Budgeting thesis

- 1. 1 Titleof Dissertation ASSESSMENTOFTHERELATIVEIMPORTANCEOFHAVINGTHEOLDTRADITIONAL BUDGETINGTECHNIQUEASA PLANNINGANDMANAGEMENT CONTROLTOOL AND ITSCRICITISMS. Author [FredM’mbololo Supervisor [ StefanoAttici] Purpose of the thesis: To contribute tothe budgeting theory ingeneral andmake recommendations on how to improve on the oldtraditional budgeting technique. Academic Year [2013-2014]

- 2. ii Acknowledgement Thisthesisiswritten aspart of furtherresearchonbudgetingbut notforsubmittingforanyparticular degree course. Thisresearchstudyprovidesme withdeeperunderstandingof how oldtraditional budgetingactsas a planningand managementcontrol tool whilecriticallyassessingitscriticismsand consideringthe alternativesmethodsof budgetingsuchasBeyondbudgetingandthe restas outlinedin thisresearchstudy. Firstof all,Ithank my HeavenlyFatherforthe Grace and Healthhe has grantedme Secondly,Iappreciate Stefano Atticci forall hissupportand deepguidance duringthisresearchstudy.I alsothank the facultymembersof LSBFfor theirendlesssupport. Of course,itisneedlesstoshowmygratitude tomycolleagueshere inKenyawho participatedinthe interviewsand helped me incollectingthe relevantdatathrough qualitativemethodapproach. Finally,Ithankmyfamilyandfriendswhoprovidedme withapeace of mindandencouragedme to complete this researchstudy. FredM’mbololo 23, January,2014

- 3. iii Abstract Purpose – Traditional budgetsare seenbypractitionersasbeingincapableof meetingthe demands of the competitiveenvironmentandare criticizedforimpedingefficientresource allocationand encouragingdysfunctional behaviorsuchasmyopicdecisionmakingandbudgetgames.However, budgetingisstill regardedasanorganizational imperative managementtool andthere islittle empirical evidence thatorganizationsaltertheirexistingbudgetingpractices.Iintendtoassessthe relative importance of havinga propertool forbudgetingversusthe abilityof whoever“owns”the budgeting processto criticallyassessthe indicationsthatthe tool isgenerating. Design/methodology/approach –A case studyA was chosenandthe use of budgetsas a management control tool was assessedindetails,the budgetingprocesswasalsoreviewed,alternative methodsto budgetingwere alsoconsidered. Findings–The researchresultsconfirmthere isa contradiction of a highdegree of criticismon traditional Budgetingasmanagementcontrol tool butveryfew organizationshave adoptedthe alternative methodsof budgeting.Itseemsthatthere needs tobe acertainlevel of dissatisfaction withinanorganizationintermsof dysfunctionalbehavior,gamingandgoal incongruency before itstarts to examine itscurrent situationandsearchforalternatives.Assuch,itseemsthatsome momentumfor change needstoexist before changesare considered,ratherthanthatorganizationsare continuously lookingforthe best possible alternative totheirbudgetingprocess.A lackof a needforchange – because the processis consideredsatisfactorilyefficient –is the mostimportantfactor why organizationsare not consideringchangestotheirbudgetingprocess,followedbycognitiveand preconsciousconstraints. Originality/value –The papercontributestothe accountingliterature asitprovidesevidence onthe factors thatcouldinfluence the acceptance of changes inthe budgetingprocess.Knowingthesefactors will increase the chance thatmanagerscan successfullyintroduceandimplementanadjusted budgetingprocessandhence criticallyevaluatebudgetingasanappropriate managementtool. Keywords:Budgeting,Budgets, managementtool Papertype Researchpaper

- 4. iv Acronyms and Abbreviations ABC ActivitybasedCosting ABB Activitybasedbudgeting ABM Activitybasedmanagement BB Beyondbudgeting BBRT Beyond budgetingroundtable BSC Balance Score Card CRM Customerrelationshipmanagement EVA Economicvalue added KPIs Keyperformance indicators MCS Managementcontrol systems RB Rollingbudgeting RAPM Reliance onaccountingperformance measures VBM Value basedmanagement ZBB Zerobasedbudgeting

- 5. v Content of table TITLE PAGE..................................................................................................................................................i ACKNOWLEDGEMENTS............................................................................................................................ ii ABSTRACT..................................................................................................................................................iii ACRONYMS& ABBREVIATIONS................................................................................................................ iv TABLE OF CONTENTS................................................................................................................................v LIST OF TABLES..........................................................................................................................................xi LIST OF FIGURES........................................................................................................................................xii CHAPTER ONE: INTRODUCTIONTO THERESEARCH STUDY 1.0 Introduction............................................................................................................................1 1.1 ResearchBackground.................................................................................................2 1.2 Statementof the problem..........................................................................................3. 1.3 Purpose of the study...................................................................................................4. 1.4 Objectivesof the study...............................................................................................4 1.5 Research questions.....................................................................................................4 1.6 Significance of the study.............................................................................................5 1.7 Scope of the study......................................................................................................5 1.8 Assumptionsof the study...........................................................................................5 1.9 Limitationsof the study...............................................................................................6 1.10 Mitigatingfactorsto the study....................................................................................7

- 6. vi 1.11 Delimitationstothe study..................................................................................7 1.12 Definitionsof terms............................................................................................7 1.13 Structure of the study........................................................................................8 CHAPTER TWO: LITERATUREREVIEW ONBUDGETING 2.0 Introduction..........................................................................................11 2.1 Theory and Evolution of budgeting.............................................11. 2.1.1 The theory of budgeting...................................................11 2.1.2 Evolution of budgeting in France......................................12 2.1.3 Evolution of budgeting in Great Britain............................13. 2.1.4 Evolution of budgeting in United States............................13 2.1.5 Dramatic changes in budgeting.........................................15 2.1.6 Evolution of budgeting within the three waves of economic change................................................................................16 2.2 Other descriptions of a budget and budgeting............................16 2.2.1 Uses of budgets..................................................................16 2.3 The process of budgeting.............................................................20 2.3.1 Budgeting process at Case study A......................................22 2.4 Classification of budgets...............................................................25 2.5 Problems with traditional budgeting in practice..........................26 2.5.1 Additional problems with traditional budgeting...............28 2.5.2 Other benefits of throwing out the budget process and its associated annual performancetrap. ...............................32

- 7. vii 2.6 The role of budgetary data in performanceevaluation...............33 2.6.1 Budget constrained style....................................................33 2.6.2 A profit conscious style.......................................................33 2.6.3 A non-accounting style.......................................................33 2.7 Overview of activity-based budgeting...........................................36 2.7.1 The role of budgeting in planning and control....................36 2.7.2 Activity-based budgeting.....................................................37 2.7.3 The two main benefits of ABB.............................................38 2.7.4 Using ABM for operational improvements and strategic Decisions...............................................................................40 2.7.5 A model of activity-based budgeting....................................44 2.8 Alternatives to traditional budgeting..............................................47 2.8.1 Rolling budget.......................................................................47 2.8.2 Activity-based budgeting...................................................... 48 2.8.3 ZBB beginnings.......................................................................50 2.8.3.1 What ZBB does...................................................51 2.8.3.2 ZBB basics...........................................................52 2.8.3.3 Identifications of organizational decision units..54 2.8.3.4 Construction of decision packages.....................54 2.8.3.5 Ranking of decision packages and allocation of Resources.............................................................55 2.8.3.6 Applicability.........................................................59 2.8.3.7 What can we expect of ZBB.................................61 2.8.4 Beyond budgeting....................................................................62 2.8.4.1 The ‘beyond budgeting’ model-private sector....66

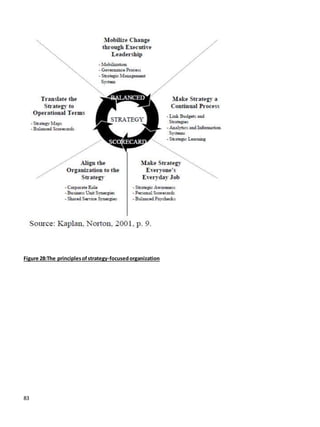

- 8. viii 2.8.4.2 The public sector..........................................68 2.9 Conclusion.........................................................................69 2.10 The beyond budgeting round table (BBRT).......................72 2.10.1 The beyond budgeting or coherent model...74 2.11 Balance Scorecard.............................................................78 2.12 Balance Scorecard as a management control tool............79 2.12.1 Strategy focused organization.......................81 2.12.2 Summary of literature review........................84 CHAPTER THREE: RESEARCH METHODOLOGY 3.0 Introduction............................................................................................87 3.1 Criticism of prior research methods.............................................87 3.2 Research philosophy.....................................................................90 3.2.1 Quantitative research.........................................................90 3.2.2 Qualitative research............................................................91 3.3 Validity, reliability and generalization............................................92 3.3.1 Data quality issues associated with semi-structured and in- depth interviews..................................................................91 3.3.2 Reliability..............................................................................93 3.3.3 Validity..................................................................................94 3.3.4 Generalizability.....................................................................95 3.4 Secondary data................................................................................96 3.5 Primary data....................................................................................97 3.6 Data analysis....................................................................................97 3.7 Ethical considerations in the research study...................................98

- 9. ix CHAPTER FOUR: FINDINGS, ANALYSISAND DISCUSSIONS 4.0 Introduction.....................................................................................102 4.1 Strategic planning..................................................................103 4.1.1 Operational Integration...............................................103 4.1.2 Performancemeasures................................................103 4.1.3 Progress evaluation.....................................................104 4.1.4 Reporting.....................................................................104 4.1.5 Analysis and continuous improvements......................104 4.2 Top down approach budgeting practices...............................106 4.2.1 Advantages of top-down approach of budgeting........106 4.2.2 Disadvantages of top-down approach of budgeting...106 4.3 Budget performance................................................................107 4.3.1 Budget as a fixed contract.............................................109 4.3.2 Performanceevaluation................................................109 4.3.2.1 Time consuming........................................110 4.3.2.2 Planning and forecasting...........................110 4.4 Uncertain and competitive environment.................................111 4.4.1 Budgets are rarely strategically focused and often contradictory..................................................................111 CHAPTER FIVE: CONCLUSIONS, RECOMMENDATIONS AND FURTHERRESEARCH 5.0 Introduction.........................................................................................112 5.1 Some criticisms of the current budgeting systemas a management control tool................................................................................113

- 10. x 5.2 Budgeting at Borealis company........................................................115 5.3 Recommendations...........................................................................116 5.4 The ‘beyond budgeting’ journey towards adaptivemanagement...122 5.5 Areas for further research study......................................................127 6.0 References.......................................................................................128

- 11. xi List of tables: 1. How the budget underminesthe various budgetingmodels............................................32 2. Comparingtraditional andbeyondbudgetingprocesses.................................................71 3. The principlesof the coherentmodel...............................................................................74 4. How leadersneedtochange tomeettoday’scompetitive successfactors...................75 5. The three conditionsrelatedtofive majorresearchstrategies.......................................92

- 12. xii List of figures: 1. Structure of the researchstudy..............................................................................................10 2. Evolution.................................................................................................................................15 3. Outline of the budgetaryprocess...........................................................................................19 4. Budgetaryprocess...................................................................................................................22 5. Illustrationof masterbudget....................................................................................................24 6. Pitfallsof conventional budgeting.............................................................................................29 7. Purposesof budgeting...............................................................................................................36 8. ABCand ABB compared.............................................................................................................39 9. UsingABM foroperational improvementsandstrategicdecisions...........................................40 10.. Outputsof the ABMmodel......................................................................................................42 11. A model of ABB..........................................................................................................................43 12 Overview of the ABBapproach...................................................................................................46 13. Summaryof the rollingbudget..................................................................................................48 14. Summaryof ABB........................................................................................................................49 15. A brief historyof zero-base budgeting......................................................................................50 16. Decisionpackage form...............................................................................................................53 17. Formulationof decisionpackages..............................................................................................55 18. Summaryof ZBB.........................................................................................................................58 19. Management’sinvolvementinthe zero-basedbudgeting........................................................60 20. Advantagesof beyondbudgeting..............................................................................................62 21. Summaryof beyondbudgetingmodel-private sector...............................................................67 22. Summaryof beyondbudgetingmodel-publicsector.................................................................70 23 Traditional budgetingmodel versusthe beyondbudgetingmodel............................................72 24. Managementtoolsandtheirrelationshipwithbudgeting........................................................77 25. Using BSC as a strategicmanagementsystem..........................................................................79

- 13. xiii 26. Linkingstrategytobudgetsina step-downprocedure................................................................81 27. Balance Scorecardstrategymap..................................................................................................82 28. The principlesof astrategyfocusedorganization........................................................................83 29. Impactof advancedbudgetingtechniqueson oldtraditional budgeting.....................................86 30. The budgetperformance cycle....................................................................................................105 31. Breakingthe budgetatBorealis-the fourpillarsof the budget-lessorganization.......................115 32. Separatingperformance managementfromfinancialreporting.................................................116 33. The beyondbudgetingidea;the continuousadaptive process....................................................121

- 14. 1 Chapter 1-Introductiontothe ResearchStudy 1.0 Introduction Budgetingis“still regardedasanorganizational imperative if costsare to be controlled andfinancial performanceto be achieved”(Frow,Marginson, Ogden.,2010). However,traditional budgetsare seenbypractitionersof being incapable of meeting the demands of the competitive environment(Ekhol andWallin,2000, p. 1; Østergren and Stensaker,2011, p. 150) and are heavilycriticizedforimpedingefficientresource allocation,encouragingmyopic decisionmakingandencouragingbudgetgames (Otley,2003; Hansen et al.,2003; Hope and Fraser,2003). At the same time there seemstobe little empirical evidence of organizationsadoptingneworadjusted budgetingpractices (EkholmandWallin, 2000). Beyondbudgetingis: ‘An idea thatcompaniesneed to movebeyond budgeting becauseof theinherentflawsin budgeting especially when used to set contracts.Itis argued thata rangeof techniques,such asrolling forecastsand marketrelated targets,can takethe place of traditionalbudgeting.’ CIMA OfficialTerminology,2005 BeyondBudgetinghasbeenproposedasan influentialideathatwill reinvigorate managementaccounting contributioninbusiness operationandperformance.Itisclaimedthatthe traditional system has lostrelevance withthe modernbusinessenvironmentandisno longersatisfyingthe needsof managers. Budgetshave beeningrained inthe culture of businesssince theirinceptioninthe 1920s and managerswill finditextremelydifficulttoradicallyshifttoasystemwithoutbudgets.The implicationsof aBeyond Budgetingsystemare; performance measuresrelative tocompetitorsanda decentralized organization structure. Alternativessuchasthe rollingbudgetingandactivitybasedbudgeting techniquesmaybe more favorable to managementwhodesiresaformal planningandcontrol system butthe problemisthattheyare evenmore time consumingthanthe traditional budgetingtechniqueshence maynotbe consideredasanappropriate substitute managementcontrol tool.The BeyondBudgetingconceptis still initsinfancyandrequiresfurtherdevelopmentand practical implementation. Hope and Fraser(2003) contendedthatthe budgetingsystem, asimplementedbymostbusinesses, shouldbe eradicated.The budgetingdebate hasarisendue toamovementintothe informationage (Drury,2008).

- 15. 2 Thisthesis discusseshowbudgetinghasevolvedintoits currentstate,before examiningwhythisuniversal technique hascome undersuchheavy criticismof late.The limitationsandweaknessesof usingthe traditional budgetingsystem asamanagementtool will be assesseddoingthe appropriate literaturereview..Atthe core of this researchstudy isthe evaluation whetherthe BeyondBudgetingmodel ismore relevantintoday’s business environmentandif itcan be a prominent managementtool inthe future practicesof managementaccounting 1.1 Research Background I choose a qualitative studyinordertoanswerthe researchquestions. The directorsof this chosen company wantedthe name of the companyto remainanonymoushence Iwill onlyrefertoitas Case studyA. Gerring,(2004:341) suggeststhatregretfully,the term“case study”isa definitional morass. Toreferto a work as a case studymightmean(a) that itsmethodisqualitative, small-N (Yin1994);(b) that the researchis ethnographic, clinical,participant-observation,orotherwise“inthe field”(Yin1994); (c) thatthe researchischaracterizedby process-tracing(George andBennett2004);(d) that the researchinvestigatesthe propertiesof asingle case (Campbell andStanley1963, ; Eckstein[1975] 1992); or (e) thatthe researchinvestigatesasingle phenomenon, instance,orexample (the mostcommonusage). Case StudyA isa local medium-sizedcompanybasedinKenyaandwasestablishedinthe 1990’s; itoperatesina competitivemarketwithshiftingconditions. Ithasa few directorswhoare at the same time shareholders. I had an opportunitytoworkinthat companyand realizedthatthe budgetingprocesswasnotalwaystakenseriouslyby boththe executive managementandthe subordinate staff. Inthe past capital assetshave beenboughtwithoutany formal analysisdone andoutside the budgetedfiguresconsequentlythe companyincurredabig bankloanand has beenrunningona bankoverdraftto finance itsworkingcapital. The banks have of late compelledthe companytocarry outbudgetingastheyneedtosee the companyvari ous budgets tosee whetherthe companywill defaultonthe interestpaymentsandloanpayments. The budgetsare usedinthe companyas a performance evaluator forall itsstaff and alsousedas the ultimate managementplanning and control tool. The budgetingprocessusedisthe oldtraditional budgetingprocess,financial indicatorsare the onlyKey performance indicatorswhile the non-financial indicatorsare largelyignored,itisatop downapproach budgeting approach andbudgetstargetsare imposedonthe lowermanagementlevels. The managementstyle isautocratic, goodachieverswhomeetthe budgetedtargetsare rewardedwithadditional bonuswhilenon-achieversare severely punishedand insome casesactuallydismissed fromwork thusthere isahighturnoverof staff. There is

- 16. 3 hardlyany participative budgetingstyleadoptedinthe company,communicationandco-ordinationof activitiesis usuallypoor. The variance analysis isusually done atthe year-endbythe accountantbutisrarely givenback as feedbacktothe subordinate staff toenable themimprove orcorrecttheirprocesses. 1.2 Problemstatement Case studyA for manyyearshas usedthe traditional budgetingasa managementtool,theyhave notalways preparedthe annual budgets some years back,the annual budgetwasnot preparednot because the companywas practicingbeyondbudgetingbutthe mainreasonwasthe accountant’slack of knowledge onthe budgetingprocess or importance of budgets. Thusthe company is notable to complywiththe annual budget. The problemsthatface case studyA are numerous,tostart with,the budgetaryprocessis usuallyatopbottommanagementandis not punctual and the budgetworkscounterproductive due tothe unrealistictargets. Secondly,the performanceculture isunsatisfactory. AtCase StudyA, the participantsof the budgetaryprocessdo not always workas a team,there isa lot of gaming,dysfunctional behaviorandincongruence inthe company inthat certainindividuals only strivetoattaintheirowngoals while overlookingthe importance of the overall organizational objectivesandgoalsandonlya few individualstrytorealistic achieve the companybudgetswhichare useful andveryhighbutat leastattainable. Therefore,synergiesfromrunningefficientprocessesand accountabilityare fullymissed,andthe budgetmissesitspurpose asa planningand control managementtool for the organizationdue lackof communicationandco-ordinationof activities And thirdly,the companyhasnumerousbankoverdraftsandloanstherefore the topmanagementis always compelledtoprepare budgetsforthemmainlythe cashbudgetandthe budgetedincomesstatementandbalance sheetforthe nextfive yearstosatisfythe bankconditions Therefore,itisnecessaryto critical assess traditionalbudgetingasamanagementplanningand control tool andalso lookat the criticismof thistool and the personincharge of the budgetingprocess.The availableliterature and analysisshouldshowwhetherthe traditional budgetingprocessis still avalidmanagementcontrol tool or alternative budgetingtechniquesare bettertools.

- 17. 4 1.3 Purpose of the study Many organizationsmainly use the traditional budgetingprocessasa managementtool toplanandcontrol the businessoperationsandinordertoassessthe relative importance of havingapropertool forbudgetingand criticismof usingthattool at organization- Case studyA. The traditional budgetingprocessisdiscussedindepthis compared to the alternative budgetingtechniquesthathave beendevelopedrecently. The thesiswill contributetoa betterunderstandingof the traditional budgetingprocessinaholisticwayandto explainthe weaknessesof budgetarycontrol thathave beenfoundinthe literature.A goodunderstandingof the budgetingprocessisanecessityforelaboratingonthe alternative budgetingtechniquesthathave beendeveloped to overcome those weaknesses. 1.4 Objectivesofthe Study To fulfil the purpose of the Research,the followingobjectiveswillbe addressed. (i) To describe and examinethe budgetingprocessat Case StudyA and make recommendationsonhowto improve it (ii) To contribute tothe available literature byexploringthe traditionalbudgetingasamanagement planningandcontrol tool and consideringthe alternative methodsof budgeting. (iii) To describe and examinethe budgetperformance of Case StudyA andmake recommendationonhow to improve whileconsideringthe alternativestothe oldtraditional budgeting andhow theycanbe implementedinthe company (iv) To describe andestablishthe relationshipbetweenthe budgetingprocessandbudgetperformance and make suggestionsonhowtoimprove it. (v) Criticallyevaluate the importance of the oldtraditional budgetingasamanagementplanningand control tool at Case studyA. 1.5 Research Questions (i) What isthe budgetingprocessat Case StudyA (ii) Whatisthe budgetperformance of Case StudyA (iii) Whatisthe relationshipbetweenthe budgetingprocessandperformance in Case StudyA (iv) ShouldCase StudyA Ltd abandonthe traditional budgetingpracticesandadoptotheralternative budgetingtechniqueslike beyondbudgetingapproach.

- 18. 5 1.6 Significance of the Study (i) The studywill benefitthe Shareholders,directorsandthe managementteamof Case StudyA by helpingthem finda solutiontothe problemof poorbudgetperformance. (ii) The studywill be usedbyacademiciansandotherresearchersfor furtherresearchwork. (iii) Make suggestionsandrecommendations thatwill goalong wayinimprovingthe qualityof the budgeting processthat will improve budgetperformance at Case StudyA (iv) The study will be usedtoassessthe linkage andrelationshipbetweenbudgetingprocessand performance. 1.7 Scope of the Study (i) The studywas focusedonthe budgetingprocessintermsof level of participation,degreeof feedbackandcontrol and overall budgetperformance. (ii) Generallyassessthe importanceof havingbudgetingasa managementtool andcriticizingthe importance of that tool. 1.8 Assumptionsof the Study The researcher made the following assumptions regarding this study: i. Participantsansweredthe interviewandsurveyquestionsabout budgets and budgeting process within the organization truthfully. ii. Participants were familiar enough with the budgeting process to answer the survey questions. iii. The researcherexpectedthe entire exercise to move on smoothly relying on the maximum cooperation of all those who were involved. That the case study was ideal to examine the traditional budgeting as a management tool and also assess the alternative methods of traditional budgeting, the data collection instruments had validity and measured the desired parameters and that the participants truthfully and correctly answered the questions.

- 19. 6 1.9 Limitationsof the Study Limitationsare potentialweaknessesorproblemswiththe studyidentifiedby the researcher. The limitations often relate toinadequate measures of variables,lossor lack of participants, small sample sizes, errors in measurement, and other factors typically related to data collection and analysis. These limitations are useful to other potential researchers who may choose to conduct a similar or replication study (Creswell, 2005). The limitations of this qualitative case study include; i. The study involved the perception of participants of a budgeting process but was only within one organization-Case Study A. ii. Perceptions of those who participated are not factual information and are biased based on the participant’s own experiences and attitudes. iii. The expanse of the study area, inadequate financial resources and time constraints also reduced the chances of interviewing more participants and reviewing in details the budgeting process over a given period of time. iv. Concern that case studies lack rigor: Case studies have been viewed in the evaluation and research fields as less rigorous than surveys or other methods. Reasons for this include the fact that qualitative research in general is still considered unscientific by some and in many cases, case study researchers have not been systematic in their data collection or have allowed bias in their findings. v. Not generalizable: A common complaint about case studies is that it is difficult to generalize fromone case to another.Butcase studieshave alsobeenprone toovergeneralization, which comes from selecting a few examples and assuming without evidence that they are typical or representative of the population.

- 20. 7 1.10 Mitigation factors to the study These limitations were mitigated by making sure that; i. The data was collected from individuals who were closely involved or participated in the budgeting process and knowledgeable enough for this study. ii. In writingthe case study,care was takento provide the richinformationinadigestible manner by using a lot of diagrams and simple illustrations. iii. In conductingandwritingthe case study, care has been used in being systematic in the data collection and take steps to ensure validity and reliability in the study and bias findings was also avoided. iv. Yin,a prominentresearcher,advisescase studyanalyststogeneralizefindings to theories, as a scientist generalizes from experimental results to theories , iv The case studyshownwasappropriate throughpilotingandcareful scrutinyof the perceivedparameters involved in the budgeting process. 1.11 Delimitationstothe Study Delimitation narrows the scope of the study. The follow were delimitations of this study: i. Participation in this study was voluntary. ii. The case study only covered the budgeting process in details in one organization. 1.12 Definitionofterms Budget: Bhimani,Horngren,Datar& Foster,(2008) define abudgetasa quantitative future plancreatedbymanagersto assistthe implementationof thisplan. A budgetisan agreeduponplan,expressedinfinancial terms,againstwhich performance tobe realizedinthe future ismeasuredandcompared(de Waal etal.,2004). Shimand Siegel,(2009) gave the mostcomprehensivedefinitionof abudgetas a follows; “A budgetis defined asthe formalexpression of plans,goals,and objectivesof management thatcoversall aspectsof operationsfora designated timeperiod.The budgetis a tool providing targetsand direction.Budgetsprovidecontroloverthe immediate environment,help

- 21. 8 to masterthe financialaspectsof the job and department,and solveproblemsbeforethey occur.Budgetsfocuson the importanceof evaluating alternativeactionsbeforedecisions actually are implemented. A budgetis a financial plan to controlfutureoperationsand results.Itis needed to operate effectively and efficiently.Budgeting,when used effectively,is a techniqueresulting in systematic,productivemanagement.Budgeting facilitatescontroland communication andalso providesmotivation to employees.” As such,the budgetisa financial reflectionof the organization’sannual operatingplan,whichinturnisa translation of the long-termstrategicobjectivesintoshort-termactions. Budgetingprocess The budgetingprocessisthe iterative processinwhichthe budgetisdeterminedinseveral roundsof dialogue betweenhigherandlowermanagementlevels.Thisdialogue resultsinaperformance contractbetweenlowerand highermanagement,stipulatingthe targetstobe achieved.Throughoutthe year, the organizationchecks regularly (oftenmonthly)whetheritisstill ontrackto reach itstargets.Thus, the budget isoftenusedforcontrol purposes withinthe organization. 1.13 Structure of the study: Chapter1: Thisresearch studyaimsto 1) assesscriticallythe oldtraditional budgetingprocessasaplanningand managementcontrol tool,itscriticismsandatthe same time evaluate the otheralternative budgetingtechniques,2) discussthe budgetingprocessandperformance andsuggestsolutionsand3) To describe andestablishthe relationshipbetweenthe budgetingprocessandbudgetperformance andmake suggestionsonhow toimprove it. Chapter2 will focusonthe literature review of budgeting. Itsstartswithdiscussing the theoryand evolutionof budgeting,thenotherdescriptionsof budgeting,the usesandtypesof budgets,criticismsof the oldtraditional budgeting,the commonbudgetingstylesusedbycompanies andotheralternativesof budgetingare alsodiscussed indetails

- 22. 9 Chapter3 It does discussthe researchmethodologyusedinthisstudy. Itelaboratesonthe criticismsof the prior researchmethods. Italsoexplainsthe reasonwhythe qualitativemethodof datacollectionwaspreferredoverthe quantitative one,the rationale of the researchapproachusedandalsoethical considerationsare explainedindepth. Chapter4 The chapterfocuses mainlyonthe findings,analysisanddiscussionof the researchresults. The chapter explainsthe currentproblemsfoundin Case StudyA,budgetary processbasedon itsweaknesses. The use of the budgetsasa performance evaluatorandasa managementcontrol tool isevaluated. The oldtraditional budgeting process isbenchmarkedagainstthe otheralternativebudgetingtechniques like activity-basedbudgeting(ABB), Zero-basedbudgeting,beyondbudgetingtechniquesandthe like thathave been developedrecently decadesto overcome those weaknesses. Chapter5 will summarizethe main conclusions fromthis researchstudy.Itwill alsodiscussthe recommendations and implications forundertakingfurtherresearchinthisfield. Basedon the outcome,anoverviewof the actionsandcontrolswill be giventoensure the bestviablebudgeting solutionforCase studyA.

- 23. 10 Figure1: Structure of the Researchstudy Chapter 1: Introduction of the Research study Problemdefinition, research purpose andobjectives, andstructure ofthe thesis Chapter 2: Literature Review on budgeting ingeneral TheoryandEvolutionof budgeting, Usesand types ofbudgets, budgetingtechniques Chapter 5: Conclusions Conclusions, recommendations andfurther researchwork Chapter 3: Research Methodology Criticisms of priormethods, rationale forthe qualitative approach andethical considerations Chapter 4: Findings/Analysis and Discussions of the results Budgetaryprocess andproblems, alternative budgeting techniques reviewed

- 24. 11 Chapter 2: LITERATURE REVIEW ON BUDGETING 2.0 Introduction: Thischapter mainly focusesonthe literaturereview of budgeting ingeneral.Itsstartswithdiscussingthe theoryand evolutionof budgeting inthe developednationslikeFrance,GreatBritain,the UnitedStates,the evolutionof budgetinginthree economicwave is alsodiscussed. The otherdescriptionsof budgeting are given,the usesand typesof budgets are explained,the criticismsof the oldtraditional budgeting asa planningandmanagementcontrol tool is discussed,the commonbudgetingstylesusedbycompaniesandotheralternativesof budgeting processes are elaboratedonandtheirsuitabilityincomparisontothe oldtraditional budgetingtechnique isalsocritically assessed 2.1 Theory and Evolution ofBudgeting 2.1.1 The Theory of budgeting In social sciencesatheoryisa testable model of humaninteractionscapable of predictingfuture occurrencesor eventsof the same kindas well ascapable of beingtestedthroughexperimentorotherwise verifiedthrough observation.Budgetingdoesnothave atheoryinthe classical sense of providinganorientationtothe field,stating assumptionsandpointingtosome hypothesesaboutwhatcauseswhat(Rubin1997). Accordingto Rubin,budgettheory“isfragmentedandincomplete…[it] isinthe process of beinginvented”(Rubin 1997: 185). Inother words,the theoryof effectivebudgeting iscontinuallyevolving.Scholarssee “the studyof budgetingaspart of a largerresearch agendawhichwouldultimatelyenable prediction of consequencesandthe comparative analysisof governmentalpolicy”(Caiden1994: 44). Many budgetpolicies,procedures,andtechnical practicesthatwe currentlyassociate withmodernbudgetingwere developedduringthe nineteenthcenturywhenmajorchangesinbudgetpracticesoccurredinFrance.Atthe time Napoleon’sprimaryconcernwaswithmasteringthe militarybudget.Toobtainbetterinformationandcontrol on militaryspending,Napoleon establishedthe CoursdesComptes(WebberandWildavsky 1986).

- 25. 12 2.1.2 Evolution of budgetinginFrance Early 19th centuryFrance sawthe establishmentof the wordsbudgetandbudgetaryprocedures.Bythe 1860s, France had developedauniformaccountingsystemthatitappliedtoall departmentsandunitswithindepartments, a standard fiscal year,conventionsonhowlongencumbrancescanbe heldopenafterthe close of the fiscal year, and a requirementthatall departmentsexplainprogrammaticallyandaccountfiscallyforall fundswhichtheywere allocated.The budgetwasconsideredtobe one of the government’sprimarypolicydocuments.Indeed,the control of governmentexpenditureswasassuredthroughthe schedulingof expendituresbydifferentdepartments. Expenditure claimsthatexceededabudgetcategory wouldnotbe honoredforpayment. 2.1.3 Evolution of budgetingin Great Britain Britishbudgetarypracticesof the mid-19thcenturylackednotonlymanyof the technical featuresof the French budgetarysystem,buthadnotadoptedthe emphasisonconsistencyanduniversalityof applicationthatwascentral to the underlyingpublicsectorbudgetprocess.Forexample,althoughmostfundsunderthe mid-19thcentury Britishsystemwere appropriatedbyParliament,there wasnosingulardocumentreflectingall government expenditures,nocomparisonsbetweenbudgetedexpendituresversusactual expenditures,anddifferentaccounting mechanismswhere usedbyvariousdepartments.Lumpsumappropriationswere widelyused.Duringthe period whenWilliamGladstonewas Chancellorof the ExchequerandlaterPrime Minister,he andotherreformers integratedmanyof the more advancedfeaturesof Frenchbudgetarytechniquesasa wayof controllinggovernment finances. For example,in1861 the PublicAccountsCommittee wascreatedinEngland. In 1866, the officesof the Comptrollerand AuditorGeneral were created. Gladstone emphasizedthe notionof balancingthe budget. Thisprincipal became atechnical feature of hisbudgets(WebberandWildavsky1986). Thus bythe endof the 19th centurythe frameworkformoderngovernmentbudgeting (unity,balance,comprehensiveness,andcontrol) hademergedinEurope.

- 26. 13 2.1.4 Evolution of budgetingin the UnitedStates In contrastto Europe,budgetreforminthe UnitedStateswas initiallyestablished atthe local notnational governmentlevels.Thiswasinpartdue to the fact that the public hadmore directcontrol overlocal activities.Mass immigration,coupledwithincreasing industrializationandurbanization,createdlarge demandsuponlocal governmentsforhousing,education,healthcare andtransportation(Rabin1997; WebberandWildavsky 1986). To more efficientlymanage theseincreasingdemandsongovernmentservices, Standardized accounting,reporting, and auditingpracticeswere introduced. The budgetingprocessinthe UnitedStateswaslargelyimpactedbytwocompetingcoalitions: (1) The Federalists(Whigs) whosupportedanactive governmenttopromote commerce,buildinfrastructure necessaryforeconomicactivity, anddevelopthe financial institutionsnecessarytosupporteconomicgrowth;and, (2) The Republicans(DemocraticRepublicans,thenlaterDemocrats) whobelievedthattaxesshouldbe keptlow and governmentkeptata minimumsothatsmall farmersandtradesmancouldfreelypursue theirtrade without governmenthindrance (Rabin1997). Competingcoalitionswere keptinequilibriumthroughthe normof abalancedbudget.The normof a balanced budgetsolidifiedintoapractical limitationongovernmentactivity.Ratherthandevelopingthe technical capabilities to control spendingaswasoccurring inEurope,the UnitedStatescontrolledbudgetaryoutlayssimplybykeeping the governmentsmall (WebberandWildavsky1986). Congressitself hadnomechanismtoensure thatappropriate spendingwasbeingimplementedwithout modifications. To addressthe problemsof mountingdebt,the fragmentationof powerandthe absence of publicaccountability and control incombatingcorruption19th and 20th century budgetreformersinthe U.S.proposedanarray of improvementsincludinguniformaccountingandauditingpractices,andaseriesof practicesforfinancial planning and administrationthatcame to be knownas the executive budgetmovement.Central tothe reformsinthe U.S.of thisera wasthe conceptof the responsible executive (i.e.,astrongmayor).Ineffect,reformerswere adoptingmany of the businesspracticesof the daywithstrongexecutiveauthority(i.e.astrongbusinessexecutive).The first

- 27. 14 principal of thismovementbecamethatbudgetsshouldbe developedandproposedbythe executivetoaccomplish statedobjectivesforwhichthe executive wouldlaterbe held accountable tothe voters. For fiscal clarity,budgetswouldbe unifiedandencompassnot onlyexpendituresbutalsorevenues.Publicsector budgetingwouldessentiallyfollowthe practice of Americancorporationsbybeingcomprehensive,balancedand annual (Taylor1911). A uniformaccountingsystem, the establishmentof acomptroller,andprotocols forbothreportingandauditing wouldaidthe developmentandimplementationof the budget. A keydevelopmentinbudgettheoryhasbeenthe differentiationbetweenmicrobudgeting andmacro-budgeting and the inherenttensionbetweenthem(LeLoup,1988). Macro-budgetingiswhere highlevel decisionsonspending,revenue anddeficit aggregatesandrelative budget share are oftenmade fromthe top down.Micro-budgetingiswhere intermediatelevel decisionsonagencies, programs,and line-itemsare usually made fromthe bottomup.Bothlevelsof budgetinganalysisare interestedin howpowerisstructuredinbudgetaryprocessesaswell ashow it isexercisedandexpressedthrough budgetary choices.These techniqueshelpedtolinkbudgetingtoalarger agendaof improvingpublicsectorperformance. The evolutionof budgettheoryandpolicy-makingpracticesillustratesthat undeniable progresshasbeenachieved, oftenonmodestfrontsandwithreasonably simpletechniques.Budgetpracticesacrossthe globe have been graduallyevolvinginto becomingmore uniformwithrespecttoaccountingandauditingpractices,balance,and control.Lost inthe evolutionof effective budgetingpracticesisthe identificationof demandside (social accountabilitytothe local community) issuesof identificationof needs(budgetplanning),managerial efficiency(budgetexecution),andeffectivenessof implementation(budget execution).

- 28. 15 2.1.5 Dramatic changesin budgeting In the 1980s and 1990s, bothnational andsubnational governmentshave witnesseddramaticchangesinbudgeting. Alongthe way,decentralizationbecameanimportantcomponentof publicsectorreformeffortseliminatingthe planningbureaucracy’smonopolyoverthe budget.Inmanycountries“[w]idespreadinterestindemocratization encourageddevolutionof authoritytoautonomousmunicipal governmentsascounterweightstothe centralized governmentsof the past,andinholdingregularlyscheduledelectionstotransferpowerfromtraditionalnational level rulingelitestoaccountable electedofficials”(Guess1997:248). In these countries,transitionfromcentrallyplannedsystemstodemocraciesledtoa demandforgreater accountability,whichinreturnrequiredatransparentfinancialmanagementsystem. An ongoingchallengeforcountriesinimplementingdecentralizationprogramsistodevelopcoordinatedbudgetary and financial managementreformpoliciesacrosslevelsof governmenttoensure correspondence withnational macroeconomicobjectivesforinflation,growth,fiscal andmonetary stabilization (Ter-Minassian,1997) and linking betterbudgetformulationandexpenditure processestoproactive civilinvolvementand oversight. Figure 2: Evolutionof budgetingwithinthe three waves of economicchange:

- 29. 16 2.1.6 Evolution of budgetingwithinthe three wavesof economicchange: In the informationanddigital erawithinwhichcompaniesoperate today,the keycompetitiveconstraintisnolonger land,laboror capital. It is knowledge orintellectual capital,competentmanagers,skilledworkers,effectivesystems, loyal customersandstrongbrands (Hope andFraser,1997:20). Thisis the periodtheycall “informationwave”,inwhichthe waya successful companyoperatesisshiftingfroma “make-and-sell”toa “sense-andrespond”approach. “Make-and-sell”isanindustrial-age model basedontransactions,capital assets,massproduction,economiesof scale and productmargins,while “sense-andrespond”isaninformationandservice age model whichemphasizes clientrelationships,intellectual assets,masscustomization,economiesof scope andvalue creation(Fraser,2001,24) If we closelylookatthe timeframe inthe above figure,itcanbe notedthat advancedbudgetingmodelshave been developedonlyrecently. Inmy ownopinion,these modelsportrayanatural response fromcompaniesthathave had to slowlyevolve inordertoavoidextinctionandcontinue survivinginthe currentmarket. 2.2 Other descriptionsof a budget and budgeting A budgetis a periodicquantitative andfinancial expressionof future plansof action. Budgetingisthe processby whichthe plansof action are chosen,coordinated,communicatedandevaluatedinthe organization.Thismeans that budgetingconsistsof bothaplanninganddecisionmakingex ante aswell asmonitoringandperformance measurementex post.Itmustlikewisebe noticedthatbudgetingischaracterizedbybeingperiodiceconomic managementthathasto be coordinatedwiththe strategicobjectivesanddecisionslike choice of placement, technology,markets,customersetc.onthe one handand the operational daytoday decisionsonthe other.There are several factorsthatmake budgetingimportantfordecisionmakingandmanagementcontrol tool. 2.21 Uses of budgets Firstly,budgetingplaysacrucial role inthe goal setting (targetsetting) procedure inmanyorganizationsasitsets the standard forthe performance inthe comingperiod.Asmentionedearlierresearchfromdifferenttheoretical standpointshasovertime paida lotof attentiontothe effectsbudgetparticipationintargetsettinghason organizational performance.Likewisethe relationshipbetweenbudgettargetachievability(budgetdifficulty) and

- 30. 17 performance hasgainedinterestasa researchobject.While there are anagreementinthe literature onthateasy achievable targetsleadstopoorperformance there maystillexistsdifferencesinthe perceptionof how stretched the targetsshouldbe to optimize the performance.While manyargue thatthe probabilitytoachieve budgettargets islessthan 50 percenta classical studycarriedoutby Merchant& Manzoni (1989) findthattargets can be challengingfororganizationsevenif theyare likelytobe achieved. Secondly,budgetingopensupforthe possibilitytoefficientlyorganize the decision making and planningprocess in the company.The circumstance that the companybecomesable toseparate the decisionpointsfromthe time of executionof actionsleadstoareductionof the time pressure onthe organization.Thathappenswhenthe company inits budgetdocumentsitsplannedactions,includingdate of executionandwhichpersonsandorganizational units that will participate.If the companyplansa salescampaign,salesmaterialisfirstdesignedandproducedtoensure that brochures,TV-commercialsetc.are readywhenthe salesseasonstarts.Butitalsohappenswhenthe decisions requiresasignificantlyamountof analytical work.Thatistypical forstrategicdecisionslike marketdevelopment, productdevelopmentorimplementationof new technology.These typesof decisionsrequiresaconscious managementof the analytical andideageneratingworkthatprecede the choice of a new strategy.Inthat connectionthe strengthof budgetingis,thatthe companyforeachbudgetperiodcandecide,whichdevelopment tasksthat shall be carriedout, whoshall be involvedandwhenthe tasksshall be carriedout. Thirdly,budgetingopensuptoa higherdegree of decentralization incertainphasesof the decisionmakingprocess. It is,thus,possible toletdifferentpersonsinthe decisionmakingprocessthanthe onesthatwill have toexecute the decision.Thiscanbe personswithknowledge withinmarketanalysis,advertising,planningasalespromotion,after whichthisisprimarilycarriedoutby the company’ssalespeople.Anotherexamplecouldbe toinclude accountants and productengineersinpreparationof the companysalesplanwiththe purpose of controllingsaleswithfocusof profitabilityandthe utilizationof scarce productioncapacity. Fourthly,control of a company’seconomyassumesthatthe company’s resources can,as far as possible,be adjusted to the expectedlevel of activity.The opportunityforacquiringanddisposingof resourcesisnaturally controlledby the opportunitytoadjustresourcestoactivitywhichisconditionedbyresourcesvariabilityandreversibility. Resource adjustmentalsoappliesinsituationswhere the companyisateitherfull capacityorat capacitydeficiency and where the capacityistherefore actingasa capacity constraint.Insuch situationsperiodicplanningwith budgetingisone wayof ensuringthatthe scarce capacityis usedinthe besteconomicwaypossible. Fifthly,budgetinggivesthe opportunitytoensure coordination of activitycreationacrossbusinessfunctions.By coordinationisinthiscontextunderstoodas thecoordination of decisions inseveral instances.The needfor coordinationariseswhenmore functionsororganizational departmentstogetherhave toparticipate inthe business activity. Intradingcompaniesitcouldbe purchasingandsale,inmanufacturingcompaniesthisalsoincludes

- 31. 18 productionandinservice companiesitcanbe the differentspecialistfunctionsthatworktogether.Butthe need for coordinationalsomayexistwhenitcomestothe company’sotherfunctionssuchasHR, finance andresearchand development.A numberof the tasksperformedbya HR departmentlike hiringandfiringof employees,employee trainingandthe development of employee policiesare largelycontrolledbythe “demand”fromthe other departmentsof the company.Thisrequirescoordinationandconcerningthe periodicfinancialcontrol,the budget acts as a central coordinationmanagementtool.

- 32. 19

- 33. 20 Figure 3 Outline of the budgetary process. Source:Adaptedfrom Lucey (1993) pp332

- 34. 21 2.3 The process of budgeting The budget traditionally flows out of the mission statement and organization strategy. The mission statement is worked out into a strategy which will be the main goal for the organization for the upcoming years. A concrete financial plan is composed from the strategy containing the financial consequences for the upcoming year. This is the budget.The management communicates the budget through the top-down method. The top-down method is one of the maincharacteristicsof the budget,andmeansthat the informationcomesfromabove;the management, and movesdowntowardsthe line management.The linemanagersthenformulate theirownbudgetand year-goals and sendtheirplansback(bottomup) to the management.The managersandthe line managers then discuss pl ans inorder to reacha final budgetandyeargoal.Next,the budgetisusedtocontrol whether or not the organization is still ontrack e.g.controllingwhetherthe goals,setinthe strategy,are beingreached. If necessary, the organization takescorrective measures.Atthe endof the year the evaluation and rewarding takes place. A comparison is made betweenthe goalssetinthe budget,andthe goalsreachedbythe staff.The diagram below givesaclearoverviewof the above mentioned process. At Case studyA thisalternative budgetingprocessisimplementedratherthanthe priorbudgetingprocessasthe operationsforthe companyare local and not complex.

- 35. 22 Figure 4: An Alternative budgetingprocess 2.3.1 Budgeting process at Case Study A In orderfor the budgettobe inuse from the start of the nextfinancial year,budgetingprocessstarts three to five monthsbefore the fiscal yearchange. The budgetcan is dividedintothree parts: 1. Revenue turnover, 2. Direct costsand 3. Indirectexpenses. Directexpensesrelate directlytorevenueasthey,ina service company,containsalarycosts.Theyare quite easyto justifyastheycan be linkedtorevenue levels.Indirectorsupportingexpensesare hardertojustifyandtheir allocationwithinthe organizationcanbe complex asthe companydoesnotuse the ABC costingmethod. In myopinion,budgetingisaback-and-forthmovementbetweenthe topandlowermanagement. In a top-downapproach like inthisCase StudyA scenario,detail-level plansare givenfromthe executive managementforwhichthe sub-unitbudgetsare basedon. Thismeansthat the uppermanagementfirstgivesout broad overall objectivesandthe constraintsof the company.Thenthe lower-levelmanagers work tomeetthe budgettargets basedon theirownexpectationsandknowledge.

- 36. 23 However, if the lower-level managersare notactivelytakingpartintothe process,theywill notcommitthemselves to the setobjectives. Commitmentisvital asthe effectiveness of budgetingprocess dependsonit. Whenmanagerstake part insettingtheirownunit’sobjectives,theyare more likelytotake responsibilityforthose objectivesandcanbe held accountable. Astheytake the settargetsas their own,theywill strive toachieve them. While creatingthe budget,the corporate level goalsmust be takenintoaccount,butin orderto make the budget realistic,itsgoalsandfigurescannot simplybe dictatedfromabove,since the lower-levelmanagersusuallyhave a deeperunderstandingontheirunit’sbusinessthanthe finance orthe uppermanagement .

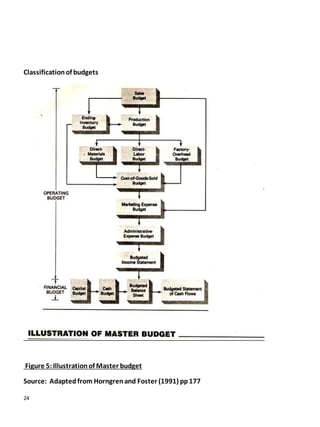

- 37. 24 Classificationof budgets Figure 5:Illustrationof Master budget Source: Adapted from Horngrenand Foster (1991) pp177

- 38. 25 2.4 Classificationof budgets Horngrenand Foster(1991) suggestthe followingasclassificationof budgets: There are countlessformsof budgets. Manyspecial budgetsandrelatedreportsare preparedincluding: -Comparisonsof budgetswithactual performance (performancereports) -Reportsforspecificmanagerial needs- forexample,cost-volumeprofitprojections -Longterm budgetsoftencalled‘capital’or“facilities”or“project”budgets. -Flexiblebudgets -Life-cyclebudgets Figure 2 showsa simplifieddiagramof the variouspartsof the masterbudget,the comprehensiveplan,a coordinatedsetof detailedfinancialstatementsforshortperiods,usuallyayear. Asthe diagramindicates,many supportingbudgetsare necessaryinactual practice. The bulkof the diagrampresentsvariouselementsthat togetherare oftencalledthe operatingbudgetwhichisthe income statementanditssupportingbudgets. In contrast,the financial budgetisthatpart of the masterbudgetthatcomprisesthe capital budget,cashbudget, budgetedbalance sheetandbudgetedstatementof cashflows. Itfocusesonthe impacton cash of operationsand otherfactors suchas plannedcapital outlaysforequipment. For simplicity,figure5doesnot showall functions (forexample,research) andthe interrelationshipsamongthe variousbudgets. Forinstance the amountof interestexpense onthe budgetedincomestatementisaffectedbythe cash budget. Moreover,toavoidclutterthe figure doesnotemphasize thatonce the salesbudgetiscompleted, purchasing,production,marketingandadministrativedepartmentscanoftenbe workingontheirbudgets simultaneously. Similarly,the variousingredientsof the financial budgetare oftenpreparedsimultaneously.

- 39. 26 2.5 Problems withtraditional budgeting inpractice A recentreportby Neely,Sutcliff,Heyns, (2001),drawnprimarilyfromthe practitionerliterature, liststhe 12 mostcitedweaknessesof budgetarycontrol as: 1. Budgetsare time-consumingtoputtogether; 2. Budgetsconstrainresponsivenessandare oftenabarrierto change; 3. Budgetsare rarelystrategicallyfocusedandoftencontradictory; 4. Budgetsadd little value,especiallygiventhe time requiredtoprepare them; 5. Budgetsconcentrate oncost reductionandnot value creation; 6. Budgetsstrengthenvertical command-and-control; 7. Budgetsdo notreflectthe emergingnetworkstructuresthatorganizationsare adopting; 8. Budgetsencourage gamingandperverse behaviors; 9. Budgetsare developedandupdatedtooinfrequently,usuallyannually; 10. Budgetsare basedon unsupportedassumptionsandguesswork; 11. Budgetsreinforce departmentalbarriersratherthanencourage knowledge sharing; and 12. Budgetsmake people feel undervalued. While notall wouldagree withthese criticisms,otherrecent critiques(e.g.,Schmidt1992; Hope and Fraser1997, 2000, 2003; EkholmandWallin2000; Marcino 2000; Jensen2001) alsosupportthe perceptionof widespreaddissatisfactionwithbudgetinginpractice.We synthesize the sourcesof dissatisfactionasfollows. Claims1, 4, 9, and10 relate tothe recurringcriticismthatby the time budgetsare used,theirassumptionsare typicallyoutdated,reducingthe value of the budgetingprocess. A more radical versionof thiscriticismisthatconventional budgetscan neverbe valid because theycannotcapture the uncertaintyinvolvedinrapidlychangingenvironments (Wallender1999). In more conceptual terms,the operationof auseful budgetarycontrol systemrequirestworelatedelements.First, there mustbe a high degree of operational stabilitysothatthe budgetprovidesavalidplanfora reasonable period

- 40. 27 of time (typically the nextyear).Second,managersmusthave goodpredictive modelssothatthe budget providesa reasonable performance standardagainstwhichtoholdmanagersaccountable (BerryandOtley1980). Where these criteriahold,budgetarycontrol isauseful control mechanism, butfororganizationsthatoperate in more turbulentenvironments,itbecomes lessuseful (Samuelson2000). Claims2, 3, 5, 6, and 8 relate toanothercommoncriticismthatbudgetarycontrolsimpose avertical command-and- control structure,centralize decisionmaking,stifle initiative,andfocusoncostreductionsratherthanvalue creation.Assuch,budgetarycontrolsoften impedethe pursuitof strategicgoalsbysupportingsuchmechanical practicesas lastyear-plusbudgetsettingand across-the-boardcuts. Moreover,the budget’sexclusive focus onannual financialperformance causesamismatchwithoperationaland strategicdecisions thatemphasize nonfinancial goalsandcutacross the annual planningcycle,leadingto budget gamesinvolvingskillful timingof revenues,expenditures,andinvestments (Merchant1985a). Finally,claims7,11, and 12 reflectorganizationalandpeople-relatedbudgetingissues. The critics argue that vertical,command-and-control,responsibilitycenter-focusedbudgetary controlsare incompatiblewithflat,network,orvalue chain-basedorganizational designs andimpede empoweredemployees frommakingthe bestdecisions(Hope andFraser 2003). Givensucha longlistof problemsandmanycallsforimprovement,itseemsoddthat the vast majorityof U.S.firms retaina formal budgetingprocess(97percentof the respondents inUmapathy[1987]). One reasonthat budgetsmaybe retainedinmostfirms isbecause theyare so deeplyingrainedinanorganization’s fabric(ScapensandRoberts1993). ‘‘Theyremainacentrallycoordinatedactivity(oftenthe onlyone) withinthe business’’(Neelyetal.2001, 9) and constitute ‘‘the onlyprocessthatcoversall areasof organizational activity’’

- 41. 28 2.5.1 Additional Problems withtraditional budgeting In the ACCA studytextof AdvancedPerformance management(2012:37), the Get through guide,postulates the followingaspitfallsof traditional budgeting. Advocatesof beyondbudgetinghave criticizedconventional budgetingprocessesonseveral counts. Itisclaimed that budgets: Cannotcope witha fast-changingenvironmentandtheyare oftenout-of-datebeforethe startof the budget period. Focustoo much managementattentiononthe achievementof short-termfinancial targets. Instead, managersshouldfocusonthe thingsthat create value forthe business(e.g.innovation,buildingbrand loyalty,respondingquicklytocompetitivethreatsandsoon). Reinforce a‘commandandcontrol’structure that preventsjuniormanagersfromexercisingautonomy. This may be particularlytrue where a top-down approach,thatallocatesbudgetstomanagers,isbeingused. Where managersfeel constrained,attemptstoretainandrecruitable managerscan be difficult. Take up an enormousamountof managementtime thatcouldbe betterused. Inpractice,budgetingcanbe a lengthyprocessthatmay involve muchnegotiation, reworkingandupdating. However,thismayaddlittle to the achievementof businessobjectives. Are basedaroundbusinessfunctions(e.gsales,marketing,productionandsoon). However,toachieve the business’sobjectives,the focusshouldbe onbusinessprocessesthatcutacross functional boundariesand reflectthe needsof the customer. Encourage incremental thinkingbyemployinga‘lastyearfigure plusa certainpercent’approachto planning. Thiscaninhibitthe developmentof ‘breakout’strategiesthatmaybe necessaryina fast-changing environment. Can protectcosts ratherthan lowercosts. In some cases,a fixedbudgetforanactivity,suchasresearchand development,isallocatedtoamanager. If the amountis notspent,the budgetmaybe takenaway and in future periods,the budgetforthisactivitymaybe eitherreducedoreliminated. Sucha response tounused budgetallocationscanencourage managerstospendthe whole of the budget,irrespective of need,inorder to protectthe allocationstheyreceive. Promote a negative mentalityamongstmanagers. Inordertomeetbudgettargets,managersaytry to negotiate lowersalestargetsorhighercostallocationsthantheyfeel isreallynecessary. Thishelpsthemto buildsome ‘slack’intothe budgetsandsomeetingthe budgetbecomeseasier.

- 42. 29 Moreover,one of the biggestproblemswithbudgetsisthattheytendtopromote an inward-looking,short- termculture that focusesonachievingbudgetfigure,ratherthanonimplementingbusinessstrategyand creatingshareholdervalueoverthe mediumtolongterm. Figure 6: Pitfallsof conventional budgeting,Source:Adaptedfrom ACCA study text,(2012:37) Otley(2003) believesbudgetsystemhasthe potential tocreate dysfunctionalbehaviour anddiscusseshis experience of acoal mine thatheld backstock to meetweeklyquotas,anexampleof ‘Cookingthe Books’.

- 43. 30 Wallander,formerexecutive forHandelsbanken inSweden,criticizedandabandonedthe budgetinthe 1970’s. He statesinhiswork “Budget-anunnecessaryevil”,thatorganizationcoulddobetterwithoutbudgeting. First, Wallanderclaimsthatthe budgetisbasedonthe principle “same weathertomorrow astoday”(Wallander,1999) The budgetindicatesanongoingnormal andcontinuoustrend,thusthe budgethasnoeffectasa managementtool for forecasting. Secondly,if somethingunexpectedoccursthe budgetwouldbe atno helpeither(Wallander,1995). The budgetrather stopspeople fromtakingactions. AccordingtoWallander,budgetsare summariesbasedon guessesandassumptionsaboutthe future andexcludeunpredictable events. Inbestcase scenariosbudgetsare onlya waste of resourcesandin worstscenariostheyare dangerousbecause theygive deceitful informationabout where firmsare heading. The majorityof criticismof traditional budgetingmethodshasbeenpublishedby the proponentsbehindthe Beyond Budgetingmovement,Hope &Fraser. Theirinitial criticismswereusedasa spearheadtocreate a better managementtool. Traditional methodsrelyonpastinformationwhichcanhave negative knockoneffects.Anexample isthe incremental budgetingtool,wherethe previousyear’sbudgetis slightlyadjusted forthe new yearwithoutany analysisintoareaswhichare over/underperforming. The performance evaluationisgenerallycarriedoutatthe end of the budgetperiod;thiscan be toolate to remedy deficiencies.Leadingonfromthis,the commonpractice isto carry outfixedpercentage cutswhenearlyresults appearunacceptable (Hope &Fraser,2003). Libby& Lindsay(2007) feel thatthe problemsare originatingfromhow budgetsare implementedandusedwithin business,if usedcorrectlytheystill canbe a veryeffective tool. Ekholm& Wallin(2010) agree withLibbyand Lindsay,andadd thatif properly usedtraditional budgetsare astrong frameworktoplanand measure acompany’s operations.Therefore itcanbe suggestedthatmany of the inadequaciesof traditional budgetscouldbe downtothe implementationandnotthe tool itself. Despite the reasoningbehindthese limitations,Hope andFraser(1997) report that 99% of Europeancompaniesuse formal budgetingprocedures,thisfigure islikelytoremainhigheventoday.Inaddition,asurveyof US organizations by Libby& Lindsay (2007) revealedthatover50% of seniormanagersfeltbusinessescouldnotcope without budgets and that theywere imperative tosuccess.Managersalsobelievedthatdespite the associatedtime andcosts, budgetswere addingvalue toacompany.

- 44. 31 Ekholm& Wallin (2010) feel the annual budgetisnotdeadyet,butit ispast itspeakand has lostusefulness and become outdated. The existingbudgetmodel cannotpossiblybe of anyuse forthe followingreasons: Budgetsdonot helpcompaniesfocusonthe performance driversof today’sorganizationse.g.innovation rates,service levels,quality,andknowledge sharingetc.(these are clearlyshowninabalancedscorecard) Budgetshave beenturnedintofixedperformance contractsandhave ledtodysfunctional behaviorwithdire circumstances - managersina studywere foundtobe inclinedtoeithertryandbeatthe systemorfelt pressuredtoachieve targetsat any cost (the same behaviorthatgeneratedmanyof the recent“managed earnings”scandals) Budgetstreatall employeesascosts;whereasateam’stalent,innovationandcommitmentare more importantindeterminingperformance thanthe “personnelcosts”of the teamthe budgetprocessbuilds silos,effectivelycompartmentalizingacompanyintosmall units. Hope and Fraser(2003a) were the firstto pointoutthat the budgetprocesslimitsthe abilityof organizationsto make full use of newmanagementphilosophiessuchaseconomicvalue added(EVA),BalancedScorecard,activity basedmanagement(ABM),customerrelationshipmanagement(CRM) androllingforecasts Hope and Fraser(2003b), the managementgurusbehindthe “Beyondbudgetingmovement”have statedthatnot onlyisthe budgetprocessa time consuming,costlyexercise generatinglittle value,butalso,andmore importantly, a major limitingfactoronhowyourorganizationcanperform.Theyhave manyexamplesof companies,following the philosophiestheyhave expounded,whichhave brokenfree andachievedsuccesswell beyondtheir expectations.Here are three quoteswhichchallengethe veryconceptof budgeting. “So long as thebudgetdominatesbusinessplanning a self-motivated workforceisa fantasy,howevermany cutting- edgetechniquesa company embraces” “Modern companiesrejectcentralization,inflexibleplanning,and command and control.So why do they cling to a processthatreinforcesthosethings?” “The samecompaniesthatvowto respond quickly to marketshiftscling to budgeting – a processthat slowsthe responseto marketdevelopmentsuntilit is too late.”

- 45. 32 2.5.2 Other benefitsofthrowing out the budgetprocess and its associatedannual performance trap Many readerswill have wonderedwhythe introductionof soundnew managementtoolshasnotworkedintheir organization.Hope andFraserhave foundthe culprit;the budgetprocess asexplainedinthe below drawntable: Model How the budget undermines the model Economic Value added (EVA) The “silo based” budgeting approach is not compatible with a process view of the organization which is required for EVA. Benchmarking The extent of under performanceagainst best-in-class standards loses its visibility as the shortterm budget (fixed performance contract) dominates thought and action Balance Scorecard (BSC) Itis easy to turn the BSC with its financial and non-financial measures into yet another fixed performancecontract with the same dysfunctionalbehavior. The silo approach to budgets again wins over the strategic and cross functionalfocus that a BSC needs Activity based management (ABM) The budget process does not focus on costdrivers or critical success factors but instead forces management to sail a coursethat was set many months earlier which may haveno relevance to the prevailing conditions Customer relationship management (CRM) The inside-out budget process is at odds with the outside-in CRM strategies. Sales staffs aretoo frequently hell bent on meeting internal goals rather than customer satisfaction and customer profitability. Table 1: How the budgetunderminesvariousbudgetingmodels (Otley1999). However,amore recentsurveyof Finnishfirmsfound thatalthough25 percentare retainingtheir traditional budgetingsystem,61percenta reactivelyupgradingtheirsystem, and14 percentare eitherabandoning budgetsorat leastconsideringit(EkholmandWallin2000). We discusstwopractice-leddevelopmentsthat illustrate proposalsto improve budgetingorto abandon it. Althoughthe twodevelopmentsreachdifferentconclusions,bothoriginatedinthe same organization,the ConsortiumforAdvancedManufacturing-International(CAM-I);one in the U.S.and the otherin Europe.The U.S.- basedCAM-IActivity-BasedBudgeting(ABB)

- 46. 33 groupadvocatesimprovingthe budgetingsystembymarryingamore complete, activitybased operational model witha detailedfinancial model. Its focusison improving budgeting’ssupport of operationalplanning.The European-basedCAM-IBeyond Budgeting (BB) group takesa more radical viewandrecommendsatwo-stage approach. The firststage addressesthe problemswithbudgetingwhentheyare usedforperformance evaluation. It suggeststhattraditional budgetarycontrolsthatcombine planningandperformance evaluationleadtobothpoor planninganddysfunctionalbehavior. Therefore,the BB-grouprecommendseitherradicallychangingtraditional budget-basedperformance evaluationsor completelyeliminatingthe budgetprocess.The secondstage of the BB-approachisto radicallydecentralizethe organizationandempowerlower-level managersandemployees. Althoughthe ABB-grouphasmore of a planning focusand the BB-groupmore of a performance evaluationfocus,theyshare acommonbeliefthattraditional budgetingisfundamentally mismatchedtotoday’srapidlychanginganduncertainenvironments. 2.6 The Role of Budgetary Datain Performance Evaluation It isimportantto recognize thatevenstandardaccounting reportswhichshow the actual andbudgetedcostsforan organizational costcentre canbe usedinmanydifferent waysinperformance evaluation.Inastudyconductedin one divisionof alarge Chicago-basedcompany,21three stylesof evaluationwhichmake distinctlydifferentusesof the monthlyaccountingdatawere isolatedandoperationally defined: 2.6.1 Budget ConstrainedStyle. Despite the manyproblemsin usingaccountingdataascomprehensive measuresof managerialperformance,the evaluationisprimarilybased uponthe costcentre head'sabilitycontinuallytomeetthe budgetona short-term basis.Thiscriterionof performance isstressedatthe expense of othervaluedcriteria. 2.6.2 A Profit ConsciousStyle. The performance of the cost centre headisevaluatedonthe basisof hisabilityto increase the long-term effectivenessof hisunitinrelation tothe purposesof the enterprise,one importantaspect beinghisconcernwith the minimizationof long-runcosts. Forthispurpose,the accountingdata have tobe used withsome care ina flexible manner,andwhere necessary, supplementedbyalternativesourcesof information.

- 47. 34 2.6.3 A Non-accountingStyle. Accountingdataplaya relatively unimportantpartinthe supervisor'sevaluationof his subordinates'performance. The stylesof evaluationwere operationallydefinedonthe basisof costcentre headrankingsof the three most importantcriteriaintheirevaluationoutof a listof eightpossible items;abudgetconstrainedorientationbeing representedby'meetingthe budget'anda profitconscious orientationby'concernwithcosts. These phraseswere selectedonthe basisof observationsmade duringan exploratoryseries of interviews,whenit was foundthattheywere usedbymembersof the companyto referto distinctpatternsof evaluativebehaviorwhichwerein agreementwiththose describedabove.The research instrumentswere pre-testedandattemptsweremade to collectevidence tofurtherestablishtheirconstruct validity. Empirical evidence indicatedthatboththe budgetconstrained andprofitconsciousstylesresultedinahigher degree of involvementwithcoststhanthe non-accountingstyle. Onlythe profitconsciousstyle,however,succeeded inattainingthisinvolvementwithoutincurringeither emotional costs forthe costcentre headsor defensive behaviorwhichwasdysfunctional forthe enterprise.The budget constrainedstyle resultedinabelief thatthe evaluationwasunjust,widespreadtensionandworryon the job,and feelingsof distrustanddissatisfactionwiththe supervisor. It is hardlysurprisingthatthese costcentre headswere foundtomanipulatethe accountingdataand make decisionswhichresultedinlessinnovative behaviorand,attimes,highertotal processingcostsforthe enterprise asawhole.Inaddition,the conflictandrivalrybetween fellow costcentre headsinsuchdepartments impededthe co-operationwhichwassoessential forcontrollingtheirinter-dependentactivities. In contrast,the profitconscious style,while seenasa verydemandingstyle,wasaccepted andrespected,and resultedinsimilarlevelsof job-relatedtension,supervisorsatisfactionandpeersupportivenessand those prevailing witha non-accountingevaluation. The study clearlydemonstratedthatthe final effectiveness withwhichabudgetarysysteminfluencesthe overall efficiencyof anenterprise,aswellasitsownmore limited purposes,isdependentnotonlyuponthe designand technical characteristics,butalsouponthe precise manner inwhichthe dataare usedby line managers.

- 48. 35 Accountingdatado not inand of themselvespose athreatto members of anenterprise,andtheirimperfections neednotnecessarily be seenasunjustwhentheyare usedinperformance evaluation. A manageris notfacedwitha simple choice betweenusingandnotusingthe data in evaluation.Instead, he can reapmany of the benefitsof the systembystressing factorswhichitattemptstomeasure withoutthisresulting in dysfunctional consequences. To do so,however,consideration hastobe giventothe widerorganizational contextwithinwhichtheyare used. While arigiduse of the data is difficulttoresist,passing down ahierarchyonce ithas beenestablishedatone level, the studyshowedthatthe way inwhichthe data are used isassociatedwithmuchmore general differencesin supervisorystyle. Both the budgetconstrainedandprofit conscioussupervisors,unlike those usinganon-accounting style,were seenastryingtocreate a structured job environmentwhichwasdemandinganddifficulttosatisfy. The profitconscioussupervisors,however,werealsoseen asmaintainingawarmand friendlyatmospherewhich was supportive andconduciveformutual trustandrespect. Withoutthe moderatingeffectof thisconsiderate attitude towardsthe costcentre heads,the concernforthe accountingdata wasseenas threateningandstressful,servingasa triggerfordefensive and oftendysfunctional behavior. The profitconsciousstyle appearstobe one aspectof a general problem-solvingapproachto management,as distinctfroman approachwhichattemptsto impose afalse measure of cognitivesimplicityontoacomplex and interdependentseriesof activities. The evaluationof performance isof primaryimportance initself withthe budgetconstrained style,influencingall aspectsof the supervisor'sandthe cost centre head's behavior.Inthiscontext,evaluationisnot viewedas an ongoingpartof the managerial process, interrelatedwithotherimportantaspectsof the job,and justone part of the processof influence.Rather,itisseen asa distinctanddominantactivity,andthe primarysource of influence and control,overshadowingothervital elements of the process.The budgetbecomesnotanaidto management but a constrainton it. While cautionneedstobe exercisedin generalizingthe findings,thisstudyof the role anduse of important aspects of a formal informationandcontrol systemhighlights the crucial inter-dependencyof specialistmanagement functionswhenthese are viewedaspartof a widersocial system.The veryeffectivenessof the budgetarysystem

- 49. 36 was bothdependentupon,aswell asreinforcing,the characteristicsof the widerorganizationalclimatewithin whichitsuse occurred. 2.7 Overview of Activity-BasedBudgeting 2.7.1 The Role of BudgetingIn Planningand Control Budgetingplaysacrucial role in planningandcontrol. Plansidentifyobjectivesand the actionsneededtoachieve them.Budgetsare the quantitative expressionsof these plans,statedineitherphysical orfinancial termsorboth. Whenusedfor planningabudgetisa methodfor translatingthe goalsandstrategiesof an organizationinto operational terms.Budgetscanalsobe usedincontrol. Control isthe processof settingstandards,receiving feedbackonactual performance,andtakingcorrective actionwheneveractual performance deviatessignificantly fromplannedperformance.Thus,budgetscanbe usedto compare actual outcomeswithplannedoutcomes,and they can steeroperationsbackoncourse,if necessary.The illustrationof the relationshipof budgetstoplanning, operating,andcontrol showedasbelow.Budgetsevolve from the long-runobjectivesof the firm;theyformthe basisforoperations.Actual resultsare comparedwith budgeted amountsthroughcontrol.Thiscomparison providesfeedbacksbothforoperationsandforfuture budgets(Hansen and Mowen,2003). Figure7: Purposesof budgeting