of the product. b. income is recognized when the cash received from the sale of the product is greater than the cost of the product. c. income is recognized immediately. d. none of these. 55. Winser, Inc. is engaged in extensive exploration for water in Utah. If, upon discovery of water, Winser does not recognize any revenue from water sales until the sales exceed the costs of exploration, the basis of revenue recognition being employed is the a. production basis. b. cash (or collection) basis. c. sales (or accrual) basis. d. cost recovery basis. 56. The deposit method of revenue recognition is used when a. the product can be marketed at quoted prices and units are interchangeable. b. cash is received before the sales transaction is complete. c. the contract is short-term or the percentage-of-completion method can’t be used. d. there are no significant costs of distribution. 57. The cost-recovery method a. is prohibited under current GAAP due to its conservative nature. b. requires a company to defer profit recognition until all cash payments are received from the buyer. c. is used by sellers when there is a reasonable basis for estimating collectibility. d. recognizes total revenue and total cost of goods sold in the period of sale. *58. Types of franchising arrangements include all of the following except a. service sponsor-retailer. b. wholesaler-service sponsor. c. manufacturer-wholesaler. d. wholesaler-retailer. *59. In consignment sales, the consignee a. records the merchandise as an asset on its books. b. records a liability for the merchandise held on consignment. c. recognizes revenue when it ships merchandise to the consignor. d. prepares an “account report” for the consignor which shows sales, expenses, and cash receipts. *60. Some of the initial franchise fee may be allocated to a. continuing franchise fees. b. interest revenue on the future installments. c. options to purchase the franchisee's business. d. All of these may reduce the amount of the initial franchise fee that is recognized as revenue.

- 14. Test Bank for Intermediate Accounting, Thirteenth Edition 18 - 14 *61. Continuing franchise fees should be recorded by the franchisor a. as revenue when earned and receivable from the franchisee. b. as revenue when received. c. in accordance with the accounting procedures specified in the franchise agreement. d. as revenue only after the balance of the initial franchise fee has been collected. *62. Occasionally a franchise agreement grants the franchisee the right to make future bargain purchases of equipment or supplies. When recording the initial franchise fee, the franchisor should a. increase revenue recognized from the initial franchise fee by the amount of the expected future purchases. b. record a portion of the initial franchise fee as unearned revenue which will increase the selling price when the franchisee subsequently makes the bargain purchases. c. defer recognition of any revenue from the initial franchise fee until the bargain purchases are made. d. None of these. *63. A franchise agreement grants the franchisor an option to purchase the franchisee's business. It is probable that the option will be exercised. When recording the initial franchise fee, the franchisor should a. record the entire initial franchise fee as a deferred credit which will reduce the franchisor's investment in the purchased outlet when the option is exercised. b. record the entire initial franchise fee as unearned revenue which will reduce the amount of cash paid when the option is exercised. c. record the portion of the initial franchise fee which is attributable to the bargain purchase option as a reduction of the future amounts receivable from the franchisee. d. None of these. *64. Revenue is recognized by the consignor when the a. goods are shipped to the consignee. b. consignee receives the goods. c. consignor receives an advance from the consignee. d. consignor receives an account sales from the consignee. Multiple Choice Answers—Conceptual Item Ans. Item Ans. Item Ans. Item Ans. Item Ans. Item Ans. Item Ans. 21. c 28. d 35. b 42. c 49. b 56. b *63. a 22. b 29. c 36. a 43. d 50. b 57. d *64. d 23. a 30. d 37. b 44. a 51. c *58. b 24. b 31. b 38. d 45. d 52. d *59. d 25. d 32. c 39. a 46. b 53. b *60. d 26. b 33. b 40. c 47. c 54. b *61. a 27. d 34. c 41. a 48. c 55. d *62. b

- 15. Revenue Recognition 18 - 15 MULTIPLE CHOICE—Computational Use the following information for questions 65-68: Seasons Construction is constructing an office building under contract for Cannon Cafe. The contract calls for progress billings and payments of $620,000 each quarter. The total contract price is $7,440,000 and Seasons estimates total costs of $7,100,000. Seasons estimates that the building will take 3 years to complete, and commences construction on January 2, 2010. 65. At December 31, 2010, Seasons estimates that it is 30% complete with the construction, based on costs incurred. What is the total amount of Revenue from Long-Term Contracts recognized for 2010 and what is the balance in the Accounts Receivable account assuming Cannon Cafe has not yet made its last quarterly payment? Revenue Accounts Receivable a. $2,480,000 $2,480,000 b. $2,130,000 $ 620,000 c. $2,232,000 $ 620,000 d. $2,130,000 $2,480,000 66. At December 31, 2011, Seasons Construction estimates that it is 75% complete with the building; however, the estimate of total costs to be incurred has risen to $7,200,000 due to unanticipated price increases. What is the total amount of Construction Expenses that Seasons will recognize for the year ended December 31, 2011? a. $5,400,000 b. $3,150,000 c. $3,195,000 d. $3,270,000 67. At December 31, 2011, Seasons Construction estimates that it is 75% complete with the building; however, the estimate of total costs to be incurred has risen to $7,200,000 due to unanticipated price increases. What is reported in the balance sheet at December 31, 2011 for Seasons as the difference between the Construction in Process and the Billings on Construction in Process accounts, and is it a debit or a credit? Difference between the accounts Debit/Credit a. $1,690,000 Credit b. $620,000 Debit c. $440,000 Debit d. $620,000 Credit 68. Seasons Construction completes the remaining 25% of the building construction on December 31, 2012, as scheduled. At that time the total costs of construction are $7,500,000. What is the total amount of Revenue from Long-Term Contracts and Construction Expenses that Seasons will recognize for the year ended December 31, 2012? Revenue Expenses a. $7,440,000 $7,500,000 b. $1,860,000 $1,875,000 c. $1,860,000 $2,100,000 d. $1,875,000 $1,875,000

- 16. Test Bank for Intermediate Accounting, Thirteenth Edition 18 - 16 The following information relates to questions 69 and 70. Cooper Construction Company had a contract starting April 2010, to construct a $9,000,000 building that is expected to be completed in September 2012, at an estimated cost of $8,250,000. At the end of 2010, the costs to date were $3,795,000 and the estimated total costs to complete had not changed. The progress billings during 2010 were $1,800,000 and the cash collected during 2010 was 1,200,000. 69. For the year ended December 31, 2010, Cooper would recognize gross profit on the building of: a. $316,250 b. $345,000 c. $405,000 d. $0 70. At December 31, 2010 Cooper would report Construction in Process in the amount of: a. $345,000 b. $3,795,000 c. $4,140,000 d. $3,540,000 71. Hayes Construction Corporation contracted to construct a building for $1,500,000. Construction began in 2010 and was completed in 2011. Data relating to the contract are summarized below: Year ended December 31, 2010 2011 Costs incurred $600,000 $450,000 Estimated costs to complete 400,000 — Hayes uses the percentage-of-completion method as the basis for income recognition. For the years ended December 31, 2010, and 2011, respectively, Hayes should report gross profit of a. $270,000 and $180,000. b. $900,000 and $600,000. c. $300,000 and $150,000. d. $0 and $450,000. 72. Monroe Construction Company uses the percentage-of-completion method of accounting. In 2010, Monroe began work on a contract it had received which provided for a contract price of $15,000,000. Other details follow: 2010 Costs incurred during the year $7,200,000 Estimated costs to complete as of December 31 4,800,000 Billings during the year 6,600,000 Collections during the year 3,900,000 What should be the gross profit recognized in 2010? a. $600,000 b. $7,800,000 c. $1,800,000 d. $3,000,000

- 17. Revenue Recognition 18 - 17 Use the following information for questions 73 and 74. In 2010, Fargo Corporation began construction work under a three-year contract. The contract price is $2,400,000. Fargo uses the percentage-of-completion method for financial accounting purposes. The income to be recognized each year is based on the proportion of costs incurred to total estimated costs for completing the contract. The financial statement presentations relating to this contract at December 31, 2010, follow: Balance Sheet Accounts receivable—construction contract billings $100,000 Construction in progress $300,000 Less contract billings 240,000 Costs and recognized profit in excess of billings 60,000 Income Statement Income (before tax) on the contract recognized in 2010 $60,000 73. How much cash was collected in 2010 on this contract? a. $100,000 b. $140,000 c. $20,000 d. $240,000 74. What was the initial estimated total income before tax on this contract? a. $300,000 b. $320,000 c. $400,000 d. $480,000 75. Adler Construction Co. uses the percentage-of-completion method. In 2010, Adler began work on a contract for $3,300,000 and it was completed in 2011. Data on the costs are: Year Ended December 31 2010 2011 Costs incurred $1,170,000 $840,000 Estimated costs to complete 780,000 — For the years 2010 and 2011, Adler should recognize gross profit of 2010 2011 a. $0 $1,290,000 b. $774,000 $516,000 c. $810,000 $480,000 d. $810,000 $1,290,000 Use the following information for questions 76 and 77. Gomez, Inc. began work in 2010 on contract #3814, which provided for a contract price of $7,200,000. Other details follow: 2010 2011 Costs incurred during the year $1,200,000 $3,675,000 Estimated costs to complete, as of December 31 3,600,000 0 Billings during the year 1,350,000 5,400,000 Collections during the year 900,000 5,850,000

- 18. Test Bank for Intermediate Accounting, Thirteenth Edition 18 - 18 76. Assume that Gomez uses the percentage-of-completion method of accounting. The portion of the total gross profit to be recognized as income in 2010 is a. $450,000. b. $600,000. c. $1,800,000. d. $2,400,000. 77. Assume that Gomez uses the completed-contract method of accounting. The portion of the total gross profit to be recognized as income in 2011 is a. $900,000. b. $1,350,000. c. $2,325,000. d. $7,200,000. Use the following information for questions 78 and 79. Kiner, Inc. began work in 2010 on a contract for $8,400,000. Other data are as follows: 2010 2011 Costs incurred to date $3,600,000 $5,600,000 Estimated costs to complete 2,400,000 — Billings to date 2,800,000 8,400,000 Collections to date 2,000,000 7,200,000 78. If Kiner uses the percentage-of-completion method, the gross profit to be recognized in 2010 is a. $1,440,000. b. $1,600,000. c. $2,160,000. d. $2,400,000. 79. If Kiner uses the completed-contract method, the gross profit to be recognized in 2011 is a. $1,360,000. b. $2,800,000. c. $1,400,000. d. $5,600,000. Use the following information for questions 80 and 81. 80. Horner Construction Co. uses the percentage-of-completion method. In 2010, Horner began work on a contract for $5,500,000; it was completed in 2011. The following cost data pertain to this contract: Year Ended December 31 2010 2011 Cost incurred during the year $1,950,000 $1,400,000 Estimated costs to complete at the end of year 1,300,000 — The amount of gross profit to be recognized on the income statement for the year ended December 31, 2011 is a. $800,000. b. $860,000. c. $900,000. d. $2,150,000.

- 19. Revenue Recognition 18 - 19 81. If the completed-contract method of accounting was used, the amount of gross profit to be recognized for years 2010 and 2011 would be 2010 2011 a. $2,250,000. $0. b. $2,150,000. $(100,000). c. $0. $2,150,000. d. $0. $2,250,000. 82. Remington Construction Company uses the percentage-of-completion method. During 2010, the company entered into a fixed-price contract to construct a building for Sherman Company for $30,000,000. The following details pertain to the contract: At December 31, 2010 At December 31, 2011 Percentage of completion 25% 60% Estimated total cost of contract $22,500,000 $25,000,000 Gross profit recognized to date 1,875,000 3,000,000 The amount of construction costs incurred during 2011 was a. $15,000,000. b. $9,375,000. c. $5,625,000. d. $2,500,000. Use the following information for questions 83 and 84. Eilert Construction Company had a contract starting April 2011, to construct a $15,000,000 building that is expected to be completed in September 2012, at an estimated cost of $13,750,000. At the end of 2011, the costs to date were $6,325,000 and the estimated total costs to complete had not changed. The progress billings during 2011 were $3,000,000 and the cash collected during 2011 was $2,000,000. Eilert uses the percentage-of-completion method. 83. For the year ended December 31, 2011, Eilert would recognize gross profit on the building of a. $0. b. $527,083. c. $575,000. d. $675,000. 84. At December 31, 2011, Eilert would report Construction in Process in the amount of a. $6,900,000. b. $6,325,000. c. $5,900,000. d. $575,000.

- 20. Test Bank for Intermediate Accounting, Thirteenth Edition 18 - 20 85. Hiser Builders, Inc. is using the completed-contract method for a $5,600,000 contract that will take two years to complete. Data at December 31, 2010, the end of the first year, are as follows: Costs incurred to date $2,560,000 Estimated costs to complete 3,280,000 Billings to date 2,400,000 Collections to date 2,000,000 The gross profit or loss that should be recognized for 2010 is a. $0. b. a $240,000 loss. c. a $120,000 loss. d. a $105,600 loss. Use the following information for questions 86 through 88. Gorman Construction Co. began operations in 2010. Construction activity for 2010 is shown below. Gorman uses the completed-contract method. Billings Collections Estimated Contract Through Through Costs to Costs to Contract Price 12/31/10 12/31/10 12/31/10 Complete 1 $3,200,000 $3,150,000 $2,600,000 $2,150,000 — 2 3,600,000 1,500,000 1,000,000 820,000 $1,880,000 3 3,300,000 1,900,000 1,800,000 2,250,000 1,200,000 86. Which of the following should be shown on the income statement for 2010 related to Contract 1? a. Gross profit, $450,000 b. Gross profit, $1,000,000 c. Gross profit, $1,050,000 d. Gross profit, $600,000 87. Which of the following should be shown on the balance sheet at December 31, 2010 related to Contract 2? a. Inventory, $680,000 b. Inventory, $820,000 c. Current liability, $680,000 d. Current liability, $1,500,000 88. Which of the following should be shown on the balance sheet at December 31, 2010 related to Contract 3? a. Inventory, $200,000 b. Inventory, $350,000 c. Inventory, $2,100,000 d. Inventory, $2,250,000

- 21. Revenue Recognition 18 - 21 89. Oliver Co. uses the installment-sales method. When an account had a balance of $8,400, no further collections could be made and the dining room set was repossessed. At that time, it was estimated that the dining room set could be sold for $2,400 as repossessed, or for $3,000 if the company spent $300 reconditioning it. The gross profit rate on this sale was 70%. The gain or loss on repossession was a a. $5,880 loss. b. $6,000 loss. c. $600 gain. d. $180 gain. 90. Spicer Corporation has a normal gross profit on installment sales of 30%. A 2009 sale resulted in a default early in 2011. At the date of default, the balance of the installment receivable was $24,000, and the repossessed merchandise had a fair value of $13,500. Assuming the repossessed merchandise is to be recorded at fair value, the gain or loss on repossession should be a. $0. b. a $3,300 loss. c. a $3,300 gain. d. a $7,500 loss. 91. Fryman Furniture uses the installment-sales method. No further collections could be made on an account with a balance of $18,000. It was estimated that the repossessed furniture could be sold as is for $5,400, or for $6,300 if $300 were spent reconditioning it. The gross profit rate on the original sale was 40%. The loss on repossession was a. $4,800. b. $4,500. c. $12,000. d. $12,600. 92. Melton Company sold some machinery to Addison Company on January 1, 2010. The cash selling price would have been $568,620. Addison entered into an installment sales contract which required annual payments of $150,000, including interest at 10%, over five years. The first payment was due on December 31, 2010. What amount of interest income should be included in Melton's 2011 income statement (the second year of the contract)? a. $15,000 b. $47,548 c. $30,000 d. $41,862

- 22. Test Bank for Intermediate Accounting, Thirteenth Edition 18 - 22 93. Carperter Company has used the installment method of accounting since it began operations at the beginning of 2011. The following information pertains to its operations for 2011: Installment sales $ 1,400,000 Cost of installment sales 980,000 Collections of installment sales 560,000 General and administrative expenses 140,000 The amount to be reported on the December 31, 2011 balance sheet as Deferred Gross Profit should be a. $168,000. b. $252,000. c. $336,000. d. $840,000. 94. Daily, Inc. appropriately used the installment method of accounting to recognize income in its financial statement. Some pertinent data relating to this method of accounting include: 2010 2011 Installment sales $750,000 $900,000 Cost of sales 450,000 630,000 Gross profit $300,000 $270,000 Collections during year: On 2010 sales 250,000 250,000 On 2011 sales 300,000 What amount to be realized gross profit should be reported on Daily’s income statement for 2011? a. $165,000 b. $190,000 c. $220,000 d. $270,000 95. Sutton Company sells plasma-screen televisions on an installment basis and appropri-ately uses the installment-sales method of accounting. A customer with an account balance of $5,600 refuses to make any more payments and the merchandise is repossessed. The gross profit rate on the original sale is 40%. Sutton estimates that the television can be sold as is for $1,750, or for $2,100 if $140 is spent to refurbish it. The loss on repossession is a. $3,850. b. $2,240. c. $1,610. d. $1,400. Use the following information for questions 96-98. During 2010, Vaughn Corporation sold merchandise costing $1,500,000 on an installment basis for $2,000,000. The cash receipts related to these sales were collected as follows: 2010, $800,000; 2011, $700,000; 2012, $500,000.

- 23. Revenue Recognition 18 - 23 96. What is the rate of gross profit on the installment sales made by Vaughn Corporation during 2010? a. 75% b. 60% c. 40% d. 25% 97. If expenses, other than the cost of the merchandise sold, related to the 2010 installment sales amounted to $90,000, by what amount would Vaughn’s net income for 2010 increase as a result of installment sales? a. $110,000 b. $177,500 c. $200,000 d. $710,000 98. What amount would be shown in the December 31, 2011 financial statement for realized gross profit on 2010 installment sales, and deferred gross profit on 2010 installment sales, respectively? a. $175,000 and $375,000 b. $325,000 and $175,000 c. $375,000 and $125,000 d. $175,000 and $125,000 Use the following information for questions 99 – 101. During 2010, Martin Corporation sold merchandise costing $2,100,000 on an installment basis for $3,000,000. The cash receipts related to these sales were collected as follows: 2010, $1,200,000; 2011, $1,050,000; 2012, $750,000. 99. What is the rate of gross profit on the installment sales made by Martin Corporation during 2010? a. 30% b. 40% c. 60% d. 70% 100. If expenses, other than the cost of the merchandise sold, related to the 2010 installment sales amounted to $120,000, by what amount would Martin’s net income for 2010 increase as a result of installment sales? a. $1,080,000 b. $360,000 c. $270,000 d. $240,000 101. What amount would be shown in the December 31, 2011 financial statements for realized gross profit on 2010 installment sales, and deferred gross profit on 2010 installment sales, respectively? a. $315,000 and $225,000 b. $585,000 and $315,000 c. $225,000 and $675,000 d. $315,000 and $675,000

- 24. Test Bank for Intermediate Accounting, Thirteenth Edition 18 - 24 Use the following information for questions 102 and 103. Coaster manufactures and sells logging equipment. Due to the nature of its business, Coaster is unable to reliably predict bad debts. During 2010, Coaster sold equipment costing $2,400,000 for $3,600,000. The terms of the sale were 20% down, with equal payments due quarterly over the next 3 years. All payments for 2010 were made on schedule. Round answers to two places. 102. Assuming that Coaster uses the installment method of accounting for its installment sales, what amount of realized gross profit will Coaster report in its income statement for the year ended December 31, 2010? a. $1,680,000 b. $1,120,000 c. $560,000 d. $369,600 103. Assuming that Coaster uses the cost-recovery method of accounting for its installment sales, what amount of realized gross profit will Coaster report in its income statement for the year ended December 31, 2011? a. $0 b. $240,000 c. $316,800 d. $960,000 104. On January 1, 2010, Shaw Co. sold land that cost $210,000 for $280,000, receiving a note bearing interest at 10%. The note will be paid in three annual installments of $112,595 starting on December 31, 2010. Because collection of the note is very uncertain, Shaw will use the cost-recovery method. How much revenue from this sale should Shaw recognize in 2010? a. $0 b. $21,000 c. $28,000 d. $70,000 *105. On April 1, 2010 Weston, Inc. entered into a franchise agreement with a local business- man. The franchisee paid $240,000 and gave a $160,000, 8%, 3-year note payable with interest due annually on March 31. Weston recorded the $400,000 initial franchise fee as revenue on April 1, 2010. On December 30, 2010, the franchisee decided not to open an outlet under Weston's name. Weston canceled the franchisee's note and refunded $128,000, less accrued interest on the note, of the $240,000 paid on April 1. What entry should Weston make on December 30, 2010? a. Loss on Repossessed Franchise.......................................... 128,000 Cash........................................................................... 128,000 b. Loss on Repossessed Franchise.......................................... 118,400 Cash........................................................................... 118,400 c. Loss on Repossessed Franchise.......................................... 278,400 Cash........................................................................... 118,400 Note Receivable ........................................................ 160,000 d. Revenue from Franchise Fees.............................................. 400,000 Interest Income.......................................................... 9,600 Cash........................................................................... 118,400 Note Receivable ........................................................ 160,000 Revenue from Repossessed Franchise.................... 112,000

- 25. Revenue Recognition 18 - 25 *106. On January 1, 2010 Dairy Treats, Inc. entered into a franchise agreement with a company allowing the company to do business under Dairy Treats's name. Dairy Treats had performed substantially all required services by January 1, 2010, and the franchisee paid the initial franchise fee of $560,000 in full on that date. The franchise agreement specifies that the franchisee must pay a continuing franchise fee of $48,000 annually, of which 20% must be spent on advertising by Dairy Treats. What entry should Dairy Treats make on January 1, 2010 to record receipt of the initial franchise fee and the continuing franchise fee for 2010? a. Cash....................................................................................... 608,000 Franchise Fee Revenue............................................ 560,000 Revenue from Continuing Franchise Fees ............... 48,000 b. Cash....................................................................................... 608,000 Unearned Franchise Fees......................................... 608,000 c. Cash....................................................................................... 608,000 Franchise Fee Revenue............................................ 560,000 Revenue from Continuing Franchise Fees ............... 38,400 Unearned Franchise Fees......................................... 9,600 d. Prepaid Advertising ............................................................... 9,600 Cash....................................................................................... 608,000 Franchise Fee Revenue............................................ 560,000 Revenue from Continuing Franchise Fees ............... 48,000 Unearned Franchise Fees......................................... 9,600 *107. Wynne Inc. charges an initial franchise fee of $920,000, with $200,000 paid when the agreement is signed and the balance in five annual payments. The present value of the future payments, discounted at 10%, is $545,872. The franchisee has the option to purchase $120,000 of equipment for $96,000. Wynne has substantially provided all initial services required and collectibility of the payments is reasonably assured. The amount of revenue from franchise fees is a. $200,000. b. $721,872. c. $745,872. d. $920,000. Use the following information for questions 108 and 109. On May 1, 2010, TV Inc. consigned 80 TVs to Ed's TV. The TVs cost $270. Freight on the shipment paid by Ed’s TV was $600. On July 10, TV Inc. received an account sales and $12,900 from Ed's TV. Thirty TVs had been sold and the following expenses were deducted: Freight $600 Commission (20% of sales price) ? Advertising 390 Delivery 210 *108. The total sales price of the TVs sold by Ed's TV was a. $15,375. b. $16,125. c. $16,388. d. $17,625.

- 26. Test Bank for Intermediate Accounting, Thirteenth Edition 18 - 26 *109. The inventory of TVs will be reported on whose balance sheet and at what amount? Balance Sheet of Amount of Inventory a. TV Inc. $13,875 b. TV Inc. $13,500 c. Ed's TV $13,875 d. Ed's TV $13,500 Multiple Choice Answers—Computational Item Ans. Item Ans. Item Ans. Item Ans. Item Ans. Item Ans. Item Ans. 65. c 72. c 79. b 86. c 93. b 100. d *107. b 66. d 73. b 80. a 87. c 94. b 101. a *108. d 67. b 74. d 81. c 88. a 95. d 102. c *109. a 68. c 75. c 82. b 89. d 96. d 103. b 69. b 76. b 83. c 90. b 97. a 104. a 70. c 77. c 84. a 91. a 98. d *105. d 71. c 78. a 85. b 92. b 99. a *106. c MULTIPLE CHOICE—CPA Adapted 110. According to the FASB's conceptual framework, the process of reporting an item in the financial statements of an entity is a. recognition. b. realization. c. allocation. d. matching. 111. Green Construction Co. has consistently used the percentage-of-completion method of recognizing revenue. During 2010, Green entered into a fixed-price contract to construct an office building for $12,000,000. Information relating to the contract is as follows: At December 31 2010 2011 Percentage of completion 15% 45% Estimated total cost at completion $9,000,000 $9,600,000 Gross profit recognized (cumulative) 600,000 1,440,000 Contract costs incurred during 2011 were a. $2,880,000. b. $2,970,000. c. $3,150,000. d. $4,320,000.

- 27. Revenue Recognition 18 - 27 112. Bruner Constructors, Inc. has consistently used the percentage-of-completion method of recognizing income. In 2010, Bruner started work on a $35,000,000 construction contract that was completed in 2011. The following information was taken from Bruner's 2010 accounting records: Progress billings $11,000,000 Costs incurred 10,500,000 Collections 7,000,000 Estimated costs to complete 21,000,000 What amount of gross profit should Bruner have recognized in 2010 on this contract? a. $3,500,000 b. $2,333,334 c. $1,750,000 d. $1,166,667 113. During 2010, Gates Corp. started a construction job with a total contract price of $3,500,000. The job was completed on December 15, 2011. Additional data are as follows: 2010 2011 Actual costs incurred $1,350,000 $1,525,000 Estimated remaining costs 1,350,000 — Billed to customer 1,200,000 2,300,000 Received from customer 1,000,000 2,400,000 Under the completed-contract method, what amount should Gates recognize as gross profit for 2011? a. $225,000 b. $312,500 c. $475,000 d. $625,000 114. Hogan Farms produced 800,000 pounds of cotton during the 2010 season. Hogan sells all of its cotton to Ott Co., which has agreed to purchase Hogan's entire production at the prevailing market price. Recent legislation assures that the market price will not fall below $.70 per pound during the next two years. Hogan's costs of selling and distributing the cotton are immaterial and can be reasonably estimated. Hogan reports its inventory at expected exit value. During 2010, Hogan sold and delivered to Ott 600,000 pounds at the market price of $.70. Hogan sold the remaining 200,000 pounds during 2011 at the market price of $.72. What amount of revenue should Hogan recognize in 2010? a. $420,000 b. $432,000 c. $560,000 d. $576,000

- 28. Test Bank for Intermediate Accounting, Thirteenth Edition 18 - 28 115. Braun, Inc. appropriately uses the installment-sales method of accounting to recognize income in its financial statements. Some pertinent data relating to this method of accounting include: 2010 2011 Installment sales $750,000 $720,000 Cost of installment sales 570,000 504,000 Gross profit $180,000 $216,000 Rate of gross profit 24% 30% Balance of deferred gross profit at year end: 2010 $108,000 $ 36,000 2011 198,000 Total $108,000 $234,000 What amount of installment accounts receivable should be presented in Braun's December 31, 2011 balance sheet? a. $720,000 b. $810,000 c. $780,000 d. $866,666 116. Hartz Co., which began operations on January 1, 2010, appropriately uses the installment- sales method of accounting. The following information pertains to Hartz's operations for the year 2010: Installment sales $1,200,000 Regular sales 480,000 Cost of installment sales 720,000 Cost of regular sales 288,000 General and administrative expenses 96,000 Collections on installment sales 288,000 The deferred gross profit account in Hartz's December 31, 2010 balance sheet should be a. $115,200. b. $192,000. c. $364,800. d. $480,000. 117. On January 1, 2010, Orton Co. sold a used machine to King, Inc. for $350,000. On this date, the machine had a depreciated cost of $245,000. King paid $50,000 cash on January 1, 2010 and signed a $300,000 note bearing interest at 10%. The note was payable in three annual installments of $100,000 beginning January 1, 2011. Orton appropriately accounted for the sale under the installment method. King made a timely payment of the first installment on January 1, 2011 of $130,000, which included interest of $30,000 to date of payment. At December 31, 2011, Orton has deferred gross profit of a. $70,000. b. $66,000. c. $60,000. d. $51,000.

- 29. Revenue Recognition 18 - 29 118. Piper Co. began operations on January 1, 2010 and appropriately uses the installment method of accounting. The following information pertains to Piper's operations for 2010: Installment sales 1,800,000 Cost of installment sales 1,080,000 General and administrative expenses 180,000 Collections on installment sales 825,000 The balance in the deferred gross profit account at December 31, 2010 should be a. $330,000. b. $495,000. c. $390,000. d. $720,000. 119. Moon Co. records all sales using the installment method of accounting. Installment sales contracts call for 36 equal monthly cash payments. According to the FASB's conceptual framework, the amount of deferred gross profit relating to collections 12 months beyond the balance sheet date should be reported in the a. current liabilities section as a deferred revenue. b. noncurrent liabilities section as a deferred revenue. c. current assets section as a contra account. d. noncurrent assets section as a contra account. 120. Crane, Inc. is a retailer of home appliances and offers a service contract on each appliance sold. Crane sells appliances on installment contracts, but all service contracts must be paid in full at the time of sale. Collections received for service contracts should be recorded as an increase in a a. deferred revenue account. b. sales contracts receivable valuation account. c. stockholders' valuation account. d. service revenue account. Multiple Choice Answers—CPAAdapted Item Ans. Item Ans. Item Ans. Item Ans. Item Ans. Item Ans. 110. a 112. d 114. c 116. c 118. c 120. a 111. b 113. d 115. b 117. c 119. c DERIVATIONS — Computational No. Answer Derivation 65. c $7,440,000 .30 = $2,232,000. 66. d ($7,200,000 .75) – ($7,100,000 .30) = $3,270,000. 67. b ($7,440,000 .75) – ($620,000 8) = $620,000 debit. 68. c $7,440,000 .25 = $1,860,000 $7,500,000 – ($7,200,000 .75) = $2,100,000.

- 30. Test Bank for Intermediate Accounting, Thirteenth Edition 18 - 30 DERIVATIONS — Computational (cont.) No. Answer Derivation 69. b ($9,000,000 – $8,250,000) ($3,795,000 ÷ $8,250,000) = $345,000. 70. c $3,795,000 + $345,000 = $4,140,000. 71. c $600,000 —————————— ×($1,500,000 – $1,000,000) = $300,000 $600,000 + $400,000 ($1,500,000 – $1,050,000) – $300,000 = $150,000. 72. c $7,200,000 ———————————×($15,000,000 – $12,000,000) = $1,800,000. $7,200,000 + $4,800,000 73. b $240,000 – $100,000 = $140,000. 74. d $300,000 – $60,000 = $240,000 $240,000 ————————— ×($2,400,000 – Total estimated cost) = $60,000 Total estimated cost Total estimated cost = $1,920,000 $2,400,000 – $1,920,000 = $480,000. 75. c $1,170,000 —————- ×($3,300,000 – $1,950,000) = $810,000 $1,950,000 ($3,300,000 – $2,010,000) – $810,000 = $480,000. 76. b $1,200,000 ————— ×($7,200,000 – $4,800,000) = $600,000. $4,800,000 77. c $7,200,000 – $4,875,000 = $2,325,000. 78. a $3,600,000 ————— ×($8,400,000 – $6,000,000) = $1,440,000. $6,000,000 79. b $8,400,000 – $5,600,000 = $2,800,000. 80. a [$1,950,000 ÷ ($1,950,000 + $1,300,000)] × $2,250,000 = $1,350,000 ($5,500,000 – $3,350,000) – $1,350,00 = $800,000. 81. c $5,500,000 – $3,350,000 = $2,150,000.

- 31. Revenue Recognition 18 - 31 DERIVATIONS — Computational (cont.) No. Answer Derivation 82. b ($25,000,000 × .60) – ($22,500,000 × .25) = $9,375,000. 83. c ($6,325,000 ÷ $13,750,000) × $1,250,000 = $575,000. 84. a ($6,325,000 ÷ $13,750,000) × $1,250,000 = $575,000. $6,325,000 + $575,000 = $6,900.000. 85. b $5,600,000 – ($2,560,000 + $3,280,000) = –$240,000. 86. c $3,200,000 – $2,150,000 = $1,050,000. 87. c $1,500,000 – $820,000 = $680,000. 88. a ($2,250,000 – $150,000) – $1,900,000 = $200,000. 89. d $8,400 – $5,880 = $2,520 ($3,000 – $300) – $2,520 = $180 gain. 90. b $24,000 – $7,200 = $16,800 $16,800 – $13,500 = $3,300 loss. 91. a $18,000 – $7,200 = $10,800 ($6,300 – $300) – $10,800 = $4,800 loss. 92. b 2010: $150,000 – ($568,620 × 10%) = $93,138. 2011: ($568,620 – $93,138) × 10% = $47,548. 93. b [($1,400,000 – $980,000) ÷ $1,400,000] × $840,000 = $252,000. 94. b ($300,000 ÷ $750,000) × $250,000 = $100,000 [($270,000 ÷ $900,000) × $300,000] + $100,000 = $190,000. 95. d [$5,600 × (1 – .40)] – ($2,100 – $140) = $1,400. 96. d ($2,000,000 – $1,500,000) ÷ $2,000,000 = 25% 97. a ($800,000 × .25) – $90,000 = $110,000, 98. d $700,000 × .25 = $175,000; $500,000 × .25 = $125,000. 99. a ($3,000,000 – $2,100,000) ÷ $3,000,000 = 30%. 100. d ($1,200,000 .30) – $120,000 = $240,000. 101. a $1,050,000 .30 = $315,000 $900,000 – [($1,200,000 + $1,050,000) .30] = $225,000.

- 32. Test Bank for Intermediate Accounting, Thirteenth Edition 18 - 32 DERIVATIONS — Computational (cont.) No. Answer Derivation 102. c ($3,600,000 – $2,400,000) ÷ $3,600,000 = 33 1/3% ($3,600,000 .20) + [(3,600,000 .80) 4/12)] = $1,680,000 $1,680,000 33 1/3% = $560,000. 103. b [($3,600,000 .20) + ($3,600,000 .80 8/12] – $2,400,000 = $240,000. 104. a $0. *105. d Revenue = $400,000 Interest income = $160,000 ×8% ×9/12 = $9,600 Cash = $128,000 – $9,600 = $118,400 Repossession revenue: $240,000 – $128,000 = $112,000. *106. c Cash = $560,000 + $48,000 = $608,000 Franchise Fee Revenue = $560,000 Unearned Franchise Fees = $48,000 ×20% = $9,600 Revenue from Continuing Franchise Fees = $48,000 – $9,600 = $38,400. *107 b $200,000 + $545,872 – $24,000 = $721,872. *108. d Sales – (Sales ×20%) – $600 – $390 – $210 = $12,900 .8 Sales = $14,100 Sales = $17,625. *109. a ($270 ×50) + [($600 ÷ 80) ×50] = $13,875. DERIVATIONS — CPA Adapted No. Answer Derivation 110. a Conceptual. 111. b ($9,600,000 ×45%) – ($9,000,000 ×15%) = $2,970,000. $10,500,000 112. d —————— ×($35,000,000 – $31,500,000) = $1,166,667. $31,500,000 113. d $3,500,000 – $1,350,000 – $1,525,000 = $625,000. 114. c 800,000 lbs. ×$.70 = $560,000. 115. b ($36,000 ÷ 24%) + ($198,000 ÷ 30%) = $810,000. 116. c $1,200,000 – $720,000 = $480,000 gross profit (40% gross profit rate) $480,000 – ($288,000 ×.4) = $364,800.

- 33. Revenue Recognition 18 - 33 DERIVATIONS — CPA Adapted (cont.) No. Answer Derivation 117. c $300,000 + $50,000 = $350,000 $350,000 – $245,000 = $105,000 gross profit (30% gross profit rate) ($300,000 – $100,000) × 30% = $60,000. 118. c $1,800,000 – $1,080,000 = $720,000 (40% gross profit rate) $720,000 – ($825,000 ×40%) = $390,000. 119. c Conceptual. 120. a Conceptual. EXERCISES Ex. 18-121— Revenue recognition (essay). The revenue recognition principle provides that revenue is recognized when (1) it is realized or realizable and (2) it is earned. Instructions Explain when revenues are (a) realized, (b) realizable, and (c) earned. Solution 18-121 (a) Revenues are realized when goods or services are exchanged for cash or claims to cash (receivables). (b) Revenues are realizable when assets received in exchange are readily convertible to known amounts of cash or claims to cash. (c) Revenues are earned when the earnings process is complete or virtually complete. Ex. 18-122—Revenue recognition (essay). The earning of revenue by a business is recognized for accounting purposes when the transaction is recorded. Revenue is often recognized at time of sale. Instructions At what times, other than at time of sale, may it be appropriate to recognize revenue? Explain and justify each of these times.

- 34. Test Bank for Intermediate Accounting, Thirteenth Edition 18 - 34 Solution 18-122 Revenue is also recognized (1) during production, (2) at completion, and (3) at collection. (1) During production. The most common situation is the use of the percentage-of-completion method for long-term construction contracts. The point of sale is much less significant than production activity. If the contractor can expect to perform the contractual obligation, the revenue is assured by the contract. To defer recognition until completion of the entire contract misrepresents the efforts (costs) and accomplishments (revenues) of the interim periods. If progress toward completion can be estimated with reasonable accuracy, the percentage-of- completion method should be used. (2) At completion. Examples of revenue recognition at completion of production involve precious metals and agricultural products with quoted prices. These sales prices are reasonably assured, there are low additional costs of distribution, and unit costs cannot be determined because of joint costs. (3) At collection. When collection is highly uncertain and there is no reasonably objective basis for estimating the degree of collectibility, revenue should not be recognized until cash is received. In addition, if collection costs and bad debts are expected to be high and their amount cannot be reasonably estimated, revenue recognition should be deferred. Ex. 18-123—Long-term construction contracts (essay). In accounting for long-term construction contracts (those taking longer than one year to complete), the two methods commonly followed are percentage-of-completion and completed-contract. Instructions (a) Discuss how earnings on long-term construction contracts are recognized and computed under these two methods. (b) Under what circumstances should one method be used over the other? (c) How are job costs and interim billings reflected on the balance sheet under the percentage-of- completion method and the completed-contract method? Solution 18-123 (a) The revenue recognized on a long-term construction contract under the percentage-of- completion method is determined by applying a percentage representing the degree of completion to the total contract price at the end of the accounting period. The percentage may be derived by dividing the costs incurred to date by the total estimated costs of the entire contract based on the most recent information. The revenue so derived is then reduced by the direct contract costs to determine the gross profit recognized in the initial period. In subsequent periods, since the percentage-of-completion method described produces cumulative results, revenue and gross profit recognized in prior periods must be subtracted to obtain current revenue and gross profit to be recognized.

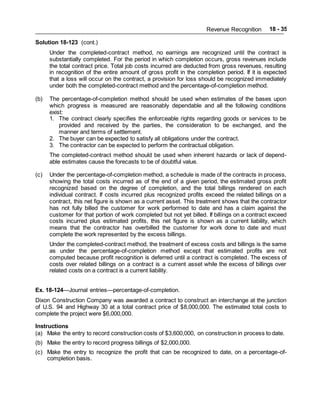

- 35. Revenue Recognition 18 - 35 Solution 18-123 (cont.) Under the completed-contract method, no earnings are recognized until the contract is substantially completed. For the period in which completion occurs, gross revenues include the total contract price. Total job costs incurred are deducted from gross revenues, resulting in recognition of the entire amount of gross profit in the completion period. If it is expected that a loss will occur on the contract, a provision for loss should be recognized immediately under both the completed-contract method and the percentage-of-completion method. (b) The percentage-of-completion method should be used when estimates of the bases upon which progress is measured are reasonably dependable and all the following conditions exist: 1. The contract clearly specifies the enforceable rights regarding goods or services to be provided and received by the parties, the consideration to be exchanged, and the manner and terms of settlement. 2. The buyer can be expected to satisfy all obligations under the contract. 3. The contractor can be expected to perform the contractual obligation. The completed-contract method should be used when inherent hazards or lack of depend- able estimates cause the forecasts to be of doubtful value. (c) Under the percentage-of-completion method, a schedule is made of the contracts in process, showing the total costs incurred as of the end of a given period, the estimated gross profit recognized based on the degree of completion, and the total billings rendered on each individual contract. If costs incurred plus recognized profits exceed the related billings on a contract, this net figure is shown as a current asset. This treatment shows that the contractor has not fully billed the customer for work performed to date and has a claim against the customer for that portion of work completed but not yet billed. If billings on a contract exceed costs incurred plus estimated profits, this net figure is shown as a current liability, which means that the contractor has overbilled the customer for work done to date and must complete the work represented by the excess billings. Under the completed-contract method, the treatment of excess costs and billings is the same as under the percentage-of-completion method except that estimated profits are not computed because profit recognition is deferred until a contract is completed. The excess of costs over related billings on a contract is a current asset while the excess of billings over related costs on a contract is a current liability. Ex. 18-124—Journal entries—percentage-of-completion. Dixon Construction Company was awarded a contract to construct an interchange at the junction of U.S. 94 and Highway 30 at a total contract price of $8,000,000. The estimated total costs to complete the project were $6,000,000. Instructions (a) Make the entry to record construction costs of $3,600,000, on construction in process to date. (b) Make the entry to record progress billings of $2,000,000. (c) Make the entry to recognize the profit that can be recognized to date, on a percentage-of- completion basis.

- 36. Test Bank for Intermediate Accounting, Thirteenth Edition 18 - 36 Solution 18-124 (a) Construction in Process ................................................................. 3,600,000 Materials, Cash, Payables, Etc.......................................... 3,600,000 (b) Accounts Receivable...................................................................... 2,000,000 Billings on Construction in Process.................................... 2,000,000 (c) Construction Expenses .................................................................. 3,600,000 Construction in Process (60% complete)....................................... 1,200,000 Revenue from Long-Term Contracts ................................. 4,800,000 Ex. 18-125—Percentage-of-completion method. Dalton Construction Co. contracted to build a bridge for $5,000,000. Construction began in 2010 and was completed in 2011. Data relating to the construction are: 2010 2011 Costs incurred $1,650,000 $1,375,000 Estimated costs to complete 1,350,000 — Dalton uses the percentage-of-completion method. Instructions (a) How much revenue should be reported for 2010? Show your computation. (b) Make the entry to record progress billings of $1,650,000 during 2010. (c) Make the entry to record the revenue and gross profit for 2010. (d) How much gross profit should be reported for 2011? Show your computation. Solution 18-125 (a) $1,650,000 ————— × $5,000,000 = $2,750,000 $3,000,000 (b) Accounts Receivable...................................................................... 1,650,000 Billings on Construction in Process ................................... 1,650,000 (c) Construction Expenses .................................................................. 1,650,000 Construction in Process ................................................................. 1,100,000 Revenue from Long-Term Contracts ................................. 2,750,000

- 37. Revenue Recognition 18 - 37 Solution 18-125 (cont.) (d) Revenue $5,000,000 Costs 3,025,000 Total gross profit 1,975,000 Recognized in 2010 (1,100,000) Recognized in 2011 $ 875,000 Or Total revenue $5,000,000 Recognized in 2010 (2,750,000) Recognized in 2011 2,250,000 Costs in 2011 (1,375,000) Gross profit in 2011 $ 875,000 Ex. 18-126—Percentage-of-completion method. Penner Builders contracted to build a high-rise for $14,000,000. Construction began in 2010 and is expected to be completed in 2013. Data for 2010 and 2011 are: 2010 2011 Costs incurred to date $1,800,000 $5,200,000 Estimated costs to complete 7,200,000 4,800,000 Penner uses the percentage-of-completion method. Instructions (a) How much gross profit should be reported for 2010? Show your computation. (b) How much gross profit should be reported for 2011? (c) Make the journal entry to record the revenue and gross profit for 2011. Solution 18-126 (a) $1,800,000 ————— × $5,000,000 = $1,000,000 $9,000,000 (b) $5,200,000 —————— × $4,000,000 = $2,080,000 $10,000,000 Less 2010 gross profit 1,000,000 Gross profit in 2011 $1,080,000 (c) Construction in Process ................................................................. 1,080,000 Construction Expenses .................................................................. 3,400,000 Revenue from Long-Term Contracts ................................. 4,480,000

- 38. Test Bank for Intermediate Accounting, Thirteenth Edition 18 - 38 Ex. 18-127—Percentage-of-completion and completed-contract methods. On February 1, 2010, Marsh Contractors agreed to construct a building at a contract price of $6,000,000. Marsh estimated total construction costs would be $4,000,000 and the project would be finished in 2012. Information relating to the costs and billings for this contract is as follows: 2010 2011 2012 Total costs incurred to date $1,500,000 $2,640,000 $4,600,000 Estimated costs to complete 2,500,000 1,760,000 -0- Customer billings to date 2,200,000 4,000,000 5,600,000 Collections to date 2,000,000 3,500,000 5,500,000 Instructions Fill in the correct amounts on the following schedule. For percentage-of-completion accounting and for completed-contract accounting, show the gross profit that should be recorded for 2010, 2011, and 2012. Percentage-of-Completion Completed-Contract Gross Profit Gross Profit 2010 ___________ 2010 __________ 2011 ___________ 2011 __________ 2012 ___________ 2012 __________ Solution 18-127 Percentage-of-Completion Completed-Contract Gross Profit Gross Profit 2010 $750,000a 2010 — 2011 $210,000b 2011 — 2012 $440,000c 2012 $1,400,000d a$1,500,000 ————— × $2,000,000 = $750,000 $4,000,000 b$2,640,000 ————— × $1,600,000 = $960,000 $4,400,000 Less 2010 gross profit (750,000) 2011 gross profit $210,000 cTotal revenue $6,000,000 Total costs 4,600,000 Total gross profit 1,400,000 Recognized to date (960,000) 2012 gross profit $ 440,000 dTotal revenue $6,000,000 Total costs 4,600,000 Total gross profit $1,400,000

- 39. Revenue Recognition 18 - 39 Ex. 18-128—Installment sales. Newton Co. had installment sales of $1,000,000 and cost of installment sales of $700,000 in 2010. A 2010 sale resulted in a default in 2012, at which time the balance of the installment receivable was $30,000. The repossessed merchandise had a fair value of $15,000. Instructions (a) Calculate the rate of gross profit on 2010 installment sales. (b) Make the entry to record the repossession. Solution 18-128 (a) $300,000 ÷ $1,000,000 = 30% (b) Repossessed Merchandise ............................................................. 15,000 Deferred Gross Profit, 2010 (.30 × $30,000)................................... 9,000 Loss on Repossession..................................................................... 6,000 Installment Accounts Receivable, 2010 .................................. 30,000 Ex. 18-129—Installment sales. Sawyer Furniture Company concluded its first year of operations in which it made sales of $800,000, all on installment. Collections during the year from down payments and installments totaled $300,000. Purchases for the year totaled $400,000; the cost of merchandise on hand at the end of the year was $80,000. Instructions Using the installment-sales method, make summary entries to record: (a) the installment sales and cash collections; (b) the cost of installment sales; (c) the unrealized gross profit; (d) the realized gross profit. Solution 18-129 (a) Installment Accounts Receivable................................................... 800,000 Installment Sales ................................................................ 800,000 Cash................................................................................................ 300,000 Installment Accounts Receivable....................................... 300,000 (b) Cost of Installment Sales ($400,000 – $80,000) ........................... 320,000 Inventory ............................................................................. 320,000 (c) Installment Sales ............................................................................ 800,000 Cost of Installment Sales.................................................... 320,000 Deferred Gross Profit (60%)............................................... 480,000 (d) Deferred Gross Profit (60% × $300,000) ....................................... 180,000 Realized Gross Profit on Installment Sales ....................... 180,000